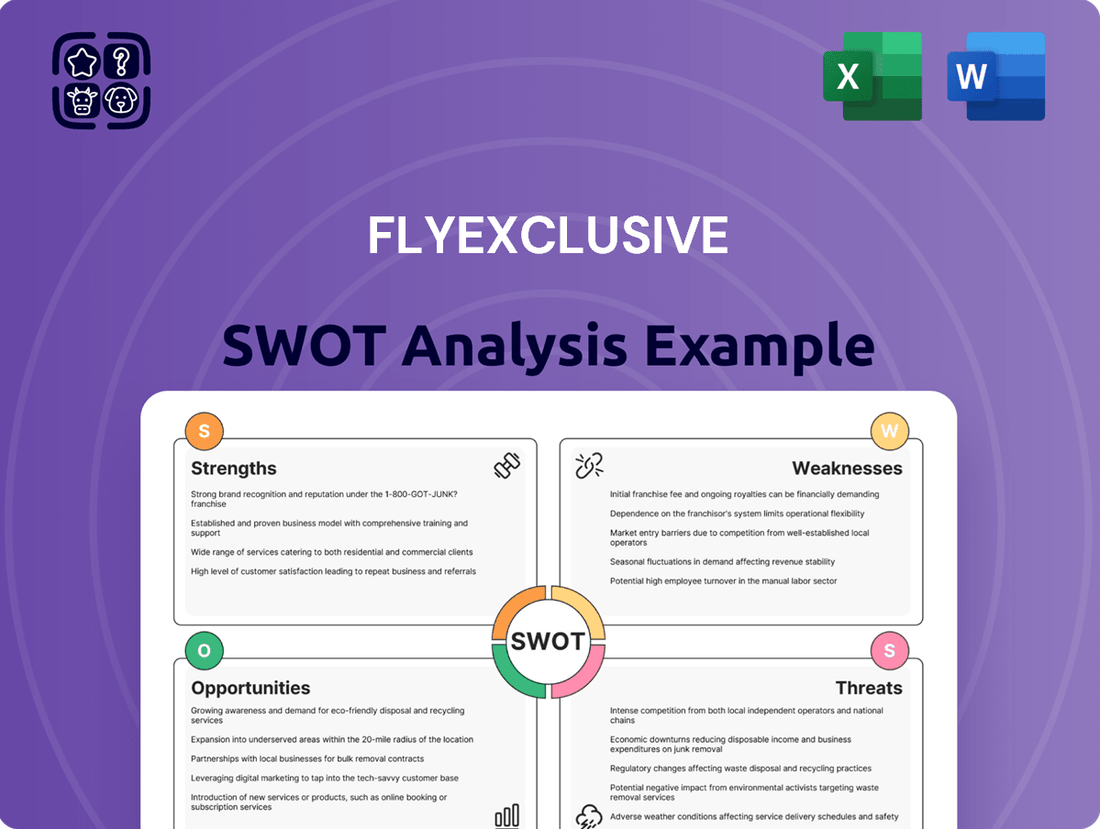

flyExclusive SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

flyExclusive Bundle

flyExclusive leverages its strong brand reputation and growing fleet to capture market share in the competitive private aviation sector. However, understanding the nuances of potential regulatory changes and the impact of economic downturns is crucial for sustained success.

Want the full story behind flyExclusive's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

flyExclusive's vertically integrated operations, which include in-house Maintenance, Repair, and Overhaul (MRO) services, give them significant control over their fleet's upkeep. This allows for enhanced quality assurance and operational efficiency, directly impacting service reliability.

By managing maintenance internally, flyExclusive can minimize aircraft downtime, a critical factor in the charter business. This capability ensures their fleet remains in top condition, upholding the high standards of safety and luxury expected by their clients, including those utilizing their MRO services for external aircraft.

flyExclusive boasts one of the world's largest fleets of Cessna Citation jets, offering a versatile range of aircraft sizes to meet varied client demands. This diverse selection is further enhanced by the strategic addition of Bombardier Challenger 350 jets, expanding their capacity and appeal.

The company's commitment to fleet modernization is a key strength, with ongoing upgrades focused on boosting operational efficiency and elevating the overall customer travel experience. This forward-thinking approach ensures they remain competitive and responsive to evolving market expectations.

flyExclusive distinguishes itself with a comprehensive suite of private aviation services, encompassing fractional ownership, exclusive Jet Club memberships, and flexible on-demand charter options. This multi-faceted approach caters to a wide array of client needs, from frequent business travelers to those seeking occasional luxury escapes.

By offering this diverse portfolio, flyExclusive effectively addresses the varied demands within the private jet market. For instance, their Jet Club program, launched to provide more accessible entry points, saw significant uptake in 2024, with membership growth exceeding 25% year-over-year, demonstrating the appeal of their structured, yet flexible, offerings.

Strong Customer Satisfaction and Program Innovation

flyExclusive has achieved significant gains in customer satisfaction, with a notable 90% of its members rating their service as Excellent or Very Good in recent surveys. This focus on client experience is a core strength, driving loyalty and positive word-of-mouth referrals within the competitive private aviation market.

The company's commitment to program innovation is evident in its strategic updates, such as the recent overhaul of its Jet Club offering. This revamp introduced simplified pricing structures and extended rate locks, making private jet access more predictable and appealing for its clientele.

- High Member Satisfaction: 90% of flyExclusive members rate service as Excellent or Very Good.

- Program Innovation: Revamped Jet Club features simplified pricing and extended rate locks.

- Customer-Centric Approach: Focus on improving the member experience drives loyalty.

Strategic Financial Maneuvering and Market Positioning

flyExclusive has shown remarkable financial dexterity, successfully raising capital and implementing cost-saving measures. This financial maneuvering, coupled with a strategic adjustment of their fleet composition, is aimed at enhancing profitability.

The company's deliberate pricing strategy, positioning them as a cost leader in specific jet card categories, is a key strength. Furthermore, their pursuit of inclusion in the Russell 2000 index is expected to significantly improve their stock's market liquidity.

- Capital Infusions: Secured vital funding to support operations and growth initiatives.

- Cost Reduction: Implemented efficiency programs to streamline operations and improve margins.

- Fleet Optimization: Strategically adjusted fleet mix to better align with market demand and profitability goals.

- Market Pricing: Established a competitive price leadership position in select jet card market segments.

flyExclusive's vertically integrated model, including in-house MRO, grants superior fleet control and reliability. This internal maintenance capability minimizes downtime, ensuring their fleet, including the extensive Cessna Citation and newer Bombardier Challenger 350 jets, remains operational and safe, a critical factor for their diverse clientele.

The company's commitment to fleet modernization and a broad service offering, from fractional ownership to Jet Club memberships, caters to a wide market. Their Jet Club saw over 25% year-over-year membership growth in 2024, highlighting the success of their diversified approach.

flyExclusive demonstrates strong financial management, securing capital and implementing cost efficiencies, which are crucial for profitability. Their strategic pricing, positioning them as a cost leader in certain jet card segments, enhances market competitiveness.

| Strength Area | Key Metric/Fact | Impact |

|---|---|---|

| Operational Control | In-house MRO services | Enhanced fleet reliability and reduced downtime |

| Fleet Diversity | Largest Cessna Citation fleet, adding Challenger 350s | Meets varied client needs and expands market appeal |

| Customer Loyalty | 90% Excellent/Very Good satisfaction rating | Drives repeat business and positive referrals |

| Financial Strategy | Cost reduction initiatives and capital infusion | Improved profitability and operational stability |

What is included in the product

Delivers a strategic overview of flyExclusive’s internal and external business factors, highlighting its competitive advantages and market challenges.

Offers a clear breakdown of flyExclusive's competitive landscape, simplifying the identification of strategic opportunities and threats.

Weaknesses

flyExclusive has faced persistent financial headwinds, reporting substantial net losses in 2024. This ongoing profitability challenge, a continuation from prior periods, raises concerns about the company's long-term financial health and its ability to generate consistent returns for stakeholders.

While there have been some sequential improvements in financial performance, the critical hurdle remains demonstrating sustained profitability. Investors and analysts will be closely watching for evidence that flyExclusive can overcome these historical losses and establish a stable, profitable operating model in the competitive private aviation market.

flyExclusive's profitability is significantly tied to its ongoing fleet modernization program, which involves replacing older aircraft with newer, more fuel-efficient models. This strategy aims to reduce operating costs and enhance service offerings. For instance, as of the first quarter of 2024, the company continued its phased retirement of older Citation aircraft, aiming to complete the transition by year-end, which is crucial for realizing projected cost efficiencies.

However, any disruptions or delays in this fleet transition, such as supply chain issues affecting new aircraft delivery or unexpected maintenance on existing planes, could directly hinder the anticipated cost savings and impact dispatch reliability. This reliance makes the modernization timeline a critical factor for the company's financial performance throughout 2024 and into 2025.

flyExclusive's significant debt load, exceeding $250 million in long-term liabilities as of early 2024, presents a considerable challenge. These substantial interest payments directly impact the company's profitability, contributing to its net losses. This financial leverage may also restrict the company's ability to pursue new opportunities or weather economic downturns.

Impact of Past Business Relationship Disruptions

The termination of the partnership with Wheels Up, a significant client, has been a major blow to flyExclusive's financial performance. This breakup directly contributed to a substantial revenue shortfall in 2023, with continued repercussions felt into 2024.

The loss of Wheels Up's business, which represented a considerable percentage of flyExclusive's overall revenue, created a notable financial gap. This disruption underscores a key weakness in the company's customer concentration risk.

- Customer Concentration Risk: Reliance on a single major customer, like Wheels Up, proved to be a significant vulnerability.

- Revenue Volatility: The breakup led to increased revenue volatility, impacting financial stability and forecasting.

- Financial Impact: flyExclusive experienced a negative financial impact in 2023 due to the loss of this key relationship, with ongoing effects in 2024.

Market Uncertainty and Competition

The private aviation sector, despite its growth trajectory, is susceptible to economic headwinds and geopolitical instability. These macro-environmental factors can significantly impact demand for charter services and influence pricing power. For instance, a slowdown in global economic growth, as projected by some analysts for late 2024 and into 2025, could dampen corporate travel budgets, a key segment for flyExclusive.

Competition within the fractional ownership and on-demand charter markets remains fierce. flyExclusive competes with established players and emerging operators, all vying for market share. This intense rivalry can pressure margins and necessitate continuous investment in service quality and fleet modernization to maintain a competitive edge. The market saw a notable increase in new entrants in 2023, further intensifying this dynamic.

- Economic Uncertainty: Potential recessions or slower growth in key markets can reduce discretionary spending on private aviation.

- Geopolitical Tensions: International conflicts or trade disputes can disrupt travel patterns and impact global business activity.

- Intense Competition: A crowded marketplace with numerous operators can lead to price wars and reduced profitability.

- Regulatory Changes: Evolving aviation regulations could impose additional costs or operational constraints.

flyExclusive's significant debt burden, exceeding $250 million in long-term liabilities as of early 2024, directly impacts its profitability through substantial interest expenses. This leverage also limits financial flexibility for growth or navigating economic downturns.

The company's reliance on a few key clients, highlighted by the termination of its partnership with Wheels Up, created considerable revenue volatility and underscored customer concentration risk. This dependence makes future revenue streams vulnerable to similar disruptions.

Persistent net losses, continuing from prior periods into 2024, raise concerns about flyExclusive's long-term financial viability and its ability to achieve sustained profitability. Demonstrating a path to consistent positive earnings remains a critical challenge.

The company's fleet modernization strategy, while aimed at cost reduction, introduces execution risk. Delays or unforeseen issues in replacing older aircraft could impede anticipated cost savings and affect operational reliability, impacting financial performance throughout 2024 and 2025.

What You See Is What You Get

flyExclusive SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use for flyExclusive's strategic planning. You're seeing the actual analysis, ensuring transparency and quality. Purchase unlocks the complete, detailed report.

Opportunities

The global business jet market is expected to see continued expansion, driven by a rising preference for personalized and adaptable travel options among affluent individuals and businesses. This trend is particularly strong in 2024 and projected into 2025.

Fractional ownership and jet sharing models are making private aviation more attainable, broadening the customer base. For instance, the market for pre-owned business jets saw significant activity in 2023, indicating strong underlying demand.

The increasing demand for flexible and accessible private aviation solutions, like fractional ownership and jet card programs, offers a prime avenue for flyExclusive's growth. These models appeal to a broader segment of the market seeking cost-effective entry into private travel. flyExclusive's strategic focus on enhancing these programs is designed to capture this expanding customer base and build a more predictable revenue foundation.

flyExclusive can leverage technological advancements to significantly boost its operations. Integrating AI and machine learning can lead to smarter predictive maintenance, reducing downtime and enhancing safety. For instance, by analyzing flight data, AI can forecast component failures before they occur, a critical advantage in the aviation sector.

Digital transformation offers a pathway to streamlined customer experiences and improved efficiency. A more intuitive booking platform, for example, could attract and retain a wider customer base. This digital shift also allows for greater transparency in pricing and flight availability, building trust with clients.

The company can also benefit from enhanced route optimization through advanced analytics, leading to fuel savings and faster travel times. In 2024, the private aviation industry is increasingly adopting data-driven solutions to manage complex logistics, and flyExclusive is well-positioned to capitalize on these trends to improve its service delivery and cost management.

Strategic Acquisitions and Partnerships

flyExclusive has significant opportunities to grow by acquiring or partnering with other companies. This strategy can help them reach more customers and boost their financial strength. For instance, their planned acquisition of Jet AI's aviation division and the onboarding of Volato customers are prime examples of this approach.

These moves are expected to bolster flyExclusive's market presence. By integrating Jet AI's operations, flyExclusive aims to enhance its service offerings and potentially tap into new customer segments. The onboarding of Volato customers further expands their client base, demonstrating a clear path toward market expansion.

- Market Expansion: Strategic acquisitions like Jet AI's aviation division can unlock new geographical markets and customer demographics for flyExclusive.

- Capital Infusion: Mergers and acquisitions can provide access to additional capital, strengthening the company's financial foundation and enabling further growth initiatives.

- Synergistic Growth: Partnerships and acquisitions can lead to operational synergies, improving efficiency and potentially reducing costs across combined entities.

- Enhanced Service Portfolio: Integrating new services or customer bases, such as through the Volato customer onboarding, diversifies flyExclusive's offerings and increases its competitive edge.

Increasing Demand for MRO Services

flyExclusive's in-house Maintenance, Repair, and Overhaul (MRO) capabilities, bolstered by its recent FAA Part 21 certification, strategically positions the company to address the significant industry-wide shortage of aircraft repair technicians and overall maintenance capacity. This allows flyExclusive to not only support its own fleet but also offer these crucial services to third-party aircraft operators.

The demand for MRO services is substantial, with the global aviation MRO market projected to reach approximately $120 billion by 2025. This growth is driven by an aging global aircraft fleet and increasing complexity of aircraft systems. flyExclusive's ability to provide certified maintenance directly addresses this market need.

- Addressing Technician Shortages: The global aviation industry faces a projected deficit of over 20,000 aircraft mechanics by 2025, creating a prime opportunity for MRO providers with certified personnel.

- Expanding Service Offerings: flyExclusive's FAA Part 21 certification enables it to perform a wider range of repairs and modifications, increasing its appeal to external clients.

- Revenue Diversification: By offering MRO services to other operators, flyExclusive can diversify its revenue streams beyond its core charter operations.

- Market Growth: The business aviation MRO sector is expected to grow at a compound annual growth rate (CAGR) of over 4% through 2027, indicating a robust market for flyExclusive's expanded services.

The increasing demand for fractional ownership and jet card programs presents a significant growth opportunity for flyExclusive, allowing them to tap into a broader market seeking accessible private aviation. Leveraging technological advancements, such as AI for predictive maintenance and digital platforms for enhanced customer experience, can streamline operations and improve service delivery. Strategic acquisitions and partnerships, like the integration of Jet AI's aviation division and Volato customers, are poised to expand market reach and financial strength.

flyExclusive's FAA Part 21 certified MRO capabilities directly address the industry-wide shortage of aircraft repair technicians, a critical need projected to see over 20,000 mechanics short by 2025. This certification allows them to offer essential maintenance services to third-party operators, diversifying revenue streams within a growing MRO market expected to exceed $120 billion by 2025. The business aviation MRO sector itself is forecast to grow at a CAGR of over 4% through 2027, providing a robust environment for flyExclusive's expanded service offerings.

Threats

Global economic volatility, marked by rising fuel costs and persistent inflation, presents a significant headwind for flyExclusive. As of mid-2024, fuel prices, a major operational expense, have seen fluctuations impacting the variable costs of private aviation. This economic uncertainty can also dampen demand for discretionary travel services like private jet charters, as corporate and individual clients tighten budgets.

Inflationary pressures extend beyond fuel, affecting maintenance, labor, and other essential operational expenditures. For instance, the Consumer Price Index (CPI) in key markets has remained elevated, directly increasing flyExclusive's cost of doing business. This environment necessitates careful cost management and strategic pricing to maintain profitability amidst these external economic pressures.

Stricter environmental regulations, especially in Europe, are pushing the private aviation sector towards higher operational costs. This includes the potential for increased carbon taxes and mandates for using Sustainable Aviation Fuel (SAF), which is currently more expensive than traditional jet fuel. For instance, the EU's RefuelEU Aviation initiative aims for 70% SAF blending by 2050, a significant shift that will require substantial investment from operators like flyExclusive.

Ongoing global supply chain issues continue to impact the aviation sector, leading to extended lead times for critical aircraft parts. This can translate into increased aircraft downtime for flyExclusive, directly affecting operational capacity and potentially increasing maintenance expenses as parts become more costly due to scarcity. For instance, the average lead time for some specialized aerospace components reportedly extended by as much as 30% in late 2024.

Furthermore, the industry faces a persistent shortage of skilled aviation mechanics and technicians. Attracting and retaining this specialized talent is a significant challenge, with industry reports indicating a potential deficit of over 200,000 technicians globally by 2030. This scarcity drives up labor costs and can further exacerbate aircraft maintenance backlogs, impacting service delivery and profitability.

Intensifying Market Competition

The private aviation sector is experiencing heightened competition, with both legacy companies and disruptive newcomers vying for market share. This dynamic environment demands constant innovation and a clear, compelling value proposition to keep existing clients and draw in new ones.

For flyExclusive, this means staying ahead of the curve in service offerings and operational efficiency. The market saw significant growth in 2024, with the global private jet market valued at approximately $30 billion and projected to expand further. New entrants often leverage technology and flexible membership models, forcing established operators to adapt.

Key competitive pressures include:

- Price Wars: Increased competition can lead to downward pressure on pricing, impacting profit margins.

- Service Differentiation: Competitors are increasingly focusing on niche markets and personalized services to stand out.

- Technological Advancements: The adoption of new booking platforms and customer relationship management tools by competitors can shift client preferences.

- Fleet Modernization: Keeping fleets current with the latest aircraft models is crucial to meet client expectations for comfort and efficiency.

Regulatory Changes and Compliance Costs

The private aviation sector, including operators like flyExclusive, faces increasing scrutiny regarding evolving regulatory landscapes. Changes in safety standards, environmental regulations, and airspace management protocols necessitate ongoing adaptation and investment. For instance, the FAA’s NextGen air traffic control modernization continues to roll out, requiring operators to ensure aircraft are equipped with compatible technology, representing a significant capital expenditure.

These regulatory shifts directly translate into compliance costs, impacting operational budgets. flyExclusive must allocate resources to maintain adherence to updated safety management systems (SMS) and potential new emissions standards, which could increase operating expenses. Failure to comply can lead to substantial fines and operational disruptions, underscoring the critical nature of proactive regulatory engagement.

The complexity of navigating these regulations can also impact operational flexibility. For example, new noise abatement procedures or flight path restrictions in certain regions could limit routing options or require flight planning adjustments, potentially affecting service delivery and efficiency.

- Increased Compliance Burden: Evolving aviation regulations from bodies like the FAA and EASA require continuous investment in training, technology, and procedural updates.

- Safety Standard Upgrades: Adherence to heightened safety management system (SMS) requirements can necessitate significant operational and financial commitments.

- Airspace Management Complexity: Adapting to changes in airspace utilization and air traffic control modernization programs, such as NextGen, requires investment in compatible avionics and updated operational procedures.

- Environmental Regulations: Potential future regulations concerning emissions or noise pollution could impose additional costs for fleet upgrades or operational modifications.

Intensified competition within the private aviation sector poses a significant threat, as new entrants and established players alike vie for market share. This can lead to price wars, eroding profit margins for operators like flyExclusive. Furthermore, the need for continuous fleet modernization to meet evolving client expectations and technological advancements requires substantial capital investment, a challenge in a market already facing economic headwinds.

SWOT Analysis Data Sources

This analysis is built upon a foundation of robust data, including flyExclusive's official financial statements, comprehensive market research reports, and expert insights from aviation industry analysts.