Franklin Resources Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Franklin Resources Bundle

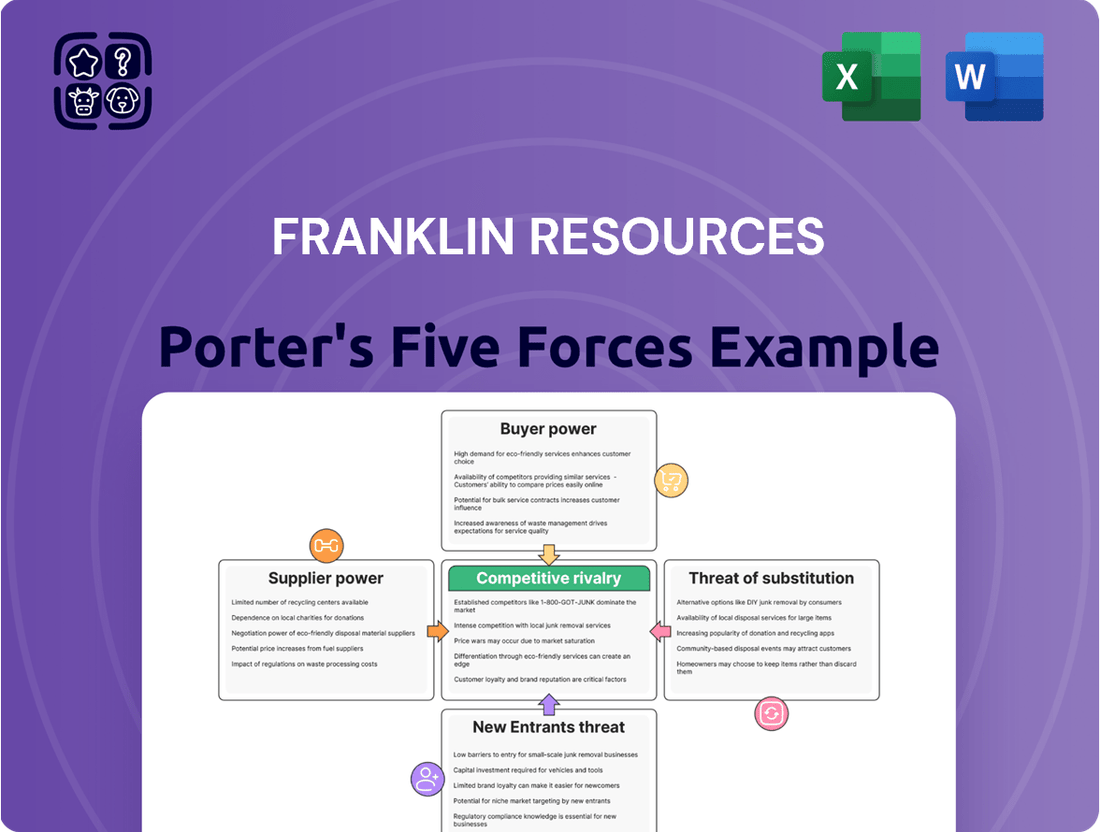

Franklin Resources faces significant competitive pressures, with the threat of new entrants and the bargaining power of buyers being particularly influential forces. Understanding these dynamics is crucial for any investor or strategist looking at the asset management landscape.

The complete report reveals the real forces shaping Franklin Resources’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Franklin Templeton's growing dependence on sophisticated technology, such as AI and advanced data analytics, amplifies the bargaining power of specialized technology providers. These vendors supply essential tools for operations, client services, and competitive investment approaches.

The significant investment and intricacy involved in adopting these new technologies create substantial switching costs for Franklin Templeton, further strengthening the leverage held by these critical tech suppliers.

Data providers wield significant influence over Franklin Resources, as access to comprehensive and timely financial market data, economic indicators, and alternative data is absolutely critical for their investment decisions and performance analysis. The proprietary and essential nature of these data offerings grants these suppliers substantial bargaining power.

In 2024, the market for financial data and analytics was valued at approximately $30 billion, highlighting the scale of this industry and the potential leverage held by key players. Franklin Templeton's reliance on these specialized data streams means that any disruption or significant price increase from a major provider could directly impact their operational efficiency and competitive edge.

The bargaining power of talent, specifically investment professionals, is a significant factor for Franklin Resources. Highly skilled portfolio managers and analysts are crucial for generating alpha and managing the company's diverse asset classes. The scarcity of top-tier talent, especially in emerging fields like alternative investments and AI-driven strategies, grants these professionals considerable leverage in negotiations.

Attracting and retaining these key individuals necessitates competitive compensation, including substantial bonuses and equity, and often involves offering flexible work arrangements and opportunities for professional development. For instance, the average compensation for a senior portfolio manager in the asset management industry can easily exceed $300,000 annually, with top performers earning significantly more, reflecting their direct impact on firm profitability.

Financial Market Infrastructure

Providers of essential financial market infrastructure, like stock exchanges and clearinghouses, wield significant bargaining power. Their services are critical for legal compliance and operational integrity, making them non-negotiable for firms like Franklin Templeton. For instance, in 2024, the global financial infrastructure market continued to consolidate, with major players like Euronext and ICE demonstrating substantial market share, reinforcing their pricing influence.

These entities, while regulated, are indispensable for trade execution, settlement, and safeguarding assets. Franklin Templeton, like other asset managers, relies heavily on the efficiency and security offered by these foundational market participants. The complexity and regulatory burden associated with establishing alternative infrastructure mean switching costs are often prohibitively high, further solidifying the existing providers' leverage.

- Criticality of Services: Stock exchanges, clearinghouses, and custodians provide essential functions for market operation and regulatory adherence.

- High Switching Costs: The complexity and regulatory hurdles make it difficult and expensive for firms like Franklin Templeton to switch infrastructure providers.

- Market Concentration: A few dominant players in financial market infrastructure often control significant market share, enhancing their bargaining position.

- Regulatory Dependence: While regulated, these providers are integral to meeting legal and compliance requirements, a non-negotiable aspect for financial institutions.

Specialized Consultants and Research Firms

Franklin Templeton, like many in the asset management industry, may engage specialized consultants and research firms for niche areas or complex strategic initiatives. These external experts often possess unique market insights and technical knowledge that are not easily replicated internally. This exclusivity can grant them considerable bargaining power, particularly when Franklin Templeton requires their specialized input for high-stakes projects or navigating intricate regulatory landscapes.

For instance, in 2024, the demand for cybersecurity consulting services, a highly specialized field, saw significant growth. Firms offering advanced threat intelligence and compliance audits could command premium rates. Similarly, firms providing in-depth ESG (Environmental, Social, and Governance) research and implementation strategies are increasingly sought after, reflecting a growing trend in the financial sector. The ability of these specialized suppliers to differentiate themselves through deep expertise and proprietary methodologies strengthens their position in negotiations with asset managers like Franklin Templeton.

- Niche Expertise: Consultants and research firms with highly specialized knowledge in areas such as AI integration in financial services or specific emerging market analysis hold strong bargaining power.

- Limited Alternatives: When few firms possess the required unique skills, the bargaining power of these suppliers increases significantly.

- Project-Based Demand: For critical, time-sensitive strategic projects, Franklin Templeton's need for immediate, high-quality external input can elevate supplier leverage.

- Information Asymmetry: Suppliers often possess market intelligence or technical know-how that Franklin Templeton lacks, giving them an advantage in pricing and terms.

The bargaining power of suppliers for Franklin Resources is significantly influenced by the critical nature of their offerings and the costs associated with switching. Key technology providers, data vendors, specialized talent, market infrastructure operators, and niche consultants all hold leverage due to the essential services they provide and the high switching costs involved.

In 2024, the financial data and analytics market, valued at approximately $30 billion, exemplifies the substantial influence of data providers. Similarly, the scarcity of top-tier investment professionals, commanding salaries exceeding $300,000 annually, underscores the power of talent.

The consolidation within financial market infrastructure, with major players like Euronext and ICE dominating in 2024, further concentrates supplier power. This reliance on specialized expertise and infrastructure makes Franklin Templeton susceptible to supplier demands.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Franklin Resources | 2024 Data/Context |

|---|---|---|---|

| Technology Providers (AI, Data Analytics) | High switching costs, proprietary technology | Increased operational costs, potential service disruptions | Market for financial data and analytics valued at ~$30 billion |

| Data Providers | Essential for investment decisions, proprietary data | Reliance on timely and accurate data, price sensitivity | Critical for performance analysis and competitive edge |

| Specialized Talent (Portfolio Managers, Analysts) | Scarcity of top skills, direct impact on alpha generation | Higher compensation demands, retention challenges | Senior portfolio manager compensation can exceed $300,000 annually |

| Financial Market Infrastructure (Exchanges, Clearinghouses) | Critical for compliance and operations, high switching costs | Non-negotiable reliance, pricing leverage | Market consolidation by players like Euronext and ICE |

| Niche Consultants & Research Firms | Unique expertise, limited alternatives | Premium rates for specialized insights, dependence on project success | Growth in demand for cybersecurity and ESG consulting services |

What is included in the product

Tailored exclusively for Franklin Resources, analyzing its position within its competitive landscape by examining the threat of new entrants, bargaining power of buyers and suppliers, threat of substitutes, and intensity of rivalry.

Instantly identify and address competitive threats with a comprehensive overview of industry forces, enabling proactive strategy adjustments.

Customers Bargaining Power

Large institutional clients, like pension funds and endowments, hold considerable sway due to their massive assets. For instance, as of Q1 2024, Franklin Templeton reported over $1.7 trillion in assets under management, with institutional clients forming a significant portion. This scale allows them to negotiate favorable fee structures and demand tailored investment strategies, directly impacting Franklin's profitability.

High-net-worth (HNW) clients, though individuals, wield significant collective power due to their substantial wealth. They demand bespoke financial solutions, including tailored investment strategies and tax planning, which allows them to negotiate fees and service levels. Franklin Templeton’s focus on hyper-personalization in wealth management directly addresses this client leverage.

Retail investors are increasingly price-sensitive, especially when it comes to investment fees. The demand for low-cost options, like ETFs and index funds, has surged, pushing down management fees across the board. For instance, the average expense ratio for passively managed equity funds in the US was around 0.06% in 2023, a stark contrast to actively managed funds.

Digital platforms and enhanced transparency empower retail investors to easily compare fees and performance, making cost-effectiveness a key decision factor. This accessibility means investors can readily switch to providers offering better value, creating continuous downward pressure on fees for traditional active management strategies.

Demand for Performance and Diversification

Customers today are quite discerning, and this is especially true in the investment world. They're not just looking for any investment; they want to see strong, consistent performance. This means that if a fund isn't delivering, clients are quick to move their money elsewhere. The demand for better risk-adjusted returns is a major driver here.

Furthermore, the desire for diversification across various asset classes, including those that were once considered niche like alternatives, is growing. Clients understand that spreading their investments can help manage risk and potentially boost overall returns. This push for broader investment options puts pressure on asset managers to offer more than just traditional stocks and bonds.

Franklin Templeton, for instance, has been actively expanding its offerings in alternative investments and multi-asset solutions. This strategic move directly addresses the evolving needs of their client base, who are seeking more sophisticated and diversified portfolio construction to meet their financial goals.

- Increased Demand for Performance: Investors are scrutinizing fund performance more than ever, with a lower tolerance for underperforming active funds.

- Diversification Needs: A significant trend is the growing client interest in alternative asset classes and complex investment strategies for portfolio diversification.

- Shift to Risk-Adjusted Returns: Clients are prioritizing investments that offer superior returns relative to the risk taken, pushing managers for better risk management.

- Franklin Templeton's Response: The company's strategic expansion into alternatives and multi-asset solutions reflects a direct adaptation to these heightened customer expectations.

Digital Sophistication and Accessibility

Customers are increasingly tech-savvy, demanding intuitive online platforms and immediate access to their investment data. This digital sophistication lowers switching costs, as clients can easily compare offerings and move their assets. For instance, in 2024, a significant portion of retail investors reported using digital channels for the majority of their investment activities, highlighting the importance of robust online tools.

Franklin Resources must prioritize its digital infrastructure to cater to these evolving client expectations. This includes investing in user-friendly interfaces and providing comprehensive digital tools for product comparison and portfolio management. Failure to do so could lead to client attrition, as customers can readily find alternatives offering superior digital experiences.

- Digital Literacy: Clients expect seamless online interactions and instant access to financial information.

- Reduced Switching Costs: Easy access to information and digital tools empower customers to switch providers more readily.

- Transparency: Digital platforms increase transparency, allowing clients to easily compare products and fees.

- Investment in Digital Platforms: Franklin Resources needs to continuously enhance its digital offerings to meet client demands and maintain competitiveness.

The bargaining power of customers for Franklin Resources is significant, driven by informed investors seeking superior performance and competitive fees. As of Q1 2024, Franklin Templeton's $1.7 trillion in assets under management indicates substantial client influence, particularly from large institutional investors who can negotiate favorable terms. This leverage is amplified by retail investors' increasing price sensitivity and demand for low-cost options like ETFs, where average expense ratios hovered around 0.06% in 2023.

| Customer Segment | Key Bargaining Factors | Impact on Franklin Resources |

|---|---|---|

| Institutional Investors | Asset size, demand for tailored strategies, fee negotiation | Pressure on management fees, need for specialized product development |

| High-Net-Worth Individuals | Wealth accumulation, demand for bespoke services, fee sensitivity | Requirement for personalized advice and premium service offerings |

| Retail Investors | Price sensitivity, preference for low-cost funds (ETFs, index funds), digital access | Downward pressure on fees, need for competitive digital platforms and transparent pricing |

Full Version Awaits

Franklin Resources Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The Franklin Resources Porter's Five Forces Analysis meticulously examines the competitive landscape, detailing the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry among existing firms, and the threat of substitute products. This comprehensive breakdown provides actionable insights into the strategic positioning and potential challenges faced by Franklin Resources within the asset management industry.

Rivalry Among Competitors

The asset management landscape is currently experiencing intense fee compression. This is largely due to the growing popularity of low-cost passive investment options and greater transparency around pricing, pushing down management fees across the board.

For active managers like Franklin Templeton, this persistent fee pressure directly squeezes profit margins. It necessitates a strong focus on operational efficiency and developing unique value propositions to stand out in a crowded market.

In 2023, the average expense ratio for actively managed equity funds in the U.S. was 0.67%, a notable decrease from previous years, highlighting the ongoing trend of fee reduction.

Franklin Templeton navigates a global asset management landscape characterized by both fragmentation and consolidation, facing a multitude of competitors. These range from giants like BlackRock and Vanguard, which manage trillions in assets, to smaller, specialized firms, all vying for investor capital.

The market is flooded with similar investment products across diverse asset classes, fueling aggressive competition for client inflows. For instance, as of Q1 2024, the top 10 global asset managers collectively oversaw over $50 trillion in assets under management, highlighting the scale of the competitive field.

A significant trend is the increasing market share captured by the largest global asset managers, often driven by the growing popularity of low-cost passive investment strategies. This dynamic puts pressure on firms like Franklin Templeton to innovate and differentiate their offerings.

Competitive rivalry in the asset management industry is intense, driven by a constant need for product innovation and differentiation. Firms like Franklin Resources are continuously expanding their offerings, moving into areas like alternative investments and creating sophisticated multi-asset solutions to capture market share. This dynamic environment means companies must adapt quickly to client demands for customized products and new investment strategies.

Franklin Templeton, for instance, has demonstrated a commitment to this competitive landscape through strategic acquisitions and organic growth initiatives. These efforts aim to diversify its business across a broad spectrum of investment vehicles and client segments, ensuring it remains competitive against peers who are also aggressively innovating and broadening their product suites. For example, in 2023, Franklin Templeton continued to integrate its acquisitions, enhancing its capabilities in areas like private markets and ESG investing, reflecting the industry-wide push for specialized and differentiated products.

Technological Race and AI Adoption

The financial services industry, including asset management giants like Franklin Resources, is caught in a fierce technological race, especially concerning Artificial Intelligence (AI). This isn't just about staying current; it's about survival and growth. Firms that can effectively leverage AI are finding new ways to operate more efficiently, offer highly personalized client experiences, and conduct sophisticated data analysis. This is fundamentally reshaping the competitive landscape.

The impact of AI adoption is creating a noticeable divergence in performance. Companies that are early and effective adopters of AI are pulling ahead, gaining significant competitive advantages. Conversely, those lagging in technology integration risk falling behind. For instance, by late 2023, many leading asset managers were reporting substantial investments in AI capabilities, with some estimating that AI could drive a 10-20% increase in operational efficiency within the next few years.

- AI-driven efficiencies: Automating tasks like data entry and compliance checks can free up human capital for higher-value activities.

- Personalized client services: AI enables tailored investment recommendations and proactive client communication, enhancing customer loyalty.

- Advanced analytics: AI tools provide deeper market insights and predictive capabilities, leading to potentially better investment performance.

- Widening adoption gap: A significant percentage of financial firms, estimated to be around 30% by early 2024, were still in the nascent stages of AI integration, highlighting the growing divide.

Strategic Mergers and Acquisitions (M&A)

The asset management industry is seeing a wave of consolidation, with companies actively pursuing mergers and acquisitions (M&A) to achieve greater scale, enhance their service portfolios, and reach new customer bases. This strategic activity intensifies competition among the surviving entities as they battle for increased market share and specialized investment talent. For instance, Franklin Templeton has been a notable player in this M&A trend, with significant past acquisitions including Putnam Investments and Legg Mason, which significantly reshaped its operational footprint and capabilities.

These M&A activities directly fuel competitive rivalry by creating larger, more resource-rich competitors. For example, in 2023, the global M&A market saw substantial activity across various sectors, and the financial services industry was no exception, as firms sought to adapt to evolving client demands and technological advancements. This consolidation means fewer, but stronger, players are vying for assets under management (AUM).

- Increased Scale: Acquisitions allow firms to manage larger pools of assets, leading to economies of scale and potentially lower operating costs per dollar managed.

- Broader Offerings: M&A can quickly expand a firm's product suite, incorporating new investment strategies or asset classes that might otherwise take years to develop organically.

- Talent Acquisition: Acquiring other firms often brings in experienced investment teams and specialized expertise, bolstering research and management capabilities.

- Enhanced Distribution: Mergers can provide access to new distribution channels and client segments, broadening market reach.

Competitive rivalry within the asset management sector is fierce, driven by fee compression and the pursuit of scale. Firms like Franklin Resources face intense pressure from both passive giants and specialized active managers, necessitating continuous innovation and strategic acquisitions to maintain market share.

The industry is characterized by a large number of players, from global behemoths managing trillions to niche firms, all competing for investor capital. This intense competition is further amplified by the increasing market share of the largest asset managers, often fueled by the demand for low-cost passive investments.

Franklin Templeton, for example, has actively engaged in M&A, acquiring firms like Putnam Investments and Legg Mason to bolster its capabilities and expand its product offerings, a common strategy to stay competitive in this dynamic environment.

The ongoing technological race, particularly in AI, is creating a significant divergence between leading firms and laggards, with early adopters gaining substantial competitive advantages through enhanced efficiency and personalized client services.

SSubstitutes Threaten

Robo-advisors and digital platforms are a growing threat, offering automated investment management at a lower cost. For example, Betterment, a prominent robo-advisor, had over $40 billion in assets under management as of early 2024, demonstrating their significant market penetration.

These platforms attract investors, especially younger demographics and those prioritizing affordability and digital convenience, by leveraging algorithms for portfolio construction and rebalancing. Their accessibility and reduced fees directly challenge traditional financial advisory models that often involve higher overheads and management charges.

The sustained shift towards passive investment vehicles like ETFs and index funds presents a significant threat to Franklin Templeton's actively managed strategies. These products offer broad market exposure at substantially lower fees, appealing to investors prioritizing cost efficiency. For instance, assets in U.S. passive funds reached an estimated $15 trillion by the end of 2023, a figure that has continued to climb, underscoring their growing dominance and the pressure they exert on active management fees.

The threat of substitutes for Franklin Resources, particularly in the realm of direct investing and self-managed portfolios, is significant. Many individual and even institutional investors now possess the tools and knowledge to bypass traditional asset managers. For instance, the proliferation of low-cost online brokerage platforms, such as Robinhood and Charles Schwab, has made it easier than ever for people to trade stocks, bonds, and ETFs directly. This trend is amplified by the widespread availability of free financial data and research, empowering investors to make their own decisions and potentially reducing demand for actively managed funds.

Alternative Investments and Direct Private Placements

For high-net-worth and institutional clients, direct investments in real estate, private equity deals, or other alternative assets outside of commingled funds can serve as a substitute. Investors may seek to bypass traditional fund structures for greater control, potentially higher returns, or unique diversification benefits. For instance, as of Q1 2024, private equity fundraising reached $250 billion globally, indicating strong investor interest in direct deal sourcing.

Franklin Templeton itself has recognized this trend and has diversified into these areas to capture this demand. Their expansion into alternative investments, including direct private placements, allows them to offer a broader suite of products that cater to sophisticated investors seeking non-traditional opportunities. This strategic move helps mitigate the threat of substitutes by bringing those alternative offerings in-house.

- Direct Real Estate: Significant capital flows into commercial real estate, with global transaction volumes expected to remain robust in 2024.

- Private Equity Deals: Increased appetite for venture capital and growth equity, particularly in technology and healthcare sectors, offering alternatives to public markets.

- Hedge Funds: Continued interest in absolute return strategies and uncorrelated asset classes as diversification tools.

- Commodities and Digital Assets: Growing investor allocation towards tangible assets and cryptocurrencies as inflation hedges and alternative growth drivers.

Integrated Wealth Management and Financial Planning Services

Banks, independent financial advisors, and family offices present a significant threat of substitutes by offering integrated wealth management and financial planning services. These comprehensive offerings often bundle investment management with crucial elements like tax planning and estate planning, providing a one-stop shop for clients.

For example, many large banks in 2024 have expanded their wealth management divisions, aiming to capture a larger share of client assets by offering a full suite of financial solutions. This holistic approach can be highly appealing to individuals seeking to simplify their financial lives, directly competing with Franklin Templeton's specialized investment management services.

- Holistic Approach: Competitors offer integrated services beyond just investment management, including tax and estate planning.

- Client Convenience: A single provider for all financial needs appeals to clients seeking simplification.

- Competitive Landscape: Banks and independent advisors are actively broadening their service portfolios.

The increasing accessibility of direct investing platforms and the rise of passive investment vehicles like ETFs pose a substantial threat to Franklin Resources. Investors are increasingly opting for lower-cost, self-directed options, bypassing traditional asset management. For instance, by early 2024, robo-advisors like Betterment managed over $40 billion in assets, showcasing a significant shift towards automated, cost-effective solutions.

Furthermore, alternative investments such as direct real estate and private equity deals offer substitutes for traditional fund structures, attracting investors seeking greater control and diversification. Global private equity fundraising reached $250 billion by Q1 2024, highlighting strong investor interest in these alternative avenues.

The threat is compounded by competitors offering integrated wealth management services, including tax and estate planning, which appeal to clients seeking convenience. Many large banks have expanded their wealth management divisions in 2024 to capture a broader share of client assets by providing these comprehensive financial solutions.

| Substitute Type | Key Characteristics | Market Trend/Data Point (as of early-mid 2024) |

|---|---|---|

| Robo-Advisors | Automated, lower-cost investment management | Betterment: Over $40 billion AUM (early 2024) |

| Passive Investments (ETFs/Index Funds) | Broad market exposure, low fees | U.S. Passive Funds: Estimated $15 trillion AUM (end of 2023), continued growth |

| Direct Investing Platforms | Self-directed trading, accessible data | Proliferation of low-cost online brokerages |

| Alternative Assets (Direct Real Estate, PE) | Greater control, unique diversification | Global PE Fundraising: $250 billion (Q1 2024) |

| Integrated Wealth Management | Holistic financial planning, convenience | Banks expanding wealth management divisions |

Entrants Threaten

The investment management industry faces substantial regulatory and compliance hurdles, acting as a significant deterrent for new entrants. Navigating complex licensing requirements, stringent reporting obligations, and evolving compliance frameworks demands considerable expertise and resources. For instance, in 2024, firms seeking to offer advisory services in the US must comply with SEC regulations, which can involve extensive documentation and ongoing oversight.

These regulatory burdens, alongside the critical need for robust risk management systems, create formidable barriers. Establishing and maintaining the necessary compliance infrastructure requires significant upfront financial investment and a dedicated team of skilled professionals. The cost associated with legal counsel, compliance officers, and technology solutions can easily run into hundreds of thousands of dollars annually, making it challenging for smaller or less capitalized players to compete.

Building a strong brand and earning client trust in asset management is a marathon, not a sprint. Franklin Templeton, for instance, has cultivated its reputation over decades, fostering deep client relationships and a perception of unwavering reliability. This makes it incredibly difficult for newcomers to gain traction.

New entrants must overcome the significant hurdle of establishing credibility, a process that can take years and substantial investment. They face an uphill battle against established firms that already hold a substantial share of the market due to their long-standing track records and ingrained client loyalty.

Achieving competitive scale in asset management, particularly with the growing influence of technology and artificial intelligence, demands considerable capital outlays. New players must allocate substantial funds towards advanced technology platforms, robust data infrastructure, and attracting top-tier talent to vie effectively in the market.

The escalating expenses associated with cutting-edge technology and operational infrastructure present a significant hurdle for potential entrants. For instance, developing and maintaining sophisticated AI-driven investment tools and secure cloud-based data management systems can easily run into tens of millions of dollars, a cost that deters many smaller firms from entering the arena.

Access to Distribution Channels

New entrants face significant hurdles in establishing their own distribution channels to reach various client segments, from individual retail investors to large institutional ones. Existing firms, like Franklin Resources, have cultivated deep-rooted relationships with financial advisors, consultants, and direct client bases over many years. For instance, in 2024, the average time for a new financial advisory firm to build a substantial client base and secure significant assets under management often stretches beyond five years, requiring substantial upfront investment in marketing and sales infrastructure.

The cost and time associated with replicating these established networks are substantial deterrents. Building trust and securing access to these crucial intermediaries, who control significant client inflows, demands considerable resources and a proven track record. Without these established relationships, new entrants struggle to gain visibility and market share, making it difficult to compete with incumbents who already possess these vital distribution advantages.

- Distribution Channel Barrier: New entrants must overcome the challenge of building their own extensive distribution networks, a process that is both time-consuming and capital-intensive.

- Established Relationships: Incumbent firms benefit from pre-existing, strong relationships with financial advisors, institutional consultants, and direct client segments, which are difficult for newcomers to replicate.

- Cost and Time Investment: The significant financial outlay and extended timeframe required to develop comparable distribution capabilities represent a major barrier to entry.

- Market Access Limitation: Without established channels, new entrants face limited access to potential clients, hindering their ability to compete effectively in the market.

Talent Acquisition and Retention

The ability to attract and retain top-tier investment professionals and specialized talent is a significant barrier for new entrants in asset management. Established firms like Franklin Resources can leverage their strong brand recognition, competitive compensation packages, and extensive resources to secure the best minds. For instance, in 2024, the demand for talent in areas like artificial intelligence and sustainable investing continues to drive up salary expectations, making it difficult for newcomers to match the offerings of incumbents.

New entrants often find it challenging to compete with the established reputations and extensive training programs that foster loyalty and development within incumbent firms. The intense competition for talent, especially in high-demand fields such as alternative investments and quantitative strategies, means that firms with deep pockets and a proven track record have a distinct advantage. This "war for talent" can significantly limit the ability of new players to build a competitive team, impacting their service offerings and growth potential.

- Talent is a key differentiator: Firms that can attract and retain skilled professionals gain a competitive edge.

- Compensation challenges for new entrants: Start-ups struggle to match the salaries and benefits offered by established players.

- Specialized skills are in high demand: The market for experts in areas like ESG and AI remains highly competitive in 2024.

The threat of new entrants in the investment management sector, including firms like Franklin Resources, is significantly mitigated by high capital requirements and the need for specialized talent. New players must invest heavily in technology, compliance, and experienced personnel, creating substantial barriers to entry. For instance, in 2024, the cost of building a compliant and technologically advanced investment platform can easily exceed $5 million, deterring many potential competitors.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Franklin Resources leverages data from Franklin Templeton's annual reports, SEC filings, and investor presentations. We also incorporate industry-specific reports from research firms like Cerulli Associates and Morningstar, alongside macroeconomic data from sources like the World Bank to provide a comprehensive view of the asset management landscape.