Flywire Payments Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flywire Payments Bundle

Flywire Payments operates in a dynamic fintech landscape, where understanding the competitive forces is crucial for strategic success. Our analysis reveals moderate buyer power due to increasing payment options, while supplier power is relatively low thanks to a fragmented provider base. The threat of substitutes is a significant concern, with emerging technologies constantly challenging traditional payment methods.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Flywire Payments’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Payment network providers, such as banks and regional payment partners, hold moderate bargaining power over Flywire. Flywire's reliance on these entities for its global transaction capabilities, spanning over 240 countries and 140 currencies, necessitates their participation. However, Flywire's substantial investment in its proprietary network and technology mitigates the risk of over-dependence on any single provider.

Technology and software vendors, such as those providing ERP systems like NetSuite, Ellucian, Workday, and Unit4, hold significant sway over Flywire. These integrations are crucial for Flywire to streamline client operations and deliver complete payment solutions. The bargaining power of these vendors can be substantial, particularly for widely adopted or highly specialized platforms, as Flywire depends on their seamless integration capabilities.

Data security and compliance providers hold moderate bargaining power over Flywire. This is because the sensitive nature of financial transactions necessitates robust security and compliance measures, making these services critical. Flywire's inclusion on the PCI Security Standards Council 2025-2027 Board of Advisors highlights the importance of these specialized suppliers in maintaining secure payment operations.

Financial Institutions for Settlement and Liquidity

Flywire's reliance on financial institutions for payment settlement and liquidity management means these banks hold a moderate level of bargaining power. Flywire absolutely needs their infrastructure for global fund movements and reconciliation, a critical function for its operations.

However, Flywire's significant transaction volumes, particularly within its specialized industry verticals, can provide some leverage. For instance, in 2024, Flywire processed billions of dollars in cross-border payments, making its business attractive to banking partners seeking to expand their transaction flows.

- Moderate Bargaining Power: Financial institutions are essential for Flywire's core operations, providing settlement and liquidity.

- Flywire's Leverage: Large transaction volumes and niche market focus can give Flywire some negotiation advantage.

- Industry Dependence: Flywire's global reach necessitates partnerships with banks that have extensive international networks.

Cloud Infrastructure Providers

Flywire's reliance on cloud infrastructure means the bargaining power of suppliers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud is a critical factor. These providers dominate the market, offering extensive economies of scale and advanced technological capabilities that are difficult for competitors to match.

The significant investment required to migrate large-scale cloud operations creates high switching costs for Flywire, further enhancing the bargaining power of these major cloud providers. As of early 2024, the global cloud computing market continues its robust growth, with the top three providers holding substantial market share, indicating their strong negotiating position.

- Dominant Market Share: AWS, Azure, and Google Cloud collectively hold over 60% of the global cloud infrastructure market, giving them considerable leverage.

- High Switching Costs: Migrating complex financial platforms involves substantial time, technical expertise, and potential service disruption, making it costly for Flywire to change providers.

- Essential Services: The continuous need for reliable, scalable, and secure cloud services for Flywire's payment processing platform underscores the indispensable nature of these suppliers.

Technology and software vendors, particularly those providing ERP systems, exert significant influence over Flywire due to the critical nature of integrations for seamless client operations and comprehensive payment solutions. The bargaining power of these vendors is amplified when their platforms are widely adopted or highly specialized, directly impacting Flywire's ability to offer integrated services.

Cloud infrastructure providers like AWS, Azure, and Google Cloud hold substantial bargaining power over Flywire. Their dominance in the market, coupled with high switching costs for complex financial platforms, means Flywire has limited leverage. This is underscored by the fact that these providers collectively controlled over 60% of the global cloud infrastructure market in early 2024.

| Supplier Type | Bargaining Power | Key Factors | Flywire's Leverage |

|---|---|---|---|

| ERP & Software Vendors | Significant | Critical integrations, platform adoption | Depends on vendor-specific integration needs |

| Cloud Infrastructure Providers | Substantial | Market dominance, high switching costs | Limited due to reliance and switching barriers |

| Financial Institutions | Moderate | Essential for settlement and liquidity | Large transaction volumes, niche focus |

What is included in the product

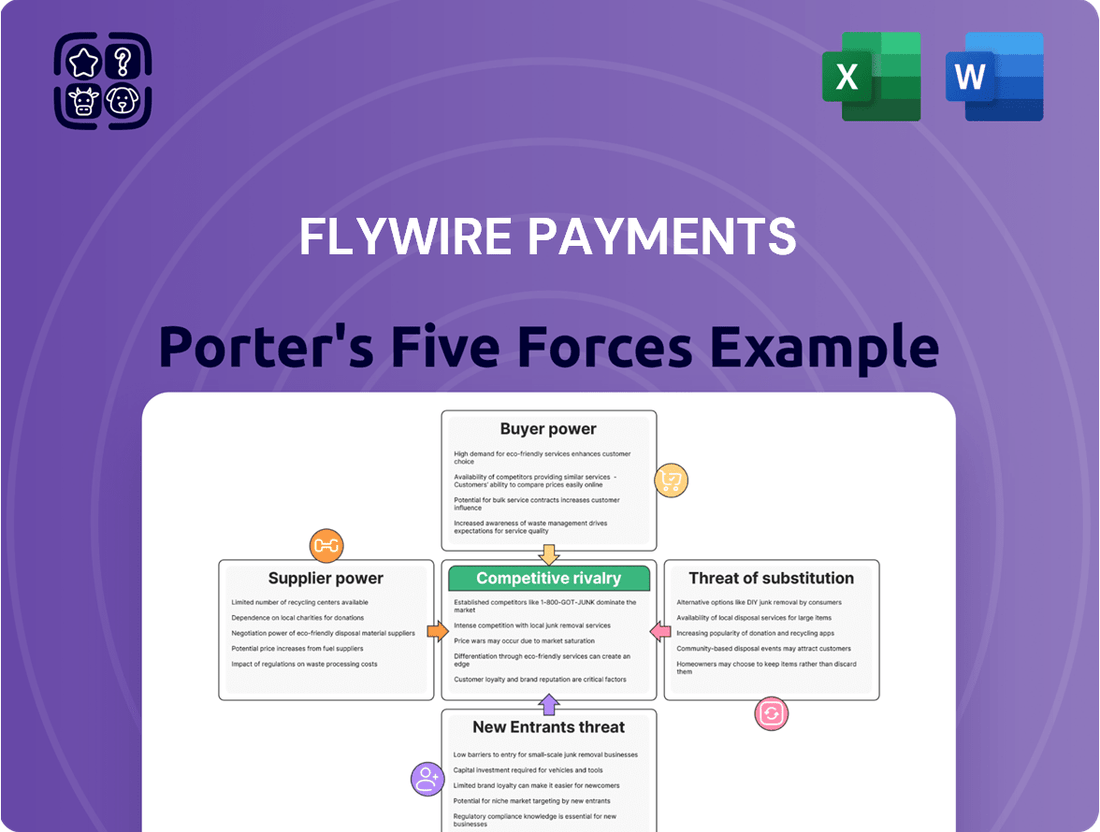

This analysis unpacks the competitive forces impacting Flywire Payments, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the cross-border payments and receivables market.

Instantly assess competitive intensity by visualizing the bargaining power of suppliers and buyers, and the threat of substitutes, all within a user-friendly framework.

Customers Bargaining Power

Flywire's large enterprise clients, such as major universities, hospital systems, and multinational corporations across education, healthcare, travel, and B2B sectors, represent a significant portion of its business. These clients typically process substantial payment volumes, giving them considerable leverage.

The substantial payment volumes handled by these large enterprises empower them to negotiate more favorable terms, such as lower transaction fees or enhanced service level agreements. This ability to influence pricing and service conditions indicates a moderate level of bargaining power for these key customers.

For Small and Medium-sized Businesses (SMBs), their bargaining power with payment providers like Flywire is generally considered low to moderate. While Flywire did onboard over 800 new clients in fiscal year 2024, many of these are likely larger organizations. SMBs, by their nature, tend to have smaller individual transaction volumes. This means that while they represent a significant aggregate market, their individual leverage to negotiate terms or pricing is limited compared to larger enterprise clients.

Flywire's strength in vertical-specific software means it caters to industries with unique, complex payment needs. This specialization can sometimes give clients with highly specific requirements a bit more leverage, especially if Flywire is among the few processors capable of handling their intricate demands. For instance, in the education sector, where Flywire has a strong presence, institutions often require customized solutions for international student payments, including currency conversion and regulatory compliance, which can influence their negotiation stance.

Switching Costs for Clients

Flywire's deep integration into client accounts receivable (A/R) systems and ERP platforms significantly raises switching costs. This technical entanglement means clients face substantial effort and expense to replace Flywire with a competitor.

For instance, in 2024, businesses often reported that the cost of reconfiguring their financial software and retraining staff could range from tens of thousands to hundreds of thousands of dollars, depending on the complexity of their existing infrastructure. This financial and operational hurdle effectively dampens a client's ability to easily switch providers, thereby diminishing their bargaining power.

- Deep Software Integration: Flywire embeds its payment solutions directly into clients' A/R workflows, making it a core part of their financial operations.

- ERP System Connectivity: Seamless integration with Enterprise Resource Planning (ERP) systems further locks clients into Flywire's ecosystem.

- High Reintegration Costs: The expense and time required to switch to a new payment provider, including software updates and staff retraining, can be substantial, often running into significant figures for businesses.

- Reduced Client Leverage: These elevated switching costs directly limit the bargaining power of clients, as the practical barriers to changing vendors are considerable.

Availability of Alternative Payment Solutions

The availability of numerous alternative payment solutions significantly influences customer bargaining power. Customers can readily switch to providers like Wise, Stripe, or PayPal, or opt for traditional methods such as direct bank transfers or checks, based on cost, features, and convenience.

This broad accessibility empowers customers, granting them moderate leverage to negotiate better terms or seek out more favorable payment options. For instance, in 2024, the global digital payments market was valued at over $9 trillion, indicating a highly competitive landscape where customer choice is paramount.

- Increased Competition: The proliferation of fintech companies and digital wallets intensifies competition, forcing payment providers to offer competitive pricing and superior user experiences.

- Customer Choice: Customers can easily compare and select payment solutions that best fit their needs, reducing reliance on any single provider.

- Price Sensitivity: The availability of alternatives makes customers more price-sensitive, pushing providers to optimize their fee structures.

- Innovation Driver: This competitive pressure encourages continuous innovation in payment technology and service offerings.

Flywire's large enterprise clients, processing substantial payment volumes, possess moderate bargaining power due to their ability to negotiate favorable terms and lower fees. While Flywire onboarded over 800 new clients in fiscal year 2024, the leverage of smaller businesses remains limited by their lower individual transaction volumes. However, Flywire's deep software integration and high switching costs for clients, which can run into significant figures for businesses in 2024, effectively dampen customer bargaining power.

The competitive landscape, with numerous alternative payment solutions available in the global digital payments market valued at over $9 trillion in 2024, grants customers moderate leverage to negotiate better terms or seek more favorable options. This intense competition drives innovation and makes customers more price-sensitive.

| Customer Segment | Bargaining Power Drivers | Impact on Flywire |

|---|---|---|

| Large Enterprises | High Payment Volumes, Negotiation Leverage | Moderate Bargaining Power, Pressure on Fees |

| SMBs | Lower Individual Transaction Volumes | Low to Moderate Bargaining Power |

| Clients with High Switching Costs | Deep Software Integration, ERP Connectivity, Reintegration Expenses | Reduced Bargaining Power due to Lock-in |

| All Customers | Availability of Alternative Payment Solutions, Price Sensitivity | Moderate Bargaining Power, Competitive Pressure |

Preview Before You Purchase

Flywire Payments Porter's Five Forces Analysis

This preview showcases the complete Flywire Payments Porter's Five Forces Analysis, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you are viewing is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholders. You're looking at the actual, ready-to-use document that will be available for instant download, providing you with comprehensive insights into Flywire's competitive landscape.

Rivalry Among Competitors

The payment processing industry is incredibly competitive and constantly changing. You have a wide variety of companies involved, from established banks to newer fintech startups. This intense competition means companies like Flywire have to stay on their toes.

New technologies are really shaking things up, making the rivalry even fiercer. Think about things like instant payments, artificial intelligence, and blockchain technology. These innovations are rapidly changing how payments are made, pushing all players to adapt or risk falling behind.

For instance, the global digital payments market was valued at over $9 trillion in 2023 and is projected to grow significantly. This massive market size attracts many participants, from large financial institutions to specialized payment gateways, all vying for market share.

Flywire operates in a crowded market, facing rivals from general payment giants like Stripe and PayPal, who offer broad payment solutions. The competitive intensity is further amplified by specialized cross-border payment providers such as Wise and Payoneer, directly challenging Flywire's core offerings in international transactions.

Beyond payment processing, Flywire also contends with accounts receivable automation specialists like Invoiced and Billtrust, who target the efficiency aspects of its business. This multi-faceted competition necessitates Flywire to continually innovate and highlight its unique value proposition across different service areas to stand out.

Flywire's strategy of concentrating on intricate payment flows within specific sectors such as education, healthcare, and travel allows it to establish a strong foothold. This specialization creates a distinct advantage, as it can cater to unique client needs more effectively than general payment processors.

However, this niche focus also invites increased competition. Rivals can adapt by developing or acquiring similar vertical-specific capabilities, intensifying rivalry within these lucrative segments. For instance, in the education vertical, competitors like Convera and PayU offer specialized solutions, directly challenging Flywire's market share.

Technological Innovation and Differentiation

Competitive rivalry in the payment processing industry is intensely fueled by ongoing technological innovation. Companies are pouring resources into advanced technologies like artificial intelligence and machine learning, alongside robust security measures, to craft more seamless and secure payment experiences for their customers. This relentless pursuit of technological superiority is a primary driver of competition.

Flywire differentiates itself through its unique 'Flywire Advantage,' a strategic combination of its extensive network, sophisticated platform, and specialized vertical software solutions. This integrated approach allows Flywire to offer tailored and efficient payment processing, setting it apart from competitors who may offer more generalized services. For instance, in 2024, Flywire continued to expand its platform capabilities, enhancing its appeal to businesses seeking specialized payment solutions.

- Technological Advancement: The payments sector sees intense rivalry driven by continuous innovation in AI, machine learning, and security.

- Flywire's Differentiation: Flywire's 'Flywire Advantage' leverages its network, platform, and vertical software to provide superior payment experiences.

- Market Impact: This focus on technology allows companies to attract and retain clients by offering enhanced functionality and security.

Price Sensitivity and Fee Structures

In the payments industry, clients often scrutinize transaction fees and the overall cost of services. This price sensitivity means competitors can readily engage in price wars, particularly for more standardized payment solutions. For instance, many payment processors offer tiered pricing based on transaction volume, and a slight difference in per-transaction fees can sway a large client. This intense competition directly impacts Flywire's ability to maintain its profit margins, as clients may switch to providers offering lower rates.

The pressure to offer competitive pricing is significant, especially in segments where payment processing is viewed as a commodity. Flywire, like its rivals, must balance offering attractive pricing to win and retain business against the need to cover its operational costs and invest in innovation. In 2024, the global digital payments market continued to see aggressive pricing strategies from established players and new entrants alike, with many focusing on acquiring market share through lower fee structures for initial onboarding or high-volume transactions.

- Price Sensitivity: Customers in the payments sector are highly attuned to transaction fees and overall pricing models, making them susceptible to competitive offers.

- Fee-Based Competition: Competitors frequently leverage lower fees as a primary differentiator, especially for commoditized payment processing services.

- Margin Pressure: Aggressive pricing by rivals can directly squeeze Flywire's profit margins, necessitating careful cost management and value-added service differentiation.

- Market Dynamics: The global digital payments market in 2024 witnessed ongoing price competition, with many providers using reduced fees to gain market share.

Competitive rivalry in the payment processing sector is fierce, driven by constant technological advancements and a crowded marketplace. Flywire faces direct competition from broad payment providers like Stripe and PayPal, as well as specialized cross-border services such as Wise and Payoneer, all vying for market share. This intense competition, amplified by price sensitivity and the commoditization of some payment solutions, pressures Flywire to continually innovate and differentiate its offerings, particularly within its specialized verticals.

| Competitor Type | Example Competitors | Key Competitive Factor |

|---|---|---|

| General Payment Processors | Stripe, PayPal | Broad functionality, ease of integration |

| Cross-Border Specialists | Wise (formerly TransferWise), Payoneer | Lower international transfer fees, speed |

| AR Automation Specialists | Invoiced, Billtrust | Efficiency in billing and receivables |

| Vertical-Specific Competitors | Convera, PayU (Education) | Tailored solutions for specific industries |

SSubstitutes Threaten

For cross-border and high-value B2B payments, traditional bank wire transfers still serve as a substitute, particularly for businesses that prioritize established methods over speed or advanced digital features. These legacy systems, while familiar, often come with higher fees and less transparency compared to modern solutions.

Flywire distinguishes itself by offering a more streamlined, cost-effective, and transparent alternative to these traditional wire transfers. For instance, while a typical international wire transfer might incur fees ranging from $25 to $50 and take several business days, Flywire aims to reduce these costs and delivery times significantly, enhancing the overall payment experience.

Automated Clearing House (ACH) and direct debit payments represent significant substitutes for certain domestic B2B transactions, offering a cost-effective alternative. In 2023, ACH network volume grew by 5.1% year-over-year, processing over 31 billion payments, highlighting their widespread adoption.

However, Flywire's value proposition extends beyond simple domestic transfers, particularly for international and complex payment scenarios. While ACH is cost-efficient for routine domestic payments, Flywire's platform provides enhanced features like currency conversion, compliance management, and tailored client experiences that differentiate it from these more basic substitute methods.

The proliferation of digital wallets like Apple Pay and Google Pay, alongside other alternative payment methods (APMs), presents a significant threat of substitution for Flywire. These solutions offer user-friendly and often lower-cost alternatives for many everyday transactions, directly competing with Flywire's core services.

While Flywire aims to cater to complex, cross-border payments, businesses with simpler payment needs might find it more efficient to adopt APM-centric solutions. For instance, a university accepting tuition payments could potentially leverage a platform solely focused on credit card processing or digital wallet integration if their international student base is limited or their payment flows are straightforward.

The convenience and widespread adoption of these APMs mean that customers are increasingly accustomed to seamless digital payment experiences. This user preference can pressure businesses to adopt simpler, more readily available payment options, potentially diverting volume from more comprehensive platforms like Flywire, especially for less complex payment scenarios.

In-house Payment Processing Systems

Large organizations, especially those with high payment volumes and robust IT departments, may opt for in-house payment processing systems. This offers greater control but typically requires significant initial capital expenditure and continuous operational investment. For instance, major retailers or financial institutions might build proprietary systems to manage their vast transaction flows, potentially bypassing third-party providers like Flywire.

These in-house solutions act as a direct substitute, allowing companies to internalize functions that might otherwise be outsourced. While this can lead to cost savings in the long run and enhanced data security, the complexity and maintenance overhead are considerable. Companies must weigh the benefits of control against the substantial resources needed for development and ongoing support.

- High Upfront Investment: Developing an in-house system can cost millions, depending on complexity and scale.

- Ongoing Operational Costs: Maintenance, security updates, and compliance require continuous spending.

- Technical Expertise: Requires a dedicated team of skilled IT professionals.

- Scalability Challenges: Ensuring the system can handle growth in transaction volume can be difficult.

Manual Payment Processes (Checks, Cash)

Despite the ongoing digital transformation, manual payment methods like paper checks and cash persist as viable substitutes, particularly within certain business-to-business (B2B) and consumer-to-business (C2B) transactions. For instance, a 2024 report indicated that approximately 15% of B2B payments in the United States still involved checks, highlighting their continued relevance.

Flywire's core value proposition directly addresses the inefficiencies and security concerns associated with these legacy manual processes. By offering streamlined digital payment solutions, Flywire aims to migrate clients away from methods that are slower, more prone to errors, and less secure than modern digital alternatives.

- Persistence of Manual Payments: Even in 2024, a notable percentage of B2B transactions, estimated around 15% in the US, still relied on paper checks, demonstrating their enduring presence as a substitute payment method.

- Flywire's Strategic Response: Flywire positions its digital payment platform as a superior alternative, directly targeting the inefficiencies and security vulnerabilities inherent in manual payment processes like checks and cash.

- Value Proposition: The company's aim is to facilitate a shift from these traditional, less efficient methods towards more secure, faster, and automated digital payment solutions for its clients.

The threat of substitutes for Flywire is significant, with traditional bank wires, ACH, and digital wallets all offering alternative payment methods. While Flywire excels in complex, cross-border transactions, simpler payment needs can be met by these substitutes, potentially diverting volume.

Digital wallets and other alternative payment methods (APMs) are increasingly popular due to their user-friendliness. This trend pressures businesses to adopt more readily available payment options, potentially impacting Flywire's market share for less complex transactions.

In-house payment processing systems offer greater control for large organizations but require substantial investment and technical expertise. Manual methods like checks, though declining, still represent a portion of B2B payments, indicating a persistent substitute threat.

| Substitute Method | Key Characteristics | Flywire's Advantage |

|---|---|---|

| Traditional Bank Wires | Established, familiar, but often higher fees and less transparency. | Streamlined, cost-effective, and transparent alternative. |

| ACH/Direct Debit | Cost-effective for domestic transactions; over 31 billion processed in 2023. | Enhanced features for international and complex payments (currency conversion, compliance). |

| Digital Wallets/APMs | User-friendly, low-cost for everyday transactions. | Focus on complex, cross-border, and high-value payments. |

| In-house Systems | High control, significant upfront and ongoing costs, requires technical expertise. | Outsourced solution, reducing operational burden and capital expenditure for clients. |

| Manual Payments (Checks) | Still used in ~15% of US B2B payments in 2024. | Targets inefficiencies and security concerns of manual processes with digital solutions. |

Entrants Threaten

Establishing a global payment network, securing necessary licenses across various jurisdictions, and building robust, compliant technology platforms require substantial capital investment. For instance, in 2024, companies looking to enter the cross-border payments space often face initial setup costs that can easily run into tens of millions of dollars for technology development, regulatory compliance, and operational infrastructure.

This significant upfront financial commitment acts as a considerable barrier to entry for new players aiming to compete with established companies like Flywire, which have already made these investments. The sheer scale of capital needed to replicate a comprehensive, secure, and legally compliant payment infrastructure deters many potential competitors.

The payments industry is a minefield of regulations, demanding strict adherence to anti-money laundering (AML), know-your-customer (KYC), and robust data security protocols across numerous countries. For instance, in 2024, the Financial Action Task Force (FATF) continued to emphasize enhanced due diligence for cross-border transactions, adding another layer of complexity.

Successfully navigating this intricate web of global compliance and securing the requisite licenses presents a formidable hurdle for any aspiring new player. The sheer cost and expertise needed to manage these requirements mean only well-capitalized and knowledgeable entities can realistically enter the market.

Flywire's robust network effects present a significant barrier to new entrants. As more clients and payment partners join the platform, its value proposition strengthens, making it more attractive to others. This creates a virtuous cycle that is difficult for newcomers to disrupt.

Established relationships with thousands of clients across key sectors like education, healthcare, and travel are crucial. Flywire's deep integrations with critical ERP systems in these verticals further solidify its market position. These entrenched partnerships and technical integrations are not easily replicated by emerging competitors, effectively raising the cost and complexity of entry.

Technological Expertise and Specialization

Developing proprietary global payment networks and next-generation payment platforms demands significant technological prowess. New entrants would need substantial investment in research and development, alongside acquiring specialized talent, to rival Flywire's established infrastructure and capabilities. For instance, in 2023, the global fintech market saw substantial investment, with companies focusing on advanced payment technologies, highlighting the high barrier to entry.

Vertical-specific software development, a key differentiator for Flywire, requires deep industry knowledge in sectors like education and healthcare. Replicating this level of specialization is a considerable challenge for newcomers, often necessitating years of focused effort and customer engagement. Flywire's 2023 annual report indicated continued growth in its specialized vertical solutions, underscoring the value of this expertise.

- High R&D Investment: New entrants face substantial upfront costs to develop comparable payment technologies and specialized software.

- Talent Acquisition Costs: Securing engineers and domain experts with the necessary skills is a significant hurdle.

- Time to Market: Building robust, secure, and compliant payment systems takes considerable time, allowing incumbents like Flywire to maintain a lead.

- Regulatory Compliance: Navigating complex global financial regulations adds another layer of difficulty and expense for new players.

Brand Reputation and Trust

In the financial services industry, particularly for a company like Flywire, a strong brand reputation and established trust are significant barriers to entry for new competitors. Flywire has cultivated an image of reliability and security in handling complex cross-border transactions, a crucial factor for its clients in sectors like education and healthcare.

New entrants must invest heavily to build comparable trust and brand recognition. For instance, in 2023, the global fintech market saw significant investment, but establishing a foothold against established players requires more than just capital; it demands a proven track record of secure and transparent operations. Building this level of confidence takes considerable time and effort, making it a formidable challenge for newcomers aiming to disrupt Flywire's market share.

- Brand Loyalty: Flywire's existing customer base, built on years of reliable service, is less likely to switch to an unproven new entrant.

- Regulatory Hurdles: New financial service providers face stringent regulatory compliance, which can be a costly and time-consuming process to navigate, especially in sensitive industries.

- Security Perception: In payment processing, perceived security is paramount; new entrants must overcome skepticism regarding their data protection and transaction integrity.

- Customer Acquisition Cost: Acquiring customers in the financial sector often involves high marketing and support costs, especially when trying to displace an incumbent with a strong reputation.

The threat of new entrants for Flywire is moderate, primarily due to the substantial capital, regulatory hurdles, and established network effects required to compete effectively. Building a global payment infrastructure and securing necessary licenses across various jurisdictions demands significant upfront investment, often in the tens of millions of dollars in 2024. Furthermore, Flywire's deep integrations with vertical-specific software and its strong brand reputation built on trust and security present considerable challenges for newcomers seeking to gain market traction.

Porter's Five Forces Analysis Data Sources

Our Flywire Payments Porter's Five Forces analysis is built upon a foundation of comprehensive data, including financial reports from publicly traded competitors, industry-specific market research, and regulatory filings from relevant authorities.

We leverage insights from customer surveys, transaction data analysis, and expert interviews with industry professionals to assess buyer power and the threat of new entrants in the payments sector.