Flywire Payments PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flywire Payments Bundle

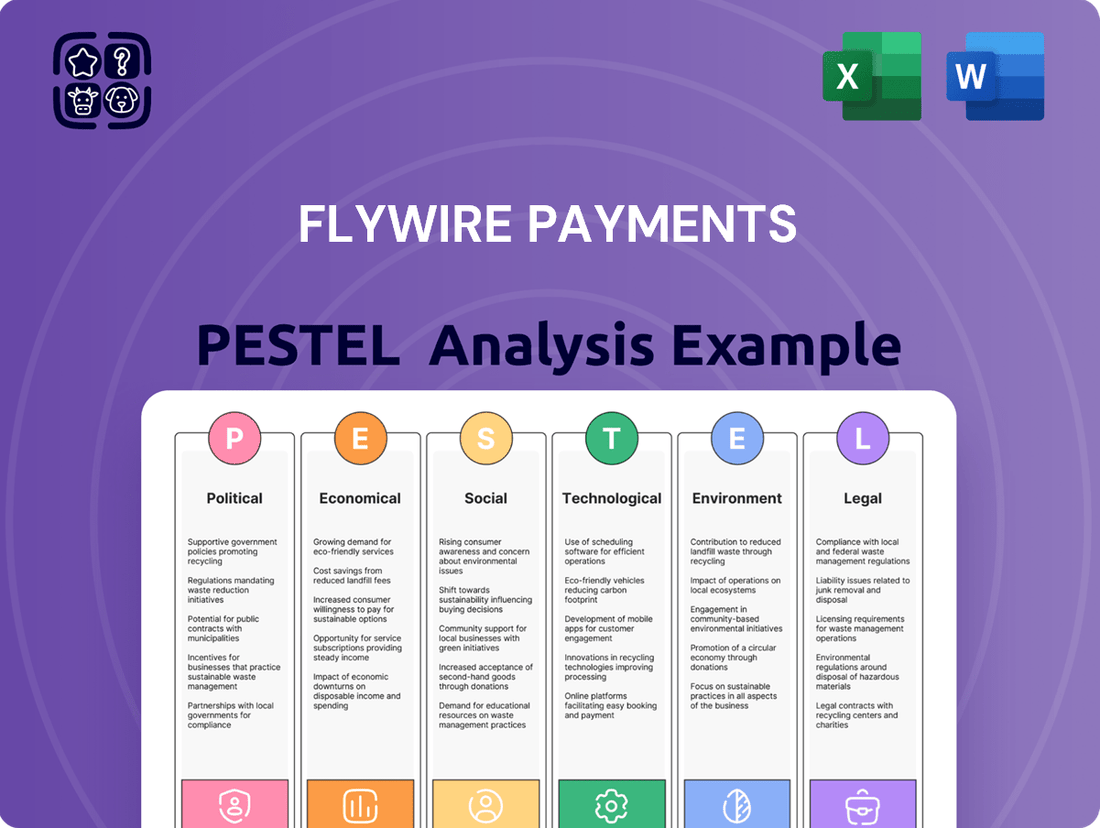

Navigate the complex global landscape impacting Flywire Payments with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors that are shaping their operations and future growth. Equip yourself with actionable intelligence to refine your strategies and gain a competitive advantage. Download the full analysis now for immediate insights.

Political factors

Government policies, particularly changes in student visa regulations in key markets like Canada and Australia, directly impact Flywire's education sector. In 2024-2025, these policy shifts have led to projected double-digit declines in international student enrollments.

This downturn is expected to cause a significant, over 30% year-over-year revenue decline for Flywire in these specific regions. The situation underscores Flywire's exposure to governmental decisions concerning immigration and international education.

Geopolitical instability, including conflicts like the ongoing situation in Eastern Europe and potential flashpoints in other regions, can significantly disrupt global payment flows and currency exchange rates, directly impacting Flywire's transaction volumes and profitability. For instance, the heightened geopolitical tensions in 2022 and 2023 led to increased volatility in foreign exchange markets, a key area for Flywire's cross-border payment services. The company's ability to navigate these turbulent waters by offering flexible payment solutions and hedging strategies is critical for maintaining client trust and operational continuity.

International trade agreements and diplomatic ties significantly influence the ease and cost of cross-border payments, a core area for Flywire. Favorable trade pacts can streamline transactions by reducing tariffs and regulatory hurdles, thereby lowering operational costs and expanding market access for Flywire's clients. For instance, the continued evolution of trade relationships following the USMCA (United States-Mexico-Canada Agreement) impacts payment flows within North America.

Government Support for Digital Payment Infrastructure

Governments worldwide are actively investing in and promoting digital payment infrastructure. For instance, in 2024, India's Unified Payments Interface (UPI) continued its rapid expansion, processing over 100 billion transactions, showcasing significant government backing for digital financial ecosystems. This robust government support directly enhances the efficiency and reach of companies like Flywire, enabling smoother cross-border transactions and faster settlement times.

Supportive policies for financial technology (FinTech) and digital transformation accelerate Flywire's market penetration. Many nations are implementing regulatory sandboxes and favorable tax treatments for FinTech innovation, as seen with initiatives in Singapore and the UAE aiming to become global FinTech hubs by 2025. These environments foster growth and allow Flywire to integrate its services more effectively into local economies.

- Government Investments: Many countries are allocating substantial funds to upgrade national payment systems and promote digital literacy, creating fertile ground for digital payment providers.

- Regulatory Frameworks: Clear and supportive regulations for cross-border payments and digital transactions reduce friction and compliance burdens for companies like Flywire.

- Digital Transformation Initiatives: National strategies focused on digitizing economies, particularly in education and healthcare sectors, directly increase the demand for efficient payment solutions that Flywire offers.

Data Residency and Sovereignty Policies

Increasing global focus on data residency and sovereignty laws significantly impacts how companies like Flywire store and process payment data across different jurisdictions. These policies dictate where data must be physically located, adding layers of complexity to cross-border operations. For instance, in 2024, countries like India continued to strengthen their data localization requirements, impacting how financial technology firms handle sensitive customer information. Compliance necessitates robust technological infrastructure and legal expertise to navigate these evolving mandates.

These diverse regulations require Flywire to maintain distinct data storage solutions in various regions, potentially increasing operational costs. The need to comply with varying data protection standards, such as those in the EU with GDPR or emerging frameworks in Asia-Pacific, demands continuous adaptation. By mid-2025, it's anticipated that more nations will implement or refine their data sovereignty rules, pushing companies to invest heavily in localized data centers and compliance teams.

- Data Localization Mandates: Countries like India and Vietnam have been actively enforcing data localization, requiring payment processors to store certain data within their borders.

- Cross-Border Data Flow Restrictions: Regulations like the EU's GDPR can limit the transfer of personal data outside the European Economic Area without adequate safeguards.

- Increased Compliance Costs: Meeting diverse data residency requirements can lead to higher infrastructure and legal expenditure for global payment providers.

- Operational Complexity: Managing data across multiple jurisdictions with differing rules adds significant complexity to payment processing and risk management.

Government policies, especially concerning international student visas in countries like Canada and Australia, directly affect Flywire's education sector. Projected double-digit declines in international student enrollments for 2024-2025 due to these policy shifts are expected to cause a significant revenue drop for Flywire in these regions.

Governments worldwide are actively investing in and promoting digital payment infrastructure, with India's UPI processing over 100 billion transactions in 2024, showcasing strong government backing for digital financial ecosystems and enhancing Flywire's operational efficiency.

Supportive FinTech and digital transformation policies, such as regulatory sandboxes and favorable tax treatments in hubs like Singapore and the UAE by 2025, accelerate Flywire's market penetration and integration into local economies.

Data residency and sovereignty laws are increasingly impacting how Flywire stores and processes payment data. India's strengthening data localization requirements in 2024 necessitate robust infrastructure and legal expertise for compliance.

What is included in the product

This PESTLE analysis examines the external macro-environmental forces impacting Flywire Payments, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats within Flywire's operating landscape.

A concise Flywire Payments PESTLE analysis highlights how navigating evolving political regulations and economic shifts can be simplified, offering businesses a clear path to manage cross-border payment complexities.

Economic factors

Global macroeconomic challenges presented a mixed landscape for businesses like Flywire throughout 2024. Despite these headwinds, the company demonstrated resilience, reporting revenue growth. This suggests effective navigation of a complex economic environment.

Sustained global economic growth generally acts as a tailwind for payment providers like Flywire. Higher economic activity typically translates to increased transaction volumes within Flywire's key sectors: education, healthcare, and travel. For instance, a stronger global economy can lead to more international student enrollments and increased cross-border travel, both of which drive payment flows.

Currency exchange rate fluctuations significantly impact Flywire's financial performance, with FX-neutral revenue growth being a key indicator. The company's ability to manage these currency impacts was evident in its Q1 2025 results, which surpassed FX Neutral Revenue Guidance.

Significant volatility in exchange rates can directly alter the value of Flywire's cross-border transactions and, consequently, its reported revenues. For instance, a strengthening USD against other currencies could reduce the reported USD value of revenue earned in those foreign currencies.

Fluctuations in global interest rates directly affect Flywire's cost of borrowing for strategic initiatives and the financial capacity of its diverse client base. For instance, as of early 2024, central banks in major economies like the US and Europe have maintained relatively stable, albeit cautiously managed, interest rate environments, impacting the cost of capital for potential acquisitions or technology investments.

Flywire's strategy to optimize business investments for sustained growth is inherently tied to the prevailing interest rate landscape, influencing the attractiveness of capital expenditures versus debt financing. The ability to secure affordable capital remains a critical enabler for Flywire's ambitious expansion plans and its continuous drive for product innovation in the payments sector.

Disposable Income and Consumer Spending

Disposable income and consumer spending are critical drivers for Flywire's business. When individuals have more money left after taxes, they tend to spend more on services like education, healthcare, and travel, all key sectors for Flywire. For instance, in 2024, consumer spending in the US was projected to grow by 2.6%, indicating a healthy environment for Flywire's transaction volumes.

Economic shifts directly impact these spending patterns. An economic downturn or rising inflation can curb discretionary spending, leading to lower demand for the services Flywire facilitates. Conversely, robust consumer spending in sectors like higher education, where tuition fees are significant, or in healthcare, which sees consistent demand, directly fuels Flywire's revenue growth.

- Consumer spending growth: US consumer spending increased by an estimated 2.6% in 2024, supporting payment volumes for services.

- Sectoral impact: Higher disposable income boosts spending in education, healthcare, and travel, directly benefiting Flywire.

- Economic sensitivity: Inflationary pressures or economic slowdowns can reduce discretionary spending, potentially impacting Flywire's total payment volume.

Competition and Market Saturation

The global payments market is intensely competitive, featuring a wide array of companies providing diverse solutions. Flywire's success hinges on its ability to consistently innovate and distinguish its specialized software and international payment capabilities to secure its market standing.

Market saturation and heightened competition can lead to pricing pressures and challenges in acquiring new clients. For instance, the digital payments market alone was valued at approximately $3.5 trillion globally in 2023 and is projected to grow significantly, indicating intense rivalry. Flywire's strategy to focus on specific verticals like education and healthcare helps it carve out a niche, but it still faces competition from established financial institutions and emerging fintech players.

- Intense Competition: The payments landscape includes global banks, payment processors, and numerous fintech startups.

- Innovation Imperative: Flywire must continually enhance its offerings, such as its cross-border tuition payment solutions, to stay ahead.

- Pricing Pressure: Increased market saturation can force companies to lower fees, impacting profit margins.

- Client Acquisition Costs: In a crowded market, acquiring new clients becomes more expensive and requires significant marketing and sales efforts.

Economic factors present a dynamic environment for Flywire. While global economic growth generally supports increased transaction volumes in sectors like education and travel, currency fluctuations significantly impact reported revenue. For example, Flywire's Q1 2025 results surpassed FX Neutral Revenue Guidance, highlighting their management of these currency impacts.

Interest rates influence Flywire's borrowing costs and client financial capacity. As of early 2024, stable interest rates in major economies like the US and Europe affected the cost of capital for investments. Furthermore, consumer spending, a key driver for Flywire, showed resilience, with US consumer spending projected to grow by 2.6% in 2024, bolstering transaction volumes.

| Economic Factor | Impact on Flywire | Supporting Data/Example |

|---|---|---|

| Global Economic Growth | Positive correlation with transaction volumes | Increased cross-border travel and education payments |

| Currency Exchange Rates | Significant impact on reported revenue | Q1 2025 FX Neutral Revenue Guidance surpassed |

| Interest Rates | Affects borrowing costs and client capacity | Stable rates in US/Europe in early 2024 influenced cost of capital |

| Consumer Spending | Directly drives transaction volumes | US consumer spending projected 2.6% growth in 2024 |

Preview Before You Purchase

Flywire Payments PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Flywire Payments provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy. Gain valuable insights to inform your business decisions.

Sociological factors

The global student mobility landscape is evolving, with significant shifts in where students choose to study. For instance, while traditional destinations like the US and UK remain popular, emerging markets are seeing increased interest. This demographic evolution directly impacts the volume and origin of cross-border tuition payments, a core segment for Flywire, necessitating agile payment solutions that cater to diverse student needs and financial behaviors.

Societies worldwide are increasingly embracing digital payment methods, driven by a desire for convenience and speed. This shift is evident in the growing volume of online transactions, with global digital payment transaction values projected to reach over $15 trillion by 2027, up from an estimated $9.5 trillion in 2023. Flywire's business model is well-positioned to benefit from this trend, offering a secure and user-friendly platform that caters to this evolving preference for digital financial interactions.

Customers today demand clear visibility and simple processes for international payments. Flywire directly addresses this by providing online tracking and 24/7 multilingual customer support, which significantly boosts user confidence and satisfaction in managing cross-border transactions.

In 2024, a significant portion of consumers and businesses are prioritizing payment providers that offer this level of transparency and ease. Failure to meet these expectations can lead to client attrition, especially as global commerce continues to expand and competition intensifies.

Consumer Trust in Online Payment Platforms

Consumer trust in online payment platforms is a critical sociological factor, particularly for Flywire's target markets in education and healthcare where transactions can be substantial and sensitive. Building and maintaining this trust hinges on robust security measures, adherence to regulations, and consistent service reliability. A significant data breach or even a temporary service outage could severely damage consumer confidence, impacting Flywire's reputation and transaction volume.

Recent surveys highlight the importance of trust in digital payments. For instance, a 2024 study indicated that over 70% of consumers consider security features the most important aspect when choosing an online payment provider. Furthermore, a 2025 report on cross-border education payments found that trust in the platform's ability to protect personal and financial data was a primary driver for student and parent adoption, with 85% of respondents citing it as a key consideration.

- Security Concerns: Consumers are increasingly aware of data privacy and security risks, making robust encryption and fraud prevention essential for platforms like Flywire.

- Reputation and Reliability: A history of successful, secure transactions builds a strong reputation, while any service disruptions can quickly erode consumer trust.

- Regulatory Compliance: Adherence to data protection laws (like GDPR or CCPA) and financial regulations is crucial for demonstrating legitimacy and safeguarding consumer interests.

Shifting Preferences for Payment Methods

Societal preferences for payment methods are in constant flux, with a growing emphasis on local payment options and the rapid rise of mobile payments. For instance, in 2024, mobile payment adoption continued its upward trajectory, with projections indicating that over 80% of global internet users will engage with mobile payments by 2025. This shift directly impacts businesses like Flywire, which must cater to these evolving consumer behaviors to remain competitive.

Flywire's strategic advantage lies in its robust infrastructure, supporting over 140 currencies and enabling transactions in more than 240 countries and territories. This extensive reach allows them to integrate with a wide array of local payment methods, from bank transfers prevalent in Europe to digital wallets popular in Asia. By offering these diverse options, Flywire ensures a seamless and familiar payment experience for its global clientele.

Adapting to these regional and demographic preferences is not merely about convenience; it's about ensuring accessibility and fostering trust. For example, in many emerging markets, mobile money platforms are the primary financial tool for a significant portion of the population. Flywire's ability to integrate with these platforms directly addresses this need, broadening its market penetration and enhancing customer satisfaction.

- Mobile Payment Growth: Global mobile payment transaction value is expected to exceed $15 trillion by 2027, underscoring the critical need for businesses to support mobile-first payment solutions.

- Local Payment Preference: In regions like Latin America, over 60% of online transactions in 2024 utilized local payment methods rather than traditional credit cards.

- Currency Support: Flywire's support for 140+ currencies is vital as cross-border e-commerce continues to grow, projected to reach $3.5 trillion by 2027.

- Emerging Market Adoption: In Sub-Saharan Africa, mobile money accounts surpassed 600 million in 2024, highlighting the importance of integrating with these systems for financial inclusion.

Societal trends highlight a growing preference for seamless, digital payment experiences, with global digital payment transaction values projected to surpass $15 trillion by 2027. Consumers increasingly prioritize transparency and user-friendly interfaces, making platforms like Flywire, which offer 24/7 multilingual support and real-time tracking, highly attractive. This demand for convenience and accessibility is a key driver for Flywire's continued growth in cross-border transactions.

Consumer trust is paramount in the digital payment space, especially for sensitive sectors like education and healthcare. Studies in 2024 and 2025 consistently show that over 70% of consumers prioritize security features, with 85% citing data protection as a key factor in choosing payment providers. Flywire's commitment to robust security measures and regulatory compliance is therefore critical for maintaining customer confidence and market share.

The increasing adoption of mobile payments globally, expected to reach over 80% of internet users by 2025, necessitates adaptable payment solutions. Furthermore, the preference for local payment methods, seen in over 60% of online transactions in Latin America during 2024, underscores the importance of Flywire's extensive currency support (140+) and integration with diverse regional payment systems. This adaptability is crucial for financial inclusion and expanding market reach, particularly in emerging economies where mobile money accounts exceeded 600 million in Sub-Saharan Africa in 2024.

| Sociological Factor | Trend/Observation | Impact on Flywire | Supporting Data (2024/2025) |

| Digital Payment Preference | Growing demand for convenient, fast online transactions | Increased transaction volume and user acquisition | Global digital payment transactions projected to exceed $15 trillion by 2027 |

| Trust and Security | High consumer priority on data privacy and platform reliability | Need for robust security measures and transparent operations | Over 70% of consumers prioritize security; 85% cite data protection as key |

| Mobile Payment & Local Options | Rise of mobile-first solutions and preference for regional payment methods | Requirement for broad currency support and local payment integrations | Over 80% of internet users to use mobile payments by 2025; 140+ currencies supported by Flywire |

Technological factors

Flywire's competitive edge is deeply rooted in its proprietary global payments network and next-generation payment platform, which are constantly being upgraded with the latest technological innovations. These ongoing advancements are crucial for processing intricate cross-border and domestic payments more rapidly, securely, and efficiently.

For instance, in 2024, the global digital payments market was valued at over $9 trillion, with significant growth driven by technological improvements in processing speed and security protocols. Flywire's commitment to staying ahead in payment infrastructure technology directly supports its ability to handle these complex transactions, ensuring a smooth experience for its clients.

Flywire's commitment to seamless integration with major Enterprise Resource Planning (ERP) systems like Ellucian, Workday, and NetSuite is a key technological advantage. This allows their payment solutions to become an intrinsic part of a client's financial operations, streamlining processes and enhancing the user experience. For instance, in the education sector, where Ellucian is prevalent, this deep integration simplifies tuition payment collection for institutions.

The financial landscape is being reshaped by the swift development of new payment technologies. Innovations like blockchain, artificial intelligence integrated into payment processing, and the rise of instant payment networks are creating significant opportunities and hurdles for companies like Flywire. These advancements demand continuous adaptation to remain competitive.

Flywire's strategic move to appoint a Chief Payments Officer highlights its dedication to pushing the boundaries of product and payment innovation. This executive role signals a clear intent to actively explore and leverage emerging payment solutions, aiming to stay ahead in a rapidly evolving market.

Successfully integrating these cutting-edge technologies is paramount for Flywire's sustained growth and operational efficiency. For instance, the global digital payments market was valued at over $2.4 trillion in 2023 and is projected to grow significantly, underscoring the importance of staying at the forefront of technological adoption.

Cybersecurity Threats and Data Protection Technologies

Cybersecurity threats are a paramount concern for Flywire, given the highly sensitive nature of the financial data it handles. The company's commitment to robust data protection is underscored by its PCI DSS Level 1 certification and successful completion of annual SOC II Type II audits, demonstrating adherence to stringent security standards. These certifications are crucial for maintaining trust and ensuring the integrity of transactions.

Compliance with a growing number of global data privacy regulations, such as GDPR and CCPA, adds another layer of complexity to Flywire's technological strategy. Failure to comply can result in significant penalties and reputational damage. Therefore, continuous investment in advanced security measures, including encryption, threat detection, and secure data storage, is not just a best practice but a business imperative to safeguard both client and customer information.

The cybersecurity landscape is constantly evolving, with threat actors developing increasingly sophisticated methods. For instance, in 2024, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report. This highlights the substantial financial and operational risks associated with security vulnerabilities. Flywire's ongoing investment in cutting-edge security technologies is therefore essential to stay ahead of these evolving threats and protect its operations and reputation.

- PCI DSS Level 1 Certification: Demonstrates compliance with the Payment Card Industry Data Security Standard, the highest level of security for cardholder data.

- SOC II Type II Audits: Validates the effectiveness of Flywire's security, availability, processing integrity, confidentiality, and privacy controls over time.

- Global Data Privacy Compliance: Adherence to regulations like GDPR and CCPA is critical for operating internationally and protecting customer data rights.

- Investment in Advanced Security: Continuous allocation of resources to technologies like AI-powered threat detection and advanced encryption is vital to mitigate emerging cyber risks.

Scalability and Reliability of Payment Platforms

The scalability and reliability of Flywire's payment platform are crucial for managing growing transaction volumes and serving a global client base. In 2023, Flywire processed over $35 billion in total payment volume, a significant increase from previous years, highlighting its capacity to handle substantial growth. This robust infrastructure supports thousands of clients and millions of payers across diverse currencies and geographies.

Ensuring consistent, high-performance service is paramount for client retention and satisfaction. Flywire's platform architecture is designed for resilience, aiming to minimize downtime and maintain operational efficiency even during peak periods. This focus on reliability is a key differentiator in the competitive cross-border payments market.

- Platform Uptime: Flywire targets industry-leading uptime percentages, crucial for businesses relying on seamless payment processing.

- Transaction Throughput: The platform is engineered to handle millions of transactions daily, demonstrating its scalability.

- Global Reach: Supporting payments in over 150 currencies underscores the platform's ability to adapt to diverse international requirements.

Technological advancements are central to Flywire's operations, driving improvements in speed, security, and efficiency for complex global payments. The company's continuous upgrades to its payment platform, including AI integration for enhanced processing and fraud detection, are vital in a market valued at over $9 trillion in 2024. Flywire's commitment to staying at the forefront of payment technology ensures it can effectively manage intricate cross-border transactions, a key factor in its competitive advantage.

Flywire's deep integration with major ERP systems like Workday and NetSuite streamlines financial operations for its clients. This technological synergy simplifies complex processes, such as tuition collection in the education sector, enhancing user experience and operational efficiency. The rapid evolution of payment technologies, including blockchain and instant payment networks, necessitates Flywire's ongoing adaptation and investment in new solutions to maintain its market position.

Security remains a paramount technological concern for Flywire, underscored by its PCI DSS Level 1 certification and annual SOC II Type II audits. These measures are critical for protecting sensitive financial data in an environment where the average cost of a data breach reached $4.45 million in 2024. Flywire's ongoing investment in advanced security technologies, including AI-powered threat detection, is essential to mitigate evolving cyber risks and maintain client trust.

The scalability and reliability of Flywire's platform are critical, as evidenced by its processing of over $35 billion in total payment volume in 2023. This robust infrastructure supports millions of payers globally across diverse currencies and geographies, ensuring high-performance service and minimizing downtime. Flywire's platform is engineered for resilience, aiming to handle millions of transactions daily and adapt to diverse international payment requirements.

| Technology Area | Key Aspect | Impact/Data Point |

|---|---|---|

| Payment Platform | Proprietary Network & Upgrades | Global digital payments market over $9 trillion (2024); enhances speed, security, efficiency. |

| System Integration | ERP Connectivity (Workday, NetSuite) | Streamlines financial operations; simplifies tuition collection for institutions. |

| Emerging Technologies | Blockchain, AI in Payments | Creates opportunities and demands continuous adaptation to remain competitive. |

| Cybersecurity | PCI DSS Level 1, SOC II Type II | Mitigates risks; average data breach cost $4.45 million (2024); builds client trust. |

| Platform Performance | Scalability & Reliability | Processed over $35 billion in payment volume (2023); supports millions of payers globally. |

Legal factors

Flywire navigates a dynamic global regulatory landscape, adapting to evolving rules like Europe's PSD2, which mandates stronger authentication for payments and aims to boost competition. In 2024, continued focus on data privacy and cross-border transaction transparency is expected to shape compliance efforts.

The company's legal team prioritizes staying ahead of these changes, recognizing that compliance is key to fostering trust and enabling secure, innovative payment solutions. For instance, Singapore's Payment Services Act, which came into full effect in 2021, continues to influence how digital payment providers operate within the region, requiring licenses for various payment activities.

Flywire, as a global payments facilitator, must navigate stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules are critical to deterring financial crime and ensuring the integrity of the payment systems. For instance, in 2024, regulatory bodies worldwide continued to emphasize enhanced due diligence for cross-border transactions, impacting how companies like Flywire onboard and monitor their clients.

Compliance necessitates sophisticated identity verification, including document checks and biometric data, alongside continuous transaction monitoring for suspicious activities. Failure to meet these requirements can result in substantial fines; for example, many financial institutions faced penalties in the hundreds of millions of dollars in recent years for AML/KYC deficiencies, underscoring the financial and reputational risks.

The complexity lies in the ever-evolving nature of these regulations across diverse international markets where Flywire operates. Staying abreast of changes, such as updated beneficial ownership rules or new reporting thresholds introduced in 2025, demands significant investment in technology and compliance personnel.

Flywire operates under a complex web of data privacy laws globally. Regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) impose strict requirements on how customer data is collected, stored, and processed. For instance, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher, making compliance critical.

In specific sectors, Flywire also navigates industry-specific privacy mandates. The Health Insurance Portability and Accountability Act (HIPAA) in the U.S. governs the handling of protected health information, while the Family Educational Rights and Privacy Act (FERPA) protects student education records. Adherence to these laws necessitates robust data security protocols and transparent data handling practices.

Consumer Protection Laws

Consumer protection laws, such as those prohibiting surcharging payers in certain situations, directly influence how Flywire designs and offers its payment solutions. These regulations are crucial for ensuring fairness and transparency in financial dealings, building consumer confidence. Flywire's adherence to these legal frameworks is paramount for its operational legitimacy and reputation.

For instance, in the United States, the Durbin Amendment (part of the Dodd-Frank Act) significantly impacted interchange fees, indirectly affecting how payment processors structure their pricing. While not a direct surcharge ban, it aimed to reduce costs for merchants and, by extension, consumers. Flywire must navigate these evolving regulations to ensure its fee structures are compliant and competitive.

- Consumer Protection Focus: Laws like the Consumer Financial Protection Act in the US establish agencies dedicated to safeguarding consumers in financial markets.

- Surcharging Restrictions: Regulations in various jurisdictions limit or prohibit merchants from adding surcharges for credit card payments, influencing Flywire's pricing models.

- Transparency Requirements: Many consumer protection laws mandate clear disclosure of fees and terms, requiring Flywire to provide transparent information to its users.

- Cross-Border Compliance: Flywire's international operations necessitate compliance with a patchwork of consumer protection laws across different countries, adding complexity.

Class Action Lawsuits and Litigation Risks

Flywire has recently been involved in class action lawsuits alleging misrepresentation of revenue growth and the understating of negative impacts from visa restrictions. These legal challenges underscore the critical need for transparent disclosures and accurate financial reporting within the payments industry.

Such litigation can impose substantial financial burdens on a company, including legal fees and potential settlement costs. Furthermore, ongoing legal disputes can erode investor confidence, potentially impacting Flywire's stock performance and ability to secure future funding.

- Litigation Costs: Legal defense and potential settlements can significantly impact profitability.

- Reputational Damage: Lawsuits can tarnish a company's image, affecting customer and partner trust.

- Regulatory Scrutiny: Litigation can attract increased attention from financial regulators, leading to further compliance requirements.

Flywire's operations are heavily influenced by evolving legal frameworks governing payments and data. Regulations like Europe's PSD2, emphasizing strong customer authentication, and Singapore's Payment Services Act, requiring licensing, shape its compliance strategies. The company must also adhere to stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) rules, with regulators in 2024 continuing to push for enhanced due diligence on cross-border transactions.

Data privacy laws such as GDPR and CCPA impose strict data handling requirements, with GDPR fines potentially reaching 4% of global annual turnover. Flywire also navigates sector-specific regulations like HIPAA for health data and FERPA for student records, demanding robust data security. Consumer protection laws, including those limiting surcharges, directly impact its pricing and service design, necessitating transparency and fairness.

The company faces legal challenges, including class action lawsuits alleging misrepresentation, highlighting the importance of accurate financial disclosures. Such litigation can lead to significant financial penalties and reputational damage, attracting further regulatory scrutiny.

| Regulation/Law | Key Impact on Flywire | Example Compliance Measure | Potential Consequence of Non-Compliance |

|---|---|---|---|

| PSD2 (Europe) | Requires Strong Customer Authentication (SCA) | Implementing multi-factor authentication for transactions | Transaction declines, regulatory fines |

| AML/KYC Regulations | Mandates identity verification and transaction monitoring | Advanced identity verification tools, real-time monitoring systems | Hefty fines, loss of operating licenses |

| GDPR (Europe) | Governs personal data collection, storage, and processing | Robust data encryption, clear consent mechanisms | Fines up to 4% of global annual turnover |

| Consumer Protection Laws | Prohibits certain surcharges, mandates transparency | Clear fee disclosures, compliant pricing models | Reputational damage, consumer complaints |

Environmental factors

Flywire, as a global payments and software provider, acknowledges the increasing emphasis on environmental sustainability within finance. The company's integration of ESG principles into its core strategy reflects a keen understanding of the financial industry's shift towards more responsible operations, aiming to minimize its own environmental footprint.

Flywire's commitment to reducing its carbon footprint, evidenced by its first greenhouse gas audit in 2023, directly addresses the significant energy consumption of digital infrastructure. Data centers, the backbone of digital operations, are major energy users, contributing to environmental concerns. This proactive stance is crucial as global energy consumption for data centers is projected to rise significantly, potentially reaching 8% of global electricity demand by 2026, according to some estimates.

Flywire integrates Environmental, Social, and Governance (ESG) principles directly into its business model, evident in its first ESG report released in 2024. This report outlines key commitments, such as utilizing technology to enhance accessibility and cultivating a diverse employee base, demonstrating a proactive approach to corporate responsibility.

The company's public disclosure of ESG metrics underscores its dedication to transparency and accountability in its environmental and social initiatives. This commitment is crucial as stakeholders increasingly scrutinize companies' sustainability practices, influencing investment decisions and brand reputation.

Impact of Climate Change on Global Travel

While climate change doesn't directly affect Flywire's physical operations, its impact on global travel patterns can indirectly influence the company's payment volumes within its travel vertical. For instance, a rise in extreme weather events, like the record-breaking heatwaves experienced in parts of Europe in summer 2023, can lead to travel disruptions and cancellations, thereby reducing transaction volumes. Flywire's strategic move to acquire Sertifi in 2024, intended to boost its travel segment, makes this vertical increasingly sensitive to these long-term environmental shifts.

The increasing frequency of extreme weather events, such as hurricanes and wildfires, poses a significant risk to the travel industry. For example, the 2023 hurricane season saw several major storms impacting popular tourist destinations, leading to widespread flight cancellations and hotel closures. These disruptions directly translate to fewer cross-border payments processed by companies like Flywire in the travel sector. The World Meteorological Organization reported that weather and climate-related disasters caused over $100 billion in damages globally in 2023 alone, highlighting the economic vulnerability of sectors reliant on predictable travel conditions.

- Increased extreme weather events: Leading to travel cancellations and reduced payment volumes.

- Shifts in travel patterns: As destinations become less viable due to climate impacts, affecting transaction flows.

- Sensitivity of the travel vertical: Amplified by Flywire's strategic growth initiatives in this sector.

Demand for Environmentally Friendly Business Practices

There's a growing push from clients, investors, and even employees for businesses to be more eco-conscious. This isn't just a trend; it's becoming a core expectation. For instance, a 2024 survey by Deloitte found that 70% of consumers consider sustainability when making purchasing decisions, a significant jump from previous years.

Flywire actively participates in events like Environmental Awareness Month. Their involvement in community volunteering and shoreline clean-ups directly addresses this demand. These initiatives showcase a tangible commitment to environmental stewardship, aligning with the values of their stakeholders.

These actions are more than just good PR; they build trust and reinforce Flywire's brand image as a responsible corporate citizen. By demonstrating a commitment to sustainability, Flywire can attract and retain talent, appeal to environmentally conscious clients, and potentially gain favor with ESG-focused investors. In 2024, ESG (Environmental, Social, and Governance) investing saw continued growth, with global sustainable fund assets projected to exceed $50 trillion by 2025, according to Bloomberg Intelligence.

- Growing Consumer Demand: 70% of consumers consider sustainability in purchasing decisions (Deloitte, 2024).

- Investor Focus: Global sustainable fund assets are on track to surpass $50 trillion by 2025 (Bloomberg Intelligence).

- Employee Expectations: Companies with strong environmental practices often see higher employee engagement and retention rates.

- Brand Reputation: Proactive environmental initiatives enhance brand image and stakeholder trust.

Flywire's environmental strategy is shaped by increasing stakeholder demand for sustainability, with 70% of consumers considering eco-consciousness in purchases (Deloitte, 2024). This aligns with a significant rise in ESG investing, projected to exceed $50 trillion by 2025 (Bloomberg Intelligence). The company's proactive stance, including its 2023 greenhouse gas audit and 2024 ESG report, demonstrates a commitment to responsible operations and transparency.

| Environmental Factor | Impact on Flywire | Data/Trend |

|---|---|---|

| Climate Change & Extreme Weather | Disrupts travel, reducing payment volumes in the travel vertical. | 2023 saw over $100 billion in damages from weather disasters globally (WMO). |

| Digital Infrastructure Energy Use | Contributes to carbon footprint; data centers are major energy consumers. | Global data center electricity demand may reach 8% by 2026. |

| Stakeholder Expectations (Consumers & Investors) | Drives demand for eco-conscious practices and ESG investments. | 70% of consumers consider sustainability (Deloitte, 2024); ESG funds projected >$50T by 2025 (Bloomberg Intelligence). |

PESTLE Analysis Data Sources

Our Flywire Payments PESTLE Analysis is informed by a comprehensive review of global financial regulations, economic indicators from organizations like the IMF and World Bank, and emerging technology trends in fintech. We also incorporate insights from industry-specific market research and reports on geopolitical stability.