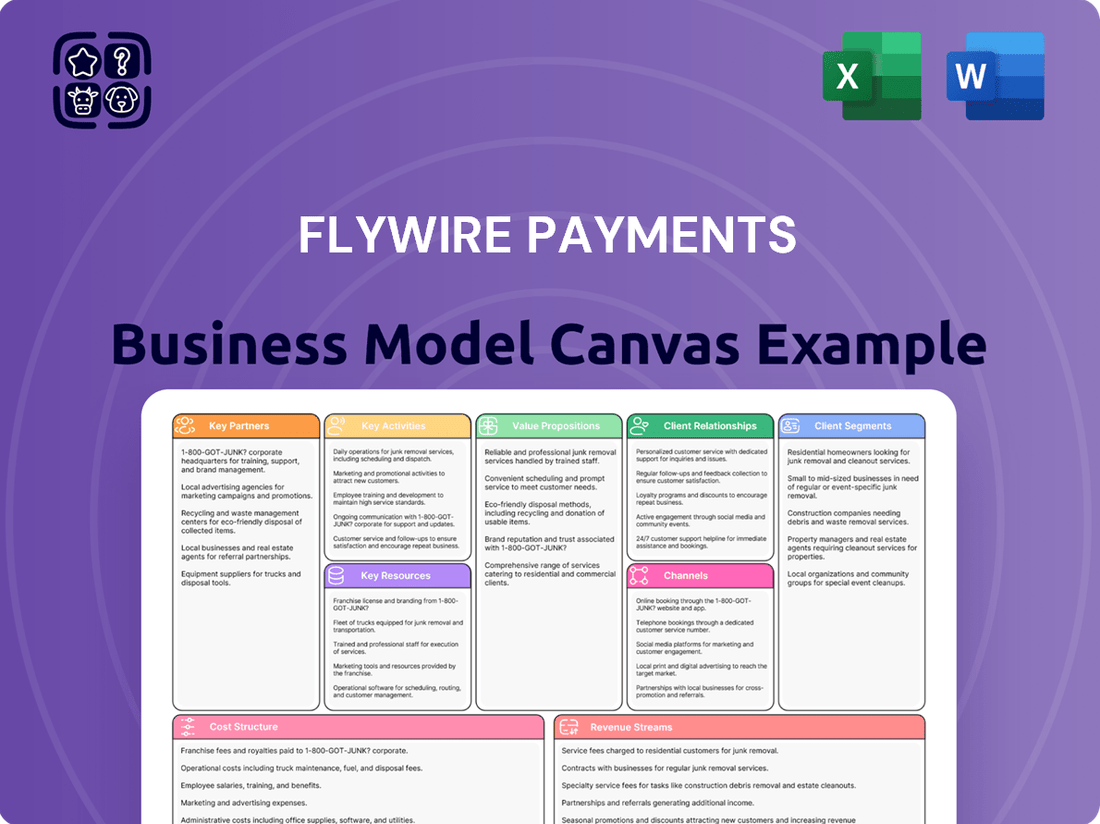

Flywire Payments Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flywire Payments Bundle

Unlock the strategic blueprint behind Flywire Payments's innovative business model. This comprehensive Business Model Canvas reveals how they connect global payers and receivers, streamline complex payment processes, and create significant value for diverse customer segments. Discover their key partnerships and revenue streams that fuel their growth.

Partnerships

Flywire's business model heavily relies on its extensive network of financial institutions and banks. These partnerships are fundamental to facilitating a wide array of payment methods and currencies, thereby enabling smooth cross-border transactions for its clients.

These collaborations are vital for broadening Flywire's global payment reach and providing localized payment choices to users across the globe. For instance, Flywire has been actively strengthening its ties with prominent banks in crucial markets such as India and China, reflecting a strategic push for deeper penetration and enhanced service offerings in these regions.

Flywire's key partnerships with major Enterprise Resource Planning (ERP) and Student Information System (SIS) providers like NetSuite, Ellucian, Workday, and Unit4 are foundational to its business model. These collaborations are crucial for embedding Flywire's payment solutions directly into the operational systems of educational institutions and other clients.

By integrating with these leading platforms, Flywire ensures that its payment capabilities seamlessly fit into existing invoicing, reconciliation, and payment management processes. This deep integration streamlines operations for clients, making it easier for them to manage student payments or other financial transactions. For instance, a university using Ellucian Banner can directly process tuition payments through Flywire without manual data entry, a significant efficiency gain.

Flywire collaborates with EdTech providers and recruitment agencies to streamline international student payments. These partnerships are crucial for reaching students globally and simplifying the financial onboarding process for educational institutions. For instance, Flywire partnered with UBION in Korea to facilitate easier cross-border tuition payments, demonstrating a commitment to accessible financial solutions in key education markets.

Further solidifying its educational sector reach, Flywire also partnered with Blackbaud in the U.S., specifically targeting K-12 schools. This alliance aims to enhance the payment infrastructure for a broader range of educational levels, making it simpler for families to manage tuition and fees. These strategic alliances are vital for Flywire’s expansion and its ability to offer a comprehensive payment solution across the education spectrum.

Travel Industry Platforms and Hotel Chains

Flywire’s strategic acquisition of Sertifi in early 2025 bolsters its position in the travel sector, forging deeper ties with hotel property management systems and major hotel brands. This integration allows for seamless embedding of secure payment solutions directly into the operational workflows of travel businesses, from large tour operators to independent boutique hotels.

These partnerships are crucial for streamlining payment processes and enhancing the customer experience within the travel industry. For instance, by integrating Flywire’s capabilities, hotel chains can offer more flexible and secure payment options at booking and check-in, potentially reducing payment friction and increasing conversion rates.

- Expanded reach: Sertifi’s existing network of hotel partners provides Flywire with immediate access to a broader customer base within the hospitality sector.

- Integrated solutions: The acquisition enables Flywire to offer end-to-end payment solutions, from booking to reconciliation, directly within hotel property management systems.

- Enhanced security and compliance: Partnerships with leading hotel chains ensure adherence to stringent industry security standards, protecting both the business and the consumer.

Strategic Software and Technology Providers

Flywire collaborates with strategic software and technology providers to broaden its payment solutions beyond core ERP systems. These alliances are crucial for integrating specialized functionalities like advanced digital invoicing, sophisticated payment analytics, and enhanced customer communication tools directly into Flywire's platform. For instance, in 2024, Flywire continued to expand its ecosystem of technology partners, aiming to offer a more seamless and feature-rich experience for its clients across various industries.

These partnerships allow Flywire to embed value-added services, thereby deepening its platform's capabilities and competitive edge. By integrating with best-in-class software providers, Flywire can offer clients a more holistic approach to managing receivables and payables. This strategic integration ensures that Flywire’s platform remains at the forefront of payment innovation.

- Integration with Digital Invoicing Platforms: Enhances the efficiency of billing and accounts receivable processes for clients.

- Partnerships for Payment Analytics: Provides deeper insights into payment trends, customer behavior, and financial performance.

- Collaboration on Customer Communication Tools: Streamlines customer interactions related to payments, improving satisfaction and reducing disputes.

- Expansion of Technology Integrations: Continues to broaden the range of software and services that seamlessly connect with Flywire's payment solutions.

Flywire's key partnerships extend to financial institutions and banks globally, which are essential for processing diverse payment methods and currencies, facilitating seamless cross-border transactions. These collaborations, like strengthening ties with Indian and Chinese banks in 2024, are crucial for expanding its payment reach and offering localized options.

Strategic alliances with ERP and SIS providers such as NetSuite, Ellucian, Workday, and Unit4 are foundational, enabling Flywire to embed its payment solutions directly into clients' operational systems. This deep integration streamlines processes like tuition payments for educational institutions, as seen with Ellucian Banner users.

Partnerships with EdTech providers and recruitment agencies, including UBION in Korea and Blackbaud in the U.S. for K-12 schools, help Flywire reach students globally and simplify financial onboarding.

The acquisition of Sertifi in early 2025 significantly bolsters Flywire's travel sector presence, deepening ties with hotel property management systems and major brands, allowing for integrated payment solutions within their workflows.

What is included in the product

This Flywire Payments Business Model Canvas provides a detailed blueprint of their strategy, outlining customer segments, channels, and value propositions for cross-border payments.

It reflects Flywire's operational reality and strategic plans, offering a comprehensive view for presentations and informed decision-making.

Flywire's Payments Business Model Canvas acts as a pain point reliever by providing a clear, actionable framework to address the complexities of global payment processing for businesses.

It simplifies and streamlines the often-frustrating experience of international transactions, offering a structured approach to managing diverse payment methods and regulatory hurdles.

Activities

A crucial activity for Flywire is the ongoing development and upkeep of its global payments network and advanced platform. This ensures the system stays secure, efficient, and adept at managing intricate cross-border and domestic transactions across diverse sectors.

Flywire's commitment to innovation means constantly updating its technology to support new payment methods and regulatory changes. For instance, in 2024, the company continued to invest heavily in its platform's scalability to handle increasing transaction volumes, which saw significant growth year-over-year.

Flywire's core operations revolve around actively acquiring new clients across its key sectors: education, healthcare, travel, and business-to-business (B2B) transactions. This proactive approach is crucial for growth and market penetration.

The company's sales and marketing engine is designed to attract a steady stream of new institutions and businesses. Once a client is secured, Flywire focuses on a streamlined onboarding process, ensuring their payment solutions are seamlessly integrated into the client's existing infrastructure.

Demonstrating significant client expansion, Flywire welcomed over 200 new clients in the first quarter of 2025. This builds upon a strong performance in fiscal year 2024, during which the company onboarded more than 800 new clients, highlighting its success in client acquisition.

Flywire's core activity involves facilitating secure and seamless payment experiences. This includes processing a vast array of payment methods, supporting over 140 currencies and operating in 240 countries and territories, ensuring global reach for its clients' customers.

A key function is the automation of payment reconciliation for clients. This significantly reduces operational burdens and enhances efficiency for businesses by streamlining the complex process of matching incoming payments to outgoing transactions.

Global Network Optimization and Expansion

Flywire's key activities revolve around constantly refining its global payment network. This involves integrating new ways to accept payments, tailoring services for specific regions, and broadening its reach. For instance, in 2024, the company continued its focus on expanding into crucial payer markets, with significant efforts directed towards India and China, aiming to streamline cross-border transactions for students and businesses alike.

The company actively works to enhance its existing offerings, such as digitizing student loan disbursements, making the process smoother and more efficient for educational institutions and international students. This strategic expansion and optimization of its network are fundamental to Flywire's ability to facilitate complex, high-value cross-border payments.

- Network Enhancement: Continuously adding new payment acceptance methods and localizing offerings to better serve diverse global markets.

- Market Expansion: Strategically growing presence in key payer regions, including significant focus on India and China in 2024.

- Service Digitization: Improving and digitizing services like student loan disbursements to enhance user experience and operational efficiency.

- Coverage Growth: Expanding the overall reach of its payment network to support an increasing volume and variety of cross-border transactions.

Product and Software Innovation

Flywire's commitment to product and software innovation is central to its strategy for maintaining a competitive edge and addressing the dynamic needs of its clients. This dedication translates into a continuous cycle of developing novel solutions and refining existing functionalities.

Key areas of focus include enhancing features such as personalized invoicing and single sign-on capabilities, alongside seamless integration with other critical business systems. These advancements are designed to streamline payment processes and improve user experience across various industries.

To further bolster its innovation efforts, Flywire recently welcomed a new Chief Payments Officer. This strategic appointment underscores the company's drive to accelerate the pace of product and payment innovation, ensuring Flywire remains at the forefront of the fintech landscape.

- Developing new payment solutions

- Enhancing existing features like tailored invoicing and single sign-on

- Integrating with essential third-party systems

- Appointing a Chief Payments Officer to spearhead innovation

Key activities for Flywire center on maintaining and expanding its sophisticated global payment network. This involves continuously integrating new payment methods and localizing offerings to cater to diverse international markets, ensuring seamless cross-border transactions.

The company actively pursues market expansion, with a notable focus in 2024 on growing its presence in key payer regions like India and China. This strategic push aims to simplify complex international payments for sectors such as education and business.

Flywire also prioritizes the digitization of its services, enhancing offerings like student loan disbursements to improve efficiency and user experience. This ongoing development underpins its ability to facilitate high-value, intricate global payments.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Network Enhancement | Adding new payment methods and localizing offerings. | Continued expansion into crucial payer markets like India and China. |

| Market Expansion | Growing presence in key payer regions. | Onboarded over 800 new clients in fiscal year 2024. |

| Service Digitization | Improving and digitizing services for efficiency. | Digitizing student loan disbursements for smoother processes. |

| Coverage Growth | Expanding payment network reach. | Supports over 140 currencies and operates in 240 countries/territories. |

Full Version Awaits

Business Model Canvas

The Flywire Payments Business Model Canvas you're previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you'll download this identical file, providing you with a complete, ready-to-use framework for understanding Flywire's business strategy.

Resources

Flywire's proprietary global payments network is its cornerstone, facilitating transactions in over 140 currencies across more than 240 countries and territories. This vast infrastructure is crucial for enabling secure, efficient, and transparent cross-border payments.

In 2023, Flywire processed a significant volume of transactions, with its network handling billions of dollars in payments. This robust network allows for direct connections to local payment methods and banks, bypassing traditional correspondent banking complexities.

Flywire's advanced technology stack, particularly its next-generation payments platform and specialized software, is a core asset. This includes features like customized invoicing, single sign-on for ease of access, and interactive dashboards for managing payments.

The platform also offers robust customer communication tools, enhancing the user experience. This technological infrastructure is crucial for processing complex, high-value transactions across various industries.

For instance, in 2024, Flywire continued to invest heavily in its platform, aiming to streamline cross-border payments for its clients in sectors like education and healthcare, where intricate billing and payment processes are common.

Flywire's deep bench of industry experts, especially those with specialized knowledge in education, healthcare, travel, and B2B sectors, is a critical asset. This human capital fuels innovation in their payment solutions and strengthens client partnerships.

In 2024, Flywire continued to leverage this expertise to refine its offerings, ensuring they meet the evolving needs of complex global payment environments. Their team’s insights directly translate into more effective product development and targeted market strategies.

Client Base and Relationships

Flywire's client base is a significant asset, boasting over 4,500 customers. This diverse group includes prominent organizations across key sectors like education, healthcare, and travel, demonstrating the platform's broad applicability and trust.

The strength of these client relationships is a cornerstone of Flywire's business model. These partnerships are not only extensive but also deeply embedded, leading to remarkably low client churn rates.

- Client Growth: Over 4,500 clients served, indicating broad market penetration.

- Sector Diversity: Strong presence in education, healthcare, and travel sectors.

- Relationship Strength: Deeply embedded relationships with clients, fostering loyalty.

- Low Churn Rate: Essential for predictable recurring revenue and sustained growth.

Data and Analytics Capabilities

Flywire's data and analytics capabilities are a cornerstone of its business model, leveraging the vast information processed through its platform. By handling billions in payment volume, Flywire generates critical insights that drive service optimization and market trend identification. For instance, in 2023, Flywire processed over $30 billion in total payment volume, a significant increase that directly fuels its data analytics engine.

This rich data stream is instrumental in enhancing fraud detection mechanisms, a vital component for any payment processor. The ability to analyze payment patterns and anomalies in near real-time allows Flywire to proactively identify and mitigate fraudulent activities, safeguarding both its clients and end-users. This analytical prowess supports informed decision-making across the organization.

The continuous improvement of Flywire's platform is directly supported by these data analytics. By understanding user behavior, transaction flows, and operational efficiencies, Flywire can make data-driven enhancements to its services. This iterative process ensures the platform remains competitive and meets the evolving needs of its diverse customer base.

- Data Volume: Processed over $30 billion in total payment volume in 2023.

- Insight Generation: Enables optimization of services and identification of market trends.

- Fraud Mitigation: Enhances fraud detection through real-time analysis of payment patterns.

- Platform Improvement: Supports data-driven decision-making for continuous enhancement.

Flywire's intellectual property, including its patented payment technologies and proprietary algorithms, forms a significant part of its key resources. These innovations enable the company to offer unique solutions in cross-border payments, differentiating it from competitors.

In 2024, Flywire continued to expand its intellectual property portfolio, focusing on advancements in AI-driven payment processing and enhanced data security measures. This commitment to innovation ensures its technological edge in a rapidly evolving financial landscape.

The company's brand reputation and established trust among its extensive client base are invaluable intangible assets. This strong brand equity, built on reliability and specialized service, attracts new clients and fosters long-term loyalty.

Value Propositions

Flywire's core value proposition is making complicated, high-value payments, especially those that cross borders, much simpler. They tackle the usual headaches of international payments, like unexpected fees, currency swings, and the difficulty of matching payments to accounts.

This streamlined approach benefits both the businesses using Flywire and their customers. For instance, in 2024, many educational institutions reported significant improvements in student payment processing efficiency, with some seeing a reduction in payment processing errors by up to 30% thanks to platforms like Flywire.

Flywire's platform provides unparalleled transparency, allowing clients and payers to track payments in real-time and receive instant status updates. This significantly reduces the anxiety and administrative overhead often associated with cross-border transactions.

The efficiency gains are substantial, stemming from Flywire's integrated software solutions that automate complex reconciliation processes. For instance, in 2024, businesses using Flywire reported an average reduction of 30% in payment processing time, freeing up valuable resources.

Flywire's global network allows clients to accept payments from virtually anywhere, supporting over 140 currencies and more than 240 countries. This broad reach is crucial for businesses operating internationally, ensuring they can connect with a wider customer base.

By offering localized payment options, Flywire significantly boosts payment success rates. For instance, in 2024, businesses leveraging localized payment methods often saw a 10-15% increase in successful transactions compared to those relying solely on traditional international transfers.

This combination of global reach and localized payment methods directly enhances customer satisfaction. When customers can pay using familiar and convenient methods, their overall experience with a business improves, fostering loyalty and repeat business.

Vertical-Specific Software and Integrations

Flywire offers specialized software designed to seamlessly integrate into the payment processes of key industries like education, healthcare, and travel. This deep embedding within clients' Accounts Receivable (A/R) systems streamlines operations and enhances the payment journey for their customers.

By providing vertical-specific tools, Flywire addresses the unique payment needs of each sector, reducing friction and improving efficiency. For instance, their solutions are built to connect with major Enterprise Resource Planning (ERP) and Student Information Systems (SIS), facilitating smoother data flow and reconciliation.

These tailored integrations are crucial for optimizing payment experiences and overcoming common operational hurdles. In 2024, Flywire continued to expand its vertical expertise, aiming to capture a larger share of the complex payment ecosystems within these targeted markets.

- Tailored A/R Workflow Integration: Flywire's software is built to fit directly into existing Accounts Receivable processes, minimizing disruption and maximizing immediate value for clients.

- Vertical-Specific Solutions: The company develops specialized payment tools catering to the distinct requirements of industries such as higher education, healthcare providers, and the travel sector.

- ERP/SIS Connectivity: Flywire ensures robust integrations with common financial and administrative systems like ERPs and SIS, enabling efficient data management and payment processing.

- Operational Challenge Elimination: The core value proposition lies in using these integrations to remove payment-related bottlenecks and improve overall operational efficiency for businesses.

Secure and Compliant Payment Processing

Flywire provides a robust and compliant payment infrastructure, a crucial element for industries handling sensitive financial data like healthcare and education. This focus on security ensures that customer information and transaction details are protected against breaches and fraud, fostering trust among users and partners.

The company's commitment to global security standards and regulatory compliance is paramount. This includes adherence to frameworks like PCI DSS for payment card data, GDPR for data privacy, and other region-specific regulations. In 2024, Flywire continued to invest in its security protocols, aiming to maintain its status as a trusted payment partner.

- Global Compliance: Flywire meets a wide array of international security and data privacy regulations, essential for cross-border transactions.

- Data Protection: Advanced encryption and fraud prevention measures safeguard sensitive customer and payment information.

- Industry Standards: Adherence to standards like PCI DSS Level 1 ensures the highest level of security for cardholder data.

- Risk Mitigation: By offering a secure platform, Flywire helps its clients mitigate financial and reputational risks associated with payment processing.

Flywire's value proposition centers on simplifying complex, high-value, and cross-border payments for businesses and their customers. They eliminate common payment friction points, such as hidden fees and currency conversion complexities, by offering a transparent and integrated solution. This allows businesses to improve payment processing efficiency and customer satisfaction. For example, in 2024, many higher education institutions reported a reduction in payment processing errors by up to 30% by utilizing Flywire's platform.

Customer Relationships

Flywire emphasizes robust customer relationships by assigning dedicated client success teams. These teams offer continuous support and strategic advice, ensuring clients maximize the platform's benefits and fostering lasting partnerships.

Flywire’s commitment to 24/7 multilingual support is a cornerstone of its customer relationships. This means clients and their end-customers can get help anytime, anywhere, in their preferred language, whether through phone, email, or chat. This constant availability is crucial for resolving payment issues quickly, boosting overall satisfaction.

In 2024, Flywire continued to invest heavily in its support infrastructure. Reports indicate that over 80% of customer inquiries were resolved on the first contact, a testament to the effectiveness of their round-the-clock, multilingual teams. This high resolution rate directly contributes to reduced payment friction and improved client retention.

Flywire's strategy of embedding its payment solutions directly into clients' accounts receivable (A/R) workflows and Enterprise Resource Planning (ERP) systems fosters exceptionally strong customer relationships. This deep integration makes Flywire an essential component of daily operations, significantly increasing client stickiness.

By becoming indispensable to a client's financial processes, Flywire achieves high client retention rates and demonstrates clear, ongoing value. For instance, in 2024, companies leveraging integrated payment solutions reported an average of 15% reduction in manual processing time for A/R, highlighting the operational efficiency gained.

Proactive Communication and Updates

Flywire prioritizes keeping its clients in the loop by proactively sharing information about platform enhancements, new features, and important market trends. This ensures clients can take full advantage of the latest tools and capabilities, underscoring Flywire's dedication to ongoing development.

This commitment to informed engagement is crucial for client retention and maximizing platform value. For instance, in 2024, Flywire's client satisfaction scores saw a notable increase, directly correlated with the frequency and relevance of their update communications.

- Enhanced Client Engagement: Proactive updates foster a stronger client-technology partnership.

- Leveraging New Features: Clients are empowered to utilize the latest functionalities for better outcomes.

- Market Adaptability: Sharing market insights helps clients navigate evolving financial landscapes.

- Increased Satisfaction: Direct communication channels contribute to higher client retention rates.

Strategic Partnerships with Industry Associations

Flywire actively cultivates strategic partnerships with prominent industry associations across its core sectors like education, healthcare, and travel. This engagement is crucial for staying ahead of evolving client demands and bolstering its reputation within these key markets. For instance, by participating in events and working groups with organizations such as the American Council on Education (ACE) or the Healthcare Financial Management Association (HFMA), Flywire gains direct insights into emerging payment challenges and regulatory shifts.

These collaborations also unlock valuable co-marketing avenues and facilitate more meaningful interactions with target clientele. By aligning with trusted industry bodies, Flywire can amplify its reach and demonstrate its commitment to serving specific industry needs. In 2024, Flywire continued to expand its presence at major industry conferences, leveraging these platforms to showcase its solutions and connect with potential partners and clients.

- Industry Association Engagement: Flywire's involvement with associations like the European Association of Universities (EUA) provides direct access to feedback on cross-border tuition payment complexities.

- Credibility Building: Partnerships enhance Flywire's standing, signaling a deep understanding and commitment to the unique financial workflows of sectors like healthcare providers.

- Co-Marketing Opportunities: Collaborations with travel industry groups, for example, can lead to joint webinars or content creation, expanding Flywire's visibility to a wider audience of travel businesses.

- Client Segment Deepening: By working with associations representing international student bodies or specific hospital networks, Flywire can tailor its offerings and strengthen relationships within these niche segments.

Flywire prioritizes deep integration into client systems, making its payment solutions essential for daily operations and fostering high client retention. By embedding its platform into accounts receivable and ERP workflows, Flywire becomes indispensable, as evidenced by a 15% average reduction in manual processing time reported by clients in 2024.

Proactive communication about platform enhancements and market trends ensures clients leverage the latest capabilities, boosting satisfaction and retention. In 2024, Flywire saw increased client satisfaction scores directly linked to the relevance and frequency of these update communications.

Strategic partnerships with industry associations in education, healthcare, and travel provide crucial insights into client needs and regulatory shifts. This engagement, including participation in events with bodies like the HFMA, strengthens Flywire's market position and reputation.

| Customer Relationship Strategy | 2024 Impact/Data | Key Benefit |

|---|---|---|

| Dedicated Client Success Teams | 80% first-contact resolution for inquiries | Maximizes platform benefits, fosters lasting partnerships |

| 24/7 Multilingual Support | Continuous availability across channels | Reduces payment friction, improves satisfaction |

| System Integration (A/R, ERP) | 15% reduction in manual A/R processing time | Increases client stickiness, demonstrates ongoing value |

| Proactive Client Updates | Correlated increase in client satisfaction scores | Empowers clients with new features, enhances market adaptability |

| Industry Association Partnerships | Expanded presence at major industry conferences | Gains insights, builds credibility, creates co-marketing opportunities |

Channels

Flywire’s direct sales force is crucial for penetrating its target markets, focusing on high-value clients within education, healthcare, and travel. This approach allows for tailored solutions and relationship building from the outset.

Account management teams are vital for nurturing these client relationships, ensuring successful implementation and ongoing satisfaction. Their efforts are key to increasing payment volumes and identifying cross-selling opportunities, contributing significantly to Flywire's revenue growth.

In 2024, Flywire continued to invest in its direct sales and account management capabilities, recognizing their importance in securing and expanding its client base across its core verticals. This strategic focus supports the company's mission to simplify complex global payments.

Flywire leverages strategic partnerships with Enterprise Resource Planning (ERP), Student Information Systems (SIS), and other critical software providers as a key channel for client acquisition. These integrations act as a gateway, allowing Flywire to embed its payment solutions directly into the workflows of businesses and educational institutions already utilizing these platforms.

By integrating with established software ecosystems, Flywire gains access to a vast and relevant client base. For example, partnerships with major SIS providers mean that universities and colleges using those systems can easily adopt Flywire for tuition payments, streamlining the process for both the institution and the students. This approach significantly expands Flywire's market penetration and reduces the friction for new client onboarding.

In 2023, Flywire reported that a significant portion of its new customer acquisition was driven by its partner ecosystem, highlighting the effectiveness of these integrations. This strategy allows Flywire to reach clients through trusted channels, enhancing credibility and driving adoption for its comprehensive payment solutions.

Flywire's digital marketing and online presence are crucial channels for reaching and engaging its diverse customer base. An active corporate website, coupled with strategic use of social media platforms like X, LinkedIn, and Facebook, drives brand awareness and communicates the company's value propositions effectively. These digital touchpoints are vital for lead generation, allowing Flywire to connect with potential clients and partners across various industries.

In 2023, Flywire reported a significant increase in digital engagement, with website traffic growing by over 30% year-over-year, indicating strong interest in their payment solutions. Their social media channels actively share insights into cross-border payments and student financial services, fostering community and trust. This robust online footprint directly supports their customer acquisition strategy, making digital outreach a primary driver of new business.

Industry Conferences and Events

Flywire actively participates in key industry conferences and events, such as the upcoming Money 20/20 USA in October 2024, to demonstrate its innovative payment solutions. This engagement is crucial for connecting with potential clients and strategic partners across various sectors, including education, healthcare, and travel. By presenting at these events, Flywire solidifies its position as a thought leader in the global payments and financial software industry.

These platforms offer Flywire a direct avenue to highlight its capabilities in handling complex, cross-border transactions and its commitment to providing seamless payment experiences. For instance, at the 2023 Sibos conference, Flywire showcased its advancements in digital payment technologies, emphasizing enhanced security and user experience.

- Showcasing Solutions: Flywire uses industry events to exhibit its latest payment technologies and platform enhancements.

- Networking Opportunities: Conferences provide a vital space for Flywire to build relationships with prospective clients, existing partners, and industry influencers.

- Thought Leadership: Presenting at or sponsoring events allows Flywire to share insights and demonstrate expertise, reinforcing its brand as an innovator in payments.

- Market Intelligence: Participation offers valuable opportunities to gather market intelligence, understand emerging trends, and identify competitive landscapes.

Referral Programs and Client Testimonials

Flywire leverages its satisfied client base through robust referral programs, turning positive experiences into new business opportunities. Showcasing testimonials and detailed case studies builds significant trust and credibility, directly attracting new clients.

The company's emphasis on high client value and consistently low churn rates are strong indicators of the potential for successful client referrals. This organic growth channel is a critical component of their customer acquisition strategy.

- Referral Programs: Incentivize existing clients to introduce new businesses to Flywire's payment solutions.

- Client Testimonials: Feature authentic feedback and success stories from diverse industries on their platform and marketing materials.

- Case Studies: Develop in-depth analyses of how specific clients have benefited from Flywire, highlighting measurable improvements in payment processing efficiency and cost savings.

- Trust Building: Utilize social proof through testimonials and referrals to overcome potential client hesitations and demonstrate reliability.

Flywire's direct sales and account management teams are core to its strategy, focusing on high-value clients in education, healthcare, and travel. These teams build relationships and tailor solutions, which is crucial for securing and expanding its client base. In 2024, Flywire continued to strengthen these capabilities to support its mission of simplifying complex global payments.

Strategic partnerships with ERP, SIS, and other software providers serve as a vital channel for client acquisition. By integrating into existing workflows, Flywire gains access to a broad, relevant client base, making onboarding smoother. In 2023, a significant portion of new customer acquisition was attributed to this partner ecosystem, demonstrating its effectiveness.

Digital marketing and online presence are essential for reaching and engaging Flywire's diverse customer base, driving brand awareness and lead generation. Website traffic saw a notable increase of over 30% year-over-year in 2023, underscoring strong interest in their payment solutions.

Industry conferences and events, such as Money 20/20 USA in October 2024, are key for showcasing solutions and building relationships. Flywire uses these platforms to highlight its expertise in cross-border transactions and digital payment advancements, as seen at Sibos in 2023.

Referral programs and client testimonials are powerful channels, leveraging satisfied customers to drive new business and build trust. Flywire's focus on high client value and low churn rates supports this organic growth strategy.

Customer Segments

Higher education institutions, including universities and colleges worldwide, are a key customer segment for Flywire. These organizations aim to simplify the process of collecting tuition and fees, especially from a diverse student body that includes many international students. Flywire's platform is designed to handle these complex cross-border transactions efficiently.

Flywire's commitment to the education sector is underscored by its partnerships with over 2,950 institutions, highlighting its significant presence and continued focus on this market. This extensive network demonstrates the trust placed in Flywire by academic bodies to manage their payment infrastructures effectively.

Private and independent K-12 schools, especially those with a significant international student population, represent a key customer segment for Flywire. These institutions are looking for streamlined ways to manage tuition payments and other associated fees, reducing administrative burdens and enhancing the experience for families.

Flywire's strategic partnership with Blackbaud, a leading provider of software for the nonprofit and education sectors, further solidifies its commitment to serving the U.S. K-12 market. This collaboration aims to offer integrated payment solutions that cater specifically to the unique needs of these educational institutions.

Hospitals, clinics, and other healthcare organizations are key customers for Flywire. They need streamlined ways to manage patient payments, particularly for those with international insurance or undergoing costly treatments. In 2024, Flywire continued to expand its reach in this vital sector.

These providers are looking for solutions that simplify the often-complex billing process, reduce administrative burdens, and improve patient satisfaction. Flywire's platform addresses these needs by offering a flexible and secure way to handle diverse payment scenarios. The company's commitment to this segment is evident, serving over 90 major healthcare systems.

Travel Companies and Hospitality Businesses

Flywire's travel and hospitality segment serves a broad range of businesses, from global tour operators and large hotel chains to independent lodging providers. This focus aims to streamline complex payment processes inherent in the travel industry.

The acquisition of Sertifi significantly bolstered Flywire's presence, extending its payment solutions to over 20,000 hotel properties globally. This expansion highlights a strategic push to capture a larger share of the travel payment market.

- Tour Operators: Facilitating payments for bookings, package deals, and ancillary services.

- Multinational Hospitality Management Companies: Centralizing payment processing across diverse property portfolios.

- Individual Hotel Properties: Offering simplified payment collection for room reservations, event bookings, and on-site services.

- Travel Agencies: Enabling efficient payment handling for client bookings and supplier payments.

Business-to-Business (B2B) Enterprises

The Business-to-Business (B2B) Enterprises segment is a cornerstone for Flywire, encompassing companies grappling with intricate payment processes, particularly those involving international transactions and the reconciliation of numerous invoices. This segment is experiencing robust organic expansion, further bolstered by strategic acquisitions such as Invoiced, which enhances Flywire's capabilities in this area.

Flywire's B2B solution caters to a diverse range of industries, addressing pain points like managing cross-border payments and streamlining complex accounts receivable and payable workflows. The demand for efficient B2B payment solutions continues to rise as global commerce grows.

- B2B Payment Complexity: Businesses often face challenges with international payments, currency conversions, and the sheer volume of invoices requiring reconciliation.

- Strategic Acquisitions: The acquisition of Invoiced in 2022 significantly expanded Flywire's B2B payment offerings, particularly in accounts receivable automation.

- Industry Reach: Flywire serves B2B clients across various sectors, including technology, financial services, and manufacturing, each with unique payment requirements.

- Growth Drivers: Increased globalization and the ongoing digital transformation of business operations are key factors driving growth within this customer segment.

Flywire serves a diverse array of customer segments, each with unique payment needs. These include higher education institutions, K-12 schools, healthcare providers, and businesses across various industries, as well as the travel and hospitality sector.

The company's expansion in 2024 saw continued growth across these verticals, with a particular emphasis on enhancing B2B payment solutions and healthcare payment processing.

Flywire's strategy involves acquiring companies like Invoiced and Sertifi to broaden its service offerings and reach, demonstrating a commitment to addressing complex payment challenges in each segment.

| Customer Segment | Key Needs | Flywire's Solution Focus | 2024/Recent Data Points |

|---|---|---|---|

| Higher Education | International student payments, tuition collection | Streamlined cross-border transactions | Partnerships with over 2,950 institutions |

| K-12 Education | Tuition payments, parent engagement | Integrated payment solutions | Strategic partnership with Blackbaud |

| Healthcare | Patient billing, insurance processing | Simplified payment collection | Serving over 90 major healthcare systems |

| Travel & Hospitality | Booking payments, ancillary services | Efficient payment handling | Extended reach to over 20,000 hotel properties |

| B2B Enterprises | Cross-border B2B payments, AR/AP automation | Complex transaction management | Acquisition of Invoiced enhanced B2B capabilities |

Cost Structure

Flywire invests heavily in developing and maintaining its sophisticated payment platform. These costs encompass significant outlays for engineering talent, product management teams, and robust IT infrastructure to ensure security and scalability. For instance, in 2023, technology and development expenses represented a substantial portion of their operating costs, reflecting the continuous innovation required in the fintech space.

Flywire's cost structure is significantly influenced by the fees associated with its global payment network. These include payments to banks, processors, and various local payment systems, all crucial for facilitating cross-border transactions. For instance, in 2024, the global fintech market saw substantial investments, with payment processing fees remaining a core operational expense for companies like Flywire, reflecting the intricate web of financial intermediaries involved.

Flywire's sales and marketing expenses are a significant investment, crucial for acquiring new clients and growing its market presence. These costs encompass the compensation for their dedicated sales force, which is essential for building relationships with businesses across diverse industries. In 2023, Flywire reported selling, general, and administrative expenses of $531.3 million, a notable portion of which is allocated to these growth-driving activities.

The company also dedicates substantial resources to advertising and promotional campaigns designed to enhance brand awareness and attract potential customers. Furthermore, participation in key industry conferences and trade shows allows Flywire to showcase its solutions, network with prospects, and stay abreast of market trends, all contributing to their overall sales and marketing expenditure.

Personnel and Operational Costs

Personnel costs are a significant component, encompassing salaries, benefits, and other compensation for Flywire's global workforce. This includes dedicated customer support, administrative functions, and the teams managing their international presence. As of early 2024, Flywire employs over 1,000 individuals worldwide.

Operational expenses are tied to maintaining this global infrastructure. These costs cover everything from office leases and technology infrastructure to regulatory compliance and marketing efforts necessary to support their payment solutions across various markets.

- Employee Salaries and Benefits: A substantial portion of Flywire's cost structure is dedicated to compensating its over 1,000 employees across various global functions.

- Global Office Operations: Maintaining offices in key international markets incurs costs for rent, utilities, and local administrative support.

- Customer Support Infrastructure: Investing in robust customer support systems and personnel is essential for handling a diverse, international client base.

- Technology and Compliance: Ongoing expenses for technology platforms, software licenses, and adherence to global financial regulations contribute to operational costs.

Acquisition and Integration Costs

Acquisition and integration costs are significant for Flywire, particularly following strategic moves like the $330 million acquisition of Sertifi. These expenses encompass not only the purchase price but also the substantial investment required to merge Sertifi's operations and technology into Flywire's existing infrastructure. This integration process involves aligning systems, retraining staff, and ensuring seamless data flow, all of which contribute to the overall cost structure.

- Acquisition Expense: The $330 million paid for Sertifi represents a major upfront cost.

- Integration Investment: Costs include technology platform consolidation, data migration, and process alignment.

- Operational Synergies: Efforts to achieve operational efficiencies post-acquisition also incur integration-related expenses.

- Ongoing Support: Maintaining and optimizing the integrated systems post-acquisition will involve continued investment.

Flywire's cost structure is heavily weighted towards technology and personnel. In 2023, technology and development were substantial operational costs, reflecting continuous innovation. Personnel costs, including salaries and benefits for over 1,000 global employees, are also a significant outlay. The company also incurs substantial fees from its global payment network, involving banks and processors.

| Cost Category | Description | Example/Data Point |

|---|---|---|

| Technology & Development | Investment in platform, engineering, and IT infrastructure | Substantial portion of operating costs in 2023 |

| Personnel Costs | Salaries, benefits for global workforce | Over 1,000 employees as of early 2024 |

| Payment Network Fees | Costs paid to banks, processors, and local payment systems | Core operational expense in the fintech sector |

| Sales & Marketing | Client acquisition, brand awareness, promotional activities | $531.3 million in SG&A expenses in 2023 |

| Acquisition & Integration | Costs related to acquiring and merging other companies | $330 million acquisition of Sertifi |

Revenue Streams

Flywire's core revenue generation hinges on transaction-based fees, a model where they earn a small percentage or flat fee for every payment processed. This approach directly ties their income to the success and volume of the transactions flowing through their network.

The complexity and size of these transactions also play a role in fee structuring, allowing for scalability as their clients' payment needs grow. This is evident in their impressive total payment volume growth; for instance, in Q1 2025, Flywire reported a substantial 20.4% increase in total payment volume, reaching $8.4 billion.

Flywire generates revenue through software and platform fees, offering clients subscription or usage-based access to its specialized solutions. These fees cover access to vertical-specific features like customized invoicing, advanced reporting tools, and seamless integration services designed to streamline payment processes.

Flywire generates additional revenue by providing value-added services that complement its core payment processing. These include specialized currency exchange services, offering competitive rates and managing foreign exchange risk for clients. This diversification taps into a significant market, as global cross-border payments continue to grow, with projections indicating continued expansion through 2024 and beyond.

Cross-Selling and Upselling Existing Clients

Flywire deepens its revenue by expanding relationships with existing clients. This involves offering them additional services, known as cross-selling, or encouraging them to adopt more advanced, higher-value solutions, which is called upselling. This approach is central to their growth strategy.

The company's 'land and expand' strategy is specifically built to extract maximum value from each client relationship. By starting with an initial service and then progressively introducing more offerings, Flywire cultivates loyalty and increases the overall revenue generated per customer.

- Cross-selling additional payment solutions

- Upselling to premium platform features

- Expanding into new verticals within existing client organizations

- Increasing transaction volume through enhanced service adoption

New Market and Vertical Expansion

Flywire's revenue streams are significantly boosted by its strategic push into new geographic regions and the diversification into emerging client sectors. This expansion is a key driver of growth.

The company is actively broadening its reach within the business-to-business (B2B) market, a sector showing substantial potential. Furthermore, Flywire has deepened its presence in the travel industry, notably through strategic acquisitions such as Sertifi, which enhances its service offerings and client base.

- Geographic Expansion: Tapping into new international markets opens up fresh revenue opportunities and diversifies the company's customer base.

- Vertical Diversification: Entering and growing within new client verticals, like B2B payments and expanded travel services, creates multiple avenues for revenue generation.

- Acquisition Synergies: Acquisitions, such as Sertifi, integrate new capabilities and client relationships, directly contributing to increased revenue through cross-selling and expanded service offerings.

Flywire's revenue model is multifaceted, combining transaction fees with recurring software and platform access charges. This dual approach ensures consistent income while capitalizing on payment volumes.

Value-added services, particularly foreign exchange solutions, and strategic client relationship expansion through cross-selling and upselling are also significant revenue contributors. The company's growth is further fueled by geographic expansion and diversification into new verticals, such as B2B payments and enhanced travel services, with acquisitions like Sertifi playing a key role in this expansion.

| Revenue Stream | Description | Impact/Example |

|---|---|---|

| Transaction Fees | Fees charged per payment processed. | Directly tied to total payment volume (TPV). Q1 2025 TPV reached $8.4 billion, a 20.4% increase. |

| Software & Platform Fees | Subscription or usage-based access to specialized payment solutions. | Provides recurring revenue for features like customized invoicing and reporting. |

| Value-Added Services | Ancillary services such as foreign exchange management. | Leverages global payment growth, offering competitive rates and risk management. |

| Client Relationship Expansion | Cross-selling and upselling additional or premium services to existing clients. | Part of a 'land and expand' strategy to maximize customer lifetime value. |

| Geographic & Vertical Expansion | Entering new markets and client sectors, including B2B and expanded travel. | Acquisitions like Sertifi enhance offerings and client reach, driving new revenue streams. |

Business Model Canvas Data Sources

The Flywire Payments Business Model Canvas is informed by a blend of internal financial data, customer transaction analytics, and competitive market intelligence. This ensures a robust understanding of revenue streams, cost structures, and customer acquisition strategies.