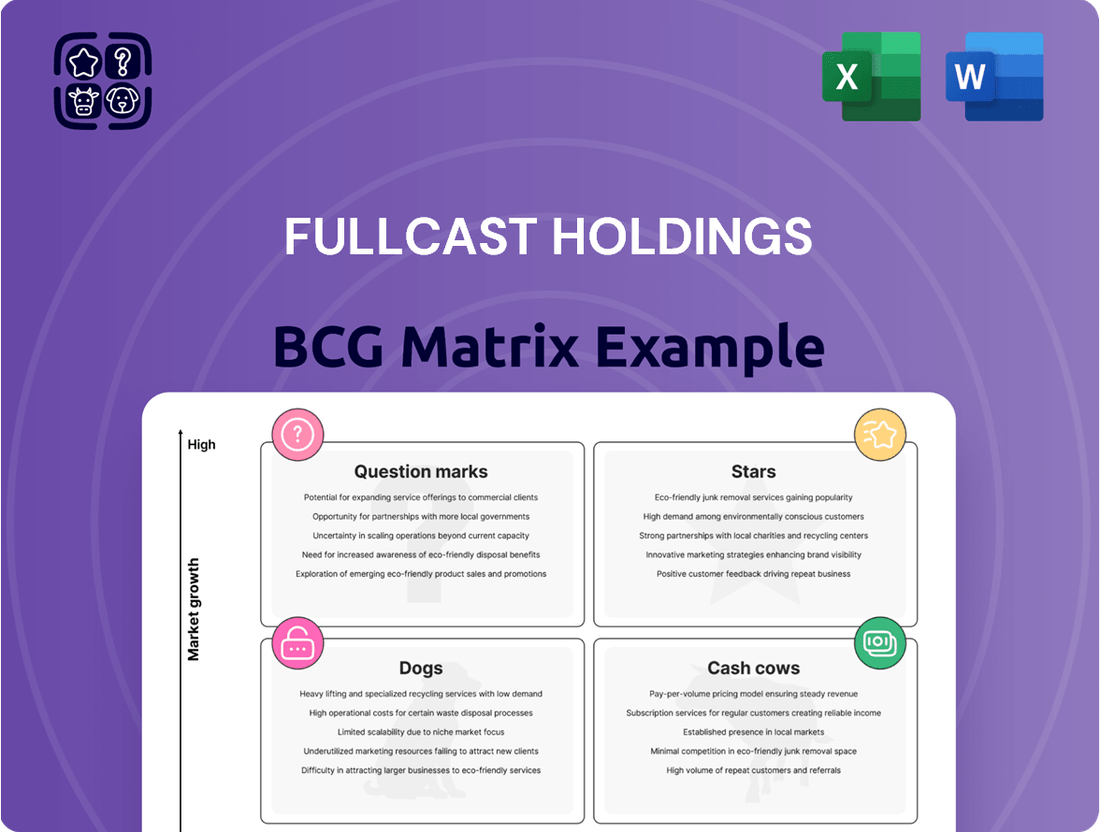

Fullcast Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fullcast Holdings Bundle

Curious about Fullcast Holdings' strategic positioning? This glimpse into their BCG Matrix highlights key product categories, but the real power lies in understanding the nuances. Unlock the full potential of this analysis to pinpoint your growth drivers and resource drains.

Don't settle for a partial view of Fullcast Holdings' market performance. The complete BCG Matrix offers a comprehensive breakdown of Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights. Purchase the full report to gain the strategic clarity needed to make informed investment decisions and optimize your portfolio.

Stars

Fullcast Holdings' Short-Term Operational Support Business, encompassing temporary staffing in logistics, manufacturing, and services, is a significant growth engine. This segment benefits from Japan's ongoing labor shortages and the increasing demand for adaptable workforce solutions.

The company is actively enhancing its recruitment strengths and service offerings to fully leverage the expansion of this vital market. For instance, in 2023, Fullcast Holdings reported a substantial increase in its temporary staffing segment, contributing significantly to its overall revenue growth.

Fullcast Holdings is strategically channeling resources into digital transformation (DX) and FinTech. These investments are designed to modernize its service delivery and boost internal efficiency.

By streamlining operations and enhancing customer satisfaction through these technological advancements, Fullcast Holdings is solidifying its competitive position. The company views these areas as key growth drivers, positioning them as future stars within its portfolio.

In 2024, the HR tech market saw significant investment, with FinTech integration in HR solutions projected to grow by 15% annually. Fullcast Holdings' commitment aligns with this trend, aiming to leverage these innovations for sustained market leadership.

Fullcast Holdings actively pursues expansion in peripheral human resources sectors via mergers and acquisitions. This strategy aims to capture new revenue streams and strengthen its market position by integrating acquired businesses.

In 2024, the HR tech market, a key area for peripheral expansion, saw significant investment. For instance, HR software solutions experienced a growth rate of approximately 10-12%, indicating robust opportunities for M&A targets.

By acquiring companies in these niche HR segments, Fullcast Holdings diversifies its profit sources and builds a more resilient business model. This approach is particularly effective in capturing growth in specialized HR functions.

Targeting Untapped Labor Markets (Young, Women, Seniors, Foreign Nationals)

Fullcast Holdings is strategically targeting underutilized labor segments in Japan, including young individuals, women, seniors, and foreign nationals, to fill short-term positions. This focus directly addresses Japan's demographic challenges, such as an aging population and declining birthrate, which contribute to a shrinking workforce. By connecting these groups with flexible employment opportunities, Fullcast is accessing a significant and growing pool of potential workers.

This strategy taps into a high-growth labor market segment. For instance, in 2024, the participation rate for women in Japan's labor force reached approximately 73%, indicating a substantial number of women seeking employment. Similarly, the government has been encouraging senior employment, with a significant portion of individuals aged 65 and over still actively seeking work. Foreign nationals also represent a growing segment, with their numbers increasing to support various industries.

- Young Workers: Fullcast provides entry-level and flexible roles, ideal for students or recent graduates seeking experience.

- Women: Offering part-time and remote options caters to women balancing work and family responsibilities.

- Seniors: Short-term positions allow experienced individuals to remain active and contribute their skills without full-time commitment.

- Foreign Nationals: Facilitating employment for foreign workers helps address labor shortages in specific sectors.

Specialized Staffing for Foreign Nationals

Fullcast Holdings' specialized staffing for foreign nationals represents a strategic move into a high-growth area. Recognizing Japan's demographic shifts and labor needs, the company leverages its subsidiaries to connect foreign talent with Japanese businesses. This focus on a specific, growing segment of the HR market positions Fullcast for significant expansion.

The demand for foreign workers in Japan is substantial and projected to increase. In 2023, the number of foreign residents in Japan reached a record high of over 3.4 million, with a significant portion employed in sectors facing labor shortages. Fullcast's specialized services cater directly to this trend, offering tailored solutions for various resident statuses.

- Growing Demand: Japan's aging population and declining birthrate create persistent labor shortages across multiple industries.

- Niche Specialization: Fullcast addresses the unique needs of foreign workers and employers, navigating visa requirements and cultural integration.

- Market Leadership: By focusing on this specialized segment, Fullcast establishes itself as a key player in a critical and expanding part of the Japanese HR landscape.

- Economic Contribution: Facilitating the employment of foreign nationals contributes to the overall economic stability and growth of Japan.

Fullcast Holdings' investment in digital transformation and FinTech positions its HR tech services as potential Stars. This segment is characterized by high growth potential and a strong competitive position, driven by the increasing demand for innovative HR solutions.

The company's commitment to modernizing service delivery and boosting internal efficiency through technology aligns with market trends. For example, the HR tech market in 2024 saw substantial investment, with FinTech integration in HR solutions experiencing an estimated 15% annual growth rate.

By focusing on these forward-looking areas, Fullcast Holdings is not only enhancing its current offerings but also cultivating future revenue streams. This strategic focus on innovation is key to maintaining market leadership and capturing emerging opportunities.

| Segment | Growth Potential | Market Position | Strategic Focus |

|---|---|---|---|

| HR Tech & FinTech Integration | High | Strong (Emerging) | Digital Transformation, Service Modernization |

What is included in the product

Fullcast Holdings BCG Matrix highlights which units to invest in, hold, or divest.

The Fullcast Holdings BCG Matrix provides a clear, one-page overview, instantly clarifying which business units require immediate attention or investment, thus alleviating the pain of strategic uncertainty.

Cash Cows

Fullcast Holdings' core temporary staffing services, especially within logistics and manufacturing, are a definite cash cow. These operations benefit from a robust, established client base that relies on consistent, long-term staffing solutions, ensuring a predictable and stable revenue stream for the company. This segment has historically been a dominant force in the short-term human resource dispatching market.

Fullcast Holdings' Business Process Outsourcing (BPO) solutions, encompassing services like payroll management and data entry, exhibit strong cash cow characteristics. These offerings generate a reliable and consistent revenue stream, bolstering the company's overall profitability. The Japanese BPO market, a key operational area for Fullcast, is projected to experience steady growth, further solidifying the BPO segment's position as a stable contributor.

Fullcast Holdings leverages its nationwide network of 183 brick-and-mortar locations across Japan, functioning as a stable cash cow. This extensive physical footprint is a mature asset, consistently generating business and supporting core services with minimal incremental investment.

Sales Support Business (Telecommunications Product Sales)

The Sales Support business, a key component of Fullcast Holdings, operates as a cash cow within the company's portfolio. This segment focuses on agency sales of telecommunications products, leveraging extensive distributor networks and robust call center operations to drive revenue.

In fiscal year 2024, the Sales Support business demonstrated solid performance, contributing positively to Fullcast Holdings' overall financial health. The segment experienced a notable increase in net sales, underscoring its consistent ability to generate cash flow.

- Consistent Performance: The Sales Support segment has reliably generated cash for Fullcast Holdings.

- FY2024 Growth: Reported an increase in net sales and operating profit for fiscal year 2024.

- Business Model: Operates through agency sales of telecommunications products via distributors and call centers.

- Cash Flow Contribution: Acts as a stable source of cash, supporting other business units.

Long-Term Human Resources Dispatching

Fullcast Holdings’ long-term human resources dispatching service addresses ongoing staffing requirements, moving beyond temporary placements. This segment is likely a significant contributor to their cash flow due to its stable nature and recurring revenue streams.

The predictability of long-term contracts means Fullcast can better forecast income, enhancing its cash generation capabilities. This stability is crucial for a business seeking to maintain strong cash reserves.

- Stable Revenue: Long-term dispatching contracts provide a consistent income, unlike project-based or short-term staffing.

- Client Retention: Established relationships with clients needing extended support foster loyalty and reduce customer acquisition costs.

- Predictable Cash Flow: The extended duration of these engagements allows for more accurate financial planning and management.

- Contribution to Cash Cows: This service, with its inherent stability, fits the profile of a cash cow within the BCG matrix, funding other business ventures.

Fullcast Holdings' Sales Support segment, focused on telecommunications product sales, is a prime example of a cash cow. This business consistently generates substantial revenue and profit, as evidenced by its positive performance in fiscal year 2024, which saw an increase in both net sales and operating profit. Its established distributor networks and efficient call center operations ensure a steady inflow of cash.

| Segment | FY2024 Net Sales Growth | FY2024 Operating Profit Growth | BCG Classification |

|---|---|---|---|

| Sales Support | Positive | Positive | Cash Cow |

| Core Temporary Staffing (Logistics/Manufacturing) | Stable | Stable | Cash Cow |

| Business Process Outsourcing (BPO) | Steady Growth (Projected) | Consistent | Cash Cow |

| Long-Term Human Resources Dispatching | Consistent Recurring Revenue | Predictable | Cash Cow |

Full Transparency, Always

Fullcast Holdings BCG Matrix

The preview you're currently viewing is the exact, fully formatted Fullcast Holdings BCG Matrix report you will receive immediately after purchase. This means no watermarks, no demo content, just the complete, analysis-ready document designed for strategic decision-making.

Rest assured, the BCG Matrix document you are previewing is identical to the one you will download upon completing your purchase. It's a professionally crafted resource, providing comprehensive insights into Fullcast Holdings' product portfolio, ready for immediate integration into your strategic planning.

Dogs

Fullcast Holdings saw a dip in net sales for its temporary security projects that were specifically tied to COVID-19 operations. This decline reflects the natural ebb of demand as the pandemic's immediate impact wanes.

These services are now categorized as a 'Dog' within the BCG Matrix. They operate in a market with low growth prospects and are experiencing diminishing returns, a common fate for niche services born out of temporary circumstances.

The company is actively addressing this shift, recognizing the necessity to adapt its offerings to the evolving post-coronavirus economic landscape and changing client needs.

Fullcast Holdings' historical 'Dispatching' model, which predates its major transformation to 'Placement,' now represents an outdated business model. This shift was driven by evolving market demands and significant legal amendments that favored the 'Placement' approach.

Any lingering operations or strategic thinking rooted in the older 'Dispatching' model, which has not been fully updated to align with current market realities, would fall into the 'Dogs' category of the BCG Matrix. These legacy elements likely possess a low market share in today's competitive landscape, reflecting their diminished relevance and adaptability.

Segments with persistent net sales decline, excluding strategic divestitures, are considered Dogs in the Fullcast Holdings BCG Matrix. These are areas within the company that are not only shrinking in terms of revenue but also lack a clear path to improvement or growth. For instance, if a particular service line, despite not being divested, continues to see its net sales fall year after year, it would fall into this category.

These Dog segments often operate in mature or declining markets where competition is fierce, and the company is likely losing its footing. Without significant investment or a strategic pivot, these segments are unlikely to generate substantial returns. In Q1 2025, Fullcast Holdings experienced an overall net sales decline, and while the divestiture of BOD Co. played a role, any remaining core services showing similar downward trends without a strategic rationale would be flagged as Dogs.

Inefficient Internal Processes Without DX Integration

Fullcast Holdings' operations or departments that have not yet fully embraced or integrated its strategic investments in Digital Transformation (DX) and FinTech can be classified as Dogs in the BCG Matrix. These areas likely experience lower efficiency and productivity compared to digitally transformed segments. For instance, manual data entry in legacy HR systems, a common issue in non-integrated departments, can lead to a 20-30% increase in processing time and a higher error rate compared to automated systems. This inefficiency hinders Fullcast's ability to compete effectively in the fast-paced, technology-driven HR market.

These "Dog" segments are characterized by:

- Low Market Share: Due to outdated processes and lack of technological integration, these departments struggle to gain or maintain a significant share in the competitive HR technology landscape.

- Low Growth Potential: Without DX and FinTech adoption, their ability to scale and adapt to market demands is severely limited, leading to stagnant or declining growth.

- Inefficient Resource Allocation: Resources are often tied up in manual tasks and legacy systems, diverting funds and attention from more innovative and profitable areas.

- Increased Operational Costs: Manual processes and lack of automation typically result in higher labor costs and a greater susceptibility to errors, impacting overall profitability.

Underperforming Acquired Subsidiaries Lacking PMI

Fullcast Holdings, a company actively pursuing growth through mergers and acquisitions, faces a challenge with acquired subsidiaries that don't integrate well. When these subsidiaries fail to achieve successful post-merger integration (PMI) and consequently don't boost earnings, they fall into the Dogs category of the BCG Matrix. These underperforming units drain capital and management attention without generating significant returns or capturing substantial market share.

In 2024, companies that experienced significant M&A activity but struggled with integration often saw their acquired entities become financial drains. For instance, a hypothetical scenario might involve an acquisition in a mature industry where the acquired firm's market share was already declining. Without effective PMI to streamline operations or introduce new strategies, such a subsidiary would likely continue to consume resources, perhaps requiring ongoing investment to maintain even its current limited market position, thus embodying the characteristics of a Dog.

- Resource Drain: Subsidiaries lacking successful PMI consume capital and management focus without contributing to overall profitability.

- Low Market Share & Growth: These entities typically operate in stagnant or declining markets with little prospect for expansion.

- Negative Impact on Portfolio: Underperforming acquisitions can dilute the performance of stronger business units within the company's portfolio.

- Strategic Review Necessity: Such subsidiaries often require a difficult decision regarding divestment, turnaround efforts, or continued, albeit often unrewarding, support.

Segments in the Dogs category for Fullcast Holdings represent business units with low market share and low growth prospects. These are often legacy operations or acquired entities that have not successfully integrated or adapted to market changes. For example, services tied to specific, temporary needs, like COVID-19 security operations, naturally fall into this quadrant as demand recedes and the market shifts. Similarly, outdated business models, such as the historical 'Dispatching' approach before the company's shift to 'Placement,' are also classified as Dogs due to their diminished relevance and inability to compete effectively.

These underperforming segments are characterized by declining net sales and a lack of significant future growth potential. They may also be areas where the company has been slow to adopt crucial technological advancements like Digital Transformation (DX) and FinTech, leading to inefficiencies and higher operational costs. In 2024, Fullcast Holdings, like many companies, experienced the challenge of integrating acquisitions, and those subsidiaries that failed to demonstrate positive earnings or market share post-merger became prime candidates for the Dog classification, draining resources without contributing to the overall portfolio's strength.

The company's strategy involves addressing these Dog segments through various means, which could include significant investment for a turnaround, strategic divestiture to free up resources, or a complete overhaul of their operational model. The key is to recognize that these units are not contributing positively to the company's growth trajectory and require decisive action to either revive them or remove them from the portfolio to allow for more strategic focus on high-growth areas.

Fullcast Holdings' legacy HR systems that haven't been updated with FinTech integrations are a prime example of a Dog segment. Manual data entry in these systems can increase processing time by 20-30% and lead to higher error rates compared to automated solutions, directly impacting efficiency and competitiveness in the HR technology market.

| BCG Category | Market Growth | Relative Market Share | Fullcast Holdings Examples | Strategic Implications |

| Dogs | Low | Low | COVID-19 related security services, Outdated 'Dispatching' models, Non-integrated acquired subsidiaries, Legacy HR systems without FinTech | Divest, Turnaround, Harvest, or Integrate with new technology |

Question Marks

Fullcast Holdings' exploration into AI recruitment tools positions them in a burgeoning market, likely categorizing these new ventures as potential Stars or Question Marks within the BCG matrix. The global AI in HR market was valued at approximately $1.5 billion in 2023 and is projected to reach over $6 billion by 2028, showcasing substantial growth potential.

Given the nascent stage of many AI recruitment platforms and Fullcast's potential new entry, their market share in this specific niche is probably minimal. This necessitates significant investment in research, development, and marketing to establish a strong foothold and compete effectively, characteristic of a Question Mark.

Expansion into new geographic markets outside of Japan for Fullcast Holdings would represent its Stars in the BCG Matrix. These new ventures offer significant growth potential, but currently hold a low market share, requiring substantial investment to establish a foothold. For instance, entering markets like Southeast Asia or North America demands considerable capital for marketing, distribution, and localizing operations.

Fullcast Holdings' development of specialized HR tech solutions, such as advanced predictive analytics for candidate fit and comprehensive employee engagement platforms, positions them in a high-growth market. These innovative offerings move beyond their traditional staffing and outsourcing core. By July 2025, the HR tech market is projected to reach over $38 billion, indicating substantial opportunity.

These new ventures, while promising, are currently in a nascent stage within this competitive landscape. Significant investment in research and development is necessary to refine these technologies and establish market leadership. For instance, implementing AI-driven recruitment tools in 2024 saw an average 30% reduction in time-to-hire for early adopters.

Unproven Service Offerings in Niche Sectors

Unproven service offerings in niche sectors for Fullcast Holdings would be classified as Question Marks in the BCG Matrix. These are ventures into highly specialized areas like AI-driven legal support or quantum computing talent acquisition, where Fullcast has minimal current market share and brand recognition.

These niche services, while potentially high-growth, demand significant upfront investment in specialized talent, technology, and targeted marketing to establish a foothold and demonstrate their value proposition. For instance, a new offering in specialized cybersecurity for the burgeoning space industry would likely start with a very small market share, perhaps less than 1% initially.

- Niche Sector Exploration: Entering specialized markets such as personalized medicine staffing or sustainable energy project outsourcing.

- Low Market Share, High Potential: These offerings begin with a small percentage of the niche market, aiming for rapid growth. For example, a new niche service might capture only 0.5% of its target market in its first year.

- Investment Needs: Requires substantial capital for R&D, specialized recruitment, and tailored marketing campaigns to build credibility and scale.

- Strategic Focus: Success hinges on precise market analysis and strategic positioning to prove viability and gain traction against established players or alternative solutions.

Early-Stage Partnerships for Emerging Workforce Solutions

Early-stage partnerships for emerging workforce solutions, like those with innovative gig economy platforms or niche talent providers for nascent industries, would likely be classified as Question Marks in the BCG Matrix for Fullcast Holdings. These ventures operate in rapidly expanding, dynamic markets, offering significant future potential.

However, Fullcast's initial market penetration and brand recognition within these specialized segments would probably be minimal, reflecting their status as emerging players. This low market share in high-growth areas is the defining characteristic of a Question Mark.

- High Growth Potential: Collaborations with startups in areas like AI-driven recruitment or specialized remote work platforms tap into rapidly expanding sectors. For instance, the global gig economy was projected to reach $455 billion in 2023, with significant growth expected in specialized skill niches.

- Low Market Share: Fullcast's involvement in these early-stage partnerships means their current footprint and influence within these specific emerging solutions are likely to be small.

- Strategic Investment Required: To convert these Question Marks into Stars, Fullcast would need to strategically invest resources, expertise, and capital to build market share and establish a dominant position.

- Risk and Reward: These partnerships represent a high-risk, high-reward scenario, where successful development could lead to significant future market leadership, but failure could result in a loss of investment.

Question Marks represent ventures with low market share in high-growth industries, demanding significant investment to capture potential. Fullcast Holdings' forays into new HR tech solutions, like AI recruitment tools, fit this description, requiring substantial capital for R&D and marketing to compete effectively.

These new service offerings, such as specialized HR tech or niche sector staffing, begin with minimal market penetration, perhaps less than 1% in their target segments. For example, a new AI-driven recruitment platform might capture a tiny fraction of the market initially, necessitating investment to grow.

The success of these Question Marks hinges on strategic investment and market analysis to prove their viability and gain traction. For instance, early adopters of AI recruitment tools in 2024 saw an average 30% reduction in time-to-hire, highlighting the potential payoff for successful development.

| Venture Area | Market Growth | Current Market Share (Est.) | Investment Need |

|---|---|---|---|

| AI Recruitment Tools | High | Low (<1%) | High (R&D, Marketing) |

| Specialized HR Tech | High | Low (<1%) | High (R&D, Talent) |

| Niche Sector Staffing | High | Low (<1%) | High (Marketing, Operations) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.