Fubon Financial Holding Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fubon Financial Holding Bundle

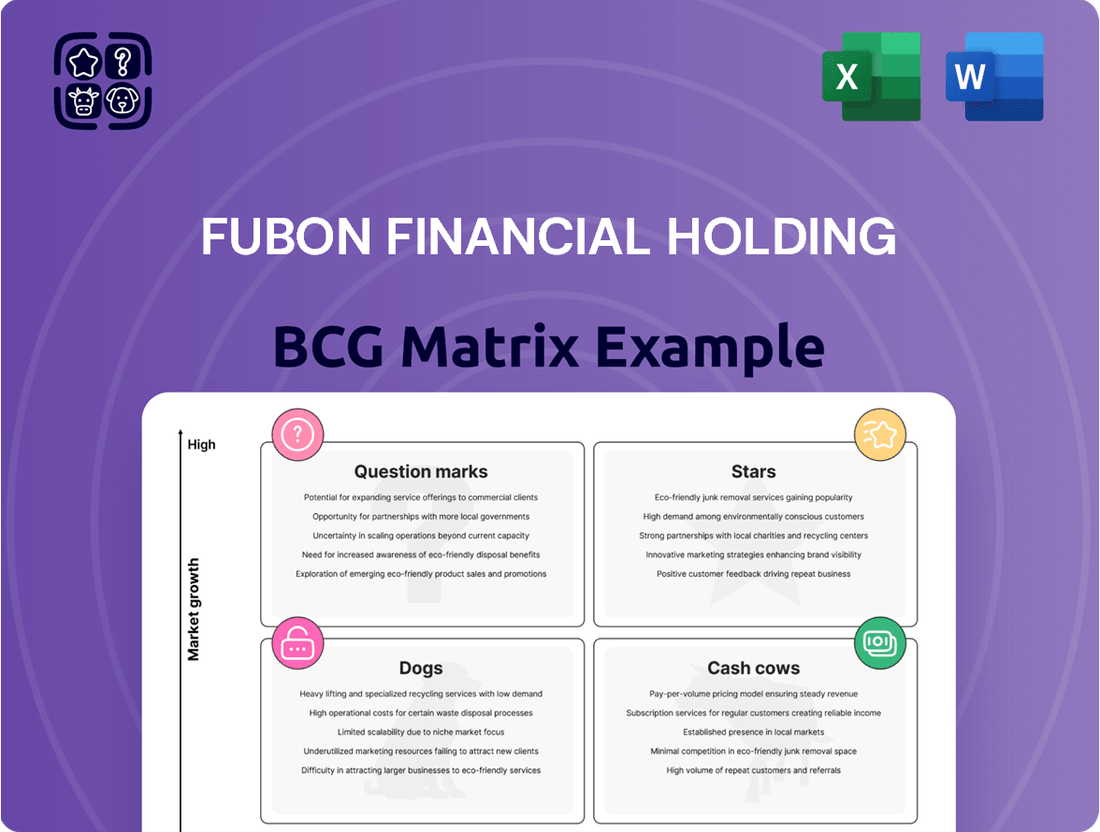

Curious about Fubon Financial Holding's strategic positioning? Our BCG Matrix preview offers a glimpse into their market performance, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly unlock the strategic advantage, dive into the full BCG Matrix report. It provides a comprehensive breakdown of each product's quadrant placement, backed by data-driven recommendations for optimizing your investment and product decisions.

Don't miss out on the complete picture; purchase the full BCG Matrix for actionable insights and a clear roadmap to navigating Fubon Financial Holding's competitive landscape.

Stars

Fubon Life is actively reorienting its product portfolio towards protection-oriented and low-guarantee policies. This strategic pivot is a direct response to the dynamic shifts occurring within Taiwan's life insurance sector, where consumer preferences are increasingly leaning towards these types of offerings.

This focus on protection products is proving to be a significant growth engine. Analysts anticipate that potential US interest rate reductions in 2024 could further invigorate sales, particularly for participating life insurance plans. Additionally, a surge in demand for variable life insurance is contributing to the robust growth of this product category, solidifying its role as a primary driver for Fubon Life's expansion.

Taipei Fubon Bank's wealth management services are a significant contributor to Fubon Financial Holding's growth, particularly within the context of a BCG matrix. The bank has seen robust expansion in its wealth management fee income, driven by Taiwan's burgeoning affluent demographic.

This segment represents a high-growth market where Fubon is strategically investing to capture a larger share. Their focus on high-net-worth individuals and leveraging cross-selling opportunities across Fubon's diverse financial products are key drivers of this expansion. For instance, Fubon Financial Holding reported a consolidated net profit attributable to shareholders of NT$53.63 billion for the first half of 2024, with wealth management playing a crucial role in this performance.

Fubon Insurance's engineering insurance segment is a star performer, showing robust growth of 50.4% in 2024. This surge is fueled by increased investment in infrastructure and a significant push towards green energy projects, highlighting a strong market demand.

Simultaneously, Fubon is actively innovating in digital auto insurance, particularly for electric vehicles. By deploying advanced AI models, they are enhancing the online application process and customer experience, tapping into a high-growth digital niche.

Fubon Securities' AI/Semiconductor Sector Brokerage

Fubon Securities' brokerage services focused on Taiwan's AI and semiconductor sectors are performing exceptionally well, fitting the profile of a Star in the BCG matrix. This strong performance is directly linked to the surge in trading activity within these high-growth industries. In 2024, the TAIEX reached record highs, driven by robust market liquidity, with AI and semiconductor stocks leading the charge.

This strategic alignment with the booming AI industry allows Fubon Securities to capitalize on a rapidly expanding market. The firm's brokerage business in this segment is experiencing significant growth, reflecting the overall market enthusiasm and investment in advanced technologies.

- Record Profits: Fubon Securities achieved record-high profits in 2024, largely due to the vibrant trading environment in AI and semiconductor stocks.

- TAIEX Surge: The Taiwan Stock Exchange (TAIEX) saw unprecedented gains in 2024, fueled by the strong performance of technology-related companies.

- Market Liquidity: Increased trading volume and market liquidity in 2024 provided a fertile ground for brokerage services in the AI and semiconductor sectors.

- Star Performer: Fubon Securities' brokerage operations in these sectors are classified as Stars due to their high growth and market share potential within a rapidly expanding industry.

Fubon Asset Management's Innovative Multi-Asset Funds

Fubon Asset Management is actively expanding its multi-asset fund offerings, notably incorporating allocations to Bitcoin ETFs and Gold ETFs. This strategic pivot demonstrates a bold approach to capturing growth in emerging asset classes, reflecting a dynamic response to shifting investor appetites.

These new funds are positioned as high-potential contenders within the multi-asset space. By integrating digital assets and traditional safe havens, Fubon aims to cater to a sophisticated investor base seeking diversified and forward-looking investment solutions. For instance, as of early 2024, Bitcoin ETFs have seen significant inflows, with some products managing billions in assets under management, underscoring the growing investor interest in this asset class.

- Fubon's diversification into Bitcoin ETFs: This move taps into the rapidly growing digital asset market.

- Inclusion of Gold ETFs: This provides investors with exposure to a traditional store of value amidst market volatility.

- Targeting evolving investor preferences: The funds are designed for individuals seeking innovative and diversified portfolios.

- Strategic positioning for high growth: Fubon aims to capitalize on nascent investment areas with significant upside potential.

Fubon Securities' brokerage services, particularly those focused on Taiwan's AI and semiconductor sectors, are clearly identified as Stars within the BCG matrix. This classification is due to their impressive growth trajectory and strong market position in industries experiencing significant expansion. In 2024, the TAIEX reached record highs, largely propelled by these technology-driven sectors, with Fubon Securities capitalizing on this surge in trading activity. The firm's record profits in 2024 directly reflect this successful alignment with high-growth markets, demonstrating substantial market share potential.

| Business Unit | BCG Category | Key Performance Indicators (2024 Data) | Strategic Rationale |

| Fubon Securities (AI & Semiconductor Brokerage) | Star | Record profits; TAIEX surge driven by tech stocks; Increased market liquidity | Capitalizing on high-growth AI and semiconductor industries; Strong market share potential |

| Fubon Insurance (Engineering & Digital Auto) | Star | 50.4% growth in engineering insurance; Innovation in digital auto insurance for EVs | Leveraging infrastructure investment and green energy push; Tapping into high-growth digital niche with AI |

| Taipei Fubon Bank (Wealth Management) | Star | Robust expansion in wealth management fee income; NT$53.63 billion consolidated net profit (H1 2024) | Capturing growth in burgeoning affluent demographic; Strategic investment in high-net-worth segment |

| Fubon Asset Management (Multi-Asset Funds incl. Bitcoin/Gold ETFs) | Star | Expansion into emerging asset classes; Bitcoin ETFs seeing significant inflows (billions in AUM as of early 2024) | Catering to sophisticated investors seeking diversification; Capitalizing on nascent investment areas with high upside |

What is included in the product

The Fubon Financial Holding BCG Matrix offers clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs within its diverse business units.

The Fubon Financial Holding BCG Matrix offers a clear, one-page overview, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Taipei Fubon Bank's core banking operations are a classic cash cow within Fubon Financial Holding's BCG Matrix, consistently generating substantial profits. In 2023, the bank reported a net profit of NT$27.1 billion, a 16.4% increase year-on-year, highlighting its robust performance in traditional deposit and lending activities.

Despite operating in a mature and competitive Taiwanese banking sector, Taipei Fubon Bank leverages its extensive asset base and deep-rooted customer relationships to maintain stable and significant cash inflows. This consistent performance allows it to reliably fund the group's investments in other business areas.

Fubon Life Insurance's traditional premium base represents a significant Cash Cow within Fubon Financial Holding's BCG Matrix. As Taiwan's second-largest life insurer, Fubon Life commands a substantial portion of the mature life insurance market, evidenced by its robust first-year and total premium figures. In 2023, Fubon Life reported total premiums of NT$817.6 billion, a testament to its established market position and consistent revenue generation.

This substantial, recurring premium income acts as a powerful cash generator, enabling Fubon Life to comfortably fund its ongoing operations and invest in its business. The predictable cash flows from this mature segment are crucial for supporting other business units within Fubon Financial Holding, contributing significantly to the group's overall financial strength and profitability.

Fubon Insurance commands a dominant position in Taiwan's property and casualty (P&C) insurance market, boasting a direct written premium market share exceeding 24%. This leadership, particularly strong in mature segments like motor insurance, provides a stable and substantial revenue stream.

Despite moderate overall growth in the non-life insurance sector, Fubon's entrenched market share translates into consistent premium income and reliable profitability. This stability is a hallmark of a cash cow, generating significant cash flow for the Fubon Financial Holding group.

Fubon Financial Holdings' Overall EPS Leadership

Fubon Financial Holdings has consistently led Taiwan's financial sector in earnings per share (EPS) for 16 consecutive years, a testament to its enduring profitability and market dominance.

This sustained high performance across its diverse business segments solidifies the entire group's status as a cash cow, reliably generating substantial returns for its shareholders.

- 16 Consecutive Years of EPS Leadership: Fubon Financial Holdings has maintained its top position in Taiwan's financial industry for earnings per share, showcasing exceptional financial stability and growth.

- Diversified Business Lines: The company's strength lies in its broad portfolio, encompassing banking, insurance, securities, and asset management, which collectively contribute to its robust cash flow generation.

- Shareholder Value Creation: This consistent profitability translates directly into significant value for shareholders, reinforcing Fubon's reputation as a reliable investment.

- Market Dominance: Fubon's sustained EPS leadership indicates a strong competitive advantage and a well-executed business strategy in a dynamic financial market.

Established Overseas Banking Operations (e.g., Hong Kong)

Fubon Bank (Hong Kong), a key overseas operation for Fubon Financial, demonstrated robust performance in 2024. The bank's net profit saw a significant 16% increase, underscoring its established and profitable position within a mature market. This consistent financial strength highlights its role as a reliable cash generator for the broader Fubon Financial group.

These established international banking operations, like Fubon Bank (Hong Kong), are crucial for diversifying Fubon Financial's revenue. They provide a steady stream of income, acting as dependable cash cows that support the company's overall financial stability and growth initiatives in other business areas.

- Fubon Bank (Hong Kong) net profit growth: 16% in 2024.

- Contribution to Fubon Financial: Stable income and revenue diversification.

- Market position: Established and profitable in a mature overseas market.

Fubon Financial Holding's core banking operations, particularly Taipei Fubon Bank, consistently act as cash cows. In 2023, Taipei Fubon Bank's net profit reached NT$27.1 billion, a 16.4% year-on-year increase, demonstrating its stable income generation from established deposit and lending activities. This strong performance in a mature market provides essential, reliable cash flows to fund other ventures within the group.

| Business Segment | Key Metric | 2023 Performance | BCG Matrix Role |

|---|---|---|---|

| Taipei Fubon Bank (Core Banking) | Net Profit | NT$27.1 billion (+16.4% YoY) | Cash Cow |

| Fubon Life Insurance (Traditional Premiums) | Total Premiums | NT$817.6 billion | Cash Cow |

| Fubon Insurance (P&C Market Share) | Direct Written Premium Share | > 24% | Cash Cow |

| Fubon Financial Holding (Overall) | EPS Leadership | 16 Consecutive Years | Cash Cow |

What You See Is What You Get

Fubon Financial Holding BCG Matrix

The Fubon Financial Holding BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive document contains no watermarks or demo content, ensuring you get a professional and actionable analysis ready for strategic planning. You can confidently expect the exact same BCG Matrix report, meticulously crafted for clarity and insight, to be delivered directly to you upon completing your transaction.

Dogs

Legacy, low-yield life insurance policies represent Fubon Life's potential "cash cows" or, more accurately, "dogs" in a BCG matrix context as the company shifts focus. These older, savings-oriented products, designed for a low-interest-rate era, now tie up capital inefficiently. For instance, in 2024, many of these policies might offer guaranteed yields below 2%, significantly underperforming current market opportunities and newer, protection-focused products that are driving Fubon Life's strategic growth.

These legacy policies, while providing a stable, albeit low, income stream, likely exhibit low profit margins and minimal growth potential. Their value lies more in their existing customer base and the capital they hold rather than their future contribution to Fubon Life's profitability or market share expansion. As Fubon Life prioritizes protection and higher-margin products, these older policies become less strategically important, fitting the profile of a "dog" that requires careful management to extract remaining value without significant investment.

In Taiwan's banking landscape, highly commoditized services like basic savings accounts without added features represent a potential 'dog' category for Fubon Financial Holding. These offerings, while essential, often generate very low margins due to intense competition and a lack of differentiation. For instance, in 2024, the average interest rate on current accounts across Taiwanese banks remained under 0.5%, highlighting the thin profitability of these fundamental products.

Fubon Financial Holding's physical branch network, while undergoing domestic optimization, faces challenges with locations in declining areas or those lacking robust digital integration. These branches, if characterized by low transaction volumes and high operational costs without substantial new customer acquisition, can be categorized as 'dogs' within the BCG Matrix framework, representing underutilized assets.

As of Q1 2024, Fubon Financial reported a continued focus on digital transformation, aiming to enhance the efficiency of its physical footprint. Branches that fail to adapt to evolving customer preferences for digital banking, particularly in regions with shrinking populations or declining economic activity, risk becoming costly liabilities. For instance, if a branch's operational expenses exceed its generated revenue and its contribution to digital customer onboarding remains minimal, its 'dog' status is reinforced, signaling a need for strategic reassessment.

Traditional, Low-Margin Securities Brokerage for Inactive Clients

Fubon Securities' traditional, low-margin brokerage services for inactive clients may be classified as a 'dog' in its BCG matrix. This segment often experiences intense competition, particularly from online platforms offering lower fees, which erodes profitability. While these services might maintain a client base, their low margins and lack of integration with higher-value offerings limit their strategic contribution.

In 2024, the Taiwanese securities market saw continued pressure on traditional brokerage margins. For instance, while overall trading volumes might have seen fluctuations, the revenue per transaction for retail clients engaging in less frequent trades remained compressed. This reality highlights the challenge for Fubon Securities in generating substantial returns from this specific client segment without evolving their service model.

The potential 'dog' status is further underscored by:

- Low Profitability: Intense price competition among brokerages for retail clients often leads to razor-thin margins on basic transaction services.

- Limited Growth Potential: Inactive clients typically do not engage in complex financial products or wealth management services, capping revenue growth from this segment.

- High Operational Costs: Maintaining infrastructure and customer support for a large, albeit inactive, retail client base can still incur significant overhead, further pressuring profitability.

- Strategic Shift Necessity: To move these operations out of the 'dog' category, Fubon Securities would need to successfully cross-sell wealth management products or leverage these clients for data analytics to offer more personalized, higher-margin services.

Small, Non-Core P&C Insurance Lines with Limited Market Share

Within Fubon Financial Holding's extensive P&C insurance portfolio, certain niche lines, while part of the overall offering, may represent "dogs" in the BCG matrix. These are typically smaller segments with limited market share and potentially low growth prospects, such as highly specialized inland marine insurance or specific types of surety bonds that do not align with Fubon's core strategic focus.

For instance, while Fubon Insurance held a significant overall market share in Taiwan's P&C sector, certain specialized lines might have accounted for less than 1% of the total market in 2024. These products often receive minimal marketing investment and may not be actively pushed by sales teams, reflecting their non-strategic nature and limited contribution to Fubon's growth trajectory.

- Limited Market Penetration: These lines often serve very specific, small customer bases, resulting in a market share that is a fraction of Fubon's dominant position in core P&C segments.

- Low Growth Potential: The underlying industries or risks associated with these niche products may be experiencing stagnant or declining growth, limiting their future revenue potential.

- Minimal Profit Contribution: Due to low volume and potentially higher administrative costs per policy, these "dog" lines may contribute negligibly to Fubon's overall profitability.

- Strategic Non-Alignment: Management may deem these lines as non-core, not fitting with Fubon's broader strategic objectives or investment priorities, leading to a lack of focused development.

Fubon Financial Holding's legacy life insurance policies, particularly those with low guaranteed yields, are considered 'dogs' within its BCG matrix. These older products, designed for a different economic environment, now tie up capital inefficiently, offering minimal growth and low profit margins. As Fubon Life strategically pivots towards protection-focused and higher-margin offerings, these legacy savings policies represent a segment that requires careful management to extract remaining value without substantial new investment.

In the broader financial services landscape, Fubon Financial faces 'dog' categories in its less differentiated offerings. This includes basic banking services like savings accounts with minimal added value, which operate on very low margins due to intense competition and commoditization. Similarly, physical bank branches in declining or digitally lagging areas can become 'dogs' if they exhibit low transaction volumes and high operational costs without contributing to new customer acquisition or digital engagement.

Fubon Securities' traditional, low-margin brokerage services for inactive clients also fit the 'dog' profile. These services face significant pressure from lower-cost online platforms, eroding profitability. The limited growth potential from this client segment, coupled with the ongoing operational costs, necessitates a strategic evolution towards cross-selling higher-value wealth management products or leveraging client data for personalized, more profitable services.

Within Fubon's Property & Casualty insurance lines, niche segments with limited market share and low growth prospects, such as specialized inland marine insurance or certain surety bonds, can be categorized as 'dogs'. These lines often receive minimal marketing investment and may not align with Fubon's core strategic focus, contributing negligibly to overall profitability and requiring careful evaluation for continued investment.

| Category | Description | Characteristics | Strategic Implication |

| Legacy Life Insurance Policies | Older, low-yield savings-oriented products. | Low profit margins, minimal growth potential, capital intensive. | Manage for cash extraction, avoid significant new investment. |

| Commoditized Banking Services | Basic savings accounts with low differentiation. | Very low margins, intense competition, lack of unique value proposition. | Focus on efficiency and integration with higher-margin services. |

| Underperforming Branches | Physical locations in declining areas or with low digital integration. | High operational costs, low transaction volumes, minimal new customer acquisition. | Optimize footprint, enhance digital capabilities, or divest. |

| Inactive Securities Clients | Retail clients with low trading frequency and basic brokerage needs. | Razor-thin margins, limited growth, potential for high overhead. | Cross-sell wealth management, leverage data for personalization. |

| Niche P&C Insurance Lines | Specialized, low-market-share insurance products. | Limited growth prospects, minimal profit contribution, non-core to strategy. | Evaluate for divestment or niche focus if strategically aligned. |

Question Marks

Taiwan's demographic shift towards a super-aged society, with over 20% of its population expected to be 65 or older by 2025, presents a significant opportunity for new retirement and senior-focused life insurance products. Fubon Life is strategically positioning itself to tap into this burgeoning market.

While Fubon Life is investing in developing these specialized offerings, its current market share in these emerging segments may be modest. This initial low share is characteristic of a question mark in the BCG matrix, indicating potential for high future growth but requiring substantial investment to gain traction and capitalize on the expanding senior demographic.

Fubon Asset Management's foray into digital asset investment products, exemplified by its multi-asset fund incorporating Bitcoin and Gold ETFs, positions it within a high-growth, albeit nascent and volatile, market segment. This strategic move into digital assets, a category characterized by rapid innovation and fluctuating values, aligns with a forward-looking approach to investment management.

The launch signifies Fubon's entry into the digital asset arena, a space with substantial growth potential but also inherent risks due to its evolving nature and price volatility. Early market share in this emerging sector is expected to be modest, necessitating a robust strategy for investment and risk mitigation.

Taipei Fubon Bank's strategic move into new overseas markets, exemplified by its Seoul Representative Office opening, highlights a pursuit of high-growth geographic opportunities in places like Japan and India. These ventures represent potential Stars in the BCG matrix, offering significant future upside.

However, entering these nascent markets means Fubon will initially possess a low market share. Substantial strategic investments will be crucial to establish a foothold and build competitive capabilities, characteristic of a Star's early development phase.

AI-Driven Risk Scoring for Emerging Insurance Segments (e.g., EVs)

Fubon Financial is pioneering AI-driven risk scoring for emerging insurance segments, notably electric vehicles (EVs). This initiative aligns with the BCG matrix, positioning AI-powered EV insurance as a potential ‘Question Mark’ due to its high growth prospects coupled with a nascent market presence. The rapid expansion of the EV market, with global sales projected to reach over 15 million units in 2024, underscores the significant opportunity.

The company's investment in advanced analytics allows for more granular risk assessment, crucial for a segment with evolving accident patterns and repair costs. For instance, AI can analyze telematics data to predict driver behavior and vehicle performance, leading to more accurate premiums. This strategic focus aims to capture market share in a sector experiencing substantial year-over-year growth, estimated at over 30% globally for 2024.

- AI Models for EV Risk: Fubon is developing AI/ML models to analyze EV-specific data, including battery health, charging patterns, and advanced driver-assistance systems (ADAS) performance.

- Market Growth Potential: The global EV market is expanding rapidly, with sales expected to exceed 15 million vehicles in 2024, presenting a significant untapped insurance market.

- New Product Offerings: Fubon's AI-driven EV insurance products are relatively new, indicating a low initial market share but high potential for future growth and market leadership.

- Data-Driven Underwriting: The use of AI allows for more precise risk assessment compared to traditional methods, potentially leading to competitive pricing and reduced claims costs.

Integration of New Fintech Innovations for Cross-Subsidiary Services

Fubon Financial Holdings actively integrates new fintech innovations to offer seamless cross-subsidiary services, aiming to bolster customer engagement and operational efficiency. The Fubon+ mobile app is a prime example, consolidating various financial products and services from different Fubon entities into a single, user-friendly platform.

This strategic integration positions Fubon within a high-growth segment of the digital finance market. While the broader digital finance sector is expanding, the successful implementation and widespread adoption of these unified fintech solutions represent a significant opportunity. For instance, by the end of 2023, Fubon reported a substantial increase in digital transactions across its platforms, reflecting the growing demand for integrated financial services.

- Fubon+ App Adoption: Fubon+ aims to achieve over 5 million active users by the end of 2024, a key metric for measuring the success of its cross-subsidiary integration.

- Digital Transaction Growth: In 2023, digital channels accounted for approximately 70% of Fubon's retail banking transactions, demonstrating a strong shift towards digital engagement.

- Fintech Investment: Fubon has allocated over NT$10 billion (approximately $310 million USD) towards digital transformation and fintech development through 2025, signaling commitment to this high-growth area.

- Cross-Selling Success: Early data from Fubon+ indicates a 15% higher cross-selling rate for products like insurance and wealth management among users who engage with multiple subsidiary services through the app.

Fubon's venture into AI-driven risk scoring for emerging insurance segments, particularly electric vehicles (EVs), exemplifies a 'Question Mark' in the BCG matrix. This is due to the high growth potential of the EV market, with global sales projected to exceed 15 million units in 2024, contrasted with a nascent market presence and the need for substantial investment in advanced analytics for accurate risk assessment.

The company's investment in AI for granular risk assessment in EV insurance, a sector experiencing over 30% global growth in 2024, aims to capture market share. This strategy leverages data-driven underwriting to potentially offer competitive pricing and reduce claims costs.

Fubon's AI models analyze specific EV data like battery health and ADAS performance, positioning these new offerings as having low initial market share but high future growth potential.

The Fubon+ app, integrating various financial services, targets over 5 million active users by the end of 2024. This initiative, backed by over NT$10 billion in fintech investment through 2025, aims to increase cross-selling rates by 15%, indicating a strong push into high-growth digital finance.

| Segment | Market Growth | Market Share | Investment Need | BCG Classification |

| Senior Life Insurance | High (Demographic Shift) | Low (Emerging) | High | Question Mark |

| Digital Assets | High (Nascent) | Low (New Entry) | High | Question Mark |

| AI-Powered EV Insurance | High (Rapid EV Growth) | Low (New Segment) | High | Question Mark |

| Integrated Fintech (Fubon+) | High (Digital Finance) | Growing (User Adoption) | High | Question Mark |

BCG Matrix Data Sources

Our Fubon Financial Holding BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.