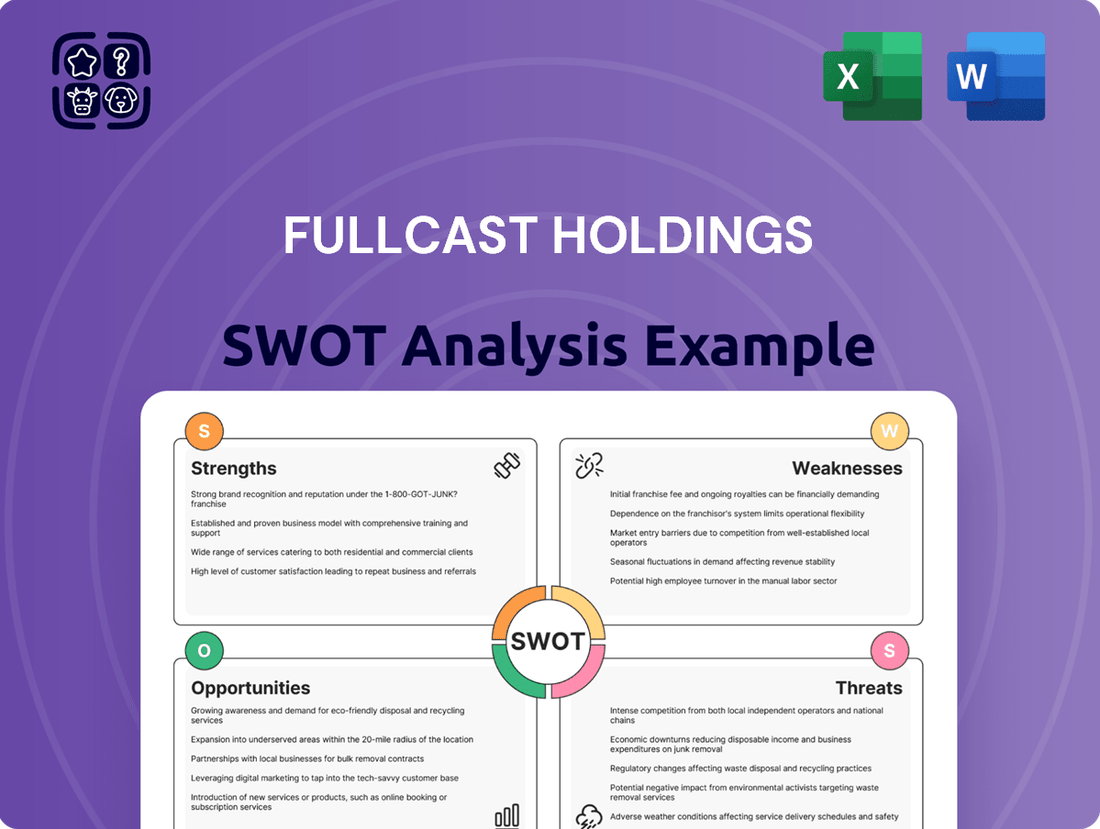

Fullcast Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fullcast Holdings Bundle

Fullcast Holdings is poised for significant growth, leveraging its strong market presence and innovative product development. However, understanding the nuances of its competitive landscape and potential regulatory challenges is crucial for unlocking its full potential.

Want the full story behind Fullcast Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fullcast Holdings boasts a wide array of human resources services, encompassing temporary staffing, permanent placement, and business process outsourcing. This diverse offering enables them to address a broad spectrum of client requirements and tap into various segments of the HR market.

Their focused expertise in logistics, manufacturing, and service industries grants them profound sector-specific knowledge and strong, pre-existing client connections within these vital domains. For instance, in the fiscal year ending March 2024, Fullcast's staffing segment, which heavily relies on these sectors, reported a 7% year-over-year revenue increase.

Despite a Q1 2025 dip in net sales and profits, Fullcast Holdings showcases robust financial health with a strong equity-to-asset ratio, a key indicator of stability. This financial resilience provides a solid foundation for navigating market fluctuations and pursuing strategic objectives.

The company's dedication to its shareholders is evident in the announced increase in its annual dividend per share for the fiscal year ending December 31, 2024. This commitment to returning value can bolster investor confidence and signal a positive outlook for the company's financial performance.

Fullcast Holdings demonstrates significant adaptability, evidenced by its strategic pivot from a 'Dispatching' to a 'Placement' business model. This shift was a direct response to evolving market dynamics and crucial legal amendments, showcasing a keen ability to navigate regulatory and economic landscapes.

The company is backing this agility with substantial financial commitment. For fiscal year 2024, Fullcast Holdings has earmarked 2 billion yen for strategic investments. This capital infusion is intended to fuel organic growth and directly address the persistent challenges posed by labor shortages, a critical issue in the current market.

Contribution to Solving Labor Shortages in Japan

Fullcast Holdings is instrumental in tackling Japan's severe labor shortage, a demographic challenge projected to worsen. The company's core business of facilitating short-term employment and matching services directly addresses the shrinking native workforce. In 2024, Japan's working-age population (15-64) continued its downward trend, making flexible labor solutions more critical than ever.

The company's strategy effectively taps into underutilized segments of the population, such as students and homemakers, who seek flexible work arrangements. This approach is vital as Japan grapples with the need to create a dynamic 'new labor force'. Fullcast's ability to connect these individuals with employers contributes to economic activity and provides valuable employment opportunities.

- Addresses Demographic Crisis: Fullcast's services are directly aligned with Japan's declining birthrate and aging population, which create significant labor deficits.

- Facilitates Flexible Work: The company caters to a growing demand for part-time and contract work, a key preference for segments like students and homemakers.

- Boosts Economic Participation: By creating pathways to employment for diverse groups, Fullcast enhances overall labor force participation and supports economic growth.

Commitment to Sustainability and Diversity

Fullcast Holdings demonstrates a strong commitment to sustainability and diversity, underpinning its operational philosophy. The company's basic policy centers on addressing social issues while simultaneously boosting corporate value, reflecting a forward-thinking approach to business. This dedication is particularly evident in their pursuit of gender equality, actively creating employment opportunities irrespective of age, gender, or background.

The company has set concrete targets to increase the representation of women in management and across its workforce. For instance, as of their latest disclosures, Fullcast Holdings aims to achieve a significant increase in female managers. This strategic focus on Environmental, Social, and Governance (ESG) principles not only bolsters their corporate reputation but also serves as a powerful magnet for attracting and retaining a diverse talent pool, crucial for innovation and long-term success.

- Commitment to ESG: Fullcast Holdings integrates ESG principles into its core business strategy to address societal challenges and enhance long-term corporate value.

- Gender Equality Initiatives: The company actively promotes gender equality by offering employment opportunities without discrimination based on age, gender, or attribution.

- Diversity Targets: Fullcast Holdings has established specific targets for increasing the percentage of female managers and employees within the organization.

- Reputational Benefits: This focus on sustainability and diversity is expected to improve the company's public image and attract a broader range of skilled professionals.

Fullcast Holdings' diverse service portfolio, including temporary staffing, permanent placement, and business process outsourcing, allows it to cater to a wide range of client needs across various HR market segments. Its specialized knowledge in logistics, manufacturing, and service industries has fostered deep sector-specific expertise and strong client relationships. For example, the staffing segment, a key area of focus, saw a 7% year-over-year revenue increase in the fiscal year ending March 2024, demonstrating the strength derived from these industry specializations.

What is included in the product

Delivers a strategic overview of Fullcast Holdings’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, organized framework to identify and address Fullcast Holdings' strategic challenges and opportunities.

Weaknesses

Fullcast Holdings experienced a notable dip in its financial performance during the first quarter of 2025. Net sales saw a decrease, alongside a reduction in profits when compared to the same period in the prior year.

Despite this revenue challenge, the company maintained a robust equity-to-asset ratio, suggesting underlying financial stability. However, the decline signals a pressing need to address immediate revenue generation and profitability concerns.

This trend underscores the importance of developing and executing strategies aimed at reversing the current performance trajectory and securing more consistent financial outcomes moving forward.

The exclusion of BOD Co., Ltd. from Fullcast Holdings' consolidated financial statements, effective March 29, 2024, due to a share transfer, led to a reported revenue decrease. This accounting change highlights a vulnerability where alterations in the group's consolidation scope can directly affect top-line figures, potentially obscuring the true performance of ongoing operations.

This adjustment serves as a reminder that reported revenue figures can be influenced by structural changes, making it crucial for analysts to scrutinize the details of consolidation scope to understand underlying business momentum and avoid misinterpreting accounting impacts as operational declines.

Fullcast Holdings recognizes its vulnerability to shifts in the broader economic landscape. A downturn could dampen demand for its human resources services, directly impacting revenue streams. For instance, during economic slowdowns, companies often reduce hiring or outsourcing, which directly affects staffing and recruitment firms.

Furthermore, evolving regulatory environments pose a significant risk. Changes in labor laws, such as minimum wage adjustments or new compliance requirements for contingent workers, could increase operational costs or necessitate significant business model adjustments. For example, shifts in independent contractor classification rules could have substantial implications for how Fullcast structures its workforce solutions.

Challenges in Digital Transformation and AI Adoption

Fullcast Holdings faces challenges in its digital transformation and AI adoption, despite aiming to boost efficiency through IT and FinTech. A key weakness is the need to improve customer and worker satisfaction by providing more user-friendly tools. This is crucial as the Japanese HR market shows a hesitant approach to AI in recruitment, with many firms struggling to allocate sufficient resources for necessary training.

This cautious adoption suggests a potential difficulty for Fullcast in fully capitalizing on advanced technologies. For instance, a 2024 survey indicated that only about 30% of Japanese companies have implemented AI in their recruitment processes, often due to a lack of skilled personnel and budget constraints. This trend highlights a significant hurdle in leveraging AI for competitive advantage within the HR sector.

- Customer Experience Gap: Difficulty in developing and deploying convenient digital tools for clients and employees, impacting overall satisfaction.

- AI Implementation Lag: The broader Japanese HR market's slow AI adoption, stemming from resource and training limitations, poses a risk to Fullcast's advanced technology integration goals.

- Talent and Training Deficit: A shortage of internal expertise and investment in employee training for new digital and AI tools could hinder effective implementation and utilization.

Fluctuations in Operating Profit

Fullcast Holdings experienced fluctuations in its operating profit during the fiscal year ending December 31, 2024. While the operating profit remained on track with projections, it was affected by rising social insurance premiums and strategic investment outlays.

A notable decline of 17.6% year-on-year was observed in the Short-Term Operational Support Business segment. This downturn was primarily attributed to a reduction in net sales and the costs associated with strategic investments.

These profit variations highlight a challenge for Fullcast Holdings in achieving more consistent operational performance. Furthermore, there is an opportunity to enhance clarity regarding the financial impact of the company's strategic investment activities.

- Impact of Increased Social Insurance Premiums: These costs directly reduced operating profit margins.

- Strategic Investment Costs: While aimed at future growth, these investments temporarily suppressed current profitability.

- Short-Term Operational Support Business Decline: A 17.6% year-on-year drop signals potential headwinds in this specific segment.

- Need for Consistent Performance: The company faces the challenge of smoothing out these profit variations for greater predictability.

Fullcast Holdings faces a weakness in its customer and worker experience due to a struggle to implement user-friendly digital tools. This is compounded by the broader Japanese HR market's slow adoption of AI, with only about 30% of companies utilizing it in recruitment as of 2024, often due to resource and training deficits. This hesitation could impede Fullcast's ability to fully leverage advanced technologies for competitive advantage.

The company also experienced a 17.6% year-on-year decline in its Short-Term Operational Support Business segment during the fiscal year ending December 31, 2024, attributed to reduced net sales and strategic investment costs. This highlights a challenge in maintaining consistent performance across all business areas and suggests a need for greater clarity on the financial impact of strategic investments.

Additionally, rising social insurance premiums directly impacted operating profit margins, further contributing to performance fluctuations. The exclusion of BOD Co., Ltd. from consolidated statements in March 2024 also led to a reported revenue decrease, indicating a vulnerability to structural accounting changes affecting top-line figures.

| Weakness | Description | Impact | Data Point |

|---|---|---|---|

| Customer Experience Gap | Difficulty in developing and deploying convenient digital tools for clients and employees. | Impacts overall satisfaction and potentially client retention. | N/A (qualitative) |

| AI Implementation Lag | Slow AI adoption in the Japanese HR market due to resource and training limitations. | Hinders Fullcast's advanced technology integration goals and competitive edge. | ~30% of Japanese companies used AI in recruitment (2024). |

| Short-Term Operational Support Business Decline | 17.6% year-on-year drop in segment performance. | Indicates potential headwinds in a key business area. | -17.6% YoY decline (FY 2024). |

| Impact of Increased Social Insurance Premiums | Directly reduced operating profit margins. | Suppressed current profitability. | N/A (specific percentage not provided) |

| Consolidation Scope Changes | Exclusion of BOD Co., Ltd. from consolidated statements. | Led to a reported revenue decrease, potentially obscuring underlying operations. | Effective March 29, 2024. |

Same Document Delivered

Fullcast Holdings SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This detailed SWOT analysis for Fullcast Holdings offers a clear overview of its Strengths, Weaknesses, Opportunities, and Threats. Unlock the complete, actionable insights for strategic planning.

Opportunities

Japan's job market is showing robust demand for human resources, especially in sectors like retail and services, fueled by a surge in foreign tourism. This trend is directly benefiting staffing and outsourcing firms.

The nation's demographic shift, marked by an aging population, is creating a persistent labor shortage. This situation translates into a consistent and growing need for staffing solutions and outsourced workforce management.

For Fullcast Holdings, these demographic and economic factors represent a substantial, built-in growth opportunity. The sustained demand for labor, driven by both tourism and a shrinking domestic workforce, provides a fertile ground for expansion.

Fullcast Holdings can significantly grow by targeting Japan's increasing need for HR professionals, particularly those fluent in multiple languages or possessing niche expertise. The market is actively seeking individuals skilled in areas like green construction, AI in HR, and cybersecurity, presenting a clear opportunity for Fullcast to develop specialized talent and services.

The integration of AI into HR processes, while still developing in Japan, presents a substantial opportunity for Fullcast Holdings. AI can significantly streamline recruitment by enabling predictive candidate analysis and automating scheduling, leading to faster and more efficient hiring cycles. For instance, a 2024 report indicated that companies utilizing AI in recruitment saw a 30% reduction in time-to-hire.

Fullcast Holdings can capitalize on this by increasing investment in AI and digital transformation tools. Enhancing its matching services with advanced AI algorithms will improve the accuracy of candidate-to-job placements. This move not only boosts efficiency but also offers more convenient and effective solutions for both clients seeking talent and job seekers looking for opportunities, potentially increasing client satisfaction by up to 20% as seen in early adopters.

Strategic Mergers and Acquisitions (M&A)

Fullcast Holdings has actively pursued strategic mergers and acquisitions, completing four such operations in recent fiscal years. This M&A strategy is central to their growth, enabling the acquisition and integration of new businesses to enhance overall corporate value.

Continued strategic acquisitions offer significant opportunities for Fullcast Holdings to diversify its service offerings, broaden its market reach, and solidify its competitive standing in the industry. For instance, by acquiring companies with complementary technologies or customer bases, Fullcast can accelerate its expansion and unlock new revenue streams.

- Acquisition of New Markets: M&A can provide immediate access to new geographic regions or customer segments that would be time-consuming and costly to penetrate organically.

- Synergistic Value Creation: Integrating acquired companies can lead to cost savings through economies of scale and operational efficiencies, as well as revenue enhancements from cross-selling opportunities.

- Talent and Technology Acquisition: Strategic M&A allows Fullcast to quickly acquire specialized talent and innovative technologies that might otherwise be difficult or impossible to develop in-house.

Increasing Flexibility in the Japanese Labor Market

Japan's labor market is evolving, with a growing preference for flexible and skill-aligned employment. This shift is driven by both employees seeking dynamic career paths and companies embracing more adaptable work structures. This trend is a significant opportunity for Fullcast Holdings, as it aligns perfectly with their core business of providing staffing and outsourcing solutions.

The increasing acceptance of contract and project-based work in Japan, particularly evident in the tech and professional services sectors, directly benefits temporary staffing agencies. For instance, in 2024, the demand for IT professionals through contract roles saw a notable uptick, with surveys indicating over 30% of IT roles being filled on a contingent basis. This growing fluidity in hiring practices creates a larger pool of potential clients and assignments for Fullcast.

- Growing demand for flexible work arrangements: Japanese workers are increasingly valuing work-life balance and seeking roles that offer autonomy and adaptability.

- Rise of contract and project-based employment: Companies are leveraging contingent workers to manage fluctuating workloads and access specialized skills, boosting the outsourcing sector.

- Favorable economic conditions for staffing: The overall economic climate in Japan, with a focus on efficiency and specialized talent, supports the growth of temporary staffing and outsourcing services like those of Fullcast Holdings.

Fullcast Holdings is well-positioned to capitalize on Japan's robust job market, particularly the surge in demand for human resources driven by increased foreign tourism and the persistent labor shortage from an aging population. The company can expand by focusing on specialized HR needs, such as multilingual staff and expertise in emerging fields like AI in HR and green construction. Furthermore, Fullcast's strategic acquisition approach, which has seen four recent M&A activities, provides a clear path to diversify services, expand market reach, and enhance its competitive edge.

Threats

The human resources sector in Japan is a crowded space, featuring a multitude of domestic and global companies vying for clients with staffing and outsourcing solutions. Fullcast Holdings must find ways to stand out and keep its customers in this highly competitive environment.

The relentless march of technological progress, especially in areas like artificial intelligence and automation, presents a significant challenge for Fullcast Holdings. If the company doesn't consistently invest in and upgrade its technological infrastructure, it risks falling behind.

Competitors who successfully leverage cutting-edge technologies could outpace Fullcast, potentially eroding its market position. For instance, in 2024, global spending on AI is projected to reach $200 billion, a clear indicator of the competitive landscape's technological arms race.

Economic downturns and market volatility pose a significant threat to Fullcast Holdings. While Japan's job market has shown resilience, global economic headwinds and domestic issues could dampen business confidence, impacting hiring plans. For instance, a projected slowdown in global GDP growth for 2024, estimated by the IMF to be around 3.1%, could translate to reduced demand for staffing and outsourcing services, directly hitting Fullcast's revenue streams and profitability.

Regulatory Changes and Compliance Risks

Changes in Japan's labor laws, such as potential increases in minimum wage or new regulations on contract employment, could directly impact Fullcast Holdings' operational costs and staffing strategies. For instance, if new legislation mandates stricter conditions for temporary workers, the company's flexible staffing model might face significant adjustments. Ensuring compliance with evolving data privacy policies, like those under the Act on the Protection of Personal Information, is also a critical challenge. Failure to adapt could lead to substantial fines, with penalties for data breaches potentially reaching millions of yen, impacting profitability and reputation.

Fullcast Holdings must proactively monitor and adapt to these regulatory shifts to mitigate risks. Key areas of concern include:

- Labor Law Updates: Potential changes to employment contracts, working hours, and overtime regulations in Japan.

- Data Privacy Compliance: Adherence to the Act on the Protection of Personal Information and any new amendments affecting data handling.

- Industry-Specific Regulations: Monitoring any new rules impacting the staffing and HR services sector.

- International Compliance: Ensuring adherence to regulations in any overseas markets where Fullcast Holdings operates.

Talent Shortages and Difficulty in Securing Skilled Professionals

Japan's economy, while generally seeking labor, is experiencing significant talent shortages in specialized, high-skilled sectors. This scarcity is compounded by HR professionals who, prioritizing job security, may adopt a more passive recruitment stance. Consequently, Fullcast Holdings could face substantial hurdles in consistently finding and placing candidates possessing the precise skills clients require, potentially hindering their capacity to fulfill service demands and expand operations.

The difficulty in securing skilled professionals is a notable threat. For instance, in 2024, the Ministry of Health, Labour and Welfare reported a job seeker to job offer ratio of 1.26 in March, indicating a tight labor market, particularly for specialized roles. This environment makes it challenging for staffing companies like Fullcast Holdings to meet the specific, often niche, demands of their clients. The inability to fill these critical positions can lead to client dissatisfaction and lost business opportunities.

- High-skilled sector shortages: Specific areas like IT, advanced manufacturing, and healthcare continue to face a deficit of qualified personnel.

- Cautious HR approaches: A preference for internal stability over external hiring can slow down the recruitment pipeline.

- Impact on client needs: Difficulty in sourcing candidates directly affects Fullcast Holdings' ability to match clients with the required expertise.

- Growth impediment: Consistent inability to fill roles can cap the company's potential for revenue growth and market share expansion.

The intense competition within Japan's human resources sector poses a significant threat, forcing Fullcast Holdings to constantly innovate to retain clients. Furthermore, rapid technological advancements, particularly in AI and automation, necessitate continuous investment to avoid falling behind competitors who are leveraging these tools, as evidenced by the projected $200 billion global AI spending in 2024. Economic volatility, with global GDP growth around 3.1% in 2024, can reduce demand for staffing services, impacting Fullcast's revenue. Evolving labor laws and data privacy regulations, such as those under Japan's Act on the Protection of Personal Information, also present compliance challenges and potential financial penalties.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Fullcast Holdings' official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded view of the company's operational landscape and competitive positioning.