Fuchs Petrolub SE Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuchs Petrolub SE Bundle

Fuchs Petrolub SE navigates a landscape shaped by moderate buyer and supplier power, with the threat of substitutes posing a significant challenge. The industry's moderate rivalry and the low threat of new entrants create a complex strategic environment.

The complete report reveals the real forces shaping Fuchs Petrolub SE’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers in the lubricant industry, affecting Fuchs Petrolub SE, is substantial due to the critical nature of base oils and additives. The prices of crude oil, a key input for mineral base oils, directly influence Fuchs Petrolub's cost structure. For instance, in early 2024, Brent crude oil prices fluctuated, impacting the cost of these essential components.

The increasing availability of Group II and Group III base oils, known for their enhanced performance, is a significant factor. This trend potentially shifts leverage towards lubricant manufacturers like Fuchs Petrolub SE, as they gain more options for sourcing premium raw materials.

Fuchs Petrolub SE faces significant supplier power due to the specialized nature of its raw materials. Many specialty chemicals and additives are proprietary and crucial for specific lubricant formulations, meaning they can only be sourced from a select few specialized suppliers. This limited supplier pool grants these entities considerable leverage in negotiations, potentially impacting Fuchs Petrolub's cost of goods sold and profit margins.

Supplier Power 4

The bargaining power of suppliers for lubricant producers like Fuchs Petrolub SE is influenced by several factors. Geopolitical tensions and trade tariffs can directly impact the pricing and availability of essential raw materials, such as additive chemicals and specialized synthetic formulations. For instance, disruptions in the supply of base oils, a key component in lubricants, due to international trade disputes or political instability in major producing regions, can force producers to accept higher prices or face production delays. This was evident in 2024 as ongoing trade friction between major economies continued to create uncertainty in global commodity markets, including those for petrochemical derivatives.

Fuchs Petrolub SE, like other major lubricant manufacturers, relies on a complex global supply chain for its diverse product portfolio. The availability and cost of critical inputs, such as specific chemical additives that enhance lubricant performance, are particularly sensitive to supplier concentration and the unique nature of these formulations. If only a few suppliers can produce a specialized additive, their leverage increases significantly.

Key considerations for Fuchs Petrolub SE regarding supplier power include:

- Concentration of Suppliers: The market for certain specialized lubricant additives or base oils may be dominated by a limited number of global producers, granting them considerable pricing power.

- Uniqueness of Inputs: Highly specialized or proprietary chemical formulations required for advanced lubricants are difficult to substitute, strengthening supplier influence.

- Cost of Switching Suppliers: The expense and time involved in qualifying new suppliers for critical raw materials can deter lubricant manufacturers from seeking alternative sources, reinforcing existing supplier relationships.

- Threat of Forward Integration: Suppliers possessing unique technological capabilities might consider integrating forward into lubricant production themselves, posing a potential competitive threat that influences their negotiating stance.

Supplier Power 5

The increasing focus on environmental sustainability is reshaping the lubricant industry, particularly for companies like Fuchs Petrolub SE. The shift towards bio-based lubricants means sourcing renewable feedstocks, which can alter the bargaining power of suppliers. While this might diversify the supplier base, it also introduces new complexities in securing consistent and high-quality raw materials.

For instance, the demand for specific bio-based oils, such as those derived from rapeseed or palm oil, could see a rise in the bargaining power of producers of these agricultural commodities. In 2024, the global bio-lubricants market was projected to reach approximately USD 23.5 billion, indicating a significant and growing segment where supplier influence could be more pronounced compared to traditional mineral oil-based lubricants.

- Diversification of Feedstocks: The push for bio-lubricants broadens the range of raw materials, potentially reducing reliance on any single supplier type.

- New Supplier Dynamics: Agricultural producers and specialized chemical companies involved in bio-feedstock processing may gain leverage.

- Supply Chain Complexity: Ensuring consistent quality and availability of bio-based inputs presents new challenges and can influence supplier power.

The bargaining power of suppliers for Fuchs Petrolub SE remains a significant factor, particularly concerning specialized additives and high-quality base oils. The concentration of suppliers for proprietary chemical components grants them considerable leverage, impacting Fuchs Petrolub's cost of goods sold. For example, in early 2024, fluctuations in crude oil prices, a primary input for mineral base oils, directly affected raw material costs for lubricant manufacturers.

The increasing demand for advanced lubricants, which require specialized additives, further amplifies supplier power. These unique inputs are often difficult to substitute, and the cost or time involved in switching suppliers can reinforce the position of existing providers. This dynamic was underscored in 2024 as global trade tensions created ripple effects in petrochemical markets, influencing the availability and pricing of these critical components.

The growing market for bio-lubricants also introduces new supplier dynamics. While diversification of feedstocks may occur, the sourcing of renewable materials like specific agricultural oils can empower their producers. The global bio-lubricants market, projected to reach around USD 23.5 billion in 2024, highlights a segment where supplier influence could be more pronounced due to specialized sourcing and processing requirements.

| Key Supplier Power Factors | Impact on Fuchs Petrolub SE | 2024 Market Context |

| Supplier Concentration for Additives | Increased pricing leverage for suppliers | Limited number of global producers for specialized chemicals |

| Uniqueness of Inputs | Difficulty in substitution, reinforcing supplier influence | Proprietary formulations for high-performance lubricants |

| Crude Oil Price Volatility | Direct impact on base oil costs | Brent crude prices fluctuated significantly in early 2024 |

| Bio-lubricant Feedstock Sourcing | Potential for increased power of agricultural commodity suppliers | Growing bio-lubricants market, projected USD 23.5 billion in 2024 |

What is included in the product

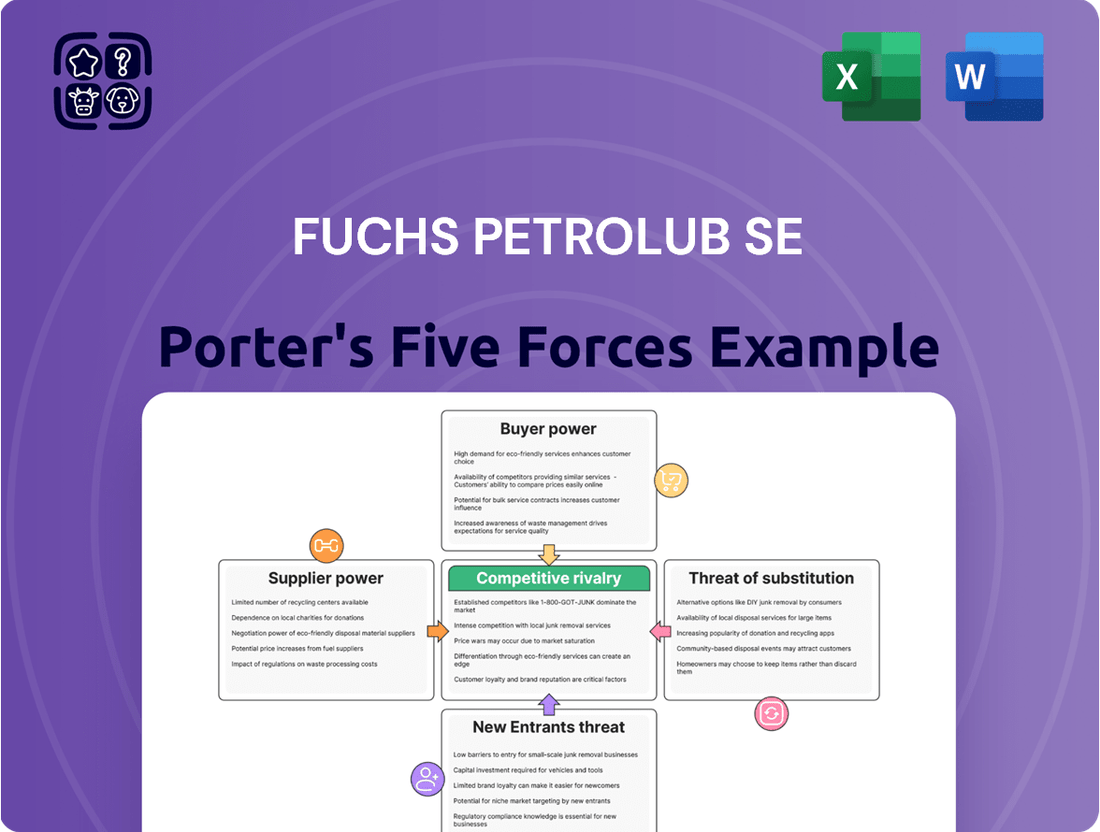

This Porter's Five Forces analysis for Fuchs Petrolub SE details the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes within the lubricants industry, providing strategic insights into its competitive environment.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces on Fuchs Petrolub SE's market landscape.

Customers Bargaining Power

Fuchs Petrolub SE's diverse customer base, spanning automotive, industrial machinery, construction, mining, and aerospace sectors, generally limits the bargaining power of any single customer segment. In 2024, the automotive sector remained a significant revenue driver, but its share was balanced by robust growth in industrial applications, preventing any one group from dominating purchasing decisions.

Fuchs Petrolub SE faces considerable buyer power from its large industrial customers and Original Equipment Manufacturers (OEMs). These entities, by virtue of the sheer volume of lubricants they procure, can exert significant leverage, often demanding tailored formulations and stringent performance specifications. This can lead to price pressures and a need for specialized product development, impacting Fuchs Petrolub's margins.

The bargaining power of customers in the lubricant industry is significant, largely due to the fragmented nature of the market and the availability of numerous manufacturers. For a company like Fuchs Petrolub SE, this means customers have a wide array of choices, making it easier for them to switch suppliers if they find better pricing or service elsewhere. This competitive landscape directly impacts Fuchs Petrolub's ability to dictate terms and pricing.

In 2024, the global lubricant market continued to be characterized by intense competition. For instance, the automotive sector, a major consumer of lubricants, saw a growing number of independent aftermarket suppliers offering competitive alternatives to OEM-branded products. This trend empowers end-users, from individual car owners to large fleet operators, to seek out the best value, thereby amplifying their bargaining power against established players like Fuchs Petrolub.

Buyer Power 4

The bargaining power of customers for Fuchs Petrolub SE is influenced by a growing emphasis on energy efficiency and environmental sustainability. Buyers who prioritize these aspects can leverage their preferences to negotiate for specific product features and more favorable pricing for advanced, eco-friendly lubricants. This trend allows informed customers to exert greater influence on product development and cost structures.

This shift empowers buyers who are increasingly discerning about the environmental impact and operational efficiency of the lubricants they purchase. For instance, in 2024, the global market for sustainable lubricants was projected to reach approximately $10.5 billion, indicating a significant and growing segment of environmentally conscious consumers. Fuchs Petrolub, like its competitors, must respond to these demands to maintain market share.

- Customer Focus on Sustainability: Buyers increasingly seek lubricants that enhance energy efficiency and minimize environmental impact.

- Demand for Advanced Products: This focus drives demand for specialized, eco-friendly formulations, giving customers leverage.

- Price Sensitivity for Eco-Features: Customers prioritizing sustainability may be willing to pay a premium, but also negotiate based on these perceived benefits.

- Market Trends: The expanding market for sustainable lubricants, valued in billions globally, underscores this buyer power.

Buyer Power 5

Fuchs Petrolub SE faces increasing buyer power as customers shift focus from basic lubricants to comprehensive predictive maintenance and lubricant management services. This move towards integrated solutions means clients are less tied to a single product and can demand more value, thereby strengthening their negotiation position. For instance, in 2024, the global industrial lubricants market, valued at approximately $60 billion, saw a growing segment dedicated to service-based offerings, indicating a tangible shift in customer expectations and leverage.

This evolving customer demand translates into higher expectations for tailored services and cost-effectiveness. Buyers are now in a stronger position to negotiate pricing and service level agreements, as they can compare not just lubricant costs but the overall value proposition of a provider's service package. This trend is particularly evident in sectors like automotive and heavy industry, where downtime is extremely costly, making proactive management solutions highly desirable.

- Shift to Services: Customers increasingly prioritize predictive maintenance and lubricant management over just product purchase.

- Value-Added Demands: Buyers are leveraging their need for holistic solutions to negotiate better terms and pricing.

- Industry Trends: Sectors like automotive and heavy industry are leading the charge in demanding integrated service offerings.

- Market Dynamics: The growing service segment within the global industrial lubricants market (estimated at $60 billion in 2024) reflects this increased buyer power.

Fuchs Petrolub SE's customers possess significant bargaining power due to the availability of numerous suppliers in the fragmented lubricant market. This allows buyers to easily switch providers if they find better pricing or service, impacting Fuchs Petrolub's ability to dictate terms.

In 2024, the automotive sector's demand for lubricants was balanced by industrial growth, preventing any single customer segment from dominating purchasing. However, large industrial clients and OEMs, due to their substantial procurement volumes, can exert considerable leverage, often demanding specialized formulations and strict performance standards, which can pressure margins.

| Customer Segment | Bargaining Power Factors | Impact on Fuchs Petrolub |

|---|---|---|

| Large Industrial Clients & OEMs | High Volume Purchases, Demand for Customization, Strict Specifications | Price Pressure, Need for Tailored Product Development |

| Automotive Aftermarket | Availability of Competitors, Price Sensitivity | Pressure on Pricing, Need for Competitive Offerings |

| Environmentally Conscious Buyers | Demand for Sustainable & Energy-Efficient Products | Need for Product Innovation, Potential for Premium Pricing Negotiation |

Full Version Awaits

Fuchs Petrolub SE Porter's Five Forces Analysis

This preview displays the comprehensive Porter's Five Forces analysis for Fuchs Petrolub SE, detailing the competitive landscape and strategic positioning of the company. You're looking at the actual document that will be delivered to you instantly upon purchase, ensuring you receive the complete, professionally formatted report without any alterations or placeholders.

Rivalry Among Competitors

Competitive rivalry within the global lubricants market is intense, with Fuchs Petrolub SE facing strong competition from giants like Exxon Mobil, Shell, BP, and Chevron. These established players possess significant brand recognition and extensive distribution networks, making it challenging for any single company to dominate. For instance, in 2024, the top oil and gas companies continued to invest heavily in their lubricant divisions, leveraging their integrated upstream and downstream operations.

Competition within the lubricants industry, including for Fuchs Petrolub SE, is intensely driven by innovation in product formulations. Companies are pouring resources into developing high-performance synthetic and bio-based lubricants. These advanced formulations offer significant advantages such as extended service intervals, which reduce maintenance downtime for customers, and enhanced biodegradability, aligning with growing environmental concerns. For example, in 2023, the global lubricants market saw continued growth, with synthetic lubricants representing a significant and expanding share due to their superior performance characteristics.

Fuchs Petrolub SE operates in a landscape where intense competition is a defining characteristic. Key players frequently forge strategic alliances with Original Equipment Manufacturers (OEMs) and aggressively expand into burgeoning markets. These tactics are designed to bolster their worldwide reach and solidify their positions in terms of market share.

In 2024, the lubricants industry continued to see significant consolidation and strategic maneuvering. For instance, major competitors have been investing heavily in research and development for advanced, eco-friendly lubricant formulations, a trend that intensifies the rivalry as companies strive to offer superior, sustainable solutions.

Competitive Rivalry 4

The lubricant industry, including players like Fuchs Petrolub SE, experiences intense rivalry. This is driven by the price volatility of key raw materials, such as base oils, which can significantly impact production costs and pricing strategies. Companies must constantly strive to optimize their operations and find cost efficiencies to maintain profitability amidst these fluctuations.

Stringent regulatory compliances, particularly concerning environmental standards and product safety, add another layer of competitive pressure. Meeting these requirements often necessitates substantial investment in research and development for new formulations and cleaner production processes. This R&D investment is crucial for companies to differentiate themselves and stay ahead in an evolving market landscape.

- Fuchs Petrolub SE's Revenue Growth: In 2023, Fuchs Petrolub SE reported a revenue of €3.4 billion, demonstrating its significant market presence.

- Industry Concentration: The global lubricants market is characterized by a mix of large multinational corporations and numerous smaller regional players, contributing to a fragmented yet competitive environment.

- R&D Investment: Companies in this sector typically allocate a notable portion of their revenue to R&D, with figures often ranging from 2-5%, to develop advanced lubricant technologies.

- Impact of Raw Material Costs: Fluctuations in crude oil prices directly influence base oil costs, creating a dynamic pricing environment that intensifies rivalry.

Competitive Rivalry 5

The lubricants market, including Fuchs Petrolub SE, faces intense competition driven by evolving industry demands. The accelerating adoption of electric vehicles (EVs) is a significant disruptor, necessitating a pivot in product development away from traditional engine oils. For instance, by the end of 2024, it's projected that over 30% of new vehicle sales in some leading markets could be electric, directly impacting the demand for internal combustion engine lubricants.

Industrial automation also plays a crucial role, increasing the need for specialized, high-performance lubricants that can withstand extreme conditions and enhance operational efficiency. This dynamic environment forces companies like Fuchs to continuously innovate and adapt their offerings to remain competitive.

- Shifting Demand: The rise of EVs and industrial automation are reshaping product requirements.

- Product Portfolio Adaptation: Companies must invest in R&D for new lubricant formulations.

- Marketing Strategy Evolution: Outreach needs to target new segments and highlight specialized solutions.

- Competitive Pressure: Intense rivalry compels continuous innovation to maintain market share.

Competitive rivalry in the global lubricants market is fierce, with Fuchs Petrolub SE contending against major oil and gas companies and specialized lubricant manufacturers. This intense competition is fueled by continuous innovation in product formulations, particularly in advanced synthetic and bio-based lubricants, as seen in the market's 2023 growth where synthetics held a significant share. Companies like Fuchs must navigate price volatility of raw materials, such as base oils, which directly impacts profitability and necessitates operational efficiency. In 2024, the industry saw substantial investment in R&D for eco-friendly solutions, further intensifying the competitive landscape.

| Competitor | 2023 Revenue (Approx.) | Key Focus Areas |

|---|---|---|

| Exxon Mobil | $285.8 billion (Total Revenue) | Integrated operations, brand recognition |

| Shell | $311.6 billion (Total Revenue) | Global reach, R&D for advanced formulations |

| BP | $215.1 billion (Total Revenue) | Strategic alliances, market expansion |

| Chevron | $196.1 billion (Total Revenue) | Technological innovation, sustainability |

| Fuchs Petrolub SE | €3.4 billion | Specialty lubricants, customer-specific solutions |

SSubstitutes Threaten

The threat of substitutes for Fuchs Petrolub SE's lubricants is moderate. While lubricants are crucial for machinery, emerging technologies like advanced self-lubricating materials could reduce reliance on traditional oil-based products in certain sectors. For instance, research into advanced polymers and composite materials capable of inherent lubrication could offer alternatives in specialized applications, potentially impacting demand for conventional lubricants.

The rise of electric vehicles (EVs) presents a growing threat to traditional lubricant markets. By 2024, EV sales are projected to continue their upward trajectory, impacting the demand for engine oils and other automotive fluids that are core to lubricant manufacturers like Fuchs Petrolub SE. EVs require specialized fluids for their transmissions and cooling systems, but these are generally lower volume and different in composition compared to the lubricants used in internal combustion engines.

The threat of substitutes for Fuchs Petrolub SE's lubricants is moderate but growing. While conventional lubricants remain essential across most industries, advancements in areas like magnetic levitation and air bearings are creating niche alternatives that reduce or eliminate the need for traditional lubrication in specialized industrial applications.

4

The threat of substitutes for Fuchs Petrolub SE is moderately high, largely driven by advancements in machinery and manufacturing. Innovations in equipment design can lead to components that naturally require less lubrication, thereby reducing the demand for traditional lubricants. For instance, improvements in material science and precision engineering allow for smoother operation and extended component life, indirectly substituting the need for frequent lubricant changes.

Furthermore, the increasing focus on energy efficiency and sustainability across industries encourages the development of alternative lubrication technologies. These might include solid lubricants, advanced coatings, or even entirely new machinery designs that minimize or eliminate the need for liquid lubricants. While these substitutes are still evolving, their potential to disrupt the market is significant.

Consider these factors impacting the threat of substitutes:

- Technological Advancements: Innovations in machinery design, such as those seen in advanced manufacturing and robotics, are creating equipment that operates with lower friction and wear, extending service intervals and potentially reducing overall lubricant volume requirements.

- Material Science Innovations: Development of new materials and surface treatments for machine components can inherently reduce the need for traditional lubricants, acting as a direct substitute in certain applications.

- Energy Efficiency Drives: A global push for greater energy efficiency is spurring research into lubrication alternatives that offer lower resistance, potentially impacting demand for conventional oil-based lubricants.

- Emerging Lubrication Technologies: While still niche, the growth of solid lubricants, dry-film coatings, and bio-based lubricants presents long-term substitution threats across various industrial sectors.

5

The threat of substitutes for Fuchs Petrolub SE's products, primarily lubricants, is present but generally considered moderate. While traditional liquid lubricants are the mainstay, certain niche applications are exploring alternatives. For instance, the push towards 'dry lubrication' or solid lubrication in environments with extreme temperatures or contamination risks presents a potential substitute. These solid lubricants, often based on materials like molybdenum disulfide or graphite, can offer performance advantages where conventional oils and greases fail.

However, the widespread adoption of these substitutes faces hurdles. The cost-effectiveness and broad applicability of liquid lubricants still make them the preferred choice for the vast majority of industrial and automotive applications. Fuchs Petrolub's extensive product portfolio and deep understanding of diverse lubrication needs position it well to adapt to these evolving demands. For example, in 2023, the global lubricants market was valued at approximately USD 160 billion, with liquid lubricants dominating this figure, underscoring the scale of the existing market.

The development and implementation of solid lubrication technologies are often application-specific and may not offer the same level of versatility or cost-efficiency as liquid lubricants across the board. Fuchs Petrolub's ongoing investment in research and development allows it to monitor and, where appropriate, integrate or offer solutions that incorporate these emerging technologies. The company's ability to innovate and tailor its offerings to specific performance requirements will be key in mitigating the impact of these potential substitutes.

Consider these points regarding substitutes:

- Dry/Solid Lubrication: Emerging in niche areas with extreme temperatures or contamination risks, offering an alternative to traditional liquid lubricants.

- Application Specificity: Substitutes are often tailored to very specific conditions, limiting their broad market appeal compared to liquid lubricants.

- Cost and Versatility: Liquid lubricants generally remain more cost-effective and versatile for a wider range of applications.

- Market Dominance: The global lubricants market, valued around USD 160 billion in 2023, is predominantly served by liquid lubricants, indicating a strong existing infrastructure and customer base.

The threat of substitutes for Fuchs Petrolub SE's lubricants is moderate, with technological advancements posing the most significant challenge. While traditional liquid lubricants continue to dominate, innovations in areas like advanced polymers and solid lubricants are creating niche alternatives. For instance, the growing adoption of electric vehicles (EVs) means a shift away from traditional engine oils, though EVs still require specialized fluids.

By 2024, EVs are expected to capture a larger share of the automotive market, impacting the demand for conventional lubricants. However, the overall lubricants market, valued at roughly USD 160 billion in 2023, still heavily relies on liquid formulations due to their cost-effectiveness and broad applicability across diverse industrial and automotive sectors. Fuchs Petrolub's R&D focus on adapting to these evolving needs is crucial.

| Substitute Type | Current Impact | Future Potential | Example Applications |

|---|---|---|---|

| Advanced Polymers/Composites | Low | Moderate (niche sectors) | Self-lubricating bearings, specific industrial components |

| Solid Lubricants (e.g., MoS2, Graphite) | Moderate (niche sectors) | Moderate to High | Extreme temperature applications, vacuum environments |

| EV Specialized Fluids | Moderate (automotive) | High (automotive) | EV transmission fluids, cooling fluids |

Entrants Threaten

The lubricants industry presents a considerable threat of new entrants due to the substantial capital required for research and development, sophisticated production facilities, and extensive global distribution networks. These high upfront costs act as a significant deterrent for potential newcomers aiming to compete with established players like Fuchs Petrolub SE.

Established players like Fuchs Petrolub SE possess significant advantages, including strong customer loyalty built over years, a wide array of specialized lubricants, and a proven track record of quality and technological advancement. These factors create substantial barriers for newcomers attempting to establish credibility and capture market share in a competitive landscape.

For instance, in 2024, the global lubricants market, valued at approximately $170 billion, saw Fuchs Petrolub maintain its strong position. New entrants would face the daunting task of matching Fuchs' extensive product range, which spans automotive, industrial, and specialty applications, and overcoming the established trust that customers place in its brand for performance and reliability.

The threat of new entrants for Fuchs Petrolub SE is generally moderate. Stringent environmental regulations and high performance standards for lubricants require significant technical expertise and substantial investment in research and development, creating a barrier for newcomers. For instance, meeting the complex specifications for automotive or industrial lubricants often involves specialized formulations and rigorous testing, which new players may find costly and time-consuming to replicate.

4

The threat of new entrants in the lubricants industry, impacting companies like Fuchs Petrolub SE, is moderately low. Securing reliable and cost-effective access to high-quality base oils and specialized additives presents a significant hurdle. Established companies often benefit from long-standing supplier relationships, making it challenging for new players to negotiate favorable terms.

Newcomers face substantial capital investment requirements for manufacturing facilities, research and development, and establishing a distribution network. For instance, building a modern lubricant blending plant can cost tens of millions of euros. Furthermore, brand recognition and customer loyalty are critical in the lubricants sector, requiring significant marketing efforts and time to build trust.

Regulatory compliance, including environmental standards and product certifications, adds another layer of complexity and cost for new entrants. Fuchs Petrolub, as a global player, navigates these regulations across various markets. The industry also demands specialized technical expertise in formulation and application, which is not easily acquired by new businesses.

Key barriers to entry include:

- Economies of Scale: Established players benefit from lower per-unit costs due to higher production volumes.

- Capital Requirements: Significant investment is needed for production, R&D, and distribution infrastructure.

- Brand Loyalty and Reputation: Building trust and recognition takes considerable time and marketing investment.

- Supplier Relationships: Access to critical raw materials at competitive prices is often secured by incumbents.

5

The threat of new entrants for Fuchs Petrolub SE is relatively low, primarily due to the substantial barriers to entry in the lubricants industry. Developing specialized, high-performance lubricants requires significant investment in research and development, a crucial factor for meeting the diverse and demanding needs of various industrial sectors.

Newcomers face challenges in establishing the necessary technical expertise and product portfolios to compete with established players like Fuchs. Furthermore, the industrial lubricants market is characterized by long sales cycles, as clients often conduct extensive testing and qualification processes before committing to a supplier. This lengthy engagement period makes it difficult for new entrants to gain traction and build a customer base quickly.

- High R&D Investment: Developing advanced lubricant formulations for specialized industrial applications demands considerable financial resources and technical know-how.

- Long Sales Cycles: Industrial customers require extensive testing and validation, creating a prolonged period before new suppliers can secure significant business.

- Brand Reputation and Trust: Established companies like Fuchs benefit from long-standing relationships and proven track records, which are difficult for new entrants to replicate.

- Regulatory Compliance: Meeting stringent environmental and performance standards across different regions adds another layer of complexity and cost for new market participants.

The threat of new entrants for Fuchs Petrolub SE is generally considered moderate to low. Significant capital investment is required for advanced manufacturing, extensive research and development for specialized formulations, and establishing a robust global distribution network. For example, the global lubricants market, projected to reach over $200 billion by 2028, demands substantial resources to compete effectively.

Established players like Fuchs benefit from strong brand recognition, customer loyalty built over decades, and deep supplier relationships that ensure access to critical raw materials. Newcomers would struggle to match the breadth of Fuchs' product portfolio, which caters to diverse automotive and industrial needs, and overcome the inherent trust associated with established quality and performance.

Regulatory compliance, including stringent environmental standards and product certifications across various international markets, adds another significant barrier. The need for specialized technical expertise in lubricant formulation and application further elevates the entry hurdle, making it challenging for new businesses to gain traction quickly.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for R&D, manufacturing, and distribution. | Significant financial hurdle. |

| Brand Loyalty & Reputation | Established trust and proven performance. | Difficult to replicate; requires extensive marketing. |

| Technical Expertise | Specialized knowledge in formulation and application. | Requires skilled personnel and R&D investment. |

| Supplier Relationships | Secured access to base oils and additives. | New entrants may face higher raw material costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fuchs Petrolub SE is built upon a foundation of publicly available financial reports, industry-specific market research from firms like Statista and IBISWorld, and regulatory filings. This combination ensures a robust understanding of the competitive landscape.