Fidelity National Financial Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fidelity National Financial Bundle

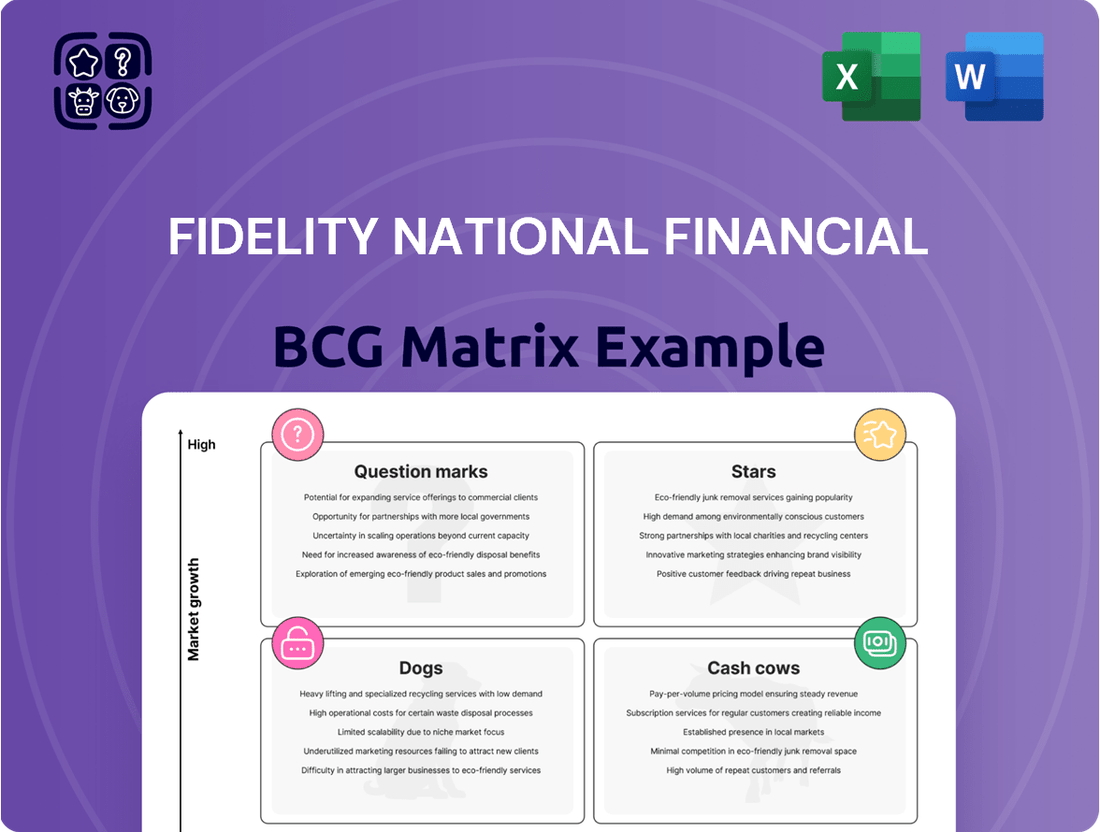

Curious about Fidelity National Financial's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse offerings stack up as Stars, Cash Cows, Dogs, or Question Marks in the market.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix report. Gain a comprehensive understanding of each product's market share and growth rate, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on the strategic insights that can drive Fidelity National Financial's success. Get the full report today and transform raw data into actionable strategies for sustained growth and competitive advantage.

Stars

F&G Annuities & Life is a clear Star within Fidelity National Financial's portfolio, showcasing impressive growth. In 2024, F&G achieved record gross sales of $15.3 billion, marking a substantial 16% jump from the previous year.

The segment’s assets under management (AUM) also hit a new high, reaching $65.3 billion by the end of 2024, a 17% increase year-over-year. This robust expansion indicates F&G is operating in a high-growth market for insurance products.

FNF's continued strategic investment to retain its majority stake underscores the confidence in F&G's future. The significant capital required to fuel this rapid expansion solidifies F&G's position as a Star, demanding investment to maintain its market leadership and capitalize on growth opportunities.

Fidelity National Financial (FNF) is channeling resources into real estate technology, aiming to streamline title and escrow services and the entire property transaction lifecycle. This strategic push aligns with a booming proptech market, which is expected to grow at a 5.00% CAGR between 2024 and 2032, propelled by advancements in AI, Big Data, VR, and IoT.

While FNF's specific market share within its tech solutions isn't publicly detailed, the company's commitment to innovation and the robust expansion of the proptech sector indicate these technological investments are crucial for securing future market positions. This focus positions FNF to capitalize on evolving industry demands and technological integration.

Direct Commercial Title Operations represent a strong growth opportunity for Fidelity National Financial (FNF). In the first quarter of 2025, this segment generated $293 million in revenue, marking a substantial 23% surge from Q1 2024. This robust performance highlights the segment's potential, especially given the often high-value nature of commercial real estate deals.

Pension Risk Transfer Solutions within F&G

F&G, a segment of Fidelity National Financial, demonstrated robust performance in 2024, achieving record full-year pension risk transfer (PRT) sales. This surge was fueled by a confluence of favorable market dynamics and persistent secular demand for such solutions.

The PRT market, a specialized and rapidly expanding segment within the broader annuities and life insurance landscape, presents a high-growth, high-potential avenue for F&G. This strategic focus on a niche yet substantial market positions FNF for significant future gains.

F&G's commitment to this specialized area is evident in its market strategy, aiming to capture a larger share of the growing PRT market.

- Record 2024 PRT Sales: F&G achieved its highest-ever full-year sales for pension risk transfer solutions in 2024.

- Market Drivers: Favorable market conditions and ongoing secular demand were key contributors to this record performance.

- Market Potential: The PRT market is identified as a high-growth, high-potential offering within the annuities and life insurance sector.

- Strategic Focus: FNF's continued emphasis on this niche segment aims to drive significant market share expansion.

Strategic Acquisitions in Growth Areas

Fidelity National Financial (FNF) has a robust history of strategic acquisitions, having completed over 20 transactions across diverse sectors, including Real Estate IT. This proactive approach to inorganic growth is a key element of its strategy.

The company's commitment to high-growth areas is evident in its 2024 expansion of the F&G segment. Notable acquisitions, such as the Roar Joint Venture, LLC and PALH, LLC, underscore this focus. These moves are designed to capture emerging market opportunities and diversify revenue streams.

Successful integration and leveraging of these recent acquisitions are expected to significantly bolster FNF's market share within these expanding segments. For instance, the F&G segment has shown strong performance, with reported adjusted net earnings of $237 million in the first quarter of 2024, up from $204 million in the prior year period, indicating successful strategic execution.

- Strategic Acquisitions: FNF has a track record of over 20 acquisitions, targeting Real Estate IT and other growth sectors.

- F&G Expansion: In 2024, FNF bolstered its F&G segment with key acquisitions like Roar Joint Venture, LLC and PALH, LLC.

- Market Share Boost: These acquisitions aim to immediately increase market share in high-growth areas.

- Financial Performance: The F&G segment's adjusted net earnings grew to $237 million in Q1 2024, reflecting successful strategic initiatives.

F&G Annuities & Life stands out as a Star in Fidelity National Financial's portfolio, exhibiting remarkable growth. In 2024, F&G recorded $15.3 billion in gross sales, a 16% increase year-over-year, and its assets under management reached $65.3 billion, up 17%. This segment's strong performance, particularly in Pension Risk Transfer (PRT) sales which hit record highs in 2024, highlights its position in a high-growth market. FNF's continued investment in F&G, including strategic acquisitions like Roar Joint Venture, LLC and PALH, LLC in 2024, reinforces its status as a Star requiring significant capital to maintain market leadership and capitalize on expansion opportunities.

| Segment | 2024 Performance Highlights | Growth Indicators |

| F&G Annuities & Life | Record gross sales of $15.3B (16% YoY increase) | Assets under management $65.3B (17% YoY increase) |

| Record full-year Pension Risk Transfer (PRT) sales | Operating in a high-growth, high-potential market niche | |

| Real Estate Technology | FNF investing in proptech to streamline property transactions | Proptech market expected to grow at 5.00% CAGR (2024-2032) |

| Direct Commercial Title Operations | Q1 2025 revenue of $293M (23% YoY increase) | Strong potential in high-value commercial real estate deals |

What is included in the product

This BCG Matrix analysis provides tailored insights for Fidelity National Financial's portfolio, highlighting strategic directions for each business unit.

A clear BCG Matrix visualizes Fidelity National Financial's portfolio, alleviating the pain of strategic uncertainty by highlighting areas for investment or divestment.

Cash Cows

Fidelity National Financial's core title insurance underwriting stands as a prime example of a Cash Cow within its business portfolio. As the nation's largest title insurer, FNF commanded an impressive 32.0% of the U.S. market share by the third quarter of 2024, leading across residential, refinance, and commercial sectors.

This segment consistently generates significant cash flow, evidenced by an industry-leading adjusted pre-tax margin of 15.1% for the entirety of 2024. Despite the inherent cyclicality of the housing market, FNF's dominant and established position in this mature industry solidifies its status as a reliable generator of substantial profits.

Fidelity National Financial's (FNF) Title segment, encompassing escrow and other title-related services like loan subservicing and valuations, represents a significant "Cash Cow" in its portfolio. These services are crucial for real estate transactions, leveraging FNF's dominant market position and expansive network to generate stable, high-margin revenue.

In 2024, FNF's Title segment continued to demonstrate its strength, with title insurance and related services forming the bedrock of its earnings. While the overall real estate market experiences cyclical shifts, the essential nature of these services provides a consistent revenue stream, characterized by low growth but exceptional profitability and operational efficiency, reflecting its established market leadership.

FNF's residential agency title operations are a clear cash cow. In 2024, these operations accounted for a substantial 57.3% of the company's total title insurance premiums, highlighting their dominance and stability within the business.

Despite the inherent cyclicality of the residential real estate market, this segment benefits from a well-established network of independent agents. This strong foundation, coupled with the consistent demand for title services in property transactions, ensures it remains a reliable source of revenue.

The mature and entrenched nature of this business means it requires minimal additional investment for growth or promotion, allowing it to generate significant cash flow with relatively low capital expenditure.

Fixed Indexed Annuities within F&G

F&G's fixed indexed annuities are a cornerstone of Fidelity National Financial's (FNF) portfolio, acting as significant cash cows. These products are key drivers of F&G's impressive growth in assets under management, with indexed annuity sales consistently performing strongly.

As a mature product within F&G, fixed indexed annuities reliably attract substantial assets and generate predictable, stable returns. This consistent performance is crucial for FNF's overall financial health, directly contributing to adjusted net earnings.

- F&G's assets under management have seen robust growth, largely fueled by strong fixed indexed annuity sales.

- Fixed indexed annuities represent a mature product line for F&G, consistently attracting assets and generating predictable revenue streams.

- These annuities provide a stable income source for FNF, significantly bolstering its adjusted net earnings.

Home Warranty Products

Fidelity National Financial's (FNF) home warranty products, nestled within its broader Title segment, represent a significant cash cow. These offerings provide a consistent and stable revenue stream, acting as a reliable contributor to the company's overall financial health. This stability is a key characteristic of a cash cow, as it requires minimal investment to maintain its strong market position.

These home warranty services are designed to meet the ongoing needs of homeowners, which means their demand is not as tightly linked to the cyclical nature of real estate transactions. Unlike title insurance, which is directly tied to property sales, home warranties offer a more predictable income. For instance, in 2023, FNF's Title segment, which includes these ancillary services, generated substantial revenue, demonstrating the underlying strength of its related businesses.

- Stable Revenue: Home warranty products generate recurring income, less impacted by real estate market volatility.

- Customer Leverage: FNF utilizes its existing customer relationships from title services to cross-sell warranties, reducing acquisition costs.

- Low Investment Needs: As established offerings, these products typically require limited new capital investment to sustain their performance.

- Consistent Profitability: The predictable demand and established operational model contribute to consistent profitability for FNF.

Fidelity National Financial's (FNF) title insurance business is a classic example of a cash cow. Its dominant market share, holding 32.0% in Q3 2024, and industry-leading adjusted pre-tax margin of 15.1% in 2024 highlight its consistent profitability. This mature segment generates substantial cash flow with minimal need for reinvestment, supporting other areas of the business.

| Business Segment | BCG Category | Key Financial Metric (2024) | Market Position |

| Title Insurance Underwriting | Cash Cow | Adjusted Pre-Tax Margin: 15.1% | Largest in U.S. (32.0% Market Share) |

| F&G Fixed Indexed Annuities | Cash Cow | Strong growth in Assets Under Management | Key driver of F&G's performance |

| Home Warranty Products | Cash Cow | Consistent revenue stream, low investment needs | Established offering within Title segment |

Delivered as Shown

Fidelity National Financial BCG Matrix

The Fidelity National Financial BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic insight, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis.

Dogs

Fidelity National Financial's underperforming legacy technology platforms represent a potential 'Dog' in the BCG Matrix. While the company actively invests in new real estate technology, certain older internal systems may not receive ongoing updates or integration, making them costly to maintain. These platforms likely offer limited competitive advantage and face low growth prospects in today's fast-paced tech environment.

Fidelity National Financial (FNF) has strategically divested several non-core assets. For instance, in 2023, FNF completed the sale of its majority stake in its FNF Vesta business, a move that generated approximately $1.1 billion. This action aligns with FNF's strategy to focus on its core title insurance and transaction services segments.

These divested or downsized subsidiaries, often smaller units with limited strategic synergy, are typically placed in the Dogs quadrant of the BCG Matrix. They might represent businesses that are not growing rapidly and have a low market share, potentially draining resources without offering substantial future growth prospects for FNF.

Within Fidelity National Financial's extensive suite of title and transaction services, there exist highly niche, low-volume offerings. These specialized services, though essential for a complete client solution, typically represent a small fraction of overall revenue. For instance, certain historical document retrieval or highly complex property lien searches might fall into this category.

These segments often operate at break-even or generate minimal profit, serving more as a value-added component to broader service packages rather than standalone profit centers. Their maintenance is strategic, ensuring Fidelity National Financial can address the full spectrum of client needs, even for infrequent or highly specialized requirements.

While specific financial data for these micro-segments isn't publicly detailed, the overall title insurance and settlement services industry, which encompasses these niche areas, saw significant activity in 2024. The Mortgage Bankers Association reported a strong refinance market in early 2024, which indirectly supports the infrastructure needed for even these low-volume services to operate efficiently.

Certain Regional Title Operations in Stagnant Markets

Certain regional title operations within Fidelity National Financial (FNF) might be categorized as Dogs in the BCG Matrix. These are operations situated in real estate markets that have shown little to no growth or are experiencing a decline. For instance, in 2024, some Midwestern or Rust Belt regions continued to face economic headwinds, impacting housing demand and title transaction volumes. These areas may have seen title order volumes flat or even decreasing year-over-year, making significant market share gains or profit expansion challenging.

These underperforming segments require careful management. While they may still contribute some revenue, their low growth potential and limited market share mean they are unlikely to be significant profit drivers. FNF's strategy might involve optimizing costs within these operations or considering divestiture if the situation persists without improvement. For example, if a specific state's title revenue has remained stagnant for three consecutive years while the national average shows modest growth, it could be flagged for review.

- Stagnant Market Conditions: Operations in regions with consistently low or negative real estate appreciation and transaction volumes.

- Limited Growth Potential: These segments struggle to increase market share due to entrenched competition or unfavorable local economic factors.

- Resource Allocation: May require ongoing management attention and resources without generating substantial returns, impacting overall portfolio efficiency.

- Profitability Challenges: Low transaction volumes and competitive pricing in these markets can squeeze profit margins, making them less attractive contributors.

Outdated or Less Competitive Service Offerings

Fidelity National Financial (FNF) might categorize certain legacy service offerings as Dogs within its BCG Matrix if they've lost competitive edge. This could happen if market demand has shifted away from these services, perhaps due to new technologies or evolving customer needs that competitors have better addressed. For instance, if FNF's traditional title insurance processing methods haven't been updated to match the speed and efficiency offered by digitally-native competitors, these services could be declining in profitability.

These underperforming services might be characterized by shrinking revenue streams and an inability to command premium pricing. Without significant investment in modernization or a strategic pivot, they risk becoming cash traps, consuming resources without generating substantial returns. In 2024, the title and settlement services industry is seeing increased pressure from proptech companies offering streamlined, digital-first solutions, making it crucial for established players like FNF to adapt.

- Declining Market Share: Services that have seen a noticeable drop in their percentage of the total market served, indicating a loss of relevance or competitive disadvantage.

- Low Profitability: Offerings generating minimal profit margins, often due to increased operational costs or pricing pressures from more innovative competitors.

- Technological Obsolescence: Services that rely on outdated technology, making them slower, less efficient, or less appealing compared to modern alternatives.

- Stagnant or Negative Growth: Business units experiencing flat or decreasing demand, signaling a lack of future potential without substantial strategic intervention.

Certain niche or legacy service offerings within Fidelity National Financial (FNF) could be classified as Dogs in the BCG Matrix. These are typically services with low market share and low growth prospects, often requiring ongoing maintenance without significant return potential. For example, highly specialized historical document retrieval services that are infrequently used might fit this description.

These segments may operate at break-even or generate minimal profits, serving more as a value-add to broader service packages. Their continued operation is strategic, ensuring FNF can meet a wide range of client needs, even for rare or complex requirements. The overall title insurance industry, which includes these niche areas, saw continued digital transformation efforts in 2024, highlighting the need for even specialized services to remain efficient.

Operations in specific, slow-growing real estate markets can also represent Dogs for FNF. These are regions with stagnant or declining transaction volumes, making it difficult to gain market share or increase profitability. For instance, areas experiencing persistent economic challenges might see flat or decreasing title order volumes year-over-year.

These underperforming segments require careful cost management and may be candidates for divestiture if improvements aren't seen. For example, a regional title operation that has shown flat revenue for three consecutive years while the national average grows could be flagged for review.

| Segment Example | Market Share | Growth Rate | Profitability | Strategic Consideration |

|---|---|---|---|---|

| Legacy Document Archiving | Low | Low | Break-even/Low | Cost optimization, potential divestiture |

| Niche Property Lien Searches | Low | Low | Low | Value-add, maintain for full service |

| Regional Title Ops (Stagnant Market) | Low | Low | Low | Cost control, performance review |

Question Marks

F&G's entry into the Registered Index-Linked Annuities (RILA) market in early 2024 positions them in a high-growth segment. These products offer a blend of potential for enhanced returns and built-in downside protection, appealing to a broad investor base. While the RILA market itself is expanding rapidly, F&G's current market share within this specialized product category is still in its nascent stages.

To capitalize on the RILA market's potential and elevate F&G's position from a developing product to a market leader, substantial investments in marketing and distribution are crucial. This strategic focus is essential for building brand awareness and driving sales, ultimately aiming to transform these new offerings into Stars within Fidelity National Financial's BCG Matrix.

Fidelity National Financial (FNF) is actively investing in digital closing solutions to enhance the real estate transaction experience, aiming for greater transparency and connectivity. This includes dedicated investments in title and escrow software, alongside solutions designed for real estate partners.

The real estate industry is witnessing a significant shift towards fully digital closings, representing a high-growth potential market. However, as a relatively new segment, FNF's current market share in these emerging digital solutions is likely modest, necessitating considerable investment to establish a strong foothold and capture significant market penetration.

The real estate sector is increasingly adopting blockchain and AI to streamline transactions, enhancing security and transparency. Fidelity National Financial (FNF) is actively investigating these technologies through its innovation programs, recognizing their significant disruptive potential.

While these advanced applications represent high-growth opportunities, FNF's current market penetration in AI and blockchain-driven real estate solutions is likely minimal. This positions them as potential 'question marks' within a BCG matrix framework, requiring substantial investment or strategic alliances to capitalize on their future growth prospects.

Expansion into New Geographic Markets (Title)

Fidelity National Financial's (FNF) expansion into new geographic markets, where its brand recognition and operational infrastructure are less established, would be classified as a Question Mark in the BCG Matrix. These ventures are characterized by operating within a growing market, such as the global real estate sector, but with a nascent market share. For instance, if FNF were to enter a developing Asian real estate market in 2024, it would face high growth potential but would need substantial investment to gain traction against local competitors.

- New Market Entry: FNF's strategic initiatives to enter markets like Southeast Asia or specific regions in Latin America in 2024 represent Question Marks.

- Market Growth vs. Share: These markets offer high growth potential, but FNF's current market share is minimal, requiring significant capital allocation.

- Investment Needs: Building brand awareness, establishing distribution channels, and adapting services to local regulations will demand considerable financial resources.

- Strategic Focus: Success in these Question Mark areas is crucial for future growth but carries inherent risks due to intense competition and unfamiliar operating environments.

Partnerships for 'Innovative Title Solutions' with Government Entities

Fidelity National Financial (FNF) is actively engaging with government entities, notably the Federal Housing Finance Agency (FHFA), to develop and implement innovative title solutions. These collaborations are strategically positioned to capitalize on high-growth potential within the evolving title insurance sector.

The primary objective of these partnerships is to explore and potentially reshape significant portions of the title insurance market, or to foster the creation of entirely new product offerings. This forward-looking approach acknowledges the dynamic nature of the industry and the opportunities for innovation.

- Government Collaboration: FNF's work with the FHFA on innovative title solutions highlights a strategic move into areas with significant future growth prospects.

- Market Reshaping Potential: These initiatives could fundamentally alter existing title insurance frameworks or lead to the development of novel products and services.

- Developing Viability: While the potential is high, the market share and commercial success of these specific innovative solutions are still in their nascent stages, necessitating continued investment and careful management.

- Strategic Investment: The classification of these ventures within a BCG matrix would likely place them in a 'question mark' or 'star' category, depending on early traction, indicating a need for strategic nurturing and further capital allocation to achieve market leadership.

Fidelity National Financial's ventures into emerging technologies like AI and blockchain for real estate transactions, alongside new geographic market entries, represent classic Question Marks. These areas offer substantial growth potential, but FNF's current market share is minimal, requiring significant investment to establish a strong presence and achieve market leadership.

The company's collaboration with entities like the FHFA on innovative title solutions also falls into this category. While the potential to reshape the market or create new products is high, the commercial viability and market share of these specific initiatives are still developing, making them prime candidates for strategic nurturing and capital allocation to transition them into Stars.

In 2024, FNF's strategic investments in digital closing solutions and RILAs also exhibit Question Mark characteristics. These markets are experiencing rapid growth, but FNF's penetration is nascent, necessitating focused marketing and distribution efforts to build brand awareness and drive sales, aiming to convert these into successful market segments.

| FNF Initiative | Market Growth Potential | Current Market Share | Investment/Strategy Focus |

|---|---|---|---|

| AI/Blockchain in Real Estate | High | Minimal | R&D, Strategic Partnerships |

| New Geographic Market Entry (e.g., SE Asia) | High | Nascent | Brand Building, Local Adaptation |

| FHFA Title Solution Collaboration | High (Market Reshaping) | Developing | Innovation, Pilot Programs |

| Digital Closing Solutions | High | Modest | Digital Infrastructure, Partner Integration |

| Registered Index-Linked Annuities (RILAs) | High | Nascent | Marketing, Distribution Expansion |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive financial disclosures, proprietary market research, and industry growth forecasts to provide a robust strategic overview.