Fuller Smith & Turner Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuller Smith & Turner Bundle

Fuller Smith & Turner faces a dynamic brewing industry, with intense rivalry from established and emerging players, and significant buyer power from large pub chains and supermarkets. The threat of substitutes, like wine and spirits, also looms large, impacting beer consumption. Understanding these forces is crucial for navigating the competitive landscape.

The complete report reveals the real forces shaping Fuller Smith & Turner’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fuller, Smith & Turner procures a broad spectrum of necessities, from fresh produce and craft beers to cleaning supplies and hotel amenities. This wide array of essential inputs inherently means the company engages with numerous suppliers across different categories.

Having a diverse supplier base significantly dilutes the bargaining power of any individual supplier. For standardized goods and services, such as basic cleaning products or common food ingredients, Fuller's ability to switch between multiple providers keeps individual supplier leverage in check.

In 2024, the UK food and beverage sector experienced fluctuating input costs, with some commodity prices seeing increases. However, for a company like Fuller's, with its established relationships and scale, the ability to source from a variety of suppliers helps mitigate the impact of any single supplier attempting to impose unfavorable terms.

Even though Fuller's exited its brewing operations in 2019, it still depends on external beverage suppliers for its pubs. Key players like Heineken UK, which has received positive ratings from pub groups, hold a significant market position. This concentration among major drink suppliers, particularly in categories like beer, indicates that these suppliers may possess moderate bargaining power.

Hospitality suppliers are grappling with escalating costs, driven by factors like increased National Insurance Contributions and the higher National Living Wage. Furthermore, lingering Brexit-related impacts continue to affect the cost of European imports, putting pressure on their margins.

These rising expenses for suppliers naturally translate into a potential for higher prices for Fuller's, thereby enhancing supplier bargaining power. For instance, the UK's National Living Wage increased to £11.44 per hour in April 2024, a significant rise impacting labor costs across the supply chain.

Despite these cost pressures, suppliers are also keen to foster collaborative relationships with operators like Fuller's to jointly navigate and mitigate these financial challenges. This shared interest in cost management can temper the extreme exercise of supplier power.

Labor as a Key Supplier Input

The availability and cost of labor are crucial inputs for Fuller's, especially in its hospitality operations. The UK's hospitality industry has been grappling with labor shortages and escalating wage demands, which naturally bolsters the collective bargaining power of employees as a supplier of essential services. This dynamic directly impacts the company's operational expenses.

Fuller's, like many in the UK hospitality sector, faces significant pressure from its labor force. For instance, in 2023, the Office for National Statistics reported that average weekly earnings in the accommodation and food service activities sector saw a notable increase. This trend is expected to continue, reflecting the tight labor market and the need for competitive compensation to attract and retain staff.

- Labor Shortages: The UK hospitality sector has experienced persistent labor shortages, particularly post-pandemic, leading to increased competition for workers.

- Rising Wage Costs: To attract and retain staff, companies like Fuller's are compelled to offer higher wages, impacting their overall cost structure.

- Skills Gap: A lack of skilled labor in areas like culinary arts and management further strengthens the bargaining position of qualified individuals.

- Employee Retention: High staff turnover in the industry necessitates investment in training and benefits, adding to labor costs and supplier power.

Importance of Quality and Consistency

Fuller's commitment to a premium pub and hotel experience means that supplier quality and consistency are paramount. This focus on reliability, particularly for fresh ingredients and distinctive beverages, can elevate the bargaining power of suppliers who consistently meet Fuller's exacting standards. For instance, a supplier of a specific craft ale that is a signature offering for Fuller's might command better terms due to the effort and potential disruption involved in finding and vetting an alternative.

The importance of consistent quality directly impacts Fuller's brand reputation. If a key ingredient or beverage is subpar, it reflects poorly on the entire customer experience. This makes switching costs for reliable, high-quality suppliers potentially significant, not just in terms of financial outlay but also in the risk to brand perception. In 2024, the hospitality sector continued to see a strong consumer demand for premium and authentic products, reinforcing the need for dependable supply chains.

- Brand Reputation: Fuller's quality focus makes suppliers of premium ingredients and beverages critical to its brand image.

- Switching Costs: The effort and risk associated with replacing proven, high-quality suppliers can increase their leverage.

- Customer Demand: In 2024, consumer preference for high-quality and authentic offerings in pubs and hotels reinforced the importance of reliable suppliers.

- Supplier Reliability: Suppliers who consistently meet Fuller's standards for freshness and quality gain a stronger negotiating position.

Fuller's diverse supplier base for essentials like produce and cleaning supplies generally limits individual supplier power. However, the company's reliance on a few key beverage distributors, such as Heineken UK, grants these suppliers moderate leverage. Rising operational costs for suppliers, including increased wages and import expenses, are pushing them to seek higher prices, thereby strengthening their bargaining position.

The hospitality sector's persistent labor shortages in 2024 have significantly boosted the bargaining power of employees, impacting Fuller's labor costs. Furthermore, Fuller's emphasis on premium quality for ingredients and beverages means suppliers consistently meeting these high standards can command better terms due to the switching costs and brand reputation risks involved.

| Factor | Impact on Fuller's | Supplier Bargaining Power |

|---|---|---|

| Supplier Diversity | Mitigates individual supplier leverage | Low to Moderate |

| Key Beverage Distributors | Concentration of power among major players | Moderate |

| Rising Supplier Costs (Wages, Imports) | Potential for price increases | Increasing |

| Labor Shortages (UK Hospitality) | Increased wage demands for staff | High (for labor) |

| Focus on Premium Quality | High switching costs for reliable suppliers | Moderate to High (for quality suppliers) |

What is included in the product

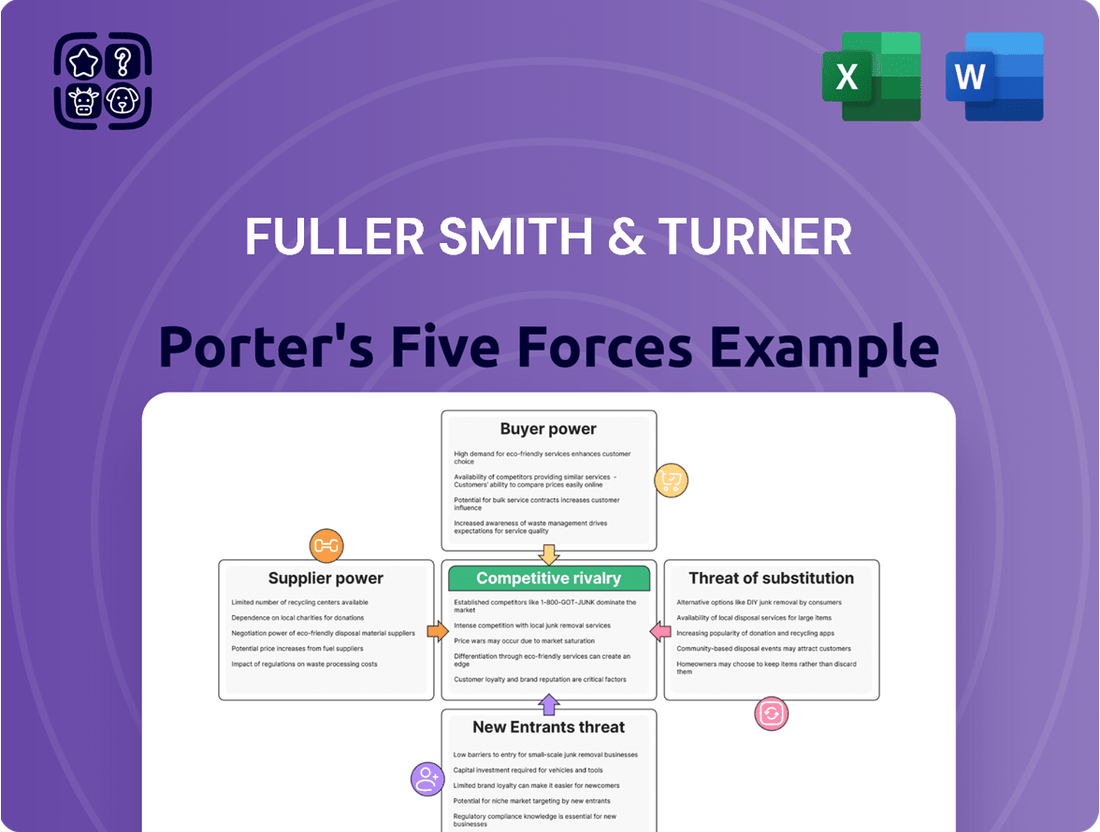

This analysis details the competitive forces impacting Fuller Smith & Turner, assessing supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the pub and brewing industry.

Instantly assess the competitive landscape and identify key strategic levers for Fuller Smith & Turner with a dynamic, interactive Porter's Five Forces model.

Customers Bargaining Power

The ongoing cost of living crisis in the UK has significantly amplified customer price sensitivity. With essential expenses rising, consumers are scrutinizing discretionary spending, including pub visits and dining out. This means Fuller's customers are more inclined to hunt for deals and prioritize value, directly increasing their bargaining power.

Data from the Office for National Statistics (ONS) in early 2024 indicated that a substantial percentage of UK adults reported cutting back on non-essential purchases due to rising prices. This trend directly translates to Fuller's customer base, who now have a stronger hand in negotiating or seeking out cheaper alternatives, impacting the company's pricing strategy and profitability.

Customers in the UK hospitality sector, including those who patronize Fuller Smith & Turner pubs, face a vast sea of choices. Beyond pubs, they can opt for restaurants, cafes, hotels offering dining, or even entirely different leisure pursuits like cinema or bowling. This abundance of alternatives means a dissatisfied customer can readily find another establishment that better meets their needs.

The ease with which customers can switch providers significantly amplifies their bargaining power. For instance, if a Fuller's pub fails to deliver on expected quality or value, a customer can simply walk to a nearby competitor or choose a different type of dining experience altogether. This dynamic forces businesses like Fuller's to remain highly competitive on price, service, and overall offering to retain their clientele.

In 2024, the UK hospitality market continued to see robust competition. Data from the Office for National Statistics indicated thousands of new food and beverage establishments opening annually, further diversifying customer options. This intense competition means that customer loyalty is hard-won, and businesses must constantly innovate and maintain high standards to counter the inherent power of a well-informed and option-rich consumer base.

Fuller Smith & Turner, known for its premium pubs and hotels, understands that customer experience is paramount. While price is a factor, patrons increasingly seek unique atmospheres, quality food and beverages, and exceptional service. This means customers hold significant sway, pushing Fuller's to constantly innovate and deliver a superior overall value proposition to maintain their business.

The company's focus on a high-quality pub and hotel experience directly addresses the bargaining power of customers. By offering more than just a transaction, Fuller's aims to build lasting relationships. For instance, in 2024, the hospitality sector saw a continued emphasis on personalized experiences, with customer satisfaction scores directly impacting repeat business and word-of-mouth referrals, giving customers leverage in their choices.

Online Reviews and Reputation

Online reviews have become a powerful tool for customers, significantly influencing their choices when selecting pubs for accommodation. In fact, a substantial 92% of consumers consider these reviews vital in their decision-making process. This widespread reliance on peer experiences grants customers considerable leverage.

The ease with which customers can share their experiences, both positive and negative, creates a transparent marketplace. Negative feedback, in particular, can swiftly damage a pub's reputation and deter potential patrons, directly impacting future revenue. This heightened accountability amplifies the bargaining power of customers.

- Customer Empowerment: Online platforms allow customers to voice opinions, influencing others and holding businesses accountable.

- Reputation Sensitivity: Pubs with poor online reviews face a direct threat to their bookings and revenue streams.

- Information Asymmetry Reduction: Customers gain access to detailed insights, leveling the playing field with businesses.

Changing Consumer Preferences

Changing consumer preferences significantly influence the bargaining power of customers for Fuller Smith & Turner. A notable trend is the increasing demand for locally sourced ingredients, with a recent survey indicating that 65% of UK consumers now prioritize locally produced food. This shift empowers customers to seek out establishments that align with their values, potentially reducing reliance on companies with less transparent supply chains.

Furthermore, the rise of plant-based diets and immersive dining experiences means customers have more choices than ever before. In 2024, plant-based food sales in the UK are projected to reach £2.5 billion, highlighting a substantial market segment that can exert pressure on traditional food service providers. Fuller's needs to actively adapt its menu and atmosphere to cater to these evolving tastes, otherwise, customers may direct their spending elsewhere.

- Growing demand for local sourcing: 65% of UK consumers prioritize locally produced food.

- Plant-based market expansion: UK plant-based food sales projected to reach £2.5 billion in 2024.

- Rise of experiential dining: Customers seek unique and immersive dining concepts.

- Value consciousness: Continued focus on competitive pricing and perceived value for money.

The bargaining power of Fuller Smith & Turner's customers is substantial, driven by a highly competitive market and increasing consumer awareness. In 2024, the UK hospitality sector continued to see significant growth in new establishments, offering customers a wide array of choices beyond traditional pubs. This abundance of alternatives means customers can easily switch providers if they are not satisfied with price, quality, or experience.

The cost of living crisis further amplifies this power, with a significant portion of UK adults cutting back on non-essential spending as of early 2024, according to the Office for National Statistics. This heightened price sensitivity forces Fuller's to remain competitive, as customers are more inclined to seek out deals and value for money. Online reviews also play a critical role, with 92% of consumers considering them vital in their decision-making, giving customers significant leverage through shared experiences and reputation management.

| Factor | Impact on Fuller's | Supporting Data (2024) |

|---|---|---|

| Market Competition | High customer choice leads to pressure on pricing and service. | Thousands of new food and beverage establishments opening annually in the UK. |

| Price Sensitivity | Customers prioritize value and are more likely to switch for better deals. | Significant percentage of UK adults reported cutting back on non-essential purchases due to rising prices (ONS early 2024). |

| Online Reviews | Negative reviews can significantly deter potential customers. | 92% of consumers consider online reviews vital in their decision-making. |

| Changing Preferences | Demand for local sourcing and plant-based options requires menu adaptation. | 65% of UK consumers prioritize locally produced food; UK plant-based food sales projected to reach £2.5 billion. |

Preview the Actual Deliverable

Fuller Smith & Turner Porter's Five Forces Analysis

This preview showcases the comprehensive Fuller Smith & Turner Porter's Five Forces Analysis, presenting the exact document you will receive immediately after purchase. You're looking at the actual, fully formatted analysis, ensuring no surprises and instant usability. Once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The UK hospitality market, encompassing pubs and hotels, is characterized by significant fragmentation. This means there are a vast number of independent establishments alongside larger, established chains, all competing for customer attention and spending. Fuller's, as a prominent player, navigates this intensely competitive landscape where rivals range from small, local pubs to major hotel groups.

The pub and restaurant sector is grappling with a significant increase in operational expenses. For example, energy prices saw a substantial jump, with the average business electricity price index reaching 177.7 in March 2024, up from 156.3 in March 2023, according to the Office for National Statistics. This, coupled with rising wages and National Insurance Contributions, puts considerable pressure on profit margins.

This profit squeeze naturally fuels more intense competition among businesses. To stay afloat, companies might engage in aggressive price wars or implement stringent cost-saving measures. However, these actions can sometimes lead to a decline in the quality of service offered to customers, creating a challenging environment for all players in the industry.

The UK hospitality sector is experiencing significant disruption, with a net loss of approximately 20 licensed venues per week in early 2025. This trend follows hundreds of pub closures throughout 2024, underscoring intense competitive pressures and a difficult economic climate.

These closures signal a market where weaker businesses are failing, which can paradoxically strengthen remaining competitors by reducing overall supply and potentially allowing for market consolidation. Fuller Smith & Turner, like other established players, must navigate this environment where survival often depends on operational efficiency and strong brand appeal.

Diversification and Innovation by Competitors

Competitors are actively broadening their services, with many now offering breakfast, transforming nightclubs into daytime venues, and pubs venturing into accommodation and unique social experiences. This dynamic landscape, marked by a surge in low and non-alcoholic beverage options, demands that Fuller's consistently innovate its own offerings to maintain its competitive edge.

Fuller's faces intense rivalry from businesses that are not only adapting but also proactively diversifying their revenue streams. For instance, the pub sector has seen a notable trend towards incorporating competitive socialising elements, such as shuffleboard or darts, within pub environments. This strategic move aims to attract a wider customer base and increase dwell time, directly impacting traditional pub models.

- Diversification of Services: Competitors are expanding beyond traditional pub offerings to include breakfast, daytime events at nightclubs, and accommodation.

- Innovation in Product Mix: There's a significant rise in the availability and popularity of low and non-alcoholic beverage options across the industry.

- Competitive Socialising Trend: Pubs are integrating activities like shuffleboard and darts to create new revenue streams and customer experiences.

- Impact on Fuller's Strategy: These competitive actions necessitate continuous adaptation and innovation from Fuller's to remain relevant and profitable.

Geographic and Segment-Specific Competition

Competitive rivalry for Fuller Smith & Turner is significantly shaped by its geographic footprint and the specific market segments it operates within. The company’s substantial presence across the South of England, particularly within the M25 orbital motorway, means it contends with a dense network of local competitors. For instance, London’s hotel sector has demonstrated robust recovery, with investment flowing into properties driven by major events. In 2024, London hotels reported an average occupancy rate of around 78%, a notable increase from previous years, indicating intense competition for tourist and business travelers.

Provincial areas, while potentially offering different growth dynamics, also present unique competitive landscapes. Fuller's strategy must therefore be finely tuned to the localized market conditions, understanding that the competitive intensity and customer preferences can vary dramatically from one town or city to another. This necessitates a granular approach to market analysis and operational adjustments.

- Localized Competition: Fuller's estate in the South of England, especially within the M25, faces numerous local pubs and hotel operators.

- London Market Dynamics: London hotels saw strong recovery in 2024, with occupancy rates nearing 80%, intensifying competition for prime locations.

- Provincial Challenges: Non-London areas may experience different competitive pressures, requiring tailored strategies for each market.

- Strategic Adaptation: Fuller's success depends on its ability to adapt its offerings and pricing to the specific competitive environment of each location.

The competitive rivalry within the UK pub and hotel sector is fierce, driven by a fragmented market and increasing operational pressures. Fuller's faces direct competition from a wide array of businesses, from independent pubs to large hotel chains, all vying for market share.

Rising costs for energy, utilities, and labor are intensifying this rivalry, forcing companies to either absorb these increases or pass them on, impacting pricing strategies. The industry is also seeing a significant number of venue closures, with around 20 licensed venues closing weekly in early 2025, a trend that began in 2024, indicating a shakeout of less competitive businesses.

Competitors are actively diversifying their offerings, incorporating new revenue streams like competitive socialising activities and expanding into accommodation. This forces Fuller's to continuously innovate its product mix and customer experience to maintain its competitive standing.

| Competitor Action | Impact on Fuller's | Example Data (2024) |

|---|---|---|

| Service Diversification | Requires Fuller's to broaden its own service portfolio | London hotel occupancy: ~78% |

| Product Innovation (Low/Non-Alc) | Necessitates adjustments to beverage offerings | N/A (Industry trend) |

| Competitive Socialising | Drives need for unique in-venue experiences | N/A (Industry trend) |

| Venue Closures | Can reduce overall supply, potentially benefiting efficient operators | ~20 licensed venues closing weekly (early 2025) |

SSubstitutes Threaten

The threat of substitutes for Fuller Smith & Turner's offerings is significant, particularly as consumers increasingly opt for home consumption. With the rising cost of living, many are finding it more economical to prepare meals and beverages at home, directly impacting pub and restaurant footfall. This shift is amplified by the growing availability of high-quality ingredients and diverse beverage options for home enjoyment.

Furthermore, alternative entertainment venues present a competitive challenge. Options such as competitive socialising spaces, cinemas, and other leisure activities outside the traditional pub and hotel experience are drawing consumer spending. For instance, the UK's leisure and hospitality sector saw significant growth in non-food and beverage related activities in 2024, indicating a broader shift in discretionary spending away from traditional hospitality.

The rise of delivery services presents a significant threat of substitutes for Fuller's, particularly impacting their food and drink offerings. Platforms like Deliveroo and Uber Eats have made it incredibly easy for consumers to get restaurant-quality meals and beverages delivered directly to their homes, offering a convenient alternative to visiting a pub or hotel.

This convenience factor directly challenges the traditional pub experience. While Fuller's might partner with these delivery services, their very existence expands consumer choice, diminishing the necessity of a physical visit. For instance, in 2024, the UK food delivery market was projected to reach over £13 billion, highlighting the scale of this shift in consumer behavior.

The hospitality sector is seeing a significant shift, with non-traditional venues increasingly offering compelling alternatives to classic pubs. Competitive socialising concepts, such as axe throwing bars or board game cafes, are gaining traction, especially among younger demographics seeking unique experiences. These venues directly compete for leisure time and disposable income that might otherwise be spent at a traditional pub.

Furthermore, the casual dining sector's robust recovery in 2024 presents another strong substitute. Restaurants offering diverse cuisines and engaging atmospheres provide a different, yet equally attractive, social outing. This broadens the range of choices consumers have when deciding where to spend their leisure time and money, potentially drawing customers away from traditional pub visits.

Self-Catering Accommodation and Short-Term Rentals

For Fuller Smith & Turner's hotel segment, self-catering accommodation and short-term rentals represent a significant threat of substitutes. Platforms like Airbnb and Vrbo offer travelers alternatives that often provide greater flexibility, unique experiences, and potentially lower costs compared to traditional hotel stays. This is particularly true for longer stays or for travelers seeking a more local feel.

The appeal of these substitutes is growing. In 2024, the global short-term rental market was valued at approximately $110 billion, with projections indicating continued growth. This market segment directly competes for the same customer base as hotels, especially leisure travelers and families who may find the space and amenities of a rental more suitable.

- Market Share: Short-term rentals captured an increasing share of the accommodation market, impacting hotel occupancy rates in key tourist destinations.

- Pricing: The often variable and competitive pricing of short-term rentals can exert downward pressure on hotel room rates.

- Guest Preferences: A segment of travelers now actively prefers the unique offerings and perceived value of short-term rentals over standardized hotel experiences.

- Regulatory Landscape: While regulations are evolving, the continued expansion of these platforms signifies a persistent competitive force for hotels.

Focus on Value and Experience by Substitutes

Fuller's faces a significant threat from substitutes as consumers increasingly seek value and unique experiences. Budget-friendly eateries and niche, experience-focused venues offer compelling alternatives, forcing Fuller's to differentiate beyond traditional hospitality.

The rise of casual dining chains and even home cooking kits presents a direct challenge, as these options often provide a lower price point or a more convenient, tailored experience. For instance, in 2024, the UK's food-to-go market saw continued growth, with many consumers prioritizing quick, affordable meals, a segment where Fuller's traditional pub model might not always compete directly on price.

- Increased competition from diverse dining options.

- Consumer demand for both value and unique experiences.

- Need for Fuller's to justify premium pricing against alternatives.

- Impact of evolving consumer preferences on market share.

The threat of substitutes for Fuller Smith & Turner is substantial, driven by evolving consumer preferences and economic pressures. The shift towards home consumption, fueled by convenience and cost-consciousness, directly impacts pub and hotel visits. For example, the UK's food delivery market was projected to exceed £13 billion in 2024, underscoring the scale of this substitution.

Alternative leisure activities and dining formats also pose a significant challenge. Competitive socialising venues and casual dining chains offer varied experiences that compete for discretionary spending. In 2024, the UK leisure and hospitality sector saw growth in non-traditional activities, indicating a broader diversification of consumer choices beyond classic pubs.

For Fuller's hotel operations, short-term rentals like Airbnb represent a growing substitute. These platforms offer flexibility and unique experiences, appealing to a segment of travelers. The global short-term rental market was valued at approximately $110 billion in 2024, highlighting its considerable market presence.

| Substitute Category | Key Substitutes | Impact on Fuller's | Relevant 2024 Data/Trend |

|---|---|---|---|

| Home Consumption | DIY Food & Beverage, Meal Kits | Reduced footfall, lower beverage sales | UK food delivery market projected > £13 billion |

| Alternative Leisure | Competitive Socialising, Cinemas | Diversion of discretionary spending | Growth in non-food/beverage leisure activities |

| Alternative Accommodation | Short-Term Rentals (Airbnb, Vrbo) | Competition for hotel bookings, potential rate pressure | Global short-term rental market valued ~$110 billion |

Entrants Threaten

Fuller's operates a portfolio of premium pubs and hotels, many situated in prime, freehold locations. The cost to acquire and meticulously refurbish properties to this high standard is substantial, often running into millions of pounds per site. For instance, acquiring a prime London pub freehold and undertaking a full renovation could easily exceed £5 million, a significant hurdle for newcomers.

The UK hospitality sector is heavily regulated, with new businesses needing to navigate a complex web of licensing laws, stringent health and safety standards, and comprehensive employment legislation. For instance, obtaining a personal alcohol license in the UK can take several weeks and involve background checks and training courses, adding to the initial setup burden.

Fuller's boasts a deeply ingrained brand in the UK, cultivated over a long history. This strong brand recognition, coupled with a reputation for quality in its pubs and hotels, makes it difficult for new entrants to compete. Establishing a similar level of customer loyalty requires substantial marketing expenditure and considerable time to build trust and a solid reputation.

Access to Supply Chains and Distribution Networks

Established players like Fuller Smith & Turner, or Fuller's, benefit from deeply entrenched relationships within their supply chains and distribution networks. These existing ties often grant them preferential terms and reliable access to essential goods, from premium beverages to unique food ingredients.

New entrants into the pub and hospitality sector would face significant hurdles in replicating these established networks. They would likely need to invest heavily in building their own supplier relationships, potentially starting with less favorable pricing and longer lead times as they gain traction.

For instance, in 2024, the cost of goods sold for many hospitality businesses saw fluctuations due to global supply chain disruptions. New entrants would have to navigate these volatile conditions without the benefit of long-standing supplier loyalty or bulk purchasing power that established companies like Fuller's possess.

- Established Relationships: Fuller's has existing, often long-term, contracts with key suppliers for everything from cask ales to fresh produce.

- Supplier Bargaining Power: New entrants may struggle to achieve the same economies of scale, leading to higher per-unit costs for raw materials.

- Distribution Challenges: Securing reliable and cost-effective distribution channels for products, especially perishable ones, is a significant barrier for newcomers.

- Brand Reputation with Suppliers: A proven track record and financial stability, as demonstrated by companies like Fuller's, often makes suppliers more willing to extend credit and prioritize orders.

Labor Shortages and Rising Employment Costs

The UK hospitality industry grapples with persistent labor shortages and escalating employment expenses. These include the National Living Wage and rising National Insurance Contributions, which directly impact profitability. In 2024, reports indicated that hospitality businesses were struggling to fill vacancies, with some operating at reduced capacity due to staffing issues.

New entrants entering the Fuller Smith & Turner market would confront these identical labor market pressures. Attracting and retaining qualified staff in a competitive environment presents a significant hurdle, potentially hindering a new business's ability to scale effectively. This difficulty in securing human capital increases the initial investment and operational complexity for newcomers.

- Labor Shortages: In Q1 2024, the Office for National Statistics reported that the hospitality sector continued to experience high vacancy rates.

- Rising Employment Costs: The increase in the National Living Wage, effective April 2024, added to the cost burden for businesses.

- Competitive Labor Market: New entrants must compete with established players for a limited pool of skilled workers.

- Operational Complexity: Managing recruitment, training, and retention adds layers of complexity for any new hospitality venture.

The threat of new entrants for Fuller Smith & Turner is moderate. While the brand loyalty and established supply chains of Fuller's present significant barriers, the sheer capital required for prime property acquisition and refurbishment, coupled with stringent UK licensing and employment regulations, deters many potential newcomers. For instance, acquiring and renovating a single pub in a desirable location can easily cost upwards of £5 million, a substantial upfront investment.

New entrants must also contend with the sector's ongoing labor shortages and rising employment costs. In Q1 2024, the hospitality sector faced high vacancy rates, and the April 2024 National Living Wage increase further squeezed margins. These factors, alongside the need to build brand recognition from scratch, make it challenging for new players to compete effectively against established entities like Fuller's.

| Barrier to Entry | Impact on New Entrants | Example/Data Point |

| Capital Requirements | High | Acquiring and renovating a prime pub can exceed £5 million. |

| Brand Loyalty & Reputation | High | Fuller's established brand requires significant marketing to replicate. |

| Regulatory Hurdles | Moderate to High | Complex licensing and health & safety laws add to setup time and cost. |

| Supply Chain Relationships | High | Established networks offer preferential terms; new entrants face higher costs. |

| Labor Market Pressures | High | Q1 2024 saw high hospitality vacancy rates; April 2024 saw National Living Wage increase. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fuller Smith & Turner leverages a comprehensive dataset including the company's annual reports, industry-specific trade publications, and market research reports from leading firms. This ensures a thorough understanding of competitive dynamics within the pub and brewing sector.