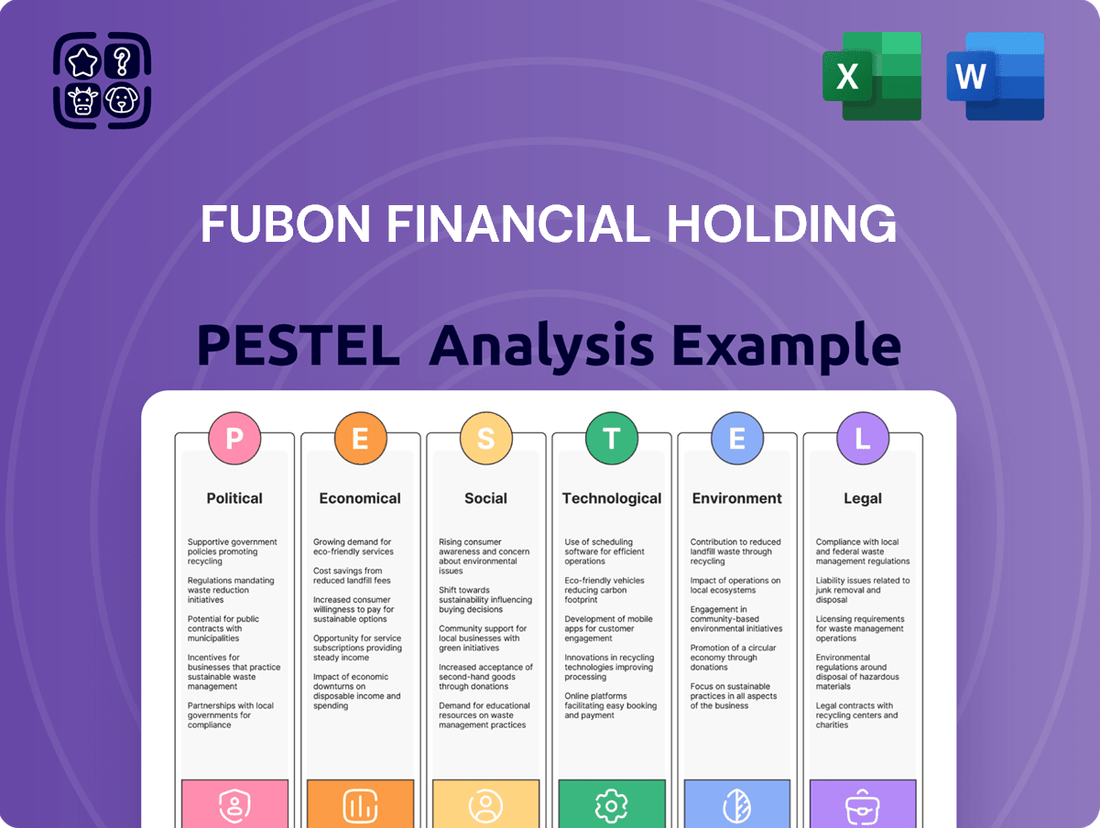

Fubon Financial Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fubon Financial Holding Bundle

Navigate the complex external landscape impacting Fubon Financial Holding with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and evolving social trends are shaping its strategic direction and market opportunities. Gain a critical advantage by downloading the full report, packed with actionable intelligence for informed decision-making.

Political factors

Fubon Financial Holding navigates a stringent regulatory environment in Taiwan, overseen by the Financial Supervisory Commission (FSC). The FSC's directives, encompassing anti-money laundering (AML) and capital adequacy requirements, significantly influence Fubon's operational strategies and compliance investments. In 2023, for instance, Taiwan’s FSC continued to emphasize robust AML frameworks, leading financial institutions like Fubon to bolster their transaction monitoring systems and employee training.

These evolving regulations necessitate ongoing adaptation, impacting Fubon's product development and risk management practices. For example, new consumer protection mandates introduced in late 2024 require enhanced transparency in financial product disclosures, prompting Fubon to revise its customer onboarding processes and marketing materials to ensure full compliance.

The political relationship between Taiwan and mainland China remains a critical factor for Fubon Financial Holdings. Tensions or détente across the Taiwan Strait directly impact regional economic stability and investor sentiment. For instance, increased military exercises or diplomatic disputes can lead to capital flight and hinder cross-border financial activities, affecting Fubon's operations and growth prospects in the greater China region.

Geopolitical stability in the Indo-Pacific is paramount for Fubon's long-term strategy. Any escalation of regional conflicts or trade disputes involving major powers could disrupt supply chains, affect market liquidity, and increase operational risks for financial institutions like Fubon. Maintaining a stable geopolitical environment is essential for fostering investor confidence and facilitating Fubon's planned regional expansion initiatives.

Taiwan's government is actively fostering financial innovation, particularly in fintech. Initiatives like the Fintech Development and Innovation and Experiment Act, often called the Sandbox Act, and the Fintech Roadmap 2.0 provide a supportive framework for new financial technologies and business models. This creates a fertile ground for companies like Fubon Financial to test and implement cutting-edge digital services.

Fubon Financial can strategically utilize these government-backed programs to explore novel business avenues and digital service enhancements. By engaging with these initiatives, Fubon aims to sharpen its competitive positioning within the dynamic and rapidly evolving financial sector. For instance, the Sandbox Act allows for regulatory sandboxing, enabling companies to test innovative financial products and services in a controlled environment before full market rollout.

Policy Support for Green Finance and ESG

Taiwan's government is actively championing sustainable development and green finance, a trend that significantly impacts financial institutions like Fubon Financial. The nation’s Green Finance Action Plans, launched with ambitious targets, underscore this commitment. For instance, by the end of 2023, Taiwan had seen substantial growth in green bonds, with total issuance reaching NT$300 billion, demonstrating a clear market shift towards sustainability.

Fubon Financial, as a major player, is strategically aligning its operations with these government initiatives. This alignment is crucial for capitalizing on emerging opportunities in green investments and developing innovative sustainable financial products. The company's proactive stance allows it to tap into a growing pool of environmentally conscious capital and meet increasing investor demand for ESG-compliant offerings.

However, this supportive policy environment also necessitates rigorous adherence to evolving ESG reporting standards and disclosure requirements. Fubon Financial must navigate these regulatory changes, ensuring transparency and accountability in its sustainability practices. By doing so, it not only meets compliance obligations but also enhances its reputation and competitive edge in the green finance landscape.

- Government Mandates: Taiwan's Financial Supervisory Commission (FSC) has been instrumental in promoting green finance, with plans to expand ESG disclosure requirements for listed companies, including financial holding companies, starting from 2025.

- Market Growth: The green finance market in Taiwan is experiencing robust expansion, with the total volume of green financial products, including loans and bonds, projected to exceed NT$1 trillion by 2025.

- Fubon's Alignment: Fubon Financial has committed to increasing its green financing portfolio, aiming for a 20% year-on-year growth in green loans and investments through 2024-2025, in line with national sustainability goals.

Financial Inclusion Policies

Taiwan's Financial Supervisory Commission (FSC) is actively pushing financial inclusion, setting specific indicators and supporting programs to broaden access to financial services. This focus directly influences Fubon Financial's strategic planning, encouraging the creation of more accessible products and services to reach previously underserved populations.

For instance, as of late 2024, the FSC's initiatives aim to increase the digital banking penetration rate among younger demographics and rural communities. Fubon Financial's response could involve tailoring digital platforms and offering simplified account opening processes, aligning with these national objectives and potentially tapping into new customer segments.

- FSC's Financial Inclusion Goals: The FSC has established clear targets for improving financial access, particularly for vulnerable groups and in remote areas.

- Fubon's Strategic Alignment: Fubon Financial must integrate these inclusion goals into its product development and market expansion strategies.

- Market Opportunity: This policy shift presents an opportunity for Fubon to innovate and capture market share by serving segments currently lacking adequate financial services.

Government policies in Taiwan significantly shape Fubon Financial's operational landscape, particularly through the Financial Supervisory Commission (FSC). The FSC's ongoing efforts to enhance green finance, with a target to exceed NT$1 trillion in green financial products by 2025, directly influences Fubon's investment strategies and product development. Furthermore, the FSC's push for financial inclusion, aiming to increase digital banking penetration among underserved populations, presents strategic opportunities for Fubon to expand its customer base.

Taiwan's commitment to financial innovation, supported by initiatives like the Sandbox Act, allows Fubon to test and deploy new fintech solutions. Geopolitical stability, especially concerning cross-strait relations, remains a crucial factor impacting regional economic confidence and Fubon's operational stability. The government's focus on ESG reporting standards also necessitates Fubon's adherence to evolving transparency and accountability measures in its sustainability practices.

| Policy Area | Key Initiative/Regulation | Impact on Fubon Financial | 2024/2025 Data Point |

| Green Finance | Green Finance Action Plans | Drives investment in sustainable products; aligns with NT$1 trillion market target by 2025. | Fubon aims for 20% YoY growth in green financing portfolio (2024-2025). |

| Financial Innovation | Fintech Development and Innovation and Experiment Act (Sandbox Act) | Facilitates testing of new digital services and business models. | Enables controlled testing of innovative financial products. |

| Financial Inclusion | FSC Programs for Underserved Populations | Encourages development of accessible products; targets increased digital banking penetration. | FSC aims to boost digital banking penetration among younger demographics and rural communities. |

| Regulatory Compliance | ESG Disclosure Requirements | Requires enhanced transparency and accountability in sustainability reporting. | Expanded ESG disclosure requirements for listed companies from 2025. |

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Fubon Financial Holding, offering a comprehensive view of its operating landscape.

A PESTLE analysis of Fubon Financial Holding serves as a pain point reliever by providing a structured framework to navigate complex external factors, enabling proactive strategy development and mitigating potential market disruptions.

Economic factors

Fubon Financial Holding's performance is intrinsically linked to Taiwan's economic vitality. Robust GDP growth, typically projected around 3-4% for 2024 and 2025, coupled with stable inflation rates, fosters a positive climate for financial services. This stability supports healthy loan demand and investment returns.

Taiwan's strong export performance, significantly bolstered by its leading role in AI and semiconductor industries, directly benefits financial institutions like Fubon. For instance, Taiwan's exports reached a record high of $432.4 billion in 2023, with semiconductors constituting a substantial portion, driving economic activity and creating opportunities for financial sector growth.

Conversely, any economic deceleration or persistent inflationary pressures could present headwinds. Such conditions might dampen consumer and business confidence, potentially leading to reduced loan origination, increased non-performing assets, and lower overall investment returns for Fubon.

The Central Bank of the Republic of China (Taiwan) (CBC) plays a crucial role in shaping the interest rate environment. In its March 2024 meeting, the CBC maintained its policy rates, with the discount rate at 1.875%, the rate on accommodations with collateral at 1.625%, and the rate on unsecured accommodations at 3.85%. This stability, while welcome for planning, means Fubon Financial Holding's profitability, particularly in its banking and insurance arms, will continue to be influenced by these existing levels.

Fluctuations in these rates directly impact Fubon's core operations. Higher rates can widen lending margins for the banking segment but also increase funding costs. For the insurance segment, investment income from fixed-income portfolios is sensitive to interest rate movements. The CBC's decisions, therefore, are a critical factor in Fubon's financial performance and strategic decision-making.

The Taiwan Stock Exchange (TWSE) experienced robust performance in 2024, with the Taiex index reaching new highs, partly driven by the booming AI sector and sustained foreign investment inflows. This positive market sentiment directly translates to increased trading volumes and higher asset under management for Fubon Financial Holding's securities and asset management arms.

Investor confidence in Taiwan remained elevated through early 2025, supported by strong corporate earnings and favorable economic outlook. For Fubon, this translates to a beneficial environment for its wealth management and brokerage services, as individuals and institutions are more likely to engage in investment activities, thereby boosting fee-based income.

Consumer Spending and Household Income

Consumer spending power and household income are critical drivers for Fubon Financial Holding, directly influencing demand across its insurance, banking, and wealth management offerings. In 2024, Taiwan's real wage growth is projected to remain positive, supporting consumer confidence. For instance, the average monthly wage in Taiwan saw an increase in early 2024, bolstering households' capacity for financial planning and investment.

Sustained wage growth and stable employment are key to boosting consumer confidence, which in turn enhances their ability to engage with Fubon's retail financial services. Data from Taiwan's Directorate-General of Budget, Accounting and Statistics indicated a steady unemployment rate throughout late 2023 and into 2024, providing a stable economic backdrop.

Here are some key factors:

- Consumer Confidence: High consumer confidence, often linked to income stability, encourages spending on discretionary financial products like life insurance and investment funds.

- Disposable Income: Increases in disposable income directly translate to greater capacity for households to save, invest, and purchase financial services.

- Wage Growth Trends: Positive real wage growth in Taiwan, as seen in recent economic reports, directly fuels consumer spending power.

- Employment Stability: Low unemployment rates ensure a larger segment of the population has consistent income, supporting Fubon's customer base.

Regional Economic Integration and Expansion Opportunities

Fubon Financial's strategic presence in the Greater China region positions it to capitalize on increasing economic integration. For instance, the Regional Comprehensive Economic Partnership (RCEP), which came into effect in early 2022 and includes China, offers a significant framework for expanded trade and investment, potentially boosting cross-border financial flows and creating avenues for Fubon to offer a wider array of financial products and services to a more diverse clientele.

This integration facilitates easier movement of capital and services, allowing Fubon to potentially diversify its revenue streams beyond its domestic market. As economic ties strengthen, opportunities arise for Fubon to leverage its expertise in areas like wealth management and digital banking across a broader customer base within the region.

However, the interconnectedness also presents risks. Economic slowdowns or escalating trade tensions, such as those that have periodically emerged between major regional players, could negatively impact Fubon's international operations and profitability. For example, fluctuations in GDP growth rates across key Greater China markets directly influence consumer spending and business investment, affecting demand for financial services.

- Increased Trade Flows: RCEP aims to reduce tariffs and non-tariff barriers, potentially increasing intra-regional trade by an estimated $422 billion annually by 2030, creating more demand for trade finance and related services.

- Investment Opportunities: Greater economic integration often correlates with increased foreign direct investment, providing Fubon with opportunities to serve both domestic and international investors.

- Digital Banking Expansion: As regional digital economies grow, Fubon can leverage cross-border digital platforms to offer banking and insurance solutions, tapping into a larger, digitally-native customer segment.

- Geopolitical Sensitivity: Any significant geopolitical shifts or trade disputes within Greater China could disrupt financial markets and Fubon's expansion plans, highlighting the need for robust risk management strategies.

Taiwan's economic trajectory, marked by projected GDP growth of 3-4% for 2024 and 2025, provides a solid foundation for Fubon Financial Holding. The nation's strength in high-tech exports, particularly semiconductors, fuels economic activity and supports demand for financial services.

The Central Bank of the Republic of China (Taiwan) maintained its policy rates in March 2024, with the discount rate at 1.875%. This stability influences Fubon's lending margins and investment income, with any future rate adjustments directly impacting profitability.

Elevated investor confidence in Taiwan through early 2025, driven by strong corporate earnings and a positive economic outlook, benefits Fubon's wealth management and brokerage services. This environment encourages increased engagement in investment activities, boosting fee-based income for the company.

Consumer spending power, supported by positive real wage growth and stable employment in Taiwan, directly fuels demand for Fubon's retail financial products. The unemployment rate remaining steady in late 2023 and into 2024 underpins this consumer capacity.

| Economic Indicator | 2023 (Actual/Estimate) | 2024 (Projection) | 2025 (Projection) |

|---|---|---|---|

| Taiwan GDP Growth | ~2.5% | 3-4% | 3-4% |

| Taiwan Exports | $432.4 billion | Projected increase | Projected increase |

| Central Bank Discount Rate | 1.875% (as of March 2024) | 1.875% (stable) | Likely stable, subject to review |

| Unemployment Rate (Taiwan) | ~3.5% | Stable | Stable |

Preview the Actual Deliverable

Fubon Financial Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Fubon Financial Holding PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping Fubon's strategic landscape.

Sociological factors

Taiwan's demographic landscape is notably shifting, with an increasing proportion of its population entering older age brackets. By the end of 2024, it's projected that over 20% of Taiwan's population will be aged 65 and above, a significant milestone indicating a rapidly aging society. This demographic transformation directly impacts the financial services sector, creating a growing demand for specialized products and services.

Fubon Financial Holding must strategically address this trend by expanding its portfolio to include more retirement planning solutions, long-term care insurance options, and wealth management services specifically designed for seniors. The company's marketing and product development efforts in 2024 and 2025 should prioritize reaching and serving this expanding demographic effectively, reflecting the evolving needs of the Taiwanese consumer base.

Taiwan's consumers are rapidly shifting towards digital platforms for financial services, with smartphone penetration reaching approximately 93% in 2024. This trend is fueled by a tech-savvy population, making Fubon Financial's investment in mobile banking and online insurance crucial. Meeting these evolving digital expectations is key for Fubon to stay competitive.

The financial literacy of Taiwan's population directly impacts the uptake of Fubon Financial Holding's diverse product suite. A higher level of financial understanding generally correlates with increased demand for more complex investment vehicles and insurance policies. For instance, a 2024 survey indicated that while 60% of Taiwanese adults felt confident managing their personal finances, only 45% could correctly answer questions about compound interest, highlighting room for growth.

The Financial Supervisory Commission (FSC) has been actively promoting financial education initiatives. These efforts, such as the FSC's 2025 plan to integrate financial literacy into secondary education curricula, aim to cultivate a more informed consumer base. This can translate into greater client engagement with Fubon's sophisticated offerings, from wealth management services to specialized insurance products.

Fubon Financial Holding itself plays a role in this ecosystem by investing in financial education programs. By offering workshops and online resources, Fubon can build stronger client relationships and foster trust, which is crucial for expanding its market share. This proactive approach is particularly valuable as the company seeks to attract younger demographics who may be less familiar with advanced financial planning.

Changes in Lifestyle and Wealth Accumulation Trends

Modern lifestyles, marked by increasing urbanization and evolving work patterns, significantly impact how individuals manage their finances and accumulate wealth. For instance, the rise of the gig economy and remote work in many developed nations by 2024-2025 necessitates more flexible financial planning tools and accessible digital banking services. This shift directly influences demand for adaptable investment vehicles and personalized insurance products, pushing financial institutions like Fubon to continually innovate their product suites.

These lifestyle changes are driving demand for specific financial solutions. In 2024, digital payment adoption continued its upward trajectory globally, with estimates suggesting over 80% of consumers in many advanced economies prefer digital transactions. Consequently, Fubon must enhance its digital payment platforms and offer tailored insurance plans that cater to the unique needs of a more mobile and digitally-native customer base.

- Urbanization Trends: By 2025, over 60% of the global population is projected to live in urban areas, concentrating financial service needs and creating opportunities for localized, yet digitally-enabled, product development.

- Work Pattern Evolution: The increasing prevalence of flexible and remote work arrangements by 2024 requires financial products that support fluctuating income streams and offer seamless online management.

- Digital Payment Dominance: Consumer preference for digital transactions is expected to grow, with mobile payment transaction values projected to exceed $10 trillion globally by 2025, highlighting the need for robust digital infrastructure.

- Demand for Flexibility: Individuals are seeking financial products that offer adaptability, such as variable insurance premiums or investment portfolios that can be easily adjusted to life changes.

Public Trust and Brand Reputation

Public trust is a cornerstone for any financial institution, and Fubon Financial Holding is no exception. Its brand reputation, meticulously cultivated through ethical conduct, transparent dealings, and dependable customer support, directly influences its ability to draw in and keep clients. A strong reputation fosters loyalty, especially in an industry where confidence is key.

In 2023, Fubon Financial Holding maintained a solid standing, as evidenced by its consistent performance and customer satisfaction metrics. While specific public trust surveys are proprietary, industry benchmarks and customer retention rates for Fubon in Taiwan generally reflect a high level of confidence. For instance, the company's consistent ranking among top financial service providers in regional surveys underscores this trust.

Conversely, widespread scandals or negative perceptions within the broader financial sector can erode customer confidence across the board, impacting even well-regarded firms like Fubon. The industry's ongoing efforts to bolster transparency and ethical governance are therefore crucial for maintaining public faith.

- Fubon Financial's commitment to corporate social responsibility (CSR) initiatives in 2023 aimed to further solidify public trust.

- Customer retention rates for Fubon's banking and insurance arms in Taiwan remained robust throughout 2023, indicating sustained public confidence.

- The company's proactive approach to digital security and data privacy in 2024 is designed to address growing public concerns about financial information protection.

- Industry awards and recognitions received by Fubon in late 2023 and early 2024 for service excellence contribute positively to its brand reputation.

Taiwan's aging population, projected to have over 20% of its citizens aged 65 and above by the end of 2024, necessitates Fubon Financial Holding to expand its offerings in retirement planning and senior-focused services. Simultaneously, a highly digitized consumer base, with smartphone penetration around 93% in 2024, demands Fubon to prioritize its mobile and online banking capabilities to meet evolving expectations and maintain competitiveness.

Technological factors

Fubon Financial is actively pursuing a comprehensive digital transformation, embedding advanced technologies such as artificial intelligence, big data analytics, and blockchain across its diverse business units. This strategic initiative aims to overhaul core operations and customer-facing services, including bolstering online banking capabilities, refining mobile application functionalities, and elevating its digital insurance platforms.

The integration of these cutting-edge technologies is paramount for Fubon Financial to achieve greater operational efficiency, deliver a superior customer experience, and crucially, maintain its competitive standing in a financial landscape increasingly shaped by fintech innovations. For instance, by mid-2024, Fubon Bank reported a significant increase in digital transaction volumes, with mobile banking transactions growing by over 25% year-over-year, underscoring the impact of these digital advancements.

Fubon Financial Holding is increasingly integrating artificial intelligence and data analytics to refine its operations. This adoption allows for more robust risk management, better fraud detection, and the creation of tailored customer experiences. For instance, in 2024, Fubon reported a significant improvement in identifying suspicious transactions through advanced AI algorithms, contributing to a reduction in financial losses.

The strategic use of AI and data analytics empowers Fubon to gain deeper insights into evolving market trends and customer preferences. This data-driven approach directly supports more informed strategic decision-making and boosts operational efficiency across Fubon's diverse business units, from banking to insurance.

As financial services increasingly move online, Fubon Financial must prioritize cybersecurity and data privacy. This means ongoing investment in cutting-edge security to safeguard customer data and fend off cyberattacks, crucial for maintaining client trust in their digital services.

The financial sector faces escalating cyber threats. For instance, global cybercrime costs are projected to reach $10.5 trillion annually by 2025, underscoring the critical need for Fubon Financial to implement robust defenses. Adherence to evolving data privacy laws, such as GDPR and similar regional regulations, is also non-negotiable, impacting how Fubon handles and stores sensitive information.

Blockchain Technology and Virtual Assets

Taiwan's regulatory environment for blockchain and virtual assets is actively developing. Discussions are underway regarding stablecoin issuance by financial institutions and the registration requirements for Virtual Asset Service Providers (VASPs). This evolving landscape presents both challenges and opportunities for companies like Fubon Financial.

Fubon Financial can leverage blockchain technology for various internal processes, including enhancing the security of transactions and improving the accuracy of record-keeping. Furthermore, as regulations mature, there's potential for Fubon Financial to explore offering regulated virtual asset services. For instance, in late 2023, Taiwan's Financial Supervisory Commission (FSC) was reportedly working on guidelines for VASPs, signaling a move towards clearer operational frameworks.

The global virtual asset market saw significant activity in 2024, with market capitalization fluctuating but underlying technological advancements continuing. Fubon Financial's strategic approach to these technologies will be crucial. By staying abreast of regulatory changes and exploring pilot programs, Fubon Financial can position itself effectively.

- Regulatory Evolution: Taiwan is actively shaping its approach to blockchain and virtual assets, with ongoing dialogues on stablecoins and VASP registration.

- Fubon's Opportunities: Blockchain offers potential for Fubon Financial in secure transactions and data management, with future prospects in regulated virtual asset services.

- Market Context: The global virtual asset market's dynamism in 2024 underscores the importance of strategic adaptation for financial institutions.

Cloud Computing and Infrastructure Modernization

Fubon Financial's move towards cloud computing is a significant technological shift. This adoption directly enhances the scalability, flexibility, and cost-effectiveness of its IT operations. By embracing cloud services, Fubon can more readily adjust its resources up or down as needed, a crucial advantage in the dynamic financial sector.

Modernizing its technological foundation via the cloud enables Fubon to roll out new financial products and services more rapidly. This agility is critical for staying competitive. Furthermore, improved data management capabilities and a bolstered capacity to handle growing digital transaction volumes and data are key benefits, ensuring the company can keep pace with market demands.

By the end of 2024, major financial institutions globally are expected to have increased their cloud spending significantly. For instance, many are targeting a 20-30% increase in cloud adoption for mission-critical workloads. This trend underscores the industry-wide recognition of cloud benefits for efficiency and innovation.

- Enhanced Scalability: Cloud infrastructure allows Fubon to adjust IT resources dynamically to meet fluctuating customer demand and transaction volumes.

- Improved Flexibility: Fubon can more easily adapt to new market opportunities and regulatory changes by leveraging cloud-based solutions.

- Cost Efficiency: Migrating to the cloud can reduce capital expenditure on hardware and lower operational costs associated with IT maintenance.

- Faster Service Deployment: Modernized infrastructure accelerates the launch of new digital banking features and financial products.

Fubon Financial's embrace of AI and data analytics is central to its strategy, enhancing risk management and customer personalization. By mid-2024, the company saw a notable uptick in digital transactions, with mobile banking up over 25% year-on-year, demonstrating the impact of these technological integrations.

The company's investment in cloud computing is also a significant factor, boosting operational scalability and flexibility. This move is aligned with a broader industry trend, as global financial institutions are expected to increase cloud spending by 20-30% for critical workloads by the end of 2024.

Fubon's proactive approach to cybersecurity is crucial, especially given that global cybercrime costs are projected to reach $10.5 trillion annually by 2025. Simultaneously, the evolving regulatory landscape for blockchain and virtual assets in Taiwan presents both challenges and opportunities for Fubon's future service offerings.

Legal factors

Fubon Financial Holding's operations are meticulously shaped by Taiwan's Financial Holding Company Act and Banking Act. These regulations dictate everything from Fubon's corporate structure and capital adequacy to the types of financial services its various subsidiaries can offer, ensuring a stable and compliant financial ecosystem.

For instance, the Financial Holding Company Act mandates specific capital ratios for the holding company itself, which in turn influences the capital requirements for its banking, insurance, and securities units. As of the end of 2024, Fubon Financial Holding maintained a robust capital position, well above the regulatory minimums stipulated by these acts, underscoring its commitment to compliance and financial resilience.

Taiwan's commitment to combating financial crime has intensified, with new Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations becoming fully operational in 2024-2025. These updated rules impose stricter obligations on all financial institutions, including Fubon Financial, and extend to virtual asset service providers.

For Fubon Financial, adherence to these enhanced regulations is paramount. This includes implementing robust Know Your Customer (KYC) processes to verify client identities and diligently reporting any suspicious transactions to the authorities. Failure to comply can result in substantial fines and damage to the company's reputation.

The Financial Action Task Force (FATF) recommendations, which Taiwan actively incorporates, emphasize the need for comprehensive AML/CTF frameworks. By maintaining rigorous compliance, Fubon Financial not only avoids penalties but also strengthens its position as a trustworthy financial partner in a globalized economy.

The Financial Consumer Protection Act in Taiwan is a cornerstone for Fubon Financial's operations. This legislation, along with other consumer protection statutes, sets stringent guidelines for how financial products are advertised, distributed, and how customer grievances are addressed. Fubon must therefore maintain a strong focus on ethical sales practices, clear disclosure, and effective dispute resolution to ensure consumer rights are upheld.

Data Privacy and Protection Laws

Fubon Financial Holding, like all financial institutions, operates under increasingly stringent data privacy and protection laws. Globally, and particularly in Taiwan, the emphasis on safeguarding customer information has intensified with the rise of digitalization. For instance, Taiwan's Personal Data Protection Act (PDPA) governs how personal data can be collected, processed, and used, with significant penalties for violations.

Adherence to these regulations is critical for Fubon. This includes strict protocols for data collection, secure storage, and transparent usage of customer information. The complexities of cross-border data transfers also demand careful navigation to ensure compliance and maintain customer trust. Non-compliance can lead to substantial fines and reputational damage, impacting Fubon's ability to operate effectively and retain its customer base.

Key aspects of these legal factors for Fubon Financial include:

- Compliance with Taiwan's Personal Data Protection Act (PDPA): Ensuring all data handling practices align with the PDPA's requirements for consent, purpose limitation, and data security.

- Cross-border data transfer regulations: Navigating international data flow rules, which can impact cloud storage solutions and international operations.

- Potential penalties for non-compliance: Understanding and mitigating risks associated with fines, which can be significant, impacting profitability and operational continuity.

- Building and maintaining customer trust: Demonstrating robust data protection measures to assure customers their personal information is secure, a crucial element in the financial services sector.

Securities and Exchange Act and Investment Regulations

Fubon Securities and Fubon Asset Management operate under the stringent Securities and Exchange Act and a host of related investment regulations. These legal frameworks dictate everything from how securities are issued and traded to the standards for investment advice and asset management. Fubon must adhere to strict disclosure requirements, maintain fair market conduct, and implement robust investor protection measures across all its capital market activities.

Compliance with these regulations is crucial for Fubon's operations. For instance, the Securities and Exchange Act of Taiwan mandates detailed public disclosures for listed companies, impacting Fubon's own reporting and the information available to investors in its managed funds. Failure to comply can result in significant penalties, affecting both reputation and financial performance.

Key regulatory areas impacting Fubon include:

- Securities Issuance and Trading: Governed by rules ensuring market integrity and transparency.

- Investment Advisory Services: Mandating ethical conduct and suitability for clients.

- Asset Management: Requiring prudent management of pooled investment funds and adherence to investment mandates.

- Disclosure Requirements: Ensuring timely and accurate information is provided to the public and regulators.

Fubon Financial Holding's legal environment is heavily influenced by Taiwan's robust regulatory framework, particularly concerning financial holding companies, banking, and securities. The Financial Holding Company Act and Banking Act set strict capital adequacy ratios and operational guidelines for its subsidiaries, ensuring stability. As of Q1 2025, Fubon Financial consistently met and exceeded these requirements, demonstrating strong financial health and compliance.

The evolving landscape of Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations, updated in 2024-2025, imposes heightened scrutiny on financial institutions. Fubon must maintain rigorous Know Your Customer (KYC) protocols and transaction monitoring to prevent illicit activities, with non-compliance risking substantial penalties and reputational damage.

Consumer protection laws, such as the Financial Consumer Protection Act, mandate ethical sales practices and transparent disclosure for all financial products offered by Fubon. This includes clear communication regarding fees, risks, and effective grievance resolution mechanisms to safeguard customer rights.

Data privacy is another critical legal factor, with Taiwan's Personal Data Protection Act (PDPA) governing the collection, processing, and security of customer information. Fubon must implement stringent data handling protocols, especially for cross-border transfers, to maintain customer trust and avoid significant fines for violations.

| Legal Area | Key Regulations | Impact on Fubon Financial | Compliance Status (as of Q1 2025) |

|---|---|---|---|

| Financial Holding Companies & Banking | Financial Holding Company Act, Banking Act | Capital adequacy, operational scope, risk management | Exceeding minimum requirements |

| Anti-Money Laundering/Counter-Terrorism Financing | AML/CTF Acts, FATF Recommendations | KYC, transaction monitoring, suspicious activity reporting | Robust implementation, ongoing audits |

| Consumer Protection | Financial Consumer Protection Act | Product disclosure, sales practices, dispute resolution | Adherence to strict guidelines |

| Data Privacy | Personal Data Protection Act (PDPA) | Data collection, storage, cross-border transfer, consent | Comprehensive data protection policies in place |

Environmental factors

Fubon Financial is actively addressing climate change, acknowledging both the risks and the emerging opportunities. The company is enhancing its management of physical risks, like those posed by extreme weather events that could impact its assets, and transition risks stemming from global shifts towards a low-carbon economy and associated policy changes.

In 2024, Fubon Financial continued to expand its green finance initiatives, aiming to support sustainable industries and develop innovative financial products designed for climate resilience. This strategic focus aligns with Taiwan's commitment to net-zero emissions by 2050, a target that drives significant investment in renewable energy and green technologies, creating a fertile ground for financial institutions like Fubon to offer specialized financing and investment solutions.

Taiwan's government is strongly pushing for green finance, with action plans and guidelines encouraging sustainable economic activities. Fubon Financial is actively aligning its investment and lending portfolios with these national policies, demonstrating a growing commitment to green investments.

This alignment means Fubon is increasingly financing projects that help combat climate change, such as those focused on renewable energy development. For instance, by the end of 2024, Fubon Financial reported a significant increase in its green financing portfolio, aiming to reach NT$1 trillion by 2026, reflecting a substantial commitment to environmental sustainability within its financial operations.

Fubon Financial Holding has committed to ambitious carbon reduction goals, aligning with Science Based Targets initiative (SBTi) to achieve net-zero emissions across its operations and value chain. This strategic focus is reshaping internal practices, evident in their increased procurement of renewable energy sources to power their facilities.

These ESG commitments directly influence Fubon's client engagement strategies, encouraging sustainable business practices and actively working to reduce financed emissions within their investment portfolios. For instance, by the end of 2023, Fubon Financial reported that over 60% of its new corporate loan applications were screened for ESG risks, demonstrating a tangible shift in lending criteria.

Environmental, Social, and Governance (ESG) Reporting and Disclosure

Taiwan is set to implement international ESG reporting standards, specifically IFRS S1 and S2, starting in 2025. This means Fubon Financial Holding, like other Taiwanese companies, will need to embed comprehensive ESG information directly into its financial reporting. This shift is designed to boost transparency regarding a company's environmental impact, its preparedness for climate-related risks, and its commitment to sustainable operations.

The adoption of these global standards will significantly enhance Fubon Financial's accountability to its diverse stakeholders, including investors, customers, and regulators. Furthermore, it positions the company to attract a growing segment of ESG-conscious investors who prioritize sustainability in their investment decisions. For instance, the global sustainable investment market reached an estimated $35.3 trillion in 2023, indicating a strong investor appetite for companies with robust ESG profiles.

- IFRS S1 & S2 Adoption: Taiwan's move to IFRS S1 and S2 from 2025 mandates integrated ESG disclosures.

- Increased Transparency: Enhanced reporting on environmental performance and climate risk management.

- Stakeholder Accountability: Greater responsibility towards investors and the public regarding sustainability.

- Investor Attraction: Potential to attract the growing pool of ESG-focused investment capital.

Sustainable Investment and Product Development

Fubon Financial is actively expanding its sustainable investment portfolio, recognizing the increasing investor appetite for environmentally responsible options. This strategic move involves developing innovative climate-related insurance products and services designed to meet evolving market needs and regulatory pressures.

The company is notably offering a range of green financial instruments, including green bonds and sustainability-linked loans. Furthermore, Fubon is developing insurance solutions specifically for environmental risks, such as those associated with extreme weather events, which have seen a marked increase in frequency and severity.

- Expanding Green Offerings: Fubon Financial's commitment to sustainable investment is demonstrated through its growing portfolio of green bonds and sustainability-linked loans, catering to a demand that saw global sustainable debt issuance reach approximately $1.5 trillion in 2023.

- Climate Risk Insurance: The development of new insurance products for environmental risks reflects a proactive approach to climate change impacts, addressing a market segment projected to grow significantly as climate-related losses escalate.

- Market Demand: This expansion directly addresses the rising global demand for environmentally conscious financial instruments, aligning with investor preferences and contributing to the broader transition towards a greener economy.

Fubon Financial Holding is navigating a landscape increasingly shaped by environmental regulations and climate change concerns. Taiwan's commitment to net-zero by 2050 is a significant driver, pushing Fubon to expand its green finance initiatives and align its portfolios with sustainable development goals. The company is actively developing green financial instruments and insurance products for environmental risks, reflecting a growing market demand for eco-conscious solutions.

The upcoming adoption of IFRS S1 and S2 standards in Taiwan from 2025 will mandate integrated ESG reporting, enhancing transparency for Fubon Financial. This move will increase accountability to stakeholders and attract ESG-focused investors, a segment that saw global sustainable investment market reach an estimated $35.3 trillion in 2023. Fubon's commitment to SBTi for net-zero operations further underscores its proactive stance on environmental sustainability.

| Environmental Factor | Fubon Financial's Response/Impact | Supporting Data/Context |

| Climate Change & Net-Zero Targets | Expanding green finance, developing climate-resilient products. | Taiwan's net-zero by 2050 target, Fubon's goal of NT$1 trillion in green financing by 2026. |

| ESG Reporting Standards | Preparing for IFRS S1 & S2 adoption from 2025, increasing transparency. | Global sustainable investment market valued at $35.3 trillion (2023), 60% of new corporate loan applications screened for ESG risks (end of 2023). |

| Green Financial Products | Offering green bonds, sustainability-linked loans, and environmental risk insurance. | Global sustainable debt issuance reached ~$1.5 trillion (2023). |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Fubon Financial Holding is built on a comprehensive review of data from official government publications, reputable financial news outlets, and reports from leading market research firms. This ensures that our insights into the political, economic, social, technological, legal, and environmental factors impacting Fubon are grounded in current and credible information.