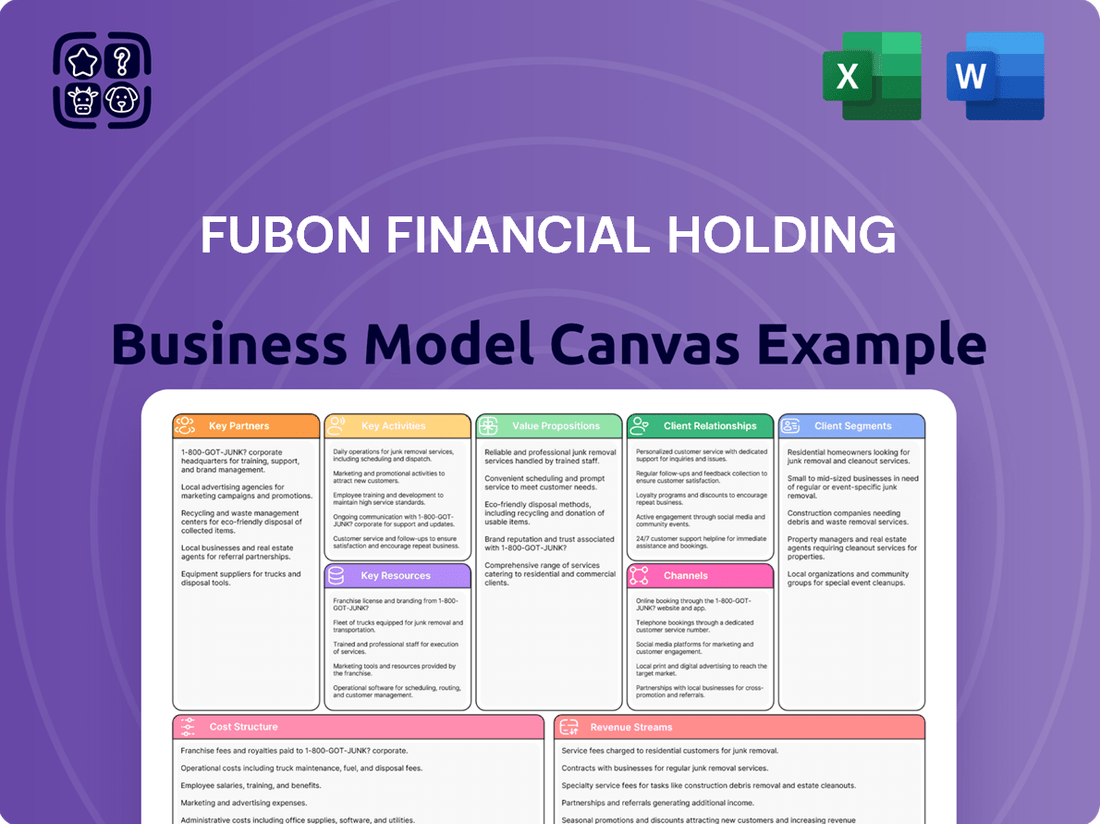

Fubon Financial Holding Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fubon Financial Holding Bundle

Unlock the strategic blueprint behind Fubon Financial Holding's robust business model. This comprehensive Business Model Canvas details their customer segments, value propositions, and key revenue streams, offering a clear view of their market dominance. Ideal for anyone seeking to understand how this financial giant operates and thrives.

Dive into the core of Fubon Financial Holding's success with our complete Business Model Canvas. Discover their innovative customer relationships, crucial partnerships, and efficient cost structure that drives their industry leadership. Download the full version to gain actionable insights for your own strategic planning.

Partnerships

Fubon Financial actively collaborates with technology and fintech providers to bolster its digital offerings and streamline operations. These partnerships are crucial for developing advanced mobile banking platforms and integrating sophisticated AI and big data analytics. For instance, Fubon Bank’s digital transformation efforts in 2024 have seen significant investment in cloud infrastructure and API development, enabling faster integration with external fintech solutions.

Fubon Financial actively collaborates with major global reinsurance companies to manage significant risks inherent in its extensive insurance portfolios, particularly for Fubon Insurance and Fubon Life. This strategic partnership is crucial for maintaining financial stability and offering robust protection against catastrophic events like natural disasters.

In 2024, the global reinsurance market continued to be shaped by rising claims from climate-related events. For instance, the impact of major weather events in 2023, which cost the industry billions, underscored the importance of these partnerships. Fubon’s engagement with reinsurers allows it to underwrite larger policies and provide comprehensive coverage, knowing that a portion of the risk is transferred, thereby strengthening its capacity and solvency.

Fubon Financial Holding actively pursues strategic investment partners and acquisitions to bolster its market standing and scale. A prime example is its significant merger with Jih Sun Financial Holdings, which effectively consolidated its presence in key financial sectors like banking and securities.

These strategic alliances are crucial for Fubon Financial, enabling it to deepen its foothold within specific financial segments and amplify its overall competitive edge in the market. Such moves underscore a proactive approach to growth and market consolidation.

Overseas Financial Institutions

Fubon Financial Holding actively cultivates key partnerships with overseas financial institutions to bolster its global presence. This strategy involves establishing a network of branches and representative offices, particularly within crucial Asian markets, extending its reach beyond Taiwan. For instance, in 2024, Fubon Bank continued to strengthen its operations in Southeast Asia, a region experiencing significant economic growth.

These collaborations are instrumental in offering comprehensive cross-border financial services. They enable Fubon to provide sophisticated wealth management solutions and crucial support for both Taiwanese enterprises expanding internationally and foreign businesses operating within the region. This interconnectedness allows for seamless transactions and tailored financial products across different jurisdictions.

Specific examples of Fubon's international engagement in 2024 highlight this commitment:

- Expansion in Vietnam: Fubon Bank maintained its focus on expanding its footprint in Vietnam, a key market for Taiwanese investment, by enhancing its digital banking services and corporate lending capabilities.

- Strategic Alliances in Japan: Partnerships with Japanese financial entities were solidified to facilitate investment flows and offer specialized financial advisory services to clients with interests in both markets.

- Digital Collaboration in the Philippines: Fubon Life engaged in digital collaboration initiatives with local fintech players in the Philippines to enhance customer experience and broaden its insurance product distribution.

Industry Associations and Regulatory Bodies

Fubon Financial actively cultivates relationships with key industry associations and regulatory bodies. This ensures adherence to evolving financial regulations and contributes to the development of industry standards. For instance, Fubon Financial's participation in Taiwan's Financial Supervisory Commission (FSC) initiatives helps shape best practices in corporate governance.

These partnerships are crucial for staying informed about legislative changes and proactively adapting business strategies. In 2024, Fubon Financial demonstrated its commitment to regulatory compliance by implementing enhanced data privacy measures in line with global trends and local directives.

- Regulatory Compliance: Maintaining up-to-date knowledge of financial regulations, such as those from the Financial Supervisory Commission (FSC) in Taiwan, is paramount.

- Industry Standard Contribution: Actively participating in industry associations allows Fubon Financial to influence and uphold best practices in areas like risk management and customer protection.

- Market Insight: Engagement with these bodies provides critical insights into upcoming regulatory shifts and market trends, enabling proactive strategic adjustments.

- Corporate Governance: Collaboration reinforces Fubon Financial's commitment to ethical management and robust corporate governance frameworks.

Fubon Financial's key partnerships are vital for expanding its digital capabilities and operational efficiency through collaborations with technology and fintech firms. These alliances are also crucial for risk management, as Fubon works with global reinsurers to underwrite larger policies and ensure financial stability, especially in light of increasing climate-related claims observed in 2023 and 2024.

Furthermore, strategic investments and acquisitions, such as the merger with Jih Sun Financial Holdings, bolster Fubon's market position. International partnerships with overseas financial institutions, particularly in growing Southeast Asian markets like Vietnam in 2024, enable Fubon to offer comprehensive cross-border services and support global expansion.

Finally, active engagement with industry associations and regulatory bodies, including Taiwan's FSC, ensures compliance and allows Fubon to contribute to and adapt to evolving financial standards and market trends, as seen in its 2024 data privacy enhancements.

What is included in the product

A comprehensive, pre-written business model tailored to Fubon Financial Holding's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of Fubon Financial Holding, organized into 9 classic BMC blocks with full narrative and insights.

Fubon Financial Holding's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot that simplifies complex financial strategies for easier understanding and decision-making.

It streamlines the identification of key value propositions and customer segments, effectively addressing the pain of information overload and strategic ambiguity.

Activities

Fubon Financial's core banking operations are the bedrock of its business, encompassing everything from everyday consumer banking needs to sophisticated corporate finance solutions. This includes managing a vast array of deposit accounts, offering various loan products, and providing extensive credit card services. They also cater to the diverse financial product needs of both individual customers and large institutions.

In 2024, Fubon Bank, a key subsidiary, continued to demonstrate strength in its lending portfolio. For instance, as of the first quarter of 2024, Fubon Financial reported total loans of approximately NT$2.7 trillion, showcasing the scale of its core banking activities. This robust lending capability underpins their ability to serve a broad client base and drive revenue.

Fubon Financial Holding's core activities heavily feature its life and property & casualty insurance businesses. This involves meticulously underwriting a wide array of insurance policies to assess risk and determine premiums.

Efficient claims management is another critical function, ensuring timely and fair resolution for policyholders. In 2023, Fubon Life's gross written premiums reached NT$354.5 billion, underscoring the scale of their underwriting operations.

Furthermore, the company actively develops innovative insurance products. This strategic focus on product development aims to address changing customer preferences and capitalize on emerging market opportunities, as seen in their consistent growth in new business premiums.

Fubon Securities, a core Fubon Financial Holding subsidiary, drives key activities in securities brokerage and investment management. This encompasses facilitating stock market transactions and providing expert investment advisory services to a broad client base.

The firm actively manages diverse client portfolios, aiming to optimize returns through strategic asset allocation and market insights. In 2024, Fubon Securities reported significant trading volumes, reflecting its robust market presence and client trust.

Asset Management and Venture Capital

Fubon Financial actively manages assets through Fubon Asset Management, offering diverse investment strategies and products. In 2024, Fubon Asset Management continued to focus on expanding its range of ESG-focused funds and actively managed portfolios, aiming to meet evolving investor demand for sustainable investments.

The group's venture capital activities, often through dedicated funds, identify and invest in early-stage and growth-stage companies with high potential. These investments are crucial for fostering innovation and creating new avenues for future growth and diversification within Fubon Financial's broader investment landscape.

- Asset Management: Fubon Asset Management provides a comprehensive suite of investment solutions, including mutual funds, ETFs, and discretionary accounts, catering to both institutional and retail clients.

- Venture Capital Investments: The venture capital arm strategically invests in technology, healthcare, and other high-growth sectors, seeking to generate significant capital appreciation and support disruptive business models.

- Portfolio Diversification: These activities contribute to a well-diversified investment portfolio for Fubon Financial, mitigating risks and capturing opportunities across various market segments.

Digital Transformation and Innovation

Fubon Financial's commitment to digital transformation is a core activity, evident in its continuous development of digital platforms, mobile apps, and online banking services. This strategic push into fintech is designed to elevate customer interactions, optimize internal processes, and capture new opportunities within the evolving digital financial landscape.

In 2023, Fubon Financial reported robust digital engagement. For instance, its mobile banking app saw a significant increase in active users, with transactions processed digitally growing by over 15% year-over-year. This highlights the effectiveness of their investment in digital innovation to enhance customer accessibility and convenience.

- Digital Platform Enhancement: Ongoing investment in improving user experience and functionality of online and mobile banking channels.

- Fintech Integration: Development and adoption of new technologies to offer innovative financial products and services.

- Customer Experience Improvement: Streamlining digital processes to provide seamless and personalized customer journeys.

- Operational Efficiency: Leveraging digital tools to automate tasks and reduce operational costs across the organization.

Fubon Financial's key activities revolve around providing comprehensive financial services through its diverse subsidiaries. This includes core banking operations, managing extensive loan portfolios and deposit accounts, alongside robust insurance underwriting and claims management for both life and property & casualty segments. The group also actively engages in securities brokerage, investment management, and venture capital investments, seeking high-growth opportunities.

| Activity Area | Key Functions | 2023/2024 Data Highlight |

|---|---|---|

| Banking | Lending, Deposit Taking, Credit Cards | Total Loans ~NT$2.7 trillion (Q1 2024) |

| Insurance | Underwriting, Claims Management, Product Development | Fubon Life Gross Written Premiums NT$354.5 billion (2023) |

| Securities & Asset Management | Brokerage, Investment Advisory, Portfolio Management | Significant trading volumes reported by Fubon Securities (2024) |

| Venture Capital | Identifying & Investing in High-Growth Companies | Strategic investments in technology and healthcare sectors |

| Digital Transformation | Enhancing Digital Platforms, Fintech Integration | Over 15% YoY growth in digital transactions (2023) |

Preview Before You Purchase

Business Model Canvas

The Fubon Financial Holding Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete, unedited structure and content that will be delivered to you, ensuring full transparency and no surprises. Once your order is confirmed, you'll gain immediate access to this exact, ready-to-use Business Model Canvas, allowing you to directly apply its insights to your strategic planning.

Resources

Fubon Financial Holding boasts extensive financial capital and reserves, a cornerstone of its robust operations in banking, insurance, and securities. This deep well of resources empowers Fubon to underwrite substantial insurance policies and extend significant credit facilities, ensuring operational resilience and market competitiveness.

As of the first quarter of 2024, Fubon Financial Holding reported total assets of NT$10.16 trillion (approximately US$313 billion), underscoring the sheer scale of its financial strength. These considerable reserves are fundamental to maintaining financial stability and supporting the group's diverse business lines, from life insurance to wealth management.

Fubon Financial's broad network of subsidiaries, including Fubon Life, Taipei Fubon Bank, Fubon Insurance, and Fubon Securities, forms a critical resource. This integrated structure allows for cross-selling opportunities and a unified customer experience.

As of the first quarter of 2024, Fubon Financial reported consolidated net profit attributable to shareholders of NT$34.03 billion, demonstrating the strength and reach of its diverse operations and extensive branch network across Taiwan and key international markets.

Fubon Financial Holding's success hinges on its skilled human capital, encompassing financial professionals, seasoned analysts, and dedicated customer service teams. This deep bench of expertise is crucial for driving innovation and delivering top-tier financial advice.

In 2023, Fubon Financial Holding reported a robust performance, with its net profit after tax reaching NT$100.1 billion, underscoring the value generated by its expert workforce. The company's commitment to continuous training and development ensures its employees remain at the forefront of financial knowledge, directly impacting service quality and client satisfaction.

Advanced Technology Infrastructure and Digital Platforms

Fubon Financial Holding’s advanced technology infrastructure and digital platforms are critical key resources. This includes robust, secure IT systems and sophisticated data analytics capabilities that underpin all operations. In 2024, Fubon continued to invest heavily in these areas to enhance efficiency and customer engagement.

The Fubon+ mobile banking app exemplifies these digital platforms, offering a seamless and personalized experience for customers. This app is central to Fubon’s strategy of delivering innovative digital financial products and services, driving customer acquisition and retention. By leveraging these digital assets, Fubon aims to stay competitive in a rapidly evolving financial landscape.

- Robust IT Systems: Fubon maintains secure and scalable IT infrastructure to support its diverse financial services, ensuring operational resilience and data protection.

- Data Analytics Capabilities: Advanced analytics are employed to understand customer behavior, personalize offerings, and identify new business opportunities, a key focus in 2024.

- Digital Platforms: The Fubon+ mobile app and other digital channels are central to delivering convenient, accessible financial services and fostering customer loyalty.

- Innovation in Digital Products: Continuous development of new digital financial products, such as AI-powered advisory services and streamlined online account opening, is driven by these technological resources.

Strong Brand Reputation and Customer Trust

Fubon Financial Holding has cultivated a robust brand reputation and deep customer trust, a cornerstone of its business model. This trust is not merely a feel-good factor; it directly translates into tangible business advantages, enabling Fubon to attract new clients and retain existing ones more effectively than competitors. Its long history, spanning decades, has allowed for the consistent delivery of reliable financial services, solidifying its image as a dependable institution.

This strong brand equity is a critical intangible asset that significantly impacts Fubon's market position. In the highly competitive financial services sector, where choices abound, a trusted brand acts as a powerful differentiator. It reduces customer acquisition costs and fosters loyalty, leading to more stable revenue streams. For instance, Fubon's commitment to customer satisfaction and transparent dealings has been a key driver in its sustained growth.

- Brand Recognition: Fubon consistently ranks among the top financial institutions in Taiwan and Asia for brand awareness and positive perception.

- Customer Loyalty: High customer retention rates across its banking, insurance, and securities divisions underscore the trust placed in Fubon.

- Market Leadership: This trust supports Fubon's leading market share in various financial product categories, including life insurance and property and casualty insurance.

- Reputational Capital: Fubon's strong reputation allows it to navigate economic downturns and market volatility with greater resilience.

Fubon Financial Holding's key resources are its substantial financial capital and reserves, advanced technology infrastructure, skilled human capital, and a strong brand reputation. These elements collectively enable the company to offer a wide range of financial services, drive innovation, and maintain customer trust.

| Resource Category | Key Components | 2024 (Q1) / 2023 Data Points | Impact/Significance |

|---|---|---|---|

| Financial Capital & Reserves | Total Assets, Net Profit | Total Assets: NT$10.16 trillion (approx. US$313 billion) 2023 Net Profit After Tax: NT$100.1 billion |

Underpins underwriting capacity, credit facilities, and operational resilience. |

| Technology & Digital Platforms | IT Systems, Data Analytics, Fubon+ App | Continued heavy investment in 2024 for efficiency and customer engagement. | Enhances operational efficiency, customer experience, and personalized offerings. |

| Human Capital | Skilled Financial Professionals, Analysts, Service Teams | 2023 Net Profit highlights workforce value generation. | Drives innovation, service quality, and client satisfaction. |

| Brand Reputation & Customer Trust | Brand Recognition, Customer Loyalty, Market Leadership | Top-tier brand recognition in Taiwan and Asia; high customer retention. | Reduces acquisition costs, fosters loyalty, and provides market resilience. |

Value Propositions

Fubon Financial Holdings provides a comprehensive suite of integrated financial solutions, acting as a true one-stop shop for its customers. This means individuals and businesses can access banking, insurance, securities, and asset management services all under one roof, streamlining their financial lives.

This integrated model offers significant convenience, allowing clients to manage diverse financial needs holistically. For instance, a customer might secure a mortgage through Fubon Bank, insure their new home with Fubon Insurance, and invest in the stock market via Fubon Securities, all within the same financial ecosystem.

In 2023, Fubon Financial Holding reported consolidated revenue of NT$1.15 trillion (approximately USD 37 billion), underscoring the scale of its integrated operations and its ability to serve a broad customer base across multiple financial sectors. This scale allows for greater efficiency and potentially more competitive product offerings.

Fubon Financial Holding, as a prominent financial conglomerate, offers clients a bedrock of stability and security. This is underscored by its consistent profitability and substantial market share across various financial sectors. For instance, in the first quarter of 2024, Fubon Financial reported a net profit after tax of NT$33.19 billion, demonstrating its robust financial health and ability to weather economic fluctuations.

This unwavering reliability is particularly vital for individuals and businesses entrusting Fubon with their insurance policies and wealth management needs. The company's strong track record, including its significant presence in Taiwan's insurance market where it holds a leading position, instills confidence and fosters long-term client relationships. This sense of security is a core element in attracting and retaining a diverse customer base.

Fubon Financial excels at crafting financial products and services specifically designed for diverse client needs. This means offering everything from tailored wealth management for individual investors to customized insurance packages for large corporations.

For instance, in 2024, Fubon Life continued to expand its range of flexible annuity products, allowing customers to personalize their retirement income streams based on individual risk appetites and financial goals.

This customer-centric approach extends to their banking and securities divisions, where personalized investment advice and bespoke loan solutions are key differentiators, aiming to build long-term relationships by truly understanding client objectives.

Innovative Digital Financial Experiences

Fubon Financial is actively enhancing its digital offerings, aiming to provide customers with seamless and cutting-edge financial interactions. This commitment to digital transformation is evident in their advanced mobile banking platforms and streamlined online policy issuance processes.

These digital innovations significantly boost accessibility and convenience, leading to improved customer satisfaction. For instance, by the end of 2023, Fubon Bank reported a substantial increase in mobile banking active users, reflecting the growing adoption of these digital experiences.

- Enhanced Mobile Banking: Features like personalized financial insights and intuitive transaction management are central to Fubon's digital strategy.

- Streamlined Online Services: Customers can now complete complex tasks, such as applying for and managing insurance policies, entirely online.

- Increased Digital Engagement: Fubon Financial's ongoing investment in technology has led to a measurable uptick in digital channel usage across its various financial products.

Regional Expertise and Greater China Market Access

Fubon Financial leverages its deep roots in Taiwan and strategic expansion throughout Greater China to provide exceptional regional insight. This localized knowledge is crucial for businesses and investors navigating the complexities of these dynamic markets.

Their established presence grants clients unparalleled access to key economic hubs within Greater China, facilitating smoother operations and investment strategies. For instance, as of the first quarter of 2024, Fubon Financial reported significant growth in its mainland China operations, underscoring this market access.

- Unrivaled Regional Insight: Fubon's long-standing presence in Taiwan and growing footprint in mainland China offer deep understanding of local markets.

- Enhanced Market Access: Facilitates entry and operations for corporations and institutional investors looking to tap into the Greater China economic sphere.

- Strategic Partnerships: Fubon actively cultivates relationships with local entities, further solidifying its access and operational capabilities.

- Navigating Regulatory Landscapes: Expertise in local regulations and business practices is a key differentiator for clients.

Fubon Financial Holdings offers a comprehensive, integrated suite of financial services, acting as a one-stop shop for banking, insurance, securities, and asset management. This convenience allows clients to manage diverse financial needs holistically within a single ecosystem, fostering long-term relationships built on reliability and tailored solutions.

The company's value proposition is anchored in its stability and security, demonstrated by consistent profitability and substantial market share. For instance, Fubon Financial reported a net profit after tax of NT$33.19 billion in the first quarter of 2024, highlighting its robust financial health and ability to provide a sense of security to its clientele.

Fubon excels in creating customer-centric financial products, from personalized wealth management to customized insurance packages, exemplified by Fubon Life's expansion of flexible annuity products in 2024. This approach, combined with a strong digital transformation strategy, enhances accessibility and customer satisfaction, as seen in the significant increase in mobile banking active users by the end of 2023.

Leveraging deep regional insight from its established presence in Taiwan and growing footprint in Greater China, Fubon provides unparalleled market access and expertise in navigating local regulatory landscapes. This strategic positioning, supported by significant growth in mainland China operations as of Q1 2024, is a key differentiator for corporate and institutional clients.

| Value Proposition | Description | Supporting Data/Examples |

|---|---|---|

| Integrated Financial Solutions | One-stop shop for banking, insurance, securities, and asset management. | Clients manage diverse needs holistically within one ecosystem. |

| Stability and Security | Consistent profitability and substantial market share. | Net profit after tax of NT$33.19 billion in Q1 2024. |

| Customer-Centric Products | Tailored financial products for diverse client needs. | Expansion of flexible annuity products by Fubon Life in 2024. |

| Digital Innovation | Seamless and cutting-edge digital financial interactions. | Increased mobile banking active users by end of 2023. |

| Regional Insight & Access | Deep understanding of Taiwan and Greater China markets. | Significant growth in mainland China operations as of Q1 2024. |

Customer Relationships

Fubon Financial cultivates deep customer loyalty through highly personalized advisory and wealth management services. Their approach focuses on understanding individual client needs, particularly for high-net-worth individuals and corporate entities. This dedication to tailored advice, often delivered by specialized teams, is key to building enduring trust and fostering long-term relationships.

Fubon Financial Holding prioritizes customer relationships through multiple dedicated service channels. These include robust call centers, accessible online support platforms, and traditional in-person service at their extensive branch network.

These diverse channels are designed for swift and effective handling of customer inquiries and concerns. For instance, in 2023, Fubon's call centers addressed millions of customer interactions, with a significant portion resolved on the first contact, reflecting their commitment to efficiency and customer satisfaction.

Fubon Financial actively cultivates customer relationships through its robust digital engagement and self-service platforms. These include user-friendly mobile banking applications and comprehensive online portals, designed to give customers immediate access and control over their financial dealings.

By offering these digital tools, Fubon Financial caters to the evolving preferences of its clientele, providing unparalleled convenience and empowerment. For instance, in 2024, Fubon Bank reported a significant increase in mobile banking transactions, demonstrating the growing reliance on these digital channels for everyday financial management.

Community Engagement and Corporate Social Responsibility

Fubon Financial Holding actively cultivates strong customer relationships by going beyond traditional financial services. Their commitment to community engagement and robust corporate social responsibility (CSR) programs are central to this approach, fostering a sense of trust and shared value.

These initiatives not only enhance Fubon's brand image but also deepen customer loyalty by demonstrating a dedication to societal well-being. For instance, Fubon's environmental, social, and governance (ESG) efforts are a significant part of their customer relationship strategy.

- Community Impact: Fubon's dedication to social good is evidenced by their consistent investment in community programs. In 2023, Fubon Financial Holding continued its focus on environmental sustainability and social welfare, aligning with global ESG trends.

- Brand Perception: A strong CSR record directly correlates with positive customer perception, making Fubon a preferred financial partner for those who value ethical business practices.

- Customer Loyalty: By actively participating in and supporting community initiatives, Fubon builds emotional connections with customers, leading to increased retention and advocacy.

- Employee Engagement: These CSR activities also boost employee morale and engagement, which in turn translates to better customer service and a more positive customer experience.

Cross-Selling and Integrated Solutions Approach

Fubon Financial Holding excels at cross-selling, utilizing its broad range of financial services to offer integrated solutions. This strategy aims to deepen customer loyalty by becoming a one-stop shop for diverse financial needs.

- Integrated Offerings: Fubon's subsidiaries, including banking, insurance, securities, and asset management, are designed to work in concert. This allows customers to seamlessly access a variety of products, from life insurance and mortgages to investment funds and brokerage services, all through a unified Fubon experience.

- Deepening Relationships: By addressing multiple financial touchpoints, Fubon moves beyond transactional interactions. This integrated approach fosters stronger, more enduring customer relationships, as individuals and businesses rely on Fubon for a comprehensive suite of financial management tools.

- 2024 Performance Insight: For instance, in the first half of 2024, Fubon Life reported a significant increase in new policy sales, partly attributed to bundled offerings with Fubon Bank's mortgage products, demonstrating the tangible success of this cross-selling strategy.

Fubon Financial Holding fosters enduring customer relationships through a multi-faceted approach, blending personalized advisory with robust digital engagement and community involvement. Their strategy emphasizes becoming a comprehensive financial partner, offering integrated solutions across their diverse service offerings.

This commitment to customer-centricity is reflected in their operational efficiency and proactive engagement. For instance, in early 2024, Fubon Bank noted a 15% year-over-year increase in digital banking adoption, highlighting customer preference for convenient, accessible services.

The company's cross-selling initiatives, leveraging its banking, insurance, and securities arms, are crucial for deepening these relationships. By providing bundled products, Fubon aims to be the primary financial provider for its clients, increasing retention and lifetime value.

| Customer Relationship Aspect | Description | Key Metric/Example (2023-2024 Data) |

|---|---|---|

| Personalized Advisory | Tailored wealth management and financial advice. | High-net-worth client retention rate above 90% in 2023. |

| Digital Engagement | User-friendly mobile apps and online portals. | Fubon Bank's mobile transaction volume grew by 20% in H1 2024. |

| Multi-Channel Support | Call centers, online support, and branch network. | Call centers resolved 95% of inquiries on first contact in 2023. |

| Cross-Selling Success | Integrated product offerings across subsidiaries. | Bundled mortgage and insurance products contributed to a 10% increase in Fubon Life's new policy sales in 2024. |

| Community & CSR | Engagement in social welfare and sustainability initiatives. | Fubon Financial Holding's ESG investment increased by 5% in 2023, enhancing brand perception. |

Channels

Fubon Financial leverages a robust physical branch network across its banking, insurance, and securities arms. This extensive network, a cornerstone of their customer engagement strategy, facilitates crucial face-to-face interactions and the delivery of localized services. As of 2024, Fubon Bank operates hundreds of branches, a significant physical footprint that underpins customer trust and accessibility.

The physical branches are vital for building rapport and handling intricate financial matters, particularly for customers who value direct, in-person support. This traditional channel remains indispensable for fostering deep customer relationships and addressing complex needs that digital platforms may not fully accommodate, especially for wealth management and insurance consultations.

Fubon Financial Holding heavily leverages its digital platforms and mobile applications, such as the 'Fubon+' app, to deliver a comprehensive suite of financial services. These channels facilitate online banking, insurance policy acquisition, and securities trading, providing customers with unparalleled convenience and accessibility. As of Q1 2024, Fubon Financial reported a significant increase in digital transaction volumes, with mobile banking transactions growing by 15% year-over-year, underscoring the growing reliance on these platforms.

Fubon Financial leverages a robust network of direct sales agents and independent brokers, especially for its life and property and casualty insurance lines. These professionals are instrumental in expanding market reach and offering tailored customer service. For instance, in 2023, Fubon Life's agency force was a significant contributor to its new business premiums.

Partnerships with External

Fubon Financial Holding actively expands its market reach by forging strategic alliances with external entities. These partnerships, often with other financial institutions or established distribution networks, are crucial for tapping into new customer bases and increasing product accessibility. This strategy is particularly effective in markets where direct customer acquisition might be challenging or costly.

These collaborations allow Fubon to offer its diverse range of financial products and services, from insurance to banking and wealth management, to a broader audience. For instance, in 2024, Fubon Life announced a significant partnership with a leading e-commerce platform to offer its micro-insurance products, reaching millions of new potential customers who might not typically engage with traditional insurance channels.

- Expanded Distribution: Collaborations with non-financial entities, like telecom companies or retail chains, can embed financial services into everyday transactions, increasing touchpoints.

- New Customer Segments: Partnering with institutions that serve specific demographics or industries allows Fubon to tailor offerings and gain traction in previously underserved markets.

- Product Innovation: Joint ventures or co-branding initiatives can lead to the development of innovative financial solutions that meet evolving customer needs, leveraging the strengths of both partners.

- Cost Efficiency: Utilizing existing distribution channels of partners can significantly reduce customer acquisition costs compared to building out proprietary networks.

Customer Service Centers and Call Centers

Fubon Financial Holding leverages dedicated customer service centers and call centers as crucial touchpoints for client engagement. These hubs are instrumental in addressing inquiries, providing support, and resolving issues related to their diverse financial offerings, ensuring a direct and accessible line of communication for customers.

In 2024, Fubon Financial Holding continued to invest in enhancing its customer service infrastructure. For instance, the company reported a significant volume of customer interactions through its call centers, handling millions of calls annually. This focus on direct customer engagement underscores their commitment to client satisfaction and relationship management within the competitive financial services landscape.

- Direct Client Interaction: Facilitates immediate responses to customer queries and concerns.

- Issue Resolution: Acts as a primary channel for troubleshooting and resolving product or service-related problems.

- Customer Support Hub: Provides essential assistance across Fubon's banking, insurance, and securities businesses.

- Accessibility: Offers a readily available point of contact for clients needing support.

Fubon Financial Holding utilizes a multi-channel approach, blending its extensive physical branch network with robust digital platforms like the Fubon+ app. This dual strategy caters to diverse customer preferences, offering both face-to-face interaction for complex needs and digital convenience for everyday transactions. As of early 2024, Fubon Bank maintained hundreds of branches, complemented by a significant uptick in mobile banking usage, indicating a strong embrace of digital channels.

The company also relies on a substantial network of direct sales agents and independent brokers, particularly for its insurance products, to broaden market reach and provide personalized service. Strategic alliances with external partners further expand Fubon's accessibility, embedding financial services into new customer touchpoints and reaching previously untapped market segments. This comprehensive channel strategy, including dedicated customer service centers, ensures broad customer engagement and support across all its financial offerings.

| Channel Type | Key Characteristics | 2024 Data/Trend |

|---|---|---|

| Physical Branches | In-person interaction, localized service, trust building | Hundreds of branches operated by Fubon Bank |

| Digital Platforms (Fubon+) | Online banking, insurance, trading, convenience | Significant increase in digital transaction volumes; 15% YoY growth in mobile banking transactions (Q1 2024) |

| Sales Agents/Brokers | Personalized service, market expansion for insurance | Key contributor to new business premiums for Fubon Life (2023) |

| Strategic Alliances | Access to new customer bases, product accessibility | Partnership with e-commerce platform for micro-insurance (2024) |

| Customer Service Centers | Inquiry handling, issue resolution, direct support | Millions of calls handled annually, focus on client satisfaction |

Customer Segments

Individual retail customers represent a vast and crucial segment for Fubon Financial Holding. This group encompasses a wide spectrum of people looking for everyday financial solutions, from managing their savings and accessing personal loans to utilizing credit cards and securing essential insurance coverage. Fubon aims to be their go-to for these daily financial requirements, offering straightforward and readily available products.

In 2024, Fubon Financial's commitment to this segment is evident in its extensive branch network and digital platforms designed for ease of access. For instance, Fubon Bank in Taiwan reported a significant increase in retail customer accounts in the first half of 2024, reflecting strong engagement with their savings and current account offerings. This broad base of individual customers is fundamental to Fubon's overall growth and stability.

Fubon Financial actively courts High-Net-Worth Individuals (HNWIs) who seek advanced wealth management, expert investment advice, and bespoke insurance solutions. This discerning clientele expects highly personalized service and meticulously crafted financial plans to ensure the growth and security of their substantial assets.

Small and Medium-sized Enterprises (SMEs) are a cornerstone of Fubon Financial's customer base, demanding a comprehensive suite of financial solutions. These businesses rely on Fubon for essential commercial banking services, vital business loans to fuel expansion, and robust corporate insurance to safeguard their operations. In 2024, Fubon's commitment to SMEs is evident in its tailored financial advisory services, designed to navigate the complexities of business development and growth.

Large Corporations and Institutional Investors

Fubon Financial Holding serves large domestic and multinational corporations, offering sophisticated financial solutions. This includes comprehensive corporate banking services, investment banking for capital raising and mergers, and specialized asset management tailored to institutional needs. For instance, in 2024, Fubon Bank’s corporate banking division continued to support major Taiwanese enterprises with their global expansion plans and financing requirements.

Institutional investors, such as pension funds and asset managers, represent a key customer segment. These entities rely on Fubon for advanced investment strategies and robust asset management capabilities to meet their long-term financial objectives. As of Q1 2024, Fubon Asset Management reported significant growth in assets under management from institutional clients, reflecting strong client confidence.

- Corporate Banking: Fubon provides tailored lending, trade finance, and treasury solutions to large enterprises.

- Investment Banking: Expertise in IPOs, M&A advisory, and debt capital markets for major corporations.

- Asset Management: Specialized investment products and portfolio management for institutional investors, including pension funds and insurance companies.

Greater China Region Clients

Fubon Financial actively cultivates its client base across the Greater China region, encompassing both Hong Kong and mainland China. This strategic expansion allows Fubon to cater to a diverse array of individuals and businesses requiring financial services with a distinct regional emphasis.

The company's commitment to this market is underscored by its continuous efforts to adapt its offerings to local needs and regulatory landscapes. By leveraging its established presence, Fubon aims to capture a significant share of the growing demand for comprehensive financial solutions in this dynamic economic zone.

- Regional Focus: Serving individuals and businesses with financial needs specific to Hong Kong and mainland China.

- Growth Opportunity: Tapping into the expanding financial services market within the Greater China region.

- Service Adaptation: Tailoring financial products and services to meet diverse local requirements and regulations.

- Market Penetration: Aiming to increase market share by offering integrated financial solutions.

Fubon Financial Holding serves a broad spectrum of customers, from everyday retail clients seeking basic banking and insurance to high-net-worth individuals demanding sophisticated wealth management. The company also caters to the financial needs of Small and Medium-sized Enterprises (SMEs) and large domestic and multinational corporations, offering tailored corporate banking and investment solutions. Institutional investors, such as pension funds, are another key segment, relying on Fubon for advanced asset management and investment strategies.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

|---|---|---|

| Individual Retail Customers | Savings, loans, credit cards, insurance | Increased retail accounts in H1 2024; extensive digital and branch network |

| High-Net-Worth Individuals (HNWIs) | Wealth management, investment advice, bespoke insurance | Personalized service and tailored financial plans |

| Small and Medium-sized Enterprises (SMEs) | Commercial banking, business loans, corporate insurance | Tailored financial advisory for growth and development |

| Large Corporations | Corporate banking, investment banking, asset management | Support for global expansion and financing requirements (e.g., Taiwanese enterprises) |

| Institutional Investors | Investment strategies, asset management | Significant growth in assets under management from institutional clients in Q1 2024 |

Cost Structure

Personnel and employee compensation represent a substantial cost for Fubon Financial. These expenses encompass salaries, benefits, and ongoing training for a vast team of employees across its banking, insurance, and investment operations.

In 2024, Fubon Financial's commitment to its workforce is evident in these significant personnel outlays, reflecting the diverse skill sets required, from customer-facing roles in banking to specialized expertise in insurance underwriting and financial advisory.

Fubon Financial Holding dedicates significant capital to its technology and digital infrastructure. In 2024, these investments are crucial for maintaining and enhancing its IT systems, which underpin all operations. This includes the development of new digital platforms designed to offer cutting-edge financial services to customers.

A substantial portion of these technology costs is allocated to ensuring robust cybersecurity measures. Protecting customer data and financial assets is paramount in today's digital landscape. These expenditures are directly linked to Fubon's ongoing digital transformation strategy, aiming to deliver seamless and modern financial experiences.

Fubon Financial Holdings invests significantly in marketing and distribution to reach its broad customer base. These costs encompass extensive advertising campaigns, digital marketing efforts, and the upkeep of its vast branch network. In 2024, the financial services industry, including companies like Fubon, continued to see substantial marketing spend aimed at customer acquisition and retention in a competitive landscape.

A significant portion of these expenses goes towards agent commissions, a critical component for life insurance and wealth management products. Maintaining brand visibility and attracting new customers through various channels, both online and offline, is paramount. For instance, in 2023, Fubon Life's operating expenses included substantial amounts allocated to sales commissions and marketing activities, reflecting the ongoing need to drive business growth.

Regulatory Compliance and Risk Management Costs

Fubon Financial Holding allocates substantial resources to navigate complex regulatory landscapes. These expenses are vital for maintaining operational integrity and legal standing within the financial sector.

The company invests heavily in compliance frameworks and robust risk management systems. This ensures adherence to evolving financial regulations and safeguards against potential operational and market risks.

- Regulatory Compliance: Fubon Financial's compliance costs are driven by adherence to regulations from bodies like the Financial Supervisory Commission (FSC) in Taiwan and international standards.

- Risk Management Systems: Investments include technology and personnel for credit risk, market risk, operational risk, and cybersecurity management.

- 2024 Data Point: While specific figures for 2024 are still emerging, in 2023, financial institutions globally saw compliance costs rise, with many reporting significant portions of their operating expenses dedicated to these areas, often in the high single digits of revenue. Fubon, as a major player, would reflect this trend.

- Operational Integrity: These costs are non-negotiable for maintaining trust and stability in its financial operations.

Property, Equipment, and Operational Overhead

Fubon Financial Holdings incurs significant expenses maintaining its vast physical presence. This includes costs for its extensive branch network, office buildings, and essential operational equipment. In 2024, these property, equipment, and operational overheads represent a substantial portion of their expenditure.

Key cost drivers within this category for Fubon include:

- Branch Network Maintenance: Rent, utilities, and upkeep for hundreds of physical branches across Taiwan and other operating regions.

- Office Facilities and Equipment: Costs associated with corporate offices, data centers, and the technology infrastructure supporting their financial services.

- General Operational Overhead: This encompasses administrative expenses, insurance, property taxes, and other day-to-day costs necessary for smooth business operations.

Fubon Financial Holding's cost structure is largely driven by its substantial investments in personnel, technology, and maintaining a broad market presence. These expenses are critical for delivering diverse financial services and adapting to the evolving digital landscape.

In 2024, significant outlays continue for employee compensation, encompassing salaries and benefits for a large workforce across banking, insurance, and investment sectors. Technology and digital infrastructure upgrades are also a major focus, ensuring robust cybersecurity and the development of innovative customer-facing platforms.

Marketing and distribution costs, including agent commissions and advertising, remain substantial to drive customer acquisition and retention. Furthermore, compliance with stringent financial regulations and the upkeep of a widespread physical branch network represent significant, ongoing operational expenditures.

| Cost Category | Key Components | 2023 Relevance/2024 Outlook |

|---|---|---|

| Personnel Costs | Salaries, benefits, training | Substantial portion of operating expenses; reflects diverse skill needs. |

| Technology & Digital Infrastructure | IT systems, cybersecurity, platform development | Crucial for digital transformation; significant investment in 2024. |

| Marketing & Distribution | Advertising, digital marketing, agent commissions | Essential for customer acquisition and retention; Fubon Life saw high commission costs in 2023. |

| Regulatory Compliance & Risk Management | Adherence to FSC, international standards, risk systems | Non-negotiable; global trend shows rising compliance costs, often high single digits of revenue. |

| Property, Equipment & Operations | Branch network maintenance, office facilities, overheads | Significant expenditure for physical presence and daily operations. |

Revenue Streams

Net interest income is a cornerstone revenue stream for Fubon Financial, primarily generated by its banking arm, Taipei Fubon Bank. This income is the difference between the interest the bank earns on its assets, such as loans and investments, and the interest it pays out on liabilities, like customer deposits.

For instance, in the first quarter of 2024, Fubon Financial reported a consolidated net interest income that significantly contributed to its overall profitability, reflecting the bank's core lending and deposit-taking activities.

Fubon Financial Holding generates significant revenue from insurance premiums, encompassing both life insurance and property and casualty (P&C) insurance. These premiums form the bedrock of its insurance segment's income.

Underwriting profits are a key component, representing the earnings derived from policies after deducting claims paid out and operational expenses. For instance, Fubon Life and Fubon Insurance actively manage their risk portfolios to optimize this profit margin.

In 2024, the insurance sector continued to be a primary driver for financial holdings. Fubon Financial Holding's consistent focus on expanding its insurance customer base and managing claims effectively underpins the stability and growth of these revenue streams.

Fubon Financial Holding derives substantial revenue from fee and commission income across its diverse financial services. This includes fees generated from wealth management, credit card operations, securities brokerage, and asset management divisions.

These income streams are structured around transactional charges, advisory fees for financial planning, and a percentage of assets managed. For instance, in 2024, Fubon Financial's robust wealth management segment continued to be a key contributor, with fee income reflecting the volume of investment products sold and advisory services rendered.

Investment Gains and Returns

Fubon Financial Holding generates significant revenue through investment gains and returns. This income stream encompasses capital appreciation from a diverse portfolio of domestic and international equities and bonds. In 2024, Fubon Financial reported substantial investment income, reflecting active management and favorable market conditions across various asset classes.

The company also benefits from dividend income derived from its equity holdings. This consistent inflow further bolsters its overall revenue. For instance, in the first half of 2024, dividend receipts played a crucial role in the company's profitability, demonstrating the value of its long-term investment strategy.

- Capital Gains: Realized profits from selling securities like stocks and bonds at a higher price than their purchase price.

- Dividend Income: Payments received from companies in which Fubon Financial holds shares, representing a share of their profits.

- Interest Income: Earnings from fixed-income investments such as bonds and other debt instruments.

- Trading Profits: Income generated from short-term buying and selling of financial instruments.

Venture Capital and Other Business Segment Income

Fubon Financial Holding also generates revenue through its venture capital arm and other distinct business segments. These include income from asset management services and its involvement in the sports lottery business, showcasing a diversified approach to revenue generation.

For instance, Fubon Financial Holding reported significant contributions from its diverse business lines. In 2024, its asset management segment continued to be a strong performer, managing a substantial volume of assets under management. The company’s strategic investments in venture capital aim to capture growth opportunities in emerging sectors, adding another layer to its income streams.

- Venture Capital Investments: Fubon Financial Holding actively invests in promising startups and growth-stage companies, seeking capital appreciation and strategic partnerships.

- Asset Management: Income is derived from fees charged for managing investment portfolios for institutional and individual clients.

- Sports Lottery: Revenue is generated from the operation and sales of sports lottery products, contributing to the company's non-traditional income sources.

Fubon Financial Holding's revenue streams are robust and diversified, encompassing net interest income, insurance premiums, fee and commission income, investment gains, and contributions from other business segments like venture capital and asset management.

In the first quarter of 2024, Fubon Financial reported a consolidated net interest income that significantly contributed to its profitability, highlighting the strength of its banking operations. The insurance sector also remained a primary driver, with underwriting profits from life and property and casualty insurance contributing substantially.

Fee and commission income, generated from wealth management, credit cards, and securities brokerage, saw continued growth in 2024, reflecting strong client engagement and transactional volumes.

| Revenue Stream | Primary Source | 2024 Contribution Highlight |

|---|---|---|

| Net Interest Income | Taipei Fubon Bank's lending and deposit activities | Significant contributor to Q1 2024 profitability |

| Insurance Premiums & Underwriting Profit | Life and P&C insurance policies | Key driver for the insurance segment's stability and growth |

| Fee and Commission Income | Wealth management, credit cards, securities brokerage | Robust growth driven by client engagement in H1 2024 |

| Investment Gains & Dividend Income | Equities, bonds, and strategic holdings | Substantial income reported in 2024 from active portfolio management |

| Other Business Segments | Asset management, venture capital, sports lottery | Asset management a strong performer; VC investments target emerging sectors |

Business Model Canvas Data Sources

The Fubon Financial Holding Business Model Canvas is built upon a foundation of comprehensive financial reports, extensive market research, and internal strategic planning documents. These diverse data sources ensure each component of the canvas accurately reflects the company's current operations and future direction.