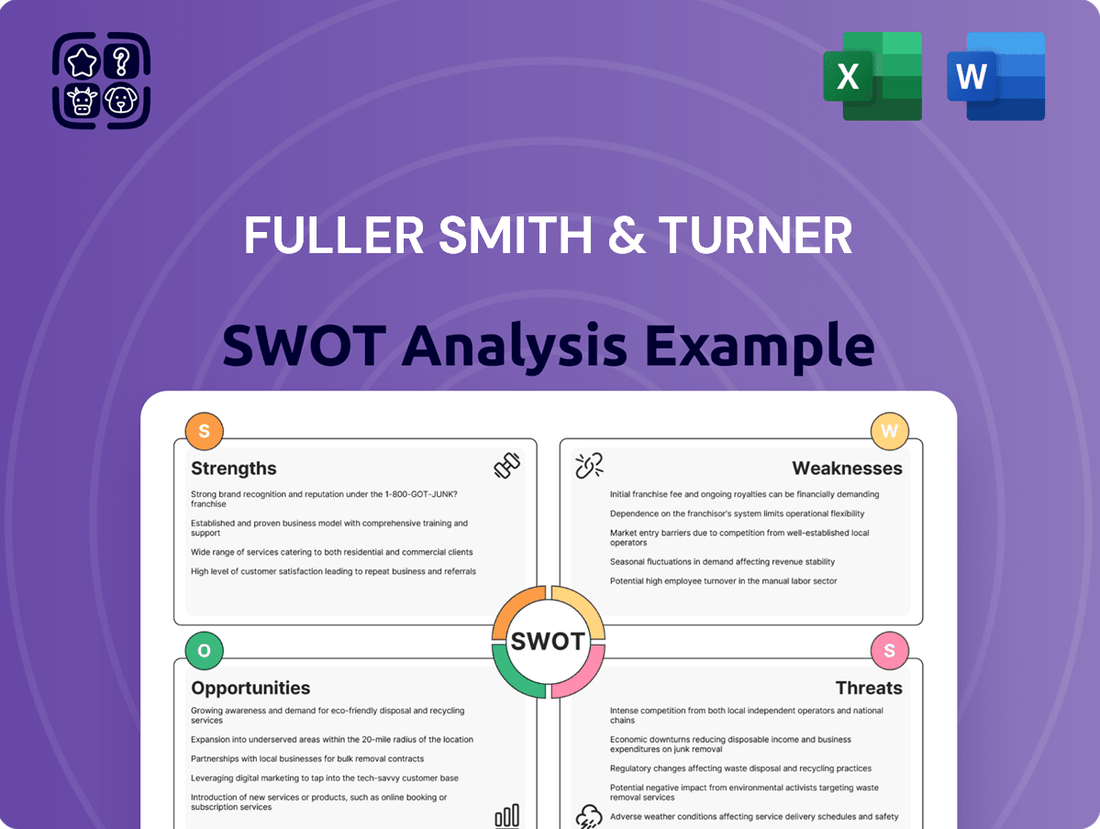

Fuller Smith & Turner SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuller Smith & Turner Bundle

Fuller Smith & Turner boasts a strong brand heritage and a loyal customer base, but faces increasing competition and evolving consumer preferences. Our comprehensive SWOT analysis delves into these dynamics, revealing key opportunities for expansion and potential threats to their market share.

Want the full story behind Fuller Smith & Turner's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fuller, Smith & Turner boasts a premium portfolio of pubs and hotels concentrated in the southern half of England, underpinning a robust brand reputation for a superior hospitality experience. This commitment to quality is evident in their offerings of fresh, delicious food, a diverse beverage selection, and attentive customer service.

As of the fiscal year ending March 2024, the company managed 185 pubs and hotels, featuring a combined total of 1,028 bedrooms. Complementing this, they also operated 153 tenanted inns, all strategically positioned to elevate customer satisfaction and reinforce the brand's premium standing.

Fuller Smith & Turner has shown impressive financial results. For the full year 2025, their revenue climbed 4.8% to £376.3 million, and adjusted profit before tax saw a significant 32% jump to £27.0 million. This indicates a healthy and growing business.

Their Managed Pubs & Hotels segment is a key driver, with like-for-like sales increasing by 5.2% in FY2025. This performance outpaced the wider industry, highlighting the company's competitive edge. The positive trend has carried forward, as the first 10 weeks of the new financial year saw like-for-like sales rise by 4.2%.

Fuller's possesses a high-quality, largely freehold property portfolio, featuring well-known pubs and hotels. This strong asset base offers substantial backing and supports consistent operations.

The company demonstrates a commitment to maintaining and enhancing its estate, investing £28 million in FY2025. These investments are directed towards significant upgrades and modernizing hotels, including a shift to fully electric operations, ensuring the properties remain competitive and in prime condition.

Effective Strategic Portfolio Management

Fuller's excels at strategic portfolio management, actively refining its pub and hotel holdings to boost profitability and concentrate on its strongest assets. This proactive approach ensures the business remains agile and focused on growth areas.

A prime example of this strategy in action occurred in summer 2024. Fuller's divested 37 non-core tenanted pubs for £18.3 million and The Mad Hatter for £20 million. Concurrently, the company invested £22.5 million to acquire seven new pubs through its Lovely Pubs business, showcasing a clear commitment to disciplined capital allocation and targeted expansion.

- Strategic Disposals: Sold 37 non-core tenanted pubs (£18.3m) and The Mad Hatter (£20m) in summer 2024.

- Targeted Acquisitions: Acquired seven new pubs via Lovely Pubs for £22.5m in summer 2024.

- Enhanced Profitability: Focuses on optimizing returns by selling underperforming or non-core assets and investing in promising ventures.

- Core Strength Focus: Portfolio adjustments allow for greater concentration on Fuller's most successful and strategically important pubs and hotels.

Robust Balance Sheet and Financial Flexibility

Fuller Smith & Turner's robust balance sheet provides significant financial flexibility. As of the first half of FY2025, the company reported net debt, excluding lease liabilities, at £142.2 million. This translates to a healthy net debt to EBITDA ratio of 2.3 times, demonstrating manageable leverage.

Further bolstering its financial strength, Fuller's secured a new £185 million bank facility in FY2025, which extends until August 2028. This facility was arranged at a reduced interest margin, underscoring the company's strong creditworthiness and providing substantial financial headroom for future strategic initiatives.

- Strong Financial Position: Net debt (excluding leases) of £142.2 million as of H1 FY2025.

- Healthy Leverage: Net debt to EBITDA ratio of 2.3 times in H1 FY2025.

- Enhanced Financial Headroom: New £185 million bank facility secured until August 2028.

- Favorable Financing Terms: Facility obtained at a lower interest margin.

Fuller's boasts a premium, largely freehold property portfolio, featuring well-regarded pubs and hotels. This strong asset base provides significant financial backing and supports consistent operational performance.

The company demonstrates a clear commitment to enhancing its estate, investing £28 million in FY2025 for significant upgrades and modernization, including a move towards fully electric operations.

Strategic portfolio management is a key strength, with Fuller's actively refining its holdings to boost profitability and concentrate on its most successful assets.

The company's financial health is robust, with a net debt to EBITDA ratio of 2.3 times as of H1 FY2025 and a new £185 million bank facility secured until August 2028.

| Metric | FY2025 (Full Year) | H1 FY2025 |

|---|---|---|

| Revenue | £376.3 million (up 4.8%) | N/A |

| Adjusted Profit Before Tax | £27.0 million (up 32%) | N/A |

| Managed Like-for-Like Sales | +5.2% | N/A |

| Net Debt (excluding leases) | N/A | £142.2 million |

| Net Debt to EBITDA Ratio | N/A | 2.3x |

| Bank Facility | N/A | £185 million (until Aug 2028) |

What is included in the product

Analyzes Fuller Smith & Turner’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Highlights key strengths and weaknesses for targeted problem-solving.

Weaknesses

Fuller's significant reliance on the UK market makes it highly susceptible to domestic economic slowdowns. The ongoing cost-of-living pressures, which began impacting discretionary spending in 2022 and continued through 2023, have directly curtailed consumer expenditure on leisure and hospitality, affecting Fuller's core business. This economic sensitivity is further underscored by the uneven recovery in the UK's hospitality sector, with London hotels showing resilience while regional areas continue to face challenges, potentially limiting growth opportunities outside the capital.

Fuller's, like many in the UK hospitality industry, is grappling with persistent inflationary pressures. This means the cost of essential inputs such as wages, food, and energy continues to climb, directly impacting the company's bottom line.

Looking ahead to the new financial year, Fuller's anticipates further cost headwinds. These include anticipated increases in Employers' National Insurance Contributions, the National Living Wage, and Business Rates, all of which add to the operational expense burden.

Even with robust sales growth, these escalating operational costs pose a significant threat. They have the potential to squeeze profit margins, meaning that even if more revenue is generated, the company may retain less of it as profit.

Fuller's operates in a UK pub and hotel market characterized by fierce competition. This includes a wide array of businesses, from small independent pubs to large, established national pub chains. This crowded landscape can put pressure on pricing strategies and requires ongoing investment in property upkeep and service quality to retain customers.

Reliance on Discretionary Consumer Spending

Fuller Smith & Turner's reliance on discretionary consumer spending presents a significant vulnerability. A substantial part of their income is tied to consumers' willingness to spend on food, drinks, and lodging, which are often considered non-essential.

Current economic conditions are forcing consumers to be more budget-conscious. Data indicates that a notable percentage of consumers, around 35% for 2025, are planning to cut back on dining and drinking out. This trend directly impacts Fuller's sales volume and revenue predictability.

- Sensitivity to Disposable Income: Fuller's revenue streams are highly sensitive to fluctuations in consumer disposable income.

- Consumer Spending Trends: Approximately 35% of consumers anticipate reducing spending on dining and drinking out in 2025, directly affecting Fuller's core business.

- Impact on Sales Volume: Economic pressures can lead to lower sales volumes as consumers prioritize essential goods over leisure activities.

- Revenue Stability Concerns: The dependence on discretionary spending creates inherent instability in revenue, making forecasting more challenging.

Leadership Transition Impact

Fuller Smith & Turner faces a notable leadership transition with the upcoming retirement of Chairman Michael Turner and the move of Simon Emeny to Executive Chairman in July 2025. This planned change, while executed strategically, could introduce a temporary adjustment period for the company. Maintaining consistent strategic execution and a clear vision throughout this handover is vital for continued operational success.

The leadership shift presents a potential weakness if not managed with exceptional foresight. A key challenge will be ensuring that the new leadership structure effectively maintains the company's established strategic direction and operational tempo. For instance, Fuller's reported revenue for the fiscal year ending September 2024 was £955 million, and continuity in leadership is essential to building upon this performance.

- Leadership Transition: The planned succession of Michael Turner to Executive Chairman and Simon Emeny's appointment as Chairman in July 2025 introduces a period of change.

- Potential Adjustment Phase: Any significant leadership change, even when well-planned, can lead to a brief period of adaptation for the organization and its stakeholders.

- Maintaining Strategic Momentum: Ensuring a smooth and effective handover of responsibilities is critical to prevent any disruption to Fuller's ongoing business strategies and growth initiatives.

Fuller's significant reliance on the UK market makes it highly susceptible to domestic economic slowdowns and inflationary pressures. The ongoing cost-of-living crisis directly curtails consumer discretionary spending, impacting Fuller's core pub and hotel business. For instance, the company anticipates further cost headwinds in the new financial year, including increases in Employers' National Insurance Contributions and the National Living Wage.

The company operates in a highly competitive UK pub and hotel market, requiring continuous investment in property and service to retain customers. This intense competition, coupled with sensitivity to disposable income, creates revenue stability concerns, as approximately 35% of consumers plan to reduce spending on dining and drinking out in 2025.

Fuller's faces a leadership transition with the retirement of Chairman Michael Turner and Simon Emeny's move to Executive Chairman in July 2025. While planned, this change could introduce a temporary adjustment period, making it crucial to maintain strategic momentum. Ensuring continuity is vital, especially as Fuller's reported revenue for the fiscal year ending September 2024 was £955 million.

| Weakness | Description | Impact | Supporting Data/Context |

|---|---|---|---|

| Economic Sensitivity | High dependence on the UK economy and consumer disposable income. | Reduced consumer spending on leisure and hospitality. | 35% of consumers plan to cut back on dining/drinking out in 2025. |

| Cost Inflation | Rising operational costs including wages, food, and energy. | Squeezed profit margins despite sales growth. | Anticipated increases in National Insurance, National Living Wage, and Business Rates. |

| Competitive Landscape | Operating in a crowded UK pub and hotel market. | Pressure on pricing and need for ongoing investment. | Presence of numerous independent and national pub chains. |

| Leadership Transition | Planned succession of key leadership roles. | Potential for a temporary adjustment period. | Michael Turner retiring, Simon Emeny moving to Executive Chairman July 2025. |

Preview the Actual Deliverable

Fuller Smith & Turner SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

Fuller's has a clear long-term goal to expand its pub and hotel portfolio, actively pursuing suitable acquisition targets. The recent purchase of Lovely Pubs exemplifies this strategic intent.

The UK hospitality sector is currently seeing a surge in merger and acquisition activity, with improved access to debt financing fueling this trend. This presents a fertile ground for Fuller's to further grow its estate and strengthen its market position through strategic purchases.

Fuller Smith & Turner's commitment to enhancing customer experience through substantial investment in its properties is a key opportunity. For instance, the ongoing refurbishment of pubs and hotels, such as the fully electric Head of the River hotel, directly improves the guest environment. These upgrades, including a focus on sustainability, are designed to attract a broader customer base and foster loyalty, reinforcing the company's premium brand image.

The UK hotel market is expected to see increased demand in 2025, with inbound tourism playing a key role, especially if the pound remains weak. This presents a significant opportunity for Fuller Smith & Turner to attract more international visitors to its establishments.

Major events like concerts and festivals are proven revenue drivers, causing sharp upticks in hotel occupancy in urban centers. Fuller's can strategically position its hotels in proximity to these events to capture this surge in demand, boosting both occupancy rates and overall revenue.

Leveraging Technology for Operational Efficiency and Customer Engagement

Fuller Smith & Turner can significantly boost its operational efficiency and customer engagement by embracing technological advancements. The hospitality industry is seeing a surge in tech adoption, from sophisticated loyalty programs to automated back-office functions. For instance, by mid-2024, many pub chains were reporting a 15-20% increase in repeat business through well-executed digital loyalty schemes.

Implementing advanced technology allows for streamlined working practices, reducing manual effort and minimizing errors. This not only cuts costs but also frees up staff to focus on delivering superior customer experiences. Think about integrating AI-powered inventory management systems or automated booking platforms to optimize resource allocation.

Furthermore, technology provides invaluable insights into customer behavior and preferences. By analyzing data gathered from digital interactions, Fuller Smith & Turner can craft highly personalized offers and marketing campaigns. This data-driven approach is crucial for fostering customer loyalty and, ultimately, enhancing profitability. In 2024, companies that effectively utilized customer data saw an average uplift of 10% in customer lifetime value.

- Enhanced Customer Loyalty: Digital loyalty programs can drive repeat visits and increase customer lifetime value.

- Operational Streamlining: Automation of tasks like inventory management and booking reduces costs and improves efficiency.

- Data-Driven Insights: Technology enables the collection and analysis of customer data for personalized marketing.

- Improved Profitability: Optimized operations and targeted engagement lead to better financial performance.

Advocacy for Favorable Policy Changes

Fuller's CEO has been vocal in advocating for changes to the UK's business rates system, which is seen as outdated and burdensome for the hospitality industry. This proactive stance positions the company to benefit significantly if these reforms are enacted.

Successful policy changes could directly translate to lower operational expenses for Fuller's, enhancing its profit margins. For instance, the British Beer & Pub Association has highlighted that business rates account for a substantial portion of pub operating costs, with some pubs paying over £10,000 annually. A reduction here would be a material improvement.

- Potential Cost Reduction: Reforms could lower Fuller's significant business rates expenditure.

- Improved Profitability: Reduced costs would directly boost the company's bottom line.

- Enhanced Competitiveness: A more favorable cost structure would allow Fuller's to compete more effectively.

- Industry-Wide Benefit: Broader reforms would also benefit competitors, potentially stabilizing the sector.

Fuller's strategic acquisitions, like the recent purchase of Lovely Pubs, align with the growing M&A trend in the UK hospitality sector, supported by improved debt financing availability in 2024-2025. Continued investment in property enhancements, such as the fully electric Head of the River hotel, aims to attract a wider customer base. The anticipated 2025 surge in UK hotel demand, boosted by inbound tourism and a potentially weaker pound, offers a prime opportunity for increased international visitor numbers.

Leveraging technology for enhanced customer loyalty, operational streamlining, and data-driven insights presents a significant opportunity, with digital loyalty schemes in 2024 showing up to a 20% increase in repeat business for pub chains. Furthermore, advocating for and benefiting from potential UK business rates reforms could directly reduce operational expenses, as business rates can account for over £10,000 annually for some pubs.

Threats

Fuller's faces ongoing threats from persistent inflation, with food and energy costs remaining stubbornly high despite some recent easing. These elevated operating expenses directly impact the company's ability to maintain healthy profit margins in the hospitality sector.

Further compounding these pressures, the upcoming financial year brings anticipated increases in Employer's National Insurance Contributions and the National Living Wage. Additionally, rising Business Rates will add to the cost burden, creating a challenging environment for managing profitability.

The persistent cost-of-living crisis and elevated interest rates are significantly dampening consumer confidence, directly impacting discretionary spending. This economic pressure means many individuals are tightening their belts, making decisions about where and how much they spend on dining and drinking out.

Looking ahead to 2025, a considerable segment of consumers are signaling their intention to reduce expenditures on eating and drinking outside the home. This trend poses a direct threat to Fuller's, potentially leading to fewer customers walking through the doors and a decrease in the average amount each customer spends.

Consequently, Fuller's could experience slower sales growth as a result of this anticipated decline in consumer spending on hospitality services. For instance, if consumer spending on eating out falls by a projected 5% in 2025, as some forecasts suggest, this would directly translate to reduced revenue for pub and hotel operators like Fuller's.

The UK hospitality sector is fiercely competitive, with Fuller Smith & Turner facing pressure from both long-standing pub and hotel groups and agile new entrants. This intense rivalry means constant innovation and customer focus are essential to maintain market position.

The trend of consolidation within the hotel industry, evidenced by significant merger and acquisition (M&A) activity, presents a growing threat. Larger, consolidated entities can leverage economies of scale, potentially leading to increased pricing power and a more challenging environment for independent operators like Fuller Smith & Turner.

Regulatory and Tax Burden Uncertainty

Fuller's Smith & Turner faces ongoing threats from evolving government policies, particularly concerning taxation and business rates. Changes in these regulations can directly increase operational expenses and administrative complexity, potentially hindering profitability. For instance, the UK's business rates system, which is periodically reviewed, could see adjustments that negatively impact pub and hotel businesses like Fuller's.

The uncertainty surrounding future regulatory frameworks, including potential shifts in alcohol duty or employment law, adds a layer of risk to long-term financial projections. Unforeseen policy changes could necessitate costly adaptations or reduce the attractiveness of the hospitality sector. In the 2024-2025 fiscal year, the hospitality sector continues to navigate a landscape where government support measures may be withdrawn while new compliance requirements could be introduced.

The company must remain agile to adapt to these potential shifts. For example, a significant increase in business rates, which have seen fluctuations in recent years, could directly affect Fuller's net operating income. The government's approach to inflation and its impact on the cost of living can also influence consumer spending on leisure activities, indirectly affecting the company through regulatory and tax decisions that impact disposable income.

Broader Economic and Geopolitical Instability

Broader economic and geopolitical instability presents a significant threat to Fuller Smith & Turner. Global economic uncertainty, coupled with potential geopolitical disruptions, could dampen inbound tourism and erode overall consumer confidence. This is particularly concerning for the hospitality sector, as these external factors, largely outside the company's direct control, can heavily influence market demand and recovery trajectories.

The ongoing war in Ukraine and its ripple effects on energy prices and supply chains, for instance, could continue to impact operational costs and discretionary spending by consumers throughout 2024 and into 2025. Furthermore, shifts in international relations or trade policies could affect the ease and cost of travel, thereby influencing the number of international visitors to the UK, a key demographic for many hospitality businesses.

For example, the World Bank's projections for global growth in 2024, while showing some improvement, still highlight significant downside risks stemming from persistent inflation, high interest rates, and ongoing geopolitical tensions. This fragile economic environment directly translates to a more cautious consumer, potentially leading to reduced spending on leisure activities like dining out and overnight stays.

- Economic Slowdown: A global or UK recession could reduce disposable income, impacting consumer spending on hospitality services.

- Geopolitical Tensions: Conflicts or political instability can deter international travel and disrupt supply chains, increasing costs.

- Inflationary Pressures: Persistent inflation, especially in energy and food, directly affects operating margins and consumer affordability.

- Currency Fluctuations: A weaker pound can make the UK a more attractive destination for tourists but increases the cost of imported goods for the business.

Fuller's faces significant threats from ongoing inflation, particularly in food and energy, which directly squeezes profit margins. Additionally, anticipated increases in labor costs through higher National Living Wage and National Insurance contributions for 2024-2025, coupled with rising business rates, will further elevate operating expenses.

The persistent cost-of-living crisis and high interest rates are dampening consumer confidence, leading to reduced discretionary spending on dining and drinking out. Projections for 2025 indicate a segment of consumers intend to cut back on these activities, directly impacting Fuller's revenue potential.

Intensifying competition within the UK hospitality sector, from both established players and new entrants, necessitates continuous innovation and customer focus to maintain market share. Furthermore, consolidation in the hotel industry creates larger entities with greater economies of scale, potentially increasing pricing pressure.

Broader economic and geopolitical instability poses a risk, potentially deterring inbound tourism and impacting consumer confidence. For instance, the World Bank projected significant downside risks to global growth in 2024 due to persistent inflation and geopolitical tensions, which could translate to reduced consumer spending on leisure.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Fuller Smith & Turner's official financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic overview.