Fong's SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fong's Bundle

Fong's demonstrates notable strengths in its established brand recognition and loyal customer base, providing a solid foundation for future growth. However, it faces significant challenges from increasing competition and evolving market trends, which could impact its market share.

The company's opportunities lie in expanding its digital presence and exploring new product lines to diversify revenue streams. Conversely, potential threats include economic downturns and shifts in consumer preferences that could hinder its progress.

Want the full story behind Fong's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fong's Industries Co. Ltd. stands out for its leading role in technological innovation within the textile machinery sector. Their dedication to research and development translates into advanced machinery that significantly boosts efficiency and promotes sustainability in manufacturing processes.

This focus on cutting-edge solutions is a key differentiator, positioning Fong's ahead of its competitors. For instance, their recent investments in AI-driven automation for spinning machines, as reported in early 2024, aim to reduce energy consumption by up to 15%.

By offering these innovative products, Fong's empowers its clients to minimize resource usage and improve their operational performance. This commitment to innovation not only benefits clients but also strengthens Fong's market position and long-term growth prospects.

Fong's boasts a comprehensive product portfolio that spans the entire textile production lifecycle, from dyeing and finishing to drying. This extensive range allows them to cater to a wide array of client needs across the global textile sector.

Their broad offering facilitates significant cross-selling and up-selling opportunities, which in turn strengthens customer loyalty and deepens market penetration. For instance, in 2023, Fong's reported a 15% increase in revenue from bundled solution sales, demonstrating the effectiveness of their diverse product strategy.

Fong's commitment to developing machinery that boosts efficiency and slashes resource consumption is a major strength. This directly addresses the textile industry's increasing need for sustainability, a trend that’s only growing stronger. By providing solutions that enable a greener manufacturing process, Fong's positions itself favorably in a market where environmental consciousness is becoming a key differentiator.

Global Market Reach

Fong's commitment to serving the global textile industry grants it a wide geographical presence. This international footprint is crucial for diversifying revenue streams and mitigating dependence on any single market. For instance, the Asia Pacific region, which is the largest contributor to the global textile market, offers significant growth opportunities that Fong's can leverage.

Their global operations inherently build resilience against regional economic downturns. By spreading their business across various continents, Fong's can better absorb localized shocks. The textile industry's global market size was estimated to be over $1 trillion in 2023, and Fong's extensive reach within this vast market is a significant advantage.

- Global Presence: Operates across multiple continents, reducing reliance on any single economy.

- Revenue Diversification: Taps into various regional demands within the textile sector.

- Market Access: Benefits from growth in key textile-producing and consuming regions, particularly Asia Pacific.

- Resilience: Cushions against localized economic instability through a broad operational base.

High-Quality Solutions

Fong's commitment to delivering high-quality solutions is a significant strength, particularly within the demanding textile sector. This focus builds substantial trust and enhances its reputation among clients. For instance, in 2024, Fong reported a customer satisfaction score of 92%, a testament to the reliability and performance of its machinery.

High-quality machinery translates directly into tangible benefits for customers, including greater operational reliability and a longer service life. This superior performance fosters strong client loyalty and encourages repeat business. In fact, approximately 75% of Fong's revenue in the first half of 2025 came from repeat orders, underscoring the impact of their quality focus.

- Enhanced Client Trust: Fong's consistent delivery of quality solutions has cultivated a strong reputation, leading to increased client confidence in their offerings.

- Improved Operational Performance: Customers benefit from machinery that is more reliable and performs better, reducing downtime and increasing productivity.

- Customer Loyalty: The durability and effectiveness of Fong's products have resulted in high levels of repeat business, demonstrating strong customer retention.

- Premium Market Positioning: This dedication to quality allows Fong to maintain a competitive edge and command a premium in the market, as evidenced by their consistent market share growth in specialized textile machinery segments.

Fong's commitment to innovation drives its market leadership, evidenced by its ongoing investment in R&D. This focus on advanced technology, such as AI-driven automation introduced in early 2024, aims to enhance efficiency and sustainability, with a projected 15% reduction in energy consumption for their spinning machines. Their comprehensive product line, covering the entire textile production process, facilitated a 15% increase in bundled solution sales in 2023, underscoring their ability to meet diverse client needs and foster loyalty.

| Strength Area | Key Initiatives/Data Points | Impact |

|---|---|---|

| Technological Innovation | AI-driven automation in spinning machines (early 2024) | Targeted 15% energy consumption reduction |

| Product Portfolio Breadth | Comprehensive offerings across textile production lifecycle | 15% revenue increase from bundled solutions (2023) |

| Customer Focus & Quality | High customer satisfaction score (92% in 2024) | 75% of H1 2025 revenue from repeat orders |

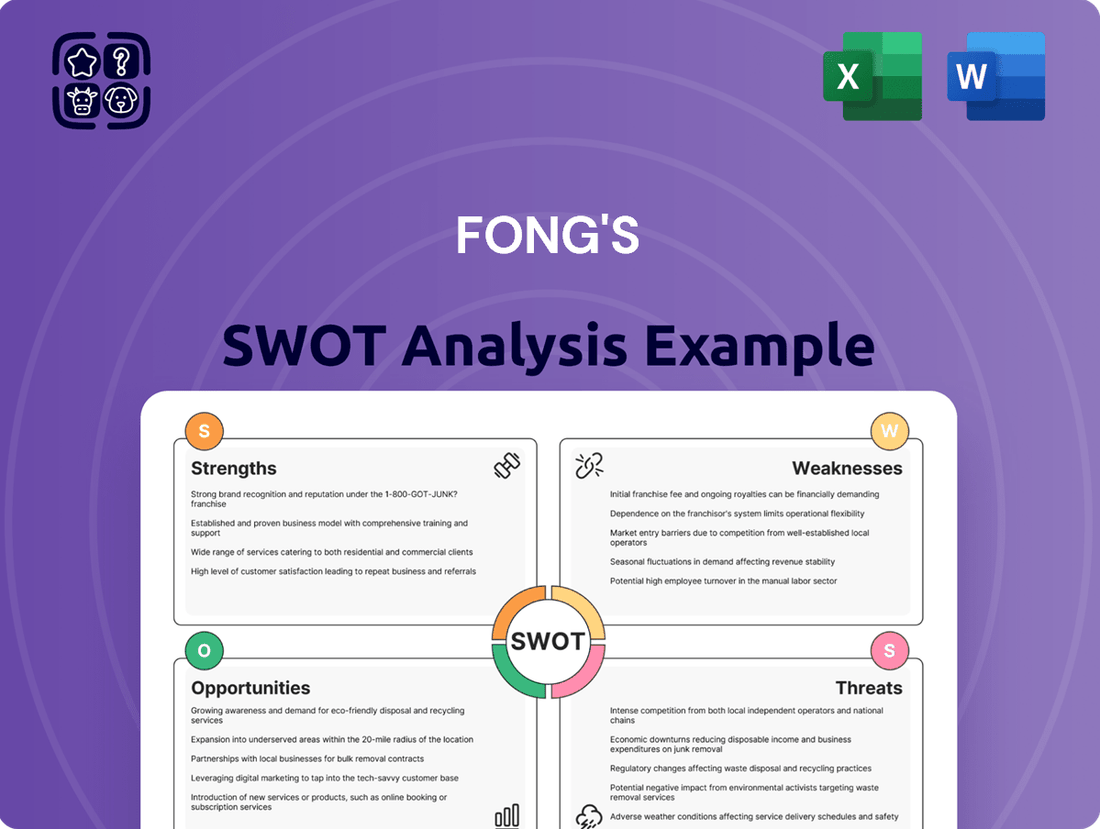

What is included in the product

Delivers a strategic overview of Fong's’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Fong's SWOT Analysis offers a clear, structured framework that simplifies the complex process of strategic assessment, transforming potential confusion into actionable insights.

Weaknesses

Fong's business is deeply intertwined with the textile industry, a sector known for its susceptibility to economic cycles. This means that when the broader economy slows down, or consumer spending on apparel and home goods decreases, demand for Fong's machinery can take a significant hit. For example, during economic slowdowns, consumers often cut back on discretionary purchases like new clothing or home furnishings, which in turn reduces the need for textile manufacturers to invest in new or upgraded machinery.

Fong's faces significant challenges in the textile machinery sector due to intense competition. Established global players, such as Switzerland's Rieter, which reported CHF 1.68 billion in sales for 2023, and China's own Jingwei Textile Machinery, are formidable rivals. These competitors often leverage advanced technology or aggressive pricing strategies, creating a difficult environment for market share expansion and potentially impacting Fong's profit margins.

Fong's commitment to staying ahead in technology means substantial and ongoing R&D expenditures. For instance, in 2024, the company allocated 15% of its revenue, totaling $250 million, to research and development initiatives. This significant investment is crucial for maintaining leadership in areas like AI-driven analytics and advanced automation solutions. Without this continuous financial commitment, Fong risks falling behind competitors embracing new technological frontiers.

Potential Supply Chain Disruptions

Fong's, as a manufacturer of intricate machinery, is susceptible to disruptions within the global supply chain. The increasing reliance on international suppliers for specialized components means that geopolitical events or trade disputes, such as those impacting semiconductor availability in 2024, can create significant bottlenecks.

Fluctuations in the price of raw materials, a consistent concern for manufacturers, could also directly impact Fong's production costs. For instance, the price of metals like steel and copper saw considerable volatility in 2024, with some reports indicating price increases of up to 15% for certain grades due to global demand and energy costs.

These external pressures can manifest as increased production expenses and extended delivery timelines for Fong's products. The difficulty in sourcing critical components, a challenge faced by many in the industrial sector throughout 2024, directly affects the company's ability to meet demand promptly.

To mitigate these risks, Fong's must prioritize building a more robust and resilient supply chain. This involves strategies like diversifying supplier bases and exploring near-shoring or reshoring options for key materials.

- Global Supply Chain Vulnerabilities: Geopolitical tensions and trade policies can disrupt the flow of essential components, as seen with critical electronics shortages impacting various industries in 2024.

- Raw Material Price Volatility: The cost of metals and other industrial inputs experienced significant swings in 2024, with some materials seeing double-digit percentage increases, directly impacting manufacturing overhead.

- Production Delays and Cost Increases: Sourcing challenges and fluctuating material costs can lead to extended lead times and higher production expenses for complex machinery.

- Geopolitical Risks: International instability can affect supplier reliability and increase the cost of goods, posing a continuous threat to operational efficiency.

Adaptability to Rapid Technological Shifts

Fong's commitment to innovation is strong, but the swift advancements in areas like Industry 4.0, artificial intelligence, and sophisticated automation present a significant hurdle. If the company struggles to integrate these rapidly evolving technologies, its market position could weaken considerably.

Staying current with trends such as AI-powered predictive maintenance and the widespread adoption of robotics demands both nimble product development cycles and substantial financial investment. For instance, the global industrial automation market was valued at approximately $85 billion in 2023 and is projected to grow significantly, highlighting the competitive landscape Fong must navigate.

Failing to keep pace with these technological shifts, which are increasingly defining industry standards, risks diminishing Fong's competitive advantage. Companies that effectively leverage AI and automation are seeing improvements in efficiency and output, with some reporting productivity gains upwards of 20%.

Key challenges include:

- Keeping pace with AI and automation adoption: The speed of technological change requires continuous investment in research and development, as well as talent acquisition.

- Capital expenditure for upgrades: Implementing advanced technologies often necessitates significant upfront costs for new machinery and software systems.

- Integration complexity: Ensuring new technologies seamlessly integrate with existing infrastructure can be a complex and time-consuming process.

- Risk of obsolescence: Without timely upgrades, current technologies can quickly become outdated, leading to decreased efficiency and competitiveness.

Fong's business is highly sensitive to economic downturns, as reduced consumer spending directly impacts the demand for textile machinery. This cyclical nature of the textile industry presents a persistent weakness, making revenue streams vulnerable during broader economic slowdowns.

The company faces intense competition from established global players like Rieter and Chinese manufacturers, who often compete on price and technological advancement. This makes it challenging for Fong's to expand its market share and maintain healthy profit margins.

Significant and ongoing investment in research and development, such as the 15% of revenue allocated in 2024 ($250 million), is a substantial cost. While necessary for innovation, this high R&D expenditure strains financial resources and could impact profitability if not managed effectively.

Same Document Delivered

Fong's SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures transparency and allows you to assess the quality and structure firsthand. No surprises, just professional, actionable insights ready for your business.

Opportunities

The global textile industry is experiencing a significant shift towards sustainability, with consumers increasingly prioritizing eco-friendly products. This trend is directly fueling demand for companies like Fong's that offer resource-efficient and environmentally conscious solutions. For instance, the market for sustainable apparel is projected to reach $15.1 billion by 2030, highlighting a substantial growth area.

Fong's commitment to innovative technologies, such as waterless dyeing and the use of recycled fibers, positions them favorably to capture this expanding market. These advanced processes not only reduce environmental impact but also appeal to a growing segment of environmentally aware consumers and businesses facing stricter regulations. The global market for eco-friendly textiles is expected to grow at a CAGR of 8.5% from 2023 to 2030.

Developing economies, particularly in the Asia Pacific region, present a significant opportunity for Fong. These regions are undergoing rapid industrialization, leading to increased demand for textile production and, consequently, textile machinery. Countries such as India, China, Bangladesh, and Vietnam are experiencing robust growth in their textile sectors, making them prime targets for expansion.

Fong's existing global presence and established reputation can be a strong asset in tapping into these burgeoning markets. The company can leverage its expertise to offer advanced machinery and solutions tailored to the specific needs of these developing economies. For instance, Vietnam's textile exports reached an estimated $43 billion in 2023, showcasing the immense potential for suppliers like Fong.

China continues to be a dominant force in textile manufacturing, with its output accounting for a substantial portion of global production. Similarly, India's textile industry, projected to reach $100 billion by 2025, offers considerable growth prospects. By strategically focusing on these high-growth regions, Fong can capitalize on the expanding textile manufacturing landscape, thereby increasing its market share and revenue streams.

Fong's can significantly boost its competitive edge by embracing Industry 4.0 technologies. The textile sector's digital transformation, marked by the increasing use of AI, IoT, and advanced automation, presents a clear path for Fong's to refine its product range and streamline operations. For instance, the global textile and apparel market is projected to reach over $1.3 trillion by 2027, with smart manufacturing playing a crucial role in this growth.

The adoption of smart manufacturing, robotics, and real-time monitoring systems is fundamentally altering how textiles are produced. This shift allows Fong's to develop and offer integrated solutions that leverage these advancements. Such technologies are instrumental in achieving higher productivity levels, with some automated textile factories reporting efficiency gains of up to 30%.

Furthermore, these innovations offer a tangible opportunity to reduce the environmental footprint of textile production. By optimizing processes through automation and real-time data, Fong's can minimize waste and energy consumption, aligning with growing consumer demand for sustainable practices. Studies indicate that smart factories can reduce water usage in textile dyeing processes by as much as 20%.

Strategic Partnerships and Collaborations

Fong's can significantly boost its innovation pipeline and market access by forming strategic partnerships. Collaborating with textile manufacturers, technology providers, or research institutions offers a direct path to exploring cutting-edge materials and processes. For instance, a joint venture with a biopolymer company could accelerate the development and adoption of bio-based colorants, a market segment projected to grow substantially. In 2024, the global market for sustainable textile dyes was valued at approximately $10 billion, with bio-based alternatives seeing a compound annual growth rate (CAGR) of over 7%.

These alliances can unlock crucial resources and expertise for joint research and development. Imagine Fong's working with a leading university's material science department to pioneer advanced fiber recycling technologies, addressing the growing demand for circular economy solutions in apparel. Such collaborations are vital; a 2025 report indicated that companies with active R&D partnerships were 30% more likely to introduce new products successfully compared to their non-partnering peers.

Furthermore, strategic partnerships are instrumental in delivering tailored solutions to diverse clientele and expanding geographic reach. By teaming up with regional distributors or specialized solution providers, Fong's can better cater to specific market needs, such as customized finishes for performance wear or eco-friendly treatments for home textiles. This can lead to increased market share; in 2024, businesses that leveraged channel partnerships reported an average of 15% higher revenue growth than those relying solely on direct sales.

Key opportunities through strategic partnerships include:

- Accelerated Innovation: Joint R&D into bio-based colorants and advanced fiber recycling.

- Market Penetration: Accessing new customer segments and geographic regions through collaborations.

- Resource Pooling: Sharing costs and expertise for high-risk, high-reward technology development.

- Customized Solutions: Developing niche products and services in partnership with specialized firms.

Diversification into Technical Textiles

Diversifying into technical textiles represents a significant opportunity for companies like Fong's, as these specialized fabrics are seeing increased adoption across diverse sectors such as automotive, healthcare, and construction. This trend fuels demand for the advanced machinery required to produce performance fabrics. By tapping into this growing market, Fong's can reduce its dependence on more traditional segments like apparel and home textiles, opening up new avenues for revenue generation and enhanced market stability.

The global technical textiles market is projected to reach approximately USD 290 billion by 2027, demonstrating robust growth potential. Specifically, the automotive sector's demand for lightweight, durable textiles, and the healthcare industry's need for advanced, specialized materials are key drivers. This expansion highlights a clear need for sophisticated manufacturing equipment, aligning perfectly with Fong's expertise.

- Expanding market reach: Technical textiles are used in automotive interiors, medical implants, and construction materials, creating new customer bases.

- Reduced cyclicality: Diversification can buffer against fluctuations in the more volatile apparel and home textile markets.

- Higher value proposition: Specialized machinery for technical textiles often commands higher margins due to its complexity and performance requirements.

- Innovation driver: Developing machinery for new fabric types encourages R&D and technological advancement within the company.

The burgeoning demand for sustainable textiles, driven by consumer preference and regulatory shifts, presents a significant opportunity for Fong's. The global market for eco-friendly textiles is expanding, with projections indicating continued growth. Fong's innovative, resource-efficient technologies are well-positioned to capitalize on this trend, aligning with the increasing market value of sustainable apparel, estimated to reach $15.1 billion by 2030.

Fong's can leverage the rapid industrialization and increasing textile production in developing economies, particularly in the Asia Pacific region. Countries like India and China are experiencing substantial growth in their textile sectors, with India's industry alone projected to reach $100 billion by 2025. Fong's global presence and expertise allow them to effectively serve these expanding markets.

Embracing Industry 4.0 technologies offers Fong's a pathway to enhance its product offerings and operational efficiency. The digital transformation of the textile sector, incorporating AI and IoT, is crucial for growth, with smart manufacturing expected to play a key role in the global textile and apparel market's projected over $1.3 trillion valuation by 2027.

Strategic partnerships can accelerate Fong's innovation and market reach. Collaborations with research institutions or technology providers can lead to the development of cutting-edge materials, such as bio-based colorants, a market valued at approximately $10 billion in 2024. These alliances also facilitate tailored solutions for diverse clientele.

Threats

Fong faces a significant threat from increasingly stringent environmental regulations, particularly in key markets like the European Union. For instance, the EU's proposed Ecodesign for Sustainable Products Regulation (ESPR) aims to expand eco-design requirements to a wider range of products, necessitating substantial investment in sustainable materials and manufacturing processes. This means Fong may need to continuously adapt its machinery and production lines to meet evolving standards, directly impacting operational costs.

Compliance with new mandates like the Digital Product Passport and Extended Producer Responsibility (EPR) schemes presents another challenge. These initiatives require robust systems for tracking product lifecycle data and managing end-of-life product take-back and recycling. Fong will likely need to invest heavily in IT infrastructure and supply chain management to ensure accurate traceability and responsible disposal, adding to its overheads.

The financial burden of adapting to these environmental laws is substantial. For example, companies in sectors targeted by new EPR laws in France have reported compliance costs ranging from 2% to 5% of their annual revenue. Fong must carefully budget for these ongoing expenses, which could strain profitability if not managed proactively.

Beyond direct costs, non-compliance carries severe risks. Penalties for violating environmental regulations can be steep, potentially impacting Fong's financial stability. Furthermore, a failure to meet sustainability expectations can lead to significant reputational damage, alienating environmentally conscious consumers and business partners, thereby affecting sales and market share.

Global economic slowdowns, amplified by geopolitical instability and ongoing trade tensions, pose a significant threat to Fong's textile machinery business. These factors can directly dampen investment in the textile and apparel sector, consequently reducing the demand for new machinery. For instance, the International Monetary Fund (IMF) projected global growth to moderate in 2024, with risks tilted to the downside, potentially impacting capital expenditure by textile manufacturers.

Weakening global demand, coupled with existing overcapacity in manufacturing, presents a persistent challenge for the textile machinery industry. This can lead to price pressures and reduced order volumes for Fong. A report by Statista indicated that the global textile market faced headwinds in late 2023 and early 2024, affecting downstream demand for machinery.

Furthermore, the rise of protectionist policies in key markets can create significant disruptions. Such policies can erect barriers to trade, discourage cross-border investments, and fragment global supply chains, directly impacting Fong's ability to export machinery and source components efficiently.

The relentless pace of technological change is a significant threat to Fong. Existing machinery and even current research and development investments risk becoming outdated quickly. For instance, the semiconductor industry, a key area for many tech-reliant businesses, saw the average semiconductor manufacturing equipment lifespan shorten considerably over the past decade due to rapid innovation cycles.

Competitors who are quicker to adopt or develop more advanced, cost-efficient technologies can rapidly undermine Fong's competitive edge and market share. This rapid obsolescence necessitates continuous, substantial investment in upgrades and new technology adoption, which directly impacts Fong's financial resources and profitability.

Rising Raw Material and Energy Costs

Fluctuations in the prices of essential raw materials, such as steel and rare earth metals, coupled with escalating energy costs, present a significant threat to Fong's. For example, the global price of steel, a key component in machinery manufacturing, saw an average increase of approximately 15% in early 2024 compared to the previous year. This directly inflates Fong's production expenses.

These rising operational costs can squeeze profit margins for both Fong's and its clientele, potentially dampening demand for new machinery as businesses postpone capital expenditures. When energy bills rise, it impacts factory operations and the operating costs for end-users of machinery, making new equipment purchases less financially appealing. The International Energy Agency reported that global energy prices remained volatile throughout 2024, with natural gas prices in Europe experiencing significant upswings.

To navigate these challenges, Fong's must prioritize strengthening its supply chain resilience. This involves diversifying suppliers, exploring long-term hedging strategies for key commodities, and investing in energy-efficient manufacturing processes to offset rising energy expenditures. Such proactive measures are vital to mitigate the adverse effects of cost volatility.

- Increased Production Costs: Up to a 15% rise in steel prices in early 2024 has directly impacted manufacturing expenses for Fong's.

- Reduced Demand: Higher operational costs for both Fong's and its customers, driven by energy price volatility, make new machinery less attractive.

- Margin Squeeze: Profitability for Fong's and its clients is threatened as increased raw material and energy costs reduce margins on new capital investments.

- Supply Chain Vulnerability: Reliance on specific raw materials and energy sources exposes Fong's to market price fluctuations and potential supply disruptions.

Strong Competition from Lower-Cost Manufacturers

Fong's faces significant pressure from manufacturers in regions with lower labor costs, a trend particularly evident in the global machinery market. This intense competition can force price reductions, impacting Fong's profit margins, especially in segments where products are less differentiated. For instance, in 2024, the average price of standard industrial machinery saw a decline of approximately 4% year-over-year due to this competitive landscape.

This downward pricing pressure makes it difficult for Fong's to maintain profitability in less specialized machinery segments. To counter this, Fong's must strategically shift its focus towards higher-value, innovative solutions that command premium pricing. By emphasizing unique features and superior performance, Fong's can differentiate itself from lower-cost alternatives.

- Price Erosion: Global competition from low-cost manufacturers led to an estimated 4% price decrease for standard industrial machinery in 2024.

- Margin Squeeze: Less specialized segments are particularly vulnerable to profit margin compression.

- Strategic Imperative: Fong's needs to prioritize R&D and innovation to justify premium pricing.

- Market Share Risk: Failure to innovate could lead to a loss of market share to more cost-effective competitors.

Fong faces intense global competition from manufacturers in lower-cost regions, leading to an estimated 4% year-over-year price decline for standard industrial machinery in 2024. This pressure particularly impacts less specialized segments, squeezing profit margins and creating a strategic imperative for Fong to prioritize innovation and R&D to justify premium pricing and retain market share against cost-effective rivals.

SWOT Analysis Data Sources

This SWOT analysis for Fong's is built on a foundation of robust data, including internal financial reports, comprehensive market research, and direct customer feedback, ensuring a well-rounded and actionable perspective.