Fidelity National Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fidelity National Financial Bundle

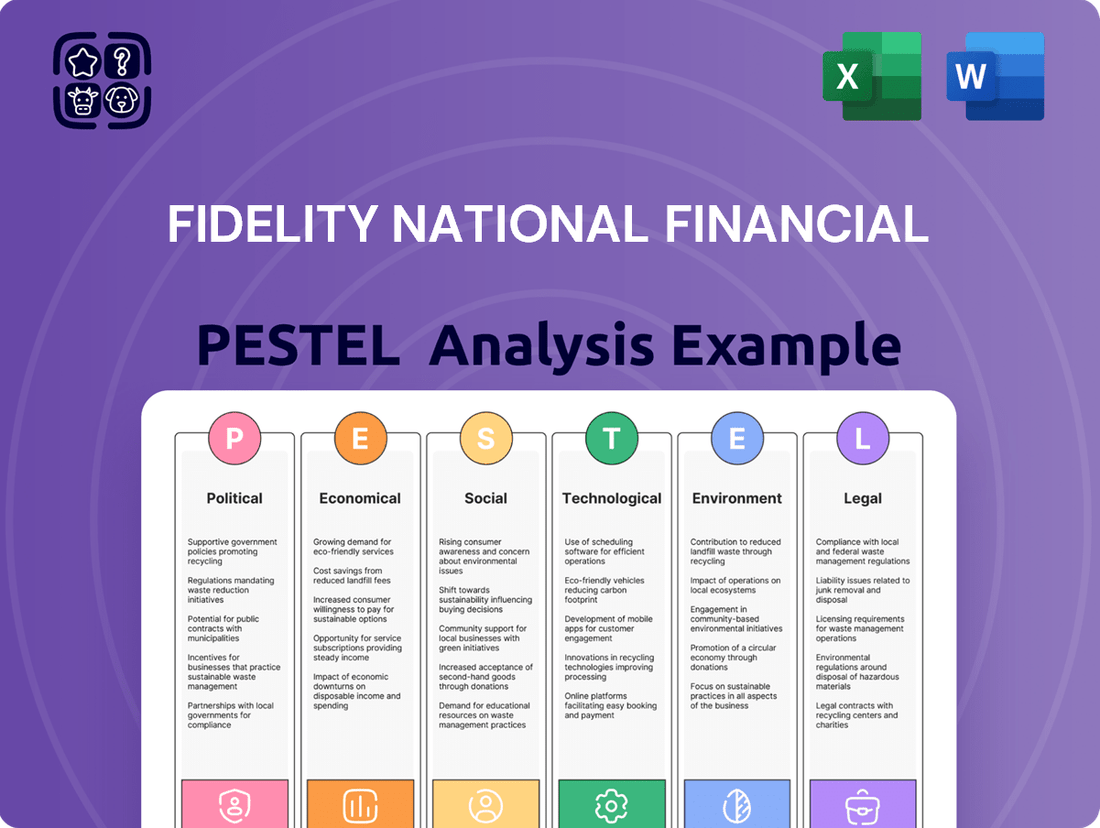

Gain a critical understanding of the external forces shaping Fidelity National Financial's trajectory. Our PESTLE analysis dives deep into political stability, economic fluctuations, and evolving social trends that directly impact the title insurance and real estate services sectors. Uncover the technological advancements and regulatory shifts that present both opportunities and challenges for FNF's strategic planning.

Don't get left behind in a rapidly changing market. Our comprehensive PESTLE analysis for Fidelity National Financial provides actionable intelligence to inform your investment decisions and business strategies. Download the full version now to unlock a deeper understanding of the external landscape and secure your competitive advantage.

Political factors

Government policies significantly shape Fidelity National Financial's (FNF) operating landscape, particularly concerning housing affordability and mortgage lending. For example, the Federal Housing Finance Agency (FHFA) sets conforming loan limits, which directly impact the volume of mortgages eligible for purchase by Fannie Mae and Freddie Mac, thereby influencing FNF's title and escrow services. In 2024, these conforming loan limits saw an increase, with the baseline limit for a one-unit property rising to $766,550 in most areas, a notable adjustment that can stimulate higher-value real estate transactions.

The Federal Reserve's monetary policy, especially its stance on interest rates, is a critical political factor influencing Fidelity National Financial (FNF). Decisions by the Fed directly shape the mortgage market, which is FNF's core business.

When the Federal Reserve raises interest rates, it typically leads to higher mortgage rates. This makes it more expensive for consumers to borrow money, potentially slowing down the housing market and reducing the volume of new mortgages and refinances that FNF processes.

For 2025, the Mortgage Bankers Association (MBA) projects that mortgage rates will hover in the mid-6% range. This sustained level of higher rates could continue to suppress demand in the mortgage sector, impacting FNF's transaction volumes and revenue.

Geopolitical tensions, such as ongoing conflicts and trade disputes, are creating significant economic uncertainty. This instability directly impacts investor confidence, making them more hesitant to commit capital, which in turn affects the stability of the real estate market.

This cautious sentiment translates into a more reserved approach from both potential buyers and sellers. Consequently, transaction volumes in real estate may see a slowdown, and property value appreciation could be tempered as market participants await greater clarity.

The Mortgage Bankers Association, in its outlook for 2025, has identified global uncertainty as a primary driver influencing the broader economic landscape and, by extension, the demand for mortgages. This underscores the direct link between international political stability and domestic financial markets.

Trade Policies and Their Impact on Construction Costs

Trade policies, particularly tariffs on imported construction materials, directly influence the cost of building new homes. For instance, steel tariffs implemented in recent years have added to project expenses, impacting the overall supply and pricing dynamics of the housing market, which is a key area for Fidelity National Financial’s title and escrow services.

Higher construction costs translate into elevated home prices. This can dampen housing affordability, potentially slowing down the volume of new home sales. In 2024, the U.S. housing market experienced a slowdown in new home sales compared to previous years, partly due to affordability challenges exacerbated by material costs.

Furthermore, proposed or existing tariffs can create economic uncertainty that might influence broader monetary policy. For example, persistent inflation driven by trade costs could delay anticipated Federal Reserve interest rate cuts. This would keep mortgage rates higher, further impacting housing demand and the volume of transactions FNF facilitates.

- Tariffs on steel and lumber can increase construction costs by an estimated 5-15% in affected regions.

- Higher construction costs contribute to a rise in median home prices, potentially reducing affordability for a significant portion of the population.

- The Federal Reserve’s monetary policy, including interest rate decisions, is sensitive to inflation, which can be influenced by trade policies.

Consumer Protection Regulations

Consumer protection regulations, particularly those enforced by bodies like the Consumer Financial Protection Bureau (CFPB), significantly shape the operational landscape for companies like Fidelity National Financial (FNF). These regulations are designed to safeguard consumers in critical areas such as real estate and mortgage transactions. For instance, the CFPB's focus on eliminating 'junk fees' and scrutinizing restrictive contract clauses directly influences how FNF structures its service offerings and pricing models. Compliance with these evolving rules necessitates ongoing adaptation and potential adjustments to existing business practices.

The impact of these regulations can be substantial. In 2023, the CFPB continued its enforcement actions against various financial institutions for unfair or deceptive practices, underscoring the heightened regulatory scrutiny. For FNF, this translates to a continuous need to review and potentially revise its title insurance policies, escrow services, and other related offerings to ensure full adherence.

- CFPB Enforcement: The CFPB's ongoing investigations and penalties against financial service providers highlight the critical need for FNF to maintain robust compliance programs.

- 'Junk Fee' Scrutiny: Regulations targeting excessive or hidden fees directly impact FNF's revenue streams and require transparent pricing strategies.

- Contractual Clause Review: Scrutiny of restrictive contract clauses necessitates FNF to ensure its agreements are fair and compliant with consumer protection standards.

- Market Impact: Increased consumer confidence due to stronger protections can lead to more stable and predictable market conditions for FNF's services.

Government policies, including interest rate decisions by the Federal Reserve and conforming loan limits set by the FHFA, directly influence Fidelity National Financial's (FNF) business volume in 2024 and 2025. For instance, the baseline conforming loan limit increased to $766,550 in 2024, potentially boosting higher-value transactions. Projections for 2025 suggest mortgage rates remaining in the mid-6% range, impacting demand for FNF's mortgage-related services.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Fidelity National Financial, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying key trends and potential challenges within these critical dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for Fidelity National Financial.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the Political, Economic, Social, Technological, Legal, and Environmental influences affecting Fidelity National Financial.

Economic factors

Mortgage interest rates significantly shape the real estate landscape. For 2025, projections indicate rates will likely hover in the mid-6% range, continuing to impact how much buyers can afford and influencing overall demand.

Fidelity National Financial's (FNF) financial performance is directly linked to mortgage origination and refinance volumes. These volumes are particularly sensitive to shifts in interest rates, meaning any movement in the mid-6% range will have a noticeable effect on FNF's revenue streams.

The supply of homes for sale and their average prices are key drivers for Fidelity National Financial (FNF). When more homes are available and prices are stable or rising, more real estate deals happen, which directly boosts FNF's title insurance and transaction service revenues.

Nationally, housing inventory is still tighter than before the COVID-19 pandemic. For instance, in early 2024, the U.S. had roughly 1 million homes for sale, significantly less than the 2-3 million typically seen pre-2020. This scarcity, while easing some price appreciation, still supports a relatively active market.

FNF benefits from this activity. When sales volume is high, the demand for title searches, insurance policies, and closing services increases. Even with moderating price growth, the sheer number of transactions remains crucial for FNF's business volume.

Fidelity National Financial's (FNF) core operations are intrinsically linked to the ebb and flow of mortgage origination and refinance volumes. In 2025, the market is anticipated to be primarily driven by purchases, signaling a modest rebound in overall origination activity from prior periods.

However, refinance volumes are projected to stay relatively low. This is largely because a significant number of homeowners have already secured mortgages at historically low interest rates, diminishing the incentive to refinance.

These trends directly impact FNF's revenue generation, as higher origination and refinance volumes typically translate to increased demand for title insurance and other related services that form the backbone of their business.

Inflation and Economic Growth

Inflationary pressures and the pace of economic expansion directly impact consumer spending power and real estate investment. While the U.S. economy demonstrated considerable strength, a modest slowdown is anticipated for 2025, with inflation continuing to be a point of attention, potentially affecting housing affordability.

A robust economy typically fuels a healthy real estate sector, which is advantageous for Fidelity National Financial. For instance, the U.S. GDP growth was estimated to be around 2.5% in 2024, but projections for 2025 suggest a slight moderation. Meanwhile, the Consumer Price Index (CPI) showed a year-over-year increase of approximately 3.1% as of early 2024, indicating persistent inflationary concerns.

- Economic Growth: U.S. GDP growth projected to moderate from an estimated 2.5% in 2024 to around 1.8% in 2025.

- Inflation: CPI inflation stood at roughly 3.1% year-over-year in early 2024, with ongoing monitoring required.

- Housing Affordability: Rising inflation and interest rates can constrain housing affordability, impacting transaction volumes.

- FNF Benefit: A resilient economy generally supports higher transaction volumes in title insurance and mortgage services, benefiting FNF.

Consumer Debt Levels and Access to Credit

High consumer debt levels, particularly in student loans and credit cards, directly impact individuals' capacity to secure mortgages and accumulate down payments, subsequently influencing first-time homebuyer engagement. As of Q1 2024, total U.S. household debt reached a record $17.7 trillion, with student loan debt at $1.77 trillion and credit card debt exceeding $1.1 trillion. These figures suggest a significant portion of the population may face hurdles in qualifying for new real estate purchases.

The ease with which consumers can access credit on favorable terms is a vital determinant of ongoing real estate market activity. When credit is readily available and interest rates are manageable, consumers are more likely to finance home purchases, driving demand. Conversely, tighter lending standards or elevated interest rates can dampen this activity, creating headwinds for the sector.

- Record Household Debt: U.S. household debt hit $17.7 trillion in Q1 2024, impacting purchasing power.

- Student Loan Burden: $1.77 trillion in student loan debt can delay homeownership.

- Credit Card Strain: Over $1.1 trillion in credit card debt affects individuals' debt-to-income ratios.

- Credit Access Impact: Favorable credit terms are essential for sustained real estate market health.

Economic growth is a key driver for Fidelity National Financial (FNF), as a stronger economy typically translates to more real estate transactions. While U.S. GDP growth was estimated around 2.5% in 2024, it's projected to moderate to about 1.8% in 2025, which could slightly temper transaction volumes. Inflation, with CPI around 3.1% year-over-year in early 2024, remains a factor that can impact housing affordability and, consequently, FNF's business. Consumer debt levels, such as the $17.7 trillion in total U.S. household debt as of Q1 2024, also play a role by potentially limiting purchasing power.

| Economic Factor | 2024 Estimate/Data | 2025 Projection | Impact on FNF |

|---|---|---|---|

| U.S. GDP Growth | ~2.5% | ~1.8% | Slight moderation in transaction volumes |

| U.S. CPI Inflation | ~3.1% (early 2024) | Monitoring required | Potential impact on housing affordability |

| Total U.S. Household Debt | $17.7 trillion (Q1 2024) | Continued impact | May affect purchasing power and mortgage qualification |

Full Version Awaits

Fidelity National Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Fidelity National Financial delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the strategic landscape and potential challenges and opportunities.

Sociological factors

Demographic shifts are significantly reshaping the housing market. The aging population, for instance, may lead to increased demand for accessible or single-story homes, while the rising average age of first-time homebuyers, which reached 36 in 2024 according to the National Association of Realtors, impacts affordability and loan product needs.

Multigenerational living is also on the rise, with approximately 20% of Americans living in multigenerational households as of 2023 data. This trend influences the demand for larger homes with more bedrooms and flexible living spaces, presenting both opportunities and challenges for property developers and related service providers like FNF.

Fidelity National Financial must adapt its offerings to serve these evolving buyer profiles. This includes developing specialized title insurance and escrow services that accommodate the unique transaction needs of older adults and families opting for multigenerational arrangements.

Population movements between urban and suburban areas significantly impact local real estate markets, influencing demand for housing and related services. For instance, in 2024, many metropolitan areas continued to see a net outflow of residents to surrounding suburbs, a trend amplified by the sustained adoption of remote work, which allows greater flexibility in housing choices.

These shifts towards suburban or exurban living, often motivated by a desire for more space or lower costs of living, can create new pockets of growth in property transactions and title insurance needs, while potentially leading to a slowdown in denser urban centers. Fidelity National Financial's geographically diverse operations mean it is well-positioned to capitalize on or mitigate these regional demographic realignments.

Consumers now demand effortless digital interactions for everything, and real estate transactions are no exception. This means online portals, e-signatures, and virtual property tours are becoming standard expectations. For instance, a 2024 survey indicated that over 70% of homebuyers prefer to conduct as much of the process online as possible.

Fidelity National Financial (FNF) needs to prioritize investment in and the adoption of cutting-edge digital technologies to keep pace with these evolving consumer preferences. Failing to do so risks falling behind competitors who are already offering these streamlined, digital-first experiences. The company's ability to adapt its digital offerings will be crucial for maintaining market share and customer satisfaction in the coming years.

Public Perception of Real Estate Market Stability

Public confidence in real estate stability directly impacts transaction volumes, a key driver for Fidelity National Financial (FNF). When consumers perceive the market as stable and poised for growth, they are more likely to engage in buying and selling activities, boosting demand for FNF's title insurance and transaction services. Conversely, fears of a downturn can significantly dampen market activity.

For instance, in early 2024, consumer sentiment surveys indicated a cautious optimism regarding the housing market, with many anticipating stable or slightly increasing prices, which supported a healthier transaction environment for companies like FNF. This contrasts with periods of high uncertainty, where fear of a crash can lead to a freeze in sales.

FNF's business model is intrinsically linked to the health and perceived stability of the real estate sector. A strong perception of long-term appreciation encourages investment, directly benefiting FNF through increased title insurance premiums and escrow service fees.

- Consumer Confidence Index: Fluctuations in consumer confidence directly correlate with housing market activity. For example, the Conference Board's Consumer Confidence Index, which often reflects housing market sentiment, showed a notable rebound in late 2023 and early 2024, signaling increased willingness to make major purchases like homes.

- Home Price Appreciation Expectations: Surveys by organizations like Fannie Mae consistently track consumer expectations for home price growth. In Q1 2024, a significant percentage of homeowners expected home prices to increase, a sentiment that underpins continued market participation.

- Recession Fears vs. Market Resilience: While concerns about economic slowdowns can create apprehension, the actual resilience of housing prices in many areas, supported by factors like limited inventory in 2024, can bolster public perception of stability despite broader economic anxieties.

- Impact on Transaction Volume: A positive public perception of market stability translates into higher mortgage origination volumes and increased real estate transactions, directly benefiting FNF's core revenue streams.

Impact of Social and Economic Inequality on Housing Access

Significant income and wealth disparities directly affect who can access homeownership. For instance, in 2023, the median household income in the U.S. was $84,000, yet homeownership rates varied considerably across different demographic groups, highlighting these access barriers.

Younger generations, particularly millennials and Gen Z, face substantial hurdles entering the housing market. Stagnant wage growth, coupled with an estimated $1.7 trillion in outstanding student loan debt as of early 2024, makes accumulating down payments and qualifying for mortgages increasingly challenging, potentially dampening overall real estate transaction volumes.

The broad accessibility of real estate, or lack thereof, directly shapes Fidelity National Financial's market reach. If large segments of the population are priced out or unable to secure financing, the demand for title insurance, escrow services, and other FNF offerings naturally contracts.

- Income Disparities: In 2023, the wealth gap continued to widen, with the top 10% of households holding a disproportionately large share of national wealth, impacting the purchasing power of lower and middle-income brackets for housing.

- Student Debt Impact: The average student loan debt for borrowers graduating in 2024 is projected to be over $30,000, a significant obstacle for young adults aiming for homeownership.

- Transaction Volume: A decline in first-time homebuyers due to affordability issues can lead to fewer overall property sales, directly affecting the volume of title insurance policies and escrow services FNF can underwrite.

- Market Reach Limitation: If housing remains inaccessible for a substantial portion of the population, FNF's potential customer base shrinks, limiting its ability to expand its market share.

Societal attitudes towards homeownership are evolving, with a growing emphasis on flexibility and alternative living arrangements. This shift can influence demand for traditional housing, impacting FNF's core business. For instance, a 2024 survey by the Urban Institute found that a notable percentage of younger adults prioritize experiences and mobility over long-term property ownership.

Cultural norms around family structures also play a role, with trends like delayed marriage and smaller family sizes potentially altering housing needs. The increasing acceptance of diverse household compositions, including single-person households which represented over 30% of U.S. households in 2023, means FNF must cater to a wider array of client needs.

The perception of real estate as a primary investment vehicle is also subject to societal trends. If alternative investment opportunities gain more traction, or if the perceived risk of real estate increases due to economic factors, it could lead to reduced transaction volumes, directly affecting FNF's revenue streams.

Technological factors

The real estate industry is undergoing a significant digital transformation, streamlining transactions. Online platforms are now standard for communication, document handling, and progress tracking, making the entire process quicker and more efficient. For instance, in 2024, the adoption rate of digital closing solutions in the US saw a notable increase, with many states actively promoting e-notarization and remote online notarization (RON) for real estate deals.

Fidelity National Financial (FNF) must continue to invest in and integrate these advanced digital tools. This proactive approach is crucial for enhancing the efficiency and competitiveness of its title insurance and escrow services. By embracing technologies that facilitate faster, more secure, and transparent transactions, FNF can better serve its clients and adapt to evolving market expectations in the digital age.

AI and machine learning are revolutionizing title insurance. For Fidelity National Financial (FNF), this means automating title searches, a process that traditionally consumes significant human capital and time. These advancements allow for faster, more accurate identification of title defects.

Predictive analytics, powered by AI, is also a game-changer for risk assessment in the title insurance sector. FNF can leverage these tools to better understand and price risk associated with specific property transactions. This data-driven approach to risk management is crucial in a dynamic real estate market.

Furthermore, AI-powered customer support can enhance the client experience for FNF. Chatbots and intelligent virtual assistants can handle routine inquiries, freeing up human agents for more complex issues. This boosts operational efficiency and can lead to improved customer satisfaction, a key differentiator in the competitive financial services landscape.

Blockchain technology offers a robust framework for improving the transparency and security of property title records, significantly mitigating the risks of fraud and errors. This distributed ledger system ensures that each transaction is immutable and verifiable, creating a more trustworthy system for all parties involved.

While widespread adoption is still developing, Fidelity National Financial (FNF) might consider integrating blockchain solutions to bolster transaction security and maintain its competitive advantage in the evolving real estate market. For instance, pilot programs exploring blockchain for title insurance have shown promise in streamlining processes and reducing administrative overhead.

Cybersecurity Threats and Data Protection

The real estate sector, including giants like Fidelity National Financial (FNF), is increasingly vulnerable to sophisticated cyberattacks. As operations migrate online, threats such as ransomware, phishing, and business email compromise (BEC) become more prevalent. For instance, the FBI's 2023 Internet Crime Report noted a significant rise in BEC scams, costing businesses billions annually, a trend that directly impacts companies handling sensitive client and financial data.

Protecting this data is not just a matter of compliance but a critical business imperative. FNF's reliance on digital platforms for title insurance, escrow services, and other financial transactions means that robust cybersecurity measures are essential. Companies are investing heavily in advanced threat detection and response systems. In 2024, global cybersecurity spending was projected to exceed $200 billion, highlighting the industry's commitment to mitigating these risks.

- Increased Sophistication of Cyber Threats: Ransomware and phishing attacks are becoming more targeted and effective, posing a constant risk to data integrity.

- Data Protection Mandates: Stringent regulations like GDPR and CCPA necessitate significant investment in data security protocols to avoid hefty fines and reputational damage.

- Operational Continuity: Successful cyberattacks can disrupt FNF's core services, impacting transaction timelines and client trust, underscoring the need for resilient systems.

Remote Online Notarization (RON) and E-Closings

The increasing adoption of Remote Online Notarization (RON) and e-closings is fundamentally reshaping the real estate transaction landscape. These technologies eliminate the necessity for in-person document signing, replacing it with secure, digital platforms that allow for virtual closing rooms. This shift offers significant advantages in terms of speed and convenience.

Fidelity National Financial (FNF) can capitalize on this trend by integrating RON and e-closing capabilities into its service offerings. By enabling more convenient and efficient closings, FNF can enhance its customer experience, potentially leading to increased client satisfaction and market share. For instance, in 2024, a significant portion of mortgage closings are expected to utilize e-closing technologies, with projections indicating continued growth throughout 2025.

- Streamlined Process: RON and e-closings reduce closing times by removing physical document handling and travel requirements.

- Enhanced Convenience: Clients can participate in closings from any location, improving accessibility.

- Cost Efficiencies: Digital processes can lead to reduced operational costs for title and escrow companies like FNF.

- Market Competitiveness: Offering advanced digital closing solutions positions FNF favorably against competitors.

Technological advancements are profoundly reshaping the real estate and financial services sectors, directly impacting Fidelity National Financial (FNF). The widespread adoption of digital platforms for communication, document management, and transaction tracking is accelerating deal closures. For instance, in 2024, the US saw a significant uptick in digital closing solutions, with many states actively supporting e-notarization and remote online notarization (RON) for real estate transactions.

AI and machine learning are particularly transformative, enabling automation in critical areas like title searches, leading to faster and more accurate defect identification. Predictive analytics, also AI-driven, enhances risk assessment and pricing for property transactions, a crucial capability for FNF in navigating market volatility. Furthermore, AI-powered customer support, through chatbots and virtual assistants, promises to improve operational efficiency and client satisfaction.

Blockchain technology offers a pathway to greater transparency and security in property title records, mitigating fraud and errors through its immutable ledger system. While still in its developmental stages for widespread adoption, FNF could explore integrating blockchain to bolster transaction security and reduce administrative burdens, building on promising pilot programs. The increasing reliance on digital operations also elevates the importance of cybersecurity, with global spending projected to exceed $200 billion in 2024 to combat sophisticated threats like ransomware and phishing, which cost businesses billions annually.

| Technology | Impact on FNF | 2024/2025 Data/Trend |

| Digital Platforms & E-Closings | Streamlined transactions, enhanced convenience, cost efficiencies | Increased adoption of RON and e-closing technologies in mortgage closings, with continued growth projected through 2025. |

| AI & Machine Learning | Automated title searches, improved risk assessment, enhanced customer support | AI adoption in title insurance for faster, more accurate processes; predictive analytics for better risk pricing. |

| Blockchain | Increased transparency, enhanced security, fraud mitigation | Pilot programs showing promise in streamlining title insurance processes and reducing administrative overhead. |

| Cybersecurity | Protection of sensitive data, operational continuity, compliance | Global cybersecurity spending projected to exceed $200 billion in 2024; significant rise in BEC scams impacting businesses. |

Legal factors

Fidelity National Financial (FNF) navigates a dense regulatory landscape, with federal and state laws dictating mortgage lending, property transactions, and title insurance practices. Staying current with evolving mandates, like those concerning appraisal independence and consumer protection disclosures, is paramount for operational integrity and avoiding severe penalties.

In 2024, the Consumer Financial Protection Bureau (CFPB) continued to emphasize fair lending practices and oversight of mortgage servicing rules, impacting FNF's operational procedures and compliance costs. Failure to adhere to these stringent requirements, which can include hefty fines and legal challenges, poses a significant risk to FNF's financial performance and market standing.

The increasing digitalization of real estate transactions means Fidelity National Financial (FNF) must navigate a complex web of data privacy laws. Regulations like the California Consumer AI Act, which took effect in 2023, are setting new standards for how companies handle consumer data, particularly sensitive financial information. FNF's handling of vast amounts of personal and financial data necessitates robust data protection measures to avoid significant legal liabilities and maintain crucial consumer trust.

The real estate sector is grappling with antitrust lawsuits concerning algorithmic pricing software, with accusations of potential price-fixing. This legal scrutiny could significantly alter how real estate services, particularly those involving valuation and pricing, are executed and overseen.

These challenges may directly impact Fidelity National Financial's (FNF) technology partners and internal practices, especially if regulations tighten around the use of AI in pricing. For instance, the ongoing investigations into algorithmic collusion in various industries highlight the increasing regulatory focus on fair competition in technology-driven markets.

Title Insurance Specific Regulations and Underwriting Requirements

Title insurance operates under a distinct regulatory framework, with specific underwriting requirements that Fidelity National Financial (FNF) must navigate. These rules, often state-specific, dictate the meticulous processes of title searches, examinations, and the issuance of policies, ensuring accuracy and legal standing. For instance, in 2024, many states continued to refine their consumer protection mandates within title insurance, requiring greater transparency in fee structures and policy terms.

FNF's adherence to these evolving legal landscapes is crucial for its operational integrity and market position. The company's ability to adapt to changes in state-level regulations, such as those impacting escrow services or digital record-keeping for property transactions, directly influences its underwriting efficiency and risk management. For example, updates to data privacy laws in late 2024 and early 2025 necessitate robust compliance measures for handling sensitive property and personal information.

- State-Specific Regulations: FNF must comply with varying state laws governing title insurance, impacting everything from reserve requirements to permissible policy endorsements.

- Underwriting Standards: Adherence to stringent underwriting guidelines, including property lien searches and ownership verification, is paramount to policy validity.

- Consumer Protection Trends: Increased regulatory focus on consumer protection in 2024-2025 has led to enhanced disclosure requirements and scrutiny of closing costs.

- Data Privacy Compliance: Evolving data privacy laws require FNF to implement advanced security protocols for customer and property data.

Contract Law and Dispute Resolution in Real Estate

Fidelity National Financial's (FNF) operations are deeply intertwined with legal frameworks governing real estate contracts, encompassing purchase agreements, leases, and financing documents. These contracts form the bedrock of every transaction FNF facilitates, dictating terms, rights, and obligations.

Changes in contract law or an uptick in litigation surrounding real estate disputes can significantly affect the complexity and risk profiles of transactions. For instance, shifts in consumer protection laws related to disclosure requirements in purchase agreements could necessitate updated contract templates and increased legal review, potentially impacting FNF's service delivery timelines and costs.

The clarity and legal soundness of these contracts are paramount for risk mitigation. In 2024, the U.S. real estate market saw continued emphasis on transparent and robust contractual terms, especially as interest rates fluctuated, leading to more renegotiations and potential disputes. FNF's ability to navigate these legal intricacies directly influences its operational efficiency and client trust.

- Contractual Clarity: Ensuring purchase agreements, leases, and financing documents are legally unambiguous is critical for FNF to minimize potential disputes and litigation.

- Litigation Trends: Monitoring trends in real estate litigation, such as those related to property defects or financing defaults, helps FNF anticipate and manage emerging legal risks.

- Regulatory Compliance: Adherence to evolving contract laws, including those related to digital signatures and electronic record-keeping, is essential for FNF's compliance and operational integrity.

- Risk Mitigation: Robust legal review of all real estate contracts processed by FNF is a key strategy for mitigating financial and reputational risks associated with transaction complexities.

Fidelity National Financial (FNF) operates under a complex web of state and federal regulations, particularly concerning mortgage lending and title insurance. Staying compliant with evolving consumer protection laws, such as enhanced disclosure requirements for closing costs which saw increased scrutiny in 2024-2025, is crucial to avoid penalties.

Data privacy laws, like the California Consumer AI Act effective 2023, are increasingly impacting how FNF handles sensitive customer information, necessitating robust security measures to prevent legal liabilities.

The company must also navigate antitrust concerns and potential litigation related to algorithmic pricing in the real estate sector, a trend that intensified regulatory focus on fair competition in 2024.

FNF's legal responsibilities extend to meticulous adherence to state-specific underwriting standards and contractual clarity in all transactions, ensuring policy validity and minimizing dispute risks.

Environmental factors

Climate change is directly impacting real estate, with a noticeable effect on property values and insurance. The increasing frequency and intensity of events like wildfires and floods, as reported by agencies like NOAA, are making some areas less desirable and significantly raising insurance premiums. For instance, coastal property insurance rates have seen substantial hikes in 2024.

Fidelity National Financial (FNF), as a major player in title insurance, must navigate these environmental shifts. Their underwriting processes are increasingly challenged by the rising risk associated with properties in vulnerable locations. This necessitates a more rigorous assessment of climate-related hazards to accurately price policies and manage potential future claims.

Environmental regulations are tightening globally, impacting the real estate sector where Fidelity National Financial (FNF) operates. For instance, new building codes increasingly mandate higher energy efficiency standards, potentially increasing upfront construction costs but also influencing long-term property value and the types of mortgages FNF might underwrite. In 2024, many regions saw renewed focus on green building certifications, with studies indicating properties with such certifications can command higher rental yields.

The push for sustainable development extends to property management and renovation. FNF's title and escrow services are indirectly affected as properties undergo retrofits to meet evolving environmental standards, such as waste reduction during demolition or the integration of renewable energy sources. This trend is expected to continue, with projections for 2025 indicating further growth in green financing options and related regulatory frameworks.

Climate change is directly impacting where people choose to live. For instance, areas prone to extreme weather events like hurricanes or wildfires are seeing residents relocate, often to regions perceived as safer. This migration trend, observed globally, means Fidelity National Financial (FNF) must be prepared for shifts in demand for its title insurance and real estate services across different markets.

The increasing frequency and severity of climate-related disasters, such as the record-breaking wildfire seasons in the Western United States or the intensified hurricane activity in the Gulf Coast, are accelerating these population movements. By 2025, projections indicate continued migration away from coastal flood zones and drought-prone interiors, directly affecting property values and transaction volumes in those specific locales.

Availability of Homeowners Insurance in High-Risk Areas

The increasing frequency and severity of natural disasters, such as hurricanes and wildfires, are making it significantly harder for homeowners in high-risk areas to secure affordable insurance coverage. This trend directly impacts Fidelity National Financial (FNF) by potentially reducing transaction volumes in affected real estate markets. For instance, in 2023, states like Florida and California saw substantial increases in homeowners insurance premiums and, in some cases, insurers withdrawing from the market altogether, creating a challenging environment for FNF's title and escrow services.

This scarcity of available and affordable insurance can stifle real estate activity, as buyers and lenders often require proof of adequate coverage. Consequently, FNF’s core business, which relies on the smooth functioning of property transactions, faces headwinds in these vulnerable regions. The economic impact is substantial, with rising insurance costs and reduced market liquidity affecting property values and sales volume.

- Increased Insurance Premiums: Homeowners in coastal and wildfire-prone areas are experiencing double-digit percentage increases in premiums, with some facing annual costs exceeding tens of thousands of dollars.

- Insurer Withdrawal: Several major insurance carriers have scaled back or exited markets like Florida and California, citing unmanageable risk from climate-related events.

- Impact on Transactions: The inability to obtain insurance can halt mortgage approvals and property sales, directly affecting the demand for title insurance and closing services provided by FNF.

- Market Volatility: This environmental factor contributes to greater volatility in real estate markets, making long-term planning and investment strategies more complex for FNF and its clients.

ESG (Environmental, Social, Governance) Initiatives in Real Estate

The real estate sector is rapidly integrating environmental, social, and governance (ESG) principles, particularly concerning sustainable development and property management. This trend impacts Fidelity National Financial (FNF) as its clients, including developers and property owners, increasingly demand ESG-compliant services and products.

While FNF's direct environmental impact may be less pronounced than that of a large-scale developer, demonstrating a commitment to ESG can significantly bolster its brand image and appeal to a growing segment of environmentally conscious clients and investors. This alignment is becoming a competitive differentiator in the financial services landscape.

- Growing Demand for Green Buildings: In 2024, the global green building market is projected to reach over $3.4 trillion, indicating a strong client preference for sustainable properties.

- Investor Focus on ESG: By mid-2025, it's anticipated that ESG-focused investments will constitute a significant portion of institutional portfolios, driving demand for ESG-aware financial partners.

- Regulatory Scrutiny: Governments worldwide are implementing stricter environmental regulations for real estate, pushing companies like FNF to ensure their partners and services align with these standards.

- Reputational Benefits: Companies with strong ESG initiatives often report higher customer loyalty and better talent acquisition, crucial for FNF's long-term success.

Climate change directly influences property insurability and value, with events like floods and wildfires becoming more frequent. This trend is already causing significant increases in insurance premiums in vulnerable areas, with some coastal regions seeing double-digit hikes in 2024.

Fidelity National Financial (FNF) must adapt its underwriting to account for these escalating climate risks, particularly in its title insurance operations. The increasing difficulty in securing affordable insurance in disaster-prone areas can also slow down real estate transactions, impacting FNF's business volume.

Environmental regulations are also evolving, pushing for greener building standards and sustainable development practices. By 2025, expect continued growth in green financing and related regulatory frameworks, influencing property development and, consequently, the services FNF provides.

The growing demand for ESG-compliant services and products affects FNF as clients increasingly prioritize sustainability. Demonstrating strong ESG initiatives is becoming a key differentiator, with projections indicating ESG-focused investments will significantly grow by mid-2025.

| Environmental Factor | Impact on Real Estate | FNF Relevance | 2024/2025 Data/Projections |

|---|---|---|---|

| Increased Extreme Weather Events | Higher insurance premiums, property devaluation in high-risk zones | Underwriting risk, transaction volume impact | Coastal insurance premiums up 10-20% in 2024; continued migration from flood/fire zones expected by 2025. |

| Stricter Environmental Regulations | Increased construction costs for green buildings, focus on energy efficiency | Underwriting new property types, compliance needs | Global green building market projected over $3.4 trillion in 2024; increased focus on green certifications. |

| ESG Integration | Demand for sustainable properties and services | Brand image, client acquisition, competitive advantage | ESG investments to form significant portion of institutional portfolios by mid-2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Fidelity National Financial is built on a robust foundation of data from government agencies, financial regulatory bodies, and leading industry research firms. We incorporate economic indicators, legislative updates, technological advancements, and social demographic shifts to provide comprehensive insights.