Flywire Payments Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flywire Payments Bundle

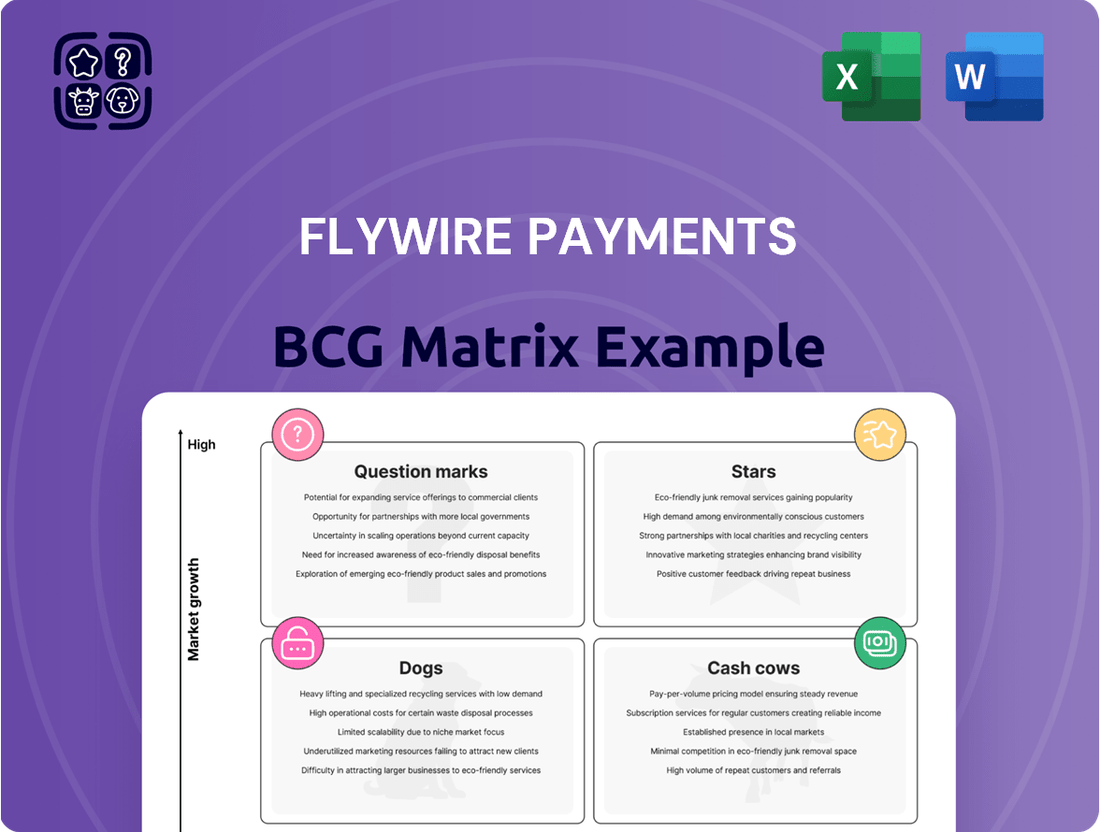

Curious about Flywire Payments' strategic positioning? Our BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks in the market. Understand the foundational insights into their product portfolio's health and potential.

Don't stop at the surface level; dive deeper into Flywire Payments' strategic blueprint. Purchase the full BCG Matrix for a comprehensive breakdown of each product's quadrant placement, actionable recommendations, and a clear roadmap for optimizing their market approach.

Stars

Flywire's travel vertical is a star performer, demonstrating over 50% organic growth in 2024 and now representing its second-largest revenue segment. This impressive expansion highlights Flywire's strong position in a thriving market.

The strategic acquisition of Sertifi in February 2025 for $330 million is a significant catalyst for this vertical. It dramatically broadens Flywire's reach, now covering more than 20,000 hotel locations and solidifying its market share.

This move is poised to further accelerate growth within the travel segment, contributing substantially to Flywire's overall revenue. The acquisition underscores the high potential and rapid expansion of the travel market for Flywire's payment solutions.

Flywire's global education sector is performing exceptionally well in key regions, even with some economic challenges. For instance, in the UK, revenue saw a significant surge, nearly doubling in the first quarter of 2024, highlighting robust growth.

The company is also strengthening its presence in rapidly expanding markets, including India and China. This strategic focus aims to capture substantial payment volumes, particularly those related to education loans, which are growing in these corridors.

These international education pathways are vital for Flywire, as they represent segments where the company holds a dominant market position. This leadership is crucial in a global education payment market that continues to expand year over year.

Flywire's Total Payment Volume (TPV) saw a significant jump, growing by 20.4% to reach $8.4 billion in the first quarter of 2025. This impressive expansion highlights strong customer adoption and a deepening presence across Flywire's various payment solutions.

This consistent upward trend in transaction volume is a clear indicator of Flywire's robust standing within the challenging payments sector. It demonstrates their capability to attract and process substantial payment flows, reinforcing their substantial market share.

Strategic Software Integrations

Flywire's strategic software integrations, particularly with major ERP systems like Ellucian, Workday, and Unit4, solidify its position in the higher education sector. These deep connections streamline payment processing, making Flywire an integral part of institutional operations and fostering significant customer loyalty.

This embedded strategy creates a powerful competitive advantage, effectively locking in clients by making Flywire an indispensable component of their financial infrastructure. By becoming essential to daily workflows, Flywire secures a substantial market share and a strong moat against competitors.

- ERP Integrations: Flywire's partnerships with Ellucian, Workday, and Unit4 are key.

- Workflow Enhancement: These integrations simplify complex payment processes for clients.

- Embedded Presence: Flywire becomes a critical part of client operational systems.

- Competitive Moat: This strategy builds strong customer loyalty and market share.

Consistent New Client Acquisition

Flywire exhibits robust new client acquisition, a key indicator for its position within the BCG matrix. In the first quarter of 2025, the company secured over 200 new clients across its various business sectors. This consistent growth is further underscored by the acquisition of more than 800 new clients throughout fiscal year 2024.

This sustained client onboarding reflects a strong market presence and effective sales strategies. The ability to attract a significant number of new customers, combined with a low client churn rate, points to increasing market penetration and customer satisfaction within Flywire's target industries.

The company's success in acquiring new clients contributes to its already substantial market share. This ongoing expansion fuels its growth trajectory and reinforces its position as a leader in the payment solutions space.

- Q1 2025 New Client Acquisitions: Over 200

- FY 2024 New Client Acquisitions: More than 800

- Indicator of Success: Growing market penetration and low client churn

- Strategic Impact: Reinforces market leadership and 'land and expand' model

Flywire's Travel and Education verticals are clear Stars in the BCG matrix. The Travel segment experienced over 50% organic growth in 2024, becoming its second-largest revenue contributor. This is further bolstered by the February 2025 acquisition of Sertifi for $330 million, expanding its hotel coverage to over 20,000 locations.

The Global Education sector is also a strong performer, with UK revenue nearly doubling in Q1 2024 and significant expansion efforts in India and China, particularly for education loan payments. Flywire's total payment volume (TPV) grew 20.4% to $8.4 billion in Q1 2025, demonstrating strong customer adoption and market penetration.

Strategic ERP integrations with systems like Ellucian and Workday solidify its position in higher education, creating a competitive moat. Furthermore, Flywire's client acquisition remains robust, adding over 200 new clients in Q1 2025 and more than 800 in FY 2024, indicating increasing market share and customer satisfaction.

| Segment | Growth Driver | Key Metric | Strategic Move |

| Travel | Market expansion, digital adoption | 50%+ organic growth (2024) | Sertifi acquisition ($330M, Feb 2025) |

| Global Education | International pathways, loan payments | UK revenue doubled (Q1 2024) | Focus on India & China markets |

| Overall | Client acquisition, TPV growth | TPV up 20.4% to $8.4B (Q1 2025) | ERP integrations (Ellucian, Workday) |

What is included in the product

This BCG Matrix overview analyzes Flywire's payment solutions, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

It provides strategic recommendations for investing in or divesting from each segment of Flywire's payment offerings.

The Flywire Payments BCG Matrix offers a clean, distraction-free view optimized for C-level presentation, simplifying complex payment portfolios to identify growth opportunities.

This export-ready design allows for quick drag-and-drop into PowerPoint, effectively communicating strategic payment initiatives and alleviating the pain of portfolio analysis.

Cash Cows

Flywire's U.S. Higher Education Core Payments segment is a classic cash cow. The company processed over $2 billion in 529 tuition payments to U.S. colleges and universities in 2024, demonstrating a strong hold in this established market.

This segment, supporting over 750 institutions through its partnership with Ascensus, is characterized by its maturity and stability. While not experiencing explosive growth, it reliably generates substantial and consistent cash flow for Flywire.

Flywire's proprietary global payments network is a significant cash cow, processing transactions in over 140 currencies across 240 countries. This robust infrastructure ensures transparent, cost-effective, and efficient cross-border payments, solidifying its market share in payment processing. For instance, in 2023, Flywire facilitated billions of dollars in transactions, demonstrating the network's substantial and consistent cash generation capabilities with minimal need for new capital investment.

Flywire's established cross-border education payments are a significant cash cow, leveraging decades of expertise in well-trodden international student payment corridors. This segment benefits from deep, specialized integrations within educational institutions, ensuring a dominant market share and consistent, substantial revenue. For instance, in 2023, Flywire processed billions in education payments, demonstrating the segment's robust performance and its role as a stable income generator.

Existing Client Relationships and Retention

Flywire's existing client relationships are a significant cash cow, with a reported client churn rate that is notably low. This stability is a direct result of the deep value clients derive from Flywire's comprehensive payment solutions, ensuring consistent and predictable revenue streams.

The company's successful 'land and expand' strategy further solidifies these cash cow dynamics. Once a client is integrated into the Flywire ecosystem, opportunities for additional services and increased transaction volume naturally arise, fostering predictable, recurring revenue growth and minimizing the need for costly new client acquisition to maintain baseline income.

- Low Churn Rate: Flywire's ability to retain clients is a cornerstone of its cash cow status, providing a reliable revenue base.

- Deep Client Value: Clients consistently find significant value in Flywire's offerings, leading to long-term partnerships and stable cash generation.

- 'Land and Expand' Strategy: This approach ensures that initial client onboarding leads to predictable, recurring revenue as relationships deepen and services expand.

- Efficient Cash Flow: Strong client retention reduces the pressure and cost associated with acquiring new customers, optimizing cash flow management.

Healthcare Payments (Current Operations)

Flywire's Healthcare Payments segment, currently operating as a Cash Cow, serves over 90 healthcare systems. This vertical, while smaller than education or travel, provides a stable revenue stream through its payment enablement solutions. The consistent payment volumes from this established client base underscore its Cash Cow status.

The company's strategic focus on enhancing patient payment experiences and optimizing collections within healthcare directly aims to sustain and potentially grow the cash flow from this segment. This indicates a mature market where Flywire leverages its existing infrastructure for reliable returns.

- Established Client Base: Serves over 90 healthcare systems.

- Steady Revenue: Payment enablement solutions generate consistent income.

- Optimized Operations: Focus on patient experience and collections enhances cash flow.

- Mature Market: Represents a reliable, albeit not high-growth, revenue source.

Flywire's U.S. Higher Education Core Payments segment, a prime example of a cash cow, processed over $2 billion in 529 tuition payments in 2024. This segment benefits from deep integrations within over 750 educational institutions, ensuring a dominant market share and consistent, substantial revenue. Its stability and maturity mean it reliably generates significant cash flow for Flywire with minimal need for new capital investment.

| Segment | 2024 Data Point | Key Characteristic |

| U.S. Higher Education Core Payments | Processed >$2 billion in 529 tuition payments | Mature, stable, high client retention |

| Proprietary Global Payments Network | Processed billions in transactions (2023) | Robust infrastructure, efficient cross-border capabilities |

| Existing Client Relationships | Notably low client churn rate | Deep value, predictable recurring revenue |

| Healthcare Payments | Serves >90 healthcare systems | Stable revenue stream, optimized collections |

What You’re Viewing Is Included

Flywire Payments BCG Matrix

The Flywire Payments BCG Matrix preview you see is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously crafted by industry experts, provides actionable insights into Flywire's payment solutions portfolio. You can trust that the strategic depth and professional formatting displayed here are precisely what you'll download, ready for immediate integration into your business planning and decision-making processes.

Dogs

The Canadian education market segment for Flywire experienced a sharp contraction of 35% in 2024. This downturn was primarily driven by new student visa policies enacted by the Canadian government, creating a low-growth environment.

This significant policy shift has directly impacted Flywire's market share within this region, as fewer international students are now entering Canada. The ongoing weakness in this segment is expected to persist, positioning it as a resource drain with limited potential for substantial returns.

The Australian education market, a significant segment for Flywire, is facing headwinds due to tightened student visa regulations. Similar to changes seen in Canada, these new rules are projected to dampen international student enrollment numbers. This regulatory shift places Flywire's Australian operations in a challenging position, potentially impacting payment volumes.

Australia's tightening visa policies for international students are a key factor influencing Flywire's market position there. The Australian government's move to restrict student visas is anticipated to lead to a decrease in the number of international students. In 2023, Australia welcomed over 600,000 international students, a number that could see a reduction following these policy changes, directly affecting Flywire's transaction volumes.

This regulatory environment positions Australia within the BCG matrix as a low-growth, potentially declining market. The impact on international student numbers, a primary driver for Flywire's payment services in the education sector, necessitates a careful review of the company's strategic approach and investment in this region.

Inefficient legacy payment processes represent Flywire's 'Dogs' within its payment solutions portfolio. These are the remnants of manual, paper-based systems that consume valuable resources and offer minimal efficiency. For instance, Flywire's initiative to digitize over 200,000 paper checks for 529 tuition payments in 2024 highlights their commitment to phasing out such outdated methods.

Underperforming Non-Strategic Offerings

Flywire's recent announcement of a workforce reduction affecting around 10% of its employees, coupled with a strategic portfolio review, points towards the identification of underperforming, non-strategic offerings. These segments likely represent areas where resources were being allocated without generating substantial returns or contributing to the company's core market position.

Such offerings, often characterized by low market share and slow growth, become prime candidates for strategic reassessment, potentially leading to their minimization or divestiture. This aligns with a broader corporate strategy to enhance overall efficiency and concentrate on high-potential business areas. For instance, if a particular payment processing niche saw minimal adoption or faced intense competition in 2024, it might be flagged for such a review.

- Underperforming Offerings: Segments with low growth and market share.

- Resource Allocation: These areas may consume capital without significant ROI.

- Strategic Review: Candidates for minimization or divestiture to improve efficiency.

- Focus on Core Strengths: Realigning resources towards more profitable ventures.

Segments with Limited Scalability or High Operational Costs

Segments with limited scalability or high operational costs are categorized as Dogs in the BCG matrix. For Flywire, this could represent niche payment solutions that, despite potential strategic importance, struggle to achieve economies of scale. High operational expenses associated with supporting these specialized services, relative to the revenue they generate, would place them in this quadrant. For instance, if a particular cross-border payment corridor requires extensive manual intervention or specialized regulatory compliance that is costly to maintain, it might fall into this category.

Flywire's emphasis on optimizing operations and making strategic investments signals an ongoing assessment of business segments. The company's commitment to efficiency suggests that areas with disproportionately high operating costs, hindering their ability to scale effectively, are likely candidates for review. This continuous evaluation process is crucial for resource allocation and ensuring the overall health of the business.

The company's strategic restructuring, as indicated by recent developments, often involves divesting or optimizing underperforming assets. This includes segments that, while perhaps once promising, now present challenges in terms of scalability or profitability due to their high operational demands. For example, if a particular vertical market payment solution requires a significant, ongoing investment in specialized technology or personnel without a corresponding increase in transaction volume or revenue, it could be considered a Dog.

- Niche Payment Solutions: Flywire might have specific payment processing services for very specialized industries or geographies that are costly to support and difficult to expand.

- High Operational Costs: Segments requiring extensive manual processing, complex regulatory navigation, or specialized infrastructure that doesn't scale efficiently contribute to high operational expenses.

- Low Revenue Contribution: When the revenue generated by these segments does not justify their operational costs, they become prime candidates for the Dog quadrant.

- Strategic Review: Flywire's focus on efficiency implies a regular assessment of all business units to identify and address those that are not meeting scalability or profitability targets.

Flywire's 'Dogs' likely represent niche payment solutions with high operational costs and limited scalability. These are segments where the revenue generated doesn't offset the expenses incurred in supporting them, such as specialized cross-border payment corridors requiring significant manual intervention or complex compliance. The company's focus on efficiency and strategic portfolio review suggests these underperforming areas are candidates for minimization or divestiture to concentrate on more profitable ventures.

| BCG Quadrant | Flywire Segment Example | Characteristics | 2024 Data/Observation |

| Dogs | Legacy, Paper-Based Payment Processes | Low market share, slow growth, high operational costs, low ROI | Digitization of over 200,000 paper checks for 529 tuition payments in 2024 highlights efforts to phase out these inefficient methods. |

| Dogs | Certain Niche Vertical Payment Solutions | Limited scalability, high specialized infrastructure costs, low transaction volume relative to cost | Segments requiring significant ongoing investment in specialized technology or personnel without a corresponding increase in transaction volume or revenue. |

Question Marks

The B2B Payments vertical presents a compelling high-growth opportunity for Flywire, demonstrating a remarkable 69% revenue increase in Q4 2024. However, this segment currently constitutes a modest 3% of Flywire's total revenue as of Q4 2024.

Flywire's strategic acquisition of Invoiced in August 2024 underscores a significant commitment to penetrate the estimated $10 trillion global B2B payments market. This move signals a deliberate effort to secure a meaningful share within this burgeoning sector.

Despite Flywire's acknowledged relative inexperience and higher perceived risk in the B2B payments space, substantial investment is necessary to effectively compete and gain market share. This strategic investment is crucial for realizing the full potential of this high-growth vertical.

Flywire's strategic expansion into new geographic markets within its travel vertical, such as Indonesia and Chile, highlights a clear move towards capturing high-growth potential. These regions represent emerging opportunities where Flywire aims to build a strong presence.

While the potential for future revenue is substantial, these new ventures are currently in their nascent stages of market penetration. Significant investment in tailored local solutions, strategic alliances, and dedicated sales initiatives will be crucial to elevate these markets from question marks to stars in the BCG matrix.

Flywire's research points to a significant patient desire for flexible payment options like installment plans and buy-now, pay-later (BNPL) in U.S. healthcare. This trend suggests a rapidly expanding market for innovative payment solutions within the sector, with a projected growth rate of 15% annually through 2025 for healthcare BNPL services.

While this presents a substantial opportunity, Flywire's current market penetration in these nascent healthcare payment models may be limited. Capturing this demand will likely require considerable investment in technology and partnerships to establish a strong competitive foothold.

Expansion into India's Education Loan Market

Flywire is making significant inroads into India's burgeoning education loan market, a strategic move that aligns with its growth objectives. By partnering with key players such as Avanse Financial Services and the State Bank of India, Flywire aims to streamline and digitize the disbursement of student loans. This expansion is particularly noteworthy given India's massive education loan payment volume, estimated to be in the billions of dollars, presenting a substantial opportunity for Flywire to capture market share.

The Indian education sector is a fertile ground for financial technology solutions, with a growing demand for accessible and efficient student financing. Flywire's focus on this segment is designed to tap into this demand, facilitating smoother transactions for students seeking higher education both domestically and internationally. The company's investment in this region is poised to unlock considerable new payment flows, bolstering its presence in a high-potential emerging market.

- Market Potential: India's education loan market is valued in the billions of dollars, signifying substantial growth prospects.

- Strategic Partnerships: Collaborations with Avanse and State Bank of India are key to digitizing loan disbursements.

- Digital Transformation: Flywire's expansion focuses on leveraging technology to enhance the student loan payment process.

- Market Share Growth: The initiative is expected to significantly increase Flywire's footprint and market share in India.

Advanced AI and Automation in Payment Workflows

Flywire's commitment to advanced AI and automation in payment workflows positions it as a potential Star or Question Mark within the BCG matrix, depending on market adoption and competitive response. These investments, focusing on streamlining complex cross-border transactions and reconciliation beyond standard ERP links, target high-growth segments of the payments market. For instance, the global payments market was projected to reach over $3 trillion in 2024, with automation and AI being key drivers of efficiency and innovation.

Developing proprietary AI models for fraud detection, intelligent routing, and automated reconciliation offers a significant competitive edge. This could lead to substantial gains in market share for Flywire if these technologies prove superior in reducing costs and improving transaction speed for clients. The company’s ongoing R&D in this area, which saw significant allocation in its 2024 fiscal year, underscores its strategy to capture these emerging opportunities.

- AI-driven reconciliation: Reducing manual effort and errors in matching payments to invoices, a critical pain point in complex payment environments.

- Intelligent payment routing: Optimizing transaction paths for speed and cost-effectiveness across various currencies and banking networks.

- Enhanced fraud prevention: Utilizing machine learning to identify and mitigate fraudulent transactions in real-time, protecting both Flywire and its clients.

- Predictive analytics for cash flow: Offering clients insights into future payment flows, aiding treasury management and financial planning.

The B2B Payments vertical, while showing a robust 69% revenue increase in Q4 2024, represents only 3% of Flywire's total revenue, indicating its nascent stage. The acquisition of Invoiced in August 2024 signals a strategic push into the $10 trillion global B2B payments market, but Flywire's relative inexperience here necessitates significant investment to gain traction.

Flywire's expansion into new geographic markets within its travel vertical, such as Indonesia and Chile, highlights a pursuit of high-growth potential. These markets are in early stages of penetration, requiring substantial investment in localized solutions and partnerships to transition them from Question Marks to Stars in the BCG matrix.

The U.S. healthcare sector exhibits a strong patient demand for flexible payment options like BNPL, with the market projected to grow 15% annually through 2025. However, Flywire's current penetration in these innovative payment models may be limited, requiring considerable investment in technology and partnerships to establish a strong competitive position.

Flywire's strategic entry into India's education loan market, partnering with Avanse Financial Services and State Bank of India, aims to digitize loan disbursements in a sector with billions of dollars in annual payment volume. This focus on a high-potential emerging market, driven by demand for efficient student financing, is expected to unlock significant new payment flows.

Flywire's investment in AI and automation for payment workflows, targeting complex cross-border transactions and reconciliation, positions it to capture high-growth segments within the over $3 trillion global payments market projected for 2024. Developing proprietary AI for fraud detection and intelligent routing could yield substantial market share gains if these technologies prove superior in reducing costs and improving transaction speed.

BCG Matrix Data Sources

Our Flywire Payments BCG Matrix is informed by comprehensive market data, including transaction volumes, payment processing trends, and competitive landscape analysis, ensuring strategic accuracy.