Franklin Resources PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Franklin Resources Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Franklin Resources's future. Our meticulously researched PESTLE analysis provides actionable intelligence, empowering you to anticipate market shifts and capitalize on emerging opportunities. Download the full report now and gain the strategic advantage you need to thrive.

Political factors

Changes in government policies, like tax laws and financial market regulations, directly shape Franklin Templeton's strategies and product development. For instance, evolving rules on capital gains or retirement savings can alter demand for specific investment vehicles.

A stable political climate in major economies, such as the United States and the European Union, bolsters investor confidence, leading to increased capital flows into managed funds. Conversely, political instability can create uncertainty, potentially reducing assets under management and impacting revenue streams for firms like Franklin Resources.

In 2024, for example, ongoing discussions around potential changes to capital gains tax rates in several key markets could influence investor behavior and the attractiveness of certain investment products offered by Franklin Templeton.

Geopolitical stability is a significant factor for Franklin Resources, influencing global financial markets and the firm's investment strategies. Tensions and conflicts can create market volatility, impacting client portfolios. For instance, the ongoing conflict in Ukraine, which began in early 2022 and continued through 2024, has led to significant energy price fluctuations and supply chain disruptions, affecting global economic growth and investment returns.

Shifts in fiscal and monetary policy significantly impact financial markets. For instance, central banks like the Federal Reserve adjusting interest rates directly influences bond yields and equity valuations. In 2024, the anticipation of potential rate cuts by the Fed, following a period of aggressive hikes in 2022-2023, created volatility in equity markets, with sectors sensitive to borrowing costs seeing notable movements.

Franklin Resources, or Franklin Templeton, actively manages its investment strategies in response to these macroeconomic changes. When interest rates rise, the firm might adjust its bond portfolio duration or increase exposure to value stocks, aiming to mitigate risk and capture opportunities. Conversely, during periods of monetary easing, they may lean into growth-oriented assets and longer-duration bonds to enhance client returns.

International Trade Relations

Franklin Resources, like many global asset managers, closely monitors international trade relations. Shifting trade policies, such as the imposition of tariffs or the emergence of trade disputes between major economic blocs, directly impact global supply chains and corporate profitability. For instance, the ongoing trade tensions between the United States and China, which saw tariffs imposed on hundreds of billions of dollars worth of goods in recent years, have created volatility in markets and forced companies to re-evaluate their sourcing strategies.

Franklin Templeton’s analysts actively assess these trade dynamics to identify potential risks and opportunities within their diverse global investment portfolios. The firm's ability to navigate these complexities is crucial for managing currency fluctuations, commodity price swings, and the overall investor sentiment that can be significantly influenced by trade agreements or their breakdown. The World Trade Organization (WTO) reported that global trade growth slowed in 2023, reflecting these geopolitical uncertainties.

- Tariff impacts: Increased tariffs can raise costs for businesses, potentially reducing profit margins and leading to higher consumer prices, affecting sectors like manufacturing and technology.

- Supply chain disruptions: Trade disputes can lead to the rerouting of supply chains, impacting logistics efficiency and increasing operational expenses for multinational corporations.

- Investor sentiment: Uncertainty surrounding trade policies often leads to increased market volatility, as investors react to potential changes in global economic growth and corporate earnings outlooks.

- Emerging opportunities: Conversely, shifts in trade relations can create new market access or competitive advantages for certain companies and regions, which Franklin Templeton seeks to identify.

Political Risk in Emerging Markets

Emerging markets present distinct political risks for investors like Franklin Resources, including potential governance weaknesses, sudden policy shifts, and the threat of expropriation. These factors can significantly impact investment returns and capital preservation.

Franklin Templeton actively assesses these risks by conducting in-depth country-level analysis and engaging with local stakeholders. Their approach aims to navigate the complexities of emerging market political landscapes to safeguard client assets.

For instance, in 2024, several emerging economies experienced political transitions or policy overhauls that led to market volatility. Franklin's due diligence process would have factored in the likelihood and potential impact of such events on their portfolio allocations.

- Governance Concerns: Franklin evaluates the rule of law, corruption levels, and the independence of regulatory bodies in emerging markets.

- Policy Unpredictability: The firm analyzes the potential for sudden changes in tax laws, trade policies, and foreign investment regulations.

- Expropriation Risk: Franklin assesses the historical and current risk of governments seizing private assets, particularly in sectors with strategic national importance.

Government stability and regulatory frameworks are crucial for Franklin Resources, influencing investor confidence and market access. Changes in tax laws, such as potential adjustments to capital gains tax rates discussed in 2024, can directly impact investment product demand and fund performance.

Geopolitical events, like the ongoing conflict in Ukraine continuing through 2024, create market volatility and affect global economic conditions, influencing Franklin Templeton's investment strategies and client portfolio management.

International trade relations and policies, including trade disputes between major economies, impact supply chains and corporate profitability, with global trade growth slowing in 2023 according to the WTO, creating both risks and opportunities for Franklin Resources.

Emerging markets present unique political risks, such as governance weaknesses and policy unpredictability, which Franklin Templeton actively assesses through country-level analysis to manage client assets effectively, particularly in 2024 where several emerging economies underwent political transitions.

What is included in the product

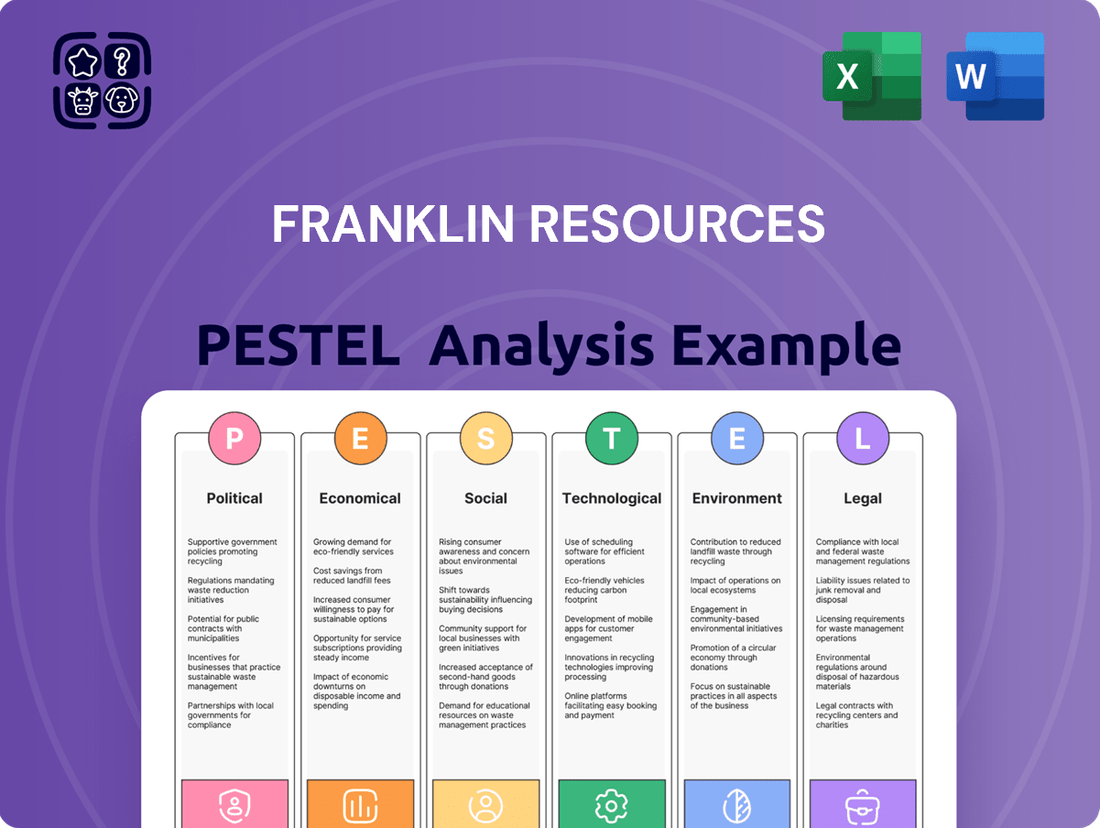

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Franklin Resources, providing a comprehensive overview of the external forces shaping its strategic landscape.

A Franklin Resources PESTLE analysis provides a structured framework to proactively identify and mitigate external threats and opportunities, thereby alleviating the pain point of strategic uncertainty.

Economic factors

The global economic growth trajectory is a primary driver for Franklin Templeton's investment strategies. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight slowdown from 2023, indicating a more moderate expansion environment.

Franklin Templeton actively monitors leading economic indicators, such as Purchasing Managers' Indexes (PMIs) and consumer confidence surveys, to anticipate shifts in economic cycles. The firm's analysts use these insights to adjust portfolio allocations, aiming to mitigate risks during potential downturns and capitalize on growth phases.

Recession risks remain a key consideration. While major economies are not universally expected to enter a deep recession in 2024, localized slowdowns or specific sector vulnerabilities are closely watched. For example, persistent inflation and higher interest rates in some regions could dampen consumer spending and business investment, impacting asset valuations across Franklin Templeton's managed portfolios.

Prevailing interest rates and inflation significantly shape investment landscapes. For instance, as of early 2024, the US Federal Reserve maintained a target federal funds rate between 5.25% and 5.50%, a level designed to curb inflation. This environment directly impacts fixed income yields, making bonds more attractive, while also increasing borrowing costs for businesses and consumers, potentially dampening equity market enthusiasm.

Franklin Templeton's strategists actively adjust portfolio allocations in response to these economic signals. With inflation showing signs of moderation but remaining above the Federal Reserve's 2% target in late 2024, the firm likely navigates a complex environment. They might increase exposure to sectors with pricing power or invest in inflation-protected securities to safeguard purchasing power across their diverse product offerings.

Franklin Resources, like all asset managers, navigates the impact of capital market volatility and liquidity on its operations. Periods of heightened volatility, such as the S&P 500 experiencing significant daily swings in early 2024, can present both challenges in executing trades at desired prices and opportunities for active managers to capitalize on mispricings.

Low market liquidity, characterized by fewer buyers and sellers, can make it more difficult and costly for Franklin Templeton to execute large transactions efficiently, potentially impacting portfolio rebalancing and the ability to enter or exit positions quickly without significant price impact.

Conversely, increased volatility can also lead to greater client demand for active management strategies, as investors seek to navigate uncertain market conditions, potentially boosting assets under management for Franklin Templeton.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact Franklin Templeton's globally diversified investment portfolios. For instance, a strengthening US dollar in late 2023 and early 2024 meant that returns generated in stronger foreign currencies translated into fewer dollars, potentially impacting reported returns for US-based clients. Conversely, a weaker dollar can boost the dollar-equivalent value of foreign holdings.

Franklin Templeton actively manages currency risk through various hedging strategies, such as forward contracts and currency options, to mitigate the impact of adverse movements on client portfolios. The firm also incorporates currency trends and forecasts into its global investment decisions, seeking opportunities presented by currency valuations and potential shifts.

- Impact on Returns: In Q1 2024, the appreciation of the US dollar against major currencies like the Euro and Yen likely presented a headwind for US dollar-denominated returns on international assets held by Franklin Templeton clients.

- Hedging Strategies: The firm utilizes derivative instruments to lock in exchange rates for future transactions, aiming to protect portfolio values from volatility. For example, a portfolio holding Japanese Yen assets might use yen-denominated forward contracts to sell yen and buy dollars at a predetermined rate.

- Currency in Investment Decisions: Franklin Templeton's global equity and fixed income teams analyze macroeconomic indicators, central bank policies, and geopolitical events that influence currency movements when making investment allocation decisions across different regions.

Consumer Spending and Savings Behavior

Consumer spending is a major driver of economic growth, and its fluctuations directly impact asset classes. For instance, robust consumer spending often signals a healthy economy, boosting equity markets and potentially increasing demand for credit, which can benefit fixed-income investments. Conversely, a slowdown in spending can lead to reduced corporate earnings and pressure on asset prices.

Savings behavior is equally critical. Higher savings rates can reduce immediate consumption but can also provide a larger pool of capital for investment, potentially lowering borrowing costs and supporting asset valuations. Franklin Templeton closely monitors these trends to gauge overall economic health and identify sectors poised for growth or contraction based on consumer purchasing power and willingness to save.

- Consumer spending in the US reached an estimated $17.5 trillion in 2023, a significant contributor to GDP growth.

- The personal saving rate in the US averaged around 4.0% in late 2023 and early 2024, down from pandemic-era highs but showing resilience.

- Household net worth in the US saw a notable increase in 2023, driven by rising stock markets, which can support future spending.

- Franklin Templeton analyzes consumer confidence indices and retail sales data to forecast spending patterns and their impact on investment portfolios.

Global economic growth is projected to moderate, with the IMF forecasting 3.2% growth for 2024, influencing investment strategies. Franklin Templeton closely watches indicators like PMIs and consumer confidence to navigate economic cycles and adjust portfolio allocations. Persistent inflation and higher interest rates in some regions pose risks, potentially dampening consumer spending and business investment.

Full Version Awaits

Franklin Resources PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Franklin Resources delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

You'll gain valuable insights into market trends, competitive landscapes, and potential challenges and opportunities that Franklin Resources faces in the global financial services industry.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed and actionable framework for understanding Franklin Resources' external environment.

Sociological factors

Global demographic shifts, like aging populations in developed nations and youthful demographics in emerging markets, significantly shape investment themes. For instance, the increasing life expectancy in countries like Japan, where the proportion of citizens aged 65 and over reached 29.9% in 2023, drives demand for retirement income solutions and healthcare-focused investments. Franklin Resources actively adapts by expanding its retirement planning services and developing investment products that cater to longevity and wealth preservation needs.

Conversely, the burgeoning youth population in emerging economies, such as India where over 50% of the population is under 25, presents opportunities for growth-oriented investments and financial literacy programs. Franklin Templeton's wealth management strategies are tailored to capture this demographic dividend, offering accessible investment vehicles and digital platforms to engage younger investors. This dual focus allows the company to address diverse global needs, from securing retirement for aging populations to empowering the next generation of investors.

Societal demand for responsible investing is surging, with investors increasingly prioritizing Environmental, Social, and Governance (ESG) factors. This trend is reshaping how investment firms operate and develop products.

Franklin Templeton is actively integrating ESG considerations across its research, portfolio construction, and product development. This strategic alignment aims to meet evolving client expectations for sustainable investments and capitalize on growing market opportunities in this space.

As of early 2024, assets under management in ESG-focused funds globally have surpassed $3.3 trillion, highlighting the significant shift in investor preferences towards sustainable and ethical investment strategies.

Financial literacy levels vary significantly among Franklin Resources' client base and across different regions, directly influencing how investment products are developed and communicated. For instance, a 2024 study by FINRA indicated that only 55% of Americans could answer basic financial literacy questions, a figure that likely impacts engagement with complex investment vehicles.

Franklin Templeton actively addresses this by investing in robust investor education programs. These initiatives, often delivered through digital platforms and partnerships, aim to equip clients with the knowledge to make informed decisions, thereby building trust and strengthening long-term relationships. Their commitment to education is crucial for fostering a more engaged and confident investor community.

Wealth Distribution and Inequality

Growing wealth and income inequality globally can significantly shape the demand for investment services. As more wealth concentrates at the top, there's a heightened need for sophisticated wealth management and ultra-high-net-worth (UHNW) solutions. Conversely, a growing mass affluent segment also requires tailored investment products and advisory services.

These societal shifts directly impact Franklin Resources' strategic focus. The firm may see increased demand for specialized services catering to both ends of the wealth spectrum, potentially altering its competitive positioning and client segmentation strategies. For instance, reports from 2024 indicate a continued widening of the wealth gap, with a significant portion of new wealth being generated by a relatively small percentage of the population.

- Increased Demand for UHNW Services: As wealth concentrates, Franklin Resources can capitalize on the growing market for bespoke investment strategies and private banking for the wealthiest individuals.

- Growth in Mass Affluent Market: While inequality persists, a substantial segment of the population continues to accumulate wealth, creating opportunities for accessible, diversified investment products and digital advisory platforms.

- Impact on Product Development: Societal trends may necessitate a broader product suite, from high-yield bonds and alternative investments for UHNW clients to low-cost ETFs and robo-advisory services for the mass affluent.

Changing Work Culture and Retirement Planning

The rise of the gig economy and remote work fundamentally alters traditional retirement planning. As of early 2025, an estimated 60 million Americans participate in the gig economy, a figure projected to grow. This shift necessitates flexible savings solutions, moving away from employer-sponsored plans towards individual retirement accounts (IRAs) and portable benefit plans. Franklin Templeton is adapting by enhancing its digital platforms for easier access and management of diverse investment vehicles, catering to a workforce that values autonomy and adaptability in their financial futures.

Furthermore, the trend of later retirement ages, with many individuals planning to work past 65, influences the types of retirement products in demand. By 2024, the average retirement age in the US had climbed to 62, with many opting for phased retirement or continued part-time employment. This longevity trend increases the need for investment strategies that can sustain income over longer periods. Franklin Templeton is responding by developing and promoting products focused on income generation and capital preservation for extended retirement horizons, ensuring their offerings remain relevant to evolving life expectancies and career paths.

- Gig Economy Growth: Over 60 million Americans actively participate in the gig economy as of early 2025, showcasing a significant shift in employment structures.

- Retirement Age Increase: The average retirement age in the US reached 62 in 2024, indicating a trend towards later retirement and longer post-work financial planning needs.

- Demand for Flexibility: Individuals in non-traditional work arrangements require flexible savings vehicles and accessible digital tools for managing their retirement assets.

- Product Evolution: Franklin Templeton is innovating its product suite to include solutions for income generation and capital preservation, addressing the needs of a longer-living and more fluid workforce.

Societal expectations for ethical business practices are increasingly influencing investment decisions, with a growing emphasis on corporate social responsibility. Franklin Resources is responding by enhancing its ESG integration capabilities, recognizing that client demand for sustainable investments is a significant driver of growth.

Financial literacy remains a critical factor, as demonstrated by a 2024 FINRA study showing only 55% of Americans could answer basic financial questions, impacting how Franklin Templeton designs its educational outreach and product offerings to ensure accessibility and understanding.

The evolving nature of work, particularly the rise of the gig economy with an estimated 60 million US participants by early 2025, necessitates flexible retirement solutions beyond traditional employer-sponsored plans, a trend Franklin Templeton is addressing with enhanced digital platforms for individual accounts.

The increasing average retirement age in the US, reaching 62 in 2024, coupled with longer life expectancies, drives demand for investment products that provide sustained income and capital preservation over extended post-work periods, prompting Franklin Templeton to focus on income-generating strategies.

Technological factors

Franklin Resources is increasingly leveraging advanced data analytics and artificial intelligence to refine its investment strategies. These technologies are crucial for dissecting vast datasets, identifying subtle market trends, and improving the accuracy of predictive models, which directly impacts risk management and portfolio optimization.

The firm utilizes machine learning algorithms to automate routine tasks in investment research, freeing up analysts to focus on higher-level strategic thinking. This technological integration allows Franklin Templeton to gain deeper, more nuanced insights into market behavior and economic indicators, enhancing overall decision-making efficiency across its diverse investment teams.

Franklin Resources, also known as Franklin Templeton, places paramount importance on cybersecurity and data privacy due to its management of extensive sensitive client financial data. The company invests heavily in advanced security infrastructure and adheres to evolving global data protection regulations, such as GDPR and CCPA, to safeguard client information and maintain unwavering trust.

Franklin Resources, like many in the asset management sector, is increasingly leveraging digital platforms to engage clients. This shift is evident in their investment in user-friendly mobile apps and online portals, offering clients 24/7 access to account details, market research, and personalized portfolio updates. For instance, in late 2023, Franklin Templeton reported a significant uptick in digital channel usage for client inquiries and transactions, reflecting a broader industry trend towards enhanced digital client experiences.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) present a significant disruptive force for financial market infrastructure. Franklin Resources is actively exploring how these innovations can revolutionize asset tokenization, enabling fractional ownership and increased liquidity for previously illiquid assets. For instance, the global tokenized assets market is projected to reach $10 trillion by 2030, according to some industry estimates, highlighting the immense potential for Franklin Templeton to leverage this trend.

The firm is monitoring DLT's impact on trade settlement, aiming to reduce transaction times and counterparty risk. By streamlining processes, DLT could significantly lower operational costs and enhance transparency in record-keeping. Franklin Templeton's strategic investments and partnerships in this space underscore its commitment to adopting these technologies to bolster efficiency and security within its global operations.

- Asset Tokenization: Potential for fractional ownership and enhanced liquidity in traditional and alternative assets.

- Trade Settlement: DLT offers the promise of near-instantaneous settlement, reducing risks and costs.

- Record-Keeping: Blockchain's immutable ledger enhances transparency and auditability, crucial for regulatory compliance.

- Franklin Templeton's Approach: Active monitoring and exploration of DLT integration for operational improvements.

Robo-Advisory and Automated Investment Platforms

Robo-advisors and automated investment platforms continue to gain traction, reshaping the investment landscape. By 2024, assets managed by robo-advisors were projected to reach over $2 trillion globally, a significant increase from previous years. This trend challenges traditional advisory models by offering lower fees and accessible digital interfaces, particularly appealing to younger investors. Franklin Resources, also known as Franklin Templeton, is actively adapting to this technological shift. They are investing in their own digital capabilities and exploring hybrid models that blend automated tools with human advisor support to cater to a wider range of client needs.

Franklin Templeton's strategic response includes enhancing its digital offerings and partnerships. For instance, by mid-2025, the company aims to further integrate AI-driven insights and personalized digital experiences across its platforms. This proactive approach aims to retain clients who value digital convenience while still providing the deeper strategic guidance that human advisors offer. The firm’s focus is on refining its value proposition to highlight the expertise and personalized service that differentiate it from purely automated solutions.

- Growth of Robo-Advisors: Global assets under robo-advisory management were expected to surpass $2 trillion by the end of 2024.

- Client Preference: Digital platforms are increasingly favored by younger demographics seeking lower costs and ease of use.

- Franklin Templeton's Strategy: The firm is developing hybrid advisory models and enhancing its digital tools to meet evolving client demands.

- Value Proposition: Emphasis is placed on combining technology with personalized, human-centric financial advice.

Technological advancements are fundamentally reshaping Franklin Resources' operational landscape. The firm is heavily investing in AI and machine learning to enhance predictive analytics for investment strategies, aiming for greater accuracy in market trend identification and risk management. By mid-2025, Franklin Templeton plans to further integrate AI-driven insights into its client-facing platforms, offering more personalized digital experiences.

The rise of robo-advisors, with global assets expected to exceed $2 trillion by the end of 2024, is driving Franklin Resources to adopt hybrid models. These models blend automated tools with human advisory services to cater to diverse client preferences, particularly the younger demographic favoring digital convenience.

Blockchain and DLT are being explored for asset tokenization and trade settlement, with the tokenized asset market potentially reaching $10 trillion by 2030. Franklin Templeton's strategic focus on these areas aims to improve operational efficiency, reduce costs, and enhance transparency in its global financial operations.

Legal factors

Franklin Resources operates within a complex and constantly shifting global regulatory environment, overseen by agencies such as the U.S. Securities and Exchange Commission (SEC), the UK's Financial Conduct Authority (FCA), and the European Securities and Markets Authority (ESMA). Adherence to these diverse mandates, including MiFID II and the Dodd-Frank Act, is paramount for maintaining operational integrity and avoiding significant penalties, which can impact profitability and market trust.

Franklin Resources, like all global financial institutions, must navigate a complex web of data protection and privacy laws. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) impose strict requirements on how the company collects, stores, processes, and uses client data. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher.

To address these legal mandates, Franklin Templeton has implemented robust data governance frameworks. These frameworks are designed to ensure compliance with evolving privacy legislation across its international operations, safeguarding client confidentiality and maintaining trust. This includes establishing clear policies for data handling, consent management, and data breach notification, crucial for operating in a data-sensitive industry.

Franklin Resources, like all financial institutions, faces stringent legal obligations under Anti-Money Laundering (AML) and sanctions laws. These regulations, globally enforced, mandate robust measures to prevent money laundering and terrorist financing. For instance, the Bank Secrecy Act in the United States, and similar legislation worldwide, requires firms to establish and maintain effective AML programs.

To comply, Franklin Templeton implements rigorous Know Your Customer (KYC) procedures. This involves verifying the identity of clients and understanding the nature of their business to assess risk. In 2024, regulatory bodies continue to emphasize the importance of up-to-date KYC data, with fines for non-compliance reaching millions of dollars for breaches in data accuracy and ongoing monitoring.

Furthermore, the firm employs sophisticated transaction monitoring systems. These systems are designed to detect suspicious activities, such as unusual transaction patterns or dealings with sanctioned individuals or entities. The effectiveness of these systems is crucial, as demonstrated by the Financial Crimes Enforcement Network (FinCEN) in the US, which actively uses data from these programs to identify illicit financial flows.

Consumer Protection and Investor Rights

Franklin Templeton operates within a robust legal landscape designed to safeguard consumers and investors. Regulations like the Securities Act of 1933 and the Investment Advisers Act of 1940 in the U.S., and similar frameworks globally, mandate transparent disclosure of fund information, fees, and risks. These laws also emphasize the suitability of investment products for specific client profiles, ensuring that recommendations align with an investor's financial goals and risk tolerance. Furthermore, mechanisms for investor redress are crucial, providing avenues for dispute resolution and compensation when necessary.

Franklin Templeton actively ensures its marketing, sales, and client servicing practices adhere to these stringent consumer protection laws. This includes rigorous review processes for all client communications to guarantee accuracy and prevent misleading statements. The company invests in ongoing training for its employees to stay abreast of evolving regulations and best practices in client engagement. For instance, in 2024, regulatory bodies globally, including the SEC and ESMA, continued to emphasize enhanced disclosures and fee transparency for investment products, a trend Franklin Templeton actively incorporates into its operations to maintain compliance and build client trust.

- Regulatory Compliance: Adherence to global financial regulations, including those from the SEC, FCA, and ESMA, is paramount.

- Disclosure Standards: Maintaining clear and comprehensive disclosures on fund performance, fees, and risks is a legal requirement.

- Suitability Frameworks: Implementing robust processes to ensure investment products are suitable for individual investor needs and risk profiles.

- Redress Mechanisms: Providing accessible channels for investors to raise concerns and seek resolution for grievances.

Cross-Border Regulatory Harmonization and Divergence

Franklin Templeton, operating in over 170 countries, faces a dynamic landscape of cross-border regulatory harmonization and divergence. While efforts like the EU's UCITS framework aim to standardize fund management, significant differences persist in areas such as capital requirements, disclosure mandates, and investor protection rules. This necessitates a robust compliance infrastructure to navigate varying legal frameworks, ensuring adherence to local laws while offering global investment solutions.

The firm must continually adapt to evolving regulations, such as the ongoing implementation of the EU's Digital Operational Resilience Act (DORA), which impacts how financial entities manage IT risks. Similarly, differing data privacy laws, like GDPR in Europe versus other regional regulations, require tailored approaches to data handling. Franklin Templeton's strategy involves close monitoring of regulatory changes and proactive engagement with policymakers to anticipate and manage compliance challenges, thereby minimizing operational risks and maintaining market access.

- Regulatory Divergence Challenges: Varying capital adequacy ratios and differing prospectus requirements across jurisdictions increase operational complexity and compliance costs for Franklin Templeton.

- Harmonization Opportunities: Initiatives like the IOSCO Principles for Investment Management aim to create a more level playing field, potentially reducing regulatory arbitrage and simplifying cross-border fund distribution.

- Compliance Costs: In 2023, global financial institutions reported significant investments in regulatory compliance, with estimates suggesting a continued upward trend driven by new regulations and enforcement actions.

- Navigating Local Laws: Franklin Templeton maintains dedicated legal and compliance teams in key markets to ensure adherence to specific national laws, such as the Securities and Exchange Board of India (SEBI) regulations for its Indian operations.

Franklin Resources must navigate a complex web of international and local legal frameworks, including stringent data protection laws like GDPR and CCPA, with non-compliance potentially leading to substantial fines, such as up to 4% of global annual turnover under GDPR. The company also faces rigorous Anti-Money Laundering (AML) and sanctions regulations globally, necessitating robust Know Your Customer (KYC) procedures and transaction monitoring systems to prevent illicit financial activities. Ensuring transparency and suitability in investment products, as mandated by laws like the Securities Act of 1933, is crucial for client protection and maintaining trust.

| Legal Factor | Impact on Franklin Resources | 2024/2025 Relevance |

| Regulatory Compliance | Adherence to SEC, FCA, ESMA mandates is critical to avoid penalties and maintain operational integrity. | Ongoing enforcement actions and evolving regulations in 2024/2025 necessitate continuous adaptation. |

| Data Privacy Laws | Strict adherence to GDPR, CCPA, etc., impacts data handling, storage, and processing. | Increased scrutiny on data breaches and privacy violations in 2024/2025; fines remain a significant deterrent. |

| AML & Sanctions | Robust KYC and transaction monitoring are essential to prevent financial crime. | Global efforts to combat financial crime continue to intensify, with regulators focusing on the effectiveness of AML/KYC programs in 2024/2025. |

| Consumer Protection | Ensuring disclosure, suitability, and providing redress mechanisms are legal imperatives. | Regulators are emphasizing enhanced disclosures and fee transparency for investment products in 2024/2025. |

Environmental factors

Franklin Resources, like many in the financial sector, navigates significant climate change risks. Physical risks, such as extreme weather events, can directly impact the value of assets held in their portfolios. For instance, a portfolio heavily invested in coastal real estate or agriculture could face substantial losses due to rising sea levels or prolonged droughts, events that have become more frequent and intense globally.

Transition risks are equally important, arising from the shift towards a low-carbon economy. This includes policy changes, technological advancements, and evolving market preferences that could devalue carbon-intensive industries. Franklin Templeton actively assesses these risks by analyzing industry-level exposure and asset-specific vulnerabilities, influencing how they construct investment portfolios to mitigate potential downturns.

Simultaneously, the transition presents opportunities. Franklin Resources identifies investment themes aligned with sustainability and the low-carbon economy, such as renewable energy infrastructure, electric vehicles, and green technology. By integrating climate considerations into their investment research and strategy, they aim to capitalize on growth sectors driven by global decarbonization efforts, aiming for long-term value creation for their clients.

Franklin Resources is experiencing a significant shift in client demand, with both institutional and retail investors increasingly seeking investment products that align with robust Environmental, Social, and Governance (ESG) principles. This trend is reshaping the financial landscape, pushing asset managers to adapt their offerings.

In response, Franklin Templeton is actively developing and promoting ESG-integrated strategies and thematic funds. For instance, by the end of 2024, the firm had a substantial portion of its assets under management (AUM) incorporating ESG considerations, reflecting a strategic pivot to meet these evolving client preferences and navigate growing regulatory mandates across various global markets.

Environmental concerns like water scarcity and resource depletion pose significant risks to global supply chains, impacting companies within Franklin Templeton's investment portfolio. For instance, the increasing frequency of droughts in key agricultural regions, such as California which experienced severe water shortages in 2022-2023, can disrupt food production and affect commodity prices, thereby influencing investment returns.

Franklin Templeton's analysis of corporate sustainability includes evaluating how companies manage and mitigate these environmental risks. This involves assessing their resilience to climate change impacts, their strategies for resource efficiency, and their commitment to responsible sourcing to ensure long-term viability and protect investor capital.

Regulatory Pressure for Green Finance

Franklin Resources faces increasing regulatory pressure to embrace green finance, with jurisdictions worldwide implementing stricter rules for sustainable investing and climate disclosures. For instance, the European Union's Sustainable Finance Disclosure Regulation (SFDR) has significantly impacted how asset managers classify and report on their investment products, requiring detailed information on sustainability risks and impacts. This evolving landscape necessitates Franklin Templeton to adapt its reporting frameworks, refine product classifications, and integrate sustainability considerations into its core investment processes to ensure compliance and meet investor demand for transparent, environmentally conscious options.

The push for green finance is evident in the growing number of regulations and policies designed to promote sustainable investing and climate-related financial disclosures. Many countries are aligning with global initiatives, leading to a more standardized approach to environmental, social, and governance (ESG) reporting. Franklin Templeton, like its peers, must navigate these diverse and often overlapping regulatory requirements, which can influence everything from data collection methodologies to the way investment strategies are communicated to clients. The firm's ability to proactively adapt its reporting, product classifications, and investment processes is crucial for maintaining market trust and competitive positioning in this dynamic sector.

- SFDR Compliance: Franklin Templeton, like other asset managers, is actively adapting its reporting and product classifications to meet the requirements of the EU's Sustainable Finance Disclosure Regulation (SFDR), which came into full effect in March 2021 and continues to evolve.

- Climate-Related Disclosures: The Task Force on Climate-related Financial Disclosures (TCFD) recommendations are increasingly being adopted into mandatory reporting frameworks globally, requiring companies to disclose their climate-related risks and opportunities.

- Product Evolution: Regulatory shifts are driving the development and reclassification of investment products, with a growing emphasis on those demonstrating clear environmental benefits or adhering to specific sustainability criteria.

Corporate Environmental Footprint and Sustainability Reporting

Franklin Resources, like many global corporations, is increasingly focused on its environmental footprint. This includes managing energy consumption in its offices, reducing waste generation, and monitoring carbon emissions. The company is actively working to minimize its operational impact, aligning with broader industry trends towards environmental stewardship and corporate responsibility.

In 2023, Franklin Templeton reported progress on its sustainability initiatives, aiming to integrate environmental considerations into its business practices. The firm is committed to transparency through its sustainability reporting, providing stakeholders with insights into its environmental performance and future reduction targets. This commitment reflects a growing expectation from investors and regulators for demonstrable action on climate change and environmental impact.

Key areas of focus for Franklin Templeton's environmental strategy include:

- Energy Efficiency: Implementing measures to reduce electricity consumption across its global facilities.

- Waste Reduction: Initiatives to minimize waste sent to landfills through recycling and responsible disposal programs.

- Carbon Emissions: Tracking and working to lower greenhouse gas emissions associated with its operations.

- Sustainable Procurement: Considering environmental factors when selecting vendors and managing its supply chain.

Franklin Resources, like many in the financial sector, must contend with the increasing prevalence of extreme weather events, which can negatively impact asset values within their portfolios. The firm is also navigating transition risks associated with the global shift towards a low-carbon economy, which may devalue carbon-intensive industries. These environmental factors are driving demand for ESG-integrated strategies, with a significant portion of Franklin Templeton's AUM incorporating ESG considerations by the close of 2024.

Water scarcity and resource depletion present tangible risks to supply chains, potentially affecting companies held by Franklin Templeton. For example, droughts in key agricultural regions can disrupt production and influence commodity prices, impacting investment returns. The firm actively assesses how companies manage these environmental risks to ensure long-term viability and protect investor capital.

Regulatory pressures are mounting for green finance, with frameworks like the EU's SFDR requiring detailed disclosures on sustainability risks and impacts. Franklin Templeton is adapting its reporting, product classifications, and investment processes to comply with these evolving global regulations and meet investor demand for transparent, environmentally conscious options.

Franklin Templeton is committed to reducing its operational environmental footprint, focusing on energy efficiency, waste reduction, and carbon emissions. In 2023, the firm reported progress on its sustainability initiatives, demonstrating a commitment to environmental stewardship and transparency in its sustainability reporting, including future reduction targets.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Franklin Resources is built upon a robust foundation of data from reputable financial news outlets, economic forecasting agencies, and regulatory bodies. We integrate insights from government publications and industry-specific reports to ensure a comprehensive understanding of the macro-environment.