Fuller Smith & Turner Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuller Smith & Turner Bundle

Curious about Fuller Smith & Turner's strategic product portfolio? This glimpse into their BCG Matrix reveals how their brands are positioned as Stars, Cash Cows, Dogs, or Question Marks in the market. Don't miss out on the complete picture; purchase the full report for actionable insights and a clear roadmap to optimizing your own business strategy.

Stars

Fuller's premium managed pubs, especially those situated in prime urban areas and popular tourist destinations such as London, are firmly positioned as 'Stars' within the BCG Matrix. These pubs are demonstrating robust like-for-like sales growth, significantly exceeding the broader industry's performance, which is a testament to the recovering and expanding UK hospitality sector.

These high-performing venues are benefiting from increased consumer spending on experiences and dining out. For instance, in the fiscal year ending March 2024, Fuller's reported a 12% increase in like-for-like sales for its managed pubs, with its London pubs showing even stronger growth.

Ongoing capital investment in these flagship locations is crucial for maintaining their competitive edge and market dominance. This strategic focus ensures they continue to capture a substantial share of a thriving market, capitalizing on their premium branding and prime real estate.

Fuller Smith & Turner's portfolio of high-performing boutique hotels, strategically located in areas like the Cotswolds, are well-positioned within a buoyant UK hotel market. This sector is experiencing significant investment and a notable expansion of luxury offerings, creating a favorable environment for these establishments.

The company's commitment to high-quality accommodation, evidenced by recent investments in sites such as The Chamberlain, allows these hotels to effectively capitalize on increasing consumer demand. This strategic focus ensures they maintain a robust market presence and are likely to be considered Stars in a BCG matrix analysis.

Fuller's focus on experience-led pubs, including events and competitive socialising, taps into a significant growth area within the UK's hospitality industry. These concepts are designed to draw in customers looking for more than just a meal or drink, reflecting a broader shift in consumer preferences. For instance, the competitive socialising market in the UK was valued at £1.3 billion in 2023 and is projected to grow substantially in the coming years.

Strategic High-Quality Acquisitions

Strategic High-Quality Acquisitions represent a key growth driver for Fuller, Smith & Turner, positioning them firmly within the Stars category of the BCG Matrix. Recent examples like the acquisition of the Lovely Pubs portfolio, comprising seven freehold pubs, and The White Swan in Twickenham, exemplify this strategy. These moves are specifically targeted at the premium, high-growth segment of the pub market.

These newly acquired establishments are swiftly integrated into Fuller's managed pub estate. This integration is designed to unlock immediate revenue and profit contributions. The company anticipates these acquisitions will significantly bolster its financial performance, reflecting their high growth potential and Fuller's commitment to expanding its market share in desirable locations.

- Acquisition Focus: Targeting premium, high-growth pub segments.

- Integration Strategy: Seamlessly incorporating new pubs into the managed estate.

- Expected Impact: Significant contributions to revenue and profit growth.

- Market Position: Enhancing market share in key areas.

Food and Premium Drink Sales in Managed Estate

Fuller, Smith & Turner's managed estate has seen a steady climb in like-for-like food and premium drink sales, underscoring their solid position in the premium market. This growth indicates that customers are increasingly prioritizing quality and are willing to spend more per visit, even if the total number of visits has seen some moderation.

This trend is particularly evident in their performance data. For the 52 weeks ending March 30, 2024, Fuller's like-for-like sales in their premium pubs were up 10.6%. This strong showing in food and drink sales within these establishments highlights a successful strategy of attracting and retaining customers who value a higher-quality experience.

- Consistent Like-for-Like Growth: Fuller's managed pubs and hotels have demonstrated a sustained increase in like-for-like food and premium drink sales, reflecting a robust market share in the premium segment.

- Premiumization Trend: Consumers are showing a greater willingness to spend more on quality food and beverages during their visits, a key driver of revenue growth.

- Financial Performance: For the 52 weeks ending March 30, 2024, Fuller's reported a 10.6% increase in like-for-like sales within their premium pubs, a testament to the success of their premium offerings.

- Customer Spending Habits: Despite potential shifts in overall pub visit frequency, the data indicates an upward trend in average customer spending per visit, driven by the appeal of premium food and drink options.

Fuller's premium managed pubs, particularly those in prime urban and tourist locations like London, are classified as Stars. These pubs are experiencing strong like-for-like sales growth, outpacing the wider industry. This success is driven by increased consumer spending on dining and experiences, with Fuller's London pubs showing particularly robust performance.

The company's high-performing boutique hotels, strategically situated in desirable areas such as the Cotswolds, also fall into the Stars category. They benefit from significant investment in the luxury hotel market and a growing demand for quality accommodation. Fuller's investment in sites like The Chamberlain reinforces their ability to capitalize on this trend.

Fuller's strategic acquisitions of premium, high-growth pubs, such as the Lovely Pubs portfolio and The White Swan, further solidify their Star status. These newly integrated pubs are expected to contribute significantly to revenue and profit, enhancing Fuller's market share in key locations.

The consistent growth in like-for-like food and premium drink sales across Fuller's managed estate, with a 10.6% increase reported for the 52 weeks ending March 30, 2024, highlights the effectiveness of their premiumization strategy. This demonstrates a strong customer preference for quality, leading to increased spending per visit.

| Category | Key Characteristics | Performance Indicators (FY24) | Strategic Focus |

|---|---|---|---|

| Stars | Premium managed pubs & hotels in prime locations | 10.6% like-for-like sales growth (managed pubs) | Capital investment, strategic acquisitions, premiumization |

| Experience-led pubs | Growth in competitive socialising market (£1.3bn in 2023) | Enhancing customer experience, events |

What is included in the product

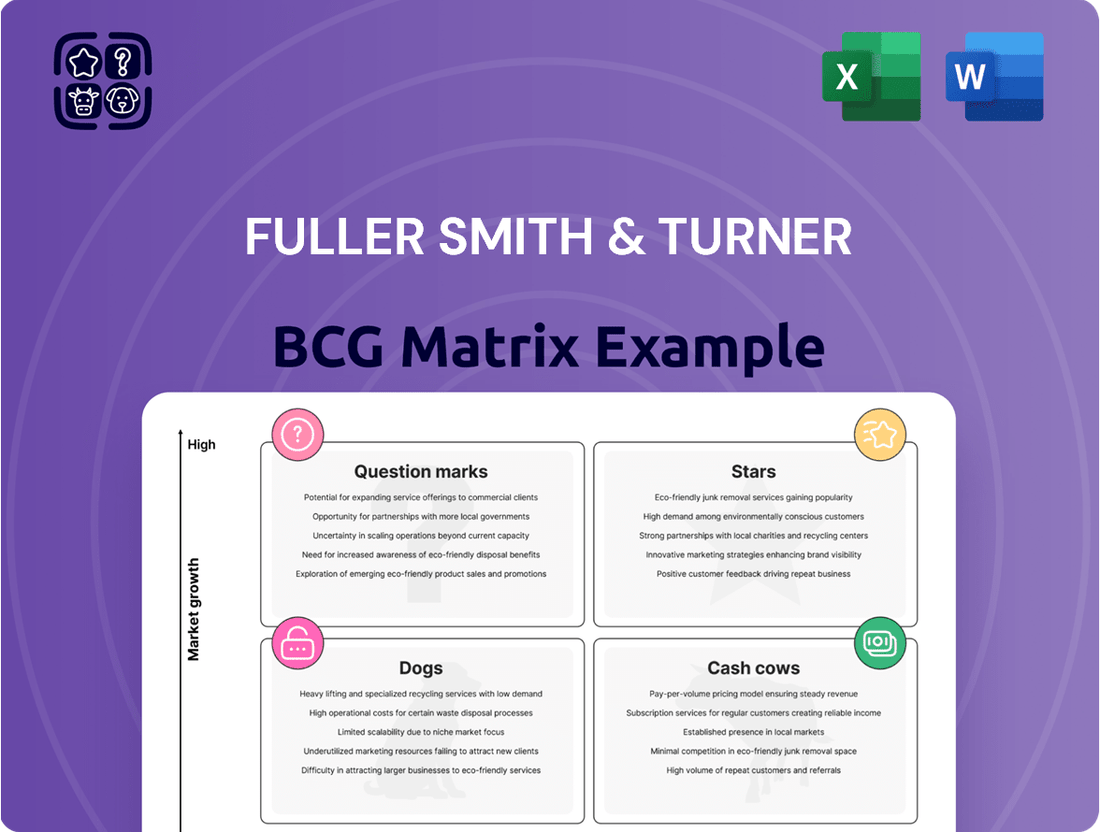

The Fuller Smith & Turner BCG Matrix offers a strategic overview of its brands, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear BCG Matrix visualizes Fuller Smith & Turner's portfolio, simplifying strategic decisions and alleviating the pain of resource allocation confusion.

Cash Cows

Fuller's established freehold managed pubs are undoubtedly its cash cows. This segment, making up a significant 87% of their entire pub estate, is characterized by mature, well-loved establishments with a strong foothold in their local communities. These pubs consistently churn out robust cash flow, thanks to their established market share and the fact that they require more maintenance than aggressive growth investment.

The 153 'excellent Tenanted Inns' within Fuller Smith & Turner's portfolio are firmly positioned as cash cows. These established pubs, operating under tenancy or lease agreements, offer a predictable and stable income stream for the company.

This model minimizes Fuller's direct operational involvement, translating to lower costs and a consistent, high-market-share position in a mature segment of the pub industry. Despite recent strategic disposals of other assets, these tenanted inns continue to be a bedrock of reliable earnings.

Fuller Smith & Turner's core accommodation business in mature locations represents their cash cows. These are established hotel properties, often in well-trodden tourist or business hubs, that reliably deliver consistent revenue. Think of their pubs with rooms in popular city centers or historic towns; these are the bedrock of their hospitality income.

These locations benefit from existing brand recognition and customer loyalty, meaning they don't require massive marketing pushes to attract guests. For instance, in 2023, Fuller's reported that their managed pubs, which often include accommodation, saw like-for-like sales growth, underscoring the stability of these mature assets. This segment generates strong, predictable cash flows that can be reinvested elsewhere in the business.

Traditional Ale and Core Beverage Offerings

Fuller's historic strength in brewing, particularly its traditional ales, formed a bedrock of its business. Even after the 2019 sale of its brewing operations to Asahi, the brand's legacy in this area continues to resonate, fostering a loyal customer base. These core beverage offerings, while not necessarily high-growth segments, represent a stable market share within their niche.

These established drink lines are key cash generators for the company. They provide a predictable and consistent cash flow, essential for funding other areas of the business. In 2023, Fuller's reported a revenue of £922.3 million, with their pub and hotel operations being the primary drivers, supported by the enduring appeal of their core beverage portfolio.

- Stable Market Share: Traditional ales and core beverages maintain a significant, albeit mature, market share.

- Predictable Cash Flow: These offerings are reliable cash cows, generating consistent revenue.

- Brand Legacy: Fuller's historical brewing prowess underpins the continued loyalty to these products.

- Supporting Investment: The cash generated supports investment in growth areas like hotels and premium food offerings.

The Overall Robust Property Portfolio

Fuller Smith & Turner's extensive property portfolio is a significant cash cow. The company's balance sheet is bolstered by a high-quality, largely freehold estate, which provides substantial financial stability.

This valuable property asset base not only ensures stability but also serves as crucial collateral. It enables the company to secure financing on more favorable terms, which is a key advantage in the current financial climate. For instance, their recent bank facility highlights how this owned estate can be strategically utilized for capital generation or reinvestment.

- Strong Balance Sheet: Underpinned by a high-quality, predominantly freehold property estate.

- Financial Stability: The value of owned properties provides a solid foundation.

- Collateral Advantage: Enables access to advantageous financing options.

- Strategic Leverage: Properties can be used for capital generation and reinvestment.

Fuller's established managed pubs, representing a substantial 87% of its estate, are core cash cows. These mature, community-focused establishments generate consistent cash flow with minimal need for growth investment, highlighting their stable market position and operational efficiency.

The company's 153 tenanted inns also function as significant cash cows, providing a predictable income stream with reduced operational overhead for Fuller's. This segment benefits from a high-market-share in a mature industry sector, contributing reliably to earnings despite strategic asset adjustments.

Fuller's accommodation business, particularly in its mature locations, acts as a dependable cash cow. These established hotels in prime tourist and business areas leverage existing brand recognition and customer loyalty, requiring less marketing spend and ensuring consistent revenue generation. For example, Fuller's reported positive like-for-like sales growth in its managed pubs, which often include accommodation, in 2023, demonstrating the stability of these mature assets.

| Segment | BCG Classification | Key Characteristics | Financial Contribution (Illustrative) |

|---|---|---|---|

| Managed Pubs (Freehold) | Cash Cow | Mature, high market share, stable cash flow, low growth investment | 87% of estate, consistent revenue generation |

| Tenanted Inns | Cash Cow | Predictable income, low operational involvement, stable market position | 153 inns, reliable earnings |

| Accommodation (Mature Locations) | Cash Cow | Established hotels, brand loyalty, consistent revenue, minimal marketing needs | Supports overall revenue, positive like-for-like sales in 2023 |

What You See Is What You Get

Fuller Smith & Turner BCG Matrix

The Fuller Smith & Turner BCG Matrix preview you're seeing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready report ready for your strategic planning. You can confidently use this preview to understand the comprehensive insights into Fuller Smith & Turner's business portfolio, knowing the purchased version is identical and instantly available for your use. This ensures you get precisely what you need to make informed decisions about their market position and future investments.

Dogs

The 37 non-core tenanted pubs sold to Admiral Taverns in summer 2024 for £18.3 million clearly represent Dogs in Fuller's portfolio. These assets were identified as having low market share and low growth potential, generating minimal profit and deemed non-strategic to the company's premium focus, making them prime candidates for divestment.

Fuller Smith & Turner's strategic decision to sell The Mad Hatter hotel in Southwark for £20 million in July 2024 aligns with a common BCG matrix approach of divesting underperforming or non-core assets. This move allows the company to reallocate capital from what was likely a low-growth, low-market-share "dog" in their portfolio.

Underperforming individual pub sites within Fuller Smith & Turner's estate, when viewed through a BCG Matrix lens, would fall into the Dogs category. These are pubs that are not growing and do not have a significant market share. For instance, pubs in areas with declining demographics or facing intense competition from newer, more attractive venues might exhibit these characteristics.

These underperforming sites represent a drain on resources, tying up capital and management focus without delivering adequate returns. In 2024, Fuller Smith & Turner, like many in the hospitality sector, would likely be scrutinizing such sites closely. A pub with consistently low sales, perhaps below £5,000 per week, and a declining customer base, would be a prime candidate for re-evaluation, potentially leading to closure or a significant strategic shift.

Outdated or Non-Premium Accommodation Offerings

Outdated or non-premium accommodation offerings within Fuller Smith & Turner's portfolio would likely fall into the 'Dogs' quadrant of the BCG Matrix. These are hotel rooms or facilities that haven't seen recent investment, leading to a sub-standard guest experience. They might also be situated in locations experiencing a downturn in tourism or business travel.

These underperforming assets typically exhibit low occupancy rates and find it challenging to compete as the hotel market increasingly shifts towards premium experiences. For instance, in 2024, the UK hotel sector saw a general recovery, but properties lacking modern amenities or located in less desirable areas would struggle to capture market share, potentially facing occupancy rates significantly below the national average, which hovered around 70-75% for well-performing establishments.

- Low Occupancy Rates: Properties with outdated facilities often struggle to attract and retain guests, leading to significantly lower occupancy compared to competitors.

- Declining Revenue: The inability to command premium pricing due to outdated offerings directly impacts revenue generation.

- High Maintenance Costs: Older properties may incur higher ongoing maintenance and repair costs without a corresponding increase in revenue.

- Limited Competitive Advantage: In a market prioritizing modern amenities and experiences, these offerings lack a competitive edge.

Segments Heavily Affected by Unmitigated Cost Pressures

Fuller Smith & Turner's pubs that are heavily affected by unmitigated cost pressures are those struggling to absorb increases in energy, wages, and business rates. These establishments are experiencing significant margin erosion without a concurrent rise in revenue, making it difficult to even break even. Such units become a drain on the company's resources, hindering overall profitability.

In 2024, the hospitality sector, including pubs, continued to grapple with these persistent cost challenges. For instance, the Office for National Statistics reported that in early 2024, energy prices remained elevated compared to pre-pandemic levels, impacting operational expenses significantly. Similarly, wage inflation, driven by labor shortages and increased minimum wage rates, added further pressure on margins.

- Energy Costs: Pubs facing unmitigated energy cost increases are seeing their utility bills consume a larger portion of their revenue.

- Wage Pressures: Rising staff costs, due to competitive labor markets and statutory wage increases, are squeezing profitability.

- Business Rates: Increases in property-related taxes can further diminish margins for struggling locations.

- Margin Erosion: Without the ability to pass on these costs through price increases or by boosting sales volumes, these pubs experience a direct hit to their profit margins.

Fuller Smith & Turner's 'Dogs' are assets with low market share and low growth potential, often representing underperforming pubs or outdated accommodation. These units are typically divested to reallocate capital and management focus, as seen with the sale of non-core tenanted pubs in 2024. They drain resources without delivering adequate returns, facing challenges like declining customer bases and high maintenance costs.

| Asset Type | BCG Category | Reasoning | Example (2024) | Financial Impact |

|---|---|---|---|---|

| Non-core tenanted pubs | Dogs | Low market share, low growth, minimal profit | 37 pubs sold to Admiral Taverns (£18.3m) | Divestment frees up capital |

| Underperforming individual pubs | Dogs | Declining demographics, intense competition, low sales | Pubs with < £5k weekly sales, declining customer base | Resource drain, hinders profitability |

| Outdated accommodation | Dogs | Lack of investment, sub-standard guest experience, low occupancy | Hotels lacking modern amenities | Struggles to compete, below-average occupancy |

Question Marks

Fuller's emerging 'No and Low Alcohol' product lines fit into the Question Mark category of the BCG Matrix. This segment of the beverage market is booming in the UK, with sales showing a substantial increase and forecasts predicting a market value of £800 million by 2028.

Given the rapid expansion and Fuller's likely nascent position within this specific, high-growth area, these products represent an opportunity that demands strategic attention and investment. Capturing a more significant share of this evolving consumer preference is key.

Fuller's exploration into new experiential hospitality concepts, such as competitive socialising or niche entertainment within their pubs, would initially be positioned as Question Marks. These ventures target high-growth markets but currently hold a low market share. For instance, the competitive socialising market in the UK saw significant growth in 2023, with many new venues opening, indicating a strong demand for interactive experiences.

The hospitality sector is seeing a significant surge in digital ordering systems and online travel agencies, indicating a robust market for digital interaction. Fuller Smith & Turner's efforts to bolster its digital platforms, mobile applications, and direct booking channels are vital for staying competitive, positioning these initiatives as Question Marks as the company seeks to expand its digital footprint.

Exploration of New Geographic Markets or Niche Hotel Segments

Expanding into new UK geographic markets or niche hotel segments, such as converting underutilized office spaces into hotels in emerging urban centers, represents a classic "Question Mark" in the BCG matrix for Fuller, Smith & Turner. These initiatives are characterized by high growth potential but currently hold a low market share for the company. Significant capital investment and meticulous strategic planning are essential to assess their long-term viability and potential to transition into "Stars."

For instance, the UK hotel market saw a robust recovery in 2024, with occupancy rates in many regional cities approaching pre-pandemic levels. Fuller's entry into a new, underserved regional market could capitalize on this trend. Similarly, the office-to-hotel conversion trend gained momentum in 2024, driven by changing work patterns and demand for unique accommodation experiences. Fuller's exploration in this area would require careful analysis of local demand, regulatory environments, and conversion costs.

- High Growth Potential: New geographic markets and niche segments often offer untapped customer bases and less competition initially.

- Low Market Share: As a new entrant, Fuller's market share in these areas would naturally be low, necessitating significant effort to build brand recognition and customer loyalty.

- Substantial Investment Required: Entering new territories or developing niche offerings demands considerable upfront capital for property acquisition, development, marketing, and staffing.

- Strategic Assessment Needed: Thorough market research, feasibility studies, and a clear strategy are crucial to determine if these ventures can achieve the necessary scale and profitability to become future market leaders (Stars).

Aggressive Sustainability Initiatives with Direct Consumer Impact

Fuller's aggressive sustainability initiatives, while commendable, position them in a nascent market for direct consumer impact. For instance, while they have a strong overall sustainability commitment, the development of specific, consumer-facing programs like carbon-neutral pub events or hyper-local sourcing campaigns places them in a growing but currently small segment of conscious consumerism.

Their market share within these specialized, environmentally-focused offerings is likely low, necessitating significant investment to build brand recognition and customer loyalty. As of 2024, the demand for verifiable sustainable consumer experiences is increasing, with reports indicating that over 70% of consumers consider sustainability when making purchasing decisions.

- Market Position: Fuller's sustainability initiatives targeting direct consumer impact are in a developing market.

- Investment Need: Cultivating these specialized segments requires investment to grow market share.

- Consumer Trend: Growing consumer preference for sustainable choices presents an opportunity.

- Competitive Landscape: While a growing area, direct competitors with established eco-friendly consumer programs may already exist.

Fuller's emerging 'No and Low Alcohol' product lines fit into the Question Mark category of the BCG Matrix. This segment of the beverage market is booming in the UK, with sales showing a substantial increase and forecasts predicting a market value of £800 million by 2028.

Given the rapid expansion and Fuller's likely nascent position within this specific, high-growth area, these products represent an opportunity that demands strategic attention and investment. Capturing a more significant share of this evolving consumer preference is key.

| Product/Initiative | BCG Category | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| No and Low Alcohol Beverages | Question Mark | High | Low | Invest to gain share or divest if potential is not realized. |

| Experiential Hospitality Concepts | Question Mark | High | Low | Requires significant investment and market testing. |

| Digital Platform Expansion | Question Mark | High | Low | Crucial for future competitiveness; needs ongoing development. |

| New Geographic/Niche Hotel Markets | Question Mark | High | Low | High risk, high reward; requires thorough feasibility studies. |

| Consumer-Facing Sustainability Programs | Question Mark | Growing | Low | Tap into conscious consumerism; build brand loyalty. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.