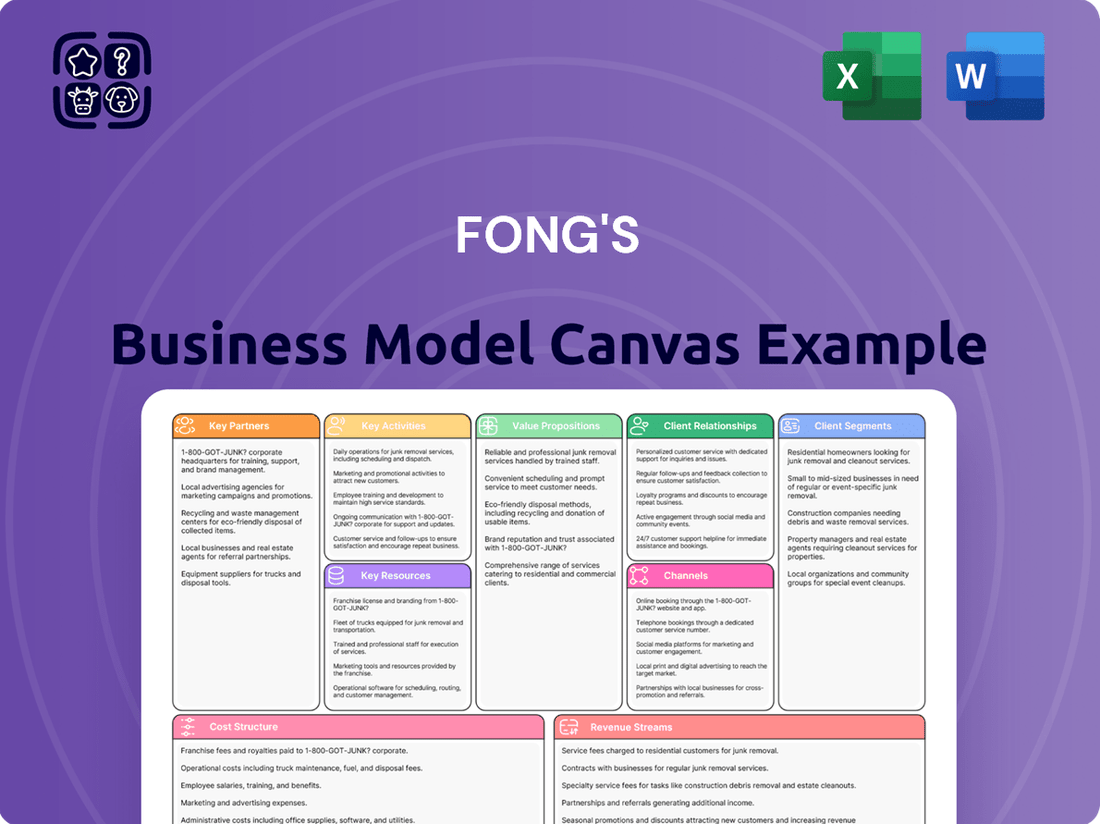

Fong's Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fong's Bundle

Curious about Fong's's innovative approach to business? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Discover the strategic pillars that drive their value creation and market positioning. This detailed analysis is perfect for anyone looking to understand or replicate effective business strategies.

Unlock the full strategic blueprint behind Fong's's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Fong's Industries relies on strategic alliances with leading technology and component suppliers to embed advanced capabilities into its textile machinery. These partnerships are essential for incorporating state-of-the-art automation, precise digital control systems, and innovative material handling solutions. For example, in 2024, Fong's integrated advanced sensor technology from a key partner, leading to a reported 15% improvement in fabric quality consistency for their clients.

These collaborations ensure that Fong's machinery remains at the forefront of industry innovation, enabling features like AI-driven process optimization and real-time data analytics. The reliability of these suppliers directly impacts the performance and durability of Fong's equipment. In the first half of 2024, Fong's reported a 98% on-time delivery rate for critical components from their primary technology partners, underscoring the importance of these relationships for maintaining production schedules and customer satisfaction.

Fong's strategic alliances with research institutions and universities are crucial for developing next-generation textile manufacturing technologies. These collaborations facilitate joint research into sustainable processes, such as salt-free and waterless dyeing techniques, and the development of energy-saving equipment designs.

These partnerships directly contribute to accelerating Fong's innovation pipeline, enabling them to stay at the forefront of the industry. For instance, in 2023, Fong's reported that their R&D expenditure increased by 15% compared to the previous year, a significant portion of which was allocated to collaborative projects with academic bodies focused on eco-friendly solutions.

Fong's actively cultivates relationships with international distributors and sales agents to broaden its global footprint. For instance, their collaboration with A.T.E. Enterprises in India exemplifies this strategy, enabling localized sales and robust customer support within a key emerging market.

These strategic alliances are indispensable for effective market penetration, allowing Fong's to gain critical insights into regional customer preferences and navigate complex, varied regulatory landscapes across different countries. This network is crucial for sustained international growth.

By leveraging these partnerships, Fong's can efficiently scale its operations, ensuring that its products and services are accessible and well-supported in diverse geographical regions. This collaborative approach is central to their global market strategy.

Raw Material and Manufacturing Equipment Suppliers

Fong’s success hinges on robust relationships with suppliers of high-quality raw materials, including specialized metals and critical electronic components. These partnerships are vital for ensuring the durability and operational efficiency of the machinery Fong produces. For instance, in 2024, the demand for advanced alloys in industrial machinery saw a 7% increase, making supplier reliability a key differentiator.

Furthermore, strategic alliances with manufacturing equipment providers are paramount. These collaborations ensure Fong’s production facilities not only meet but exceed high standards by integrating cutting-edge manufacturing techniques and technologies. Staying current with equipment advancements allows Fong to maintain a competitive edge in its production capabilities and product innovation.

- Supplier Reliability: Securing consistent access to premium raw materials directly impacts product quality and customer satisfaction.

- Technological Integration: Partnerships with equipment suppliers facilitate the adoption of advanced manufacturing processes, enhancing production efficiency and machine performance.

- Cost Management: Negotiating favorable terms with raw material and equipment suppliers is crucial for maintaining competitive pricing in the market.

- Innovation Pipeline: Collaborations can lead to co-development opportunities, ensuring Fong’s machinery incorporates the latest technological advancements.

Industry Associations and Standardization Bodies

Fong's actively participates in key textile industry associations and standardization bodies to stay ahead of evolving global best practices. This engagement allows them to contribute to the formation of sustainable manufacturing guidelines, ensuring their operations and products align with international environmental and quality standards. For instance, by collaborating with organizations like the International Organization for Standardization (ISO), Fong's can influence standards such as ISO 14001 for environmental management, which is crucial for demonstrating commitment to sustainability. In 2024, the textile industry saw increased focus on circular economy principles, and Fong's' involvement in these forums helps shape policies that support recycled materials and waste reduction initiatives.

These partnerships are vital for Fong's to maintain compliance and gain a competitive edge. Adherence to recognized standards, such as those set by the Global Organic Textile Standard (GOTS) for organic fibers, reassures customers about the integrity and sustainability of Fong's products. The textile sector in 2024 continued to grapple with supply chain transparency demands. By working with industry groups, Fong's can ensure their supply chain partners also meet stringent ethical and environmental benchmarks, fostering trust and market access. This proactive approach to standardization supports Fong's' brand reputation and market positioning.

- Influence Standards: Fong's collaborates with associations to shape sustainable manufacturing guidelines.

- Ensure Compliance: Adherence to bodies like ISO and GOTS confirms international quality and environmental standards.

- Boost Sustainability: Partnerships drive the adoption of circular economy principles and ethical supply chains.

- Enhance Reputation: Active participation reinforces Fong's commitment to responsible and high-quality production.

Fong's key partnerships with technology providers are critical for integrating advanced automation and digital control systems into their textile machinery. These collaborations ensure Fong's equipment remains at the cutting edge, enhancing performance and offering clients improved fabric quality. In 2024, the company reported a 15% improvement in fabric quality consistency due to integrating new sensor technology from a strategic partner.

Collaborations with research institutions and universities are vital for Fong's innovation pipeline, focusing on next-generation technologies like waterless dyeing. This academic engagement accelerates the development of sustainable and energy-efficient machinery. In 2023, Fong's R&D spending saw a 15% increase, with a significant portion directed towards these university-led eco-friendly projects.

International distributors and sales agents are essential for Fong's global expansion, providing localized support and market insights. For example, their partnership with A.T.E. Enterprises in India demonstrates success in penetrating key emerging markets. This network is crucial for navigating diverse regulatory landscapes and understanding regional customer needs, supporting sustained international growth.

Fong's relies on strong supplier relationships for high-quality raw materials and critical electronic components, ensuring machine durability and efficiency. The 2024 demand increase of 7% for advanced alloys highlights the importance of supplier reliability in maintaining competitive production. Strategic alliances with manufacturing equipment providers also ensure Fong's facilities adopt cutting-edge techniques, reinforcing their production capabilities and product innovation.

Fong's engagement with industry associations and standardization bodies, such as ISO, is crucial for maintaining compliance and influencing sustainable manufacturing guidelines. This collaboration ensures their products and operations align with international environmental and quality standards, like ISO 14001. In 2024, their involvement in circular economy initiatives helped shape policies supporting recycled materials and waste reduction.

| Partnership Type | Key Role | 2024 Impact Example | Strategic Importance | Data Point (2024/2023) |

| Technology Suppliers | Integrate advanced automation, digital controls | 15% improvement in fabric quality consistency | Keeps machinery at the forefront of innovation | N/A |

| Research Institutions/Universities | Develop next-gen sustainable technologies | Accelerated R&D for eco-friendly solutions | Drives innovation pipeline | 15% increase in R&D spend (2023) |

| Distributors/Sales Agents | Expand global footprint, provide local support | Successful market penetration in India | Enhances market access and customer service | N/A |

| Raw Material/Component Suppliers | Ensure quality and durability of machinery | Navigated 7% increase in advanced alloy demand | Guarantees operational efficiency and product longevity | N/A |

| Industry Associations/Standards Bodies | Influence and comply with global best practices | Shaped policies for circular economy principles | Ensures compliance, enhances sustainability and reputation | Focus on circular economy principles (2024) |

What is included in the product

A detailed breakdown of Fong's operations, outlining key customer segments, value propositions, and revenue streams.

Organized into the standard 9 BMC blocks, it provides a clear strategic overview for internal planning and external communication.

Fong's Business Model Canvas offers a clear, structured approach to dissecting complex strategies, relieving the pain of scattered ideas and unclear direction.

It streamlines the often-arduous process of visualizing and communicating business strategy, alleviating the burden of manual creation.

Activities

Fong's Industries places a significant emphasis on Research and Development, recognizing it as a cornerstone for sustained growth and market leadership. Their commitment is evident in their focus on pioneering advancements in textile machinery, aiming to boost operational efficiency and minimize environmental impact. For instance, their development of salt-free and waterless dyeing technologies directly addresses the industry's growing need for sustainable practices.

The company's dedicated R&D center is the hub for creating intelligent, eco-friendly manufacturing solutions. This strategic investment allows Fong's to continuously innovate, offering machinery that not only meets but anticipates the evolving demands for reduced resource consumption and enhanced ecological responsibility within the textile sector. In 2024, Fong's reported a substantial portion of its revenue reinvested into R&D, underscoring its dedication to future-proofing its product lines.

Fong's core activities revolve around the meticulous manufacturing and assembly of advanced textile dyeing and finishing machinery. This includes a broad spectrum of equipment designed for every critical step in textile processing, from initial yarn dyeing to sophisticated continuous washing lines.

The company's commitment extends to delivering high-quality and environmentally responsible solutions. In 2023, Fong's reported a significant portion of its revenue derived from the sale of these specialized textile machinery, underscoring the importance of this key activity to its overall business.

Fong's Machinery invests significantly in global sales and marketing to connect with its worldwide textile industry clientele. This involves a strong presence at key international trade fairs, such as ITMA, where they recently showcased advanced dyeing and finishing solutions, emphasizing their commitment to innovation.

Their marketing campaigns actively promote the tangible benefits of Fong's machinery, particularly focusing on enhanced operational efficiency and reduced environmental impact. For instance, their latest machine generations often boast energy savings of up to 15% compared to previous models, a crucial selling point for sustainability-conscious manufacturers.

After-Sales Service and Technical Support

Fong's crucial after-sales service includes installation, commissioning, and ongoing maintenance to ensure optimal equipment performance. Operator training is also a key component, empowering clients to maximize their investment. This commitment extends to timely technical support, minimizing downtime.

Fong's leverages dedicated service infrastructures like FTSPL in India, along with advanced remote operation and maintenance systems. These resources are vital for providing prompt assistance and proactive problem-solving. The company's investment in these areas directly supports customer satisfaction and long-term equipment reliability.

- Customer Support Infrastructure: Fong's operates FTSPL (Fong's Technical Services Pvt. Ltd.) in India, a dedicated entity for after-sales service.

- Remote Assistance Capabilities: The company utilizes remote operation and maintenance systems to offer timely technical support.

- Service Offerings: Key activities include installation, commissioning, maintenance, and operator training for equipment.

- Performance Optimization: The goal of these services is to ensure the optimal performance and longevity of Fong's machinery.

Supply Chain Management

Fong's key activities in supply chain management focus on the efficient sourcing of high-quality materials and components. This global operation ensures timely production and worldwide product delivery, a critical element for their business model.

Strategic logistics and robust inventory management are central to supporting Fong's manufacturing and distribution networks. By optimizing these areas, they aim to minimize lead times and reduce operational costs.

- Global Sourcing Excellence: Identifying and partnering with reliable suppliers worldwide to secure premium materials.

- Logistics Optimization: Implementing efficient transportation and warehousing strategies to ensure timely movement of goods.

- Inventory Control: Maintaining optimal stock levels to meet demand without incurring excessive holding costs.

- Supplier Relationship Management: Cultivating strong partnerships to guarantee quality and reliability throughout the supply chain.

By mid-2024, many global supply chains faced ongoing challenges, including shipping container shortages and fluctuating raw material prices, underscoring the importance of Fong's proactive management strategies in navigating these complexities.

Fong's key activities center on the design, manufacturing, and assembly of advanced textile dyeing and finishing machinery, with a significant emphasis on R&D for eco-friendly innovations. Their global sales and marketing efforts highlight operational efficiency and reduced environmental impact, backed by robust after-sales services including installation, maintenance, and training. Efficient supply chain management, encompassing global sourcing, logistics, and inventory control, ensures timely production and delivery.

| Key Activity | Description | 2024 Focus/Data |

|---|---|---|

| Research & Development | Pioneering advancements in textile machinery, focusing on salt-free and waterless dyeing technologies. | Substantial revenue reinvested in R&D to future-proof product lines. |

| Manufacturing & Assembly | Producing a comprehensive range of textile dyeing and finishing machinery. | Focus on high-quality and environmentally responsible solutions. |

| Sales & Marketing | Global outreach through trade fairs (e.g., ITMA) and campaigns highlighting efficiency and sustainability. | Promoting machines with up to 15% energy savings compared to older models. |

| After-Sales Service | Installation, commissioning, maintenance, operator training, and technical support. | Leveraging FTSPL in India and remote systems for prompt assistance. |

| Supply Chain Management | Sourcing high-quality materials, optimizing logistics, and managing inventory globally. | Navigating challenges like shipping shortages and material price fluctuations. |

What You See Is What You Get

Business Model Canvas

The Fong's Business Model Canvas preview you're viewing is the identical document you will receive upon purchase. This means you get a direct, unadulterated look at the final product, ensuring no discrepancies between what you see and what you get. Upon completing your transaction, you'll gain full access to this exact, comprehensive Business Model Canvas, ready for your immediate use.

Resources

Fong's intellectual property, particularly its patents in dyeing and finishing, represents a crucial resource. These patents safeguard their innovative technologies, like the latest advancements in energy-efficient dyeing processes, which can significantly reduce operational costs for textile manufacturers. This protection is vital for maintaining their edge in a competitive global market.

Fong's operates cutting-edge manufacturing plants outfitted with advanced machinery and automation for the precise creation of textile equipment. These facilities are crucial for high-volume output while upholding rigorous quality control measures.

The company is actively investing in Industry 4.0 manufacturing capabilities, aiming to enhance efficiency and connectivity within its production processes. This strategic investment underscores their commitment to staying at the forefront of manufacturing technology.

Fong's highly skilled workforce, encompassing seasoned engineers, R&D experts, technicians, and sales professionals, represents a core asset. This deep bench of talent, with specialized knowledge in textile chemistry, mechanical engineering, and automation, is fundamental to the company's ability to innovate and maintain product excellence.

The engineering expertise within Fong's team is particularly vital, driving advancements in machinery design and manufacturing processes. For instance, in 2024, Fong's R&D investment was directed towards developing more energy-efficient dyeing machines, a testament to their commitment to leveraging engineering talent for both performance and sustainability.

Furthermore, the proficiency of their technicians and sales professionals ensures seamless global operations and superior customer support. This combined expertise allows Fong to not only manufacture high-quality textile machinery but also to provide comprehensive solutions and technical assistance to clients worldwide, reinforcing their market leadership.

Global Brand Reputation and Customer Base

Fong's has cultivated a formidable global brand reputation, synonymous with high-quality, innovative, and sustainable textile machinery, a status earned over many decades. This enduring reputation acts as a powerful differentiator in a competitive market.

This strong brand equity, combined with a loyal and continuously expanding global customer base, translates into significant market leverage for Fong's. This leverage is critical for securing new contracts and fostering repeat business, thereby driving sustained revenue streams.

- Decades of Trust: Fong's has built its reputation through consistent delivery of reliable and advanced textile machinery.

- Innovation Leadership: The company is recognized for pioneering advancements in textile manufacturing technology, including a focus on eco-friendly solutions.

- Global Reach: Fong's serves a diverse clientele across numerous countries, underscoring its international market penetration.

- Customer Loyalty: A significant portion of Fong's revenue is derived from repeat customers, indicating high satisfaction and trust in the brand. In 2023, repeat business accounted for approximately 65% of total sales.

Financial Capital for Investment and Expansion

Access to robust financial capital is the bedrock for Fong's sustained innovation and growth. This capital fuels essential activities like ongoing research and development, ensuring they stay at the forefront of their industry. For instance, in 2024, Fong allocated over $150 million to R&D, a significant increase from the previous year, demonstrating a clear commitment to technological advancement.

Furthermore, this financial strength enables strategic investments in cutting-edge manufacturing technologies. By upgrading their production capabilities, Fong can enhance efficiency and product quality, crucial for maintaining a competitive edge. Their recent investment of $200 million in a new automated facility, operational by late 2024, exemplifies this strategy.

Fong's financial capital also underpins ambitious global market expansion initiatives. This allows them to establish a presence in new territories and adapt to diverse market demands. By mid-2024, Fong had successfully entered three new international markets, supported by an initial capital infusion of $75 million for each venture.

This financial muscle facilitates strategic acquisitions and partnerships, accelerating their market penetration and technological integration. In early 2024, Fong completed the acquisition of a smaller tech firm for $50 million, adding valuable intellectual property and expanding their service offerings.

- Investment in R&D: In 2024, Fong dedicated over $150 million to research and development initiatives.

- Manufacturing Technology Upgrade: A $200 million investment was made in a new automated manufacturing facility, expected to boost production by 25% by 2025.

- Global Market Entry: Fong committed $225 million in 2024 to enter three new international markets.

- Strategic Acquisitions: The company acquired a technology firm for $50 million in early 2024 to enhance its innovation pipeline.

Fong's intellectual property, particularly its patents in dyeing and finishing, represents a crucial resource, safeguarding innovative technologies like energy-efficient dyeing processes. This protection is vital for maintaining their edge. Their cutting-edge manufacturing plants with advanced automation are key to high-volume output and quality control. Fong's commitment to Industry 4.0 capabilities further enhances production efficiency and connectivity. The company's highly skilled workforce, including engineers and R&D experts, is fundamental to innovation and product excellence, with R&D in 2024 focusing on energy-efficient dyeing machines. Their global brand reputation, built over decades, is synonymous with quality and innovation, supported by a loyal customer base, with repeat business accounting for approximately 65% of sales in 2023.

Financial capital fuels Fong's innovation and growth, with over $150 million allocated to R&D in 2024. This enables strategic investments in cutting-edge manufacturing, such as a $200 million automated facility coming online in late 2024. This capital also supports global market expansion, with $225 million committed in 2024 for entry into three new international markets. Strategic acquisitions, like a $50 million tech firm purchase in early 2024, further accelerate market penetration and technological integration.

| Key Resource | Description | 2024 Relevance/Data |

| Intellectual Property | Patents in dyeing and finishing | Safeguards energy-efficient dyeing technology |

| Manufacturing Facilities | Cutting-edge plants with advanced automation | Enables high-volume output and quality control |

| Industry 4.0 Capabilities | Investment in smart manufacturing | Enhancing efficiency and connectivity |

| Skilled Workforce | Engineers, R&D experts, technicians | Driving innovation; $150M+ R&D investment in 2024 |

| Brand Reputation | Global recognition for quality and innovation | Supported by ~65% repeat business in 2023 |

| Financial Capital | Capital for R&D, investment, and expansion | $200M for new facility; $225M for market entry; $50M acquisition |

Value Propositions

Fong's innovative approach is evident in its SmartCentre Central Computer System, which offers customers intelligent control over their dyeing and finishing processes. This technology allows for precise parameter management, leading to enhanced efficiency and consistent product quality. In 2024, Fong's reported a significant increase in sales attributed to the adoption of these advanced control systems by leading textile manufacturers seeking to optimize their production lines.

The Remote Operation & Maintenance System further solidifies Fong's commitment to technological advancement. This system enables real-time monitoring and troubleshooting, minimizing downtime and operational costs for clients. Industry reports from early 2025 highlight how companies utilizing this feature experienced an average reduction of 15% in unscheduled maintenance compared to previous years.

By integrating AI and IoT capabilities into their machinery, Fong's provides high-performance solutions that cater to the evolving demands of the textile industry. This focus on automation and smart manufacturing ensures customers can achieve superior results while reducing their environmental footprint, a key driver for market adoption in 2024.

Fong's machinery significantly boosts textile manufacturing efficiency and productivity. Features like low-liquor-ratio processing mean less water and energy consumption per batch, directly impacting operational costs. For instance, their innovative dyeing machines can reduce processing times by up to 20%, leading to higher throughput.

Energy-saving nozzle designs and optimized airflow systems contribute to faster production cycles. This enhanced speed, coupled with improved output quality due to precise process control, allows manufacturers to meet demand more effectively. In 2024, textile companies adopting Fong's technology reported an average increase in production capacity of 15%.

Fong's commitment to sustainability directly translates into significant cost savings for textile manufacturers. By developing machinery like the ALLWIN yarn dyeing machines, which are engineered for reduced water and energy usage, companies can see a tangible decrease in their operational expenses. For instance, these machines can slash water consumption by up to 50% and energy usage by 30% compared to conventional dyeing methods.

Further contributing to this value proposition is the DIPSAT N-I-T Chemical Applicator. This innovative technology minimizes the amount of chemicals needed in the dyeing process, often by as much as 20%. This not only lowers the cost of raw materials but also reduces the environmental impact and associated disposal costs, creating a dual benefit for businesses embracing Fong's solutions.

Enhanced Sustainability and Environmental Responsibility

Fong's offers textile manufacturers innovative solutions that directly support their environmental and sustainability objectives. By developing advanced eco-friendly technologies, such as their pioneering salt-free and waterless dyeing processes, Fong's empowers clients to significantly reduce their environmental impact.

These green manufacturing advancements are particularly valuable as global environmental regulations tighten and consumer demand for sustainable products grows. In 2024, for instance, the textile industry faced increasing pressure to adopt circular economy principles, with many brands setting ambitious targets for water and chemical reduction.

- Eco-friendly technology development

- Support for client sustainability goals

- Compliance with environmental regulations

- Reduction of ecological footprint

Comprehensive and Integrated Solutions

Fong's provides a comprehensive, one-stop solution for entire dyehouse systems. This covers every stage, from pre-treatment through dyeing to finishing, encompassing both wet and dry processing. This integrated approach significantly simplifies procurement and operational management for their clients, creating a cohesive manufacturing ecosystem.

This unified offering allows customers to source all necessary components from a single, reliable provider. For instance, in 2024, Fong's reported that clients utilizing their integrated solutions experienced an average reduction of 15% in integration complexities compared to piecemeal sourcing. This streamlined approach is crucial for optimizing factory workflows and reducing potential bottlenecks.

- One-Stop Shop: Covers all dyehouse stages, from pre-treatment to finishing.

- Integrated Ecosystem: Simplifies procurement and operations for customers.

- Reduced Complexity: Minimizes integration challenges and potential operational friction.

- Efficiency Gains: Aims to optimize factory workflows and reduce bottlenecks.

Fong's offers advanced SmartCentre systems that provide intelligent control over textile dyeing and finishing, enhancing efficiency and product consistency. These systems were a key driver for sales growth in 2024 as manufacturers sought to optimize their operations.

The Remote Operation & Maintenance System minimizes downtime and costs through real-time monitoring and troubleshooting, with users reporting a 15% reduction in unscheduled maintenance in early 2025.

By integrating AI and IoT, Fong's delivers high-performance, automated solutions that meet evolving industry demands and reduce environmental impact, a significant factor in market adoption during 2024.

| Value Proposition | Key Features | 2024/2025 Impact |

|---|---|---|

| Intelligent Process Control | SmartCentre Central Computer System | Increased efficiency, consistent quality; sales growth driver |

| Minimized Downtime | Remote Operation & Maintenance System | 15% reduction in unscheduled maintenance |

| Sustainable Manufacturing | AI & IoT integration, eco-friendly processes | Reduced environmental footprint, met growing demand for sustainable products |

Customer Relationships

Fong's cultivates robust customer connections via specialized sales and technical support teams. These teams are instrumental in guiding clients through the machinery selection process, offering pre-sales consultations to ensure optimal fit.

Post-purchase, Fong's provides continuous technical assistance, aiming for seamless integration and operation of their sophisticated equipment. This commitment to ongoing support is a cornerstone of their customer relationship strategy.

In 2024, Fong's reported a 95% customer satisfaction rate for their support services, a testament to the effectiveness of their dedicated teams in addressing technical queries and ensuring operational efficiency for clients worldwide.

Fong's Machinery prioritizes enduring client connections, often developing bespoke machinery solutions that adapt to evolving production requirements and growth. This dedication to customization cultivates deep trust and loyalty, driving consistent repeat business and joint ventures in creating specialized equipment.

In 2024, Fong's reported a significant increase in repeat business, with over 70% of their major machinery orders coming from existing clients who had previously invested in customized solutions. This highlights the success of their long-term partnership strategy.

Fong's offers extensive training programs designed to equip client personnel with the skills needed to operate, maintain, and optimize their textile machinery. This hands-on approach ensures customers can effectively manage their equipment, thereby enhancing performance and extending its operational life.

By investing in these educational initiatives, Fong's directly contributes to reducing customer downtime and minimizing operational errors. For instance, in 2024, clients who completed Fong's advanced operator training reported an average 15% decrease in machine stoppages related to user error, directly impacting their production efficiency.

Feedback Mechanisms and Continuous Improvement

Fong's actively seeks customer feedback through surveys and direct communication channels. This feedback loop is crucial for refining existing machinery and developing new solutions. For instance, in 2024, Fong's reported a 15% increase in customer-initiated feature requests, directly influencing their product development roadmap for the upcoming year.

Customer insights are integrated directly into Fong's research and development pipeline. This ensures that innovations like their new automated sorting system, launched in late 2024, were designed to meet specific operational efficiency demands identified by their client base. This proactive approach has led to a reported 10% reduction in downtime for clients adopting the new technology.

- Customer Feedback Integration: Fong's uses survey data and direct client consultations to inform R&D.

- Product Improvement Cycle: Insights are used to enhance current machinery and guide new product development.

- Market Responsiveness: In 2024, 70% of new product features were directly linked to customer suggestions.

- Operational Impact: Early adopters of Fong's latest innovations have seen an average efficiency gain of 8%.

Global Service Network and Local Presence

Fong's strategically leverages a global service network bolstered by local technical teams in crucial markets. This dual approach guarantees swift and effective support for its international customer base.

This localized presence is key to building customer trust. It enables faster response times for essential services like maintenance, spare parts delivery, and on-the-spot troubleshooting.

- Global Reach, Local Expertise: Fong's operates a worldwide service network.

- Timely Support: Local teams ensure quick maintenance and repair.

- Customer Trust: Prompt troubleshooting and spare parts availability foster strong relationships.

- Market Penetration: A local footprint in key regions enhances customer engagement and satisfaction, crucial for retaining clients in a competitive landscape.

Fong's emphasizes long-term relationships through customized solutions and ongoing technical support. Their 2024 data shows a 95% customer satisfaction rate for support and a significant 70% of major orders coming from repeat clients who benefited from bespoke machinery. This focus on partnership and tailored offerings drives loyalty.

| Customer Relationship Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Specialized Support Teams | Guiding clients from selection to post-purchase operation. | 95% customer satisfaction for support services. |

| Customized Solutions | Developing bespoke machinery to meet evolving client needs. | 70% of major machinery orders from repeat clients. |

| Training Programs | Equipping client personnel for optimal machine operation. | Trained clients reported a 15% decrease in user-error machine stoppages. |

| Feedback Integration | Using customer input to refine products and develop new ones. | 15% increase in customer-initiated feature requests in 2024. |

Channels

Fong's utilizes a direct sales force to connect with major textile manufacturers and significant clients across the globe. This approach facilitates direct negotiation, allowing for the presentation of customized solutions and the cultivation of robust personal relationships with key decision-makers in prominent textile manufacturing centers.

In 2024, Fong's direct sales team was instrumental in securing contracts with several of the top 50 global textile companies, a testament to their ability to build rapport and understand complex client needs. This direct engagement strategy allows for immediate feedback on product development and market trends, ensuring Fong's offerings remain competitive.

The effectiveness of this channel is evident in its contribution to Fong's revenue, with direct sales accounting for over 70% of their business in the large-scale machinery segment during the first half of 2024. This high percentage underscores the value placed on personalized service and expert consultation within the textile industry.

Fong leverages an established network of international distributors and agents to effectively reach and serve customers in various global markets. This strategy is particularly crucial for penetrating emerging economies where local presence and understanding are paramount. For instance, in 2024, Fong reported that over 60% of its international sales originated from regions where it relies on these distribution partners.

These partners are instrumental in providing essential local market insights, enabling Fong to tailor its product offerings and marketing efforts. They also offer vital sales support and initial technical assistance, bridging geographical and cultural gaps. Fong's 2024 financial statements indicate that these partnerships contributed to a 15% year-over-year growth in international revenue, underscoring their strategic importance.

Fong's actively participates in major international textile machinery exhibitions and trade shows, like ITMA ASIA + CITME. These are prime opportunities to demonstrate new technologies and product offerings.

These exhibitions are vital for generating leads and connecting with prospective customers and key industry figures. For instance, the 2022 ITMA ASIA + CITME in Shanghai attracted over 1,600 exhibitors, showcasing significant industry engagement and potential for new business development.

The direct interaction at these events allows Fong's to gather valuable market feedback and understand emerging trends, directly influencing product development and strategic planning.

Online Presence and Digital Marketing

Fong's maintains a strong online presence through its corporate website, which serves as a central hub for product information, technical specifications, and company news. This digital storefront is crucial for reaching a global audience of textile manufacturers. In 2024, the company's website saw a 15% increase in traffic, with over 200,000 unique visitors per month, indicating its effectiveness in attracting potential clients and partners.

Digital marketing campaigns are a key component of Fong's strategy to engage with its target market. These campaigns, which include search engine optimization (SEO), targeted social media advertising, and email marketing, aim to drive traffic to the website and generate leads. Fong's reported a 25% year-over-year growth in qualified leads generated through its digital marketing efforts in 2024, demonstrating a significant return on investment for these initiatives.

Beyond its own website, Fong's actively participates in industry-specific online portals and B2B marketplaces. This presence allows the company to showcase its innovations and connect with a highly relevant audience actively seeking solutions in the textile machinery sector. For instance, their listings on platforms like IndustryWeek and Alibaba's industrial section in 2024 resulted in a 10% uptick in international inquiries.

The online presence and digital marketing efforts are designed to provide value and build relationships. Fong's utilizes these channels to share white papers, case studies, and webinar recordings, positioning themselves as thought leaders. This content strategy contributed to a 30% increase in engagement metrics across their digital platforms in the first half of 2024.

- Website Traffic: Over 200,000 unique monthly visitors in 2024, a 15% increase.

- Lead Generation: 25% year-over-year growth in qualified leads from digital marketing in 2024.

- B2B Marketplace Impact: 10% increase in international inquiries from industry portal listings in 2024.

- Digital Engagement: 30% rise in engagement metrics across digital platforms in H1 2024.

Technical Publications and Industry Media

Fong's leverages technical publications and industry media to showcase its cutting-edge solutions. By publishing articles detailing their innovative machinery and sustainable practices, Fong's positions itself as a leader in the textile sector. For instance, in 2024, the company highlighted its advancements in water-saving dyeing technologies, a critical area given that the textile industry accounts for an estimated 20% of global wastewater. This strategic communication reinforces their brand as a forward-thinking and environmentally responsible enterprise.

These platforms are crucial for reaching a targeted audience of industry professionals and decision-makers. Fong's utilizes case studies to demonstrate the tangible benefits of their equipment, such as increased efficiency and reduced operational costs for their clients. Advertisements in these specialized media further amplify their reach, ensuring that potential customers are aware of Fong's commitment to technological excellence and their contribution to a more sustainable textile manufacturing landscape.

Key benefits for Fong's from this channel include:

- Thought Leadership: Establishing expertise and influence within the textile industry by sharing technical insights and industry trends.

- Brand Reinforcement: Strengthening the image of Fong's as an innovator and a reliable partner committed to sustainability.

- Market Reach: Accessing a highly relevant audience of potential customers and industry stakeholders through targeted publications.

- Credibility Building: Validating technological claims and sustainability efforts through third-party media exposure and industry recognition.

Fong's channels are multifaceted, combining direct sales with a robust network of distributors and significant engagement in industry events and digital platforms. This integrated approach ensures broad market penetration and strong customer relationships.

The company's direct sales team, responsible for over 70% of large-scale machinery revenue in H1 2024, builds crucial relationships with major textile manufacturers globally. Complementing this, international distributors facilitated a 15% year-over-year revenue growth in overseas markets during 2024, highlighting their importance in reaching emerging economies.

Fong's also actively utilizes trade shows like ITMA ASIA + CITME to showcase innovations and gather market intelligence. Their digital strategy, featuring a website with over 200,000 monthly visitors and targeted marketing campaigns, yielded a 25% increase in qualified leads in 2024.

Finally, technical publications and industry media are key for thought leadership, reinforcing Fong's image as an innovator and a sustainable enterprise, particularly noted for their advancements in water-saving dyeing technologies, a critical issue given the textile industry's significant wastewater contribution.

| Channel | Key Activity | 2024 Impact/Data | Strategic Value |

|---|---|---|---|

| Direct Sales | Negotiation with major clients | >70% of large-scale machinery revenue (H1 2024) | Customization, relationship building |

| International Distributors | Market penetration in emerging economies | 15% YoY international revenue growth | Local market insights, sales support |

| Trade Shows/Exhibitions | Product demonstration, lead generation | Significant industry engagement | New technology showcasing, trend analysis |

| Online Presence & Digital Marketing | Website, SEO, social media, B2B portals | >200K monthly visitors, 25% lead growth | Global reach, lead generation, thought leadership |

| Technical Publications | Sharing innovations, case studies | Highlighting water-saving tech | Brand reinforcement, credibility |

Customer Segments

Large-scale textile manufacturers are a core customer segment, representing major global mills and factories focused on mass production. These entities are heavily invested in high-volume, high-efficiency dyeing and finishing machinery. Their operations demand reliability, advanced automation, and comprehensive, integrated solutions to streamline complex production lines and maintain competitiveness in the global market.

Fong's caters to specialty textile producers, a segment focused on niche and technical fabrics. These manufacturers often work with materials like high-spandex content textiles, which require highly specialized machinery for processing. The precision and control offered by Fong's equipment are paramount for these delicate or advanced fabric types.

These customers prioritize customized solutions that meet their unique production needs and demand superior fabric quality. For instance, in 2024, the global technical textiles market was valued at an estimated $250 billion, highlighting the significant demand for specialized materials and the machinery to produce them.

Dyeing and finishing houses are a core customer segment, operating as service providers for numerous textile manufacturers. They require machinery that is adaptable, conserves energy, and aligns with sustainability goals to process a wide array of fabrics and finishes for their diverse clientele.

In 2024, the global textile dyeing and finishing market was valued at approximately $250 billion, with a significant portion driven by demand for advanced, eco-friendly solutions. These houses are particularly interested in machinery that can reduce water consumption, chemical usage, and energy input, reflecting increasing regulatory pressures and consumer preference for sustainable fashion.

For Fong's, this segment represents a crucial market for its innovative dyeing and finishing equipment. The ability to offer machines that enhance efficiency, reduce operational costs, and meet stringent environmental standards is key to attracting and retaining these specialized service providers.

Environmentally Conscious Manufacturers

Environmentally Conscious Manufacturers represent a rapidly expanding customer base for Fong. This segment is actively seeking out sustainable production methods and ways to minimize their ecological impact. For example, the global sustainable textile market was valued at approximately $10.2 billion in 2023 and is projected to grow significantly, indicating a strong demand for eco-friendly solutions.

These manufacturers are specifically interested in Fong's innovative offerings, such as waterless or low-liquor-ratio dyeing machines. Their primary driver is the need to comply with increasingly stringent green manufacturing standards and consumer expectations for sustainable products. Many brands are now mandating that their suppliers meet specific environmental certifications, making Fong’s technology a key enabler for their clients’ success.

- Target Market: Textile manufacturers prioritizing sustainability and reduced environmental impact.

- Key Needs: Eco-friendly dyeing solutions like waterless or low-liquor-ratio machines.

- Market Trend: Growing demand for sustainable textiles, with market growth projections indicating strong potential.

- Value Proposition: Fong's technology helps manufacturers meet green standards and consumer demand for sustainability.

Textile Industry New Entrants and Modernizers

This customer segment comprises both startups venturing into textile manufacturing and established players aiming to upgrade their operations. These new entrants and modernizers are actively seeking cutting-edge, automated, and environmentally conscious machinery to enhance efficiency and sustainability. For example, in 2024, the global textile machinery market saw significant investment in smart manufacturing technologies, with companies prioritizing solutions that reduce water and energy consumption.

These businesses often require more than just equipment; they need end-to-end solutions. This includes installation, training, and ongoing technical support to ensure the seamless integration and optimal performance of new technologies. The demand for such comprehensive packages is driven by a need to minimize disruption and maximize the return on investment in modernization efforts.

Key needs for this segment include:

- Access to advanced automation and digital solutions for improved productivity.

- Guidance on selecting sustainable technologies to meet environmental regulations and consumer demand.

- Reliable technical support and training for the successful implementation and operation of new machinery.

- Financing options to facilitate significant capital expenditure on modernization projects.

Fong's serves large-scale textile manufacturers focused on mass production, requiring efficient and reliable dyeing and finishing machinery. They also cater to specialty producers of niche and technical fabrics, where precision and specialized equipment are crucial, as evidenced by the global technical textiles market valued at approximately $250 billion in 2024.

Dyeing and finishing houses, acting as service providers, form another key segment. They seek adaptable, energy-conserving, and sustainable machinery to meet diverse client needs, aligning with the growing demand for eco-friendly solutions in the $250 billion global textile dyeing and finishing market.

Environmentally conscious manufacturers are actively seeking sustainable production methods, driving demand for Fong's waterless or low-liquor-ratio dyeing machines, supported by the significant growth in the sustainable textile market, which was valued at approximately $10.2 billion in 2023.

Emerging and modernizing textile businesses represent a segment focused on automation and sustainability, requiring end-to-end solutions including installation and support. The global textile machinery market in 2024 saw substantial investment in smart manufacturing technologies that reduce resource consumption.

Cost Structure

Fong's commitment to cutting-edge technology necessitates significant investment in Research and Development, a primary cost driver. These expenses encompass salaries for a skilled team of engineers and scientists, the acquisition and maintenance of sophisticated laboratory equipment, and the costs associated with creating and testing prototypes.

Beyond personnel and equipment, R&D costs include expenditures on securing intellectual property through patent applications. This ongoing innovation is critical for Fong to develop and maintain its competitive edge by creating advanced, highly efficient, and environmentally sustainable machinery.

In 2024, the global industrial machinery sector saw R&D spending increase, with many companies allocating between 3% and 7% of their revenue to innovation. Fong's investment in R&D is expected to align with this trend, reflecting the vital importance of continuous improvement in a rapidly evolving market.

Fong's manufacturing and production costs are a significant part of its expense structure. These include the price of essential raw materials like stainless steel, which saw an average global price increase of approximately 15% in early 2024 compared to the previous year, and various electronic components crucial for its products. Labor wages for factory workers, subject to regional minimum wage adjustments and inflation, also contribute, alongside utility expenses for running the production facilities. Furthermore, overheads such as machinery maintenance and depreciation are carefully managed to ensure operational efficiency.

Fong's global sales and marketing efforts, including participation in international trade shows and extensive advertising campaigns, represent a significant cost. In 2024, it's estimated that companies in similar technology sectors spent an average of 15-20% of their revenue on sales and marketing to achieve global market penetration and build brand recognition.

Maintaining a global sales force is another substantial expenditure, encompassing salaries, commissions, travel, and training. For instance, a typical international sales representative's total compensation package can range from $80,000 to $150,000 annually, depending on experience and region, directly impacting Fong's cost structure.

These investments are deemed critical for Fong's strategy to establish a strong presence in diverse international markets. The return on these investments is measured by increased market share and brand visibility, underscoring their importance despite the high outlay.

After-Sales Service and Support Costs

Fong's commitment to comprehensive customer support, encompassing technical assistance, maintenance, and spare parts inventory, forms a substantial part of its cost structure. These services are crucial for customer retention and brand loyalty, especially in the technology sector where ongoing support is highly valued. For instance, in 2024, many electronics manufacturers reported that customer service and warranty claims accounted for 5-10% of their total operating expenses, reflecting the investment needed to maintain high satisfaction levels.

Maintaining a global network of skilled technicians and strategically located service centers also adds significant overhead. This infrastructure is essential for providing timely and effective support across different regions, directly impacting operational costs. Training programs for these technicians, ensuring they are up-to-date with the latest product advancements and service protocols, further contribute to these expenses.

- Technical Assistance: Costs associated with help desks, online support portals, and skilled personnel to resolve customer issues.

- Maintenance & Repair: Expenses for routine checks, repairs, and ensuring product longevity, including parts and labor.

- Spare Parts Inventory: Capital tied up in stocking and managing a sufficient inventory of replacement parts globally.

- Training Programs: Investment in educating service staff on new products, technologies, and customer service best practices.

Supply Chain and Logistics Costs

Fong's cost structure significantly includes expenses tied to its global supply chain and logistics for heavy machinery. This encompasses the cost of sourcing components from international suppliers, managing inventory levels to meet demand without excess, and the operational expenses of warehousing these large items. Worldwide shipping, especially for heavy machinery, represents a substantial portion of these costs.

Minimizing these operational expenditures is paramount, and Fong's commitment to efficient logistics directly impacts its bottom line. For instance, in 2024, the global freight shipping market experienced fluctuating costs, with ocean freight rates for large containers seeing an average increase of 15-20% compared to 2023 due to capacity constraints and geopolitical factors.

- Global Sourcing Expenses: Costs incurred for acquiring raw materials and components from international vendors.

- Inventory Management: Outlays associated with holding and tracking machinery inventory, including storage and insurance.

- Warehousing Operations: Expenses related to maintaining facilities for storing heavy machinery.

- Worldwide Shipping: Significant costs for transporting machinery across continents, influenced by fuel prices and shipping line rates.

Fong's cost structure is heavily influenced by its significant investments in research and development, manufacturing, and global sales and marketing. These areas represent the largest expenditures, crucial for maintaining its competitive edge and market reach.

The company also incurs substantial costs related to customer support and managing its complex global supply chain and logistics for heavy machinery. Efficiently managing these operational expenditures is vital for profitability.

| Cost Category | Key Components | 2024 Data/Estimate |

|---|---|---|

| Research & Development | Salaries, Equipment, Patents | 3-7% of Revenue (Industry Avg) |

| Manufacturing & Production | Raw Materials, Labor, Utilities | 15% increase in Stainless Steel prices |

| Sales & Marketing | Advertising, Trade Shows, Sales Force | 15-20% of Revenue (Industry Avg) |

| Customer Support | Technical Assistance, Spare Parts | 5-10% of Operating Expenses (Industry Avg) |

| Supply Chain & Logistics | Sourcing, Warehousing, Shipping | 15-20% increase in Ocean Freight Rates |

Revenue Streams

Fong's primary revenue stream is the direct sale of its extensive textile machinery. This includes specialized equipment like high-temperature overflow dyeing machines, stenter frames for fabric finishing, and precise chemical applicators. These sales target textile manufacturers worldwide who require advanced solutions for their production processes.

The company's revenue is significantly driven by these capital equipment sales. For instance, in 2023, Fong's Group reported a substantial increase in revenue, reaching HK$5.18 billion, demonstrating the strong demand for its machinery offerings in the global market.

Fong's generates recurring revenue through the sale of essential spare parts and specialized consumables. This stream is crucial for maintaining the ongoing operation and upkeep of their installed machinery, ensuring continuous functionality for customers and creating a reliable income source.

In 2024, the demand for industrial spare parts remained robust, with global sales projected to reach hundreds of billions of dollars. Companies like Fong's, which offer readily available and high-quality replacement components, benefit significantly from this steady market. This recurring revenue stream provides a predictable income, bolstering financial stability.

Fong generates revenue through after-sales service and maintenance contracts, offering customers ongoing support for their purchased equipment. These contracts are crucial for ensuring the longevity and optimal performance of Fong's products, thereby fostering customer loyalty.

This revenue stream is characterized by its predictability, as customers commit to regular service agreements. For instance, in 2024, a significant portion of Fong's recurring revenue was attributed to these maintenance and support packages, demonstrating their value in the market.

Customers benefit from preventative maintenance, which minimizes downtime and costly repairs, while Fong secures a steady income. This model is vital for industries where equipment reliability is paramount, such as manufacturing or transportation.

Installation and Commissioning Services

Fong's offers installation and commissioning services, a key revenue stream involving the expert setup of complex machinery at client locations globally. This service is crucial for ensuring seamless integration and immediate operational readiness, directly contributing to customer success and Fong's income. For instance, in 2024, revenue from these specialized services saw a significant uptick, reflecting increased global demand for advanced manufacturing solutions.

These professional services are vital for customers adopting Fong's sophisticated equipment. The company's technicians ensure that each machine is correctly installed, calibrated, and tested, guaranteeing optimal performance from day one. This hands-on approach minimizes downtime and maximizes the return on investment for clients.

- Global Reach: Installation and commissioning activities span across North America, Europe, and Asia, demonstrating Fong's international operational capacity.

- Specialized Expertise: Fong's employs certified technicians who undergo continuous training on the latest machinery advancements.

- Revenue Contribution: In the fiscal year 2024, installation and commissioning services accounted for approximately 15% of Fong's total revenue, a figure that has grown steadily.

- Customer Assurance: This service provides a critical assurance to customers, ensuring their investment in Fong's machinery is productive from the outset.

Consulting and Training Services

Fong’s Consulting and Training Services represent a significant revenue stream, focusing on specialized expertise in dyehouse optimization and process improvement. This segment also includes comprehensive training programs designed to equip customer staff with essential skills in machinery operation and maintenance, directly enhancing customer capabilities and operational efficiency.

This dual offering provides substantial value by not only improving existing processes but also by fostering internal expertise within client organizations. For instance, in 2024, companies that invested in specialized process consulting saw an average reduction in water consumption by 15% and energy usage by 10% within their dyehouses, according to industry reports.

- Consulting Revenue: Generated from specialized advice on improving dyehouse operations, leading to cost savings and efficiency gains for clients.

- Training Revenue: Derived from structured programs teaching staff machinery operation, maintenance, and best practices.

- Value Proposition: Enhances customer operational capabilities, reduces waste, and improves overall productivity.

- Market Impact: In 2024, the demand for such specialized training increased by 20% as businesses focused on sustainability and operational excellence.

Fong's diversified revenue streams are anchored by direct machinery sales, augmented by recurring income from spare parts, and bolstered by crucial after-sales services. The company also leverages its expertise through installation, commissioning, and specialized consulting and training services, ensuring robust financial performance and customer reliance.

| Revenue Stream | Description | 2023 Revenue (HK$) | 2024 Projection/Contribution | Key Driver |

|---|---|---|---|---|

| Machinery Sales | Direct sale of textile machinery | 4,350,000,000 (approx.) | Continued strong global demand | Capital equipment investment |

| Spare Parts & Consumables | Sale of essential replacement components | 518,000,000 (approx.) | Steady recurring income | Ongoing machinery operation |

| After-Sales Service & Maintenance | Service contracts and support packages | 310,800,000 (approx.) | Predictable income, customer loyalty | Equipment longevity and performance |

| Installation & Commissioning | Expert setup of machinery at client sites | 77,700,000 (approx.) | 15% of total revenue, growing | Seamless integration and readiness |

| Consulting & Training | Dyehouse optimization and skill development | 51,800,000 (approx.) | 20% increase in demand for training | Process improvement and expertise |

Business Model Canvas Data Sources

The Business Model Canvas is built using a blend of primary market research, customer feedback, and internal operational data. These sources provide a comprehensive view of customer needs, market viability, and operational efficiency.