Fubon Financial Holding Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fubon Financial Holding Bundle

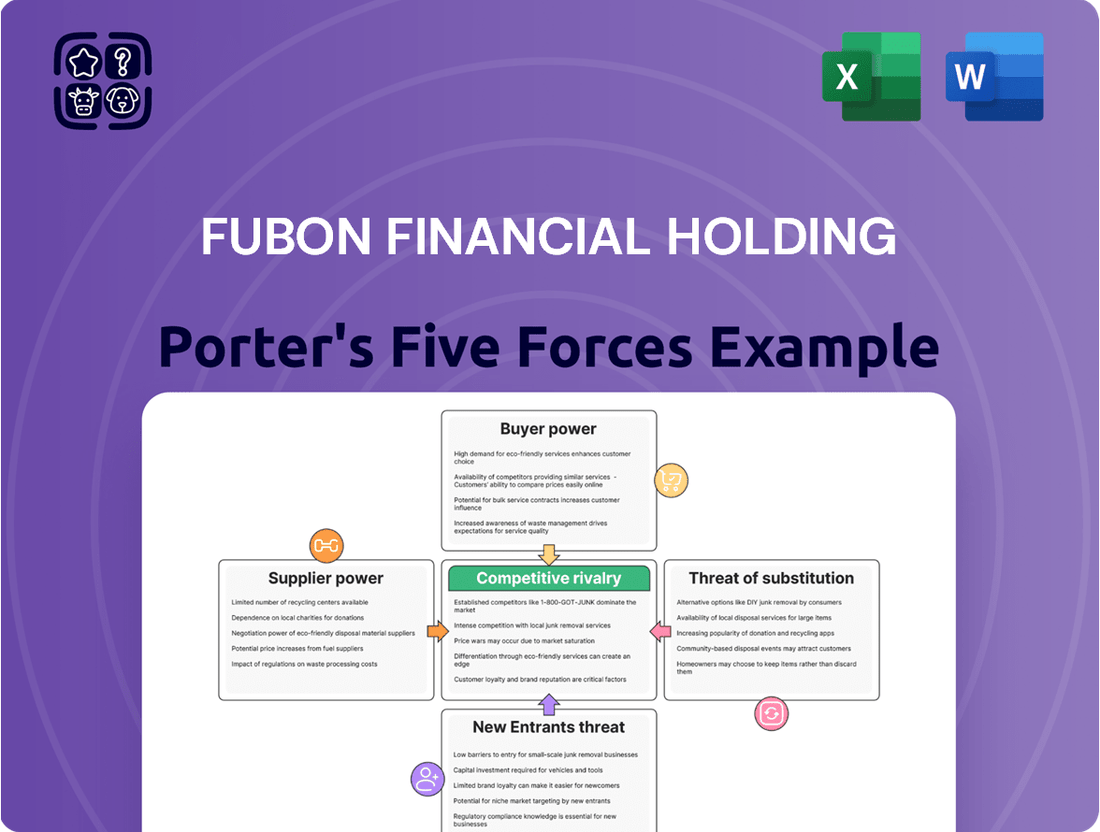

Fubon Financial Holding operates within a dynamic financial services landscape, where understanding competitive forces is paramount. Our analysis reveals that while buyer power is moderate, the threat of new entrants and substitutes presents significant challenges.

The complete report reveals the real forces shaping Fubon Financial Holding’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Fubon Financial Holding's reliance on a select group of specialized technology and software providers for critical functions like digital transformation, core banking operations, and cybersecurity significantly impacts supplier bargaining power. When these technology vendors are few or possess highly unique, proprietary solutions, they can command higher prices or impose less favorable contract terms on Fubon.

The intensifying digital shift and fintech advancements within Taiwan's financial landscape further amplify the influence of these specialized IT and cybersecurity suppliers. As Fubon, like its peers, increasingly depends on cutting-edge technological infrastructure, the leverage held by these niche providers grows, potentially affecting Fubon's operational costs and strategic flexibility.

Suppliers of financial data, market intelligence, and advanced analytics tools wield considerable influence over Fubon Financial. These providers are crucial for Fubon's operations, underpinning its risk management, investment strategies, and understanding of customer behavior.

The reliance on specialized data, often with limited alternatives, grants these suppliers leverage in setting prices and terms. For instance, access to real-time market feeds or proprietary analytical models can be a significant cost for Fubon, impacting its profitability.

In 2024, the global financial data market was valued at over $30 billion, highlighting the substantial revenue streams for data providers and their inherent bargaining strength. Fubon's ability to secure favorable terms with these critical suppliers directly affects its operational efficiency and competitive edge.

The availability of highly skilled professionals in fields such as artificial intelligence, cybersecurity, and fintech development significantly impacts Fubon Financial Holding. A constrained talent pool can escalate recruitment expenses and intensify the competition for qualified employees, thus increasing the effective cost of this vital resource.

In 2024, the demand for AI specialists saw a notable surge, with some reports indicating a 70% increase in job postings for AI engineers compared to the previous year. This heightened demand, coupled with a limited supply of experienced professionals, directly translates to higher salary expectations and more competitive benefits packages for Fubon when seeking to acquire and retain top talent in these critical areas.

Regulatory Compliance and Consulting Services

The financial sector in Taiwan operates under strict regulations, making Fubon Financial's dependence on specialized legal, compliance, and audit consultants significant. These service providers, holding unique expertise and certifications, can exert considerable influence, particularly as new rules emerge in areas like fintech and anti-money laundering. For instance, the Financial Supervisory Commission (FSC) continuously updates its directives, requiring ongoing expert consultation to ensure adherence.

The bargaining power of these suppliers is amplified by the niche nature of their services. Finding providers with the specific knowledge required for complex regulatory environments, such as navigating Taiwan's cybersecurity regulations for financial institutions, is challenging. This scarcity of specialized talent means Fubon Financial may face less favorable terms or higher fees.

- Specialized Expertise: Legal and compliance consultants possess in-depth knowledge of Taiwan's financial laws, including recent updates from the FSC.

- Regulatory Dependence: Fubon Financial requires these services to ensure compliance, particularly with evolving fintech and anti-money laundering (AML) regulations.

- Limited Substitutes: The scarcity of firms with proven track records in financial regulatory consulting in Taiwan can increase supplier leverage.

- Impact of New Regulations: The introduction of new financial technology (fintech) regulations or stricter AML requirements in 2024 and beyond could further empower these specialized suppliers.

Infrastructure and Utility Providers

Fubon Financial Holding relies heavily on fundamental infrastructure like telecommunications and power. While these markets are generally competitive, a significant disruption or concentrated regional control could elevate supplier bargaining power. For instance, in 2024, the telecommunications sector in Taiwan, Fubon's primary market, saw continued consolidation, potentially increasing the leverage of major providers. This could directly impact Fubon's operational costs and the reliability of its digital services.

The bargaining power of infrastructure and utility providers for Fubon is influenced by several factors:

- Dependence on Essential Services: Fubon's digital operations and physical branches are critically dependent on reliable power and telecommunications.

- Market Concentration: In specific regions, a limited number of providers for these essential services can lead to increased supplier leverage.

- Potential for Cost Increases: Any significant price hikes or service disruptions from these providers could directly affect Fubon's profitability and operational efficiency.

Fubon Financial Holding's reliance on specialized technology providers, particularly for AI and cybersecurity, grants these suppliers significant bargaining power. The escalating demand for these skills, with AI specialist job postings reportedly up 70% in 2024, means Fubon faces higher costs and more competitive recruitment, directly impacting its operational budget and strategic agility.

Similarly, providers of essential financial data and market intelligence hold considerable sway due to the niche nature of their offerings and Fubon's operational dependence. With the global financial data market exceeding $30 billion in 2024, these suppliers are well-positioned to command premium pricing, influencing Fubon's profitability and competitive positioning.

The bargaining power of suppliers for Fubon Financial Holding is notably influenced by the scarcity of specialized expertise in critical areas like regulatory compliance and advanced IT. As new fintech and AML regulations emerged in 2024, the demand for consultants with specific knowledge of Taiwan's financial laws intensified, allowing these firms to dictate terms and potentially increase service fees.

Infrastructure providers, such as telecommunications companies, also possess leverage, especially given the ongoing consolidation within Taiwan's telecom sector observed in 2024. Fubon's fundamental reliance on these services for its digital operations means any price adjustments or service disruptions from these concentrated providers can directly impact operational costs and service reliability.

| Supplier Category | Key Dependencies for Fubon | Factors Amplifying Bargaining Power | 2024 Data Point/Trend |

|---|---|---|---|

| Technology Providers (AI, Cybersecurity) | Digital transformation, core banking, cybersecurity | Few specialized vendors, proprietary solutions, high demand for skills | 70% increase in AI specialist job postings |

| Data & Analytics Providers | Risk management, investment strategies, customer insights | Niche data, limited substitutes, critical for operations | Global financial data market > $30 billion |

| Legal & Compliance Consultants | Regulatory adherence (fintech, AML) | Specialized expertise, regulatory dependence, limited qualified firms | Increased demand due to evolving FSC directives |

| Infrastructure Providers (Telecom, Power) | Digital operations, physical branches | Essential services, potential market concentration | Telecom sector consolidation in Taiwan |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Fubon Financial Holding's position in the financial services industry.

Instantly visualize Fubon Financial Holding's competitive landscape with a dynamic Porter's Five Forces dashboard, simplifying complex market pressures for strategic clarity.

Customers Bargaining Power

Fubon Financial Holding caters to a wide array of clients, encompassing individuals, businesses, and institutional investors. This broad reach, however, translates into a complex landscape of diverse customer needs and expectations across its banking, insurance, securities, and asset management divisions. For instance, in 2024, while Fubon's retail banking segment saw continued growth in digital adoption, corporate clients often prioritize tailored financial solutions and competitive pricing, influencing their bargaining power.

The leverage a particular customer segment holds is directly tied to its economic significance, such as its contribution to profitability, and the availability of comparable services from competitors. For example, large corporate clients might negotiate more favorable terms on loans or investment products due to their substantial transaction volumes and the potential for significant revenue generation for Fubon, a dynamic observed throughout 2024’s competitive financial market.

The ease with which customers can switch between financial service providers in Taiwan significantly impacts their bargaining power. In 2024, the proliferation of digital banking platforms and fintech solutions is actively lowering these switching costs. This increased flexibility allows consumers to more readily compare and move to providers offering better rates, reduced fees, or more advanced digital services, thereby enhancing their leverage.

Customers' price sensitivity significantly impacts financial services, especially for straightforward products. In Taiwan's competitive financial landscape, greater transparency in fees and interest rates, often driven by digital tools, empowers consumers to readily compare options. This heightened ability to shop around directly increases their bargaining power, putting downward pressure on profit margins for companies like Fubon Financial Holding.

Information Availability and Financial Literacy

A financially savvy customer base, armed with readily available information on financial products and services, can significantly influence pricing and service quality. In 2024, Taiwan's Financial Supervisory Commission (FSC) continued its push for enhanced financial literacy, a move that directly empowers consumers to seek better value and compare offerings more effectively. This increased transparency shifts bargaining power towards the customer.

The FSC's initiatives, such as public awareness campaigns and accessible educational resources, contribute to a more informed populace. For instance, a significant portion of Taiwanese adults reported increased confidence in managing their finances in recent surveys, indicating a growing ability to scrutinize financial institutions' terms and conditions. This heightened awareness translates into a greater propensity for customers to switch providers if they perceive better deals elsewhere, thereby increasing their bargaining leverage.

- Increased Information Access: Customers in 2024 have unprecedented access to online comparison tools and financial news, allowing for easy evaluation of Fubon Financial Holding's offerings against competitors.

- Financial Literacy Programs: The FSC's ongoing commitment to financial education empowers individuals to understand complex financial products, leading to more demanding customer expectations.

- Consumer Choice: A well-informed customer base can readily switch to alternative financial providers, forcing Fubon to offer competitive rates and superior service to retain business.

- Demand for Value: With greater knowledge, customers are more likely to negotiate for better terms or seek out providers offering superior value propositions, directly impacting Fubon's pricing power.

Impact of Digitalization and Fintech Adoption

The increasing embrace of digital financial services and fintech innovations significantly bolsters customer bargaining power. These advancements offer unparalleled convenience, speedier transactions, and increasingly tailored financial experiences. For instance, by mid-2024, over 70% of retail banking transactions in many developed markets were conducted digitally, a trend that continues to grow.

Digital-native banks and agile fintech companies are attracting customers with intuitive interfaces and novel offerings, intensifying competition for established players like Fubon. This shift forces traditional institutions to enhance their own digital capabilities and customer service to retain market share. By Q1 2024, fintech investment globally had already surpassed $20 billion, indicating a rapid evolution driven by customer demand for better digital solutions.

- Increased Choice: Digitalization broadens the range of financial providers available to consumers, moving beyond traditional brick-and-mortar banks.

- Enhanced Information Access: Customers can more easily compare products, fees, and services across different fintech platforms and digital banks.

- Lower Switching Costs: Digital onboarding and account management make it simpler for customers to switch providers, further pressuring incumbents.

The bargaining power of customers for Fubon Financial Holding is a significant factor, amplified by increased information access and a growing emphasis on financial literacy. In 2024, consumers are more informed than ever, readily comparing Fubon's offerings against competitors using readily available online tools and financial news. This heightened awareness directly translates into greater customer demand for value, pushing Fubon to offer competitive rates and superior service to retain its client base.

The ease with which customers can switch providers in Taiwan, a trend accelerated by digital banking and fintech innovations, further empowers them. By mid-2024, digital financial services were experiencing rapid growth, with over 70% of retail banking transactions in many markets occurring digitally. This digital shift lowers switching costs, making it simpler for customers to move to alternative providers, thereby increasing their leverage over established institutions like Fubon.

| Factor | Impact on Fubon | 2024 Data/Trend |

|---|---|---|

| Information Access | Increased ability to compare offerings | High adoption of online comparison tools |

| Financial Literacy | Higher customer expectations for value | FSC initiatives promoting consumer education |

| Switching Costs | Lowered by digital platforms | Growing digital banking penetration |

| Digitalization | Empowers customers with choice and convenience | Fintech investment exceeding $20 billion globally by Q1 2024 |

Preview the Actual Deliverable

Fubon Financial Holding Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces analysis for Fubon Financial Holding. You are viewing the exact, professionally formatted document that will be delivered instantly upon purchase, ensuring no surprises or missing information. This comprehensive analysis details the competitive landscape, including supplier power, buyer power, threat of new entrants, threat of substitutes, and industry rivalry, all ready for immediate use.

Rivalry Among Competitors

Taiwan's financial services sector, encompassing both banking and insurance, presents a landscape with a substantial number of participants. This high degree of fragmentation means Fubon Financial operates within a market where numerous entities vie for customers and market share, intensifying the competitive environment.

The presence of many commercial lenders and insurance providers creates a highly saturated market. This intense rivalry can put downward pressure on key financial metrics, potentially squeezing net interest margins and impacting overall profitability for established institutions like Fubon Financial.

As of the end of 2023, Taiwan's banking sector alone comprised over 30 domestic banks and numerous foreign bank branches, underscoring the market's fragmentation. Similarly, the insurance industry features a large number of life and non-life insurers, contributing to the competitive intensity Fubon Financial navigates.

Fubon Financial operates within a dynamic market characterized by the presence of substantial domestic and international competitors. It contends with a multitude of Taiwanese banks and insurance providers, alongside other major financial holding companies. This intense rivalry necessitates a focus on service excellence, novel product development, and extensive market penetration to stand out.

The Taiwanese financial sector sees significant competition from both established local entities and global players. For instance, in 2024, the banking sector alone comprised over 30 domestic and foreign banks operating in Taiwan, each vying for market share. This crowded field means Fubon Financial must constantly innovate and refine its offerings to maintain its competitive edge and attract a diverse customer base.

The competitive landscape for financial institutions like Fubon Financial Holding is increasingly shaped by digital-only banks and innovative fintech companies. These agile players are disrupting traditional banking models by offering specialized services, often at a lower cost, directly challenging incumbents.

Fintech innovation is a major driver of this intensified rivalry. For instance, by mid-2024, the global fintech market was projected to reach over $350 billion, showcasing the significant investment and growth in this sector. These innovations allow new entrants to bypass legacy systems and offer user-friendly, efficient digital experiences, forcing established institutions to adapt rapidly.

These digital challengers often target specific customer segments or financial needs, such as payments, lending, or wealth management, with tailored digital solutions. This focused approach allows them to gain market share quickly. In 2023, neobanks globally saw a substantial increase in customer acquisition, with some reporting double-digit percentage growth year-over-year, underscoring their impact on traditional banks’ customer bases.

Product Diversification and Cross-Selling Strategies

Fubon Financial Holding leverages its extensive product portfolio, encompassing life insurance, property and casualty insurance, banking, securities, and asset management, to create integrated financial solutions. This broad offering facilitates significant cross-selling opportunities, aiming to capture a larger share of customer financial needs.

However, this strategy intensifies rivalry as other major financial conglomerates in Taiwan, such as CTBC Financial Holding and Cathay Financial Holding, also aggressively pursue product diversification and cross-selling. For instance, in 2024, the Taiwanese banking sector saw continued efforts to bundle services, with many banks offering preferential rates or rewards for customers holding multiple products, directly challenging Fubon’s integrated approach.

- Fubon Financial's diversified services: Life insurance, P&C insurance, banking, securities, asset management.

- Cross-selling benefits: Integrated financial solutions, increased customer wallet share.

- Competitive landscape: Intense rivalry from other financial holding companies pursuing similar strategies.

- 2024 market trend: Banks actively bundling services to attract and retain customers across product lines.

Regulatory Environment and Consolidation Efforts

Taiwan's financial regulator has a history of encouraging industry consolidation to tackle market overcrowding and boost overall competitiveness. However, despite these intentions, substantial progress in this area has been somewhat limited.

The existing regulatory framework, while designed to ensure market stability, also plays a crucial role in shaping competitive dynamics. It achieves this by establishing barriers to entry for new players and dictating the scope of business activities that financial institutions can undertake.

- Regulatory Encouragement for Consolidation: Taiwanese authorities have voiced support for mergers and acquisitions within the financial sector to create larger, more resilient entities.

- Limited Progress to Date: Despite regulatory encouragement, the pace of actual consolidation has been slower than anticipated, with fewer significant mergers materializing.

- Impact on Competition: The regulatory environment creates a dual effect by setting entry barriers, which can limit new competition, while also influencing the strategic options for existing players.

- Focus on Stability: The primary driver behind regulatory actions remains the stability of the financial system, which indirectly influences the competitive landscape by prioritizing sound financial practices.

Fubon Financial Holding faces intense rivalry in Taiwan's fragmented financial services market, with numerous domestic and international banks and insurers competing for customers. This high degree of competition, evident in the over 30 banks operating in Taiwan as of 2024, pressures margins and necessitates continuous innovation. The rise of fintech and digital-only banks further amplifies this rivalry, forcing traditional players to adapt rapidly to new digital offerings and customer acquisition strategies.

Major financial conglomerates like CTBC and Cathay Financial also aggressively pursue diversified product portfolios and cross-selling, mirroring Fubon's strategy and intensifying competition for customer wallet share. For instance, in 2024, many Taiwanese banks actively bundled services, offering preferential rates to customers holding multiple products, directly challenging Fubon's integrated financial solutions approach.

| Competitor | Key Business Areas | 2024 Market Presence Indicator |

|---|---|---|

| CTBC Financial Holding | Banking, Insurance, Securities, Asset Management | Significant market share in banking and insurance sectors. |

| Cathay Financial Holding | Life Insurance, P&C Insurance, Banking, Securities | Strong presence in insurance, growing in banking and other financial services. |

| Digital-Only Banks (e.g., Rakuten Bank Taiwan) | Digital Banking Services | Rapidly growing customer base, focusing on user experience and niche services. |

| Foreign Banks (e.g., Citibank Taiwan, Standard Chartered Taiwan) | Corporate Banking, Wealth Management | Targeting specific customer segments, leveraging global networks. |

SSubstitutes Threaten

The threat of substitutes for Fubon Financial's diverse offerings is significant, as customers can increasingly turn to non-traditional providers for similar financial needs. Direct investment in individual stocks or exchange-traded funds (ETFs) provides an alternative to Fubon's mutual fund products, allowing investors to bypass fund management fees. In 2024, the global ETF market saw substantial inflows, indicating a growing preference for these more direct investment vehicles.

Furthermore, the rise of peer-to-peer (P2P) lending platforms and crowdfunding sites presents a direct substitute for traditional bank loans and financing services offered by Fubon. These platforms often provide more accessible and potentially lower-cost alternatives for both borrowers and lenders. For example, by mid-2025, P2P lending volumes are projected to continue their upward trajectory, demonstrating a clear shift in how individuals and businesses access capital.

Fintech companies are increasingly offering services that directly compete with Fubon Financial Holding's traditional offerings. For instance, mobile payment solutions and digital investment platforms provide convenient and often more cost-effective alternatives for consumers. In 2024, the global fintech market was valued at over $1.1 trillion, indicating a significant and growing threat.

Customers are increasingly empowered by greater financial literacy and readily available online tools, leading them to bypass traditional financial intermediaries. This trend directly impacts Fubon Financial Holding by presenting a significant threat of substitution. For instance, the rise of robo-advisors and online investment platforms allows individuals to manage their portfolios directly, substituting the need for Fubon's wealth management services.

Direct online purchasing of insurance products also represents a substantial substitute for Fubon's traditional agent-based sales channels. In 2024, the digital insurance market continued its robust growth, with a significant percentage of new policies, particularly for simpler products like travel or term life insurance, being initiated online without direct human interaction. This disintermediation erodes the value proposition of Fubon's advisory and sales force, forcing a strategic re-evaluation of service delivery models.

Cryptocurrencies and Decentralized Finance (DeFi)

The emerging cryptocurrency and Decentralized Finance (DeFi) landscape poses a nascent but growing threat of substitutes for traditional financial services offered by companies like Fubon Financial Holding. These digital assets and platforms provide alternative avenues for value storage, fund transfers, and access to financial services, bypassing conventional intermediaries. As of mid-2024, the total market capitalization of cryptocurrencies hovered around $2.5 trillion, indicating significant user adoption and a growing ecosystem.

While regulatory frameworks in Taiwan are still developing, the underlying technology of blockchain and DeFi offers compelling alternatives that could erode market share from established financial institutions. For instance, DeFi lending protocols in 2024 facilitated billions of dollars in transactions, demonstrating a tangible shift in how some consumers and investors engage with financial products.

- Growing Market Cap: The global cryptocurrency market capitalization reached approximately $2.5 trillion in mid-2024, signaling substantial investor interest and adoption.

- DeFi Transaction Volume: Decentralized finance platforms processed billions of dollars in transactions throughout 2024, highlighting their increasing relevance as financial service alternatives.

- Regulatory Uncertainty: The evolving regulatory environment in Taiwan for cryptocurrencies and DeFi creates both opportunities and challenges for traditional financial players.

- Disintermediation Potential: DeFi's core function of removing intermediaries presents a long-term threat to traditional banking and financial service models.

Alternative Funding and Risk Management Mechanisms

Corporate clients increasingly explore alternative funding avenues, bypassing traditional bank loans. For instance, direct bond issuance and various crowdfunding platforms present viable substitutes, allowing companies to access capital without relying solely on financial institutions like Fubon. This trend is amplified as capital markets become more accessible and diverse.

In the insurance sector, large corporations are also developing their own risk management solutions. Self-insurance and captive insurance arrangements allow these entities to retain risk internally, thereby reducing their dependence on commercial property and casualty insurers. This strategic shift can significantly impact the market share of established players.

For example, in 2023, the global alternative lending market saw substantial growth, with deal volumes increasing significantly year-over-year. This indicates a growing appetite for non-traditional financing. Similarly, data from industry reports suggests a steady rise in the number of large corporations establishing or expanding their captive insurance operations.

- Alternative Funding: Direct bond issuance and crowdfunding offer capital access beyond traditional bank loans.

- Risk Management Substitutes: Self-insurance and captive insurance allow corporations to manage risks internally.

- Market Impact: These alternatives reduce reliance on financial institutions and commercial insurers, potentially altering market dynamics.

The threat of substitutes for Fubon Financial Holding is amplified by the growing accessibility of direct investment options and alternative financing channels. Customers are increasingly bypassing traditional intermediaries for services like wealth management and loans, opting for digital platforms and direct market access. This trend is evident in the substantial growth of ETFs and P2P lending, which offer often lower-cost and more convenient alternatives.

Fintech innovations, including mobile payments and robo-advisors, directly challenge Fubon's core offerings by providing streamlined and cost-effective solutions. The burgeoning cryptocurrency and Decentralized Finance (DeFi) sectors also present a significant, albeit nascent, threat, offering alternative avenues for value storage and financial services that circumvent traditional institutions. This disintermediation potential forces established players to adapt their service models to remain competitive.

| Substitute Area | Example | 2024 Data/Trend |

|---|---|---|

| Investment Products | ETFs, Direct Stock Investing | Global ETF market saw substantial inflows in 2024. |

| Lending & Financing | P2P Lending, Crowdfunding | P2P lending volumes projected to continue upward trajectory by mid-2025. |

| Digital Services | Mobile Payments, Robo-Advisors | Global fintech market valued over $1.1 trillion in 2024. |

| Insurance | Direct Online Purchase, Captive Insurance | Digital insurance market showed robust growth in 2024. |

| Digital Assets | Cryptocurrencies, DeFi | Crypto market cap ~ $2.5 trillion mid-2024; DeFi facilitated billions in transactions in 2024. |

Entrants Threaten

The financial services sector in Taiwan presents a formidable challenge for new entrants due to extensive regulatory oversight and substantial capital requirements. For instance, establishing a new bank typically necessitates a minimum paid-in capital of NT$10 billion (approximately US$310 million as of mid-2024), a significant hurdle that filters out many potential competitors. Similarly, insurance and securities firms face rigorous licensing processes and ongoing compliance costs, effectively limiting the influx of new players and reinforcing the market position of established entities like Fubon Financial.

Fubon Financial, boasting over six decades of operational history in Taiwan, has cultivated formidable brand recognition and deep-seated customer trust. This established reputation acts as a significant barrier for any new entrant aiming to disrupt the market, as replicating such loyalty and confidence takes considerable time and investment.

In the financial services sector, customers frequently gravitate towards institutions perceived as secure and dependable. This inherent preference for established players means newcomers face an uphill battle in persuading consumers to switch, particularly when entrusting their financial well-being. For instance, as of early 2024, Fubon Financial consistently ranks among the top financial institutions in Taiwan by market capitalization, underscoring its entrenched market position.

Fubon Financial, like other established players, leverages significant economies of scale. This translates to lower per-unit costs in areas such as IT infrastructure and marketing campaigns, giving them a competitive edge. For instance, in 2023, Fubon's operating expenses as a percentage of revenue remained competitive, reflecting efficient scale.

New entrants often struggle to match this cost efficiency. They must invest heavily to build comparable operational capacity and brand recognition, which can be a substantial barrier. This initial investment hurdle makes it challenging for newcomers to offer services at a price point competitive with incumbents.

Furthermore, Fubon benefits from economies of scope by cross-selling a diverse suite of financial products, from banking to insurance. This integrated approach enhances customer loyalty and revenue streams. A new entrant would need to develop a similarly broad product portfolio to achieve comparable synergy, a complex and costly undertaking.

Challenges for Digital-Only Banks

While Taiwan has welcomed digital-only banks, these new entrants still grapple with profitability and market penetration. Despite regulatory approvals, achieving break-even and capturing significant market share from established players presents a formidable challenge. This indicates that even with reduced regulatory barriers, operational and competitive hurdles remain substantial for these digital disruptors.

The threat of new entrants, particularly digital-only banks, is moderate for Fubon Financial Holdings. Although Taiwan has licensed these new players, their path to profitability and substantial market share is arduous. For instance, as of early 2024, many digital banks were still operating at a loss, highlighting the difficulty in overcoming the established infrastructure and customer loyalty of incumbent institutions.

- Digital-only banks in Taiwan face significant hurdles in achieving profitability and gaining substantial market share against incumbent institutions.

- Despite regulatory advancements, operational complexities and intense competition continue to challenge new digital entrants.

- The established customer base and extensive branch networks of traditional banks represent a considerable barrier for digital-only banks seeking to disrupt the market.

- As of early 2024, many digital banks were still in the process of reaching break-even points, underscoring the ongoing challenges in this segment.

Fintech Innovation and Collaboration vs. Direct Competition

The threat of new entrants for Fubon Financial Holding is nuanced, leaning more towards agile fintech firms offering specialized services rather than traditional, large-scale financial institutions. These fintech disruptors pose a challenge not through direct, broad market capture, but via innovative solutions that could be integrated by incumbents or foster strategic partnerships.

For instance, the Financial Supervisory Commission (FSC) in Taiwan actively promotes collaboration between established financial players and burgeoning fintech companies. This regulatory environment encourages a symbiotic relationship, mitigating the risk of outright market displacement. In 2023, Taiwan saw a significant increase in fintech investment, with over NT$10 billion flowing into the sector, highlighting the growing influence of these innovative entities.

- Fintech Focus: New entrants are typically specialized fintechs, not broad financial service providers.

- Innovation as Threat: The primary threat lies in their novel technologies and service models.

- Collaboration Potential: Existing players may adopt fintech innovations or partner with these firms.

- Regulatory Encouragement: Taiwan's FSC supports partnerships between banks and fintechs, fostering integration over direct competition.

The threat of new entrants for Fubon Financial is moderate, primarily stemming from specialized fintech firms rather than large traditional institutions. These agile disruptors challenge the market through innovative technologies and niche services, often leading to potential collaborations or acquisitions by incumbents.

Taiwan's regulatory landscape, as overseen by the FSC, encourages partnerships between established banks and fintech companies, fostering integration rather than direct market displacement. This environment, coupled with significant fintech investment in 2023, suggests that the primary threat is innovation adoption rather than outright competition.

While digital-only banks have emerged, they face substantial hurdles in achieving profitability and market share, with many still operating at a loss as of early 2024. The established trust, extensive infrastructure, and customer loyalty of incumbents like Fubon Financial remain significant barriers to entry for these new digital players.

| Entity Type | Primary Challenge to Incumbents | Key Barrier for New Entrants | Fubon's Advantage |

|---|---|---|---|

| Traditional Banks | High capital requirements, regulatory hurdles | Capital, regulatory compliance, brand trust | Established infrastructure, customer loyalty |

| Digital-Only Banks | Profitability, market penetration | Achieving break-even, customer acquisition | Operational scale, cross-selling capabilities |

| Fintech Firms | Innovative technology, specialized services | Integration with existing systems, scaling | Agility, potential for strategic partnerships |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Fubon Financial Holding is built upon a foundation of comprehensive data, including Fubon's annual reports, investor presentations, and regulatory filings. We also leverage industry-specific research from reputable financial analysis firms and macroeconomic data from government sources to provide a robust assessment of the competitive landscape.