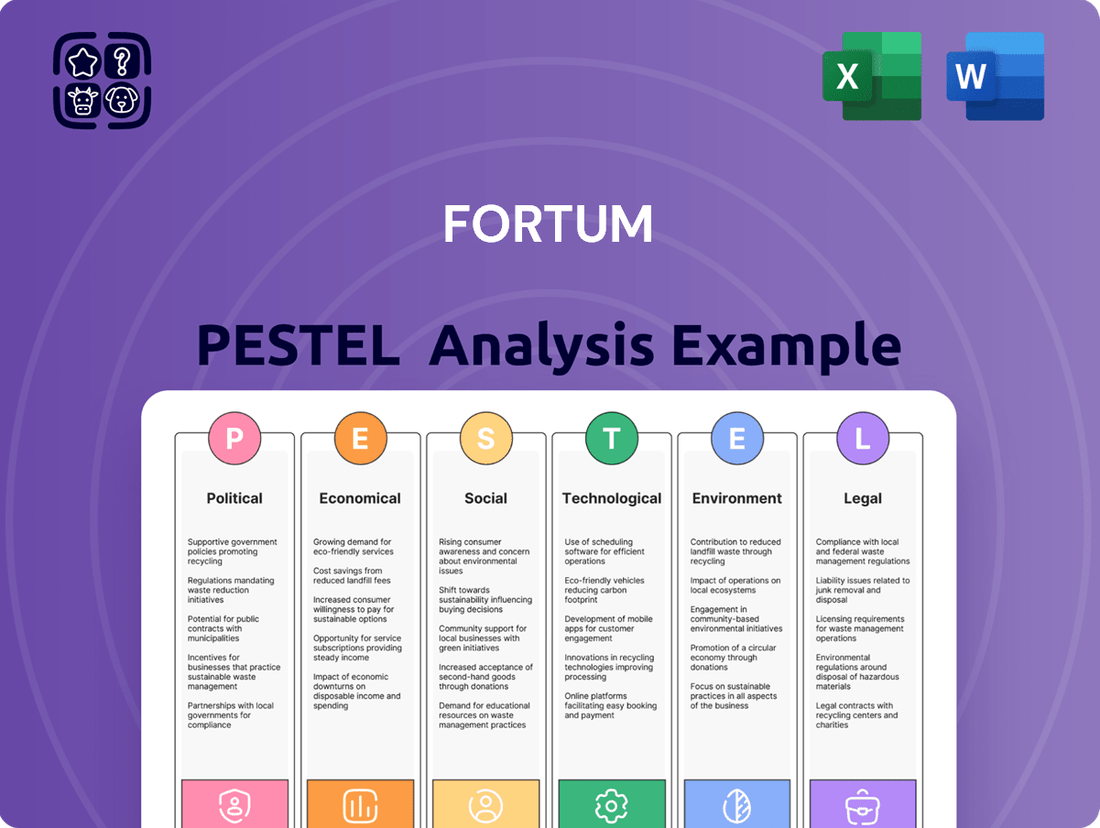

Fortum PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fortum Bundle

Navigate the complex external landscape impacting Fortum with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping the energy giant's future. Gain the strategic foresight needed to identify opportunities and mitigate risks. Download the full analysis now and empower your decision-making.

Political factors

Fortum's business is heavily influenced by the energy policies enacted by Nordic and EU governments. These policies are progressively steering towards clean energy adoption and significant decarbonization efforts. For instance, the EU's Fit-for-55 package, aiming to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, directly impacts Fortum's strategic planning and investment choices in renewable energy and carbon-neutral solutions.

Geopolitical tensions and evolving trade policies, including potential US tariff adjustments, are creating a more volatile and less predictable operating landscape for major industrial investments in the Nordics. Fortum recognizes these elevated geopolitical risks and their ripple effects on global supply chains and commodity prices.

For instance, ongoing geopolitical instability in Eastern Europe has directly impacted energy markets, with significant price fluctuations observed throughout 2024 and into early 2025. A stable and transparent regulatory framework remains paramount for fostering economic expansion and supporting Fortum's long-term investment strategies, particularly in areas like renewable energy infrastructure.

Governments in Finland and Sweden are actively exploring ways to support new nuclear projects through financing and electricity market reforms. This is a significant development for Fortum, as it aligns with their long-term strategy to expand nuclear capacity to meet future energy demands. For instance, in early 2024, discussions were ongoing regarding potential state loan guarantees for new nuclear builds, aiming to de-risk investments for companies like Fortum.

Permitting and Licensing Processes

The speed and efficiency of permitting and licensing for new energy infrastructure are critical political considerations for Fortum. Streamlined processes are essential for accelerating investments in crucial net-zero technologies, directly impacting the feasibility and cost of projects like wind and solar farms.

Fortum actively advocates for faster permitting to drive the energy transition. For instance, in Finland, efforts are underway to reduce the timeframes for renewable energy permits, with some proposals aiming to cut processing times by up to 50% for certain types of projects by 2025, aiming to unlock significant investment potential.

- Streamlined Permitting: Reduces project development timelines and associated costs for new renewable energy installations.

- Advocacy for Net-Zero: Fortum's push for quicker approvals supports the deployment of technologies vital for decarbonization.

- Impact on Investment: Efficient processes directly influence the attractiveness and financial viability of large-scale energy projects.

EU Industrial Competitiveness Initiatives

The European Union's commitment to an Industrial and Competitiveness Deal, running alongside the EU Green Deal, is a significant political factor for Fortum. This initiative prioritizes industrial decarbonization and electrification, directly influencing Fortum's strategic direction and investment priorities. For instance, the EU's stated goal to boost industrial competitiveness by 2030 through green transitions underscores the importance of companies like Fortum in achieving these targets.

Fortum actively engages with these EU policies, advocating for crucial support mechanisms. The company champions the need for strategic, excellence-based funding and de-risking instruments. These are essential to encourage and underwrite the substantial, high-impact industrial and energy investments required for the green transition. This advocacy is crucial as the EU aims to mobilize significant private and public investment, potentially trillions of euros, for its climate goals.

The alignment of Fortum's business model with these overarching EU initiatives is vital for maintaining the competitiveness of the energy sector. By supporting decarbonization and electrification, the EU creates a more favorable investment climate, which directly benefits energy companies like Fortum. This political backing helps ensure that the energy industry can adapt and thrive within the evolving European economic landscape, facilitating future growth and innovation.

- EU Industrial and Competitiveness Deal: Focuses on decarbonization and electrification, directly impacting Fortum's strategy.

- Fortum's Advocacy: Pushes for strategic funding and de-risking instruments for green investments.

- Competitiveness Focus: Aims to ensure the energy industry remains competitive within the EU's green transition.

- Investment Climate: EU initiatives create favorable conditions for energy sector investments.

Government support for new nuclear projects in Finland and Sweden is a key political factor for Fortum, with discussions in early 2024 exploring state loan guarantees to de-risk these significant investments. The EU's Fit-for-55 package, targeting a 55% emissions reduction by 2030, directly shapes Fortum's strategic investments in clean energy and decarbonization efforts.

Fortum advocates for streamlined permitting processes to accelerate the deployment of renewable energy infrastructure, with Finnish proposals aiming to cut permit times by up to 50% for certain projects by 2025. The EU's Industrial and Competitiveness Deal, alongside the Green Deal, prioritizes industrial decarbonization and electrification, influencing Fortum's strategic direction and investment focus.

Geopolitical tensions, particularly in Eastern Europe, have led to volatile energy markets throughout 2024 and into early 2025, impacting commodity prices and global supply chains. A stable regulatory environment is crucial for Fortum's long-term investments, especially in renewable energy infrastructure development.

| Policy Area | Objective | Impact on Fortum |

|---|---|---|

| EU Fit-for-55 | 55% GHG emission reduction by 2030 | Drives investment in renewables & decarbonization |

| Nuclear Support (Finland/Sweden) | Facilitate new nuclear builds | Aligns with Fortum's nuclear expansion strategy |

| Permitting Reform (Finland) | Reduce renewable energy permit times by up to 50% by 2025 | Accelerates project development & reduces costs |

| EU Industrial Deal | Boost industrial competitiveness via green transition | Shapes strategic direction & investment priorities |

What is included in the product

This Fortum PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operations and strategic direction.

It offers actionable insights by detailing how these macro-environmental forces present both challenges and opportunities for Fortum's growth and sustainability.

A clear, concise PESTLE analysis of Fortum's external environment, presented in an easily digestible format, removes the burden of sifting through complex data, enabling faster strategic decision-making.

Economic factors

Fortum's financial performance, particularly its sales and operating profit, is notably susceptible to shifts in power prices and volumes. For instance, the first quarter of 2025 presented a scenario where lower power prices and reduced volumes impacted results.

Despite these headwinds, Fortum demonstrated resilience by securing a strong power price. This was largely attributed to their effective management and optimization of their low-carbon energy generation assets.

The Nordic power market has experienced increased price volatility. In response, Fortum revised its annual optimization premium guidance for 2025, reflecting these dynamic market conditions.

High inflation and rising interest rates can significantly impact investment decisions, potentially causing businesses to delay major industrial projects. This economic climate creates uncertainty across various sectors.

Fortum is actively managing these challenges by implementing its strategy in stages and focusing on operational efficiency. A key element of this approach is a program designed to lower annual fixed costs.

The company has set a target to reduce its annual fixed costs by EUR 100 million by the end of 2025. This initiative is crucial for enhancing profitability and ensuring robust cash flow generation amidst economic headwinds.

Fortum's strategic investment plans are crucial for its future growth, particularly in the clean energy sector. For the period 2025–2027, the company anticipates capital expenditure of roughly EUR 1.4 billion. This figure encompasses essential maintenance but notably excludes any potential acquisition costs.

Within this broader capital expenditure, Fortum has earmarked EUR 150–300 million annually specifically for growth initiatives. This demonstrates a focused strategy on expanding its clean energy portfolio, prioritizing projects that offer compelling financial returns while carefully managing associated risks.

To meet escalating customer demand for renewable energy solutions, Fortum is actively cultivating a pipeline of ready-to-build onshore wind and solar projects. This proactive development approach ensures they are well-positioned to capitalize on market opportunities and deliver clean energy to their customers.

Financial Performance and Credit Rating

Fortum's financial strategy centers on maintaining a robust credit profile, targeting a BBB rating and a leverage ratio of 2.0-2.5 times net debt to comparable EBITDA. This commitment underscores its focus on financial stability and prudent debt management.

As of the first quarter of 2025, Fortum's financial standing is characterized by a low financial net debt, reinforcing its healthy balance sheet. This strong financial position provides flexibility and resilience in its operations and investment strategies.

The company's dividend policy reflects this financial strength, with a payout ratio of 60-90% of comparable earnings per share. This policy aims to reward shareholders while retaining sufficient capital for future growth and operational needs.

- Credit Rating Target: Fortum aims for a stable BBB credit rating.

- Leverage Guidance: Long-term financial net debt to comparable EBITDA target is 2.0-2.5 times.

- Q1 2025 Financials: Low financial net debt reported, indicating a robust financial position.

- Dividend Policy: Payout ratio of 60-90% of comparable EPS.

Market Demand and Customer Contracts

Fortum observes consistent underlying demand for electricity, aligning with projections for long-term power consumption growth. However, significant industrial investments in the Nordic region might encounter hurdles due to prevailing geopolitical uncertainties.

Currently, customers are demonstrating a preference for securing power through short- and mid-term contracts, typically spanning the next three to five years. This shift indicates a cautious approach to long-term energy procurement amidst evolving market conditions.

- Customer Contract Focus: A notable trend is the increasing emphasis on 3-5 year power contracts, reflecting customer risk management strategies.

- Demand Resilience: Underlying power demand remains robust, underscoring the essential nature of electricity in modern economies.

- Geopolitical Impact: Geopolitical risks pose a potential challenge to large-scale industrial investments planned in the Nordic region, which could influence future demand patterns.

- Fortum's Strategy: Fortum's core strategy is centered on providing dependable clean energy solutions and actively supporting industrial decarbonization efforts.

Economic factors significantly shape Fortum's operational landscape, with power price volatility and inflation posing key challenges. The company's financial performance, particularly in Q1 2025, was impacted by lower power prices and volumes, though they managed to secure strong prices through efficient asset management.

Rising interest rates and inflation create uncertainty for major industrial investments, potentially delaying projects. Fortum is actively mitigating these economic headwinds by focusing on operational efficiency and a cost reduction program targeting EUR 100 million in annual fixed cost savings by the end of 2025.

Fortum's strategic investments, projected at approximately EUR 1.4 billion for 2025–2027, are geared towards expanding its clean energy portfolio. This includes EUR 150–300 million annually for growth initiatives, underscoring a commitment to developing ready-to-build wind and solar projects to meet growing demand.

| Economic Factor | Impact on Fortum | Fortum's Response/Data |

|---|---|---|

| Power Price Volatility | Affects sales and operating profit | Q1 2025 saw lower prices; revised 2025 optimization premium guidance |

| Inflation & Interest Rates | Potential delay of industrial projects | Focus on operational efficiency; EUR 100M fixed cost reduction target by end of 2025 |

| Capital Expenditure (2025-2027) | Investment in clean energy growth | Approx. EUR 1.4 billion total; EUR 150-300 million annually for growth initiatives |

Preview the Actual Deliverable

Fortum PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fortum delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the energy company. Understand the external forces shaping Fortum's strategy and operations.

Sociological factors

There's a strong and growing appetite for clean electricity across many industries. Companies are actively seeking ways to reduce their carbon footprint, which directly fuels the demand for dependable, green energy sources.

This commitment to cutting emissions is a significant driver for the energy sector. For instance, by the end of 2023, renewable energy sources accounted for over 40% of the EU's electricity generation, showcasing this shift in action.

Fortum's mission to foster a world where people, businesses, and nature flourish together aligns perfectly with this trend. They are positioned to provide the smart, clean energy solutions that businesses and consumers increasingly desire.

Societal expectations for decarbonization are a major driver for Fortum. There's a strong, growing public demand for carbon neutrality and more sustainable ways of living, which directly shapes the company's strategy. This push means companies like Fortum are increasingly expected to lead the charge in environmental responsibility.

Fortum actively supports this societal shift by helping its customers reduce their carbon footprints and by contributing to the broader goal of carbon neutrality. Their work focuses on balancing economic development with ecological preservation, a key concern for many communities. This aligns with the global trend of moving away from fossil fuels and embracing electrification across different industries.

Fortum prioritizes a safe and inspiring work environment for its roughly 4,500 employees, underscoring a commitment to equality and societal benefit through responsible operations. This focus on well-being is a key sociological consideration, influencing employee morale and productivity.

The company's efficiency initiatives, which include personnel adjustments for structural realignment, directly impact the workforce. While aiming for cost reduction, these programs necessitate careful management of employee relations and support to maintain a positive sociological impact.

Community Engagement and Local Impacts

Fortum places a strong emphasis on engaging with the communities where it operates and those affected by its supply chains. This commitment is demonstrated through proactive local initiatives and active participation in developing science-based methods for evaluating environmental effects, with a particular focus on the aquatic impacts of hydropower generation. For instance, Fortum’s projects, such as repurposing waste heat for district heating systems, offer tangible benefits to local residents.

The company's dedication to community well-being is further illustrated by its investment in local development and its adherence to responsible operational practices. In 2024, Fortum continued to invest in community programs, with specific figures for local impact initiatives being detailed in their annual sustainability reports, often highlighting job creation and local economic contributions. Their approach aims to foster positive relationships and ensure that their energy solutions contribute to the quality of life in the regions they serve.

- Local Impact: Fortum’s waste heat utilization projects directly improve local air quality and provide affordable heating solutions.

- Environmental Stewardship: The company actively participates in developing science-based methodologies to assess and mitigate environmental impacts, particularly on aquatic ecosystems.

- Community Investment: Fortum’s operations in 2024 included targeted investments in local social programs and infrastructure development in key operational areas.

- Supply Chain Responsibility: The company extends its community engagement principles to its supply chains, promoting ethical and sustainable practices throughout its value network.

Shifting Consumer Behavior towards Sustainability

Consumer demand for sustainable and electrified solutions is a significant sociological driver for Fortum. As societies become more electrified and prioritize smart, eco-friendly living, Fortum's service portfolio must adapt. The company's commitment to providing value through smart solutions, stability, and expert advice to over 2 million customers directly addresses these evolving consumer expectations.

Fortum's strategic focus on district heating and cooling solutions also reflects this growing consumer consciousness. These offerings appeal to a customer base increasingly concerned with environmental impact and seeking efficient, sustainable energy alternatives.

- Growing Electrification: By 2024, electric vehicle sales in Europe are projected to reach 2.1 million units, indicating a strong societal shift towards electrification that influences energy demand and infrastructure needs.

- Sustainability as a Priority: A 2023 survey revealed that 70% of European consumers consider sustainability when making purchasing decisions, directly impacting utility choices and service provider preferences.

- Smart Home Adoption: The smart home market in Europe is expected to grow by 15% annually through 2025, signaling a consumer desire for integrated, efficient, and digitally managed energy services.

Societal expectations for decarbonization are a major driver for Fortum, with a strong public demand for carbon neutrality shaping its strategy. Fortum actively supports this shift by helping customers reduce their carbon footprints and by contributing to the broader goal of carbon neutrality, aligning with the global trend of embracing electrification.

Consumer demand for sustainable and electrified solutions is significant, with societies increasingly prioritizing smart, eco-friendly living. Fortum's service portfolio, including district heating and cooling, directly addresses these evolving consumer expectations and a customer base concerned with environmental impact.

Fortum prioritizes a safe and inspiring work environment for its approximately 4,500 employees, underscoring a commitment to equality and societal benefit through responsible operations. The company's efficiency initiatives necessitate careful management of employee relations to maintain a positive sociological impact.

The company's dedication to community well-being is illustrated by its investment in local development and responsible operational practices. In 2024, Fortum continued to invest in community programs, with specific figures for local impact initiatives detailed in their annual sustainability reports, often highlighting job creation and local economic contributions.

Technological factors

Fortum is heavily invested in advancing renewable energy technologies, evident in its substantial pipeline of 5 GW of onshore wind and solar projects currently in the permit process across the Nordic region. This strategic focus directly supports its clean energy objectives.

The commissioning of its 380 MW Pjelax wind project in 2024 underscores Fortum's ongoing commitment to expanding its renewable energy portfolio. The company consistently works to advance its development pipeline, ensuring a steady growth in clean energy generation capacity.

Fortum is actively investigating the potential of new nuclear technologies, particularly Small Modular Reactors (SMRs), as a strategic long-term solution to address anticipated increases in customer demand. This exploration is being conducted in close collaboration with both existing customers and potential partners.

While a recent feasibility study indicated that new nuclear projects might face economic viability hurdles if operated on a purely merchant basis, Fortum maintains a positive outlook on their role. The company views SMRs as a crucial component for facilitating the expansion of renewable energy sources like wind and solar within the Nordic power grid.

The growing reliance on weather-dependent renewable energy sources like wind and solar power directly fuels the demand for advanced energy storage solutions. Fortum is actively investigating pumped-hydro storage as a key component of grid flexibility, with a significant focus on new plants in Sweden.

A comprehensive two-year feasibility study is currently in progress to thoroughly evaluate the commercial viability, technological feasibility, environmental impact, and regulatory landscape for these potential pumped-hydro projects. This initiative is crucial for bolstering grid resilience and effectively managing the inherent fluctuations in energy supply and demand.

Waste Heat Recovery and Heat Pump Innovations

Fortum is actively integrating waste heat recovery into its district heating operations, notably partnering with Microsoft. This collaboration aims to leverage waste heat from data centers, with projections indicating Microsoft's facilities could supply over 40% of Espoo's district heating needs.

The company is making significant investments in advanced technologies such as heat pump plants and electric boilers. These are crucial for phasing out coal in heat production, a key step towards Fortum's ambitious goal of achieving coal-free district heat in Finland by 2025 and carbon neutrality before 2030.

- Waste Heat Integration: Microsoft data centers in Espoo are set to provide more than 40% of the city's district heating.

- Heat Pump Investment: Fortum is deploying heat pump plants to enhance efficiency and reduce reliance on fossil fuels.

- Coal Phase-Out: The company targets a coal-free district heat supply in Finland by 2025.

- Carbon Neutrality Goal: Fortum aims for complete carbon neutrality in its heat production before 2030.

Digitalization and Optimization of Operations

Fortum actively uses advanced technologies to fine-tune its hydropower operations, aiming for peak efficiency and flexibility. This digital approach also supports the sale of environmental values, creating an optimization premium. For instance, in 2024, Fortum reported that its digitalization efforts contributed to enhanced asset performance, allowing for more agile responses to fluctuating market conditions and power price volatility.

The company's commitment to best-in-class operations means continuously integrating new technologies to maximize efficiency. This focus on technological advancement is crucial for navigating the complexities of the energy market. By optimizing processes, Fortum can better manage the inherent risks associated with energy price swings.

Key technological factors impacting Fortum include:

- Advanced analytics and AI for hydropower plant optimization, leading to improved energy generation and reduced operational costs.

- Digital platforms for trading environmental certificates and carbon credits, enhancing revenue streams from sustainability initiatives.

- Investments in smart grid technologies and grid modernization, improving the reliability and efficiency of energy distribution networks.

- The use of IoT devices and sensors across its asset base for real-time monitoring and predictive maintenance, minimizing downtime and maximizing output.

Fortum's technological advancements are central to its renewable energy strategy, with a 5 GW pipeline of wind and solar projects in the Nordics. The company is also exploring Small Modular Reactors (SMRs) to complement renewable energy growth and is investing in advanced heat pumps and electric boilers to phase out coal by 2025.

Digitalization is enhancing hydropower efficiency, with advanced analytics improving generation and reducing costs. Fortum is also leveraging waste heat from data centers, with Microsoft's Espoo facilities expected to supply over 40% of the city's district heating needs.

| Technological Factor | Description | Impact on Fortum | Relevant Data (2024/2025) |

| Renewable Energy Tech | Development of wind and solar projects | Expands clean energy portfolio | 5 GW pipeline in Nordics |

| Nuclear Tech (SMRs) | Exploration of Small Modular Reactors | Supports renewable energy expansion | Feasibility studies ongoing |

| Energy Storage | Pumped-hydro storage development | Enhances grid flexibility | Focus on new plants in Sweden |

| Waste Heat Recovery | Integration of data center waste heat | Improves district heating efficiency | Microsoft facilities to supply >40% of Espoo's district heating |

| Digitalization & AI | Optimizing hydropower operations | Increases efficiency and revenue | Enhanced asset performance reported in 2024 |

Legal factors

Fortum's sustainability reporting from the 2024 annual reporting onwards adheres to the rigorous standards set by the EU Corporate Sustainability Reporting Directive (CSRD). This directive significantly enhances the depth and comparability of environmental, social, and governance (ESG) disclosures, impacting how companies like Fortum present their sustainability performance.

The CSRD requires more granular data, including forward-looking information and value chain reporting, ensuring stakeholders receive a comprehensive view of Fortum's sustainability impact. For instance, under CSRD, Fortum will need to elaborate on its climate transition plans, potentially detailing Scope 3 emissions and specific mitigation strategies, which were less standardized previously.

Fortum navigates a landscape shaped by stringent environmental laws, including the EU Battery Regulation. This regulation mandates specific targets for battery carbon footprints, the incorporation of recycled materials, and responsible end-of-life handling, directly impacting Fortum's product development and supply chain strategies.

Compliance extends to operational standards, such as adhering to Best Available Techniques (BAT) for minimizing emissions across its facilities. Furthermore, the Water Framework Directive guides Fortum's wastewater discharge practices, ensuring water quality protection and sustainable resource management.

The permitting and licensing laws for new power plants and infrastructure projects significantly influence Fortum's project execution speed and overall expenditure. These regulations, which can vary widely by jurisdiction, dictate the approvals needed for construction and operation, directly impacting investment timelines for renewable energy and other critical infrastructure.

Fortum actively participates in lobbying initiatives aimed at simplifying and expediting these regulatory processes. The company views this engagement as crucial for unlocking investments in clean energy technologies, recognizing that efficient permitting is a key enabler for achieving its sustainability goals and expanding its renewable energy portfolio. For instance, in 2024, Fortum highlighted the need for faster permitting for offshore wind projects in several European countries as a way to accelerate the energy transition.

Carbon Pricing Mechanisms and Emissions Trading Schemes

Fortum actively participates in carbon pricing mechanisms, particularly the EU Emissions Trading System (ETS), a key policy tool driving decarbonization efforts across the European Union. This system places a price on carbon emissions, incentivizing companies to reduce their environmental footprint.

The company advocates for expanding carbon pricing to sectors not yet covered by the EU ETS, believing it is crucial for comprehensive climate action. Fortum also champions market-driven instruments, suggesting that economic incentives are the most effective way to achieve emissions reductions.

- EU ETS Performance: In 2023, the benchmark EU Allowances (EUAs) traded in a range, reflecting market adjustments to policy changes and energy market volatility, with prices often fluctuating around €90-€100 per tonne of CO2.

- Fortum's Stance: Fortum supports the strengthening of the EU ETS and the introduction of similar mechanisms for sectors like transport and buildings to ensure a level playing field and drive broader decarbonization.

- Advocacy for Expansion: The company's position aligns with broader European policy discussions aimed at extending carbon pricing to cover a larger share of the economy, as seen in proposals for a separate EU ETS for fuels used in road transport and buildings (ETS2), expected to become operational in 2027.

Nuclear Safety and Licensing

Nuclear safety and licensing are paramount for Fortum's operations, particularly concerning its Loviisa nuclear power plant. Stringent regulations govern every aspect of plant operation and any potential lifetime extensions. Fortum is actively engaged in extending the Loviisa plant's operational life until 2050, a process that involves significant modernization efforts, including turbine upgrades and pump renewals.

This commitment to extending the plant's lifespan is intrinsically linked to Fortum's continuous demonstration of compliance with long-term safety and operational standards mandated by regulatory bodies. Such compliance is crucial for maintaining the license to operate and ensuring public safety.

- Regulatory Oversight: Fortum's Loviisa plant operates under strict Finnish nuclear safety regulations, overseen by the Radiation and Nuclear Safety Authority (STUK).

- Lifetime Extension: The ongoing project to extend the Loviisa plant's operational life until 2050 involves significant investments in safety-critical systems and infrastructure upgrades.

- Safety Modernization: Key modernization initiatives include upgrading turbines and renewing essential pumps, directly addressing long-term operational safety requirements.

Fortum's operations are heavily influenced by evolving environmental legislation, such as the EU Battery Regulation, which sets strict requirements for recycled content and carbon footprints. The company's adherence to Best Available Techniques (BAT) for emission control and the Water Framework Directive are critical for its operational permits and environmental stewardship.

Permitting and licensing procedures for new energy infrastructure projects, including renewable energy installations, significantly impact Fortum's investment timelines and project execution. The company actively engages in lobbying to streamline these processes, recognizing their importance for accelerating clean energy deployment, as seen in their calls for faster offshore wind permitting in 2024.

Fortum operates within the framework of the EU Emissions Trading System (ETS), a key policy driving decarbonization, and advocates for its expansion to other sectors. The company also manages stringent nuclear safety regulations for its Loviisa plant, with ongoing projects to extend its operational life until 2050 requiring continuous compliance with safety standards.

Environmental factors

Fortum has set a bold target to achieve net-zero greenhouse gas (GHG) emissions across its entire value chain by 2040. This commitment is not just a statement; it's backed by near- and long-term targets that have been validated by the Science Based Targets initiative (SBTi). This ambitious goal acts as a guiding principle for every operational and strategic decision Fortum makes concerning decarbonization efforts.

Fortum's commitment to exiting coal by the end of 2027 is a significant environmental step. This move aligns with global decarbonization efforts and positions the company for a cleaner energy future. The closure of the Espoo district heat coal unit in spring 2024 demonstrates tangible progress towards this goal.

Fortum is actively working to reduce its greenhouse gas (GHG) emissions across all scopes. The company has set ambitious targets to cut Scope 1 and 2 GHG emissions by 85% per MWh by 2030 and 90% by 2040, using 2023 as a baseline year.

Further demonstrating its commitment, Fortum aims to achieve a 69% reduction in Scope 1 and 3 GHG emissions related to fuel and energy activities by 2030, escalating to a 94% reduction by 2040.

Specifically addressing its value chain, Fortum has set a target to reduce absolute Scope 3 emissions stemming from sold fossil fuels by 55% by the year 2033.

High Share of CO2-Free Power Generation

Fortum's commitment to sustainability is evident in its exceptionally clean power generation mix. In 2024, a remarkable 99% of its electricity output originated from CO2-free sources, primarily renewable energy and nuclear power. This positions Fortum as a leader in environmental stewardship within the European energy sector.

This high proportion of emissions-free generation is fundamental to Fortum's strategy for mitigating climate change and aligns with global decarbonization efforts. The company's operational focus heavily supports the transition towards a low-carbon economy.

- 2024 CO2-Free Generation: 99%

- Primary Sources: Renewable energy and nuclear power

- European Standing: Among the cleanest power generators

- Strategic Impact: Key to climate change mitigation efforts

Biodiversity and Resource Efficiency Initiatives

Fortum is actively pursuing biodiversity and resource efficiency, targeting no net loss of biodiversity from its Scopes 1 and 2 operations by 2030, with an exclusion for aquatic impacts. This commitment underscores a strategic shift towards more sustainable operational practices.

The company's approach involves a keen focus on enhancing energy and resource efficiency throughout its projects and ongoing operations. This includes rigorous assessment of life-cycle impacts to minimize environmental footprints.

Preventing pollution is a key tenet, achieved through the adoption of cleaner technologies and robust waste reduction strategies. For instance, in 2023, Fortum reported a total waste generation of 1,215 kilotons, with a significant portion being recycled or recovered.

- Biodiversity Target: No net loss of biodiversity from Scopes 1 & 2 operations by 2030 (excluding aquatic impacts).

- Resource Efficiency: Focus on improving energy and resource efficiency across all projects and operations.

- Life-Cycle Assessment: Comprehensive evaluation of environmental impacts throughout the product and operational lifecycle.

- Pollution Prevention: Implementation of cleaner technologies and waste reduction measures to minimize pollution.

Fortum's environmental strategy is deeply rooted in decarbonization, aiming for net-zero emissions by 2040, with SBTi validation. The company is phasing out coal by the end of 2027, evidenced by the closure of its Espoo district heat coal unit in spring 2024.

In 2024, Fortum achieved an impressive 99% CO2-free electricity generation, primarily from renewables and nuclear power, positioning it as a leader in clean energy. The company is also committed to reducing GHG emissions across Scopes 1, 2, and 3, with specific targets for 2030 and 2040.

Furthermore, Fortum is actively working towards no net loss of biodiversity from its operations by 2030 and emphasizes resource efficiency and pollution prevention, as seen in its 2023 waste management data.

| Environmental Target | Status/Progress | Key Initiatives |

| Net-zero GHG emissions | Target: 2040 (SBTi validated) | Value chain decarbonization |

| Coal phase-out | Target: End of 2027 | Espoo coal unit closure (Spring 2024) |

| CO2-free generation | 99% in 2024 | Renewable energy, nuclear power |

| Scope 1 & 2 GHG reduction | Target: 85% by 2030 (vs 2023 baseline) | Operational efficiency improvements |

| Biodiversity | Target: No net loss by 2030 (Scopes 1 & 2) | Resource efficiency, pollution prevention |

PESTLE Analysis Data Sources

Our Fortum PESTLE Analysis draws from a comprehensive range of data sources, including official government publications, international energy organizations, and leading market research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors affecting Fortum are robust and current.