Fortum Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortum Bundle

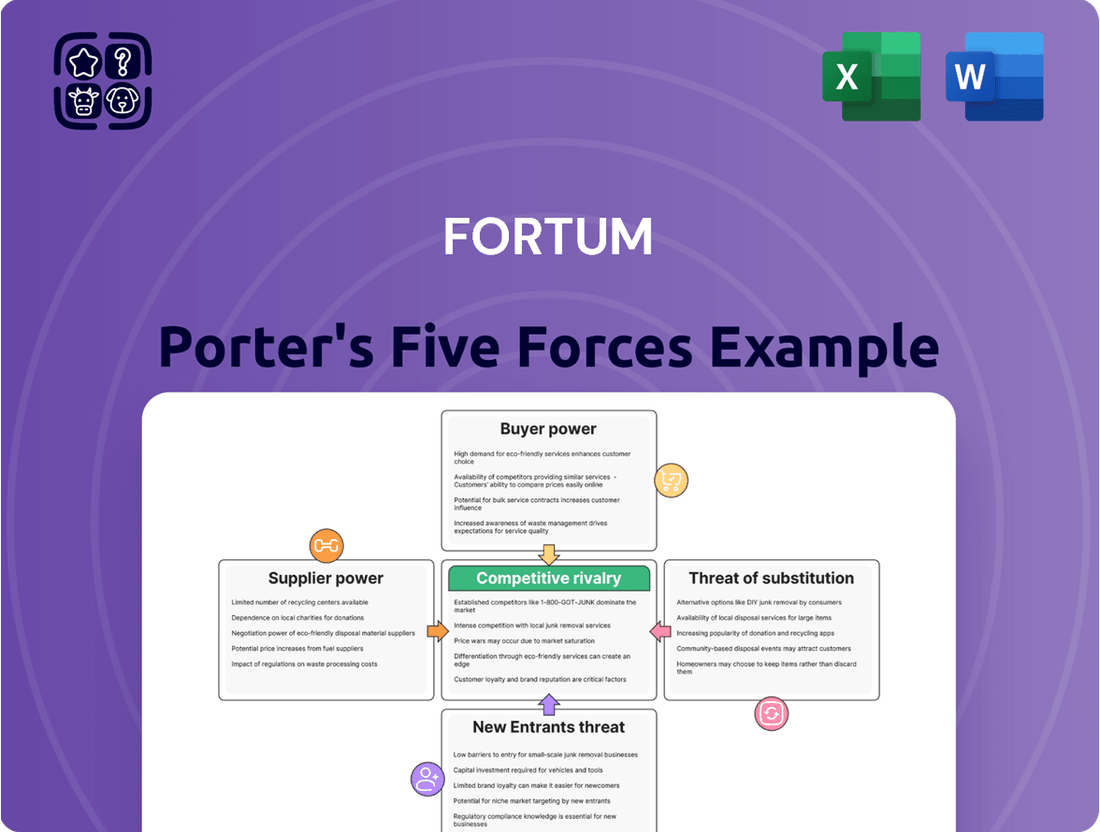

Fortum's competitive landscape is shaped by the interplay of five key forces: the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for navigating the energy sector. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Fortum’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly impacts the bargaining power of suppliers in the energy sector. For Fortum, a company with a broad generation portfolio including hydro, nuclear, and thermal power, the reliance on specialized suppliers for critical components like nuclear fuel or unique hydropower equipment can create a concentrated supplier base. This concentration grants these specific suppliers greater leverage.

Conversely, for more commoditized supplies and services, Fortum likely benefits from a wider array of providers, which dilutes individual supplier bargaining power. For instance, in 2024, the global nuclear fuel market, while essential, is dominated by a few key producers, giving them considerable influence over pricing and supply terms for Fortum's nuclear operations. This contrasts with the more competitive market for general maintenance services or standard electrical components.

Switching costs for Fortum's suppliers can be a significant factor in their bargaining power. For specialized equipment or technology, like critical components for power generation or advanced grid management systems, Fortum might face substantial costs and operational disruptions if they decide to switch providers. This could include retooling, retraining staff, and lengthy integration periods.

For example, if Fortum relies on a specific vendor for the complex maintenance of its nuclear power plants, the switching costs would be exceptionally high due to safety regulations, proprietary knowledge, and specialized tooling. This dependency grants that supplier considerable leverage.

Conversely, for more commoditized supplies such as general office supplies or basic raw materials, the switching costs are likely to be minimal. Fortum can readily find alternative suppliers for these items, which consequently reduces the bargaining power of those particular suppliers.

The availability of substitute inputs significantly influences the bargaining power of suppliers for Fortum. While certain specialized components in nuclear power or specific hydropower infrastructure may have few direct alternatives, the broader energy market offers increasing substitution possibilities. For instance, the growing deployment of wind and solar power generation directly competes with traditional fossil fuel-based electricity production, thereby diminishing the leverage of coal and natural gas suppliers.

Fortum's strategic pivot towards expanding its renewable energy portfolio, particularly in wind and solar, is a key factor in mitigating supplier power. By diversifying its primary energy sources, Fortum reduces its reliance on any single type of input or supplier. This strategic move aligns with global trends; for example, in 2023, renewable energy sources accounted for approximately 30% of the EU's gross final energy consumption from electricity, a figure projected to rise significantly.

Supplier's Importance to Fortum's Business

Suppliers of critical infrastructure, specialized technology, or essential fuels wield considerable influence over companies like Fortum. Fortum's dependence on a steady and dependable flow of these inputs for its hydro and nuclear power generation assets positions these suppliers with substantial bargaining power, given their indispensable role in Fortum's fundamental operations.

For instance, in 2023, Fortum's generation segment, which includes its nuclear and hydro assets, represented a significant portion of its operations. The cost and availability of nuclear fuel, or specialized components for maintaining hydro turbines, directly impact Fortum's operational efficiency and profitability. A disruption or significant price increase from a key supplier in these areas could severely affect Fortum's ability to generate power reliably.

- High dependence on specialized nuclear fuel suppliers: The sourcing of uranium and enriched uranium, crucial for nuclear power, often involves a limited number of global suppliers, granting them leverage.

- Critical infrastructure components for hydro power: Suppliers of large turbines, generators, and specialized maintenance services for aging hydro facilities can command higher prices due to the unique nature of the equipment and the expertise required.

- Fuel volatility for thermal generation (where applicable): While Fortum is increasingly focused on clean energy, any remaining reliance on fossil fuels for backup or specific generation units would mean suppliers of coal or natural gas could exert pressure through price fluctuations.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Fortum's business is generally low. This is due to the highly regulated and capital-intensive nature of the energy generation and distribution sector, making it difficult for raw material or component suppliers to replicate Fortum's infrastructure, regulatory approvals, and market access.

For instance, the sheer scale of investment required for power generation and grid operation, often running into billions of euros, acts as a significant barrier. Fortum's 2023 financial statements show substantial assets in property, plant, and equipment, reflecting this capital intensity.

While direct forward integration by traditional suppliers of fuels or basic components is unlikely, there's a nuanced threat from technology providers. These companies might offer increasingly integrated solutions, potentially increasing their leverage by controlling key aspects of the energy value chain.

- Low Threat of Forward Integration: The energy sector's high capital requirements and regulatory hurdles make it difficult for suppliers to directly compete with established players like Fortum.

- Capital Intensity as a Barrier: Fortum's significant investments in infrastructure, as evidenced by its substantial property, plant, and equipment assets, deter potential supplier integration.

- Nuanced Threat from Technology Providers: While traditional suppliers pose little risk, technology companies offering integrated solutions could exert greater influence by controlling specific parts of the energy value chain.

Suppliers of critical components for Fortum's nuclear and hydropower operations, such as specialized fuel or large turbines, possess significant bargaining power due to market concentration and high switching costs. This leverage is evident in the limited global producers of nuclear fuel, a market where Fortum actively sources its requirements. Conversely, for more commoditized supplies, Fortum benefits from a wider supplier base, reducing individual supplier influence.

Fortum's strategic expansion into renewables like wind and solar directly counters supplier power by diversifying energy sources and reducing reliance on specific inputs. For example, the increasing share of renewables in the EU's energy mix, reaching around 30% in 2023, highlights this industry-wide shift. However, the threat of forward integration by suppliers is generally low due to the immense capital and regulatory barriers in the energy generation sector.

| Key Input | Supplier Concentration | Switching Costs | Fortum's Dependence |

|---|---|---|---|

| Nuclear Fuel | High (few global producers) | Very High (safety, expertise) | High (essential for nuclear plants) |

| Hydro Turbine Components | Moderate to High (specialized manufacturers) | High (customization, integration) | Moderate (maintenance, upgrades) |

| Renewable Energy Components (e.g., Solar Panels) | Moderate (increasing competition) | Moderate (standardization varies) | Low to Moderate (growing portfolio) |

What is included in the product

Fortum's Porter's Five Forces analysis examines the intensity of competition, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and their impact on Fortum's profitability and strategic positioning.

Fortum's Porter's Five Forces analysis provides a structured framework to identify and mitigate competitive threats, offering clarity on market dynamics to alleviate strategic uncertainty.

Customers Bargaining Power

Customer concentration for Fortum means understanding how much power individual customers or groups of customers have. Fortum serves many different types of customers, from homes to big factories, across places like the Nordic countries and Poland. While one person buying electricity doesn't have much say, a huge factory using a lot of energy can definitely ask for better terms.

For instance, large industrial clients or even city governments that buy significant amounts of power can leverage their volume to negotiate. This is especially true when energy demand is high or when Fortum is looking to secure stable, long-term sales. In 2023, Fortum’s total electricity generation capacity was around 13 terawatt-hours (TWh), and securing consistent offtake from major consumers is key to managing this output effectively.

Fortum also utilizes long-term power purchase agreements, or PPAs, with key industrial partners. These agreements lock in prices and volumes, providing predictability for both Fortum and its large-scale customers. The bargaining power of these customers in such agreements is often balanced by the security and stability they provide to Fortum’s operations.

Switching costs for customers are a key factor in assessing their bargaining power. For many retail electricity consumers, the process of changing providers is straightforward, particularly in markets where deregulation has fostered competition. For instance, in Finland, a significant portion of Fortum's retail customer base operates in such an environment, allowing for relatively easy transitions between suppliers.

However, the situation changes for industrial clients or those deeply integrated with Fortum's infrastructure. For example, businesses reliant on Fortum's district heating and cooling systems face substantial switching costs. These can involve significant investments in new infrastructure or the renegotiation of long-term contracts, effectively raising the barrier to switching and reducing their immediate bargaining power.

Customers, particularly large businesses and industrial clients, are increasingly well-informed about energy prices, market dynamics, and available alternatives. This enhanced transparency, fueled by digital platforms and readily accessible market data, significantly strengthens their position.

With better information, customers can make more strategic purchasing decisions and are better equipped to negotiate favorable terms with energy providers like Fortum. For instance, in 2024, the widespread availability of real-time wholesale electricity price data allows major industrial consumers to pinpoint optimal times for energy procurement, thereby increasing their bargaining leverage.

Threat of Backward Integration by Customers

The threat of backward integration by Fortum's customers is generally low. Most customers, even large industrial ones, typically lack the expertise, capital, and regulatory approvals necessary to generate their own electricity or heat on a scale that would significantly impact Fortum's operations. For instance, the substantial investment required for a new power plant, often in the billions of euros, acts as a significant barrier.

While the overall threat remains low, some large industrial players might explore on-site renewable generation for their own consumption. This strategy aims to reduce their reliance on external energy suppliers like Fortum. For example, a major manufacturing facility might install solar panels or a small wind turbine to offset a portion of its energy needs.

This trend is supported by declining renewable energy costs. In 2024, the levelized cost of electricity (LCOE) for utility-scale solar PV continued to fall, making on-site generation more economically viable for large consumers. However, the scale of Fortum's operations, often serving entire regions, means that individual customer integration efforts have a limited impact on the company's overall market position.

- Low Expertise Barrier: Customers generally lack the specialized knowledge in power generation technology and grid management.

- High Capital Investment: Building power generation facilities requires substantial upfront capital, often running into billions of euros.

- Regulatory Hurdles: Obtaining permits and complying with energy sector regulations is complex and time-consuming.

- Scale Disparity: Individual customer integration efforts are unlikely to match the scale and efficiency of Fortum's established infrastructure.

Price Sensitivity of Customers

Customer price sensitivity is a major driver for Fortum, especially among retail and small business clients. As energy is a basic necessity, predictable pricing is highly valued. However, the fluctuating nature of the Nordic power market often pushes customers to actively seek out the most cost-effective options.

In 2024, the average electricity price in Finland, Fortum's primary market, saw significant fluctuations. For instance, the Nord Pool system price averaged around €45 per MWh in the first half of 2024, a decrease from the previous year but still subject to considerable daily variations. This volatility directly impacts consumer behavior, making them more inclined to switch providers based on price alone.

- Price Sensitivity Drivers: Energy's status as a fundamental commodity makes customers highly attuned to price changes.

- Market Volatility Impact: Fluctuations in the Nordic power market, like the €45/MWh average in early 2024, intensify price sensitivity.

- Competitive Seeking: Customers actively compare offers and switch providers to secure the lowest available electricity rates.

- Retail and SME Focus: Smaller consumers, including households and small businesses, are particularly susceptible to price-driven decisions.

Fortum faces moderate bargaining power from its customers, particularly large industrial clients who can negotiate better terms due to their significant energy consumption. While retail customers have lower individual power, collective action or switching can still influence pricing. The threat of customers integrating backward, like generating their own power, is generally low due to high capital costs and expertise requirements, though on-site renewables offer a partial offset.

Customers' increasing access to market data in 2024, including real-time wholesale prices, empowers them to negotiate more effectively, especially large industrial consumers. Price sensitivity is high across Fortum's customer base, amplified by market volatility, such as the average Nord Pool system price of approximately €45 per MWh in early 2024, encouraging switching for cost savings.

| Customer Segment | Bargaining Power Factors | Impact on Fortum |

|---|---|---|

| Large Industrial Clients | High volume, long-term contracts, market knowledge | Ability to negotiate lower prices and favorable terms |

| Retail/SME Customers | Price sensitivity, ease of switching in deregulated markets | Pressure on margins due to competition and price-driven decisions |

| District Heating/Cooling Users | High switching costs due to infrastructure integration | Lower immediate bargaining power, but potential for long-term contract renegotiation |

Full Version Awaits

Fortum Porter's Five Forces Analysis

This preview showcases the complete Fortum Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape within the energy sector. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently proceed with your acquisition, knowing you'll gain instant access to this comprehensive strategic tool.

Rivalry Among Competitors

The Nordic energy market, Fortum's primary arena, hosts a robust and varied competitive landscape. This includes established giants like Vattenfall and Ørsted, alongside a growing number of agile renewable energy specialists, all actively competing across generation, distribution, and advanced energy services.

While the overall energy demand in the Nordic region has seen modest growth, the renewable energy sector is a notable exception, expanding rapidly. This dynamic presents both opportunities and challenges for established players like Fortum.

Fortum's strategic pivot towards decarbonization and its investments in clean energy, such as wind and solar, position it well to capitalize on this expanding market. However, this growth attracts considerable competition, with numerous companies vying for market share in the burgeoning renewable space.

For instance, in 2024, investments in European renewable energy projects continued to surge, with significant capital flowing into offshore wind and solar photovoltaic installations. This heightened investor interest fuels the competitive rivalry as more entities seek to establish a strong presence in these lucrative segments.

In the electricity sector, differentiating products is tough because it's often seen as a commodity. Fortum stands out by heavily investing in clean energy sources. A significant portion of their generation, specifically 90% in 2023, comes from CO2-free sources like hydro and nuclear power, which is a key differentiator.

Beyond just generation, Fortum emphasizes sustainable solutions and actively partners with industries to help them decarbonize. This commitment, coupled with the development of value-added services and digital tools, further sets them apart in a competitive landscape.

Exit Barriers

Exit barriers for companies like Fortum in the energy sector are notably high. This is largely because the infrastructure involved, such as power plants and extensive grid networks, requires massive upfront capital investment and has very long operational lifespans, often spanning decades. For example, building a new nuclear power plant can cost tens of billions of euros, and these assets are designed for 60-year operational lives.

The process of divesting or decommissioning these substantial assets is inherently complex and financially burdensome. Companies often face significant costs associated with environmental remediation, regulatory compliance for closure, and the disposal of specialized equipment. These factors can trap companies in markets even when profitability is low, as the cost of exiting is simply too prohibitive.

- High Capital Intensity: Energy infrastructure requires billions in investment, making asset sales difficult.

- Long Asset Lifespans: Power plants and grids are built for decades, locking in capital.

- Regulatory Obligations: Strict rules govern asset decommissioning and environmental standards.

- Specialized Nature: Energy assets are not easily repurposed or sold on open markets.

Strategic Stakes

The competitive rivalry within the energy sector is intense, with strategic stakes exceptionally high for Fortum and its peers. This heightened competition is fueled by the global push for energy transition, ambitious decarbonization goals, and the critical imperative to ensure stable, long-term energy supplies. Companies are channeling significant capital into renewable energy sources and innovative technologies, creating a fierce race for market dominance and future expansion.

Fortum, like other major energy players, faces a landscape where substantial investments are being made across the board. For instance, in 2024, the European Union continued to see massive investments in renewable energy projects, with billions allocated to offshore wind and solar power expansion. This investment climate means that companies must innovate and adapt rapidly to maintain their competitive edge.

The strategic importance of securing market leadership and future growth opportunities drives this intense rivalry. Companies are not just competing on current market share but on their ability to shape the future of energy. This includes developing and deploying new technologies, such as advanced battery storage solutions and green hydrogen production, which are crucial for meeting evolving energy demands and regulatory requirements.

- High Investment in Renewables: Companies are pouring billions into renewable energy projects, with significant growth expected in solar and wind power throughout 2024 and beyond.

- Decarbonization Targets: National and international climate goals are forcing a rapid shift away from fossil fuels, intensifying competition to develop and scale low-carbon solutions.

- Technological Innovation: The race to develop and commercialize new energy technologies, like advanced grid management systems and carbon capture, is a key battleground for future market share.

- Energy Security Concerns: Geopolitical events and supply chain vulnerabilities underscore the importance of reliable energy sources, making companies that can secure diverse and sustainable energy portfolios highly competitive.

Competitive rivalry is a major force for Fortum, especially in its core Nordic market where established players like Vattenfall and Ørsted are strong. The rapid growth in renewables, attracting significant investment in 2024 across Europe, means many companies are vying for position in solar and wind. Fortum differentiates itself through its high percentage of CO2-free generation, with 90% in 2023 coming from hydro and nuclear, and by focusing on sustainable solutions and decarbonization partnerships.

The high capital intensity and long asset lifespans in the energy sector create significant exit barriers, making it difficult for companies to leave the market even if profitability dips. Building infrastructure like power plants and grids requires billions, and these assets are designed for decades of operation, such as the 60-year lifespan of nuclear facilities. Decommissioning also incurs substantial costs related to environmental remediation and regulatory compliance, effectively trapping companies in their existing markets.

The drive for decarbonization and energy security intensifies competition, pushing companies like Fortum to invest heavily in renewables and innovative technologies. The race to develop solutions like advanced battery storage and green hydrogen is crucial for securing future market share and meeting evolving energy demands and climate goals.

| Key Competitor | Primary Focus | 2023/2024 Highlight |

|---|---|---|

| Vattenfall | Renewables, Electricity Generation & Distribution | Continued expansion in offshore wind projects. |

| Ørsted | Offshore Wind Development | Significant investments in new offshore wind farms globally. |

| Fortum | Clean Energy, Circular Economy Solutions | Emphasis on decarbonization services and sustainable energy production. |

SSubstitutes Threaten

Direct substitutes for electricity and heat, Fortum's core offerings, are indeed limited. While individual consumers can take steps like reducing consumption or investing in more energy-efficient appliances, these actions don't represent a true substitute for the fundamental need for power and heat. For instance, in 2023, the average household electricity consumption in Finland, Fortum's primary market, remained significant, underscoring the difficulty in finding direct replacements for essential energy needs.

The price-performance trade-off for substitutes to Fortum's energy offerings, particularly district heating, is generally unfavorable. While individual heat pumps or biomass boilers are available for heating, their initial investment costs are often significantly higher, and they may not match the scale and consistent reliability of a centralized district heating system. For instance, a typical residential heat pump installation can range from €10,000 to €20,000, a substantial upfront cost compared to the ongoing charges for district heating.

In the electricity sector, especially for industrial applications, viable large-scale substitutes are limited. This scarcity means that many industrial processes are heavily reliant on the existing electricity grid, reducing the threat of substitution in this critical segment. The capital expenditure required to develop comparable, independent large-scale electricity generation and distribution for heavy industry is immense, often running into hundreds of millions of euros.

Customer propensity to substitute for Fortum's services is a key factor. This is shaped by the price of alternative energy sources, their convenience, and growing environmental awareness. For instance, as the cost of solar panels and battery storage continues to fall, homeowners might find it increasingly appealing to generate their own power, directly reducing demand for Fortum's grid services.

In 2024, the energy market saw significant shifts. The International Energy Agency reported that renewable energy capacity additions are expected to grow by over 10% globally compared to 2023, driven by supportive policies and falling technology costs. This trend suggests a rising customer inclination towards decentralized solutions, potentially impacting traditional utility providers like Fortum.

Furthermore, energy efficiency measures are becoming more accessible. Smart home technologies that optimize energy consumption are gaining traction, allowing consumers to reduce their overall energy needs. This, combined with the increasing availability and affordability of electric vehicles, which can also offer grid services through vehicle-to-grid technology, presents a growing substitution threat.

Technological Advancements in Substitutes

Technological advancements are significantly increasing the threat of substitutes for traditional energy providers like Fortum. Innovations in solar panel efficiency and falling costs, for instance, make distributed generation increasingly attractive. In 2024, the global solar PV market continued its robust growth, with installations reaching new highs, driven by both utility-scale projects and rooftop solar adoption.

Battery storage solutions are also becoming more viable, allowing consumers to store excess solar energy and reduce reliance on the grid. This integration of renewables and storage creates a more self-sufficient energy ecosystem. The cost of lithium-ion battery packs, a key component in energy storage, has seen a dramatic decrease over the past decade, making these systems more accessible.

Furthermore, the development of localized microgrids offers an alternative to centralized power distribution. These microgrids can operate independently or connect to the main grid, providing enhanced resilience and potentially lower costs for consumers. This trend empowers customers with greater control over their energy supply, directly challenging the established market positions of companies like Fortum.

The increasing efficiency and decreasing costs of these substitute technologies directly impact Fortum's market share potential in segments where customers can more easily adopt these alternatives.

- Solar Panel Efficiency: Global average solar panel efficiency has steadily increased, with commercially available panels now exceeding 22%.

- Battery Storage Costs: The levelized cost of storage for utility-scale battery systems has fallen significantly, making them more competitive with traditional grid services.

- Microgrid Deployment: The number of operational microgrids worldwide is growing, indicating a shift towards more localized energy solutions.

Regulatory and Policy Support for Substitutes

Government policies and incentives are a major driver for the threat of substitutes, particularly in the energy sector. For instance, the European Union's commitment to decarbonization through initiatives like the Fit for 55 package, aiming for a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels, directly encourages the adoption of renewable energy sources and energy efficiency measures.

These policies can significantly increase the attractiveness and affordability of alternative solutions to traditional energy generation. In 2023, the EU saw a substantial increase in renewable energy capacity, with solar and wind power leading the charge. For example, Germany alone added over 14 GW of new solar capacity in 2023, a record year, further highlighting the impact of supportive regulations.

The push for distributed generation, such as rooftop solar panels and battery storage, is also bolstered by government support. Many countries offer feed-in tariffs or tax credits for homeowners and businesses that invest in these technologies. This trend can erode demand for centralized power generation, a core area for companies like Fortum.

The threat of substitutes is amplified by these regulatory tailwinds, which can accelerate the transition away from fossil fuels and towards cleaner, more decentralized energy systems.

- Regulatory Support: EU's Fit for 55 package targets a 55% emissions reduction by 2030, promoting renewables and efficiency.

- Renewable Growth: Germany's record 14 GW of new solar capacity in 2023 exemplifies the impact of policy on substitute adoption.

- Distributed Generation: Incentives for rooftop solar and battery storage directly challenge traditional centralized power models.

- Market Shift: Supportive policies accelerate the shift from fossil fuels to cleaner, decentralized energy solutions, increasing substitute threat.

The threat of substitutes for Fortum's core energy offerings, electricity and heat, is steadily growing, primarily driven by technological advancements and supportive government policies. While direct, perfect substitutes remain scarce, the increasing viability and affordability of decentralized energy solutions like rooftop solar, battery storage, and microgrids present a significant challenge. These alternatives empower consumers with greater control and potential cost savings, directly impacting demand for traditional utility services.

In 2024, the global energy landscape continued to embrace these alternatives. For instance, the International Energy Agency projected over a 10% increase in renewable energy capacity additions worldwide compared to 2023, fueled by falling technology costs and favorable regulations. This trend underscores a growing consumer inclination towards self-generation and distributed energy, directly competing with established grid-based providers.

The economic viability of these substitutes is improving rapidly. The cost of solar panels has continued its downward trend, making them more accessible for residential and commercial adoption. Similarly, battery storage costs have decreased significantly, enabling more effective utilization of renewable energy. For example, the levelized cost of storage for utility-scale battery systems is becoming increasingly competitive with traditional grid services, further enhancing the appeal of these alternatives.

Government incentives play a crucial role in accelerating this shift. Policies aimed at promoting renewable energy and energy efficiency, such as feed-in tariffs and tax credits for distributed generation, directly encourage consumers to adopt substitute solutions. The EU's Fit for 55 package, targeting a 55% emissions reduction by 2030, exemplifies this, driving substantial investment in solar and wind power, as seen in Germany's record 14 GW of new solar capacity in 2023.

| Substitute Technology | Key Metric | 2023/2024 Trend | Impact on Fortum |

|---|---|---|---|

| Rooftop Solar PV | Global Capacity Additions | Continued robust growth, exceeding 2023 levels | Reduces demand for grid electricity |

| Battery Storage | Levelized Cost of Storage | Decreasing, becoming more competitive | Enhances viability of intermittent renewables |

| Microgrids | Number of Operational Systems | Growing globally | Offers localized, independent energy supply |

| Energy Efficiency | Smart Home Tech Adoption | Increasingly accessible and adopted | Lowers overall energy consumption |

Entrants Threaten

The energy sector, especially power generation and distribution, demands massive upfront capital. Think billions of dollars for building new power plants, upgrading grids, and ensuring reliable energy delivery. For instance, a new nuclear power plant can cost upwards of $20 billion, and even large-scale solar or wind farms require hundreds of millions in investment.

These substantial capital requirements create a significant barrier for potential new companies looking to enter the market. It’s not just about having the idea; it’s about securing the enormous funding needed to even get started, which naturally deters many aspiring players.

Fortum, a major player in the energy sector, enjoys substantial cost advantages due to its vast operational scale. This means they can produce and deliver energy more cheaply per unit than smaller competitors.

For instance, Fortum's extensive network of power plants and distribution infrastructure, built over decades, allows for optimized resource allocation and lower per-unit operating costs. New companies entering the market would need immense capital to replicate such infrastructure, making it a significant barrier.

In 2024, the energy industry continues to see high capital expenditure requirements for new generation capacity, particularly renewables, further solidifying the advantage of established players like Fortum who can leverage existing scale for more efficient financing and deployment.

Established energy giants, including Fortum, possess deeply entrenched and highly regulated distribution networks. These vital arteries, like extensive power grids and district heating pipelines, represent a formidable barrier for any newcomer aiming to enter the market.

The sheer scale of investment and the complex web of regulatory approvals required to build or even access these essential distribution channels make it incredibly challenging for new entrants to compete effectively. For instance, in 2024, the average cost to connect a new industrial customer to a national electricity grid can range from tens of thousands to millions of euros, depending on the capacity and distance, highlighting the capital intensity involved.

Government Policy and Regulation

The energy sector is a prime example of an industry where government policy and regulation act as significant deterrents to new entrants. Strict licensing requirements, coupled with rigorous environmental and safety standards, demand substantial upfront investment and expertise. For instance, in 2024, the European Union continued to emphasize stringent emissions targets under its Fit for 55 package, requiring new power generation facilities to meet very specific sustainability criteria, which can easily run into billions of euros for compliance. This regulatory landscape creates high barriers, making it challenging for smaller or less capitalized companies to even begin the process of entering the market.

Navigating these complex legal and administrative frameworks is a considerable hurdle. New companies must invest heavily in legal counsel and compliance teams to understand and adhere to evolving regulations, from obtaining permits to managing waste disposal. The lengthy approval processes can also delay market entry, increasing costs and uncertainty. In 2024, countries like the United States saw continued debate and implementation of new grid modernization and cybersecurity regulations, adding further layers of compliance for any new operator seeking to connect to the national infrastructure.

- High Capital Investment: Compliance with environmental and safety regulations often necessitates significant capital expenditure for new entrants.

- Complex Permitting Processes: Obtaining necessary licenses and permits can be time-consuming and resource-intensive.

- Evolving Regulatory Landscape: Keeping pace with changing policies, such as carbon pricing or renewable energy mandates, adds ongoing costs and complexity.

- Operational Standards: Meeting stringent operational and safety standards requires specialized knowledge and robust management systems, which are costly to establish.

Brand Loyalty and Switching Costs for Customers

While price is a factor, Fortum, particularly in its retail energy segment, benefits from a degree of brand loyalty. Customers often prioritize dependable service and a trusted provider, which can deter new entrants. For instance, in 2023, customer retention rates in mature markets remained robust, indicating established trust.

Even if the direct switching costs for an individual household are minimal, a new competitor faces a significant hurdle. They must invest heavily in marketing and customer acquisition to build a recognizable brand and attract a meaningful customer base away from established players like Fortum. This collective effort and marketing expenditure represent a substantial barrier.

- Brand Loyalty: Customers in the retail energy sector often value reliability and service, fostering brand loyalty that new entrants must overcome.

- Switching Costs (Collective): While individual switching costs might be low, the aggregate marketing and customer acquisition efforts required for a new entrant to gain significant market share are substantial.

- 2023 Data: Fortum's customer retention figures in established markets in 2023 demonstrated the strength of existing customer relationships.

The threat of new entrants in the energy sector, particularly for Fortum, is significantly mitigated by the industry's immense capital requirements and established infrastructure. Building new power generation facilities or distribution networks demands billions, a hurdle that deters most potential competitors.

Furthermore, stringent regulatory environments and licensing complexities add layers of difficulty, requiring extensive legal and compliance resources. For example, in 2024, the cost of compliance with new grid modernization and cybersecurity regulations in the US added substantial upfront investment for any new operator.

Established players like Fortum also benefit from economies of scale and existing brand loyalty, making it challenging for newcomers to gain market share without massive marketing and customer acquisition investments.

| Barrier Type | Description | Example Data (2024/2023) |

| Capital Requirements | Massive upfront investment for infrastructure | New nuclear plant cost: $20B+; Large solar/wind farm: $100M+ |

| Regulatory Hurdles | Licensing, environmental, safety standards | EU Fit for 55 package compliance: Billions € for new power plants |

| Distribution Networks | Entrenched, regulated access | Industrial customer grid connection cost: Tens of thousands to millions € |

| Brand Loyalty/Customer Acquisition | Need for significant marketing spend | Customer retention in mature markets remained robust in 2023 |

Porter's Five Forces Analysis Data Sources

Our Fortum Porter's Five Forces analysis is built upon a robust foundation of data, including Fortum's annual and sustainability reports, investor presentations, and financial statements. We supplement this with industry-specific market research reports, energy sector news from reputable publications, and relevant regulatory filings from energy authorities in the regions Fortum operates.