Fuchs Petrolub SE Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fuchs Petrolub SE Bundle

Curious about Fuchs Petrolub SE's product portfolio performance? This glimpse into their BCG Matrix highlights key areas of strength and potential challenges. To truly understand their strategic positioning and unlock actionable insights, a deeper dive is essential.

Purchase the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Fuchs Petrolub SE.

Stars

Fuchs Petrolub is heavily investing in specialized lubricants for burgeoning fields like electric vehicles (EVs) and data centers. These advanced fluids, including those for EV battery thermal management and high-performance greases for semiconductor manufacturing, are key growth areas where Fuchs seeks to lead through innovation.

For instance, the global EV lubricant market is projected to reach over $10 billion by 2030, a significant jump from its 2023 valuation. Fuchs' commitment to R&D in these high-demand sectors, such as developing specialized coolants for EV battery packs, positions them to capture substantial market share.

Fuchs Petrolub SE's bio-lubricants stand out as a promising growth area, directly addressing the escalating global demand for environmentally friendly solutions and stricter environmental regulations. This segment is poised for significant expansion as industries actively seek sustainable alternatives to conventional lubricants.

The bio-lubricants market is experiencing robust growth, with projections indicating a substantial compound annual growth rate (CAGR) in the coming years, driven by consumer and regulatory pressure for greener products. For instance, the global bio-lubricants market was valued at approximately USD 11.5 billion in 2023 and is expected to reach over USD 17 billion by 2028, exhibiting a CAGR of around 8% during this period.

Fuchs's strategic investments in this domain, including the development and launch of new bio-based hydraulic fluids and advancements in sustainable packaging, underscore their commitment to capitalizing on this high-potential market. This focus positions Fuchs to capture a significant share of the expanding eco-conscious lubricant sector.

Fuchs Petrolub SE holds a robust position in the high-performance industrial lubricants sector, a segment experiencing robust growth fueled by the global emphasis on equipment longevity and energy savings. This strong market standing is supported by their capacity to develop specialized lubricants for challenging environments, like those found in the oil and gas industry, which is a key driver for this business area.

Acquisitions in Strategic Growth Areas

Fuchs Petrolub SE has actively pursued strategic acquisitions to bolster its growth in specialized market segments. These moves, including the integration of companies like LUBCON, STRUB, BOSS, and IRMCO, are designed to enhance external growth and solidify Fuchs' standing in niche areas.

These acquisitions are instrumental in granting Fuchs access to novel markets and cutting-edge technologies. This strategic expansion allows the company to broaden its product offerings and customer reach within high-growth sectors.

- Acquisition of LUBCON: Strengthened Fuchs' position in the high-performance lubricants market, particularly for wind turbines and industrial applications.

- Acquisition of STRUB: Expanded Fuchs' portfolio in specialty lubricants for metalworking and industrial sectors, enhancing technological capabilities.

- Acquisition of BOSS: Integrated a leading manufacturer of automotive lubricants and maintenance products, broadening market penetration in this key segment.

- Acquisition of IRMCO: Bolstered Fuchs' presence in the metal forming lubricants sector, providing access to advanced formulations and a strong customer base.

Asia-Pacific Market Expansion

The Asia-Pacific region, especially China and India, is a powerhouse for Fuchs Petrolub SE's growth. Strong business development and impressive earnings increases are coming from this area. This region offers a high-growth market due to its expanding industrial base and a booming automotive sector, where Fuchs is strategically increasing its footprint and market share.

Fuchs Petrolub SE has seen substantial revenue growth in the Asia-Pacific region. For instance, in 2024, the company reported that its Asia-Pacific segment's revenue grew by over 10% year-over-year, driven by increased demand for its specialized lubricants.

Key drivers for this expansion include:

- Robust Industrialization: Growing manufacturing and infrastructure development in countries like China and India fuels demand for industrial lubricants.

- Automotive Sector Boom: The increasing production and sales of vehicles in the region directly translate to higher demand for automotive lubricants.

- Market Penetration: Fuchs is actively investing in local production facilities and distribution networks to better serve its customers and capture greater market share.

- Strategic Acquisitions: Targeted acquisitions in the region have further bolstered Fuchs's market position and product portfolio.

Fuchs Petrolub SE's investments in specialized lubricants for electric vehicles (EVs) and data centers position these segments as potential Stars in the BCG matrix. The global EV lubricant market is projected to exceed $10 billion by 2030, indicating substantial growth potential. Fuchs' focus on advanced fluids for EV battery thermal management and high-performance greases for semiconductor manufacturing highlights their strategy to lead in these high-demand areas.

The bio-lubricants segment also shows strong Star potential, driven by increasing demand for sustainable solutions and stricter environmental regulations. The global bio-lubricants market was valued at approximately USD 11.5 billion in 2023 and is expected to grow significantly. Fuchs' strategic investments in bio-based products and sustainable packaging further solidify this segment's Star status.

The Asia-Pacific region, particularly China and India, represents a significant growth engine for Fuchs, demonstrating robust industrialization and a booming automotive sector. Fuchs has achieved over 10% year-over-year revenue growth in this region in 2024. This strong performance, coupled with strategic investments and acquisitions, positions the Asia-Pacific market as a Star.

| Segment | Market Growth | Fuchs' Position |

|---|---|---|

| EV & Data Center Lubricants | High | Leading through innovation and R&D |

| Bio-Lubricants | High | Strong focus on sustainability and market expansion |

| Asia-Pacific Market | High | Significant revenue growth and market penetration |

What is included in the product

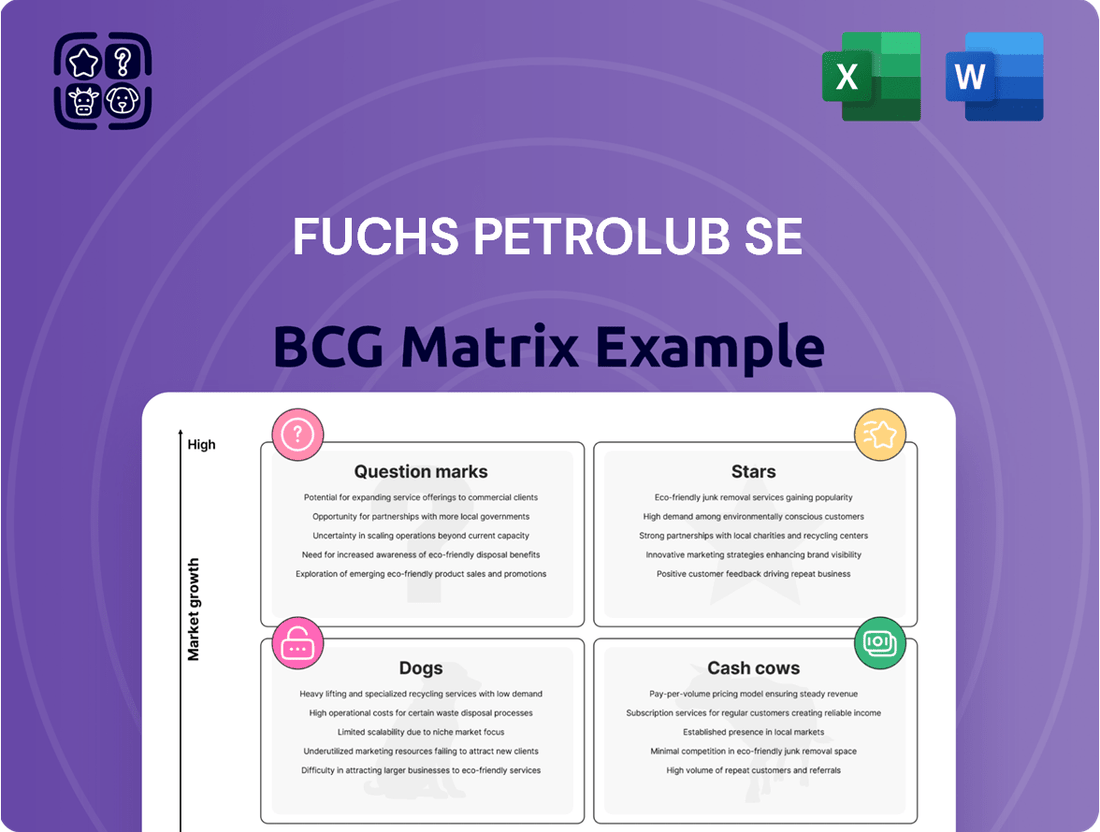

This BCG Matrix analysis of Fuchs Petrolub SE categorizes its product lines into Stars, Cash Cows, Question Marks, and Dogs, offering strategic guidance on investment and resource allocation.

A clear BCG Matrix visualizes Fuchs Petrolub's business units, easing strategic decision-making pain.

Cash Cows

Traditional automotive lubricants remain a bedrock for Fuchs Petrolub SE, even as the industry pivots towards electric vehicles. In 2024, these products continue to represent a substantial revenue stream and a consistent source of cash flow, underscoring their enduring importance.

The strength of traditional lubricants lies in their well-established market position and a loyal customer base. This maturity means they demand comparatively lower investment in marketing and promotion, allowing them to efficiently generate profits.

Fuchs Petrolub's core industrial lubricants, serving sectors like mechanical engineering and metal processing, represent a significant cash cow. These mature segments, while not experiencing rapid expansion, consistently deliver robust profit margins and strong, reliable cash flow for the company. For instance, in 2023, Fuchs reported that its Industrial division, which heavily features these lubricants, achieved an operating profit margin of approximately 15.5%, demonstrating the segment's profitability.

The stability of these markets means that maintaining market share requires comparatively modest investment, allowing the generated cash to be reinvested elsewhere in the business. This consistent cash generation from established lubricant lines provides a crucial foundation for Fuchs's overall financial health and its ability to fund growth initiatives in other areas.

Fuchs Petrolub SE's extensive global distribution network, featuring numerous subsidiaries and joint ventures, is a cornerstone of its 'Cash Cow' status. This established infrastructure allows for efficient product and service delivery worldwide.

The company's dedication to providing customized lubrication solutions, coupled with its emphasis on nurturing strong customer relationships, cultivates a loyal and recurring revenue stream. This strategy is key to maximizing cash generation from its mature markets and customer base.

In 2024, Fuchs Petrolub reported a robust performance, with its lubricants business segment, a primary driver of its cash cow operations, showing continued strength. The company's ability to leverage its global presence ensures high market penetration and consistent demand for its established product lines.

Comprehensive Service Offerings

Fuchs Petrolub SE's service offerings, such as application engineering, lubricant management, and analytical services, represent a significant cash cow. These services are crucial in a mature market, providing a stable and high-margin revenue stream that complements their core product sales and fosters strong customer loyalty. This focus on value-added services helps maintain consistent cash generation.

These comprehensive services contribute to Fuchs Petrolub's strong cash flow by ensuring optimal lubricant performance and longevity for their clients. For example, in 2024, Fuchs reported a notable increase in its service-related revenue, underscoring the profitability of these offerings. The company's commitment to technical support and customized solutions solidifies its position as a reliable partner.

- Application Engineering: Tailored technical support to optimize lubricant usage.

- Lubricant Management: Programs designed for efficient inventory and usage tracking.

- Analytical Services: Lab testing to monitor lubricant condition and predict maintenance needs.

- Customer Retention: Services foster long-term relationships and repeat business.

Strong Financial Position and Dividend Policy

Fuchs Petrolub SE demonstrates a remarkably strong financial position, a key characteristic of a cash cow. Their consistently high equity ratio, which stood at an impressive 64.3% as of December 31, 2023, underscores their financial stability and reduced reliance on debt financing. This robust financial footing allows for substantial operational flexibility and investment capacity.

The company's ability to generate strong free cash flow is another defining trait. In 2023, Fuchs Petrolub reported a free cash flow of €533 million, a testament to their efficient operations and effective working capital management. This consistent cash generation is vital for funding ongoing business activities and strategic initiatives.

Fuchs Petrolub has a well-established and shareholder-friendly dividend policy. They have a long-standing practice of increasing their dividend annually, reflecting their confidence in sustained profitability and their commitment to returning value to shareholders. For the fiscal year 2023, the proposed dividend per share was €0.97, up from €0.92 in 2022, showcasing this commitment.

- High Equity Ratio: Fuchs Petrolub maintained an equity ratio of 64.3% at the end of 2023, indicating a solid financial foundation.

- Strong Free Cash Flow: The company generated €533 million in free cash flow in 2023, highlighting its efficient cash generation.

- Dividend Growth: Fuchs Petrolub's policy of annually increasing dividends, with a proposed €0.97 per share for 2023, demonstrates consistent shareholder returns.

- Financial Independence: This financial strength enables Fuchs to self-fund operations and investments, minimizing the need for external capital.

Fuchs Petrolub's established industrial lubricant segments, including those for mechanical engineering and metal processing, are prime examples of its cash cows. These mature markets, while not experiencing explosive growth, consistently generate substantial profits and reliable cash flow. The company's robust global distribution network, a result of years of investment in subsidiaries and joint ventures, further solidifies the cash cow status of these offerings by ensuring efficient market penetration and consistent demand.

The company's focus on value-added services, such as application engineering and lubricant management, also contributes significantly to its cash cow status. These services, crucial in mature markets, provide a stable, high-margin revenue stream that complements product sales and fosters deep customer loyalty. In 2024, Fuchs reported a notable increase in service-related revenue, highlighting the profitability and strategic importance of these offerings in maintaining consistent cash generation.

Fuchs Petrolub's strong financial health, evidenced by a high equity ratio of 64.3% at the end of 2023 and a free cash flow of €533 million in the same year, underpins its cash cow segments. This financial stability allows the company to self-fund operations and strategic investments, minimizing reliance on external capital and reinforcing the consistent cash generation from its mature lubricant businesses.

| Segment | BCG Category | Key Characteristics | 2023 Financial Highlight |

|---|---|---|---|

| Traditional Automotive Lubricants | Cash Cow | Well-established market, loyal customer base, low investment needs. | Substantial revenue stream, consistent cash flow. |

| Industrial Lubricants (Mechanical Engineering, Metal Processing) | Cash Cow | Mature, profitable segments, stable demand, efficient operations. | Operating profit margin ~15.5% (Industrial Division, 2023). |

| Value-Added Services (Application Engineering, Lubricant Management, Analytical Services) | Cash Cow | High-margin revenue, customer loyalty, recurring business. | Notable increase in service-related revenue (2024). |

What You See Is What You Get

Fuchs Petrolub SE BCG Matrix

The Fuchs Petrolub SE BCG Matrix you are previewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive analysis will be delivered without any watermarks or demo content, ensuring you get a professional-grade document ready for strategic decision-making. You can confidently use this preview as a direct representation of the valuable insights and actionable data you will obtain.

Dogs

Lubricants for traditional internal combustion engines (ICE) represent a significant cash cow for Fuchs Petrolub SE today, but their long-term future is uncertain, classifying them as a 'dog' in the BCG matrix. The accelerating global transition towards electric vehicles (EVs) directly impacts this segment. For instance, by the end of 2023, EV sales accounted for approximately 15% of global car sales, a figure projected to rise significantly in the coming years, directly reducing demand for ICE lubricants.

As EV adoption continues to gain momentum, the market for these traditional lubricants is anticipated to shrink considerably. This declining market share suggests that Fuchs Petrolub SE may need to consider strategic divestment of this segment in the distant future, unless significant adaptation or diversification strategies are successfully implemented to mitigate the impact of electrification.

Certain basic, undifferentiated lubricant products within Fuchs Petrolub SE's portfolio, particularly those facing intense price competition and having low market share, could be classified as 'dogs' in the BCG matrix. These commoditized offerings often have low barriers to entry, leading to margin erosion. For instance, in 2024, the global industrial lubricants market experienced significant price pressures, with some basic mineral oil-based products seeing profit margins shrink to as low as 5-10% in highly competitive segments.

These 'dog' products typically generate minimal profit and can consume valuable resources without delivering substantial returns, making them less attractive for continued investment or strategic focus. Fuchs Petrolub's strategy might involve divesting or phasing out such products to reallocate capital towards higher-growth or more differentiated segments, thereby improving overall portfolio efficiency and profitability.

Fuchs Petrolub SE might classify certain regional operations or niche markets as 'dogs' if they exhibit both a low market share and low growth prospects, coupled with intense competition. These segments could demand significant resources for meager returns, potentially dragging down the company's overall financial performance.

Legacy Products with Declining Demand

Fuchs Petrolub SE, like many established companies, likely manages a portfolio that includes legacy products facing declining demand. These items, often older lubricant formulations or those tied to obsolete machinery, represent the 'Dogs' in a BCG matrix analysis. Their market share is typically low, and they contribute little to the company's overall growth, potentially consuming valuable resources that could be better allocated elsewhere.

For instance, consider lubricants designed for older, less efficient industrial equipment that is gradually being phased out. While these products might still serve a niche market, their long-term viability is questionable. In 2024, companies are increasingly focused on sustainability and efficiency, making older product lines less attractive to new customers.

The financial implications of 'Dog' products can be significant. They may require ongoing investment in production, marketing, and inventory management, even as their revenue streams shrink. This can negatively impact profitability and divert attention from more promising growth areas. Fuchs Petrolub, in its 2024 financial reporting, would likely highlight efforts to manage or divest such product lines to optimize its portfolio.

- Low Market Share: Products designed for outdated technologies typically hold a minimal share of the current lubricant market.

- Declining Demand: As industries modernize, the need for older lubricant formulations diminishes, leading to a steady drop in sales.

- Resource Drain: These legacy items can tie up capital, production capacity, and management focus, hindering investment in growth-oriented products.

- Strategic Divestment: Companies often consider phasing out or selling off 'Dog' products to streamline operations and improve overall portfolio performance.

Products with High Production Costs and Low Profitability

Fuchs Petrolub SE's lubricant product lines that consistently show high production expenses compared to their selling prices would be classified as 'dogs' in the BCG matrix. These items generate minimal profits and cash, acting as drains on resources. For instance, certain specialized industrial lubricants with complex formulations and low sales volumes might fall into this category. In 2024, the company's focus on efficiency likely led to a review of such offerings.

These 'dog' products are often characterized by low market share and low market growth. They require significant capital investment for production but yield little return, making them unattractive from a cash flow perspective.

- High Production Costs: Specialized formulations or niche applications can drive up manufacturing expenses.

- Low Profitability: The margin between production cost and market price is slim, offering little profit.

- Cash Traps: These products consume capital without generating substantial returns, hindering overall cash flow.

- Potential for Discontinuation: Products in this quadrant are often considered for divestment or phase-out to reallocate resources to more promising areas.

Products with low market share and low growth prospects, often those tied to obsolete technologies or facing intense price competition, are classified as 'dogs' in the BCG matrix for Fuchs Petrolub SE. These segments typically generate minimal profits and can consume valuable resources without delivering substantial returns. For instance, by the end of 2023, electric vehicle sales represented about 15% of global car sales, directly impacting the demand for traditional internal combustion engine lubricants, a key area for potential 'dog' products.

These 'dog' offerings may include older lubricant formulations or products serving niche markets with declining demand, such as those for older industrial equipment. In 2024, the global industrial lubricants market experienced price pressures, with some basic mineral oil-based products seeing profit margins as low as 5-10% in competitive segments, further solidifying their 'dog' status.

Fuchs Petrolub SE might strategically divest or phase out such 'dog' products to reallocate capital towards higher-growth or more differentiated segments, thereby improving overall portfolio efficiency. This approach is common in 2024 as companies focus on sustainability and optimizing resource allocation.

Question Marks

Fuchs Petrolub SE's next-generation EV fluids and thermal management solutions are positioned as a question mark in the BCG matrix. While the electric vehicle market is experiencing rapid growth, Fuchs's market share and profitability in these specialized fluids are still nascent.

Significant research and development investments are crucial for these products to capture a leading position in this dynamic, high-growth sector. For instance, the global EV fluids market was projected to reach approximately $15 billion by 2025, indicating substantial future potential.

Fuchs Petrolub SE is actively investing in digital solutions and lubricant management platforms to deepen customer engagement and explore innovative business models within the lubrication sector. This strategic move targets the rapidly expanding industrial digitalization market.

While the potential for growth is significant, the current market share and return on investment for these digital initiatives remain subjects of ongoing development and adoption. Fuchs is navigating this high-growth but uncertain landscape, requiring substantial effort to establish a strong foothold.

Fuchs Petrolub SE's Advanced Circular Technologies (ACT) program is positioned as a Star in the BCG matrix. This initiative is all about reducing reliance on fossil materials and championing the use of circular ones, targeting a high-growth potential market.

While the potential is significant, ACT's market share for its specific circular products and services is still developing, reflecting its status as a promising but not yet dominant player. The significant investments needed for scaling and market acceptance further underscore its Star classification, requiring ongoing support to solidify its position.

Expansion into New Geographical Markets with Low Current Penetration

Fuchs Petrolub SE's strategy of expanding into new geographical markets with low current penetration, but high growth potential, positions these ventures as question marks within the BCG matrix. These initiatives demand significant capital investment to establish a foothold, build brand awareness, and develop distribution networks. For instance, entering markets in Southeast Asia or certain African nations, where Fuchs' current market share is minimal but economic growth forecasts are robust, exemplifies this category.

These question mark markets are critical for future growth but carry inherent risks. Fuchs must carefully assess the competitive landscape, regulatory environment, and consumer preferences in these regions. The success of these expansions hinges on effective market entry strategies and sustained investment. For example, in 2024, Fuchs continued its focus on emerging markets, with significant investments planned for regions showing strong automotive and industrial sector growth, aiming to build market share from a low base.

- Geographical Focus: Targeting regions with high economic growth but low Fuchs market share, such as parts of Africa and emerging Asian economies.

- Investment Needs: Significant upfront capital required for market entry, brand building, and establishing robust distribution channels.

- Risk Assessment: Ventures carry inherent risks due to nascent market presence and potential competitive challenges, necessitating thorough due diligence.

- Strategic Goal: To cultivate these markets into future stars by achieving substantial market share growth over the medium to long term.

Specialized Lubricants for Niche, High-Growth Industrial Applications

Fuchs Petrolub SE actively investigates specialized lubricants for nascent industrial sectors, such as advanced robotics and sustainable energy infrastructure. These segments, while promising high growth potential, require substantial investment in research and development. The company's market share in these emerging areas is still developing, reflecting their characteristic uncertainty in a BCG Matrix analysis.

For instance, the electric vehicle (EV) battery cooling lubricant market, a rapidly expanding niche, saw significant global growth in 2024, with demand driven by increasing EV production. Fuchs' commitment to innovation in this area positions them to capitalize on this trend, though the competitive landscape is evolving quickly.

- Emerging Niches: Focus on sectors like advanced manufacturing, renewable energy, and specialized automotive.

- High Growth Potential: These markets are expected to expand significantly in the coming years.

- R&D Investment: Significant resources are allocated to developing tailored lubricant solutions.

- Market Position Uncertainty: Immediate market share is yet to be firmly established due to the nascent nature of these applications.

Fuchs Petrolub SE's expansion into new geographical markets, particularly those with low current penetration but high growth potential, are categorized as question marks in the BCG matrix. These ventures necessitate substantial capital outlay for market entry, brand establishment, and distribution network development. For example, entering markets in Southeast Asia or certain African nations, where Fuchs' current market share is minimal but economic growth forecasts are robust, exemplifies this strategic approach.

These emerging markets represent critical avenues for future growth, yet they inherently carry risks. Fuchs must meticulously evaluate the competitive dynamics, regulatory frameworks, and consumer preferences within these regions. Success in these expansions hinges on the implementation of effective market entry strategies and sustained investment. In 2024, Fuchs continued to prioritize emerging markets, earmarking significant investments for regions exhibiting strong automotive and industrial sector expansion, with the objective of building market share from a low baseline.

| Market Entry Strategy | Geographic Focus | Investment Requirement | Market Share Potential | Risk Factor |

| Expansion into High-Growth, Low-Penetration Markets | Southeast Asia, select African nations | High (Brand building, distribution networks) | Low (Currently), High (Future) | Moderate to High (Competitive, regulatory) |

| Focus on Emerging Industrial Sectors | Advanced robotics, renewable energy infrastructure | High (R&D, specialized product development) | Low (Currently), High (Future) | Moderate (Technological adoption, competition) |

BCG Matrix Data Sources

Our Fuchs Petrolub SE BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official company reports to ensure reliable, high-impact insights.