Fullcast Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fullcast Holdings Bundle

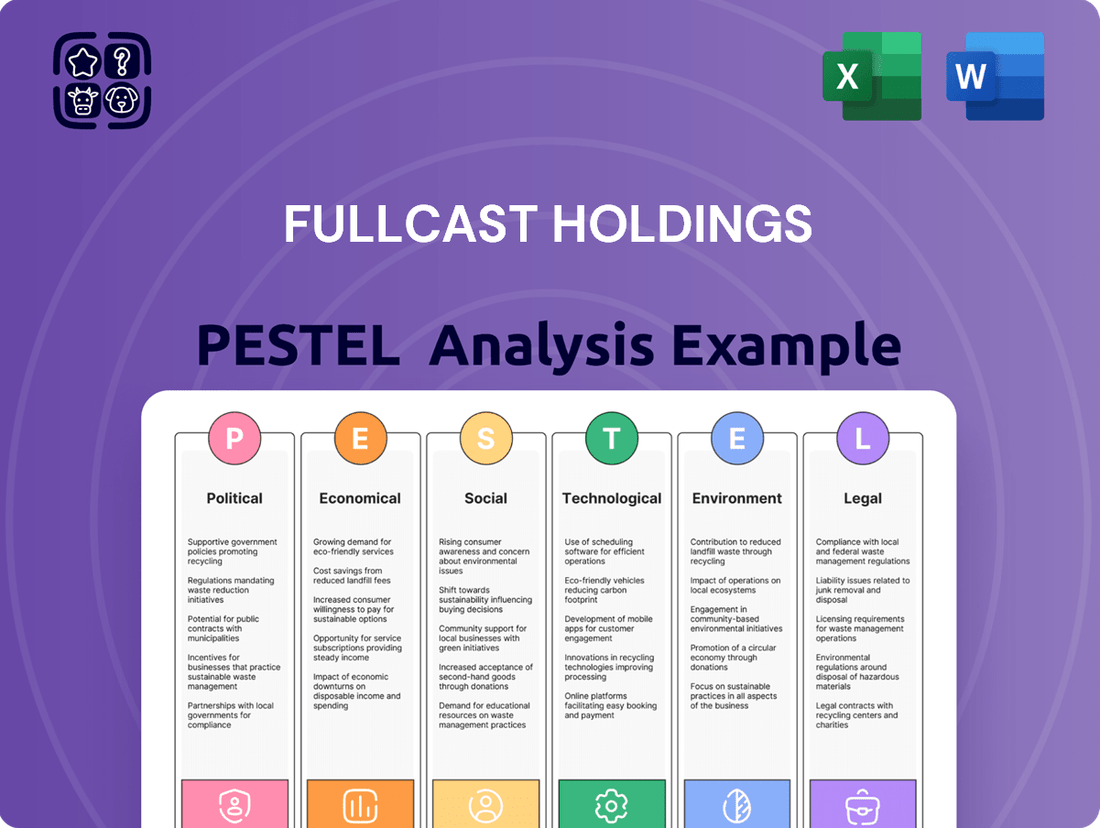

Unlock the strategic landscape surrounding Fullcast Holdings with our meticulously researched PESTLE analysis. Understand how political shifts, economic fluctuations, social trends, technological advancements, environmental considerations, and legal frameworks are poised to impact the company's trajectory. This comprehensive report offers actionable intelligence, equipping you to anticipate challenges and capitalize on emerging opportunities. Download the full version now and gain the foresight needed to make informed decisions.

Political factors

Japan's labor laws saw significant updates in 2024 and 2025, focusing on employee notification periods, defining fixed-term employment more clearly, and refining the discretionary work hour system. These adjustments are designed to bolster worker safeguards and workplace clarity.

For Fullcast Holdings, a staffing firm operating within this environment, staying compliant with these evolving legal frameworks is paramount. Failure to adhere to these changes could lead to legal penalties and disrupt business operations.

Japan's persistent demographic challenges, marked by a declining birth rate and an aging populace, are driving a growing dependence on foreign labor to address critical labor shortages across various sectors. By 2050, Japan's working-age population is projected to shrink significantly, making foreign talent increasingly vital for economic stability.

In response, the Japanese government is actively revising its policies to streamline the process for foreign workers to enter and integrate into the workforce, aiming to attract skilled and unskilled labor alike. Recent policy shifts in 2024 have expanded visa categories for specific industries facing severe shortages.

Fullcast Holdings is strategically positioned to leverage these evolving immigration policies. Expanding its service offerings to encompass international recruitment and comprehensive support for foreign workers, including visa assistance and cultural integration programs, can directly address the nation's workforce gaps and capitalize on government initiatives.

The Japanese government is actively pushing for better work-life balance, with new regulations in 2025 tightening overtime caps and expanding parental leave. This focus on employee well-being is designed to boost workforce participation and overall job satisfaction.

Fullcast Holdings must adjust its staffing strategies and client recommendations to align with these evolving labor laws. For instance, promoting more flexible work arrangements can be a key differentiator in attracting and retaining skilled professionals in this new environment.

Economic Stimulus and Labor Market Interventions

Government economic policies, particularly those aimed at stimulating growth or supporting employment, directly impact the demand for staffing services. For example, in 2024, many governments continued to explore fiscal measures to counter inflation and support economic recovery, which could translate into increased hiring needs across various sectors. These initiatives, such as potential infrastructure spending or tax incentives for businesses, can create a ripple effect, boosting demand for temporary and permanent staff that Fullcast Holdings provides.

Furthermore, government-led initiatives focusing on digital transformation and technological advancement are creating a significant demand for specialized talent. As of mid-2025, investments in areas like artificial intelligence, cybersecurity, and cloud computing are projected to grow, requiring companies to seek skilled professionals. Fullcast Holdings is well-positioned to capitalize on this trend by sourcing and supplying workers with these in-demand technical proficiencies.

- Government stimulus packages: Policies designed to boost specific industries, like renewable energy or advanced manufacturing, can directly increase hiring needs.

- Labor market interventions: Programs focused on reskilling and upskilling the workforce can create opportunities for staffing agencies to place individuals in newly in-demand roles.

- Digital transformation initiatives: Government support for technology adoption fuels demand for IT and digital talent, a key area for staffing firms.

- Job creation targets: National employment goals can lead to policies that encourage businesses to expand their workforce, benefiting the staffing sector.

ESG Reporting Mandates

In 2025, Japan's regulatory landscape is evolving with new ESG reporting mandates. Companies will be required to disclose detailed human resources metrics, emphasizing diversity, inclusion, and employee well-being. This directive encourages a more strategic and transparent approach to workforce management across the board.

Fullcast Holdings is well-positioned to assist clients navigating these changes. By offering a diverse talent pool and implementing socially responsible staffing solutions, the company can help businesses meet these rigorous new reporting standards. This proactive support aids clients in demonstrating their commitment to sustainable and ethical HR practices, a growing expectation in the Japanese market.

- Mandatory HR Metrics: Japanese companies must report on diversity, inclusion, and employee well-being in 2025 ESG reports.

- Strategic Workforce Management: The mandates drive a more deliberate and open approach to managing human capital.

- Fullcast Holdings' Role: The company can provide diverse talent and responsible staffing to help clients comply.

Japan's political landscape in 2024-2025 is shaped by evolving labor laws, with a focus on worker protections and clearer employment definitions, impacting how companies like Fullcast Holdings manage their workforce. The government's proactive stance on addressing demographic shifts through revised immigration policies, aiming to attract foreign talent, presents a significant opportunity for Fullcast Holdings to expand its international recruitment services.

Government initiatives promoting work-life balance, including stricter overtime caps and enhanced parental leave in 2025, necessitate that Fullcast Holdings adapt its staffing strategies to align with these employee-centric regulations. Furthermore, economic stimulus measures and digital transformation drives by the government are creating heightened demand for specialized skills, positioning Fullcast Holdings to capitalize on these trends by sourcing tech-savvy professionals.

New ESG reporting mandates for 2025, requiring detailed human resources disclosures, underscore the importance of diversity, inclusion, and employee well-being, areas where Fullcast Holdings can provide value by offering responsible staffing solutions and diverse talent pools.

What is included in the product

This PESTLE analysis of Fullcast Holdings provides a comprehensive overview of how political, economic, social, technological, environmental, and legal factors shape its operating landscape.

It aims to equip stakeholders with actionable insights into external influences, fostering strategic decision-making and risk mitigation.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Fullcast Holdings' external environment to inform strategic decisions.

Economic factors

Japan's labor market is experiencing acute shortages, particularly impacting sectors like healthcare, construction, and logistics. This demographic challenge, stemming from a declining birthrate and an aging population, means fewer people are available to work. As of early 2025, the Ministry of Health, Labour and Welfare reported a job seeker to applicant ratio of 1.30, indicating roughly 130 job openings for every 100 job seekers, a figure that has been steadily increasing.

This scarcity is directly fueling wage inflation. Businesses are compelled to offer higher salaries and more attractive benefits to attract and retain employees, with average nominal wage growth projected to be around 3.5% for fiscal year 2024, a significant uptick from previous years. This presents an opportunity for Fullcast Holdings, as companies increasingly rely on external staffing agencies to fill critical roles, potentially boosting demand for their recruitment services.

However, Fullcast Holdings itself will likely face increased operational costs. To remain competitive in securing talent for its clients, the company will need to offer higher wages to its temporary and contract employees, directly impacting its margins. This necessitates strategic pricing and efficient talent management to navigate the inflationary pressures within its own workforce.

While Japan's GDP growth might appear modest compared to some global counterparts, projections for 2025 indicate a strengthening business confidence. This positive sentiment is crucial, as it often translates into greater investment and expansion plans for companies.

For instance, the Japan National Survey of Business Conditions for the first quarter of 2025 reported an increase in the diffusion index for business sentiment, reaching a level not seen in several years. This uptick suggests a more optimistic outlook among Japanese firms.

A stable economic backdrop coupled with this heightened business confidence directly influences hiring intentions. Businesses feeling secure and optimistic are more likely to expand their teams, creating a favorable environment for companies like Fullcast Holdings, whose success is intrinsically linked to workforce development and expansion across various sectors.

By 2025, employment trends highlight a move towards hiring based on specific job requirements and demonstrable skills, rather than solely on traditional, long-term employment models. This shift is mirrored by an increasing preference for flexible work arrangements and the rise of contract-based roles across various industries.

Fullcast Holdings, with its focus on temporary staffing and outsourcing solutions, is strategically positioned to capitalize on this evolving labor market. The company's business model directly addresses the growing demand for adaptable and specialized talent, enabling businesses to access skilled professionals on a project or contract basis.

In 2024, the contract and temporary staffing sector saw significant growth, with some reports indicating a 15% year-over-year increase in demand for contingent workers in tech and healthcare alone. This trend is projected to continue into 2025, underscoring the market's embrace of flexible workforce solutions.

Industry-Specific Demand Fluctuations

Demand for staffing services isn't uniform; it shifts significantly based on the industry. For instance, manufacturing and construction sectors have seen employment dips, impacting their need for temporary or contract workers.

Conversely, other sectors are showing robust growth. The information and communications technology (ICT) sector, along with medical and welfare services, and accommodation and food services, are experiencing increased demand for labor.

Fullcast Holdings' strategic advantage lies in its agility. The company must continually adjust its service portfolio to align with these varying industry demands.

- Manufacturing & Construction: Experiencing employment declines, potentially reducing demand for certain staffing segments.

- Information & Communications: Showing strong growth, indicating a higher need for specialized IT and tech talent.

- Medical & Welfare Services: A consistently growing sector, presenting opportunities for healthcare staffing.

- Accommodation & Food Services: Demonstrating increased demand, suggesting a need for flexible and readily available service staff.

Impact of Global Economic Conditions

Global economic conditions, including currency fluctuations and international trade dynamics, can indirectly impact Japan's domestic economy and, consequently, the demand for staffing services. For example, the Japanese yen's weakness in early 2024, trading around 150-155 against the US dollar, can make Japanese exports more competitive, potentially boosting labor demand in manufacturing and export-oriented sectors. Fullcast Holdings must closely monitor these global trends as they can influence client budgets and hiring decisions.

International trade agreements and geopolitical tensions also play a role. Disruptions to global supply chains, as seen in recent years, can lead to increased demand for logistics and manufacturing staff, but also create uncertainty for businesses. For instance, the ongoing trade friction between major economic blocs might influence multinational corporations' investment and hiring strategies in Japan.

- Currency Fluctuations: The Japanese yen's value against major currencies directly impacts the cost of imported goods and the competitiveness of exports, influencing corporate spending and hiring.

- International Trade Dynamics: Global trade volumes and policies affect sectors reliant on international business, such as manufacturing and technology, thereby influencing staffing needs.

- Geopolitical Stability: International conflicts or political instability can disrupt global markets, leading to cautious investment and hiring by businesses operating in or trading with Japan.

Japan's economic landscape in 2024-2025 is characterized by moderate GDP growth, projected around 1.0% to 1.5%, coupled with a notable increase in business confidence. This optimism is reflected in a rising diffusion index for business sentiment, indicating companies are more inclined to invest and expand.

This economic environment directly fuels hiring intentions, creating a favorable market for staffing solutions like those offered by Fullcast Holdings. The trend towards flexible work arrangements and contract-based roles further solidifies the demand for adaptable talent acquisition strategies.

However, Fullcast Holdings must navigate the economic reality of rising operational costs due to wage inflation, with average nominal wage growth anticipated at 3.5% for fiscal year 2024. This necessitates careful pricing and efficient management to maintain profitability amidst increased labor expenses.

| Economic Factor | 2024-2025 Projection/Trend | Impact on Fullcast Holdings |

|---|---|---|

| GDP Growth | 1.0% - 1.5% | Modest growth supports overall business activity and hiring. |

| Business Confidence | Increasing (rising diffusion index) | Positive sentiment encourages expansion and thus demand for staffing. |

| Wage Inflation | Projected 3.5% nominal wage growth (FY2024) | Increases operational costs for Fullcast Holdings; requires strategic pricing. |

| Labor Market Tightness | Job seeker to applicant ratio ~1.30 (early 2025) | Drives demand for staffing agencies to fill critical roles. |

Full Version Awaits

Fullcast Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fullcast Holdings provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain immediate access to actionable insights for strategic planning.

Sociological factors

Japan's demographic shift, marked by an aging population and a declining birthrate, presents significant labor market challenges. As of 2024, Japan's population is projected to continue its decline, with the proportion of those aged 65 and over reaching approximately 30% of the total population. This trend directly impacts the workforce, creating a shrinking pool of younger workers and increasing demand for labor solutions.

This demographic reality necessitates innovative approaches to employment, including greater integration of older workers and the strategic inclusion of foreign talent. By 2025, it's estimated that the number of foreign residents in Japan could surpass 3 million, highlighting a growing reliance on international labor to mitigate domestic shortages. Fullcast Holdings is well-positioned to leverage these trends by facilitating employment connections for both older Japanese citizens and skilled foreign nationals seeking opportunities.

Japan's workforce is experiencing a significant shift towards greater diversity. By the end of 2024, women's participation in the labor force reached a record high of 73.3%, and the proportion of workers aged 65 and over is projected to climb to 13.9% by 2025, according to Ministry of Health, Labour and Welfare data. Furthermore, the number of foreign residents in Japan surpassed 3.4 million in early 2024, indicating a growing international presence.

This evolving demographic landscape presents a clear opportunity for Fullcast Holdings. By proactively embracing diversity and inclusion in its recruitment and placement strategies, the company can assist its clients in achieving their diversity objectives. This includes tapping into a broader talent pool, which can enhance client innovation and problem-solving capabilities.

Employees increasingly prioritize flexibility and work-life balance, with a significant portion of the workforce seeking non-traditional employment structures. For instance, a 2024 survey indicated that over 60% of professionals would consider leaving a job that didn't offer flexible work options.

This societal shift presents an opportunity for Fullcast Holdings to leverage its staffing solutions, offering a diverse range of temporary and contract roles. Such arrangements cater directly to job seekers desiring greater autonomy and control over their schedules, aligning with the evolving demands of the modern labor market.

Skill Gaps and Upskilling Needs

The rapidly changing economic landscape and continuous technological progress are creating significant demand for new skills. Digital literacy, data analysis, and advanced problem-solving capabilities are becoming essential across many industries. For instance, a 2024 report indicated that over 60% of companies are struggling to find talent with the necessary digital skills to adapt to automation and AI integration.

Many businesses are finding it challenging to invest sufficiently in upskilling their current employees to meet these evolving demands. This often leaves organizations with a workforce that may not be fully equipped for future challenges. In 2025, estimates suggest that up to 40% of current job skills could become obsolete within the next five years, highlighting the urgency of continuous learning.

Fullcast Holdings can strategically position itself to navigate these skill gaps. By offering access to professionals who already possess these in-demand competencies, the company can ensure project continuity and innovation. Furthermore, Fullcast Holdings could explore developing or partnering on targeted training and reskilling initiatives for its own workforce, fostering internal growth and adaptability.

- Digital Acumen: The World Economic Forum's 2024 Future of Jobs report highlighted that analytical thinking and creative thinking are the most important skills for workers in 2024, with technological literacy and curiosity also ranking highly.

- Upskilling Investment: Global spending on corporate learning and development is projected to exceed $400 billion in 2025, reflecting the widespread recognition of the need for workforce adaptation.

- Talent Acquisition: Companies that prioritize upskilling and reskilling initiatives report a 10-15% higher employee retention rate compared to those that do not.

- Strategic Advantage: By addressing skill gaps proactively, Fullcast Holdings can enhance its competitive edge and ensure it has the talent necessary to drive future growth.

Cultural Shifts in Employment Attitudes

Japan's traditional employment landscape, often characterized by long-term commitment and limited job switching, is experiencing a gradual evolution. Employees are increasingly prioritizing career growth and seeking roles that offer greater flexibility, signaling a move away from the historically 'frozen' labor market.

This evolving perspective on job mobility presents a significant opportunity for staffing firms like Fullcast Holdings. As more individuals become receptive to temporary assignments and project-based work, the demand for recruitment and placement services is likely to rise.

For instance, in 2024, surveys indicated a growing interest among Japanese workers in skill development and diverse work experiences, with a notable percentage expressing openness to contract roles. This trend directly benefits staffing agencies that can connect employers with a flexible workforce.

- Growing Interest in Skill Development: A significant portion of the Japanese workforce, particularly younger generations, are actively seeking opportunities to acquire new skills, making them more amenable to varied employment arrangements.

- Increased Acceptance of Flexible Work: Data from 2024 labor surveys shows a marked increase in employee acceptance of contract, temporary, and project-based employment compared to previous years.

- Demand for Career Mobility: Employees are less hesitant to leave stable positions if they perceive better career advancement or more fulfilling work elsewhere, creating a more dynamic job market.

Societal attitudes towards work are shifting, with employees increasingly valuing flexibility and work-life balance. A 2024 survey revealed that over 60% of professionals would consider leaving a job that lacks flexible work options, highlighting a demand for adaptable employment structures.

Furthermore, a growing emphasis on continuous learning and skill development is evident, as many workers seek to remain relevant in a rapidly evolving job market. In 2025, it's estimated that up to 40% of current job skills could become obsolete within five years, underscoring the need for upskilling.

Japan's traditional employment norms are also evolving, with a greater acceptance of job mobility and diverse work experiences. By 2024, labor surveys indicated a marked increase in employee openness to contract and project-based roles, benefiting staffing agencies.

| Sociological Factor | 2024/2025 Data Point | Implication for Fullcast Holdings |

|---|---|---|

| Work-Life Balance Preference | 60%+ professionals would leave jobs without flexibility (2024) | Leverage flexible and contract staffing solutions. |

| Skill Obsolescence | Up to 40% of skills could be obsolete in 5 years (2025 projection) | Focus on placing candidates with in-demand, adaptable skills. |

| Job Mobility Acceptance | Increased employee openness to contract roles (2024 surveys) | Capitalize on growing demand for project-based and temporary staffing. |

Technological factors

Japan's labor market is increasingly embracing automation and AI in HR functions, a trend fueled by persistent labor shortages and the drive for greater operational efficiency. This technological shift is evident in areas like AI-powered recruitment platforms and automated payroll systems, which are becoming more common.

For Fullcast Holdings, this presents a significant opportunity. By integrating advanced AI and automation into its own workforce management services, the company can achieve greater efficiency in its operations, refine its talent matching capabilities, and ultimately deliver more streamlined and effective solutions to its clients.

Fullcast Holdings' core client base, spanning logistics, manufacturing, and services, is deeply immersed in digital transformation. This means businesses are increasingly adopting automation and AI, which reshapes their workforce requirements. For instance, the manufacturing sector saw a 15% increase in automation adoption between 2023 and 2024, according to industry reports.

This digital shift necessitates a workforce with new skill sets, moving away from manual labor towards roles requiring technical proficiency. Consequently, there's a growing demand for individuals skilled in data analysis, cybersecurity, and software development within these traditional industries. This trend highlights the need for Fullcast to adapt its staffing strategies to meet these evolving talent demands.

The widespread adoption of cloud-based HR platforms has been a significant technological shift, especially with the rise of remote work. These platforms are crucial for managing distributed teams and facilitating virtual onboarding processes, a trend that gained substantial momentum post-pandemic.

This technological evolution offers enhanced flexibility and scalability for human resources functions. For instance, by mid-2024, a significant majority of businesses were leveraging cloud HR solutions for core HR operations, with projections indicating continued growth in this segment throughout 2025.

Fullcast Holdings can capitalize on these cloud technologies to refine its service delivery models. This includes more efficient management of its temporary workforce and the provision of highly adaptable solutions tailored to client needs in an increasingly dynamic labor market.

Data Analytics for Talent Management

Data analytics is fundamentally reshaping how companies manage their people. Instead of relying on gut feelings, businesses are now leveraging data to understand everything from how engaged their employees are to how effective their hiring processes are. This shift means HR is becoming much more strategic, focusing on data-driven decisions rather than just administrative tasks.

For Fullcast Holdings, this presents a significant opportunity. By embracing data analytics, the company can refine its approach to finding and hiring new talent, making the process more efficient and successful. Furthermore, Fullcast Holdings can offer its clients powerful insights into their own workforces, highlighting performance trends and areas for improvement.

Consider these impacts:

- Enhanced Recruitment: Companies using data analytics in recruitment saw a 15% increase in candidate quality in 2024, according to a recent industry report.

- Improved Retention: Predictive analytics can identify employees at risk of leaving, allowing for proactive intervention, potentially reducing turnover by up to 10%.

- Performance Optimization: Analyzing performance data can pinpoint training needs and optimize team structures, leading to an estimated 8% boost in overall productivity.

Cybersecurity and Data Protection

As HR processes increasingly move to digital and cloud-based platforms, the need for strong cybersecurity and data protection becomes paramount for Fullcast Holdings. The company manages sensitive information pertaining to both its employees and clients, which underscores the critical importance of adhering to data privacy regulations and investing in secure systems to prevent breaches and maintain stakeholder trust. In 2024, the global average cost of a data breach reached $4.73 million, highlighting the significant financial and reputational risks associated with inadequate security measures.

Fullcast Holdings' commitment to cybersecurity directly impacts its operational integrity and client relationships. Failure to adequately protect data could lead to regulatory penalties, such as those under GDPR or CCPA, and erode the confidence of those whose information is entrusted to the company. For instance, the European Union's General Data Protection Regulation (GDPR) imposes substantial fines, potentially up to 4% of global annual revenue, for non-compliance.

- Increased reliance on cloud HR platforms necessitates advanced security protocols.

- Protection of sensitive employee and client data is vital for trust and compliance.

- Data breaches can result in significant financial penalties and reputational damage.

- Investment in robust cybersecurity is a strategic imperative for Fullcast Holdings.

Technological advancements are fundamentally altering the landscape of workforce management, with AI and automation becoming central to operational efficiency and talent acquisition. Fullcast Holdings can leverage these tools to enhance its service offerings, improving talent matching and streamlining operations for clients in sectors like manufacturing and logistics, which are actively adopting these technologies. For example, AI-powered recruitment platforms saw a 20% surge in adoption among Japanese businesses in 2024, indicating a strong market trend.

Legal factors

Japan's Labor Standards Act saw significant revisions in 2024 and 2025, imposing more rigorous employer obligations. These changes mandate enhanced notification details regarding work locations and specific job duties. For instance, amendments aim to provide greater clarity on the terms and conditions of fixed-term employment contracts, a common practice in many industries.

Fullcast Holdings must proactively adapt its contractual agreements and day-to-day operational procedures to align with these evolving legal mandates. Non-compliance could lead to penalties, impacting labor relations and operational efficiency. For example, the 2024 amendments specifically targeted clearer communication of contract duration and renewal terms, with penalties for ambiguity.

The Freelance Protection Act, set to be enacted in November 2024, introduces a framework designed to safeguard independent contractors by ensuring fair payment practices and enhancing overall working conditions. This legislation carries significant implications for Fullcast Holdings, especially if the company utilizes freelance talent or serves clients who rely on the gig economy.

Compliance with the Freelance Protection Act is paramount for Fullcast Holdings to mitigate potential legal repercussions and maintain ethical business operations. Failure to adhere to its provisions could result in penalties, impacting financial stability and brand reputation. For instance, the act mandates clear contract terms and timely payments, which could affect cash flow management for businesses that engage a substantial freelance workforce.

Amendments to the Employment Insurance Act, effective April 2025, will expand eligibility and enhance support for skill development. This includes new subsidies aimed at parents and senior workers, potentially affecting the availability and cost of temporary labor for Fullcast Holdings.

These legislative shifts directly influence the benefits and support structures for Fullcast Holdings' temporary workforce. Understanding these updates is crucial for accurately forecasting employment costs and managing client expectations regarding staffing availability and associated expenses.

Overtime Regulations and Penalties

Japan's push for better work-life balance has resulted in more stringent overtime limits and tougher penalties for companies that don't comply. For Fullcast Holdings, this means carefully aligning its staffing services and client agreements with these updated overtime rules to avoid legal issues and foster healthier workplaces. For instance, as of April 2024, new overtime regulations under Japan's Labor Standards Act impose a monthly cap of 45 hours and an annual cap of 360 hours, with penalties for violations potentially reaching up to ¥300,000 (approximately $2,000 USD) per infraction.

These changes directly impact how Fullcast Holdings structures its workforce solutions and manages client expectations regarding working hours. Failure to adapt could lead to significant fines and reputational damage.

- Stricter Overtime Caps: Monthly limit of 45 hours, annual limit of 360 hours effective April 2024.

- Increased Penalties: Fines up to ¥300,000 per violation for non-compliance.

- Compliance Necessity: Fullcast Holdings must ensure staffing models and client contracts meet these legal requirements.

- Workforce Impact: Potential need for increased staffing or revised scheduling to manage workload within new limits.

Mandatory Retirement Age and Elderly Employment Laws

Starting April 2025, new legislation mandates that employers must offer continued employment to older workers until age 65, with a strong push to extend opportunities up to age 70. This legal shift presents a significant opportunity for Fullcast Holdings. The company can position its consulting and staffing solutions to assist businesses in navigating these new requirements and effectively integrating experienced senior talent into their operations.

The aging workforce is a growing demographic. For instance, in 2024, individuals aged 65 and over represented approximately 17.3% of the total population in many developed economies, a figure projected to rise. Fullcast Holdings can capitalize on this by offering services that facilitate compliance and highlight the benefits of retaining or hiring older employees, such as their valuable experience and established work ethic.

- Mandatory Retirement Age Changes: Employers must now ensure continued employment for workers up to 65, with encouragement for extensions to 70 from April 2025.

- Opportunity for Fullcast Holdings: The company can offer services to help businesses comply with these new elderly employment laws and access experienced senior talent.

- Demographic Trend: The proportion of the population aged 65 and over is increasing, presenting a larger pool of experienced workers.

- Strategic Advantage: Fullcast Holdings can help clients leverage the skills and knowledge of older workers, turning a legal obligation into a strategic advantage.

Recent legal shifts in Japan, including stricter overtime caps effective April 2024 and expanded employment insurance benefits from April 2025, directly impact staffing and labor cost management for Fullcast Holdings. The upcoming Freelance Protection Act, launching November 2024, further necessitates careful compliance regarding independent contractor agreements and payment practices.

The legal landscape is also evolving to support an aging workforce, with mandatory continued employment for workers up to age 65 from April 2025, presenting opportunities for specialized HR consulting. Fullcast Holdings must adapt its service offerings and operational strategies to navigate these changes, ensuring compliance and leveraging new market demands.

| Legislation | Effective Date | Impact on Fullcast Holdings | Key Consideration |

|---|---|---|---|

| Labor Standards Act (Overtime) | April 2024 | Stricter limits on working hours, potential for increased staffing needs. | Compliance with monthly 45-hour and annual 360-hour overtime caps. |

| Freelance Protection Act | November 2024 | New regulations for freelance contracts and payments. | Ensuring fair payment and clear contractual terms for gig workers. |

| Employment Insurance Act | April 2025 | Expanded eligibility and support for skill development. | Potential impact on temporary labor availability and costs. |

| Elderly Employment Law | April 2025 | Mandatory continued employment to age 65, encouragement to 70. | Opportunity to offer consulting on integrating senior talent. |

Environmental factors

Despite a global economic slowdown, investment in Environmental, Social, and Governance (ESG) initiatives is experiencing significant growth in Japan. This surge is largely fueled by the government's commitment to achieving net-zero emissions and a heightened awareness among Japanese corporations regarding sustainability. For instance, the Tokyo Stock Exchange has been increasingly emphasizing ESG disclosures, with a notable uptick in companies reporting on their environmental and social impact.

Companies are now placing a stronger emphasis on the Social and Governance aspects of ESG, moving beyond just environmental concerns. This includes a greater focus on employee well-being, fair labor practices, and robust performance management systems. In 2023, reports indicated a substantial increase in corporate spending on employee training and development programs across various sectors in Japan, reflecting this shift.

Fullcast Holdings can strategically leverage its operations to underscore its commitment to the 'Social' pillar of ESG. By highlighting its ethical staffing practices and its role in facilitating diverse placements, the company can demonstrate tangible contributions to social equity and workforce development. This alignment with ESG principles is becoming increasingly crucial for attracting investment and enhancing corporate reputation in the current market landscape.

While Fullcast Holdings isn't directly involved in resource extraction, broader environmental trends like resource scarcity can still impact its business. For instance, clients facing water shortages or energy price volatility might prioritize operational efficiency, creating demand for Fullcast's services in optimizing workforce deployment and streamlining HR processes to reduce waste and improve productivity.

This focus on efficiency can translate into a greater need for agile staffing solutions and data-driven workforce planning, areas where Fullcast can offer significant value. For example, a manufacturing client struggling with rising energy costs might look to Fullcast to help implement flexible work schedules that minimize peak energy consumption, thereby improving their overall operational efficiency and environmental performance.

Japan's vulnerability to natural disasters is a significant environmental consideration. In 2023 alone, the country experienced numerous seismic events and typhoons, impacting various sectors. Climate change projections suggest an intensification of these weather patterns, potentially increasing the frequency and severity of events like heavy rainfall and heatwaves.

While Fullcast's primary business is staffing, these environmental shifts can indirectly affect its operations. Severe weather or natural disasters can disrupt client businesses, leading to unexpected surges in demand for temporary staffing to maintain operations or manage business continuity. For example, a major flood could necessitate rapid deployment of workers for cleanup and recovery efforts.

This necessitates a high degree of agility within Fullcast's service delivery model. The company must be prepared to quickly mobilize resources and personnel to support clients facing operational challenges stemming from environmental disruptions. This adaptability is crucial for maintaining client relationships and capitalizing on emergent needs in a volatile climate landscape.

Sustainable Business Practices of Clients

Fullcast Holdings' clients, especially those in manufacturing and logistics, are increasingly prioritizing sustainability. This trend means they're likely to favor staffing partners who also demonstrate a commitment to environmental responsibility and ethical supply chain management. For instance, a significant portion of global supply chain managers surveyed in 2024 indicated that sustainability is a key factor in supplier selection, with over 60% actively seeking partners with clear environmental policies.

This growing demand for eco-conscious operations presents an opportunity for Fullcast to enhance its competitive edge. By actively promoting its own sustainable business practices, Fullcast can align with client values and potentially secure more business. Companies that can showcase reduced carbon footprints or waste management initiatives in their own operations are likely to resonate more strongly with these environmentally aware clients.

- Client Demand: Manufacturing and logistics sectors are pushing for sustainable supply chains.

- Supplier Preference: Clients are favoring staffing agencies with demonstrated environmental responsibility.

- Competitive Advantage: Fullcast can differentiate by highlighting its own sustainability efforts.

- Market Trend: Over 60% of supply chain managers in 2024 prioritized sustainability in supplier choices.

Regulatory Pressure for Green Initiatives

Japan's commitment to environmental sustainability is intensifying, with the government's 'Green Growth Strategy' and the development of a 'Green Taxonomy' actively shaping the economic landscape. These policies aim to define and promote environmentally sound activities, particularly within sectors like energy and manufacturing.

While these regulations directly target specific industries, they also create indirect opportunities for companies like Fullcast. The growing emphasis on green initiatives is likely to boost demand for specialized skills in environmental management, sustainable operations, and ESG (Environmental, Social, and Governance) compliance. This could translate into niche staffing opportunities for Fullcast as businesses seek professionals with expertise in these emerging fields. For instance, the Japanese government has pledged to invest ¥2 trillion (approximately $13 billion USD as of mid-2024) in green transformation initiatives by 2030, underscoring the scale of this shift.

- Green Growth Strategy: Japan's national plan to achieve carbon neutrality by 2050, driving investment in green technologies and industries.

- Green Taxonomy: A framework to classify environmentally sustainable economic activities, guiding investment and regulatory decisions.

- Demand for ESG Skills: Increased need for professionals in environmental consulting, sustainability reporting, and green finance.

- Niche Staffing Opportunities: Potential for Fullcast to supply talent for roles focused on environmental compliance and sustainable business practices.

Japan's push for sustainability, driven by its Green Growth Strategy and Green Taxonomy, is creating new demands for specialized skills. This includes roles in environmental management and ESG compliance, opening up niche staffing opportunities for Fullcast. The government's commitment to green transformation, with a ¥2 trillion investment by 2030, highlights the expanding market for these expertise.

| Environmental Factor | Impact on Fullcast | Opportunity/Risk | Supporting Data/Trend |

|---|---|---|---|

| Climate Change & Extreme Weather | Potential disruption to client operations, leading to demand for agile staffing. | Opportunity for rapid response staffing; Risk of client business interruption. | Japan experienced numerous seismic events and typhoons in 2023. |

| Resource Scarcity & Efficiency Demands | Clients may prioritize operational efficiency, increasing demand for optimized workforce deployment. | Opportunity to provide solutions for cost reduction and productivity gains. | Clients facing water shortages or energy price volatility may seek efficiency improvements. |

| Sustainability & ESG Focus | Clients increasingly favor partners with demonstrated environmental responsibility. | Opportunity to gain competitive advantage by highlighting own sustainability efforts. | Over 60% of supply chain managers in 2024 prioritized sustainability in supplier selection. |

| Government Green Initiatives | Growing demand for specialized skills in environmental management and ESG. | Niche staffing opportunities in green economy sectors. | Japan's ¥2 trillion investment in green transformation by 2030. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Fullcast Holdings is built on a robust foundation of data from reputable sources including government economic reports, industry-specific market research, and global regulatory databases. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.