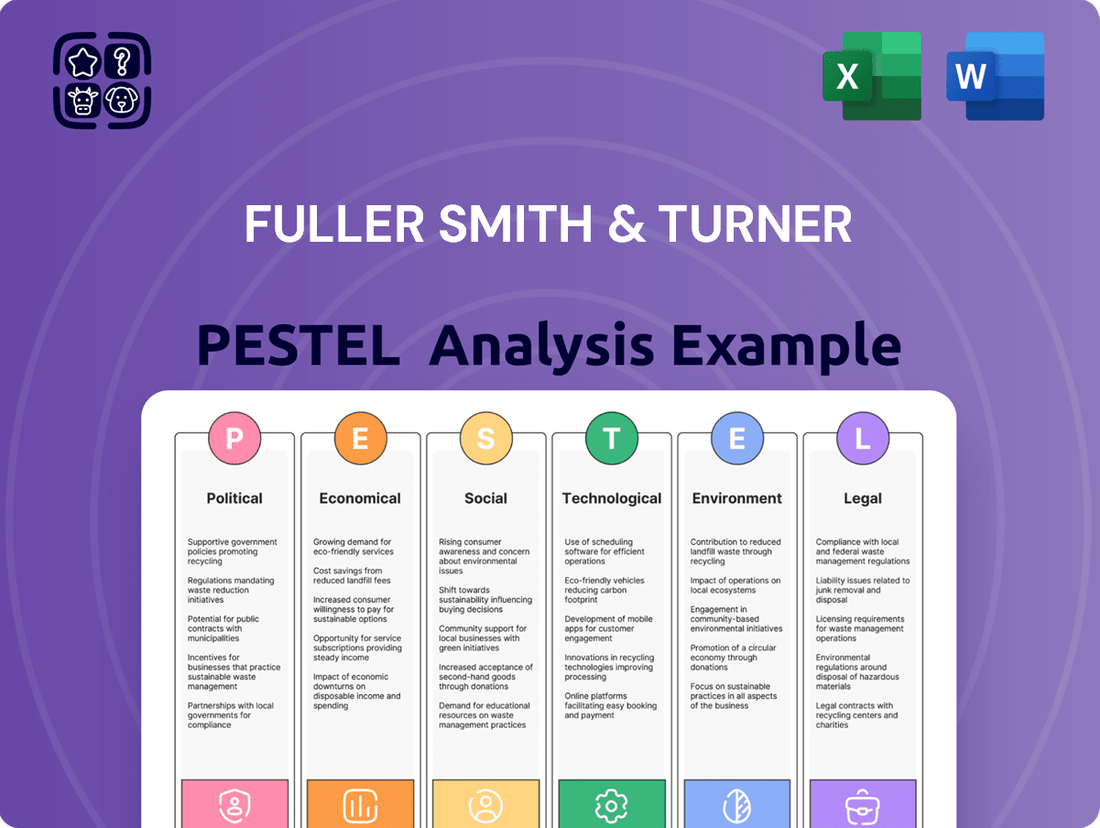

Fuller Smith & Turner PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuller Smith & Turner Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Fuller Smith & Turner's strategic landscape. Our comprehensive PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and identify opportunities. Equip yourself with actionable intelligence to navigate challenges and secure your competitive advantage. Download the full version now and gain the clarity to drive Fuller Smith & Turner's future success.

Political factors

Government policy significantly shapes the UK hospitality sector, impacting Fuller, Smith & Turner's operations through licensing, health and safety, and employment laws. For instance, the proposed Martyn's Law, aimed at enhancing security in public venues, will introduce new compliance measures and potentially increase operational costs for pubs and hotels.

Ongoing reviews of licensing frameworks, such as potential changes to alcohol sale hours or outdoor seating regulations, could offer new opportunities or necessitate adjustments to Fuller, Smith & Turner's business model. These regulatory shifts are designed to foster safer environments and responsible trading, but they require continuous adaptation from businesses.

Changes in taxation, specifically business rates and VAT, have a direct impact on the profitability of hospitality businesses like Fuller, Smith & Turner. The planned reduction in business rates relief for the sector, from 75% to 40% starting in April 2025, will lead to higher operating expenses.

This reduction in relief presents a notable challenge for Fuller, Smith & Turner, increasing their cost base. Concurrently, ongoing campaigns advocating for a decrease in VAT for the hospitality and tourism sectors could offer a substantial benefit if they succeed.

Government policies on wages and employment costs significantly influence the hospitality industry. For instance, the increase in the National Living Wage to £11.44 per hour for those aged 21 and over from April 2024, and the projected further rise in employer National Insurance contributions from April 2025, directly add to Fuller, Smith & Turner's operational expenses.

Changes in immigration rules also play a crucial role in labour availability. A potential Labour government, following the 2024 UK general election, might introduce new training initiatives to tackle skills gaps and re-evaluate immigration policies, which could impact the pool of available workers for companies like Fuller, Smith & Turner.

Public Health Initiatives

Government-led public health initiatives directly shape consumer behavior and, consequently, the revenue potential for pub operators like Fuller, Smith & Turner. While the widespread adoption of minimum unit pricing for alcohol hasn't materialized across England and Wales, Scotland's decision to raise its minimum unit price to 65p in late 2024, coupled with Wales' ongoing policy review, presents a tangible shift.

These evolving regulations on alcohol pricing could significantly influence drink sales volumes and necessitate strategic adjustments to Fuller, Smith & Turner's pricing models. For instance, if similar policies were to be implemented more broadly, the company would need to carefully consider how to absorb or pass on potential cost increases to maintain profitability without alienating its customer base.

- Scotland's minimum unit price for alcohol increased to 65p in late 2024.

- Wales is currently reviewing its alcohol pricing policies.

- Potential for increased operating costs and altered consumer spending on beverages.

Tourism and Local Authority Policies

Local authority policies significantly influence the hospitality sector. Measures designed to boost tourism, such as marketing initiatives or infrastructure development, can directly increase customer traffic for companies like Fuller, Smith & Turner. Conversely, policies that impose local levies, like a tourist tax, can impact both consumer spending and operational expenses.

The Scottish Parliament's Visitor Levy (Scotland) Act 2024 is a prime example, empowering local authorities to introduce a tourist tax. Edinburgh is anticipated to be among the first cities to implement such a charge. If Fuller, Smith & Turner experiences this levy in its operating regions, it could lead to higher costs for patrons and added administrative responsibilities for the business, although the revenue is earmarked for local improvements.

- Visitor Levy Impact: Potential for increased operational costs and altered customer pricing due to local tourist taxes.

- Scottish Legislation: The Visitor Levy (Scotland) Act 2024 enables local authorities to implement tourist taxes, with Edinburgh a likely early adopter.

- Administrative Burden: Companies may face increased administrative complexity in collecting and remitting new local levies.

- Funding Local Amenities: Levies are intended to fund local infrastructure and services, which could indirectly benefit tourism businesses.

Government policy continues to be a major influence on Fuller, Smith & Turner. The upcoming reduction in business rates relief from 75% to 40% in April 2025 will increase operating expenses, while the rise in the National Living Wage to £11.44 per hour from April 2024 also adds to labor costs. Potential changes in immigration policy following the 2024 UK general election could also affect workforce availability.

Regulatory shifts, such as the potential implementation of Martyn's Law, will introduce new compliance requirements and associated costs for security measures. Additionally, evolving alcohol pricing regulations, like Scotland's increase in minimum unit price to 65p in late 2024, could impact sales volumes and necessitate pricing strategy adjustments.

Local government actions, including marketing initiatives and infrastructure development, can boost customer traffic, but the introduction of tourist taxes, such as the Visitor Levy (Scotland) Act 2024, could increase costs for patrons and add administrative burdens for businesses like Fuller, Smith & Turner.

| Policy Area | Impact on Fuller, Smith & Turner | Key Data/Dates |

|---|---|---|

| Business Rates Relief | Increased operating expenses due to reduced relief | Reduction from 75% to 40% from April 2025 |

| National Living Wage | Higher labor costs | £11.44 per hour from April 2024 (for 21+) |

| Alcohol Pricing (Scotland) | Potential impact on sales volumes and pricing strategy | Minimum unit price increased to 65p in late 2024 |

| Tourist Taxes | Potential for increased customer costs and administrative burden | Visitor Levy (Scotland) Act 2024 enables local implementation |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Fuller Smith & Turner, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Fuller Smith & Turner's strategic discussions.

Economic factors

The persistent cost-of-living crisis and elevated inflation continue to exert pressure on consumer discretionary spending, particularly within the leisure and hospitality sectors. This environment means consumers are more mindful of their expenditure on activities like dining and drinking out.

While Fuller, Smith & Turner demonstrated resilience, reporting a 4.8% revenue increase and a 32% rise in adjusted profit before tax for the 52 weeks ending March 29, 2025, the wider industry faces a trend of consumers reducing their spending in pubs and restaurants. This necessitates a strategic focus on delivering value and attractive promotions to encourage customer visits.

Changes in interest rates directly impact borrowing costs for companies like Fuller, Smith & Turner and influence overall consumer spending. Forecasts for 2025 suggest potential reductions in UK interest rates, which could lead to a weaker pound. This currency movement might make the UK a more attractive destination for international tourists, potentially boosting the hospitality sector.

Fuller, Smith & Turner demonstrated its financial resilience by securing a new £185 million bank facility in early 2024. This facility came with a reduced interest margin, indicating the lenders' confidence in the company's financial health and its ability to manage debt effectively, thereby supporting ongoing investment and operational growth.

Rising labour costs are a significant concern for Fuller, Smith & Turner. For example, the UK's National Living Wage increased to £11.44 per hour for those aged 21 and over from April 2024, impacting the hospitality sector heavily. This, coupled with increases in employer National Insurance contributions, puts considerable pressure on businesses like Fuller's to manage staffing expenses effectively.

The availability of a skilled workforce also remains a challenge. Fuller, Smith & Turner, like its peers, must focus on attracting and retaining talent through competitive pay, benefits, and training programs. Initiatives aimed at improving employee retention are vital to ensure consistent service quality and operational continuity across its pubs and hotels.

Consumer Spending Patterns

Consumer spending patterns are undergoing a significant shift, with a pronounced focus on value, memorable experiences, and dining options that align with sustainability principles. Fuller, Smith & Turner must actively adapt its portfolio to resonate with these evolving consumer desires, including the increasing appetite for immersive and social dining occasions, alongside the strategic implementation of robust loyalty programs. For instance, in the UK, consumer spending on leisure and hospitality saw a notable increase in 2024, reflecting a desire for experiences post-pandemic, though value remains a key consideration for a majority of consumers.

The hospitality sector, including Fuller, Smith & Turner's operations, is also observing a demographic divergence in preferences. Younger consumers, in particular, are showing a greater inclination towards restaurants and more curated dining experiences compared to traditional pubs and bars. Data from early 2025 indicates that while pub visits remain popular, spending per visit in casual dining restaurants has outpaced that of pubs, suggesting a need for Fuller, Smith & Turner to explore diversified offerings that bridge this gap.

- Value-driven choices: Consumers are increasingly scrutinizing price points and seeking clear value propositions in their dining out decisions.

- Experience economy: Demand for unique, social, and memorable dining experiences continues to grow, influencing venue choice and spending.

- Sustainability focus: Ethical sourcing, waste reduction, and environmentally conscious practices are becoming important factors in consumer purchasing decisions within the hospitality sector.

- Demographic preferences: A notable trend shows younger demographics gravitating more towards restaurants and experiential dining over traditional pub settings, necessitating strategic adaptation.

Investment and Market Consolidation

The UK hotel market demonstrated notable resilience and growth through 2024, with transaction volumes recovering to pre-pandemic levels. Significant investment deals were observed, signaling a strong appetite for hospitality assets. For instance, the market saw a substantial increase in deal activity, with reports indicating a surge in hotel sales and acquisitions throughout the year.

Looking ahead to 2025, the trend of mergers and acquisitions is anticipated to persist, fueled by enhanced market liquidity and attractive opportunities for well-capitalized investors. This consolidation phase presents both challenges and strategic advantages for established players like Fuller, Smith & Turner.

Fuller, Smith & Turner's active engagement in this evolving landscape is evident through its strategic disposals of non-core pub assets, which generated capital for reinvestment. Simultaneously, the company pursued targeted acquisitions of new businesses, bolstering its portfolio and adapting to market shifts. This dual approach underscores its commitment to optimizing its business model amidst industry consolidation.

- UK hotel market transaction volumes returned to pre-pandemic levels in 2024.

- Increased liquidity is expected to drive further M&A activity in the hospitality sector in 2025.

- Fuller, Smith & Turner has actively managed its portfolio through disposals and acquisitions.

The economic landscape for Fuller, Smith & Turner is shaped by fluctuating consumer spending and interest rate policies. While the company reported a 4.8% revenue increase for the 52 weeks ending March 29, 2025, the broader hospitality sector faces headwinds from the cost-of-living crisis, prompting consumers to be more value-conscious. Potential interest rate cuts in 2025 could weaken the pound, potentially benefiting tourism.

Labour costs remain a significant challenge, with the National Living Wage rising to £11.44 per hour from April 2024 for those aged 21 and over, alongside increased National Insurance contributions. This necessitates careful management of staffing expenses and a focus on attracting and retaining a skilled workforce to maintain service quality.

| Economic Factor | Impact on Fuller, Smith & Turner | Supporting Data/Trend |

| Consumer Spending Power | Reduced discretionary spending on leisure and hospitality. | Cost-of-living crisis and inflation persist. |

| Interest Rates | Affects borrowing costs and consumer spending. Potential rate cuts in 2025 could weaken the pound. | UK interest rate forecasts for 2025. |

| Labour Costs | Increased wage bills and National Insurance contributions. | National Living Wage increase to £11.44/hour (April 2024). |

Preview Before You Purchase

Fuller Smith & Turner PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fuller Smith & Turner delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning.

Sociological factors

Modern consumer lifestyles are significantly reshaping how people interact with hospitality venues like pubs and hotels. There's a noticeable trend towards health consciousness, with a growing demand for low and no-alcohol beverage options. For instance, the UK market for low and no-alcohol drinks saw a substantial increase, with sales projected to reach £1.5 billion by 2025, indicating a clear consumer preference shift.

Sustainability is another key factor influencing choices. Consumers are increasingly looking for establishments that prioritize local sourcing and seasonal ingredients, reflecting a broader environmental awareness. Fuller, Smith & Turner's commitment to these practices can resonate strongly with this demographic, potentially driving customer loyalty.

Beyond traditional offerings, the rise of 'competitive socialising' – think pub quizzes or board game nights – and 'bleisure' travel (combining business and leisure) are creating new avenues for growth. These trends suggest opportunities for Fuller, Smith & Turner to diversify its experiences, attracting a wider customer base seeking more engaging and multi-faceted visits.

Generational differences are significantly reshaping the hospitality landscape. For Fuller, Smith & Turner, this means recognizing that younger demographics like Gen Z and Millennials often prioritize restaurants offering immersive and social experiences over traditional pub settings. For instance, a 2024 report indicated that 65% of Gen Z consumers prefer dining out with friends at least once a week, often seeking venues with unique ambiances and interactive elements.

This shift necessitates a strategic reevaluation of Fuller, Smith & Turner's offerings. Adapting marketing campaigns to highlight communal aspects and potentially introducing more diverse food and beverage options that appeal to evolving tastes is key. Understanding these demographic trends, such as the increasing demand for plant-based options and craft beverages, allows the company to tailor its pub and hotel concepts effectively, ensuring relevance and appeal across a broader customer base.

Growing consumer emphasis on health and wellness is significantly boosting demand for healthier food and drink choices, notably low and no-alcohol beverages. This shift reflects a broader societal move towards healthier lifestyles and more mindful consumption patterns.

The United Kingdom's low and no-alcohol market experienced robust growth, expanding by 15% in 2024. Fuller, Smith & Turner is well-positioned to leverage this trend by diversifying its product portfolio to include more options in this rapidly expanding category.

Sustainability and Ethical Consumption

Consumer demand for sustainability is rapidly reshaping the hospitality sector. In 2024, a significant majority of consumers, around 70%, indicated they would pay more for products from brands committed to positive social and environmental impact. This trend is directly influencing purchasing decisions, pushing companies like Fuller, Smith & Turner to integrate eco-friendly practices more deeply into their operations.

Fuller, Smith & Turner's focus on sourcing local ingredients and implementing waste reduction strategies directly addresses this growing consumer preference. For instance, many pubs within the Fuller's estate are actively working to reduce their food waste, with some reporting a 15% decrease in landfill waste over the past year through improved inventory management and composting initiatives. This not only appeals to ethically-minded customers but also contributes to operational efficiency.

- Growing Demand: Over 70% of consumers in 2024 stated a willingness to pay more for sustainable products.

- Eco-Friendly Preferences: Customers increasingly favor businesses that prioritize local sourcing and waste reduction.

- Brand Enhancement: Fuller, Smith & Turner's sustainability efforts can significantly boost its brand image and attract environmentally conscious patrons.

- Operational Benefits: Initiatives like waste reduction can lead to cost savings and improved resource management.

Community and Social Hub Role of Pubs

Pubs continue to be central to community life, adapting to new social demands. Fuller, Smith & Turner is well-positioned to capitalize on this by diversifying offerings, including enhanced food services and unique entertainment options, thereby strengthening their role as community anchors.

The evolving social landscape sees pubs transforming into multi-functional spaces. For Fuller, Smith & Turner, this means integrating elements like enhanced food menus and potential for live events or themed nights to attract a wider demographic and reinforce their community hub status.

- Community Hub Evolution: Pubs are increasingly recognized for their role beyond alcohol service, acting as vital social meeting points.

- Fuller's Diversification Strategy: The company's focus on varied experiences, from dining to social activities, directly addresses this evolving community need.

- Customer Base Expansion: By offering more than traditional pub fare, Fuller, Smith & Turner can attract a broader range of customers, including families and those seeking alternative social venues.

Societal trends are significantly influencing consumer behavior in the hospitality sector. Fuller, Smith & Turner must adapt to evolving lifestyles, which increasingly prioritize health and sustainability. For example, the UK's low and no-alcohol market is projected to reach £1.5 billion by 2025, reflecting a growing demand for healthier options.

Consumers are also showing a strong preference for businesses with ethical practices. A 2024 survey indicated that around 70% of consumers are willing to pay more for products from brands committed to positive social and environmental impact, highlighting the importance of Fuller, Smith & Turner's sustainability initiatives like local sourcing and waste reduction.

Furthermore, pubs are evolving beyond traditional drinking establishments to become community hubs offering diverse experiences. This shift, evidenced by the rise of 'competitive socialising' and a 65% weekly dining-out preference among Gen Z, presents opportunities for Fuller, Smith & Turner to diversify its offerings and attract a wider customer base.

| Sociological Factor | Description | Impact on Fuller, Smith & Turner | Supporting Data (2024/2025) |

|---|---|---|---|

| Health & Wellness | Growing consumer focus on healthier lifestyles and mindful consumption. | Increased demand for low/no-alcohol beverages and healthier food options. | UK low/no-alcohol market projected to reach £1.5 billion by 2025; 15% growth in 2024. |

| Sustainability | Consumer preference for environmentally and socially responsible businesses. | Opportunity to enhance brand image and attract ethically-minded customers. | ~70% of consumers willing to pay more for sustainable products (2024). |

| Community & Social Trends | Pubs evolving into multi-functional social spaces and community anchors. | Need to diversify offerings beyond traditional pub fare to include dining and entertainment. | 65% of Gen Z prefer dining out with friends weekly; rise of 'competitive socialising'. |

Technological factors

Technology is fundamentally reshaping how customers interact with hospitality businesses, impacting everything from initial booking to ongoing engagement. Fuller, Smith & Turner can significantly enhance its customer journey by embracing digital solutions such as sophisticated online reservation platforms, user-friendly mobile ordering apps, and personalized loyalty programs. These tools not only streamline operations but also foster deeper customer connections.

The trend towards integrating direct product search and transaction capabilities within booking interfaces is becoming a standard expectation. For instance, data from early 2024 indicates a significant portion of consumers prefer seamless digital pathways for both information gathering and purchasing, underscoring the necessity for Fuller, Smith & Turner to ensure its digital touchpoints are intuitive and efficient.

The increasing adoption of AI and automation is becoming vital for operational efficiency, particularly as labour costs continue to climb. Fuller, Smith & Turner can leverage AI-powered analytics for more accurate demand forecasting, optimized staff scheduling, and streamlined inventory management, all aimed at minimizing waste and boosting profitability.

Furthermore, AI-driven automation offers the potential to significantly enhance personalized guest experiences and assist with crucial booking decisions. This aligns with projections that anticipate over half of UK hospitality businesses will be implementing such technologies by 2025, highlighting a significant competitive advantage for early adopters.

Fuller, Smith & Turner's ability to leverage data analytics is crucial for understanding its diverse customer base. By analyzing data from loyalty programs, booking systems, and direct customer feedback, the company can gain deep insights into purchasing habits, preferred times of visit, and even dietary preferences.

This granular understanding allows for highly personalized marketing campaigns and tailored offers. For instance, a customer who frequently visits a particular pub and orders craft beers might receive targeted promotions for new craft beer releases or tasting events. In 2024, the UK pub sector saw a continued trend towards personalized experiences, with companies reporting increased customer engagement and spend when loyalty programs offered bespoke rewards.

The company can also use data to optimize inventory, staffing, and even menu offerings based on predicted demand and customer preferences. This data-driven approach not only enhances customer satisfaction but also improves operational efficiency, a key factor in maintaining profitability in the competitive hospitality industry.

Online Presence and Marketing

Fuller, Smith & Turner's success hinges on a robust online presence and savvy digital marketing. In the crowded hospitality sector, reaching and engaging customers online is paramount. This involves strategic use of social media for targeted campaigns and ensuring strong visibility on online travel agencies (OTAs) to drive bookings, alongside optimizing direct booking channels.

The company's digital strategy needs a unified approach to online engagement. This consolidation is key to preventing fragmented customer experiences and maximizing reach. For instance, by the end of 2024, it's projected that UK online travel sales will reach £62.8 billion, highlighting the sheer volume of digital engagement in the sector.

- Social Media Engagement: Fuller, Smith & Turner can leverage platforms like Instagram and Facebook to showcase their pubs and offerings, targeting specific demographics and interests.

- OTA Optimization: Maintaining high visibility and positive reviews on major OTAs such as Booking.com and Expedia is crucial for attracting new customers.

- Direct Booking Strategy: Encouraging direct bookings through a user-friendly website and loyalty programs can improve profit margins and customer relationships.

- Digital Marketing Spend: In 2024, the UK's digital advertising market is expected to grow by 10.2%, indicating a significant shift towards online marketing investments that Fuller, Smith & Turner must capitalize on.

Cybersecurity and Data Privacy

As Fuller, Smith & Turner increasingly relies on digital platforms for customer engagement and transactions, the imperative for robust cybersecurity and stringent data privacy measures escalates. The company must safeguard sensitive customer information and secure online payment gateways, particularly with the growing adoption of digital transactions. This focus is crucial for maintaining customer trust and ensuring compliance with evolving data protection laws, such as the General Data Protection Regulation (GDPR).

The threat landscape continues to evolve, with cyberattacks becoming more sophisticated. For instance, the UK saw a significant rise in cybercrime incidents reported to Action Fraud in 2023, highlighting the persistent risk. Fuller, Smith & Turner's investment in advanced cybersecurity protocols is therefore not just a compliance issue but a fundamental business necessity to prevent data breaches and protect its reputation.

The company's commitment to data privacy is paramount, especially as it leverages customer data for personalized marketing and operational improvements. Adherence to regulations like GDPR, which mandates specific data handling practices and penalties for non-compliance, requires continuous vigilance and investment in secure data management systems. This ensures that customer data is handled ethically and legally, fostering a secure digital environment for all stakeholders.

Key considerations for Fuller, Smith & Turner include:

- Implementing multi-factor authentication for all online services.

- Regularly updating and testing cybersecurity defenses against emerging threats.

- Ensuring all third-party vendors handling customer data meet rigorous security standards.

- Providing ongoing training to staff on data privacy best practices and cybersecurity awareness.

Technological advancements are crucial for enhancing customer experience and operational efficiency at Fuller, Smith & Turner. Embracing digital tools like advanced booking platforms and mobile apps streamlines interactions and fosters loyalty. The growing expectation for seamless online transactions means Fuller, Smith & Turner must prioritize intuitive digital touchpoints to remain competitive.

AI and automation are key to managing rising labor costs and improving forecasting. Fuller, Smith & Turner can leverage AI for better demand prediction and staff scheduling, reducing waste and boosting profitability. By 2025, over half of UK hospitality firms are expected to adopt these technologies, offering a significant competitive edge to early adopters.

Data analytics provides deep customer insights, enabling personalized marketing and tailored offers. In 2024, the UK pub sector saw increased customer engagement and spending through bespoke loyalty rewards. This data-driven approach optimizes inventory, staffing, and menus, enhancing customer satisfaction and operational efficiency.

A strong online presence and effective digital marketing are vital for Fuller, Smith & Turner. The UK's digital advertising market is projected to grow by 10.2% in 2024, highlighting the importance of online investment. Optimizing social media, OTAs, and direct booking channels is essential for reaching and engaging customers.

Legal factors

Fuller, Smith & Turner navigates a complex web of UK licensing and alcohol regulations, impacting everything from operating hours to responsible service. For instance, the ability to extend licensing hours for events like Euro 2024, which saw significant public engagement in 2024, directly affects potential revenue streams and operational planning.

Compliance with measures addressing drink spiking, a concern highlighted in public discourse throughout 2024, is paramount for maintaining customer safety and brand reputation. Furthermore, the ongoing implementation of minimum unit pricing for alcohol in Scotland and Wales, with Scotland's policy dating back to 2018 and Wales considering similar measures, presents a forward-looking challenge that could necessitate adjustments to pricing and product strategies across the business.

Fuller, Smith & Turner, like all hospitality businesses, must navigate stringent health and safety legislation. This includes rigorous adherence to food hygiene standards, ensuring fire safety protocols are up-to-date, and maintaining the general safety of their premises for both staff and customers. Failure to comply can result in significant fines and reputational damage.

The impending implementation of Martyn's Law is a notable development, directly impacting Fuller's operations. This legislation will introduce new legal obligations for public venue operators, mandating comprehensive risk assessments and the development of robust preparedness plans specifically designed to mitigate the threat of terrorist attacks. This proactive security enhancement is expected to add to operational costs and require dedicated resources for compliance.

Fuller, Smith & Turner operates under stringent UK employment laws, encompassing minimum wage, working hour regulations, and evolving worker protection statutes. The recent Worker Protection Act 2023, which comes into effect in October 2024, places a significant onus on employers to proactively prevent sexual harassment. This legislation introduces new employer responsibilities and could result in increased compensation claims for non-compliance, requiring Fuller's to bolster its internal policies and training programs.

Environmental Regulations and Reporting

Increasing environmental legislation, such as upcoming Sustainability Reporting Standards (SRS) and the Deposit Return Scheme (DRS), will necessitate greater transparency and adaptation from businesses like Fuller, Smith & Turner. These regulations aim to reduce environmental impact by requiring detailed disclosure of carbon emissions, energy consumption, waste management practices, and water efficiency. For example, the UK's DRS, expected to be rolled out in 2025, will impact packaging and waste handling for beverage producers and retailers.

Fuller, Smith & Turner will likely face pressure to report on its environmental performance, even if not directly mandated by all upcoming regulations initially. This is due to the influence of larger industry players adopting stricter standards and increasing demands from supply chain partners for sustainability data. By 2024, many large corporations are already integrating ESG (Environmental, Social, and Governance) reporting into their operations, setting a precedent that smaller businesses are expected to follow.

Key areas of focus for Fuller, Smith & Turner under evolving environmental regulations will include:

- Carbon Emission Tracking: Implementing systems to accurately measure and report Scope 1, 2, and potentially Scope 3 emissions.

- Waste Reduction and Recycling: Adapting waste management strategies to comply with DRS and other waste reduction targets.

- Energy Efficiency Initiatives: Investing in and reporting on measures to reduce energy consumption across pubs and breweries.

- Water Stewardship: Monitoring and improving water usage efficiency in operational processes.

Business Rates and Property Laws

Changes in business rates and property laws directly influence the operational expenses for Fuller, Smith & Turner, given its extensive portfolio of pubs and hotels. The anticipated reduction in business rates relief, effective from April 2025, is projected to elevate the financial pressure on the company.

Furthermore, the Pubs Code, which governs the dynamics between tied pub tenants and their landlords in England and Wales, presents a regulatory framework that could potentially impact Fuller, Smith & Turner's tenanted inn operations.

- Business Rates Impact: The UK government's Autumn Statement 2023 confirmed a freeze on the small business multiplier for business rates in England for 2024-25, but changes to wider relief schemes could still affect larger portfolios.

- Pubs Code Regulation: The Pubs Code aims to ensure fair dealings for pub tenants, potentially influencing rental agreements and operational flexibility for landlords like Fuller, Smith & Turner.

- Property Law Evolution: Ongoing reviews of property legislation, including potential changes to commercial lease renewals or planning permissions, could introduce new compliance requirements or costs.

Fuller, Smith & Turner must adhere to evolving employment laws, such as the Worker Protection Act 2023, which mandates proactive prevention of sexual harassment from October 2024. This legislation introduces new employer responsibilities and could lead to increased compensation claims for non-compliance, requiring robust internal policies and training.

The company also faces new security obligations under Martyn's Law, requiring comprehensive risk assessments and preparedness plans for terrorist attacks, which will likely increase operational costs and resource allocation.

Additionally, environmental regulations like the UK's Deposit Return Scheme (DRS), expected in 2025, will impact packaging and waste handling, while upcoming Sustainability Reporting Standards (SRS) will necessitate greater transparency in carbon emissions and waste management practices.

Environmental factors

Fuller, Smith & Turner, like many in the hospitality sector, faces mounting pressure to slash its carbon footprint and align with net-zero ambitions. This means a critical focus on accurately measuring and actively reducing emissions across all scopes, alongside optimizing energy usage in its pubs and hotels.

The UK government's commitment to net-zero by 2050, a target echoed by the Labour party, will increasingly necessitate greener operational practices from businesses like Fuller's. For instance, the Department for Energy Security and Net Zero reported that the UK's total greenhouse gas emissions in 2022 were 384.3 million tonnes of carbon dioxide equivalent, a 4.6% decrease from 2021, showing a clear direction of travel for all industries.

New environmental regulations are reshaping waste management for businesses like Fuller, Smith & Turner. Starting in March 2025, England's Simpler Recycling scheme will require all non-household premises to separate food waste and dry mixed recyclables.

This means Fuller, Smith & Turner needs to ensure its pubs and hotels are equipped to handle this new sorting requirement. Implementing effective waste management and recycling programs across its entire estate is crucial for compliance. Embracing zero-waste kitchen concepts could also be a strategic move to minimize waste generation in the first place.

Water efficiency is increasingly vital for hospitality firms like Fuller, Smith & Turner, impacting both sustainability credentials and operational costs. In the UK, the average hotel can consume 350-500 liters of water per occupied room per day, highlighting the potential for savings.

Fuller, Smith & Turner should prioritize water audits across its estate to pinpoint high-usage areas and potential leaks. Implementing smart water management systems, such as those offering real-time monitoring and automated shut-offs, can significantly reduce waste. Integrating this water data into their sustainability reports, as many leading hospitality groups are doing, will allow for transparent tracking of progress and the setting of achievable reduction targets, mirroring industry best practices seen in 2024.

Sustainable Sourcing and Supply Chains

Consumers are increasingly scrutinizing the origins of their food and drink, driving a demand for ethically and sustainably sourced ingredients. Fuller, Smith & Turner's commitment to local and seasonal produce, for example, directly addresses this trend. In 2024, reports indicated that over 60% of UK consumers are willing to pay more for sustainably sourced food, a significant driver for businesses like Fuller, Smith & Turner to adapt their supply chains.

Building more resilient and environmentally conscious supply chains is crucial for enhancing Fuller, Smith & Turner's brand image and operational efficiency. By prioritizing suppliers with strong environmental credentials and reducing the carbon footprint of its food and beverage logistics, the company can appeal to a growing segment of environmentally aware customers. For instance, the company's 2024 sustainability report highlighted a 5% reduction in transport-related emissions through optimized delivery routes.

- Consumer Preference: Over 60% of UK consumers in 2024 showed willingness to pay a premium for sustainably sourced food.

- Brand Appeal: Sustainable sourcing enhances brand reputation and attracts environmentally conscious customers.

- Operational Efficiency: Optimized supply chains can lead to reduced costs and a smaller carbon footprint.

- Emissions Reduction: Fuller, Smith & Turner reported a 5% decrease in transport emissions in 2024 via route optimization.

Environmental Reporting and ESG

The UK's upcoming mandatory Sustainability Reporting Standards (SRS), expected to align with global frameworks like ISSB, will significantly increase reporting burdens for companies like Fuller, Smith & Turner. This shift underscores the growing investor and regulatory focus on Environmental, Social, and Governance (ESG) factors.

Fuller, Smith & Turner must actively integrate ESG principles into its operational and strategic planning. This includes quantifying and reporting on environmental impacts, such as carbon emissions and waste management, to meet heightened transparency demands.

By 2024, many large UK companies are already preparing for enhanced ESG disclosures. Fuller, Smith & Turner's proactive approach to articulating its sustainability efforts will be crucial for maintaining investor confidence and accessing capital in an increasingly ESG-conscious market.

- Mandatory SRS adoption will require detailed environmental impact reporting.

- Investor demand for ESG transparency is at an all-time high, influencing capital allocation.

- Proactive ESG integration is essential for Fuller, Smith & Turner to meet stakeholder expectations.

- Reporting on metrics like Scope 1, 2, and 3 emissions will become standard practice.

Fuller, Smith & Turner must navigate evolving environmental regulations, including England's Simpler Recycling scheme starting March 2025, which mandates food waste and dry recyclable separation. The company's commitment to net-zero by 2050, aligning with UK government targets, necessitates a sharp focus on reducing its carbon footprint across all operations. Water efficiency is also paramount, as the average UK hotel consumes 350-500 liters per occupied room daily, presenting significant cost-saving opportunities through improved management.

| Environmental Factor | Impact on Fuller's | Key Data/Trend |

|---|---|---|

| Climate Change & Net-Zero Targets | Operational adjustments for emissions reduction (Scope 1, 2, 3) | UK target: Net-zero by 2050. UK 2022 GHG emissions: 384.3 million tonnes CO2e (4.6% decrease from 2021). |

| Waste Management Regulations | Mandatory waste segregation for pubs and hotels | England's Simpler Recycling scheme from March 2025: food waste & dry recyclables separation. |

| Water Scarcity & Efficiency | Need for water audits and smart management systems | Average UK hotel water usage: 350-500 liters/occupied room/day. |

| Sustainable Sourcing & Consumer Demand | Preference for ethically sourced ingredients, impacting supply chains | Over 60% of UK consumers in 2024 willing to pay more for sustainably sourced food. |

| ESG Reporting Requirements | Increased transparency and detailed environmental impact reporting | Upcoming mandatory UK Sustainability Reporting Standards (SRS), aligning with ISSB. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Fuller Smith & Turner is grounded in data from official government publications, reputable financial news outlets, and leading industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.