Franklin Resources Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Franklin Resources Bundle

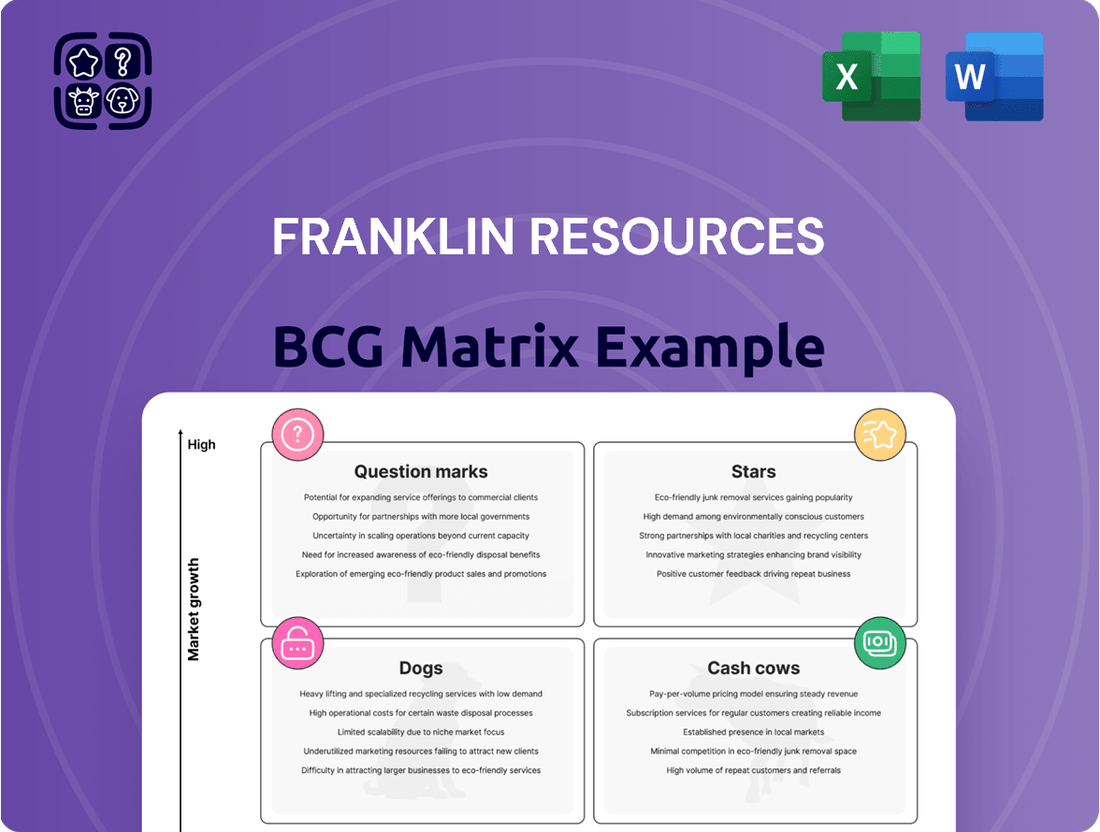

Franklin Resources' BCG Matrix offers a powerful lens to understand its product portfolio's market share and growth potential. See which of their offerings are poised for rapid expansion, which are reliable profit generators, and which might be underperforming.

Don't miss out on the strategic advantage this analysis provides. Purchase the full Franklin Resources BCG Matrix to unlock detailed quadrant placements, actionable insights, and a clear path for optimizing your investments and product development efforts.

Stars

Franklin Templeton's private market strategies, especially in private equity secondaries and private credit, are showing robust growth and are expected to continue expanding through 2025. These segments are drawing significant investor interest because of their promising long-term growth prospects and the potential to uncover opportunities in less saturated market areas.

The firm's alternative investment platform, which now manages over $250 billion in assets, underscores its prominent position in this rapidly expanding sector. This substantial AUM reflects Franklin Templeton's successful execution of its private market strategies.

Franklin Templeton's foray into digital assets with ETFs like the Franklin Bitcoin ETF (EZBC) and Franklin Ethereum ETF (EZET) positions them as a high-growth player. These products offer a regulated pathway for investors to gain exposure to the burgeoning digital asset space.

The Franklin Crypto Index ETF (EZPZ) further diversifies their digital asset ETF lineup, catering to a broader interest in the crypto market. Franklin Templeton's strategy of implementing fee waivers on these newer products is a clear move to capture substantial assets under management in this dynamic sector.

Franklin Templeton's Canvas® custom indexing platform is a standout performer, demonstrating robust growth. In the first quarter of 2024, it reached record assets under management (AUM), exceeding $40 billion, and experienced positive net flows, signaling strong client demand for its offerings.

This platform's success is driven by its ability to deliver customized, tax-managed separately managed accounts (SMAs). Recently, Canvas® expanded to incorporate managed option strategies, further enhancing its appeal by providing clients with more sophisticated tools for personalized investment solutions and risk management.

Sustainable Investing Solutions

Franklin Templeton is significantly expanding its sustainable investing offerings, recognizing the growing investor appetite for Environmental, Social, and Governance (ESG) integration. This strategic push is evident in their development of ESG-focused ETFs, such as the Franklin S&P 500 Screened and Franklin S&P World Screened ETFs, which cater to a market increasingly prioritizing responsible investment strategies.

The global emphasis on ESG principles, coupled with the accelerating energy transition, positions these sustainable solutions as prime growth opportunities for Franklin Templeton. Investor demand for impactful and ethically aligned investments continues to surge, making these product lines a critical component of the firm's future growth trajectory. For instance, in 2023, global sustainable fund assets reached a substantial figure, underscoring the market's momentum.

- Franklin Templeton's commitment to sustainable investing is demonstrated through its ESG-focused ETF lineup.

- The increasing global focus on ESG factors and energy transition fuels demand for these responsible investment solutions.

- In 2023, assets under management in sustainable funds globally saw significant growth, reflecting strong investor interest.

Multi-Asset Solutions with Positive Net Flows

Franklin Templeton's multi-asset solutions, excluding Western Asset Management, have shown a robust ability to attract capital, consistently reporting positive net flows. This performance highlights the appeal of their diversified investment strategies.

These solutions are crafted to meet a wide spectrum of client requirements, offering comprehensive wealth management. This broad appeal is a key factor in their success in attracting new investment.

- Strong Net Flows: Franklin Templeton's multi-asset strategies, excluding Western Asset Management, have consistently experienced positive net flows, indicating investor confidence.

- Diversified Offerings: The range of multi-asset products caters to diverse wealth management needs, appealing to a broad client base.

- Market Attractiveness: Their ability to attract new capital underscores their strong market positioning and the relevance of their investment approach in current market conditions.

Stars in the BCG Matrix represent high-growth, high-market-share businesses. Franklin Templeton's digital asset ETFs, like the Franklin Bitcoin ETF (EZBC) and Franklin Ethereum ETF (EZET), launched in early 2024, fit this description due to the rapid growth of the cryptocurrency market and the firm's established brand presence. The Franklin Crypto Index ETF (EZPZ) also falls into this category, offering diversified exposure to a high-growth asset class.

What is included in the product

Strategic framework for classifying business units based on market share and growth.

Franklin Resources BCG Matrix: A clear, visual guide to strategically allocate resources, easing the pain of unclear investment decisions.

Cash Cows

Franklin Templeton's core fixed income strategies, excluding Western Asset Management, are proving to be robust cash cows. Despite market fluctuations, these established products are a significant source of cash flow for the company.

These strategies benefit from appealing yields and a strategic emphasis on high-quality, shorter-maturity assets. This approach ensures stable returns, particularly as the economic landscape continues to normalize.

For instance, as of the first quarter of 2024, Franklin Templeton reported that its core fixed income assets under management remained substantial, contributing positively to overall revenue streams. The focus on quality and shorter durations helps mitigate interest rate risk, a key consideration in the current economic climate.

Franklin Templeton's established equity-oriented schemes, such as its large-cap and diversified equity funds, are prime examples of cash cows within its product lineup. These offerings have historically attracted substantial investor capital, forming a bedrock of assets under management.

As of the first quarter of 2024, Franklin Templeton managed over $1.7 trillion in global assets, with a significant portion attributed to these mature, high-performing equity products. Their market leadership in a stable segment ensures consistent revenue streams through management fees, bolstering the firm's financial stability and capacity for innovation in other areas.

Franklin Templeton's established mutual funds, boasting significant Assets Under Management (AUM), often function as cash cows within their portfolio. These mature products, having demonstrated consistent outperformance against benchmarks over extended periods, generate reliable income streams. For instance, as of the first quarter of 2024, several of their flagship funds held AUM exceeding $10 billion, contributing substantially to the firm's overall revenue through management fees.

Western Asset Management (Fixed Income)

Western Asset Management, a cornerstone of Franklin Templeton's fixed income business, functions as a classic cash cow within their portfolio. Despite facing some net outflows, its sheer scale ensures consistent revenue generation.

As of April 2025, Western Asset Management managed approximately $240 billion in assets. This substantial asset base, within a mature fixed income market, allows it to generate significant profits that can be reinvested into other, more dynamic areas of Franklin Templeton's business.

- Dominant Market Share: Western Asset Management holds a substantial position in the fixed income sector.

- Mature Asset Class: Fixed income is a well-established and stable market.

- Significant AUM: With around $240 billion in assets under management as of April 2025, it represents a large portion of Franklin Templeton's overall business.

- Revenue Generation: Despite some net outflows, its AUM generates considerable and reliable revenue.

Retirement and Defined Contribution Solutions

Franklin Templeton's retirement and defined contribution solutions, significantly strengthened by the Putnam Investments acquisition, represent a robust cash cow. This segment consistently delivers stable, recurring revenue, fueled by a substantial and expanding asset base. In 2024, the defined contribution market continued its growth trajectory, with total assets under management projected to reach trillions, providing a fertile ground for Franklin Templeton's offerings.

New legislation and evolving opportunities for wealth advisors and retirement specialists further bolster this sector's cash-generating potential. The increasing demand for personalized retirement planning and the growing awareness of long-term financial security among individuals contribute to a sustained inflow of assets. This strategic positioning allows Franklin Templeton to leverage its expertise and scale effectively.

- Significant Revenue Streams: The retirement and defined contribution sectors provide predictable and substantial income for Franklin Templeton.

- Asset Growth: A large and growing asset base in these segments ensures continued revenue generation.

- Favorable Market Conditions: New legislation and advisor opportunities create a supportive environment for growth.

- Acquisition Synergies: The integration of Putnam Investments enhances Franklin Templeton's capabilities and market reach in these key areas.

Franklin Templeton's established equity-oriented schemes, such as its large-cap and diversified equity funds, are prime examples of cash cows within its product lineup. These offerings have historically attracted substantial investor capital, forming a bedrock of assets under management.

As of the first quarter of 2024, Franklin Templeton managed over $1.7 trillion in global assets, with a significant portion attributed to these mature, high-performing equity products. Their market leadership in a stable segment ensures consistent revenue streams through management fees, bolstering the firm's financial stability and capacity for innovation in other areas.

Franklin Templeton's retirement and defined contribution solutions, significantly strengthened by the Putnam Investments acquisition, represent a robust cash cow. This segment consistently delivers stable, recurring revenue, fueled by a substantial and expanding asset base. In 2024, the defined contribution market continued its growth trajectory, with total assets under management projected to reach trillions, providing a fertile ground for Franklin Templeton's offerings.

| Product Category | Key Characteristics | 2024 Data/Trends | Revenue Impact |

|---|---|---|---|

| Core Fixed Income (ex-Western Asset) | Appealing yields, focus on high-quality, shorter-maturity assets | Substantial AUM, stable returns mitigating interest rate risk | Significant source of stable cash flow |

| Established Equity Funds | Large-cap, diversified equity, historical investor capital attraction | Over $1.7 trillion in global AUM (Q1 2024), market leadership | Consistent management fee revenue |

| Retirement & Defined Contribution Solutions | Stable, recurring revenue, expanding asset base | Growth in defined contribution market (trillions projected) | Predictable and substantial income streams |

What You See Is What You Get

Franklin Resources BCG Matrix

The Franklin Resources BCG Matrix preview you are viewing is the exact, unedited document you will receive upon purchase. This comprehensive strategic tool, designed for clarity and actionable insights, will be delivered to you in its final, professional format, ready for immediate implementation in your business planning and analysis.

Dogs

Certain fixed income funds, particularly those managed by Western Asset Management, are showing characteristics of "dogs" in the BCG Matrix. These funds have faced substantial net outflows over extended periods, indicating a lack of investor confidence and capital retention. For instance, by the end of 2023, several of their core fixed income strategies experienced outflows exceeding 15% of their assets under management.

These underperforming funds operate within a low-growth segment of the market, where demand for traditional fixed income products has been subdued due to rising interest rates and evolving investor preferences. This sluggish market environment, coupled with declining market share, suggests these funds are capital intensive without delivering commensurate returns, a classic trait of a dog in the BCG framework.

Certain fixed income strategies, like the Franklin High Yield Tax-Free Income Fund, have shown underperformance. For instance, in the second quarter of 2025, this fund lagged its benchmark due to specific allocation choices, placing it in the dog category.

These underperforming products often face challenges in growing their market presence. Their struggle to attract new assets and retain existing ones signals a need for careful review and potential strategic adjustments, possibly leading to divestiture if improvement isn't evident.

Franklin Resources' legacy products, those older investment vehicles that haven't adapted to evolving market demands, are increasingly falling into the 'Dogs' category. These offerings, often characterized by a lack of innovation, are experiencing consistent net outflows, leading to a shrinking asset under management (AUM). For instance, in the first quarter of 2024, Franklin Templeton reported a net outflow of $10.5 billion, with a significant portion attributed to underperforming legacy strategies.

These 'Dogs' typically exhibit low growth prospects and a diminished market share. While they require minimal ongoing investment to maintain, their future potential for generating substantial returns is severely limited. This situation necessitates careful management, as continued investment in these products may not yield a positive return on investment, impacting overall profitability.

Funds with Persistent Net Outflows

Funds experiencing consistent net outflows, like certain actively managed equity strategies within Franklin Templeton, would be classified as 'Dogs' in the BCG Matrix. These funds are characterized by low market share and low growth, indicating a struggle to attract new assets. For instance, as of the first quarter of 2024, some of Franklin Templeton's smaller, niche actively managed equity funds continued to report outflows, even as the broader firm saw inflows driven by fixed income and passive strategies.

These persistent outflows suggest a declining relevance or underperformance in specific market segments. While Franklin Templeton's overall assets under management (AUM) saw growth in early 2024, reaching over $1.6 trillion, this growth was not uniform across all strategies. The 'Dogs' represent areas where the firm may need to re-evaluate its product offerings or marketing efforts.

- Dogs: Funds with persistent net outflows.

- Low market share and low growth segments.

- Example: Certain actively managed equity funds showing continued outflows in Q1 2024.

- Indicates potential loss of market share in specific, low-growth areas.

Highly Concentrated, Niche Equity Funds with Poor Performance

Highly concentrated, niche equity funds from Franklin Templeton that have consistently underperformed are likely candidates for the 'dog' category within a BCG Matrix analysis. These funds would struggle to attract new investment, and existing investors might pull their money, resulting in a diminished market share and minimal growth prospects.

For example, if a specific sector fund, highly concentrated in a few stocks, experienced a -5% annual return in 2023 while its benchmark returned +10%, it would clearly be underperforming. Such a fund would likely see its assets under management (AUM) shrink, perhaps from $50 million to $30 million over the year, indicating a declining market position.

- Poor Performance Metrics: Funds showing consistent negative alpha or trailing their benchmark by a significant margin, such as 500 basis points annually over three years.

- Declining AUM: A notable decrease in assets under management, indicating investor redemptions and lack of new inflows. For instance, a fund shrinking from $100 million to $60 million in a single year.

- Niche Market Saturation: Operating in a very specific, limited market segment where growth potential is inherently capped or facing intense competition.

- Low Investor Interest: A lack of recent marketing success or positive analyst ratings, signaling low demand for the fund's strategy.

Funds classified as 'Dogs' within Franklin Resources' BCG Matrix are those experiencing persistent net outflows and operating in low-growth market segments with a declining market share. These strategies, often legacy products or highly concentrated niche equity funds, struggle to attract new assets and retain existing ones, leading to a shrinking asset base and limited future return potential. For example, in Q1 2024, Franklin Templeton reported net outflows of $10.5 billion, with a portion attributed to underperforming legacy strategies, highlighting the challenges faced by these 'Dog' investments.

| Fund Type | BCG Category | Key Indicators | 2024 Data Point |

|---|---|---|---|

| Legacy Fixed Income | Dog | Persistent net outflows, low growth market | Outflows exceeding 15% of AUM by end of 2023 for some core strategies |

| Niche Actively Managed Equity | Dog | Low market share, low growth, continued outflows | Some smaller, niche funds reported outflows in Q1 2024 |

| Underperforming Sector Fund | Dog | Negative alpha, declining AUM | A hypothetical fund shrinking from $50M to $30M in 2023 due to underperformance |

Question Marks

Newly launched digital asset products beyond Bitcoin and Ethereum ETFs, such as those focusing on altcoins or specific blockchain use cases, are likely positioned as Question Marks in Franklin Resources' BCG Matrix. These ventures operate in a rapidly expanding digital asset market, but their current market share is minimal, necessitating substantial capital infusion for development and market penetration. For instance, as of mid-2024, the total market capitalization of cryptocurrencies excluding Bitcoin and Ethereum was over $1 trillion, indicating significant growth potential but also fragmentation and early-stage development for many individual assets.

Emerging market funds, like Franklin Templeton’s own Templeton Emerging Markets Fund, often reside in the question mark quadrant of the BCG Matrix. These funds operate in high-growth potential markets, but their performance can be quite unpredictable, leading to fluctuating market share. For instance, in 2023, many emerging market equity funds experienced significant inflows, yet their net asset values saw considerable swings due to global economic headwinds and specific regional challenges.

Specific thematic or sectoral funds, particularly newer or smaller ones focusing on high-growth areas like artificial intelligence or renewable energy, often fall into the question mark category of the BCG Matrix. These funds, while promising, haven't yet secured a dominant market share, necessitating significant marketing and investment to gain traction.

For instance, a thematic fund focused on advanced robotics might have seen assets under management (AUM) grow by 50% in 2024, reaching $500 million. However, compared to the broader tech ETF market, this is still a relatively small footprint, highlighting the need for strategies to increase investor awareness and demonstrate long-term performance potential.

Early-Stage Private Market Strategies (New Verticals)

Early-stage private market strategies venturing into new or nascent verticals can be considered Question Marks within the Franklin Resources BCG Matrix. These strategies demand substantial capital investment and a considerable timeframe to mature, prove their value, and capture significant market share. For instance, in 2024, the venture capital landscape saw a notable increase in funding for AI-driven drug discovery platforms, a relatively new vertical. While promising, these ventures often face high failure rates and uncertain future cash flows, mirroring the characteristics of a Question Mark.

These emerging private market verticals require careful analysis and selective capital allocation. Their success hinges on factors like technological innovation, regulatory landscapes, and the ability to scale effectively. For example, the burgeoning field of space-based data analytics, while holding immense potential, is still in its formative stages. Companies in this sector in 2024, despite attracting significant early-stage funding, are yet to demonstrate consistent profitability or widespread market adoption, placing them firmly in the Question Mark quadrant.

- Nascent Verticals: Strategies targeting underdeveloped or emerging sectors, such as advanced materials or sustainable aviation fuel, often begin as Question Marks.

- High Risk, High Reward Potential: While capital intensive and uncertain, successful early-stage ventures in new verticals can become future Stars.

- 2024 Data: Venture capital investments in areas like quantum computing and synthetic biology saw significant year-over-year growth in early 2024, indicating a shift towards new verticals, but their long-term viability remains a question.

- Strategic Importance: Identifying and nurturing these Question Marks is crucial for long-term portfolio growth and market leadership.

Innovative Technology-Driven Solutions (e.g., BENJI platform beyond initial offerings)

Franklin Templeton's BENJI platform, as it ventures into novel applications and integrations, such as with VeChain, exemplifies a potential Star in the BCG matrix. These forward-looking initiatives, while promising high growth, face market adoption uncertainties. For instance, VeChain's focus on supply chain management through blockchain technology presents a new frontier for financial services integration, a space still maturing.

The expansion of BENJI into areas like VeChain's ecosystem signifies a strategic bet on emerging technologies. While the potential for significant market share in these nascent fields is high, the actual success hinges on widespread adoption and the platform's ability to deliver tangible value. Franklin Templeton's commitment to these ventures requires substantial ongoing investment to navigate the inherent risks and capitalize on the potential rewards.

- BENJI's integration with VeChain targets the growing blockchain-as-a-service market.

- The success of such integrations depends on broader enterprise adoption of blockchain solutions.

- Franklin Templeton's investment in these areas reflects a strategy to capture future market share in evolving technological landscapes.

Question Marks represent business units or products with low market share in high-growth industries, demanding significant investment to grow. Franklin Resources, like other asset managers, navigates these by identifying emerging trends and technologies. For example, new thematic ETFs or private equity strategies in nascent sectors often begin as Question Marks, requiring substantial capital and strategic focus to potentially become market leaders.

| Product/Strategy Type | Industry Growth Rate | Current Market Share | Investment Required | Potential Outcome |

|---|---|---|---|---|

| Emerging Market Tech Funds | High | Low | High | Star or Dog |

| AI-Focused Private Equity | Very High | Low | Very High | Star or Dog |

| Digital Asset Infrastructure ETFs | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our Franklin Resources BCG Matrix is constructed using comprehensive market data, encompassing financial performance, industry growth rates, competitor analysis, and expert market forecasts to provide actionable strategic guidance.