Fuchs Petrolub SE PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuchs Petrolub SE Bundle

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal factors shaping Fuchs Petrolub SE's landscape. Our PESTLE analysis dives deep into these external forces, revealing potential opportunities and threats. Gain the strategic foresight needed to navigate this dynamic market. Download the full version now for actionable intelligence.

Political factors

Fuchs Petrolub SE operates within a framework heavily influenced by governmental regulations affecting chemical production and environmental impact. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation dictates stringent requirements for chemical substances, impacting product development and market access. Failure to comply can lead to significant fines and operational disruptions.

Changes in industrial emissions standards, such as those related to volatile organic compounds (VOCs) or specific hazardous substances, directly affect Fuchs Petrolub's manufacturing processes. For example, stricter emission limits might require investment in new abatement technologies or reformulation of lubricants, potentially increasing production costs. The company's 2023 sustainability report highlights ongoing efforts to reduce its environmental footprint, aligning with evolving global environmental policies.

Navigating the diverse and often changing regulatory environments across its global markets, from the United States' EPA standards to China's environmental protection laws, is a critical challenge. Fuchs Petrolub must maintain robust compliance strategies and invest in research and development to adapt its product portfolio and manufacturing practices, ensuring continued market access and avoiding penalties that could impact its financial performance.

Global trade policies, including tariffs and trade agreements, significantly shape Fuchs Petrolub SE's operational landscape. For instance, the European Union's trade relations, including agreements with countries like the United Kingdom post-Brexit, directly affect the cost of importing base oils and exporting lubricants. Fluctuations in tariffs, such as those considered or implemented by major economies, can add substantial costs to Fuchs' supply chain, impacting its ability to compete on price in international markets.

Fuchs Petrolub SE's operations are significantly influenced by the political stability of its key markets and sourcing regions. For instance, the company's presence in Europe, a significant market, necessitates careful monitoring of the ongoing political and economic landscape, including the implications of the war in Ukraine on energy prices and supply chains.

Geopolitical tensions and conflicts, such as those impacting the Middle East, can disrupt the flow of crude oil, a primary feedstock for lubricants, leading to increased raw material costs and logistical challenges. In 2024, continued geopolitical instability in various regions could further exacerbate these issues, potentially impacting Fuchs's profitability and operational efficiency.

To counter these risks, Fuchs Petrolub has strategically diversified its operational footprint and supply chains. This approach, evidenced by its numerous production sites and sales organizations across the globe, aims to reduce reliance on any single region and ensure business continuity even amidst localized political unrest or conflict.

Industrial Policies and Subsidies

Government industrial policies significantly shape the operating environment for Fuchs Petrolub SE. Incentives for green technologies, such as those seen in the European Union's Green Deal initiatives, can foster demand for specialized lubricants used in electric vehicles and renewable energy infrastructure. For instance, Germany's 2024 budget allocated substantial funds towards electromobility and hydrogen technologies, directly impacting the market for advanced lubricants.

Conversely, policies that might phase out or disincentivize traditional internal combustion engine technologies could present challenges for Fuchs' established product lines. The ongoing global shift towards electrification, supported by government mandates and subsidies in markets like China and the United States, necessitates a strategic pivot towards lubricants for new energy vehicles. This dynamic creates both opportunities for innovation and potential headwinds for legacy products.

Key policy impacts for Fuchs Petrolub SE include:

- Increased demand for specialized lubricants driven by government support for electric vehicles and renewable energy sectors.

- Potential for reduced demand in traditional lubricant segments due to policies favoring electrification and emissions reduction.

- Opportunities in emerging markets where governments are actively promoting industrial modernization and green transitions, often with associated subsidies.

Political Risk in Key Markets

Political risk, including the potential for nationalization, policy shifts, or bureaucratic challenges, significantly influences Fuchs Petrolub SE's investment choices and strategic outlook in its primary markets. A stable political climate, characterized by predictable governance, is crucial for attracting foreign direct investment and fostering sustained business expansion.

Conversely, heightened political instability can discourage investment and introduce operational unpredictability for Fuchs. For instance, in 2024, geopolitical tensions in Eastern Europe, a region where Fuchs operates, led to increased supply chain disruptions and regulatory scrutiny for many industrial companies.

- Geopolitical Instability: Ongoing conflicts and trade disputes in regions like Eastern Europe and parts of the Middle East create uncertainty for Fuchs' operations and supply chains.

- Regulatory Changes: Evolving environmental regulations and trade policies in major markets such as the EU and North America can impact product development and market access.

- Government Support/Intervention: The level of government support for the automotive and industrial sectors, or potential interventions, can affect demand for lubricants and specialty fluids.

- Political Stability in Emerging Markets: Fuchs' strategic growth in emerging economies is directly tied to the political stability and policy consistency within those nations.

Government policies directly influence Fuchs Petrolub's market opportunities, particularly through incentives for electric vehicles and renewable energy, as seen in Germany's 2024 budget supporting electromobility. Conversely, regulations phasing out traditional internal combustion engines necessitate adaptation to lubricants for new energy vehicles, a trend supported by government mandates in China and the US.

Geopolitical instability, such as conflicts in Eastern Europe and the Middle East, impacts Fuchs' supply chains and raw material costs, with continued tensions in 2024 posing ongoing risks. Political stability in emerging markets is also crucial for Fuchs' strategic growth, as policy consistency directly affects investment and operational predictability.

Fuchs Petrolub must navigate diverse global regulations, like the EU's REACH, to ensure product compliance and market access, while adapting to evolving industrial emissions standards requires investment in new technologies. Trade policies, including tariffs and agreements like those post-Brexit, also significantly affect the cost of raw materials and finished goods, influencing international competitiveness.

| Political Factor | Impact on Fuchs Petrolub SE | Example/Data (2024/2025 Focus) |

|---|---|---|

| Environmental Regulations | Increased compliance costs, R&D investment for sustainable products | EU's Green Deal driving demand for EV lubricants; stricter emission standards requiring technology upgrades. |

| Industrial Policy & Subsidies | Opportunities in green tech sectors, challenges for legacy products | German government funding for hydrogen tech (2024); US/China EV subsidies impacting lubricant demand shifts. |

| Geopolitical Stability & Trade | Supply chain disruptions, raw material price volatility, market access | Ongoing Eastern European conflicts impacting logistics; potential tariff changes affecting import/export costs. |

| Political Stability in Emerging Markets | Crucial for strategic growth and investment decisions | Policy consistency in key Asian and African markets directly influences Fuchs' expansion plans. |

What is included in the product

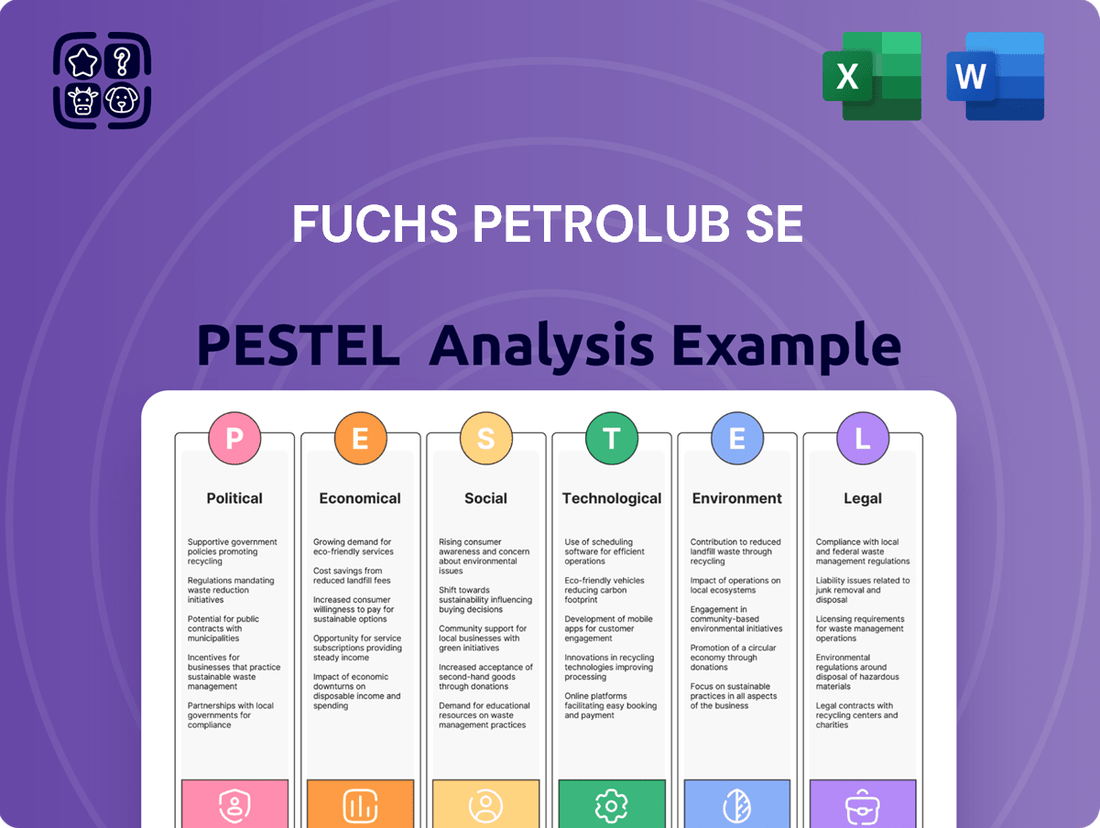

This PESTLE analysis examines the external macro-environmental factors impacting Fuchs Petrolub SE, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

A concise PESTLE analysis of Fuchs Petrolub SE offers a clear overview of external factors, simplifying complex market dynamics for strategic decision-making and reducing the burden of extensive research.

Economic factors

Fuchs Petrolub SE's fortunes are intrinsically linked to the health of the global economy and the pace of industrial output. As demand for lubricants stems directly from manufacturing, automotive, and heavy industry, a strong global economic environment fuels increased machinery usage and vehicle activity, directly benefiting lubricant sales. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from 2023, indicating a generally supportive, albeit moderate, economic backdrop for Fuchs.

Conversely, any significant slowdown in industrial production or a broader economic downturn poses a direct threat to lubricant demand. A contraction in manufacturing output, as seen in some regions during periods of global uncertainty, translates to less machinery in operation and reduced vehicle miles traveled, consequently dampening the need for lubricants. For example, if global industrial production were to contract by 1-2% in a given year, Fuchs could anticipate a corresponding negative impact on its sales volumes.

The cost of base oils and additives, the core components of lubricants, is highly susceptible to fluctuations. These price swings are largely driven by the volatile nature of crude oil prices and the intricate balance of global supply and demand. For instance, in early 2024, crude oil prices saw periods of significant upward movement, directly impacting the cost of these essential raw materials for lubricant manufacturers like Fuchs Petrolub.

These input cost variations directly affect Fuchs Petrolub's production expenses and, consequently, its profit margins. Managing these price swings is crucial for maintaining profitability. The company's ability to implement robust hedging strategies and sophisticated supply chain management is key to mitigating the financial impact of such volatility.

As a global player, Fuchs Petrolub SE operates across many countries, dealing with various currencies. This exposure means that shifts in exchange rates can significantly impact its financial performance. For example, if the Euro strengthens, Fuchs' products become pricier for buyers using other currencies, potentially dampening export sales.

Furthermore, a stronger Euro can decrease the euro-denominated value of profits earned in foreign markets. In 2023, the average EUR/USD exchange rate hovered around 1.08, a level that could impact the translation of earnings from the significant US market.

To navigate these currency risks, Fuchs Petrolub SE likely employs strategies such as hedging. These financial tools help to lock in exchange rates for future transactions, thereby safeguarding revenues and maintaining predictable profitability against currency volatility.

Inflationary Pressures and Interest Rates

Rising inflation in 2024 and 2025 is a significant concern for Fuchs Petrolub SE, potentially increasing operational costs for essential inputs like raw materials, energy, and labor. For instance, the average inflation rate in the Eurozone was projected to be around 2.5% in 2024, impacting production expenses. This necessitates careful management of pricing strategies to maintain competitive positioning and protect profit margins.

Changes in interest rates, particularly those set by the European Central Bank, directly influence Fuchs' cost of capital. Higher interest rates in 2024-2025 could make borrowing for new investments or expanding existing facilities more expensive, potentially slowing down capital expenditure plans. This financial dynamic requires a strategic balance between cost control measures and maintaining market-competitive pricing for its lubricant products.

- Increased Operating Costs: Inflationary pressures are expected to push up costs for key inputs like base oils and additives throughout 2024-2025.

- Pricing Strategy Challenges: Fuchs must navigate the delicate balance of passing on increased costs to customers without losing market share.

- Impact on Investment Decisions: Rising interest rates can increase the hurdle rate for new projects, influencing the company's capital allocation.

- Financial Performance Sensitivity: Fluctuations in interest rates can affect the cost of servicing debt and impact overall profitability.

Demand from Emerging Markets

The burgeoning economic development and rapid industrialization across emerging markets represent a substantial avenue for growth for Fuchs Petrolub SE. As these economies mature, their demand for both industrial and automotive lubricants is projected to climb significantly. For instance, by 2025, Asia-Pacific, a key emerging region, is expected to account for over 40% of global lubricant demand growth, driven by manufacturing and automotive sector expansion.

This increasing demand translates into considerable opportunities for Fuchs Petrolub. The company's extensive product portfolio, covering a wide range of industrial applications and automotive needs, positions it well to capitalize on this trend. Emerging markets are crucial for Fuchs, contributing a growing share of its overall revenue, with specific regions like China and India showing particularly strong upward trajectories in lubricant consumption.

However, navigating these dynamic markets is not without its complexities. Economic instability, including currency fluctuations and inflation, can impact profitability. Furthermore, political risks and the diverse, often evolving, regulatory landscapes in different emerging economies require careful management and strategic adaptation from Fuchs Petrolub to ensure sustained success.

- Projected Growth: Emerging markets are anticipated to drive a significant portion of global lubricant demand growth through 2025.

- Key Sectors: Industrial and automotive sectors are the primary drivers of lubricant demand in these expanding economies.

- Regional Focus: Asia-Pacific, particularly China and India, are identified as high-growth regions for lubricant consumption.

- Challenges: Economic volatility, political risks, and varying regulatory environments present ongoing hurdles for companies operating in these markets.

Global economic growth underpins Fuchs Petrolub's demand, with a projected 3.2% global growth in 2024 by the IMF suggesting a supportive, if moderate, environment. Conversely, economic slowdowns directly reduce machinery use and vehicle activity, impacting lubricant sales. For instance, a 1-2% contraction in global industrial production could negatively affect Fuchs' sales volumes.

Input costs for base oils and additives are volatile, heavily influenced by crude oil prices. Early 2024 saw upward movements in crude, directly raising these essential material costs for Fuchs. This necessitates robust hedging and supply chain management to protect profit margins.

Currency fluctuations also play a significant role, with a stronger Euro potentially reducing export competitiveness and the value of foreign earnings. The average EUR/USD rate around 1.08 in 2023 highlights this sensitivity. Inflationary pressures, with Eurozone inflation around 2.5% in 2024, increase operational costs and necessitate careful pricing strategies.

Interest rate hikes, such as those by the ECB, can increase the cost of capital, potentially slowing investment. Emerging markets, particularly Asia-Pacific, are key growth drivers, with over 40% of global lubricant demand growth expected by 2025, though economic and political instability remain challenges.

| Economic Factor | Impact on Fuchs Petrolub SE | 2024/2025 Data/Projections |

| Global Economic Growth | Drives demand for lubricants via industrial output and vehicle activity. | IMF projects 3.2% global growth in 2024. |

| Industrial Production | Directly correlates with lubricant consumption; slowdowns reduce demand. | A 1-2% contraction could negatively impact sales volumes. |

| Input Costs (Base Oils, Additives) | Fluctuations impact production expenses and profit margins. | Crude oil price volatility in early 2024 affected raw material costs. |

| Exchange Rates (e.g., EUR/USD) | Affects export competitiveness and foreign earnings translation. | Average EUR/USD around 1.08 in 2023. |

| Inflation | Increases operational costs for raw materials, energy, and labor. | Eurozone inflation projected around 2.5% in 2024. |

| Interest Rates | Impacts cost of capital and investment decisions. | Central bank rate decisions influence borrowing costs. |

| Emerging Market Growth | Offers significant growth opportunities due to industrialization. | Asia-Pacific expected to drive over 40% of global lubricant demand growth by 2025. |

Same Document Delivered

Fuchs Petrolub SE PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fuchs Petrolub SE delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape and potential challenges and opportunities for Fuchs Petrolub SE.

Sociological factors

Consumers and businesses globally are increasingly prioritizing sustainability, driving demand for eco-friendly lubricants. Fuchs Petrolub SE must respond by developing biodegradable or energy-saving alternatives to maintain market relevance.

This shift requires substantial investment in green research and development, with companies like Fuchs Petrolub dedicating resources to sustainable production. For instance, the global market for biodegradable lubricants is projected to grow significantly, reaching an estimated USD 13.5 billion by 2030, indicating a strong market pull for environmentally conscious solutions.

Fuchs Petrolub SE, like many global industrial companies, faces evolving workforce demographics. In many developed economies, an aging workforce presents a challenge in retaining institutional knowledge while simultaneously needing to attract younger talent. For instance, in Germany, where Fuchs has a significant presence, the proportion of workers aged 55 and over in the industrial sector is projected to remain substantial in the coming years, potentially impacting the availability of experienced personnel.

Concurrently, there's a pronounced global demand for specialized technical skills, particularly in areas like advanced chemistry, data analytics for product development, and digital solutions for customer service. Fuchs' ability to innovate and manage complex lubricant technologies, which are increasingly sophisticated, hinges on its access to this skilled talent pool. The company's investment in training and development is therefore critical to bridge any skill gaps.

Furthermore, diversity and inclusion are becoming increasingly important factors in talent attraction and retention. Companies that foster inclusive environments are better positioned to draw from a wider range of perspectives and experiences, which can drive innovation. By 2025, it's expected that companies with strong D&I policies will see a competitive advantage in securing top talent across various demographics.

Societal expectations for companies to demonstrate strong corporate social responsibility (CSR) are on the rise, impacting businesses like Fuchs Petrolub SE. This means a greater emphasis on ethical sourcing of raw materials, ensuring fair labor practices throughout the supply chain, and actively engaging with local communities where Fuchs operates. For instance, in 2023, Fuchs reported on its sustainability efforts, highlighting progress in reducing its CO2 emissions by 15% compared to 2018 levels, demonstrating a tangible commitment to environmental responsibility.

Fuchs must proactively manage its CSR initiatives to cultivate a positive brand image and foster trust among its diverse stakeholders, including customers, employees, and investors. Aligning with evolving global ethical standards is crucial for long-term viability and market acceptance. The company's 2024 sustainability report noted an increase in supplier audits focused on social and environmental compliance, reflecting a strategic response to these growing expectations.

Urbanization and Mobility Trends

Rapid urbanization and shifting mobility patterns are significantly impacting the lubricant market. As more people move to cities, demand for public transport, ride-sharing services, and micro-mobility solutions increases, potentially reducing reliance on personal vehicle ownership and traditional lubricants.

The global transition towards electric vehicles (EVs) presents a dual challenge and opportunity for Fuchs Petrolub. While the growth of EVs, projected to reach over 30% of new car sales globally by 2030 according to some industry forecasts, signifies a long-term decline in demand for conventional engine oils, it simultaneously opens avenues for specialized e-fluids crucial for EV thermal management and component protection. Fuchs must strategically adapt its research and development efforts and product offerings to cater to this evolving automotive landscape.

- Urban Population Growth: By 2050, it's estimated that 68% of the world's population will live in urban areas, a significant increase from 55% in 2018, according to the UN. This demographic shift fuels demand for efficient urban transport solutions.

- EV Market Share: Global EV sales surpassed 10 million units in 2022, and projections for 2024-2025 indicate continued strong growth, with some markets seeing EVs comprise over 20% of new vehicle registrations.

- Ride-Sharing Penetration: Ride-sharing services are increasingly popular in urban centers, with platforms like Uber and Lyft operating in hundreds of cities worldwide, influencing personal mobility choices.

Health and Safety Awareness

Societal expectations for robust health and safety are paramount in the lubricant sector, directly impacting Fuchs Petrolub SE. This heightened awareness means consumers and regulators alike demand assurance regarding product safety during use and disposal, pushing companies to invest in rigorous testing and transparent labeling. For instance, the European Chemicals Agency (ECHA) continuously updates regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), which mandates detailed safety data for chemical substances, including lubricants, directly influencing product formulation and market access for Fuchs.

Fuchs Petrolub SE must therefore prioritize not only the safety of its lubricants for end-users but also the well-being of its workforce. This involves maintaining state-of-the-art safety protocols across its global manufacturing sites. In 2023, the company reported a low incident rate, a testament to its ongoing commitment to workplace safety, though specific figures are often internal metrics.

Key considerations for Fuchs include:

- Ensuring lubricant formulations comply with evolving international health and safety regulations, such as those from ECHA and OSHA (Occupational Safety and Health Administration).

- Providing comprehensive safety data sheets (SDS) and clear usage instructions to prevent misuse and ensure safe handling by customers.

- Implementing and continuously improving occupational health and safety management systems, aiming for zero accidents in its production facilities.

- Investing in research and development for safer, more environmentally friendly lubricant alternatives that meet stringent health standards.

Societal expectations regarding corporate social responsibility (CSR) are intensifying, compelling companies like Fuchs Petrolub SE to emphasize ethical sourcing and fair labor practices throughout their supply chains. Fuchs' 2023 sustainability report highlighted a 15% reduction in CO2 emissions compared to 2018 levels, underscoring a tangible commitment to environmental stewardship.

The increasing global focus on health and safety mandates that Fuchs Petrolub SE ensure its lubricant formulations meet stringent international regulations, such as those from ECHA and OSHA. This commitment extends to protecting its workforce, with the company reporting a low incident rate in 2023, reflecting ongoing dedication to workplace safety.

Evolving mobility patterns, particularly the rapid growth of electric vehicles (EVs), present both challenges and opportunities for Fuchs. Projections suggest EVs could account for over 30% of global new car sales by 2030, necessitating a strategic shift towards specialized e-fluids for thermal management and component protection.

| Societal Factor | Impact on Fuchs Petrolub SE | Supporting Data/Trend |

|---|---|---|

| Sustainability Demand | Increased demand for eco-friendly lubricants, requiring R&D investment in biodegradable alternatives. | Global biodegradable lubricants market projected to reach USD 13.5 billion by 2030. |

| Workforce Demographics | Challenges with aging workforce and need to attract skilled talent in advanced chemistry and digital solutions. | Significant proportion of workers aged 55+ in Germany's industrial sector. |

| Health & Safety Regulations | Mandatory compliance with regulations like REACH and OSHA, impacting product formulation and market access. | ECHA continuously updates chemical substance safety data requirements. |

| Mobility Shifts (EVs) | Decline in conventional engine oil demand, growth opportunity in specialized e-fluids. | EVs projected to be over 30% of new car sales globally by 2030. |

Technological factors

Fuchs Petrolub SE is driven by continuous innovation in chemical engineering and material science, leading to new lubricant formulations. These advancements offer improved performance, greater efficiency, and enhanced durability across various applications.

To maintain its competitive edge, Fuchs Petrolub SE is investing significantly in research and development. This focus aims to create next-generation lubricants capable of meeting the demands of advanced machinery, performing under extreme conditions, and providing superior protection for equipment.

Fuchs Petrolub SE is navigating a landscape increasingly shaped by digitalization and Industry 4.0. The integration of the Internet of Things (IoT) and advanced automation in manufacturing directly influences how lubricants are utilized and managed. This technological shift presents Fuchs with a significant opportunity to move beyond traditional product offerings.

By embracing these trends, Fuchs can develop and market smart lubricant solutions. These could include services for predictive maintenance, allowing customers to anticipate equipment issues before they arise, and real-time monitoring of lubricant performance in operation. For instance, smart sensors embedded in machinery can provide continuous data on lubricant condition, wear particles, and operating parameters, enabling proactive interventions. This not only enhances customer value by minimizing downtime and extending equipment life but also boosts operational efficiency for Fuchs through data-driven insights and service innovation.

The accelerating global adoption of electric vehicles (EVs) presents a pivotal technological shift for Fuchs Petrolub. While demand for traditional engine oils is declining, the market for specialized EV fluids like e-greases, advanced battery coolants, and dedicated transmission fluids for electric drivetrains is expanding rapidly. For instance, the global EV fluids market was valued at approximately USD 1.5 billion in 2023 and is projected to reach over USD 5 billion by 2030, demonstrating substantial growth potential.

This technological evolution necessitates significant innovation from Fuchs to remain competitive and capture new market share. Adapting its product development and manufacturing capabilities to cater to the unique thermal management and lubrication requirements of EVs is crucial. The company's ability to quickly develop and commercialize high-performance EV fluids will be a key determinant of its success in this transforming automotive landscape.

Automation and Robotics in Production

The relentless march of automation and robotics in industrial production, including within Fuchs Petrolub SE's own operations, necessitates lubricants engineered for peak performance in these sophisticated environments. These advancements directly impact the precision and consistency of lubricant delivery, creating avenues for Fuchs to offer tailored solutions for automated lubrication systems.

The global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow significantly. This trend means Fuchs must innovate lubricants that can withstand the higher speeds and continuous operation characteristic of automated lines.

- Lubricant Requirements: Automation demands lubricants with extended service life and superior wear protection to minimize downtime in highly utilized robotic systems.

- Precision Application: The precision of robotic application systems requires lubricants with consistent viscosity and flow properties, enabling optimal film thickness and reduced consumption.

- Fuchs' Opportunity: Fuchs can develop specialized lubricant formulations and intelligent dispensing systems that integrate seamlessly with robotic production, enhancing efficiency and reliability for their clients.

Nanotechnology and Advanced Materials

Nanotechnology and advanced materials are poised to revolutionize lubricant development, offering Fuchs Petrolub SE significant opportunities. Research in these areas could lead to lubricants with dramatically reduced friction, potentially boosting fuel efficiency by several percentage points. For instance, studies in 2024 highlighted graphene-based lubricants showing up to a 15% reduction in wear compared to conventional oils.

Fuchs needs to actively invest in and explore these emerging technologies to maintain a competitive edge. The development of lubricants with extended drain intervals, possibly doubling their service life, could significantly reduce waste and maintenance costs for customers. Furthermore, self-healing capabilities, where lubricants can repair micro-damage, represent a highly differentiated offering that could command premium pricing.

- Enhanced Fuel Efficiency: Nanoparticle additives can lower friction, potentially improving fuel economy by 2-5% in automotive applications, a significant gain given global fuel consumption figures.

- Extended Component Lifespan: Advanced materials can create lubricants that offer superior wear protection, leading to longer service intervals and reduced replacement costs for machinery.

- Environmental Benefits: Lubricants with self-healing properties or significantly extended drain intervals contribute to a circular economy by reducing oil consumption and waste generation.

Technological advancements, particularly in digitalization and automation, are reshaping the lubricant industry. Fuchs Petrolub SE is leveraging Industry 4.0 principles, integrating IoT and advanced automation to develop smart lubricant solutions offering predictive maintenance and real-time performance monitoring. This strategic embrace of technology allows Fuchs to move beyond traditional product sales into value-added services, enhancing customer operational efficiency and minimizing equipment downtime.

The accelerating shift towards electric vehicles (EVs) necessitates a significant technological adaptation for Fuchs Petrolub. While traditional engine oil demand wanes, the market for specialized EV fluids, such as e-greases and advanced battery coolants, is experiencing rapid growth. The global EV fluids market was valued at approximately USD 1.5 billion in 2023 and is projected to exceed USD 5 billion by 2030, highlighting a substantial opportunity for Fuchs to innovate and capture market share in this evolving automotive sector.

Nanotechnology and advanced materials represent a frontier for lubricant innovation, promising enhanced performance and sustainability. Research indicates that nanotechnology can lead to lubricants with significantly reduced friction, potentially improving fuel efficiency by up to 5%. Fuchs' investment in these emerging technologies can yield lubricants with extended service life and self-healing capabilities, offering substantial cost savings and environmental benefits to customers by reducing oil consumption and waste.

| Technological Trend | Impact on Fuchs Petrolub SE | Market Data/Opportunity |

|---|---|---|

| Digitalization & Industry 4.0 | Development of smart lubricants, predictive maintenance services | Enhanced customer value, data-driven service innovation |

| Electric Vehicle (EV) Adoption | Shift to specialized EV fluids (e-greases, battery coolants) | Global EV fluids market projected to reach >USD 5 billion by 2030 (from USD 1.5 billion in 2023) |

| Nanotechnology & Advanced Materials | Lubricants with reduced friction, extended life, self-healing properties | Potential for 2-5% fuel efficiency improvement; reduced waste and maintenance costs |

Legal factors

Fuchs Petrolub SE navigates a complex web of global environmental protection laws, impacting everything from emissions and waste management to chemical handling and water consumption. For instance, compliance with the European Union's REACH regulation, which governs the registration, evaluation, authorization, and restriction of chemicals, is a significant operational requirement. In 2023, the chemical industry globally faced increasing scrutiny and investment in sustainable practices, with companies like Fuchs Petrolub needing to adapt to stricter standards to avoid penalties.

Failure to adhere to these stringent environmental regulations can result in substantial financial penalties, operational disruptions, and considerable damage to a company's public image. The increasing focus on sustainability means that proactive environmental management is not just a legal necessity but also a strategic imperative for long-term business success. For example, in 2024, several major chemical manufacturers faced significant fines for non-compliance with waste disposal regulations in various jurisdictions.

Fuchs Petrolub SE operates under strict product liability laws and safety standards across all its sales regions, a critical consideration for its lubricant offerings. This necessitates a robust approach to quality control, extensive product testing, and meticulous attention to labeling and safety data sheets to ensure compliance and mitigate risks.

Failure to meet these rigorous safety standards or the presence of product defects can lead to significant financial repercussions, including expensive lawsuits, product recalls, and a detrimental impact on the company's reputation. For instance, the global automotive industry, a major consumer of lubricants, faced increased scrutiny and regulatory action regarding emissions and safety in 2024, indirectly impacting lubricant manufacturers through evolving vehicle technologies and material requirements.

Fuchs Petrolub SE's extensive global footprint means navigating a labyrinth of international trade laws. This includes adhering to import/export regulations, understanding varying customs duties, and complying with an intricate web of sanctions regimes that can shift rapidly. For instance, the European Union's trade agreements and tariffs directly influence the cost of raw materials and the accessibility of key markets for Fuchs' lubricants.

Ensuring compliance with these diverse legal frameworks is paramount for the seamless cross-border movement of both essential raw materials and finished lubricant products, impacting everything from production schedules to final delivery times. Failure to comply can lead to significant delays and financial penalties, disrupting the entire supply chain.

Any shifts in global trade policies, such as the imposition of new tariffs or non-tariff barriers, can directly affect Fuchs Petrolub's supply chain efficiency and its ability to access crucial international markets. For example, a sudden increase in tariffs on base oils in a major manufacturing region could significantly increase production costs for Fuchs' subsidiaries in that area.

Labor and Employment Laws

Fuchs Petrolub SE navigates a complex web of labor and employment laws across its global operations, impacting everything from minimum wages and working hours to employee rights and anti-discrimination statutes. For instance, in Germany, where Fuchs has a significant presence, the Works Constitution Act (Betriebsverfassungsgesetz) grants employees substantial co-determination rights, influencing decisions on working conditions and personnel matters. Failure to comply can lead to costly legal battles and damage to the company's reputation.

Maintaining compliance is not just about avoiding penalties; it's fundamental to fostering positive employee relations and upholding ethical business standards. In 2024, companies globally faced increased scrutiny on fair labor practices, with reports highlighting a rise in labor disputes in sectors with significant international workforces. For Fuchs, this means ensuring consistent application of employment standards that meet or exceed local legal requirements.

Key areas of focus for Fuchs Petrolub SE concerning labor laws include:

- Compliance with national minimum wage laws and collective bargaining agreements.

- Adherence to regulations on working hours, overtime, and leave entitlements.

- Upholding anti-discrimination and equal opportunity policies in hiring and promotion.

- Ensuring safe and healthy working conditions as mandated by law.

Intellectual Property Rights (IPR) Protection

Fuchs Petrolub SE places significant emphasis on protecting its intellectual property, which is crucial for maintaining its competitive edge in the lubricants market. This includes safeguarding patents for its advanced lubricant formulations and proprietary manufacturing processes. In 2024, the company continued to invest in its R&D pipeline, with a substantial portion of its budget allocated to developing and patenting new technologies. Navigating the intricate landscape of international intellectual property laws and actively pursuing legal recourse against infringers are ongoing priorities to defend its innovations.

Strong intellectual property rights protection directly fuels Fuchs' commitment to innovation, ensuring that its unique technologies and trade secrets are shielded from unauthorized use. This robust defense mechanism allows Fuchs to maintain its market position and continue investing in the development of next-generation lubricants. The company's proactive approach to IPR management is a cornerstone of its long-term strategy, contributing to its sustained growth and technological leadership.

- Fuchs Petrolub SE's R&D expenditure in 2024 was a key driver for new patent filings.

- The company actively monitors for and addresses potential intellectual property infringements globally.

- Patents on lubricant formulations and manufacturing techniques are central to Fuchs' competitive advantage.

- Effective IPR protection is essential for fostering continued innovation and safeguarding proprietary technologies.

Fuchs Petrolub SE must comply with a myriad of regulations concerning product safety, labeling, and chemical composition across its global markets. Adherence to standards like those set by the American Petroleum Institute (API) and the Society of Automotive Engineers (SAE) is crucial for product acceptance and market access. In 2024, regulatory bodies continued to emphasize the safety and environmental impact of lubricant additives, prompting ongoing product formulation reviews.

Failure to meet these stringent product-specific regulations can lead to market exclusion, product recalls, and significant reputational damage. For instance, in 2024, the European Chemicals Agency (ECHA) continued its focus on restricting certain substances in industrial products, requiring companies like Fuchs to adapt their formulations. The company's commitment to quality management systems, such as ISO 9001, is a testament to its proactive approach in meeting these legal demands.

| Legal Area | Key Compliance Aspects | Impact on Fuchs Petrolub SE | 2024/2025 Focus |

|---|---|---|---|

| Environmental Law | Emissions, waste, chemical handling (REACH) | Operational costs, potential fines, brand image | Stricter sustainability standards, chemical substance restrictions |

| Product Liability & Safety | Quality control, testing, labeling, data sheets | Lawsuits, recalls, reputational risk | Evolving vehicle tech impacting lubricant requirements, additive safety |

| International Trade Law | Import/export, tariffs, sanctions | Supply chain efficiency, market access, cost of goods | Trade policy shifts, potential new tariffs on raw materials |

| Labor & Employment Law | Wages, working hours, employee rights, safety | Legal disputes, employee relations, operational costs | Fair labor practices scrutiny, labor disputes in international workforces |

| Intellectual Property Law | Patents, trade secrets, trademarks | Competitive advantage, R&D investment protection | Increased R&D for new patent filings, monitoring infringements |

Environmental factors

Fuchs Petrolub SE is under significant pressure to decarbonize, a trend amplified by global climate change concerns and ambitious government targets. This necessitates a reduction in greenhouse gas emissions from its manufacturing sites and a focus on optimizing its supply chain. For instance, by 2024, many European countries aim for substantial emissions reductions, influencing operational strategies.

The company is actively developing lubricant solutions designed to enhance energy efficiency and lower emissions in the vehicles and machinery that use them. This innovation is crucial for meeting evolving customer demands and regulatory requirements. Fuchs Petrolub's commitment to sustainability is also reflected in its investments in renewable energy sources for its operations and the adoption of more sustainable manufacturing processes.

The availability and sustainable sourcing of raw materials, particularly base oils derived from crude oil, are critical environmental considerations for Fuchs Petrolub. In 2024, global crude oil prices saw volatility, impacting the cost and accessibility of traditional base oils. Fuchs is actively investing in research and development for alternative, renewable, or recycled base oils, aiming to reduce its dependence on finite resources and improve its environmental footprint.

This strategic shift is vital for long-term sustainability and meeting increasing regulatory demands for circular economy principles. Optimizing resource efficiency within production processes is also a key focus, with initiatives in 2024 aimed at reducing water and energy consumption per ton of lubricant produced.

Stricter regulations around waste management, particularly for used lubricants and packaging, are a significant environmental factor. For instance, the European Union's Waste Framework Directive continues to push for higher recycling rates and reduced landfill dependency, impacting companies like Fuchs Petrolub. Societal expectations for responsible disposal and recycling are also on the rise, pressuring businesses to adopt more sustainable practices.

Fuchs Petrolub is actively embracing circular economy principles to address these environmental pressures. They are exploring innovative solutions for lubricant recycling, aiming to re-refine used oils back into high-quality base oils, thereby extending product lifecycles and minimizing the need for virgin crude oil. Their focus on sustainable packaging materials also contributes to reducing waste throughout the product lifecycle.

Biodiversity Protection and Ecosystem Impact

Fuchs Petrolub SE faces increasing scrutiny regarding the impact of its industrial operations and chemical products on biodiversity and ecosystems. This environmental factor is critical as regulatory bodies and consumers demand greater accountability for ecological footprints. The company must proactively manage its environmental impact to mitigate risks and maintain its social license to operate.

To address these concerns, Fuchs Petrolub is committed to minimizing harm to natural habitats and water sources. This involves stringent waste treatment protocols, robust spill prevention measures, and ongoing research into developing lubricants with reduced environmental toxicity. For instance, their focus on biodegradable lubricants is particularly important for applications in sensitive environments, like forestry or marine operations, where accidental release could have significant ecological consequences.

- Biodegradable Lubricant Development: Fuchs is investing in R&D for lubricants that break down naturally, reducing long-term environmental persistence.

- Ecosystem Impact Assessment: Conducting regular assessments of operational sites to understand and mitigate potential impacts on local biodiversity.

- Water Source Protection: Implementing advanced wastewater treatment technologies to ensure discharged water meets or exceeds environmental standards, protecting aquatic ecosystems.

- Responsible Waste Management: Adhering to strict regulations for the disposal and recycling of used oils and chemical waste to prevent soil and water contamination.

Water Management and Pollution Control

Water scarcity and quality are paramount environmental concerns impacting industrial operations. Fuchs Petrolub SE is actively engaged in enhancing its water management, aiming to reduce consumption in production and ensure responsible wastewater discharge. For instance, in 2023, the company reported a continued focus on optimizing water usage across its global facilities, though specific reduction figures are part of ongoing sustainability reporting.

Adherence to stringent water pollution control legislation is non-negotiable for Fuchs Petrolub SE. This commitment is vital to safeguard water resources from potential contamination and maintain operational integrity. The company's sustainability reports consistently highlight investments in advanced wastewater treatment technologies to meet and exceed regulatory standards.

Key aspects of Fuchs Petrolub SE's water management include:

- Water Use Reduction: Implementing process improvements to minimize freshwater intake in manufacturing.

- Wastewater Treatment: Employing advanced filtration and treatment methods to ensure discharged water meets environmental quality standards.

- Regulatory Compliance: Strictly adhering to national and international regulations concerning water pollution and discharge limits.

- Resource Efficiency: Exploring opportunities for water recycling and reuse within its operational footprint.

Fuchs Petrolub SE's environmental strategy in 2024 and 2025 centers on decarbonization and resource efficiency. The company is actively developing lubricants to improve energy efficiency in end-use applications, aligning with global climate goals and stringent emission reduction targets set by various nations. For example, many European countries aim for significant greenhouse gas emission cuts by 2025, directly influencing Fuchs' product development and operational planning.

The company's commitment to sustainability extends to its raw material sourcing and manufacturing processes. Recognizing the environmental impact of traditional base oils derived from crude oil, Fuchs is investing heavily in research for renewable and recycled alternatives. This diversification is crucial, especially given the price volatility of crude oil observed in 2024, which impacts the cost and availability of conventional base oils. By 2025, the push for circular economy principles will further drive demand for these sustainable alternatives.

Fuchs Petrolub SE is also addressing stricter regulations concerning waste management, particularly for used lubricants and packaging. Initiatives in 2024 and 2025 focus on increasing recycling rates and minimizing landfill waste, aligning with directives like the EU's Waste Framework Directive. The company is actively exploring lubricant recycling and re-refining technologies to create a more circular product lifecycle and reduce its environmental footprint.

| Environmental Focus Area | Key Initiatives (2024-2025) | Relevant Data/Targets |

|---|---|---|

| Decarbonization & Emissions | Developing energy-efficient lubricants; reducing operational emissions. | Aiming for significant greenhouse gas emission reductions across global operations by 2025. |

| Raw Material Sourcing | Investing in renewable and recycled base oils; reducing reliance on crude oil. | Responding to crude oil price volatility in 2024; increasing R&D for sustainable alternatives. |

| Waste Management & Circularity | Promoting lubricant recycling and re-refining; sustainable packaging. | Adhering to stricter waste management regulations; increasing recycling rates for used oils. |

| Water Management | Reducing water consumption; advanced wastewater treatment. | Continued focus on optimizing water usage across global facilities; meeting stringent water pollution control legislation. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Fuchs Petrolub SE is built on a robust foundation of data from official government publications, leading economic indicators, and respected industry research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is current and credible.