Fortum Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortum Bundle

This glimpse into Fortum's strategic positioning highlights key areas for growth and potential challenges. Understand exactly which segments are fueling Fortum's success and which require careful consideration. Purchase the full BCG Matrix for a comprehensive analysis and actionable insights to drive your own business strategy.

Stars

Fortum is significantly bolstering its onshore wind and solar development, aiming for at least 800 MW of ready-to-build projects by the end of 2026. This ambitious growth is fueled by a substantial acquisition of a 4.4 GW wind power portfolio in Finland, slated for completion in Q4 2025, which will expand its total Nordic pipeline to around 8 GW.

This strategic push into renewables is perfectly timed with the booming demand for clean energy across the Nordics, a direct consequence of the ongoing energy transition. Fortum's expansion directly addresses this high-growth market, positioning the company to capitalize on the increasing need for sustainable power solutions.

Fortum is actively forging partnerships with industrial clients to co-create innovative clean power generation solutions. This strategic focus targets the burgeoning industrial decarbonization sector, a critical area demanding substantial and dependable clean electricity. By leveraging its robust clean power generation capabilities in the Nordic region, Fortum is well-positioned to deliver bespoke solutions for energy-intensive industries.

Fortum's strength lies in optimizing its low-carbon power generation, especially hydro and nuclear assets. This allows them to capture a significant optimization premium, a crucial advantage in fluctuating energy markets. In 2024, Fortum continued to leverage this expertise to ensure efficient and flexible energy delivery, bolstering its market position.

Green Finance Framework Initiatives

Fortum's Green Finance Framework, established to channel capital towards sustainable projects, saw its first utilization with a green loan signed in June 2024. This move is significant as it aligns Fortum with the burgeoning market for green investments, aiming to attract capital specifically for its clean energy expansion plans.

This strategic framework directly supports Fortum's ambitious climate targets and underpins its future growth initiatives. By actively engaging in green financing, Fortum reinforces its commitment to sustainability and positions itself favorably within the evolving financial landscape.

- Green Loan Utilization: Fortum signed its inaugural green loan in June 2024, marking a key step in its green finance strategy.

- Capital Attraction: The framework is designed to attract capital for Fortum's clean energy investments, tapping into the growing demand for sustainable finance.

- Sustainable Financing Commitment: This initiative underscores Fortum's dedication to sustainable financing practices in a rapidly expanding green investment market.

- Support for Targets: The framework is instrumental in supporting Fortum's stated climate targets and its broader growth objectives.

Nordic Clean Energy Leadership

Fortum is cementing its status as a Nordic clean energy powerhouse, with a remarkable 99% of its power generation being CO2-free as of 2024. This high level of emissions-free generation is a significant advantage in a region actively pursuing decarbonization goals.

This leadership in the Nordic clean energy sector positions Fortum favorably within the BCG Matrix, likely classifying it as a Star. The company's strategic emphasis on this market allows it to leverage growing demand and supportive governmental policies for renewable energy sources.

- Nordic Market Dominance: Fortum's 99% CO2-free power generation in 2024 highlights its strong operational sustainability.

- Strategic Focus: The company's commitment to the Nordic region allows it to benefit from favorable market conditions and policy incentives.

- Energy Transition Leader: Fortum is well-positioned to capitalize on the ongoing shift towards cleaner energy sources in the Nordics.

Fortum's significant investment in onshore wind and solar, aiming for 800 MW of ready-to-build projects by the end of 2026, alongside a 4.4 GW wind power portfolio acquisition, firmly places its renewable energy segment as a Star in the BCG Matrix. This strategic expansion is driven by the robust demand for clean energy in the Nordics, a market experiencing rapid growth due to the energy transition. Fortum's ability to generate 99% CO2-free power in 2024 underscores its strong position in this high-growth, high-market-share quadrant.

| BCG Matrix Quadrant | Fortum's Renewable Segment Characteristics | Supporting Data (2024/2025) |

|---|---|---|

| Stars | High Market Growth, High Market Share | Nordic clean energy market experiencing strong growth due to energy transition. |

| Ambitious renewable development targets (800 MW ready-to-build by end of 2026). | Acquisition of 4.4 GW wind power portfolio slated for Q4 2025 completion. | |

| Dominant position with 99% CO2-free power generation in 2024. | Strategic focus on Nordic region, leveraging supportive policies and demand. |

What is included in the product

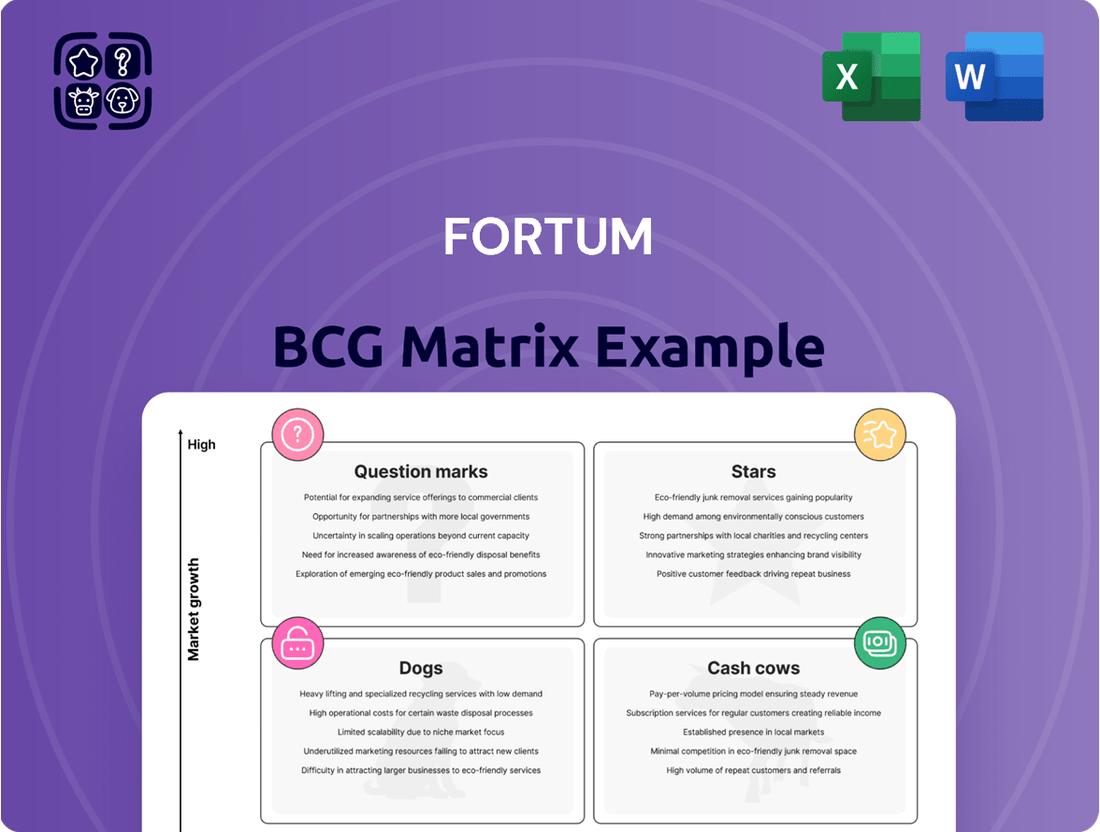

The Fortum BCG Matrix categorizes business units by market growth and share, guiding investment decisions.

A clear, visual Fortum BCG Matrix analysis simplifies complex portfolio decisions, relieving the pain of strategic uncertainty.

Cash Cows

Fortum's 4.7 GW of Nordic hydropower assets are a prime example of a Cash Cow. This mature business generates substantial, consistent cash flow with remarkably low operating costs, thanks to its established infrastructure and efficient operations.

In 2023, Fortum reported that its hydropower segment played a vital role in its overall energy generation, contributing significantly to its financial stability. The inherent predictability of hydropower revenue, coupled with its CO2-free nature, makes it a reliable performer, offering crucial flexibility and optimization to the Nordic energy market.

The Loviisa nuclear power plant, a wholly owned and operated asset by Fortum, is a significant contributor to Finland's energy landscape, supplying over 10% of the nation's electricity. Its operational license has been extended until 2050, underscoring its long-term viability.

This facility represents a stable, high-capacity, and carbon-free energy source within a well-established market. It consistently generates substantial revenue, positioning it as a classic cash cow for Fortum.

Fortum's strategic focus for Loviisa is on maintaining and enhancing its existing infrastructure through lifetime extensions and modernization, rather than pursuing expansion into new growth areas.

Fortum's Nordic electricity retail business is a prime example of a Cash Cow. With 2.1 million customers, it's the largest player in the region, a position bolstered by the 2023 acquisition of Telge Energi AB in Sweden.

This segment thrives in a mature market characterized by stable electricity demand, generating reliable and substantial revenue streams that significantly contribute to Fortum's profitability.

District Heating and Cooling Operations

Fortum's district heating and cooling operations in Finland and Poland represent a significant Cash Cow. These established businesses generated 4.1 TWh of heat in 2024, a testament to their scale and market penetration.

The demand in these mature markets is consistently steady, ensuring a reliable and predictable cash flow for the company. This stability is a hallmark of a Cash Cow, providing a strong foundation for Fortum's overall financial performance.

- Established Market Presence: Fortum's district heating and cooling businesses in Finland and Poland are mature and well-recognized.

- Significant Output: In 2024, these operations produced 4.1 TWh of heat, demonstrating substantial capacity and market share.

- Steady Demand and Cash Flow: The mature nature of the markets ensures consistent demand, leading to reliable cash flow generation.

- Decarbonization Efforts: While undergoing decarbonization, the core business remains a stable and dependable contributor to Fortum's financials.

Established Power Sales and Trading

Fortum's established power sales and trading operations are a significant cash cow, leveraging sophisticated hedging strategies to optimize its generation portfolio and secure advantageous power prices. This capability provides a crucial buffer against market volatility, ensuring consistent income generation.

The company's adeptness in managing market risks directly tied to its outright generation further solidifies its robust cash-generating capacity. This strategic advantage allows Fortum to maintain profitability even when energy markets experience fluctuations.

- Optimized Generation Portfolio: Fortum's trading arm effectively manages the output from its diverse generation assets, maximizing revenue.

- Hedging Expertise: Advanced hedging techniques protect against adverse price movements, securing predictable income.

- Market Risk Mitigation: Proactive management of market risks associated with power generation enhances financial stability.

- Stable Income Streams: These operations consistently contribute to Fortum's cash flow, even during periods of market uncertainty.

Fortum's Nordic hydropower and Loviisa nuclear power plant are classic cash cows, generating stable, predictable cash flow with low operating costs due to mature, established infrastructure. These assets, along with its large Nordic electricity retail business, contribute significantly to Fortum's profitability and financial stability, even as the company focuses on decarbonization efforts in its district heating segment.

| Business Segment | Key Characteristics | 2024 Data/Notes | BCG Category |

| Nordic Hydropower | Mature, low operating costs, CO2-free | 4.7 GW capacity; vital for Nordic energy market stability | Cash Cow |

| Loviisa Nuclear Power | Stable, high-capacity, carbon-free | Supplies over 10% of Finland's electricity; license extended to 2050 | Cash Cow |

| Nordic Electricity Retail | Large customer base, mature market | 2.1 million customers; largest player in the region | Cash Cow |

| District Heating & Cooling (Finland/Poland) | Established, steady demand | 4.1 TWh of heat generated in 2024; focus on decarbonization | Cash Cow |

| Power Sales & Trading | Hedging expertise, market risk mitigation | Optimizes generation portfolio, secures prices, provides stable income | Cash Cow |

Full Transparency, Always

Fortum BCG Matrix

The Fortum BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This means you can confidently assess the strategic insights and professional formatting, knowing the final version will be identical and ready for your immediate use in business planning and analysis.

Dogs

Fortum's recycling and waste business, once a part of its diversified portfolio, was divested in November 2024 to Summa Equity for approximately EUR 800 million. This strategic move signals that the company viewed this segment as non-core to its evolving focus on Nordic clean energy solutions. The substantial divestment value indicates a profitable operation, yet its alignment with Fortum's long-term vision for sustainable energy generation was deemed insufficient.

Fortum's divestment of its 185 MW Indian solar power portfolio in 2024 marked a significant strategic realignment. This move, part of a larger effort to sharpen its focus on European markets, suggests that these Indian solar assets, despite the global growth in solar energy, did not align with Fortum's core Nordic strategy or meet its profitability expectations within that new framework.

Fortum's strategic divestment of its turbine and generator services business in Q4 2024 signals a clear shift away from non-core assets. This move, impacting operations in Finland, Sweden, and Germany, underscores the company's commitment to sharpening its focus on clean energy and decarbonization efforts specifically within the Nordic region. The sale aligns with Fortum's broader strategy to concentrate resources on its core strengths and future growth areas.

Biobased Solutions Businesses

Biobased Solutions businesses, previously housed within Fortum's Circular Solutions segment, were earmarked for divestment as part of a broader strategic realignment. This move indicated a low strategic fit or limited market traction within Fortum's evolving core operations.

The planned exit from these biobased ventures underscores a strategic pivot, suggesting these operations did not align with Fortum's future growth objectives or competitive positioning. For instance, in 2023, Fortum reported that its Circular Solutions segment, which included these biobased activities, generated revenues of €331 million, but the specific contribution of biobased solutions was not separately detailed, highlighting their non-core status.

- Strategic Review and Divestment: Fortum announced in 2024 its intention to divest its biobased solutions businesses, signaling a shift away from these operations.

- Non-Core Asset Classification: These businesses were categorized as non-core, indicating they were not central to Fortum's long-term strategic vision.

- Low Market Share/Alignment: Their planned exit suggests they either held a minor market share or lacked strong strategic alignment with Fortum's refocused portfolio.

Russian Operations

Fortum's Russian operations are now classified as a divested business. The company completed its exit from Russia in May 2022, a move that led to the deconsolidation and full write-down of these assets in 2023. This strategic decision was driven by geopolitical factors, marking a complete cessation of business activities in the region.

The financial impact of this exit is significant. Fortum initiated legal action to recover intercompany loans, underscoring the finality of the divestment and the associated financial write-off. This action confirms the company's definitive withdrawal from a market that became unviable due to the evolving geopolitical landscape.

- Divestment Completion: May 2022

- Asset Deconsolidation & Write-down: 2023

- Reason for Exit: Geopolitical factors

- Legal Action: Recovery of intercompany loans

Fortum's strategic pivot in 2024 saw the divestment of several business units, including its recycling and waste operations for approximately EUR 800 million, its Indian solar portfolio, and its turbine and generator services. These actions clearly classify these segments as 'Dogs' within a BCG matrix framework, indicating low market share and low growth potential in relation to Fortum's core strategy.

The company's exit from biobased solutions further reinforces this classification, as these ventures were deemed non-core with limited strategic alignment. Fortum's complete withdrawal from Russia in 2022, finalized with a full asset write-down in 2023 due to geopolitical factors, also places these former operations in the 'Dog' category.

These divestments collectively highlight Fortum's deliberate strategy to concentrate on its core Nordic clean energy and decarbonization initiatives, shedding assets that did not contribute significantly to its future growth or market position in these targeted areas.

Question Marks

Fortum's exploration into new nuclear power projects in Finland and Sweden, detailed in a two-year feasibility study, concluded that such ventures are not currently economically viable solely on a merchant basis. This suggests a low current market share for new builds and significant investment uncertainty.

Despite these immediate economic hurdles, Fortum is actively cultivating its nuclear expertise, positioning it as a strategic long-term option. This forward-looking approach acknowledges the high potential for future growth in nuclear energy, particularly as demand for reliable, low-carbon power increases.

The company's commitment to developing nuclear capabilities, even with current market limitations, places new nuclear projects in a position of high potential but also high uncertainty within the Fortum BCG Matrix. This reflects the substantial upfront capital required and the long lead times associated with nuclear development, alongside evolving regulatory landscapes and public perception.

Fortum is actively exploring opportunities in the clean hydrogen market, focusing on the Nordic region and collaborating with industrial partners. This sector is poised for significant growth and offers substantial decarbonization benefits. For instance, the European Union aims to produce 10 million tonnes of renewable hydrogen by 2030, a target that underscores the market's potential.

Currently, Fortum's engagement in clean hydrogen is in its initial study and validation stages. This means the company has a minimal current market share in this nascent industry. However, scaling up production will necessitate considerable investment, reflecting the high capital expenditure typical of emerging energy technologies.

Fortum's exploration into pumped-storage hydropower in Sweden positions it as a potential future growth area within the energy sector. This initiative directly addresses the increasing need for energy storage and flexibility, vital for incorporating variable renewable sources like wind and solar into the grid. The global pumped-storage hydropower market was valued at approximately $120 billion in 2023 and is projected to grow significantly, driven by renewable energy integration needs.

Battery Recycling Business

Fortum's battery recycling business is currently positioned as a question mark in its BCG Matrix. While the company has divested other Circular Solutions segments, this particular business remains under strategic review. This indicates uncertainty about its future role within Fortum's broader strategy.

The battery recycling market itself is experiencing significant growth, fueled by the rapid expansion of electric vehicles and the increasing demand for energy storage solutions. For instance, the global electric vehicle battery recycling market was valued at approximately USD 1.8 billion in 2023 and is projected to reach USD 15.7 billion by 2030, growing at a CAGR of 37.1% during this period. This strong market potential suggests a "question mark" due to the high growth, but Fortum is still assessing its profitability and strategic alignment.

- High Market Growth: Driven by EV adoption and energy storage needs.

- Strategic Review: Fortum is evaluating its fit and profitability.

- Uncertainty: The business's future role within Fortum is still being determined.

- Potential for Investment: If deemed strategically valuable, it could become a star.

UK-based Waste-to-Energy Business

Fortum's UK-based waste-to-energy operations are currently categorized within its Circular Solutions segment, which is undergoing strategic review, similar to its battery recycling efforts. This suggests a potential "Question Mark" position in the BCG matrix, signifying a high-growth market where Fortum's investment and commitment are currently uncertain or low.

The waste-to-energy sector in the UK is indeed experiencing growth, driven by increasing environmental regulations and the push towards a circular economy. For instance, the UK government has set ambitious targets for waste reduction and recycling, indirectly bolstering the need for efficient waste management solutions like waste-to-energy.

- Market Growth: The UK waste management market, including waste-to-energy, is projected to grow steadily, with increasing volumes of municipal and industrial waste requiring treatment.

- Regulatory Environment: Stricter environmental policies and landfill diversion targets by the UK government create opportunities for waste-to-energy facilities.

- Fortum's Position: Despite the market's potential, Fortum's strategic review indicates a lack of decisive commitment to expanding its market share in this specific UK business, placing it in a Question Mark category.

- Future Uncertainty: The future of these UK waste-to-energy assets within Fortum's portfolio remains undecided, pending the outcome of the strategic review.

Fortum's ventures in new nuclear power projects and clean hydrogen are currently in nascent stages, characterized by significant investment needs and uncertain market positions. These areas represent high growth potential but also considerable risk, fitting the "Question Mark" profile in the BCG Matrix.

The company's strategic review of its UK waste-to-energy operations and its battery recycling business also places them in this category. While the markets for these activities are growing, Fortum's commitment and future role are still under evaluation.

These "Question Mark" businesses require careful analysis to determine if they can transition into "Stars" through increased investment and market penetration, or if they should be divested.

Fortum's strategic assessment of its battery recycling business highlights its position as a Question Mark. The global electric vehicle battery recycling market is projected to grow from approximately USD 1.8 billion in 2023 to USD 15.7 billion by 2030, a compound annual growth rate of 37.1%. This rapid expansion signifies high market potential, but Fortum's ongoing evaluation of profitability and strategic alignment means its future within the company remains uncertain.

| Business Area | Market Growth | Fortum's Current Position | BCG Matrix Category |

|---|---|---|---|

| New Nuclear Projects | High (long-term potential) | Feasibility studies, not economically viable on merchant basis | Question Mark |

| Clean Hydrogen | High (EU target of 10 million tonnes by 2030) | Initial study and validation stages, minimal market share | Question Mark |

| Battery Recycling | Very High (USD 1.8B in 2023 to USD 15.7B by 2030, 37.1% CAGR) | Under strategic review, future role uncertain | Question Mark |

| UK Waste-to-Energy | Moderate to High (driven by regulations) | Under strategic review, commitment uncertain | Question Mark |

BCG Matrix Data Sources

Our Fortum BCG Matrix leverages comprehensive data, including financial reports, market share analysis, and industry growth projections, to accurately position business units.