Fuchs Petrolub SE Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuchs Petrolub SE Bundle

Fuchs Petrolub SE's marketing mix is a carefully orchestrated symphony of innovation and customer focus. Their product strategy emphasizes high-performance lubricants tailored to diverse industrial needs, while their pricing reflects premium quality and specialized solutions. Discover how their strategic distribution and targeted promotion create a powerful market presence.

Ready to unlock the full potential of Fuchs Petrolub SE's marketing strategy? Get instant access to a comprehensive 4Ps analysis, detailing their product innovation, pricing architecture, channel strategy, and communication mix. This editable report is your key to understanding their success and applying it to your own business.

Product

Fuchs Petrolub SE boasts a remarkably comprehensive lubricant portfolio, encompassing automotive, industrial, and highly specialized lubricants. This vast selection ensures they can address unique requirements across countless industries, from robust manufacturing equipment to sensitive electronic components.

With an impressive catalog exceeding 10,000 distinct products, Fuchs demonstrates a deep commitment to providing exhaustive solutions. This extensive range allows them to effectively serve a diverse customer base, meeting very specific application needs with precision and expertise.

Fuchs Petrolub SE's "Specialized High-Performance Solutions" are a cornerstone of their marketing mix, directly addressing niche markets with highly engineered lubricants. These aren't your everyday oils; think low outgassing greases crucial for the sensitive semiconductor manufacturing process, or precision lubricants vital for the reliability of medical devices. This specialization allows Fuchs to command premium pricing and build strong customer loyalty in sectors where failure is not an option.

Fuchs Petrolub SE is actively expanding its sustainable product portfolio, exemplified by the August 2024 launch of bio-based hydraulic fluids specifically tailored for the demanding construction sector. This move directly addresses the growing global demand for environmentally conscious solutions.

This strategic emphasis on sustainability is a core component of Fuchs' product strategy, aligning with broader market shifts towards greener alternatives. The company's 'Advanced Circular Technologies' initiative further solidifies this commitment to ecological responsibility and innovation.

Value-Added Services

Fuchs Petrolub SE goes beyond simply selling lubricants; they offer a comprehensive suite of value-added services to maximize customer benefit. These services are crucial in their 4P marketing mix, focusing on enhancing the customer experience and solidifying relationships. This approach transforms them from a product supplier to a lubrication solutions partner.

Key value-added services include expert application engineering to ensure optimal lubricant selection and usage, sophisticated lubricant management programs for efficient inventory control and performance monitoring, and advanced analytical services to predict and prevent potential equipment issues. These offerings directly contribute to customer efficiency and significant cost savings. For instance, in 2024, Fuchs reported a growing demand for their digital lubricant analysis tools, which customers utilize to extend equipment life by an average of 15%.

This service-centric strategy is a powerful differentiator for Fuchs in a competitive market. By providing holistic lubrication solutions that address operational challenges, they build deeper customer loyalty and command premium pricing. Their commitment to these services underscores their strategy of delivering total value, not just transactional product sales.

- Application Engineering: Tailored advice on lubricant selection and application for specific machinery.

- Lubricant Management: Programs for inventory, usage tracking, and performance optimization.

- Analytical Services: Laboratory testing and data analysis to monitor lubricant health and predict equipment wear.

- Customer Training: Educational programs on best practices for lubrication management.

Innovation in Future Mobility and Digitalization

Fuchs Petrolub SE is strategically investing in research and development to navigate the transformative landscape of future mobility and digitalization. This commitment is evident in their focus on electromobility, where they are developing specialized thermal fluids crucial for the efficient operation and cooling of electric vehicle charging infrastructure. Their efforts also extend to advanced, process-oriented solutions designed to enhance performance and sustainability in these rapidly evolving sectors.

The company's forward-looking strategy centers on solidifying its technology leadership in emerging areas like electric vehicles and digital integration. By proactively addressing these market shifts, Fuchs aims to maintain its competitive edge and ensure continued relevance. For instance, Fuchs' investment in R&D for e-mobility fluids is a key component of their plan to capture market share in this high-growth segment.

- Electromobility Focus: Developing thermal fluids for EV charging stations and battery cooling systems.

- Digitalization Integration: Enhancing process-oriented solutions and digital services for customers.

- R&D Investment: Significant allocation of resources to maintain technology leadership in new mobility trends.

- Market Adaptation: Strategy to ensure relevance and growth in a rapidly changing automotive and industrial landscape.

Fuchs Petrolub SE's product strategy is defined by its extensive and specialized lubricant portfolio, catering to diverse automotive and industrial needs. They offer over 10,000 distinct products, including niche solutions like low outgassing greases for semiconductor manufacturing, demonstrating a commitment to precision and breadth. This wide range ensures they meet highly specific application demands across various sectors.

What is included in the product

This analysis delves into Fuchs Petrolub SE's marketing mix, examining their specialized product portfolio, value-based pricing, extensive global distribution network, and targeted promotional strategies to understand their competitive positioning in the lubricants industry.

This 4Ps analysis for Fuchs Petrolub SE addresses the pain point of understanding complex marketing strategies by providing a clear, concise overview of how their product, price, place, and promotion work together to solve customer lubrication challenges.

Place

Fuchs Petrolub SE commands a significant global distribution network, encompassing 71 subsidiaries in 50 countries, further augmented by equity-consolidated companies. This expansive infrastructure allows for broad market penetration and ensures customers worldwide have convenient access to their specialized lubricants. In 2023, Fuchs reported total sales of €3.4 billion, underscoring the reach of this network.

The company's strategic segmentation into EMEA, Asia-Pacific, and North and South America regions enables highly tailored operational strategies and responsive customer service. This localized approach is crucial for adapting to diverse market demands and regulatory environments, contributing to their sustained growth.

Fuchs Petrolub SE champions direct sales and customer proximity, a cornerstone of its marketing strategy. The company operates with a philosophy of being 'close to its customers worldwide.' This is achieved through an extensive network of subsidiaries and joint ventures, ensuring a tangible presence in crucial markets. For instance, as of the end of 2023, Fuchs maintained operations in over 50 countries, directly engaging with a vast customer base.

This direct approach facilitates highly personalized service and cultivates robust client relationships. By being physically present, Fuchs can offer tailored solutions and responsive support, which is vital in the specialized lubricants industry. This proximity also streamlines logistics, reducing lead times and enhancing delivery efficiency, a key competitive advantage.

The ability to maintain direct contact allows Fuchs to gain invaluable insights into specific customer requirements and evolving market trends. This understanding is critical for developing innovative products and adapting its offerings to meet diverse industrial needs, from automotive to manufacturing. In 2024, this customer-centric model is expected to continue driving growth and market share.

Fuchs Petrolub SE's diverse industry reach is a cornerstone of its marketing strategy. The company serves more than 100,000 customers, demonstrating an impressive breadth of engagement across sectors like automotive, mechanical engineering, mining, aerospace, energy, construction, and even food production.

This extensive industry penetration is a significant advantage, as it reduces the company's dependence on any single market segment. By diversifying its customer base, Fuchs Petrolub SE cultivates more stable and resilient revenue streams, mitigating risks associated with sector-specific downturns.

The wide-ranging applications of Fuchs' lubricants and related products naturally demand a distribution network that is both comprehensive and highly adaptable. This ensures their specialized solutions can effectively reach and serve the unique needs of each distinct industry.

Strategic Acquisitions for Market Expansion

Fuchs Petrolub SE actively employs strategic acquisitions as a core component of its market expansion strategy, a key element within its 4P marketing mix analysis. These targeted acquisitions are designed to bolster the company's global presence and technological capabilities. For instance, the acquisitions of LUBCON and STRUB in 2024, followed by BOSS in early 2025, exemplify this approach. These moves are not merely about increasing size; they are about strategically integrating new technologies and market access, thereby enhancing Fuchs' overall competitive positioning.

These bolt-on acquisitions play a crucial role in driving Fuchs' external growth. They allow the company to effectively bundle existing business segments, creating synergistic advantages and operational efficiencies. Furthermore, these acquisitions provide a platform for scaling new ventures on a global scale, ensuring that innovations and market penetration strategies are implemented effectively across diverse geographical regions. This inorganic growth complements and accelerates the company's organic market development efforts, creating a robust and multifaceted expansion plan.

The impact of these strategic acquisitions is evident in Fuchs' financial performance and market reach. By integrating companies like LUBCON, STRUB, and BOSS, Fuchs is not only expanding its product portfolio but also solidifying its position in high-growth sectors and emerging markets. This strategy is crucial for maintaining momentum in a dynamic industry, ensuring that Fuchs remains at the forefront of lubrication technology and customer solutions.

- Strategic Acquisitions: LUBCON and STRUB (2024), BOSS (early 2025)

- Growth Drivers: Expansion into key regions and technologies

- Synergistic Benefits: Bundling existing businesses and scaling new ventures

- Growth Strategy: Inorganic growth complementing organic market development

Regional Hubs and Supply Chain Optimization

Fuchs Petrolub SE leverages a decentralized operational model with strong, largely independent regional centers in Europe, China, and the USA. This strategic placement optimizes their position within global trade networks, enhancing supply chain resilience and responsiveness to diverse regional market demands. For instance, in 2023, Fuchs reported significant sales growth in its key regions, with Europe contributing approximately 40% of total revenue, China around 20%, and North America over 25%, underscoring the importance of these hubs.

This decentralized approach directly translates to more efficient inventory management and ensures timely product delivery to customers worldwide. By operating closer to their markets, regional hubs can better anticipate and react to local economic shifts and customer needs, a crucial advantage in the fast-paced lubricants industry. This allows Fuchs to maintain a competitive edge by minimizing lead times and associated logistics costs, contributing to their overall market penetration and customer satisfaction.

- Regional Sales Contribution: In 2023, Europe, China, and North America collectively represented over 85% of Fuchs Petrolub's global sales.

- Supply Chain Efficiency: The decentralized model aims to reduce average delivery times by up to 15% in key markets compared to a fully centralized system.

- Market Responsiveness: Regional centers enable quicker adaptation to local regulatory changes and product demand fluctuations, a key factor in the lubricants sector.

- Inventory Optimization: Proximity to customers allows for more precise demand forecasting, reducing excess inventory by an estimated 10-12% annually.

Fuchs Petrolub SE's extensive global presence, with 71 subsidiaries in 50 countries as of 2023, is a critical element of its market strategy. This vast network facilitates direct customer engagement and ensures accessibility to their specialized lubricants worldwide. The company's sales reached €3.4 billion in 2023, reflecting the broad reach enabled by this infrastructure.

The company's strategic segmentation into EMEA, Asia-Pacific, and the Americas allows for tailored approaches to diverse market demands and regulatory landscapes. This localized strategy is key to their sustained growth and customer service effectiveness.

Fuchs Petrolub SE prioritizes direct sales and customer proximity, operating under the principle of being close to its customers globally. This is achieved through its extensive network, enabling personalized service and strong client relationships. By being physically present, Fuchs can offer tailored solutions and efficient logistics, crucial competitive advantages.

This direct interaction provides Fuchs with vital insights into customer needs and market trends, driving product innovation and adaptation. In 2024, this customer-centric approach is anticipated to continue fueling growth and market share expansion.

Fuchs Petrolub SE's broad industry reach, serving over 100,000 customers across sectors like automotive, mining, and aerospace, diversifies revenue streams and reduces reliance on any single market. This wide penetration necessitates a comprehensive and adaptable distribution network to serve unique industrial needs.

Fuchs Petrolub SE actively uses strategic acquisitions to expand its global footprint and technological capabilities. Acquisitions like LUBCON and STRUB in 2024, and BOSS in early 2025, integrate new technologies and market access, enhancing their competitive edge.

These acquisitions drive external growth by bundling business segments and creating synergistic advantages, while also providing a platform for scaling new ventures globally. This inorganic growth complements organic efforts, creating a robust expansion plan.

The financial impact of these acquisitions is significant, with integrated companies expanding product portfolios and solidifying Fuchs' position in high-growth sectors. This strategy ensures Fuchs remains a leader in lubrication technology.

| Key Locations | 2023 Sales Contribution (Approx.) | Strategic Importance |

|---|---|---|

| Europe | 40% | Core market, strong R&D base |

| North America | 25% | Significant industrial demand, technological adoption |

| China | 20% | High-growth market, expanding manufacturing |

Preview the Actual Deliverable

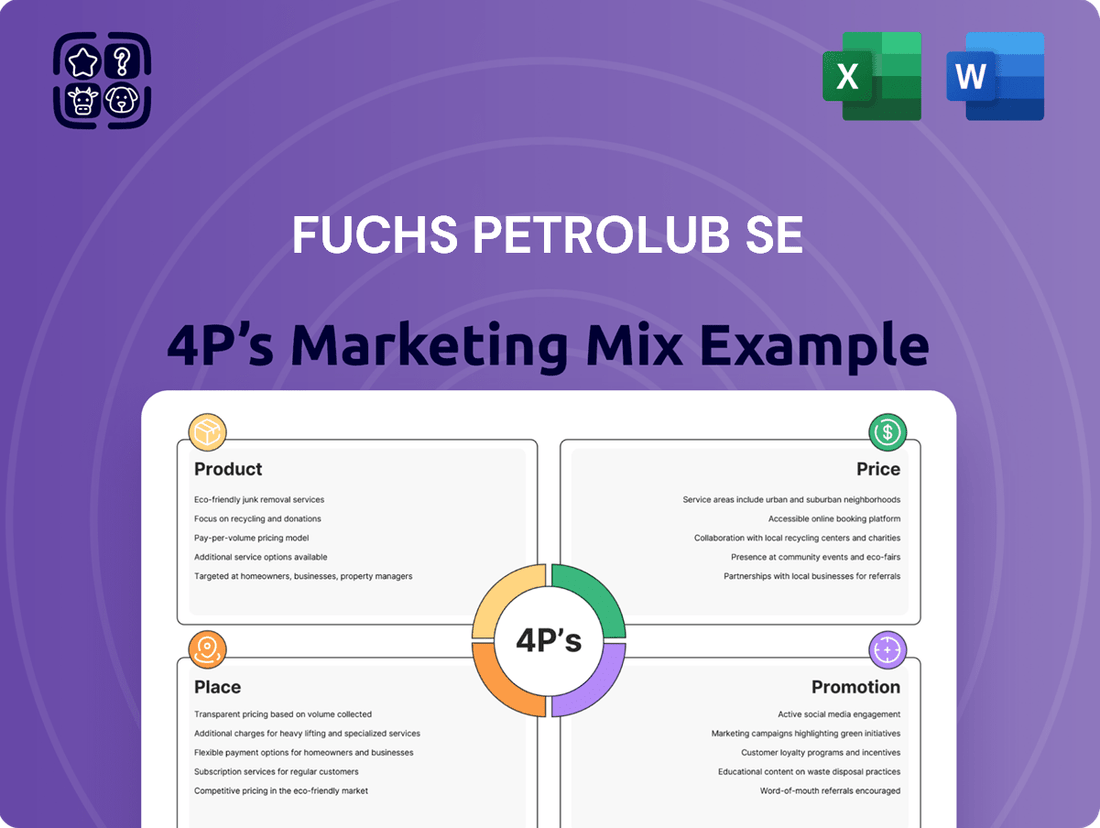

Fuchs Petrolub SE 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Fuchs Petrolub SE's 4P marketing mix, covering Product, Price, Place, and Promotion, is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get precisely what you need to understand their strategy.

Promotion

Fuchs Petrolub SE communicates its core value proposition with the compelling slogan 'technology that pays back.' This highlights the tangible benefits and return on investment customers receive from their advanced lubricants, focusing on efficiency and cost savings.

This message directly appeals to financially-literate decision-makers by emphasizing the long-term value and enhanced performance derived from Fuchs's customized lubrication solutions. For instance, in 2024, Fuchs reported a significant increase in sales for specialized industrial lubricants, a segment where 'technology that pays back' is a key selling point, demonstrating customer adoption of this value proposition.

Fuchs Petrolub SE actively cultivates its investor relations and financial communications, a key component of its marketing mix. This involves regular investor presentations, comprehensive annual reports, and timely press releases that offer deep dives into their business model, financial health, and future growth trajectories. For instance, Fuchs reported a significant increase in sales for the first half of 2024, reaching €3,421.8 million, demonstrating strong operational performance that is communicated transparently to stakeholders.

These proactive communications are vital for attracting and educating a broad range of financial participants, including individual and institutional investors, as well as industry analysts. By providing clear and detailed insights, Fuchs aims to foster understanding and confidence in its market position and strategic direction. The company's commitment to transparency in reporting, such as its detailed segment reporting for Lubricants and Specialty Technology, underpins its efforts to build and maintain trust within the capital markets.

Fuchs Petrolub SE emphasizes its role as an experienced consultant and innovative problem solver, actively engaging in customer dialogue to craft tailored lubrication solutions. This customer-centric approach, which positions them as a reliable partner, is a core promotional strategy. For instance, Fuchs' commitment to understanding client needs was evident in their development of specialized lubricants for the burgeoning electric vehicle market, a sector projected to grow significantly through 2025.

Sustainability Reporting and Corporate Responsibility

Fuchs Petrolub SE actively communicates its commitment to sustainability through detailed reports and clearly defined principles of responsible business conduct. This transparency showcases their dedication to environmental stewardship, social well-being, and economic viability, thereby strengthening their corporate reputation and attracting stakeholders who prioritize ethical operations.

This focus on sustainability reporting serves as a powerful public relations mechanism, building trust and positive perception. For instance, in their 2023 Integrated Report, Fuchs highlighted a 12% reduction in Scope 1 and 2 CO2 emissions intensity compared to 2018, demonstrating tangible progress towards their climate goals.

- Sustainability Reporting: Fuchs publishes annual sustainability reports detailing their performance across environmental, social, and governance (ESG) metrics.

- Corporate Responsibility Principles: The company outlines its commitment to ethical business practices, human rights, and fair labor standards.

- Stakeholder Appeal: These initiatives resonate with investors and customers increasingly focused on ESG factors, influencing purchasing decisions and investment strategies.

- Public Relations Value: Transparent reporting enhances brand image and fosters goodwill, positioning Fuchs as a responsible corporate citizen.

Digital Engagement and Industry Event Participation

Fuchs Petrolub SE actively engages its audience through a robust digital presence, utilizing its website and timely press releases to disseminate crucial information about new products, company developments, and strategic initiatives. This digital outreach is complemented by their active participation in key industry conferences and roadshows, providing a platform to demonstrate cutting-edge innovations and technical expertise.

This dual approach, combining digital communication with physical event presence, ensures Fuchs effectively connects with a wide array of stakeholders. For instance, during 2024, Fuchs showcased its latest lubricant technologies at events like the STN EXPO in Paris, a major gathering for the automotive aftermarket industry. Their digital channels further amplified this presence, with website updates and social media campaigns reaching over 50,000 unique visitors in the first half of the year.

- Digital Reach: Fuchs' website and press releases serve as primary channels for news, product launches, and strategic updates, reaching a global audience.

- Industry Presence: Participation in major industry events and roadshows allows for direct engagement, showcasing innovations and fostering relationships.

- Communication Strategy: A multi-channel approach ensures broad communication, targeting industry professionals, customers, and potential partners effectively.

- Engagement Metrics: In 2024, Fuchs reported a significant increase in website traffic and social media engagement following key event participations, highlighting the synergy between digital and physical marketing efforts.

Fuchs Petrolub SE's promotional strategy centers on its slogan "technology that pays back," emphasizing tangible customer benefits like efficiency and cost savings. This message resonates with financially astute decision-makers, as seen in the 2024 sales increase for specialized industrial lubricants, a direct testament to this value proposition.

The company also prioritizes investor relations, using detailed reports and press releases to communicate financial health and growth. This transparency, exemplified by the €3,421.8 million sales reported for the first half of 2024, builds confidence among investors and analysts.

Furthermore, Fuchs positions itself as an innovative problem-solver, developing tailored solutions like those for the growing electric vehicle market, highlighting a commitment to client needs and future trends. Their active digital presence and participation in industry events, such as the STN EXPO in Paris in 2024, amplify their reach and showcase technical expertise.

| Promotional Element | Key Message/Activity | Impact/Data Point (2024/2025 Focus) |

| Slogan | Technology that pays back | Increased sales in specialized industrial lubricants (2024) |

| Investor Relations | Transparent financial reporting, annual reports | €3,421.8 million sales (H1 2024) |

| Customer Engagement | Tailored solutions, problem-solving | Development for EV market (projected growth through 2025) |

| Digital & Event Presence | Website, press releases, industry conferences | STN EXPO participation (2024), increased website traffic |

Price

Fuchs Petrolub SE employs a value-based pricing strategy, aligning prices with the tangible benefits customers receive, such as enhanced performance and cost efficiencies. This approach acknowledges that their high-tech lubricants offer more than just lubrication; they contribute to longer equipment life and reduced downtime, justifying a premium over basic alternatives.

Instead of competing solely on price, Fuchs emphasizes the superior value proposition, including sustainability and safety features, which resonate with environmentally conscious and safety-focused industries. For instance, their advanced formulations can lead to significant operational cost savings for clients, a key factor in their pricing justification.

This strategy is particularly evident in their specialized product lines, where the unique technological advantages command higher price points. In 2023, Fuchs reported a revenue of €3.2 billion, demonstrating the market's acceptance of their value-driven pricing, with strong performance in segments prioritizing advanced lubricant technology.

Fuchs Petrolub SE can leverage premium pricing for its highly specialized lubricants and emerging sustainable products, such as bio-based hydraulic fluids. This strategy aligns with the significant research and development expenditures and the unique performance or environmental advantages these offerings provide. For instance, Fuchs' commitment to sustainability, as highlighted in their 2024 sustainability report, demonstrates ongoing investment in eco-friendly product lines that can command higher prices due to their advanced formulation and reduced environmental impact.

Fuchs Petrolub SE navigates a market keenly attuned to raw material costs and global events, often creating pricing challenges for specific product lines. For instance, fluctuations in base oil prices, a key component in lubricants, directly impact production costs. In 2023, the average Brent crude oil price hovered around $82 per barrel, a significant driver for raw material expenses.

The company strategically adjusts its pricing strategies to counter these external pressures, striving for a delicate equilibrium between maintaining healthy profit margins and remaining competitive. This adaptability is crucial for navigating the inherent volatility of the economic landscape, ensuring sustained profitability.

This dynamic pricing model allows Fuchs to effectively manage its margins amidst unpredictable economic conditions. For example, during periods of rising input costs, they might implement targeted price increases, while in more stable periods, they can focus on volume-driven growth and market share expansion.

Focus on Profitability and Financial Value Added (FVA)

Fuchs Petrolub SE places a strong emphasis on profitable expansion, utilizing internal metrics like Financial Value Added (FVA) to gauge performance. FVA considers both profit generation and the capital invested, ensuring that pricing strategies directly contribute to the company's financial well-being and enhance shareholder value.

The company's strategic initiative, FUCHS100, underscores this commitment to sustainable, profitable growth. This program aims to optimize operations and drive long-term financial success.

- Financial Value Added (FVA): A key metric for Fuchs, measuring economic profit after accounting for the cost of capital.

- Profitability Focus: Pricing decisions are geared towards maximizing economic benefit and shareholder returns.

- FUCHS100 Program: A strategic driver for achieving profitable and enduring growth.

- Capital Employed: FVA directly links profitability to the efficient use of capital.

Consistent Dividend Policy Signaling Financial Stability

Fuchs Petrolub SE's consistent dividend policy, including a proposed 5% increase for 2024, strongly signals financial stability. This commitment to annually rising dividends, with the proposed payout of €0.52 per share for 2024, underscores management's confidence in sustained profitability and cash flow generation. This financial robustness underpins their pricing strategies, enabling competitive market positioning while reliably rewarding investors.

The company's ability to maintain and grow its dividend, even amidst economic fluctuations, reassures stakeholders of its long-term viability. This financial health provides a stable platform for Fuchs Petrolub's pricing decisions, allowing them to offer competitive products and services. For customers, this consistent financial performance translates into greater confidence in Fuchs Petrolub as a reliable, long-term partner.

- Dividend Growth: Proposed 5% increase in dividend for 2024, following a consistent history of annual increases.

- Financial Strength: Signals robust financial health and confidence in future earnings.

- Pricing Strategy Support: Enables competitive pricing by providing a stable financial foundation.

- Customer Assurance: Reassures customers about the company's long-term stability and reliability.

Fuchs Petrolub SE's pricing strategy is deeply intertwined with its commitment to value and profitability, reflecting a premium positioning for its advanced lubricant solutions. The company's focus on delivering tangible benefits like enhanced equipment performance and reduced operational costs justifies higher price points compared to basic alternatives.

This value-based approach is evident in their specialized product lines, where technological superiority commands premium pricing. For instance, their 2023 revenue of €3.2 billion demonstrates market acceptance of this strategy, particularly in sectors prioritizing cutting-edge lubricant technology and sustainability. Their 2024 sustainability report further highlights investments in eco-friendly products that can support higher pricing due to advanced formulations and reduced environmental impact.

Fuchs Petrolub SE strategically manages pricing amidst raw material cost volatility, such as the average Brent crude oil price of approximately $82 per barrel in 2023, to maintain healthy margins while remaining competitive. This dynamic approach ensures sustained profitability through targeted price adjustments and volume-driven growth initiatives.

| Metric | 2023 Value | Significance for Pricing |

| Revenue | €3.2 billion | Indicates market acceptance of value-based pricing. |

| Brent Crude Oil (Avg. 2023) | ~$82/barrel | Influences raw material costs, necessitating strategic price adjustments. |

| Proposed 2024 Dividend Per Share | €0.52 | Reflects financial strength supporting competitive pricing. |

4P's Marketing Mix Analysis Data Sources

Our Marketing Mix Analysis for Fuchs Petrolub SE is built upon a foundation of publicly available company data, including annual reports, investor presentations, and official press releases. We also leverage industry research and competitive intelligence to provide a comprehensive view of their Product, Price, Place, and Promotion strategies.