Franklin Resources SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Franklin Resources Bundle

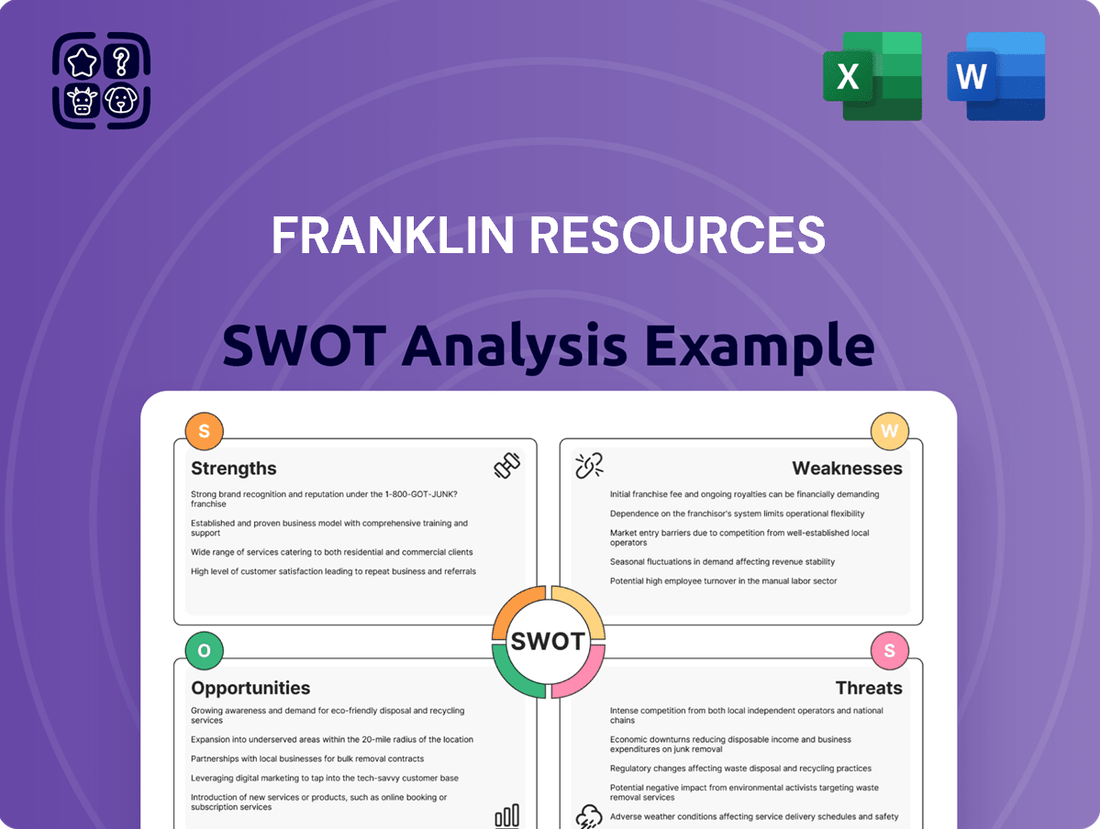

Franklin Resources, a titan in the asset management industry, boasts impressive brand recognition and a robust global presence, key strengths that position it for continued success. However, understanding the full scope of its competitive landscape, potential regulatory headwinds, and emerging market opportunities is crucial for strategic decision-making.

Want the full story behind Franklin Resources' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Franklin Templeton's strength lies in its extensive global investment capabilities, offering a wide spectrum of strategies from equities and fixed income to alternatives and multi-asset solutions. This broad product suite effectively meets the diverse needs of clients worldwide.

The company's structure, featuring specialist investment managers with deep expertise, allows for the delivery of highly specialized solutions across both public and private markets, a key differentiator in the asset management landscape.

With a client base spanning over 150 countries, Franklin Templeton demonstrates significant global reach. This extensive network includes retail investors, large institutions, and high-net-worth individuals, underscoring its diversified client engagement.

Franklin Resources has strategically bolstered its offerings through key acquisitions since 2019, notably including Legg Mason and Putnam Investments. This aggressive expansion has significantly diversified its business into higher-growth sectors, with a pronounced focus on alternative assets.

These acquisitions have dramatically increased Franklin Templeton's Assets Under Management (AUM) in alternatives, which now constitute a substantial segment of its overall AUM. As of early 2025, alternative investments are estimated to represent over $200 billion of the firm's total AUM, a testament to this strategic shift.

By deliberately growing its presence in private markets, encompassing private equity, private credit, and real estate, Franklin Templeton is well-positioned to meet escalating client demand for these less-liquid, potentially higher-return asset classes.

Franklin Templeton has cultivated a robust presence in both institutional and wealth management sectors. Their assets under management (AUM) mix has seen a notable shift, with institutional AUM experiencing significant growth in recent years, reflecting a strategic balance. This dual focus provides a stable foundation and diverse income sources.

The company has reported positive net flows within its institutional pipeline. Simultaneously, Franklin Templeton has been actively enhancing its product suite for wealth management platforms, exemplified by the expansion of its 'Alternatives by Franklin Templeton' brand, catering to evolving client needs.

Commitment to Technology and Innovation

Franklin Templeton is actively investing in technology to improve its services and cater to changing client demands. This commitment is evident in initiatives like their Canvas platform, designed for custom indexing, and the groundbreaking Franklin OnChain U.S. Government Money Fund (FOBXX), a product of their Franklin Templeton Digital Assets segment. By integrating its BENJI platform with blockchain for tokenized assets, the company is demonstrating a forward-thinking approach to digital assets, providing novel solutions for cash management and payment systems.

This focus on technological advancement is crucial in the current financial landscape. For instance, in 2023, Franklin Templeton reported significant growth in its digital assets under management, reaching over $300 million, highlighting the market's positive reception to their innovative offerings. Their investment in AI-driven analytics and client engagement tools is also a key part of their strategy to remain competitive and deliver enhanced value.

Key technological strengths include:

- Development of advanced platforms: Such as Canvas for bespoke indexing solutions.

- Pioneering digital asset funds: Like the Franklin OnChain U.S. Government Money Fund.

- Blockchain integration: Enhancing the BENJI platform for tokenized assets and new payment functionalities.

- Investment in AI and analytics: To improve client experience and operational efficiency.

Focus on ESG and Sustainable Investing

Franklin Resources, operating as Franklin Templeton, has a strong focus on Environmental, Social, and Governance (ESG) principles, integrating them into its core values and operational framework. This commitment is evident in their dedicated Corporate Social Responsibility (CSR) initiatives aimed at creating a positive societal impact.

The company's specialist investment managers actively incorporate ESG factors into their investment decision-making processes. This strategic approach has led to the development and launch of specific ESG-focused products, including Exchange Traded Funds (ETFs) that track sustainable versions of prominent market indices. For instance, by mid-2024, Franklin Templeton managed over $100 billion in assets with an ESG integration approach, showcasing significant growth in this segment.

- ESG Integration: Franklin Templeton's investment managers systematically embed ESG considerations into their research and portfolio construction.

- Product Development: The firm offers a growing suite of ESG-oriented investment products, catering to increasing investor interest.

- Market Alignment: This focus directly addresses the escalating global demand for sustainable investment opportunities, positioning Franklin Templeton for continued expansion in this crucial market segment.

Franklin Templeton's extensive global investment capabilities, offering a broad range of strategies, are a core strength. Its structure, with specialist investment managers, allows for deep expertise and differentiated solutions across public and private markets.

The company's significant global reach, serving clients in over 150 countries, and its diversified client base, from retail to large institutions, provide a stable foundation. Strategic acquisitions, like Legg Mason and Putnam Investments, have significantly broadened its business, particularly into alternative assets.

Franklin Templeton's commitment to technological advancement, including platforms like Canvas for custom indexing and its Franklin OnChain U.S. Government Money Fund, positions it for future growth. By mid-2024, the firm managed over $100 billion in assets with an ESG integration approach, reflecting strong market alignment.

| Strength Category | Description | Supporting Data/Fact |

|---|---|---|

| Global Reach & Diversification | Extensive global presence and diverse client base. | Serves clients in over 150 countries; broad mix of retail, institutional, and high-net-worth clients. |

| Product Breadth & Specialization | Wide spectrum of investment strategies and specialist expertise. | Offers equities, fixed income, alternatives, multi-asset; specialist managers for public and private markets. |

| Strategic Acquisitions & Growth | Diversification through acquisitions into high-growth sectors. | Acquired Legg Mason and Putnam Investments; alternative asset AUM grew significantly, exceeding $200 billion by early 2025. |

| Technological Innovation | Investment in technology for service enhancement and new offerings. | Developed Canvas platform, Franklin OnChain U.S. Government Money Fund; integrated BENJI platform with blockchain. Digital assets AUM surpassed $300 million in 2023. |

| ESG Integration | Commitment to ESG principles and development of sustainable products. | Over $100 billion in AUM with ESG integration approach by mid-2024; growing suite of ESG-focused ETFs. |

What is included in the product

Analyzes Franklin Resources’s competitive position through key internal and external factors, including its brand strength and the evolving investment landscape.

Offers a clear, actionable framework to identify and address Franklin Resources' strategic challenges and opportunities.

Weaknesses

Franklin Templeton faces persistent pressure on its fee income, exacerbated by substantial net outflows, especially from its Western Asset Management division. This trend directly impacts profitability in an industry where fees are increasingly scrutinized.

While the company saw some year-over-year gains in net income and gross inflows, recent quarterly reports, such as those for the quarter ending March 31, 2024, indicated a dip in net income and a contraction in assets under management (AUM). This suggests ongoing headwinds in a highly competitive and fee-compressed market.

Franklin Templeton, despite its strategic acquisitions, has seen its market share dwindle in the global retail fund sector. This decline is a direct consequence of the industry-wide migration towards more cost-effective index and passive investment vehicles. Competitors such as Vanguard and BlackRock have capitalized on this trend, capturing substantial portions of the market.

Franklin Resources, while benefiting from diversification through acquisitions, faces significant hurdles in integrating these new entities. The process of merging different investment strategies, technological infrastructures, and corporate cultures within its multi-boutique framework is complex and resource-intensive.

For instance, the integration of Legg Mason, acquired in 2020 for $4.5 billion, presented a substantial undertaking. While it expanded Franklin's global reach and product offerings, the operational complexities of harmonizing systems and cultures across such a large acquisition can lead to temporary inefficiencies and require ongoing management attention.

Sensitivity to Market Volatility and Economic Conditions

Franklin Resources, like any global investment manager, faces significant headwinds from market volatility and shifting economic landscapes. For instance, during periods of heightened uncertainty, such as the economic slowdown experienced in late 2023 and early 2024, investors often become more risk-averse, leading to outflows from actively managed funds and a potential decrease in assets under management (AUM). This sensitivity directly impacts revenue streams, as management fees are largely tied to the value of assets managed.

The company's financial performance is closely correlated with macroeconomic factors. Fluctuations in interest rates, for example, can affect bond valuations and investor appetite for different asset classes. In 2024, continued interest rate hikes by major central banks, while potentially benefiting certain fixed-income strategies, also increased the cost of capital and could dampen equity market performance, thereby impacting Franklin Templeton's overall AUM. Geopolitical events, such as ongoing conflicts or trade disputes, further exacerbate this volatility by creating unpredictable market movements and influencing investor sentiment globally.

- Market Volatility Impact: Declines in global equity markets, such as the broad market downturns observed in early 2024, directly reduce the value of Franklin Templeton's AUM, impacting fee-based revenues.

- Interest Rate Sensitivity: Rising interest rates can negatively affect bond portfolio values and potentially slow down capital inflows into equity funds, a key revenue driver for the firm.

- Geopolitical Risks: International conflicts and trade tensions create uncertainty, leading to investor caution and potential asset outflows from emerging markets or globally diversified funds managed by Franklin Templeton.

- Economic Slowdowns: Periods of economic contraction, like those anticipated in certain regions in 2024, often lead to reduced investment activity and lower overall AUM, directly affecting the company's top line.

Reliance on Western Asset Management's Performance

Franklin Resources' reliance on Western Asset Management (WAM) presents a notable weakness. WAM has experienced significant long-term net outflows, which directly affect Franklin Templeton's total assets under management (AUM) and overall financial performance. For instance, in the fiscal year ending September 30, 2023, Franklin Templeton reported a decrease in AUM, partly attributable to these outflows from its larger subsidiaries.

While Franklin Templeton is implementing strategies to streamline operations and improve efficiency by integrating certain corporate functions, the continued underperformance or net outflows from WAM could remain a substantial impediment to the company's growth trajectory and profitability. This dependency means that any challenges faced by WAM can disproportionately impact the parent company's financial health.

- Significant Net Outflows: Western Asset Management has consistently faced net outflows, impacting Franklin Templeton's AUM.

- Impact on Financial Results: These outflows directly reduce the company's reported assets under management and revenue.

- Integration Challenges: While efforts are being made to integrate functions, continued underperformance from WAM could hinder overall efficiency gains.

- Drag on Growth: The large size of WAM means its struggles can act as a significant drag on Franklin Templeton's growth and profitability.

Franklin Templeton's multi-boutique structure, while offering diversification, creates significant integration challenges. Merging disparate investment strategies, technologies, and cultures, as seen with the $4.5 billion Legg Mason acquisition in 2020, requires substantial resources and can lead to temporary operational inefficiencies.

The company faces intense competition, particularly from cost-effective passive investment providers like Vanguard and BlackRock, which has led to a decline in Franklin Templeton's market share in the global retail fund sector. This industry-wide shift towards passive investing directly pressures fee income.

Franklin Resources is heavily reliant on its Western Asset Management (WAM) division, which has experienced substantial net outflows. For the fiscal year ending September 30, 2023, these outflows contributed to a decrease in the company's overall assets under management (AUM), directly impacting revenue streams tied to AUM.

The firm's financial performance is highly sensitive to market volatility and macroeconomic shifts. For instance, economic slowdowns and rising interest rates, as experienced in late 2023 and early 2024, can reduce investor risk appetite and impact AUM, thereby affecting fee-based revenues.

Full Version Awaits

Franklin Resources SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase.

Opportunities

The increasing investor appetite for alternative assets like private credit, private equity, and real estate offers a substantial avenue for Franklin Resources. The firm has been actively expanding its presence in these sectors, demonstrating a clear strategy to capture a larger share of investor allocations.

Franklin Templeton's robust growth in alternatives, fueled by strategic acquisitions and internal development, positions it well to capitalize on this trend. As product innovation makes these complex asset classes more approachable, there's a clear opportunity to further integrate them into client portfolios.

Franklin Resources can significantly expand its reach by further developing and promoting its custom indexing platform, Canvas. This allows for tailored investment solutions, appealing to a growing segment of investors seeking personalized portfolios. The company's digital asset initiatives, including the BENJI platform and its work with tokenized U.S. Treasury bills, represent a forward-looking approach to attract tech-savvy clients and tap into the burgeoning digital asset market.

Franklin Templeton's acquisition of Putnam Investments significantly bolsters its position in the retirement and insurance markets, especially within defined contribution assets under management. This expansion provides a strong foundation for future growth in these crucial sectors.

The company has a considerable opportunity to deepen its investment in retirement and insurance channels. By leveraging data and insights from retirement planning, Franklin Templeton can refine plan designs, improve client engagement, and develop pioneering retirement income solutions to meet evolving needs.

Increased Demand for ESG and Sustainable Solutions

Franklin Templeton is well-positioned to capitalize on the escalating demand for Environmental, Social, and Governance (ESG) investing. The firm's existing ESG framework and dedication to sustainable practices provide a distinct edge in attracting investors increasingly prioritizing these factors. This trend is significant, with global sustainable investment assets projected to reach $50 trillion by 2025, according to Morningstar data as of late 2023.

The company can further leverage this opportunity by introducing new ESG-aligned investment products and integrating ESG principles across its broader investment strategies. This proactive approach is crucial for capturing market share from a growing segment of the investor base that seeks both financial performance and positive societal impact. For instance, Franklin Templeton's recent expansion of its ESG-focused ETF offerings in 2024 directly addresses this burgeoning market need.

- Growing Investor Preference: A significant percentage of global investors, estimated to be over 70% in recent surveys, now consider ESG factors in their investment decisions.

- Product Development: Launching innovative ESG ETFs and mutual funds can attract substantial new assets under management.

- Competitive Differentiation: A robust and transparent ESG integration process distinguishes Franklin Templeton from competitors lacking similar commitments.

- Regulatory Tailwinds: Increasing regulatory emphasis on ESG disclosures and sustainable finance globally creates a favorable environment for firms like Franklin Templeton.

Strategic Partnerships and Consolidations in the Industry

The asset management sector is seeing significant consolidation, with firms combining to address fee pressures and enhance their investment offerings. Franklin Templeton can leverage this by seeking strategic alliances or acquisitions that bolster its current capabilities, introduce new specialized expertise, or broaden its global presence. This approach can lead to greater scale and diversification, a key advantage in the evolving market landscape.

For instance, the global asset management industry saw a notable increase in M&A activity in 2023, with a reported 160 deals, a 10% rise from 2022, according to PwC’s Global Asset & Wealth Management Review. Franklin Templeton's strategic moves could align with this trend, potentially acquiring firms with strong ESG (Environmental, Social, and Governance) capabilities or those focused on alternative investments, areas experiencing heightened investor demand.

These opportunities could manifest in several ways:

- Acquiring niche asset managers: Targeting firms with specialized investment strategies, such as private credit or infrastructure, to diversify Franklin Templeton's product suite.

- Forming strategic alliances: Collaborating with technology providers or fintech firms to enhance digital distribution channels and client experience.

- Expanding into emerging markets: Partnering with local asset managers to gain market access and distribution networks in high-growth regions.

- Consolidating operations: Merging with or acquiring competitors to achieve cost synergies and increase market share, especially in areas facing intense fee competition.

Franklin Resources is well-positioned to benefit from the growing investor interest in alternative assets, such as private credit and real estate, which saw significant inflows in 2024. The firm's expansion into these areas, including strategic acquisitions and internal development, aims to capture a larger portion of investor allocations. Furthermore, Franklin Templeton's custom indexing platform, Canvas, and its digital asset initiatives, like the BENJI platform, offer opportunities to attract tech-savvy clients and cater to the demand for personalized portfolios.

The company can also leverage the increasing demand for ESG investing, with global sustainable investment assets projected to reach $50 trillion by 2025. Franklin Templeton's existing ESG framework and 2024 expansion of ESG-focused ETFs provide a competitive advantage. Finally, industry consolidation presents opportunities for strategic alliances or acquisitions to enhance capabilities, gain expertise, and expand global reach, aligning with the 10% rise in M&A activity observed in the asset management sector in 2023.

| Opportunity Area | Key Driver | Franklin's Action/Positioning | Market Trend Data (2024/2025) |

|---|---|---|---|

| Alternative Assets | Investor appetite for private credit, PE, real estate | Expansion via acquisitions and internal development | Inflows into alternatives continued strong in H1 2024 |

| Digital Assets & Custom Indexing | Demand for personalized and tech-forward solutions | Canvas platform, BENJI, tokenized assets | Growing adoption of digital wealth management tools |

| ESG Investing | Increasing investor focus on sustainability | Robust ESG framework, expanded ESG ETFs (2024) | Global sustainable assets projected to reach $50T by 2025 |

| Strategic Consolidation | Industry M&A for scale and capabilities | Potential for alliances/acquisitions | Asset management M&A up 10% in 2023; trend continues |

Threats

The asset management sector faces fierce competition, with a noticeable trend of fee compression. This is largely driven by the growing popularity of low-cost passive investment options and heightened investor demand for transparency. For Franklin Resources, this means ongoing pressure on its revenue streams, particularly if its actively managed funds don't consistently outperform benchmarks.

Franklin Resources, like all global investment managers, faces a significant threat from evolving regulatory landscapes. For instance, the increasing focus on Environmental, Social, and Governance (ESG) reporting, as seen with the EU's Sustainable Finance Disclosure Regulation (SFDR), necessitates substantial investment in data collection and compliance infrastructure, potentially impacting operational efficiency and profitability. New regulations around digital assets or data privacy could further add to these burdens.

Sustained underperformance in Franklin Templeton's core investment strategies or by key specialist managers poses a significant threat, potentially driving further client outflows and reducing Assets Under Management (AUM). For instance, if a substantial portion of their actively managed funds consistently lag their benchmarks, it directly impacts investor trust and market positioning.

The firm's reputation is built on delivering competitive returns across its diverse capabilities. A widespread decline in performance, especially in areas where they hold significant market share, could erode investor confidence and lead to a noticeable decrease in their overall market share, impacting revenue streams.

Geopolitical and Macroeconomic Instability

Global geopolitical tensions, such as ongoing conflicts and trade uncertainties, create a volatile environment. These issues can lead to unpredictable fiscal policies and economic slowdowns worldwide. For Franklin Resources, this translates into potential shifts in investor sentiment, directly impacting assets under management (AUM) and investment performance.

The firm's financial health is susceptible to these external shocks. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.7% in 2024, down from 3.0% in 2023, citing persistent inflation and the impact of geopolitical fragmentation. This slowdown inherently limits investment opportunities and can pressure fee-based revenues for asset managers like Franklin Templeton.

- Market Volatility: Increased uncertainty often correlates with higher market volatility, which can negatively affect portfolio values and investor confidence.

- Trade Uncertainties: Disruptions in global trade can impact corporate earnings and economic growth, indirectly affecting investment returns.

- Fiscal Policy Shifts: Unpredictable changes in government spending and taxation can create instability in financial markets.

- Investor Sentiment: Negative geopolitical events can trigger risk-off sentiment, leading to capital flight from riskier assets managed by Franklin Templeton.

Cybersecurity Risks and Technological Disruptions

Franklin Resources, like any firm deeply integrated with technology, faces significant cybersecurity threats. A data breach or system outage could severely impact operations, leading to financial losses and eroding client confidence. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of this risk for all financial institutions.

The firm's reliance on digital platforms for trading and client engagement means that technological disruptions are a constant concern. A failure in these systems could halt critical transactions and damage Franklin Templeton's reputation. In 2024, financial services firms reported an average of 147 cybersecurity incidents per organization, underscoring the pervasive nature of these challenges.

Furthermore, the rapid evolution of financial technologies, particularly artificial intelligence, presents a competitive threat. If competitors outpace Franklin Resources in adopting and leveraging these advancements, it could lead to a loss of market share and operational inefficiencies. The financial sector's investment in AI is expected to grow substantially, with some estimates suggesting it could reach hundreds of billions of dollars by the early 2030s, indicating the critical need for continuous innovation.

- Cybersecurity Threats: Increased risk of data breaches and system failures due to reliance on technology.

- Operational Impact: Potential for financial losses and reputational damage from technological disruptions.

- Competitive Disruption: Risk of falling behind competitors in adopting new financial technologies like AI.

- Client Trust: Maintaining client confidence is paramount in the face of potential security incidents.

Franklin Resources faces intense competition from low-cost passive investment options, leading to fee compression and pressure on its actively managed funds. The firm must ensure its active strategies consistently outperform benchmarks to retain revenue. For example, the global trend of passive investing saw assets in ETFs surpass $10 trillion in 2024, a significant shift impacting active managers.

Evolving regulations, particularly around ESG and digital assets, demand significant investment in compliance and data infrastructure. Failure to adapt could impact operational efficiency and profitability, as seen with the EU's SFDR implementation requiring substantial data reporting capabilities.

Persistent underperformance in key investment strategies or by specialist managers poses a direct threat to Franklin Templeton's Assets Under Management (AUM). If a significant portion of their actively managed funds consistently trails market benchmarks, investor confidence erodes, leading to outflows and reduced market share.

SWOT Analysis Data Sources

This Franklin Resources SWOT analysis is built upon a foundation of verifiable financial statements, comprehensive market intelligence, and expert industry outlooks, ensuring a robust and informed strategic evaluation.