Fidelity National Financial Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fidelity National Financial Bundle

Discover the strategic framework behind Fidelity National Financial's dominance in the title insurance and transaction services sector. This comprehensive Business Model Canvas breaks down their customer segments, value propositions, and revenue streams, offering a clear roadmap to their success.

Unlock the full strategic blueprint behind Fidelity National Financial's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Fidelity National Financial (FNF) maintains robust collaborations with a wide array of mortgage lenders and financial institutions. These partnerships are foundational to FNF's business, as the origination of mortgages by these entities directly drives demand for title insurance and escrow services. In 2023, the U.S. mortgage origination market saw significant activity, with total origination volume reaching an estimated $2.5 trillion, underscoring the substantial business generated through these relationships.

FNF's engagement with banks and other financial services firms is vital for its revenue streams. These institutions rely on FNF to provide the necessary title searches, insurance policies, and escrow management to ensure the legality and security of real estate transactions, particularly during the critical loan closing phase. This symbiotic relationship allows lenders to confidently complete property sales and transfers, while FNF secures a consistent flow of business from these key industry players.

Fidelity National Financial (FNF) cultivates robust relationships with an extensive network of real estate agents and brokers throughout the United States. These professionals are instrumental, serving as primary referral sources for FNF's crucial title insurance and closing services in both residential and commercial property transactions.

In 2023, the U.S. saw approximately 6.1 million existing home sales, a figure that underscores the sheer volume of transactions where agents play a pivotal role. By fostering strong partnerships with these agents, FNF effectively solidifies its market position and directly captures new business opportunities arising from these property sales.

Fidelity National Financial (FNF) cultivates vital partnerships with real estate developers and home builders, securing a consistent pipeline of new construction projects. These collaborations are crucial as they directly translate into demand for FNF's core offerings, particularly title insurance and comprehensive transaction services. For instance, in 2024, the residential construction sector saw continued activity, with new housing starts indicating ongoing demand for these services.

FNF's role extends beyond just title insurance; they provide end-to-end transaction management for large-scale developments. This encompasses everything from the initial land acquisition phases through to the final sale of individual homes. This integrated approach streamlines the process for developers and builders, solidifying FNF's position as a key partner in the development lifecycle.

This strategic alliance with developers and builders represents a significant volume driver for FNF, offering substantial recurring business opportunities. The sheer scale of new development projects ensures a continuous stream of transactions, contributing meaningfully to FNF's revenue and market share within the real estate services sector.

Independent Title Agents and Agencies

Fidelity National Financial (FNF) leverages a robust network of independent title agents and agencies as crucial key partners. These entities function as vital distribution channels, enabling FNF to access local real estate markets effectively. In 2024, this decentralized approach continued to be a cornerstone of FNF's operational strategy, allowing for extensive market penetration and efficient service delivery across the United States.

These independent agents are instrumental in processing a substantial volume of title insurance premiums, directly contributing to FNF's revenue streams. Their local expertise and established relationships are invaluable assets, facilitating smoother transactions and broader customer reach. This partnership model allows FNF to maintain a lean corporate structure while benefiting from the localized presence and operational capabilities of its agents.

- Distribution Network: Independent agents serve as FNF's primary distribution partners, extending its market reach.

- Premium Processing: A significant portion of title insurance premiums are processed through these independent agencies.

- Market Penetration: The decentralized model facilitates broader access to diverse geographic markets.

- Service Efficiency: Localized operations by agents enhance the efficiency of service delivery.

Technology and Service Providers

Fidelity National Financial (FNF) actively cultivates key partnerships with technology and service providers to bolster its market position and operational capabilities. These alliances are crucial for integrating cutting-edge solutions that drive innovation and efficiency across FNF's diverse business segments, particularly within the real estate and financial services sectors.

FNF collaborates with providers specializing in digital transaction platforms, advanced data analytics, and various real estate technology (proptech) solutions. For instance, in 2024, FNF continued to invest in and partner with companies offering AI-driven fraud detection and document processing, aiming to reduce operational overhead and enhance security for its title insurance and transaction services.

- Digital Transformation: Partnerships with fintech and proptech firms enable FNF to offer seamless digital experiences for real estate transactions, from online applications to digital closings.

- Data Analytics & AI: Collaborations with data science companies provide FNF with advanced analytics for risk assessment, market insights, and personalized customer offerings.

- Process Automation: Alliances with automation specialists help streamline back-office operations, improving turnaround times for title searches and policy issuance.

- Cybersecurity: FNF partners with cybersecurity firms to safeguard sensitive customer data and ensure the integrity of its digital platforms against evolving threats.

FNF's key partnerships with mortgage lenders and financial institutions are fundamental, as their loan origination volume directly fuels demand for FNF's title insurance and escrow services. In 2023, the U.S. mortgage origination market was valued at approximately $2.5 trillion, highlighting the substantial business generated through these relationships.

FNF also relies on a vast network of real estate agents and brokers who act as primary referral sources for its title and closing services. With around 6.1 million existing home sales in the U.S. in 2023, these partnerships are critical for capturing new business opportunities in property transactions.

Collaborations with real estate developers and home builders provide FNF with a consistent pipeline of new construction projects, driving demand for title insurance and transaction management. The ongoing activity in residential construction in 2024 indicates continued demand for FNF's specialized services in this sector.

Furthermore, FNF partners with technology and service providers to integrate advanced solutions, such as AI-driven fraud detection, enhancing operational efficiency and security in its 2024 operations. These alliances are crucial for digital transformation and process automation within the real estate and financial services sectors.

What is included in the product

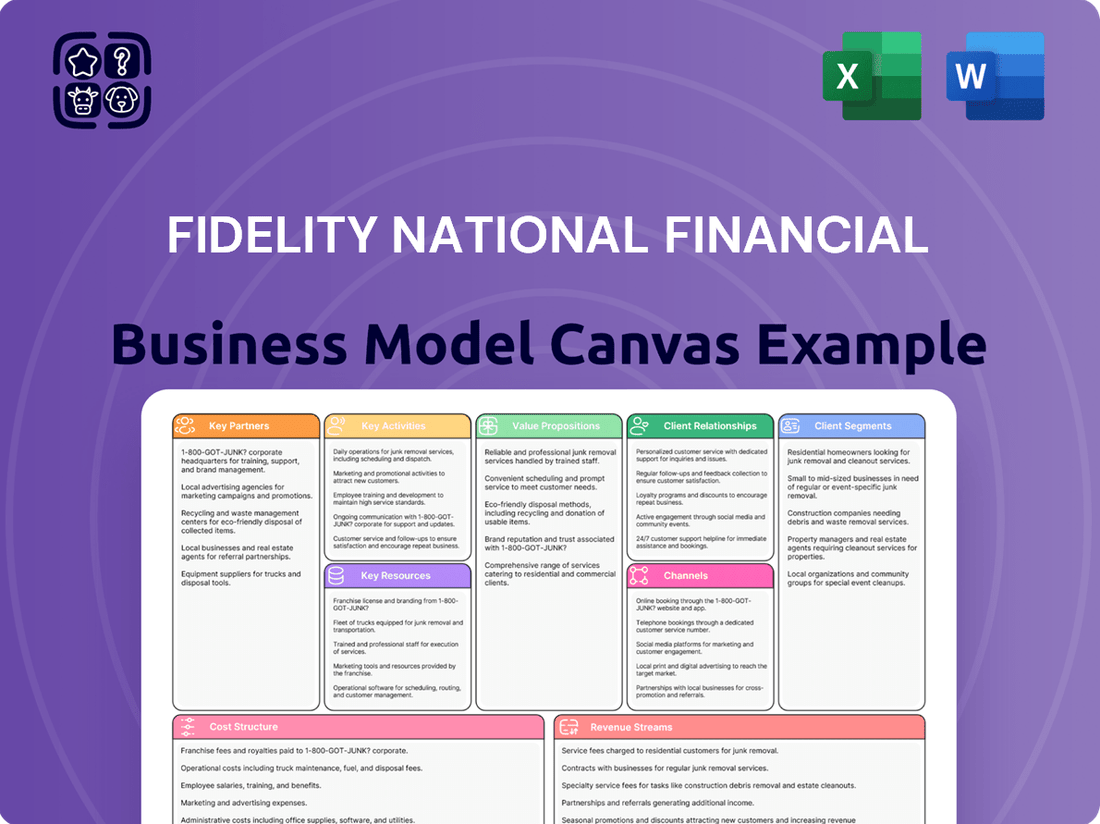

A detailed breakdown of Fidelity National Financial's operations, this Business Model Canvas outlines its customer segments, key partnerships, and revenue streams within the title insurance and transaction services industry.

It offers a strategic overview of how Fidelity National Financial creates and delivers value, focusing on its core competencies and market position.

The Fidelity National Financial Business Model Canvas offers a clear, one-page snapshot, simplifying complex strategies into easily digestible components for rapid understanding and discussion.

It effectively addresses the pain point of information overload by condensing Fidelity National Financial's strategic pillars into a visually organized and actionable framework.

Activities

Fidelity National Financial's core operation revolves around underwriting and issuing title insurance. This crucial activity involves meticulous examination of property records to uncover any potential issues like liens or ownership disputes. By identifying and addressing these risks, FNF safeguards buyers and lenders, ensuring the integrity of real estate transactions.

In 2024, the housing market continued to see activity, with title insurance playing a vital role in securing these transactions. For instance, the U.S. saw millions of home sales, each requiring title insurance to protect against future claims. FNF's expertise in this area is paramount to facilitating these deals smoothly and securely.

Fidelity National Financial's core strength lies in its escrow and closing services, which are fundamental to real estate transactions. They act as a neutral intermediary, holding funds and documents securely until all contractual obligations are fulfilled. This meticulous process ensures a secure and compliant transfer of property ownership, safeguarding both buyers and sellers.

In 2024, Fidelity National Financial, through its title and escrow operations, processed millions of real estate transactions. The company's ability to manage complex closing procedures, including title insurance, escrow, and settlement services, is a primary driver of its revenue and market position. This vital function underpins the stability and trust essential in the property market.

Fidelity National Financial (FNF) actively develops and implements advanced technology solutions to optimize real estate and mortgage operations. This strategic focus is evident in their platforms like SoftPro, a leading title and settlement software, and inHERE, a digital closing solution designed to streamline the entire transaction process.

These technological investments are crucial for FNF's competitive edge, aiming to boost operational efficiency and elevate the customer experience in an increasingly digital real estate market. By embracing cutting-edge tech, FNF addresses the evolving demands for faster, more transparent, and user-friendly real estate transactions.

Managing and Growing Annuity and Life Insurance Portfolios

Fidelity National Financial, through its subsidiary F&G Annuities & Life, actively manages and expands its annuity and life insurance product portfolios. This involves creating new products, driving sales across various channels, and managing the associated assets for both individual consumers and larger organizations.

The F&G segment is a crucial component of FNF's diversified strategy, contributing substantially to its overall financial health and market presence. In the first quarter of 2024, F&G reported record sales of $4.1 billion, highlighting strong growth in its annuity business.

- Product Innovation: F&G continuously develops and refines annuity and life insurance products to meet evolving customer needs and market demands, focusing on solutions like fixed index annuities and life insurance with living benefits.

- Sales and Distribution: The company leverages a multi-channel distribution network, including independent agents, financial institutions, and direct-to-consumer platforms, to reach a broad customer base.

- Asset Management: F&G manages a significant investment portfolio backing its insurance liabilities, aiming to generate stable returns while adhering to strict regulatory and risk management standards.

- Financial Performance: The segment's success is evident in its growing revenue and profitability, with F&G's net income attributable to common stockholders reaching $212 million in Q1 2024.

Risk Management and Regulatory Compliance

Fidelity National Financial (FNF) dedicates significant resources to risk management and regulatory compliance, essential for its operations in the heavily regulated real estate and insurance industries. This ongoing commitment ensures adherence to evolving legal frameworks and market dynamics, safeguarding the company’s financial stability and operational integrity.

Key activities include continuous monitoring of regulatory changes, implementing robust internal controls to mitigate financial and operational risks, and maintaining compliance across all business segments. For instance, in 2023, the financial services industry saw increased scrutiny on data privacy and cybersecurity, areas FNF actively addresses through its compliance programs.

- Monitoring Regulatory Landscape: FNF actively tracks and adapts to changes in real estate settlement services, title insurance, and other financial regulations to ensure ongoing compliance.

- Internal Controls: Implementing and refining internal controls is a core activity to prevent fraud, errors, and operational disruptions, thereby protecting company assets and customer data.

- Financial Stability: Maintaining strong capital reserves and sound financial practices are critical risk management activities that support FNF's ability to withstand market volatility and meet its obligations.

- Cybersecurity and Data Protection: Given the sensitive nature of customer information handled, FNF invests in advanced cybersecurity measures to protect against data breaches and ensure compliance with data privacy laws.

Fidelity National Financial's key activities include the underwriting and issuance of title insurance, ensuring secure real estate transactions by mitigating risks like liens or ownership disputes. They also provide essential escrow and closing services, acting as a neutral intermediary to manage funds and documents, facilitating the smooth transfer of property. Furthermore, FNF invests in technology to optimize operations and actively manages its annuity and life insurance products through its F&G subsidiary, while also prioritizing robust risk management and regulatory compliance across all its business lines.

In 2024, FNF's title and escrow services processed millions of real estate transactions, a testament to their crucial role in the market. The F&G segment demonstrated significant growth, with Q1 2024 sales reaching $4.1 billion, underscoring the strength of their annuity business. These operations are supported by a strong focus on technological innovation, exemplified by platforms like SoftPro, and a commitment to navigating the complex regulatory landscape of the financial services industry.

| Key Activity | Description | 2024 Relevance/Data |

| Title Insurance Underwriting | Examining property records to identify and insure against title defects, protecting buyers and lenders. | Essential for millions of home sales in 2024, securing property ownership. |

| Escrow and Closing Services | Acting as a neutral third party to hold funds and manage the closing process for property transfers. | Facilitated millions of transactions in 2024, ensuring secure and compliant property exchanges. |

| Technology Development | Investing in and deploying digital solutions like SoftPro and inHERE to streamline real estate transactions. | Aims to enhance efficiency and customer experience in a digitalizing market. |

| Annuity & Life Insurance Management (F&G) | Developing, selling, and managing annuity and life insurance products. | F&G reported record Q1 2024 sales of $4.1 billion, with net income of $212 million. |

| Risk Management & Compliance | Adhering to financial regulations and implementing internal controls to mitigate operational and financial risks. | Crucial for maintaining stability amid increased scrutiny on data privacy and cybersecurity in 2023-2024. |

Preview Before You Purchase

Business Model Canvas

The Fidelity National Financial Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering a transparent and accurate representation of what you are buying. You can trust that the insights and strategic framework presented here are exactly what you'll gain access to, ready for immediate use and customization.

Resources

Fidelity National Financial's (FNF) most crucial assets are its robust network of title insurance underwriters, featuring prominent names like Fidelity National Title, Chicago Title, and Commonwealth Land Title. This extensive group, bolstered by a vast network of agents, grants FNF unmatched market penetration and localized knowledge.

These well-recognized brands and their widespread operational presence are foundational to FNF's dominant market position and its ability to effectively deliver services across diverse geographic areas. In 2024, FNF continued to leverage this network, which is critical for underwriting title insurance policies, a core component of real estate transactions.

Fidelity National Financial's (FNF) proprietary technology platforms, like SoftPro and inHERE, are central to its business model, automating and streamlining critical title and settlement processes. These platforms are not just tools; they are the digital backbone of FNF's operations, ensuring efficiency and accuracy in a complex industry.

Access to vast amounts of real estate data and sophisticated analytics further bolsters FNF's technological resources. This data allows for more precise underwriting and significantly enhances the customer service experience by providing quicker, more informed decisions. For instance, in 2023, FNF processed millions of title insurance policies, a feat made possible by these advanced technological capabilities.

Fidelity National Financial (FNF) leverages significant financial capital, including a robust balance sheet and substantial investment portfolios, as a key resource. This financial strength is crucial for its operations, enabling it to manage potential claim losses effectively and fund strategic growth opportunities. As of the first quarter of 2024, FNF reported total assets exceeding $60 billion, with a significant portion allocated to investment securities, underscoring its capacity for investment and stability.

Highly Skilled Workforce and Industry Expertise

Fidelity National Financial (FNF) leverages a highly skilled workforce as a cornerstone of its business model. This includes seasoned title examiners, legal experts, and technology professionals who are crucial for navigating complex real estate and financial transactions.

The company's deep industry expertise across its diverse segments, from title insurance to transaction services, represents an invaluable intellectual asset. This human capital directly contributes to the superior quality of FNF's services and fuels innovation within the organization.

- Human Capital: FNF's workforce comprises individuals with specialized knowledge in real estate law, title examination, and financial technology.

- Industry Acumen: Decades of collective experience across various market cycles and regulatory environments provide a significant competitive advantage.

- Service Quality: This expertise ensures accuracy and efficiency in processing transactions, minimizing risks for clients and stakeholders.

- Innovation Driver: Skilled employees are instrumental in developing and implementing new technologies and service offerings to meet evolving market demands.

Strong Brand Reputation and Market Leadership

Fidelity National Financial (FNF) benefits immensely from its strong brand reputation, a cornerstone of its business model. As the nation's largest title insurance underwriter, FNF has cultivated a deep-seated trust among consumers and industry partners alike. This market leadership isn't just a title; it translates directly into a significant competitive edge.

This established credibility and widespread brand recognition are invaluable intangible assets. They directly contribute to customer loyalty, encouraging repeat business and attracting new clients who value reliability. In 2023, FNF reported total revenue of $14.3 billion, underscoring the sustained success driven by its market position.

- Market Dominance: FNF holds the leading market share in the title insurance industry.

- Customer Trust: A long-standing reputation fosters confidence among buyers, sellers, and real estate professionals.

- Brand Recognition: The FNF brand is synonymous with stability and expertise in real estate transactions.

- Competitive Advantage: This leadership position deters new entrants and solidifies FNF's ongoing business growth.

Fidelity National Financial's (FNF) key resources include its extensive network of title insurance underwriters, proprietary technology platforms, significant financial capital, a highly skilled workforce, and a strong brand reputation. These elements collectively enable FNF to maintain its market leadership and deliver comprehensive real estate transaction services efficiently and reliably.

| Resource Category | Specific Assets/Capabilities | 2024 Relevance/Data Point |

|---|---|---|

| Underwriting Network | Fidelity National Title, Chicago Title, Commonwealth Land Title, vast agent network | Critical for market penetration and localized expertise in real estate transactions. |

| Technology Platforms | SoftPro, inHERE, proprietary data analytics | Automate and streamline title and settlement processes, enhancing efficiency. |

| Financial Capital | Robust balance sheet, investment portfolios, total assets exceeding $60 billion (Q1 2024) | Enables management of claim losses and funding of strategic growth. |

| Human Capital | Skilled examiners, legal experts, technology professionals | Crucial for navigating complex transactions and driving innovation. |

| Brand Reputation | Nation's largest title insurance underwriter, established trust | Drives customer loyalty and provides a significant competitive advantage. |

Value Propositions

Fidelity National Financial (FNF) offers comprehensive risk protection for real estate transactions through its robust title insurance. This coverage safeguards homeowners and lenders from significant financial losses stemming from title defects, liens, or other claims against a property’s ownership. For instance, in 2023, the title insurance industry as a whole saw a substantial volume of transactions, underscoring the ongoing need for this protection.

The core value proposition is the mitigation of unforeseen risks, ensuring clear property titles and providing essential security for what is often a buyer's largest investment. This peace of mind is invaluable, especially in the complex and often opaque world of property ownership, where even minor title issues can lead to costly legal battles and financial setbacks.

Fidelity National Financial (FNF) provides streamlined escrow and closing services, simplifying the intricate journey of property transactions. By expertly handling funds, crucial documentation, and regulatory compliance, FNF guarantees a seamless and efficient closing process.

This efficiency significantly lightens the administrative load for buyers, sellers, and lenders, while also accelerating the overall transaction timeline. In 2023, FNF's title and escrow segments generated substantial revenue, reflecting the demand for their efficient transaction management.

Fidelity National Financial (FNF) integrates cutting-edge technology to elevate user experience and streamline operations. Their digital platforms simplify complex real estate transactions, offering clients and partners unprecedented transparency and ease of access. This focus on innovation ensures a contemporary and efficient engagement with FNF's comprehensive suite of services.

Financial Stability and Reliability

Fidelity National Financial (FNF) stands as a pillar of financial stability in the title insurance and transaction services sector, offering clients a profound sense of reliability. As a leading provider, FNF's robust financial health translates directly into assurance for those relying on its services.

FNF's consistent profitability and a strong balance sheet are not just numbers; they are tangible indicators of its capacity to fulfill policy obligations and offer enduring support. This financial fortitude is a significant advantage, particularly when market conditions become unpredictable.

- Industry Leadership: FNF consistently ranks among the top title insurance underwriters, demonstrating its market dominance and operational efficiency.

- Profitability Metrics: In 2023, FNF reported a net income of $1.1 billion, underscoring its sustained profitability and sound financial management.

- Capital Strength: The company maintains a strong capital position, exceeding regulatory requirements, which provides a critical buffer against economic downturns.

- Investment Grade Rating: FNF holds investment-grade credit ratings from major agencies, reflecting its low financial risk and reliability as a business partner.

Diversified Financial Solutions for Wealth Management

Fidelity National Financial, through its F&G Annuities & Life segment, offers a robust suite of diversified financial solutions designed for comprehensive wealth management. These products, including various annuity and life insurance options, aim to provide individuals and institutions with security and growth potential for their assets.

The core value proposition centers on delivering financial security and long-term wealth accumulation. F&G's annuities can offer guaranteed income streams for life, a critical component for retirement planning, while life insurance products provide essential death benefits, safeguarding beneficiaries.

This strategic expansion into wealth management diversifies FNF's revenue streams beyond its traditional real estate services. By offering these financial planning tools, FNF addresses a wider spectrum of client needs, enhancing its overall market presence and client retention.

- Income for Life: Annuities provide a predictable income stream, crucial for retirement security.

- Downside Protection: Many F&G products offer guarantees against market downturns, preserving capital.

- Death Benefits: Life insurance policies ensure financial support for beneficiaries upon the policyholder's passing.

- Broader Financial Planning: FNF's offerings extend beyond real estate, catering to holistic financial well-being.

FNF provides essential risk mitigation for property transactions through title insurance, protecting against financial loss from title defects. Their escrow and closing services streamline the complex process, simplifying it for all parties involved.

The company leverages technology for enhanced user experience and operational efficiency, offering transparency and ease of access to their services.

FNF's financial strength and industry leadership offer clients reliability and assurance, backed by strong capital positions and investment-grade ratings.

Through F&G Annuities & Life, FNF delivers diversified wealth management solutions, focusing on financial security and long-term asset growth for individuals and institutions.

| Value Proposition | Description | Key Benefit | 2023 Data Point |

|---|---|---|---|

| Title Insurance & Escrow | Comprehensive risk protection and streamlined transaction management for real estate. | Security and peace of mind for property ownership; efficient closing process. | FNF's title insurance segment revenue was $4.4 billion in 2023. |

| Technology Integration | Digital platforms enhancing user experience and operational efficiency. | Transparency, ease of access, and a modern, efficient transaction journey. | FNF invested significantly in digital transformation initiatives throughout 2023. |

| Financial Strength & Stability | Robust financial health and industry leadership. | Reliability and assurance of fulfilling obligations, even in uncertain markets. | FNF reported a net income of $1.1 billion in 2023. |

| Diversified Financial Solutions | Wealth management products including annuities and life insurance. | Financial security and long-term wealth accumulation for clients. | F&G Annuities & Life segment contributed significantly to FNF's diversified revenue streams in 2023. |

Customer Relationships

Fidelity National Financial (FNF) prioritizes customer bonds via specialized direct sales forces, fostering tailored client engagement and robust relationships. This direct approach is bolstered by a widespread network of physical offices, ensuring accessible local assistance and face-to-face interactions.

This blended strategy allows FNF to achieve extensive market penetration while simultaneously delivering customized service experiences. For instance, in 2024, FNF reported that its direct sales channels were instrumental in securing a significant portion of new commercial title insurance policies, demonstrating the effectiveness of personalized outreach.

Fidelity National Financial (FNF) leverages advanced technology to foster strong customer relationships through enhanced self-service options and digital engagement. Their commitment to digital platforms allows clients to efficiently manage transactions and access critical information whenever they need it, streamlining the overall experience. This focus on user-friendly technology directly contributes to customer satisfaction and loyalty.

Fidelity National Financial (FNF) excels in building enduring client connections by offering personalized service and dedicated account management. This focus on individual client needs, whether for title insurance, escrow services, or other offerings, ensures that each customer feels uniquely supported. For instance, FNF's commitment to understanding diverse client requirements, from individual homebuyers to large real estate developers, directly contributes to their strong market position and client loyalty.

Professional Networking and Industry Collaboration

Fidelity National Financial (FNF) cultivates robust customer relationships by actively engaging in professional networking and industry collaborations. This direct interaction is crucial for building trust and establishing FNF as a recognized authority within the real estate and financial services sectors.

Attending key industry events and conferences provides FNF with invaluable opportunities to connect with real estate professionals, lenders, and other vital stakeholders. For instance, FNF's presence at major real estate expos in 2024 allowed for direct engagement with thousands of industry participants, solidifying their market position.

- Direct Engagement: Participation in events like the National Association of Realtors Conference allows FNF to directly interact with potential and existing clients, understanding their evolving needs.

- Thought Leadership: Presenting at or sponsoring industry forums positions FNF executives as knowledgeable leaders, enhancing credibility and attracting business.

- Partnership Building: Collaborative efforts with industry associations and other service providers create mutually beneficial relationships, expanding FNF's reach and service offerings.

Consistent Communication and Transparency

Fidelity National Financial (FNF) places a strong emphasis on consistent communication and transparency with its clients. This approach is fundamental to building trust and effectively managing expectations during real estate transactions.

By providing clear and timely updates regarding title and escrow services, FNF aims to alleviate client anxiety and ensure they remain fully informed throughout the process.

FNF's commitment to this level of clarity directly supports the development of reliable and trustworthy customer relationships.

- Client-Centric Updates: FNF ensures clients receive regular updates on their transaction status, fostering a sense of security and control.

- Proactive Issue Resolution: Transparency means promptly communicating any potential title issues or delays, along with proposed solutions.

- Digital Communication Channels: In 2024, FNF continued to invest in digital platforms that facilitate easy and accessible communication for clients.

- Educational Resources: Providing clients with readily available information about the title and escrow process helps demystify complex steps.

Fidelity National Financial (FNF) cultivates strong customer relationships through a multi-faceted approach combining personalized service, digital engagement, and industry presence. Their direct sales force and physical offices ensure tailored client interactions, while technology enhances self-service options and accessibility.

FNF's commitment to transparency and consistent communication, including client-centric updates and proactive issue resolution, builds trust and manages expectations effectively throughout real estate transactions. This dedication to client support is a cornerstone of their business model.

By actively participating in industry events and fostering partnerships, FNF not only enhances its market visibility but also gains valuable insights into evolving client needs. This strategic engagement solidifies their reputation as a trusted leader in the financial services sector.

| Customer Relationship Strategy | Key Actions | Impact/Evidence (2024 Data) |

|---|---|---|

| Direct Sales & Physical Presence | Specialized sales forces, network of offices | Instrumental in securing new commercial title insurance policies; enhanced local assistance and face-to-face interaction. |

| Digital Engagement & Self-Service | Advanced technology platforms, user-friendly digital options | Streamlined transactions and information access, contributing to customer satisfaction and loyalty. |

| Personalized Service & Account Management | Understanding diverse client needs, dedicated support | Strong market position and client loyalty, catering to individual homebuyers and large developers alike. |

| Industry Engagement & Thought Leadership | Networking, sponsorships, conference participation | Direct engagement with thousands of industry participants at major real estate expos, solidifying market position and building trust. |

| Communication & Transparency | Clear, timely updates, proactive issue resolution, educational resources | Alleviates client anxiety, ensures informed transactions, and fosters reliable, trustworthy customer relationships. |

Channels

Fidelity National Financial (FNF) leverages a robust network of direct operations and company-owned branches, primarily across the United States. These physical touchpoints are crucial for direct customer interaction, offering face-to-face consultations and tailored, localized services.

This direct channel strategy empowers FNF to exert stringent control over service quality and cultivate deep relationships within the communities it serves. For instance, in 2023, FNF’s title and escrow segment, which heavily relies on these branches, generated over $9.2 billion in revenue, underscoring the significance of these operational channels.

Fidelity National Financial (FNF) heavily relies on its extensive network of independent title agents as a primary channel. These agents are vital for FNF's market penetration, acting as on-the-ground representatives in numerous local communities. This strategy allows FNF to efficiently handle a high volume of real estate transactions across diverse geographic areas.

Fidelity National Financial (FNF) leverages a robust suite of digital platforms and online portals to connect with its diverse customer base. These channels are critical for everything from initial customer engagement to ongoing service delivery, ensuring a seamless experience for users.

Key digital assets include FNF's corporate websites, which offer extensive information and resources, alongside secure client portals. These portals are designed for efficient order submission, real-time progress tracking, and easy access to vital documents, catering to a clientele that values speed and convenience.

In 2023, FNF reported significant digital engagement, with a substantial portion of customer transactions processed through its online systems. For instance, their digital title and escrow services saw a notable increase in adoption, reflecting a broader industry trend towards online transaction management.

Strategic Partnerships and Referral Networks

Fidelity National Financial (FNF) heavily relies on strategic partnerships with mortgage lenders, real estate brokers, and legal firms. These collaborations act as crucial referral engines, feeding a steady stream of customers for FNF's title insurance and transaction services. In 2024, the housing market saw continued activity, with millions of home sales, directly benefiting FNF's referral partners.

These integrated relationships are key to FNF's growth strategy. By embedding FNF's services into the workflows of its partners, the company ensures a consistent and predictable revenue stream. This approach is fundamental to expanding FNF's reach and acquiring new clients efficiently.

- Mortgage Lender Referrals: These partners are essential for title insurance, a mandatory component of most mortgage transactions.

- Real Estate Broker Networks: Brokers facilitate property sales, directly leading to title search and escrow service needs.

- Legal Firm Alliances: Attorneys involved in real estate transactions often refer clients to FNF for their expertise in closing processes.

Direct Sales Teams and Business Development Initiatives

Fidelity National Financial (FNF) leverages dedicated direct sales teams to proactively engage potential clients. These teams are instrumental in building relationships with major industry players, including national lenders and large-scale commercial developers, who represent significant revenue opportunities.

Business development initiatives further bolster FNF's client acquisition strategy. These efforts are designed to identify and secure substantial contracts, driving the company's growth trajectory. For instance, in 2024, FNF continued to focus on expanding its reach within the residential and commercial real estate sectors.

- Direct Sales Focus: Targeting national lenders and commercial developers for high-volume business.

- Business Development: Proactive initiatives to secure significant contracts and drive growth.

- 2024 Strategy: Continued emphasis on expanding market share in residential and commercial real estate services.

FNF utilizes a multi-channel approach, combining direct operations, independent agents, digital platforms, strategic partnerships, and direct sales teams to serve its diverse customer base.

These channels are critical for market penetration and customer engagement, with digital platforms and partnerships playing an increasingly significant role in transaction volume and revenue generation.

In 2023, FNF's title and escrow segment, heavily reliant on these channels, generated over $9.2 billion in revenue, highlighting the effectiveness of their integrated strategy.

| Channel Type | Key Activities | Customer Segment | 2023 Revenue Contribution (Est.) | Strategic Importance |

|---|---|---|---|---|

| Direct Operations | Face-to-face consultations, localized services | Direct consumers, local real estate professionals | Significant (Title & Escrow: >$9.2B total) | Service quality control, community relationships |

| Independent Agents | On-the-ground transaction processing | Broad consumer base, real estate agents | High volume, diverse geographies | Market penetration, efficiency |

| Digital Platforms | Online engagement, order submission, tracking | Tech-savvy consumers, industry partners | Growing (Significant digital transaction volume) | Convenience, speed, scalability |

| Strategic Partnerships | Referrals from lenders, brokers, legal firms | Mortgage borrowers, property buyers/sellers | High volume, consistent revenue | Client acquisition, embedded services |

| Direct Sales Teams | Relationship building with large entities | National lenders, commercial developers | Key for large contracts, growth | Securing substantial business, market share expansion |

Customer Segments

Residential homebuyers and sellers represent a core customer segment for Fidelity National Financial (FNF). These individuals are navigating the significant financial and emotional process of acquiring or divesting a home. FNF's role is to provide essential services that safeguard their interests throughout these transactions.

For these customers, FNF offers title insurance, a critical product that protects against unforeseen issues with property ownership, such as liens or encumbrances. Additionally, escrow services are provided to ensure that all parties fulfill their obligations, with funds and documents held securely until closing. This focus on security and clarity is paramount, especially considering the substantial investment involved in real estate.

In 2024, the U.S. housing market saw continued activity, with millions of home sales occurring. For instance, the National Association of Realtors reported that existing-home sales in the U.S. reached an annualized rate of 4.19 million in April 2024, a slight increase from the previous month. Each of these transactions typically involves title and escrow services, highlighting the vastness of this customer base for FNF.

Mortgage lenders, banks, and other financial institutions form a critical B2B customer segment for Fidelity National Financial (FNF). These entities depend on FNF for title insurance, a fundamental requirement to safeguard their mortgage loan investments and mitigate associated risks. In 2024, the mortgage origination market saw significant activity, with billions in loans requiring title insurance to ensure clear ownership and protect lenders.

Real estate developers and commercial investors are key clients who engage in substantial property transactions, from acquiring land for new projects to managing portfolios of commercial buildings. These entities, often dealing with multi-million dollar deals, depend heavily on efficient and secure title insurance and escrow services to navigate the complexities of large-scale commercial real estate. For instance, in 2024, the commercial real estate sector saw significant activity, with transaction volumes reflecting the ongoing demand for office, retail, and industrial spaces, underscoring the need for specialized financial services.

Fidelity National Financial (FNF) offers bespoke title and escrow solutions specifically designed for these sophisticated players. This includes handling intricate due diligence, managing complex closing processes for acquisitions and dispositions, and providing title policies that cover substantial commercial risks. The firm's expertise is crucial in facilitating smooth transactions for multi-unit residential projects, large retail centers, and industrial parks, ensuring legal compliance and mitigating potential title defects that could derail major investments.

Real Estate Professionals (Agents, Brokers, Attorneys)

Real estate agents, brokers, and attorneys are a crucial B2B customer segment for Fidelity National Financial (FNF). These professionals rely on FNF’s title insurance and closing services to facilitate smoother transactions for their clients, thereby bolstering their own service portfolios. FNF provides them with the necessary operational efficiency and deep industry expertise to excel in serving their clientele.

FNF's partnership empowers these real estate professionals by ensuring the integrity and security of property transactions. This collaboration is vital for maintaining client trust and streamlining the complex process of property transfer. In 2024, the U.S. housing market saw continued activity, with millions of transactions requiring robust title and closing support, underscoring the demand for FNF's services within this segment.

- Value Proposition: FNF offers reliable title insurance and escrow services, simplifying transactions and mitigating risks for clients of real estate professionals.

- Key Activities: Underwriting title insurance, managing escrow accounts, conducting closings, and providing legal expertise related to property transactions.

- Customer Relationships: FNF fosters strong partnerships through dedicated account management and ongoing support, ensuring seamless integration into the professionals' workflows.

- Revenue Streams: Fees generated from title insurance policies, escrow services, and other ancillary closing-related services provided to real estate professionals and their clients.

Retail and Institutional Annuity and Life Insurance Customers

Fidelity National Financial, through its F&G subsidiary, caters to a broad range of annuity and life insurance customers. This includes individual retail clients focused on retirement planning and safeguarding their wealth. In 2024, F&G’s annuity sales saw robust growth, contributing significantly to FNF's diversified revenue streams.

Beyond individual investors, FNF also serves institutional clients. These entities, like pension funds, leverage F&G's expertise and product offerings to manage their financial commitments effectively. This institutional segment is crucial for diversifying FNF's customer base, moving beyond its core real estate services.

- Retail Annuity and Life Insurance: F&G provides solutions for individuals seeking retirement income and legacy planning.

- Institutional Clients: Pension funds and other institutions utilize F&G's capabilities for managing financial obligations.

- Diversification: This segment broadens FNF's market reach beyond its traditional real estate focus.

- 2024 Performance: F&G’s annuity business demonstrated strong sales growth, underscoring its importance to FNF’s overall strategy.

Fidelity National Financial (FNF) serves residential homebuyers and sellers, providing essential title insurance and escrow services to protect their significant real estate investments. In 2024, millions of home sales occurred, with existing-home sales reaching an annualized rate of 4.19 million in April, highlighting the vastness of this core customer base.

Cost Structure

Fidelity National Financial's (FNF) cost structure is heavily influenced by personnel expenses, encompassing salaries, benefits, and commissions for its substantial employee base. For instance, in 2023, FNF reported total compensation and benefits expenses of approximately $2.6 billion, highlighting the significant investment in its workforce.

Beyond personnel, operational costs associated with managing its extensive network of direct operations and supporting its agent relationships represent another major expense category. These costs are essential for maintaining the infrastructure and services that underpin FNF's business.

Effectively managing these combined personnel and operational costs is paramount for FNF to ensure sustained profitability and competitive advantage in the market.

Fidelity National Financial's cost structure is heavily influenced by the provision for title claim losses, a significant expense reflecting potential payouts for title defects. For instance, in 2023, the company reported approximately $1.5 billion in title loss and loss expense, highlighting the inherent risk in this sector.

Underwriting expenses are another substantial cost. These encompass the essential activities of researching and examining property titles to ensure insurability. These operational costs are critical for mitigating future claim payouts and maintaining the integrity of the underwriting process.

Fidelity National Financial (FNF) dedicates significant resources to its technology infrastructure, encompassing proprietary software and digital platforms. In 2024, the company's commitment to technological advancement remains a core operational expense, crucial for maintaining efficiency and a competitive edge in the financial services sector.

These technology expenditures include essential investments in robust cybersecurity measures, sophisticated data management systems, and the continuous development of innovative solutions. For instance, FNF's ongoing efforts in digital transformation directly impact these costs, ensuring the security and functionality of their services.

Marketing, Sales, and Distribution Costs

Fidelity National Financial's cost structure heavily includes expenses for marketing, sales, and distribution. These encompass advertising campaigns, promotional activities, and the operational costs of maintaining its direct sales force, all crucial for acquiring new customers and solidifying its market position.

Furthermore, significant costs are incurred in managing and supporting its extensive network of independent agents and other distribution channels. These relationships are vital for reaching a broad customer base across its various business segments.

- Marketing & Sales Expenses: Costs for advertising, promotions, and direct sales teams.

- Distribution Channel Support: Expenses related to managing independent agents and other distribution networks.

- Customer Acquisition: Investment in these areas is directly tied to bringing in new business.

- Market Presence: These expenditures are fundamental for maintaining brand visibility and competitive standing.

General, Administrative, and Compliance Expenses

Fidelity National Financial’s cost structure includes significant general, administrative, and compliance expenses. These cover essential corporate functions like executive salaries, HR, and IT infrastructure, alongside crucial legal fees and the costs associated with adhering to industry regulations. For instance, in 2023, FNF reported selling, general, and administrative expenses of approximately $2.7 billion, reflecting the substantial investment in these areas.

The highly regulated environment in which FNF operates necessitates a considerable allocation of resources to ensure full compliance with legal and governmental requirements. This includes costs for internal audits, regulatory filings, and maintaining robust compliance programs. Effective management of these overheads is vital for the company’s overall financial health and reputation.

- Corporate Overhead: Costs associated with running the company’s central operations.

- Legal Fees: Expenses incurred for legal counsel and litigation.

- Compliance Costs: Investments made to meet regulatory standards in the financial services industry.

- 2023 SG&A: Approximately $2.7 billion, highlighting the scale of these operational expenditures.

Fidelity National Financial’s cost structure is significantly shaped by personnel expenses, including salaries, benefits, and commissions, reflecting its large workforce. In 2023, compensation and benefits totaled approximately $2.6 billion, underscoring the substantial investment in employees. Operational costs for managing its extensive network and supporting agent relationships are also key, essential for maintaining the infrastructure that drives FNF's services.

Title claim losses and underwriting expenses represent substantial costs, with title loss and loss expense reaching about $1.5 billion in 2023. Technology infrastructure, including cybersecurity and digital platforms, is a core operational expense, with ongoing digital transformation efforts impacting these investments. Marketing, sales, and distribution costs, covering advertising, promotions, and agent support, are crucial for customer acquisition and market presence.

General, administrative, and compliance expenses are also significant, with 2023 selling, general, and administrative (SG&A) expenses at approximately $2.7 billion. These cover corporate functions, legal fees, and regulatory compliance, which are vital for financial health and reputation in the highly regulated financial services industry.

| Expense Category | 2023 Approximate Value (USD Billions) | Key Drivers |

| Personnel Expenses | $2.6 | Salaries, benefits, commissions for employees |

| Title Loss and Loss Expense | $1.5 | Potential payouts for title defects |

| Selling, General & Administrative (SG&A) | $2.7 | Corporate overhead, legal, compliance, marketing, sales |

Revenue Streams

Fidelity National Financial's primary revenue engine is title insurance premiums. These are collected when issuing policies for residential and commercial real estate transactions, safeguarding against title issues.

This segment consistently represents the largest portion of FNF's overall income. In 2024, the company reported significant revenue from its title insurance operations, reflecting the ongoing demand in the property market.

Fidelity National Financial (FNF) captures substantial revenue through escrow and closing service fees, a critical component of real estate transactions. These fees compensate FNF for meticulously managing client funds, ensuring all necessary documentation is in order, and orchestrating the complex coordination required to finalize a property sale.

These essential closing services are frequently integrated with FNF's title insurance offerings. This bundling creates a seamless, all-encompassing solution for buyers and sellers, simplifying the often-intimidating process of transferring property ownership and reinforcing FNF's value proposition. For instance, in 2023, FNF's Title segment, which heavily relies on these services, generated over $10 billion in revenue, highlighting the significant financial contribution of these fee-based activities.

Fidelity National Financial (FNF) generates significant revenue through its subsidiary, F&G Annuities & Life. This segment focuses on selling a variety of annuity and life insurance products, including fixed indexed annuities and traditional life insurance policies.

The company also offers institutional funding agreements, further diversifying its revenue base. In 2024, FNF reported that F&G's sales of fixed indexed annuities and life insurance products saw robust growth, contributing positively to the company's overall financial performance.

Technology and Other Real Estate Services Fees

Fidelity National Financial (FNF) generates revenue by offering a suite of technology and other services to the real estate and mortgage sectors. These services are crucial for supporting various stages of property transactions and loan management.

Key revenue-generating services include loan sub-servicing, which involves managing mortgage payments and escrow accounts for lenders. Additionally, FNF earns fees from property valuations, essential for determining a property's market worth, and default services, which assist in managing distressed properties. The company also profits from providing home warranty products, offering protection to homeowners against unexpected repair costs.

These offerings are designed to work in tandem with FNF's core title insurance business, creating a more comprehensive service ecosystem and diversifying its income sources. For instance, in 2023, FNF's total revenue was approximately $10.5 billion, with a significant portion attributed to its diverse service offerings beyond traditional title insurance.

- Loan Sub-servicing: Managing mortgage payments and related borrower interactions.

- Valuations: Providing property appraisals and valuations for lending and investment purposes.

- Default Services: Assisting with foreclosure, bankruptcy, and other property default processes.

- Home Warranty Products: Offering protection plans for home systems and appliances.

Investment Income

Fidelity National Financial (FNF) generates significant revenue through its investment income, primarily from its substantial investment portfolio. This includes assets managed by its F&G subsidiary, which focuses on life insurance and annuity products. As of the first quarter of 2024, FNF reported investment income of $582 million.

This income stream is largely derived from interest earned on its holdings of fixed-maturity securities, such as bonds, and other investment assets. The performance of this revenue source is closely tied to FNF's asset management capabilities and prevailing market conditions, particularly interest rate environments.

- Investment Income Contribution: FNF's investment income is a key component of its overall revenue, bolstered by its significant asset base.

- Sources of Income: Revenue is generated from interest on fixed-maturity securities and other investment assets held within its portfolio.

- Impact of F&G: The F&G subsidiary plays a crucial role in growing the investment portfolio and, consequently, investment income.

- Market Sensitivity: This revenue stream is sensitive to interest rate changes and the effectiveness of FNF's investment management strategies.

Fidelity National Financial's revenue streams are diverse, with title insurance premiums forming the bedrock of its income. This segment, encompassing residential and commercial transactions, consistently delivers substantial revenue, as evidenced by its significant contribution in 2024.

Beyond title insurance, FNF garners income from escrow and closing services, essential for property sale finalization. These are often bundled with title insurance, creating a comprehensive offering that simplifies the transaction process for clients. In 2023, the Title segment alone generated over $10 billion in revenue.

The company's subsidiary, F&G Annuities & Life, is another key revenue driver, offering various annuity and life insurance products. F&G's robust sales growth in fixed indexed annuities and life insurance in 2024 further diversified FNF's income.

FNF also generates revenue through technology and other services for the real estate and mortgage industries, including loan sub-servicing, valuations, and default services. These diversified offerings contributed to FNF's total revenue of approximately $10.5 billion in 2023.

Investment income is also a significant contributor, with FNF reporting $582 million in investment income in the first quarter of 2024, primarily from interest on its fixed-maturity securities and other assets.

| Revenue Stream | Primary Activity | 2023 Revenue (Approx.) | 2024 Outlook/Contribution |

|---|---|---|---|

| Title Insurance | Issuing policies for real estate transactions | > $10 billion (Title Segment) | Significant contribution, reflecting market demand |

| Escrow & Closing Services | Managing funds and documentation for property sales | Included in Title Segment revenue | Integrated with title insurance for comprehensive solutions |

| F&G Annuities & Life | Selling annuities and life insurance products | N/A (Segmented reporting varies) | Robust growth in fixed indexed annuities and life insurance sales |

| Technology & Other Services | Loan sub-servicing, valuations, default services, home warranties | Part of $10.5 billion total revenue | Diversifying income, supporting core business |

| Investment Income | Interest on fixed-maturity securities and other assets | N/A (Segmented reporting varies) | $582 million (Q1 2024) |

Business Model Canvas Data Sources

The Fidelity National Financial Business Model Canvas is meticulously constructed using a blend of internal financial statements, proprietary market research, and expert strategic analysis. This comprehensive data foundation ensures each component accurately reflects the company's operational realities and market positioning.