Fortum SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortum Bundle

Fortum's strategic position is defined by its strong renewable energy portfolio, a key strength in a rapidly evolving energy market. However, navigating the complexities of regulatory changes and the capital-intensive nature of its operations presents significant challenges.

Want the full story behind Fortum's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fortum's strength lies in its remarkably clean energy generation, with a staggering 99% of its electricity production in 2024 originating from CO2-free sources like renewables and nuclear power. This commitment makes it a standout player in Europe's energy landscape.

The company's diverse portfolio, encompassing hydropower, nuclear, and an increasing presence in wind and solar, solidifies its position as a leader in the ongoing energy transition, offering a stable and sustainable energy supply.

Fortum's financial strength is a significant advantage. In Q1 2025, the company reported a low financial net debt and robust cash flow from operations, showcasing its solid financial footing. This healthy financial position allows Fortum to pursue its strategic goals with confidence and weather economic uncertainties effectively.

Fortum demonstrates a robust commitment to decarbonization, with Science Based Targets initiative (SBTi)-validated goals. The company aims for net-zero greenhouse gas emissions across its entire value chain by 2040, a significant undertaking in the energy sector.

A key milestone in this strategy is Fortum's planned exit from all coal-based generation by the end of 2027. This proactive move away from fossil fuels underscores their dedication to a sustainable energy future and aligns with increasing global climate action mandates.

This strong emphasis on sustainability not only addresses environmental concerns but also bolsters Fortum's brand reputation and long-term resilience in an evolving energy landscape. Investors and stakeholders are increasingly prioritizing companies with clear, actionable climate strategies.

Expertise in Power Generation Optimization

Fortum excels in optimizing its diverse low-carbon energy portfolio, consistently achieving strong power prices even when Nordic spot prices are subdued. This operational prowess in generation and trading enables the company to effectively navigate market volatility and capture a significant optimization premium.

For instance, in 2024, Fortum's strategic asset management and trading capabilities contributed to an optimization premium that bolstered its earnings. The company's ability to leverage its flexible generation assets, including nuclear and hydro power, allows it to respond swiftly to market demand fluctuations.

- Versatile Low-Carbon Fleet: Fortum operates a balanced mix of nuclear, hydro, and wind power, providing flexibility and resilience.

- Trading Expertise: The company's sophisticated trading operations enhance revenue by capitalizing on price differentials.

- Optimization Premium: In 2024, Fortum's operational efficiency translated into a notable optimization premium, outperforming market benchmarks.

- Nordic Market Strength: Fortum maintains a strong position in the Nordic power market, leveraging its generation capacity and trading acumen.

Strategic Focus on Nordic Markets and Industrial Decarbonization

Fortum's strategic emphasis on Nordic markets and industrial decarbonization is a key strength. The company is well-positioned to capitalize on the increasing demand for clean energy solutions within its core operating regions.

This focus allows Fortum to leverage its existing infrastructure and expertise to partner with industrial clients on their sustainability journeys. For instance, in 2024, Fortum announced several initiatives aimed at supporting industrial customers in reducing their emissions, including advanced energy efficiency projects and the development of new low-carbon solutions.

- Nordic Market Leadership: Fortum holds a significant share of the Nordic electricity market, providing a stable base for growth.

- Industrial Decarbonization Expertise: The company is developing and implementing solutions for sectors like pulp and paper, and metals, which are crucial for Nordic economies.

- Partnership Approach: Fortum actively collaborates with industrial players to co-create decarbonization pathways, as seen in its ongoing projects with major Nordic industrial groups.

- Regulatory Tailwinds: The strong political and societal commitment to climate action in the Nordic countries creates a favorable environment for Fortum's strategic direction.

Fortum's clean energy generation is a primary strength, with 99% of its 2024 electricity production coming from CO2-free sources like renewables and nuclear power, positioning it as a leader in Europe's energy transition.

The company's diverse portfolio, including hydropower, nuclear, and growing wind and solar assets, ensures a stable and sustainable energy supply. This diversification is further bolstered by strong financial health, evidenced by low financial net debt and robust cash flow from operations in Q1 2025, enabling strategic growth and resilience.

Fortum's commitment to decarbonization is underscored by SBTi-validated goals to reach net-zero emissions by 2040 and its planned exit from all coal-based generation by the end of 2027, enhancing its brand reputation and long-term market viability.

Operational excellence in managing its low-carbon fleet and sophisticated trading operations allow Fortum to achieve strong power prices and an optimization premium, as seen in 2024, effectively navigating market volatility.

| Metric | 2024 Data | Q1 2025 Data |

|---|---|---|

| CO2-Free Electricity Production | 99% | N/A |

| Financial Net Debt | Low | Low |

| Cash Flow from Operations | Robust | Robust |

| Coal Exit Target | By end of 2027 | N/A |

| Net-Zero Emissions Target | By 2040 | N/A |

What is included in the product

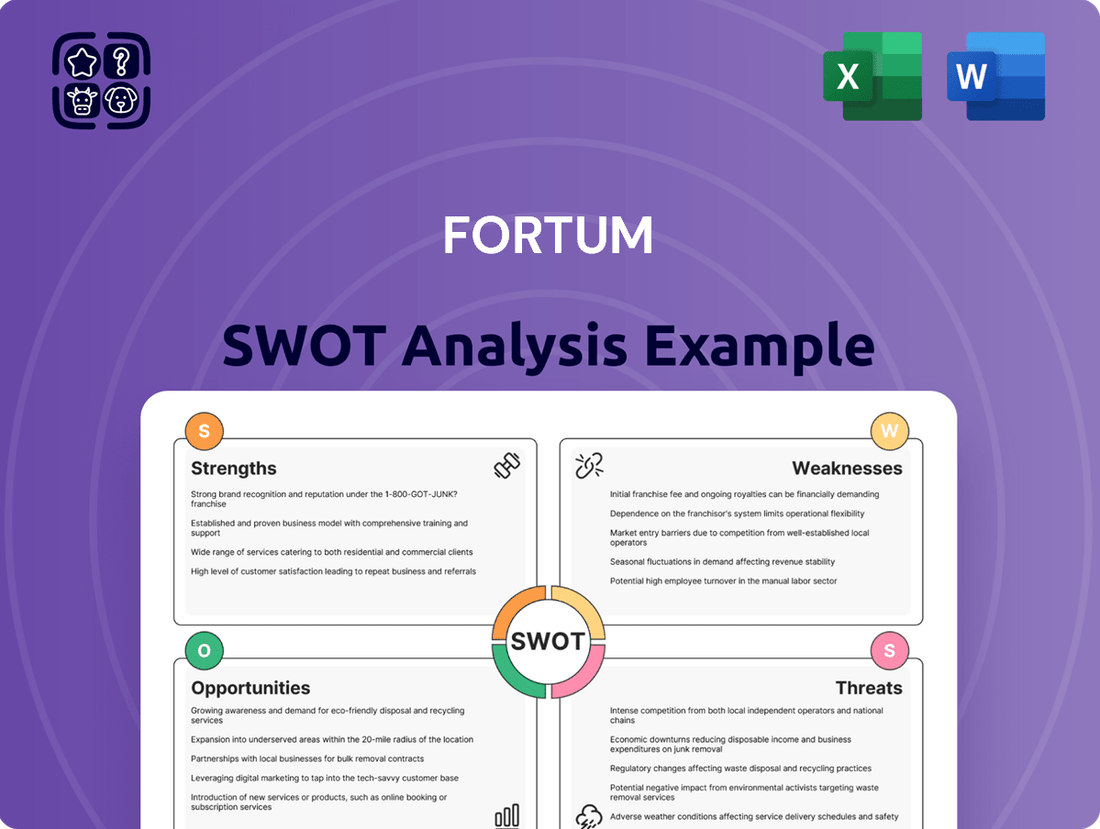

Analyzes Fortum’s competitive position through key internal and external factors, highlighting its strengths in clean energy and operational efficiency while acknowledging weaknesses in its Russian exposure and opportunities in market expansion and sustainability initiatives, alongside threats from regulatory changes and geopolitical instability.

Offers a clear, structured framework to identify and address Fortum's strategic challenges, transforming potential weaknesses into actionable opportunities.

Weaknesses

Fortum faces significant vulnerability due to the inherent volatility of Nordic spot power prices and fluctuating volumes. Even with advanced optimization strategies, this market unpredictability directly impacts financial results. For instance, Q1 2025 saw a notable dip in both sales and operating profit, underscoring the challenge to revenue stability posed by these price swings.

Fortum's Q1 2025 feasibility study revealed a significant hurdle: new nuclear projects in Finland and Sweden are not economically viable on a merchant basis alone, given current power market forecasts. This finding directly impacts the company's ability to expand its CO2-free generation capacity through this avenue without considerable government backing.

Fortum's reliance on hydropower and nuclear energy, while a core strength, also presents a significant weakness. For instance, in the first quarter of 2025, the company's hydro generation fell below its historical average, and nuclear output was hampered by planned and unplanned outages.

This demonstrates a vulnerability to factors influencing these large-scale, capital-intensive assets. Such disruptions can directly impact energy production and, consequently, the company's financial performance.

Declining Revenue Forecasts

Analyst projections for Fortum in 2025 point towards a significant downturn in revenue, signaling persistent difficulties in expanding sales even as the company navigates strategic changes. This anticipated revenue decline suggests that Fortum may face unfavorable market dynamics or intensified competition that could suppress its top-line performance.

Specifically, consensus revenue forecasts for Fortum in 2025 have been revised downwards. For instance, some analysts have adjusted their 2025 revenue estimates to approximately €8.5 billion, a notable decrease from earlier expectations. This downward revision underscores the market's current sentiment regarding the company's near-term revenue-generating capacity.

- Revenue Decline: Analyst consensus for Fortum's 2025 revenue has been revised downwards, with some projections now around €8.5 billion.

- Market Headwinds: This trend suggests ongoing challenges in achieving revenue growth due to potential market conditions or competitive pressures.

- Strategic Impact: The declining forecasts may indicate that recent strategic shifts have not yet translated into improved top-line performance.

Geopolitical and Regulatory Uncertainties

The energy sector, including Fortum's operations, faces significant headwinds from escalating geopolitical tensions and evolving regulatory frameworks. These global dynamics directly impact commodity prices, investor confidence, and the operational environment, necessitating constant strategic adjustments.

For instance, the ongoing conflict in Ukraine and its ripple effects on European energy supply chains have underscored the volatility inherent in the sector. Fortum, with its substantial presence in the Nordic region and exposure to the Russian market prior to 2022, has navigated significant shifts in energy policy and market access. The company's strategic decisions are increasingly shaped by sanctions, trade restrictions, and the push for energy independence across various nations.

- Geopolitical Instability: Conflicts and international relations directly affect energy supply routes and pricing, as seen with the impact of the Ukraine war on natural gas markets in 2022-2023, which saw significant price spikes and supply disruptions across Europe.

- Regulatory Shifts: Governments are implementing stricter environmental regulations and energy security policies, which can increase operational costs and require substantial capital investment for compliance and adaptation. For example, the EU's REPowerEU plan aims to accelerate the green transition, imposing new standards on energy producers.

- Market Access and Sanctions: Fortum's past operations in Russia meant exposure to sanctions and regulatory changes that impacted its asset divestments and overall market strategy, highlighting the risks of operating in politically sensitive regions.

Fortum's profitability is heavily influenced by the volatile Nordic spot power prices, which can lead to unpredictable financial results. For example, Q1 2025 earnings were impacted by these price fluctuations, demonstrating a weakness in revenue stability despite optimization efforts.

The economic viability of new nuclear projects in Finland and Sweden, as highlighted in a Q1 2025 feasibility study, is a concern, as they are not profitable on a merchant basis alone, requiring potential government support for expansion.

Reliance on hydropower and nuclear energy, while a strength, also presents a vulnerability. In Q1 2025, lower hydro generation and outages in nuclear facilities directly impacted Fortum's energy output and financial performance.

Analyst consensus for Fortum's 2025 revenue has been revised downwards to approximately €8.5 billion, indicating ongoing challenges in sales growth due to market dynamics or increased competition.

What You See Is What You Get

Fortum SWOT Analysis

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Fortum SWOT Analysis.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Fortum's strategic position.

You’re viewing a live preview of the actual SWOT analysis file for Fortum. The complete version, detailing all strengths, weaknesses, opportunities, and threats, becomes available after checkout.

Opportunities

The Nordic region's energy landscape is poised for significant growth, with electricity consumption expected to rise steadily in the mid-to-long term. This upward trend is largely fueled by industrial sectors actively pursuing decarbonization strategies and the rapid expansion of energy-intensive industries like data centers.

This shift towards electrification and clean energy solutions presents a compelling, multi-decade opportunity for Fortum. The company's focus on renewable energy generation and its established infrastructure position it favorably to capitalize on this expanding demand for sustainable power sources.

Fortum is strategically growing its renewable energy capacity, evidenced by its substantial acquisitions of wind power projects in Finland during 2025. This proactive approach is designed to bolster its portfolio, targeting an impressive 8 GW of onshore wind and solar projects by the close of 2026.

This aggressive expansion directly supports ambitious Nordic climate objectives and firmly establishes Fortum as a key player poised for significant future growth within the rapidly evolving sustainable energy sector.

Fortum is actively investigating opportunities in green hydrogen and small modular reactors (SMRs), collaborating with both industrial clients and strategic partners. These nascent technologies represent significant avenues for future expansion and enhanced decarbonization efforts, directly supporting Fortum's overarching long-term strategic objectives.

Strategic Partnerships and Waste Heat Utilization

Fortum is actively pursuing strategic partnerships to unlock new growth avenues. A prime example is their collaboration with P2X Solutions, focusing on green hydrogen production, a sector poised for significant expansion. This move aligns with the growing global demand for sustainable energy carriers.

Furthermore, Fortum is exploring innovative ways to enhance resource efficiency, including the recovery of waste heat from data centers. This initiative not only addresses environmental concerns but also presents a tangible opportunity to generate additional revenue streams by repurposing what would otherwise be lost energy.

- Strategic Partnership: Agreement with P2X Solutions for green hydrogen production.

- Resource Efficiency: Exploring waste heat recovery from data centers.

- Revenue Streams: New income generation through these innovative collaborations.

- Market Trends: Capitalizing on the increasing demand for sustainable energy solutions.

Optimizing Existing Assets and Digitalization

Fortum is actively working to enhance the performance of its existing energy assets, such as its hydro and nuclear power plants. The goal is to ensure these operations are as efficient and adaptable as possible to meet fluctuating energy demands. For instance, in 2023, Fortum reported that its power generation segment, which includes these assets, contributed significantly to its financial results, demonstrating the ongoing value of these investments.

The company is also embracing digitalization and advanced operating methods to boost its profitability and market responsiveness. A prime example is the Kalla Hydrogen Pilot Plant, which showcases how new technologies can improve operational effectiveness. This focus on digital transformation is crucial in an evolving energy landscape, allowing Fortum to better adapt to market shifts and capitalize on new opportunities.

- Asset Optimization: Fortum targets peak efficiency and flexibility from its hydro and nuclear power generation.

- Digitalization Drive: Implementing advanced operational models and digital solutions to improve performance.

- Kalla Hydrogen Pilot Plant: A concrete example of innovation enhancing profitability and responsiveness.

- Market Adaptability: Digital tools enable quicker reactions to changing market conditions and opportunities.

Fortum's strategic expansion into renewable energy, particularly onshore wind and solar, is a significant opportunity, with a target of 8 GW by the end of 2026. The company is also exploring emerging technologies like green hydrogen and small modular reactors, forging partnerships such as the one with P2X Solutions to tap into these growing markets. Furthermore, initiatives like waste heat recovery from data centers and optimizing existing hydro and nuclear assets through digitalization offer new revenue streams and improved operational efficiency.

| Opportunity Area | Description | Key Initiatives/Partnerships | Target/Impact | 2024/2025 Data/Projections |

|---|---|---|---|---|

| Renewable Energy Expansion | Increasing generation capacity in wind and solar. | Acquisition of wind power projects in Finland. | Target of 8 GW onshore wind and solar by end of 2026. | Continued investment in new projects throughout 2024-2025. |

| Emerging Technologies | Developing and integrating new clean energy solutions. | Green hydrogen production with P2X Solutions; exploration of SMRs. | Establishing Fortum as a leader in future energy markets. | Active R&D and pilot projects in 2024-2025. |

| Resource Efficiency & Circularity | Maximizing value from existing operations and waste streams. | Waste heat recovery from data centers; asset optimization. | Creating new revenue streams and reducing environmental impact. | Pilot projects for waste heat recovery ongoing; asset performance improvements targeted. |

Threats

Fortum navigates a fiercely competitive energy sector, challenged by established utilities and agile renewable energy developers. This dynamic environment means constant pressure on pricing strategies and the need to defend market share against a growing number of players. For instance, by the end of 2024, the European renewable energy market is projected to see significant growth, with new installations potentially reaching over 50 GW, intensifying the competitive pressure on all participants, including Fortum.

Fortum faces significant risks from evolving energy policies and regulations. For instance, shifts in government subsidies for decarbonization projects, especially those not immediately economically viable, could directly affect Fortum's strategic investment choices and overall profitability. This sensitivity is particularly evident in the company's assessment of new nuclear power, where economic viability on a merchant basis is a key consideration.

Ongoing geopolitical tensions, such as the conflict in Ukraine, continue to create significant uncertainty in the global energy market. This instability can disrupt supply chains and impact energy prices, directly affecting Fortum's operating costs and revenue streams.

A weaker economic outlook, marked by elevated inflation and interest rates through 2024 and into 2025, dampens investment sentiment. This makes securing financing for new renewable energy projects more challenging and can reduce overall power demand from industrial and commercial customers.

For instance, the European Central Bank's continued cautious approach to interest rate cuts in early 2025, following a period of high inflation, signals a sustained higher cost of capital. This directly impacts the economic viability of large-scale, capital-intensive projects that Fortum undertakes.

Challenges in Project Development and Permitting

Fortum faces hurdles in advancing its substantial renewable energy project pipeline. The process of achieving ready-to-build status and obtaining essential permits is often protracted and intricate, posing a significant challenge.

Delays encountered during project development, whether due to regulatory complexities or unforeseen site-specific issues, can directly impede Fortum's ability to meet its ambitious growth objectives. For instance, as of early 2024, the European Union's permitting processes for renewable energy projects can extend for several years, impacting the deployment speed of new capacity.

- Permitting Timelines: Average permitting durations for large-scale renewable projects in key European markets can range from 2 to 5 years.

- Regulatory Uncertainty: Evolving environmental regulations and local planning laws can introduce unexpected complexities and delays.

- Supply Chain Bottlenecks: Securing necessary components and specialized labor for construction can be subject to global supply chain disruptions, further impacting project timelines.

Cybersecurity Risks and Infrastructure Vulnerabilities

As a critical energy infrastructure provider, Fortum is exposed to significant cybersecurity risks. Attacks targeting operational technology (OT) systems could lead to widespread disruptions, impacting energy supply and causing substantial financial losses. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, highlighting the escalating threat landscape for all critical infrastructure.

Vulnerabilities in Fortum's extensive network of power plants, grids, and digital control systems present a constant challenge. A successful cyberattack could compromise grid stability, affect energy generation, and damage sensitive data. The energy sector is a prime target for state-sponsored actors and sophisticated criminal groups seeking to cause maximum disruption.

- Cybersecurity threats pose a direct risk to Fortum's operational continuity and financial stability.

- Vulnerabilities in operational technology systems are a key concern for energy infrastructure providers.

- The global cost of cybercrime is expected to reach $10.5 trillion annually by 2025, underscoring the pervasive nature of these risks.

- Disruptions from cyberattacks can have severe consequences for energy supply and the broader economy.

Fortum faces significant competition from established utilities and new renewable energy entrants, putting pressure on pricing and market share. The European renewable market is expected to add over 50 GW of capacity by the end of 2024, intensifying this competition.

Evolving energy policies and regulatory shifts, including changes in decarbonization subsidies, pose a risk to Fortum's investment strategies and profitability. For example, the economic viability of new nuclear power projects is highly sensitive to such policy changes.

Geopolitical instability, like the conflict in Ukraine, creates market uncertainty, disrupting supply chains and impacting energy prices, which directly affects Fortum's operating costs and revenues.

A challenging economic outlook, characterized by high inflation and interest rates through 2024-2025, dampens investment and can reduce power demand. The European Central Bank's cautious stance on interest rate cuts in early 2025 signals a sustained higher cost of capital for projects.

Fortum's renewable project pipeline faces delays due to complex permitting processes, which can take 2-5 years in key European markets, impacting growth objectives. Supply chain bottlenecks for components and labor also contribute to these delays.

Cybersecurity threats are a major risk, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025. Attacks on operational technology systems could disrupt energy supply and cause significant financial losses.

SWOT Analysis Data Sources

This Fortum SWOT analysis is built upon a robust foundation of data, including their official financial reports, comprehensive market intelligence from industry analysts, and expert opinions from energy sector specialists to provide a well-rounded strategic perspective.