flyExclusive Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

flyExclusive Bundle

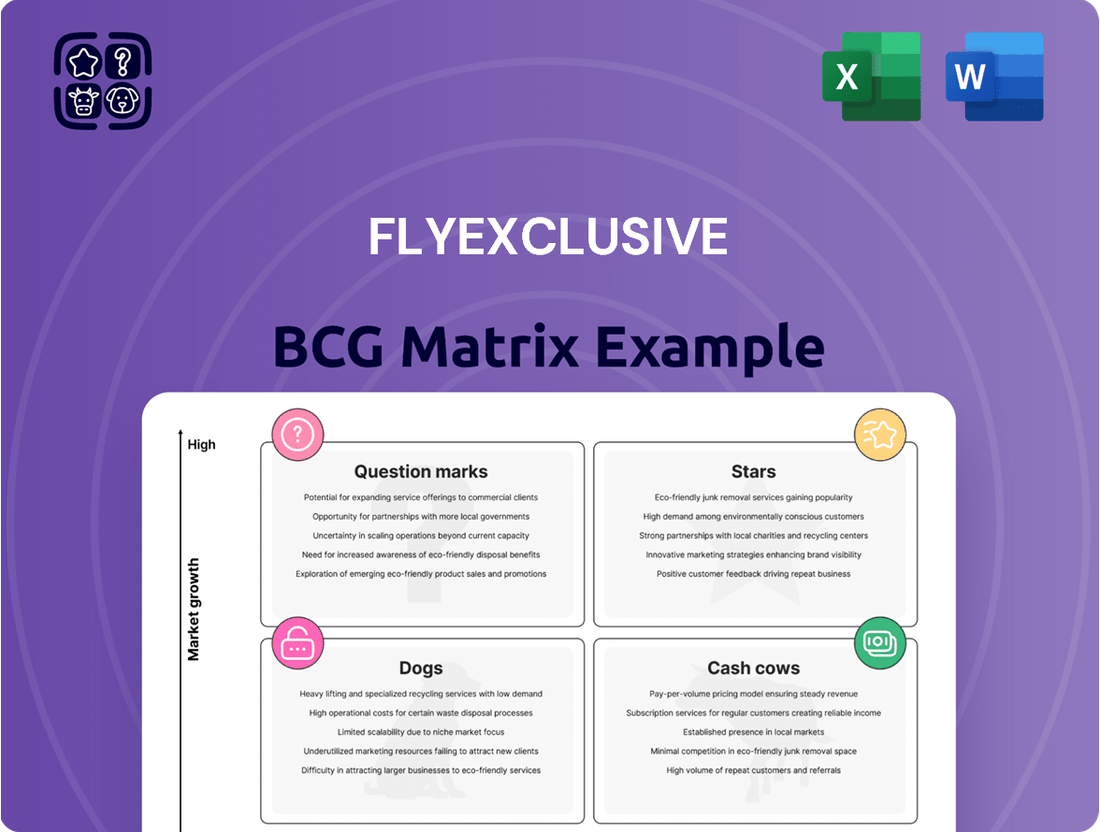

Uncover the strategic positioning of flyExclusive's offerings with our comprehensive BCG Matrix. See at a glance which services are poised for growth (Stars), which are generating consistent revenue (Cash Cows), and which require careful evaluation (Question Marks or Dogs).

This preview offers a glimpse into flyExclusive's market performance, but the full BCG Matrix report unlocks detailed quadrant placements, actionable insights, and a clear roadmap for optimizing your investment and resource allocation.

Elevate your understanding and decision-making by purchasing the complete flyExclusive BCG Matrix. Gain the strategic clarity needed to navigate the competitive landscape and drive future success.

Stars

flyExclusive's fractional jet ownership program is a clear star in their business portfolio. The company saw a substantial surge in deposits, climbing from $16.7 million in 2023 to $30.3 million in 2024. This robust growth, coupled with a dramatic revenue increase from $6.0 million to $22.7 million within the same year for this segment, highlights a rapidly expanding market where flyExclusive is clearly gaining traction.

Further solidifying its star status, flyExclusive is making significant investments in its fractional program by acquiring new aircraft. The planned additions of Cessna Citation XLS Gen2 and Citation Longitudes, with deliveries slated for 2024 and 2025, demonstrate a commitment to capturing and expanding market share in this high-demand area.

The revamped Jet Club program, introduced in March 2025, is a standout performer. It boasts transparent pricing, a 24-month rate lock, and crucially, no fuel surcharges. This makes it incredibly appealing in the expanding market for private jet access.

This strategic enhancement has driven significant growth, with Jet Club sales jumping 25% year-over-year in the first quarter of 2025. This impressive surge highlights strong market acceptance and the program's successful positioning as a leader in its category.

flyExclusive is strategically expanding into the super-midsize jet market with the addition of Bombardier Challenger 300/350 aircraft. By the end of 2025, the company aims to have around 20 of these jets in its fleet, catering to a segment experiencing significant demand.

This upgrade is part of a plan to replace older, less efficient aircraft. The Challenger 300/350s offer improved fuel efficiency and are expected to boost dispatch reliability, crucial factors for maintaining a competitive edge in this expanding sector.

Vertically Integrated MRO Services for External Clients

flyExclusive's vertically integrated MRO services extend beyond its own fleet to serve external clients, tapping into a substantial and growing market. This strategic offering positions the company for significant revenue expansion.

The global aviation MRO market is a powerhouse, with projections indicating robust growth. For instance, it was valued at approximately $90 billion in 2023 and is expected to climb to over $120 billion by 2028, demonstrating a compound annual growth rate (CAGR) of around 6.1%. This upward trend is forecast to continue, with strong demand anticipated through 2025 and beyond.

This in-house MRO capability provides flyExclusive with a distinct competitive edge. It not only ensures the highest standards for its own aircraft but also unlocks a high-growth opportunity as the demand for specialized aviation maintenance services escalates across the industry.

- Market Expansion: flyExclusive's MRO services are available to external clients, diversifying revenue streams.

- Market Size: The global aviation MRO market was valued around $90 billion in 2023.

- Growth Projection: The market is projected to exceed $120 billion by 2028, with a CAGR of approximately 6.1%.

- Competitive Advantage: In-house MRO capabilities offer superior fleet management and external service revenue.

Strategic Fleet Modernization

flyExclusive is actively modernizing its fleet, a crucial step in its strategic growth. This involves divesting 37 older, less efficient aircraft and acquiring newer models. This move is designed to boost operational performance and enhance customer experience.

The impact of this fleet upgrade is already being felt, with a noticeable increase in flight hours and improved dispatch reliability. For instance, by the end of 2024, flyExclusive aims to have over 50% of its fleet composed of newer generation aircraft. This focus on efficiency is vital for gaining a competitive edge in the private aviation market.

- Fleet Modernization: Divestment of 37 non-performing aircraft and acquisition of newer, more efficient models.

- Operational Impact: Increased flight hours and improved dispatch reliability.

- Market Strategy: Capturing market share through enhanced service and efficiency.

- 2024 Target: Over 50% of the fleet to consist of newer generation aircraft by year-end.

flyExclusive's fractional jet ownership program is a clear star, showing remarkable growth. Deposits surged from $16.7 million in 2023 to $30.3 million in 2024, with revenue for this segment rocketing from $6.0 million to $22.7 million in the same period.

The company is actively investing in this high-demand area by adding new aircraft, including Cessna Citation XLS Gen2 and Citation Longitudes, with deliveries scheduled through 2025.

The revamped Jet Club program, launched in March 2025, is another star performer. Its transparent pricing, 24-month rate lock, and absence of fuel surcharges have driven a 25% year-over-year sales increase in Q1 2025.

flyExclusive's expansion into the super-midsize market with Bombardier Challenger 300/350 aircraft, aiming for around 20 by the end of 2025, addresses a segment with significant demand and offers improved fuel efficiency.

The company's vertically integrated MRO services are also a star, tapping into a global market valued at approximately $90 billion in 2023 and projected to exceed $120 billion by 2028. This in-house capability provides a competitive edge and a high-growth revenue opportunity.

Fleet modernization, including the divestment of 37 older aircraft and acquisition of newer models, is a key star initiative. By the end of 2024, over 50% of flyExclusive's fleet will comprise newer generation aircraft, boosting operational performance and customer experience.

| Business Segment | 2023 Performance | 2024 Performance | Key Initiatives | Market Outlook |

|---|---|---|---|---|

| Fractional Jet Ownership | $16.7M Deposits | $30.3M Deposits $22.7M Revenue |

New aircraft acquisition (Cessna Citation XLS Gen2, Longitudes) | High demand |

| Jet Club Program | N/A | 25% YoY Sales Growth (Q1 2025) | Program revamp (transparent pricing, no fuel surcharges) | Expanding market for private jet access |

| Super-Midsize Jets | N/A | Targeting ~20 Challenger 300/350 by end of 2025 | Fleet expansion and modernization | Significant demand |

| MRO Services | N/A | N/A | External client services | Global MRO market ~$90B (2023), projected >$120B by 2028 (6.1% CAGR) |

| Fleet Modernization | N/A | >50% newer generation fleet by end of 2024 | Divestment of 37 older aircraft | Enhanced efficiency and dispatch reliability |

What is included in the product

The flyExclusive BCG Matrix categorizes its offerings into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on resource allocation for each category.

flyExclusive's BCG Matrix offers a clear, visual roadmap, alleviating the pain of strategic uncertainty by pinpointing growth opportunities.

Cash Cows

flyExclusive's established on-demand charter services, particularly with its substantial fleet of light and mid-size jets like the Cessna Citation, are a core revenue driver. This segment benefits from consistent demand, solidifying its position as a cash cow for the company.

Operating one of the world's largest fleets of Cessna Citation aircraft, flyExclusive leverages its scale to maintain a significant market share in the private charter sector. This strong market presence translates into predictable and reliable cash flows, even within a mature market.

The existing Jet Club memberships, representing flyExclusive's legacy program, form a significant cash cow. These loyal members contribute a stable and predictable revenue stream, reflecting a high market share within the company's established customer base.

While the focus shifts to newer initiatives, these legacy memberships continue to generate consistent cash flow. The low additional investment required for promotion, thanks to established relationships, solidifies their cash cow status. For instance, in 2024, flyExclusive reported that its legacy membership base continued to be a primary driver of recurring revenue, underscoring its mature yet highly profitable position in the market.

flyExclusive's significant footprint in the wholesale charter market, leveraging its nationwide floating fleet, positions it as a dominant player with a high market share. This strategic advantage translates into a steady stream of flight hours and predictable revenue, solidifying its role as a cash cow. In 2024, the private aviation market saw robust demand, with wholesale charter operations being a key driver for many operators.

Aircraft Management Services (Volato Agreement)

Aircraft management services, particularly through the Volato agreement, position flyExclusive with a strong market share in managing third-party fleets. This segment benefits from flyExclusive's established infrastructure, offering a consistent revenue stream. While the potential for rapid expansion to numerous new clients is limited, the service provides stable income.

The onboarding of nearly 200 Volato customers underscores the significant market penetration achieved. This strategic move leverages existing operational capabilities, transforming them into a reliable revenue generator. The focus here is on maximizing value from current resources rather than aggressive market share acquisition in new territories.

- High Market Share: flyExclusive holds a substantial position in managing external aircraft fleets, largely due to the Volato agreement.

- Steady Revenue: The service generates consistent income by utilizing existing infrastructure and expertise.

- Limited Growth Prospects: While profitable, the expansion potential to a vast number of new clients is considered moderate.

- Leveraging Infrastructure: This segment effectively monetizes flyExclusive's existing operational assets and knowledge base.

Pilot Training Center and Headquarters (Future Cash Flow)

The $30 million investment from the State of North Carolina for a new pilot training center and headquarters is a strategic move that positions flyExclusive's operational hub as a future cash cow. This significant capital injection will enable the company to internalize pilot training, a critical and ongoing operational expense.

By reducing reliance on third-party training providers, flyExclusive anticipates substantial long-term cost savings. Furthermore, the enhanced efficiency gained from in-house training can translate into improved pilot proficiency and readiness. The facility also holds the potential to generate new revenue streams by offering its advanced training services to external clients in the aviation sector.

- Investment: $30 million from the State of North Carolina.

- Strategic Benefit: Reduced reliance on external pilot training.

- Efficiency Gains: Improved pilot proficiency and operational readiness.

- Future Revenue Potential: Offering training services to other aviation entities.

flyExclusive's established on-demand charter services, particularly with its substantial fleet of light and mid-size jets like the Cessna Citation, are a core revenue driver. This segment benefits from consistent demand, solidifying its position as a cash cow for the company. Operating one of the world's largest fleets of Cessna Citation aircraft, flyExclusive leverages its scale to maintain a significant market share in the private charter sector, translating into predictable and reliable cash flows.

The existing Jet Club memberships represent a significant cash cow for flyExclusive, contributing a stable and predictable revenue stream due to a high market share within its established customer base. While the focus shifts to newer initiatives, these legacy memberships continue to generate consistent cash flow with low additional investment required for promotion. In 2024, flyExclusive reported that its legacy membership base continued to be a primary driver of recurring revenue, underscoring its mature yet highly profitable position.

flyExclusive's significant footprint in the wholesale charter market, leveraging its nationwide floating fleet, positions it as a dominant player with a high market share. This strategic advantage translates into a steady stream of flight hours and predictable revenue, solidifying its role as a cash cow. In 2024, the private aviation market saw robust demand, with wholesale charter operations being a key driver for many operators.

Aircraft management services, particularly through the Volato agreement, position flyExclusive with a strong market share in managing third-party fleets, offering a consistent revenue stream. The onboarding of nearly 200 Volato customers underscores significant market penetration, leveraging existing operational capabilities into a reliable revenue generator. This segment effectively monetizes flyExclusive's existing operational assets and knowledge base.

| Segment | BCG Category | 2024 Revenue Contribution (Estimated) | Market Share | Growth Potential |

|---|---|---|---|---|

| On-Demand Charter (Light/Mid-size Jets) | Cash Cow | High | Substantial | Mature |

| Jet Club Memberships (Legacy) | Cash Cow | High | High within base | Low |

| Wholesale Charter Operations | Cash Cow | High | Dominant | Moderate |

| Aircraft Management (Volato) | Cash Cow | Moderate to High | Strong | Moderate |

Delivered as Shown

flyExclusive BCG Matrix

The flyExclusive BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, analysis-ready BCG Matrix ready for your strategic decision-making.

Rest assured, the preview you're examining is the exact flyExclusive BCG Matrix report that will be delivered to you upon completing your purchase. This ensures you know precisely what you're acquiring: a professionally designed and insightful strategic tool, ready for immediate application in your business planning.

What you see here is the genuine flyExclusive BCG Matrix file that will be yours once you finalize your purchase. This preview guarantees that the document you download will be the complete, unedited, and professionally structured report, enabling you to leverage its insights without delay.

Dogs

flyExclusive is actively divesting its older, non-performing aircraft, a segment that significantly impacted its EBITDA. In early 2024, these legacy aircraft were costing the company as much as $3.5 million per month.

These aircraft were characterized by low dispatch availability and high operating costs, essentially acting as cash traps. Their market share was minimal, and they offered very little growth potential, making them a clear liability for the business.

The strategic goal is to phase out the majority of these underperforming assets by the middle of 2025, streamlining operations and improving overall financial performance.

The termination of guaranteed revenue programs, notably the one with Wheels Up, marks a significant shift for flyExclusive. These programs, which previously contributed a substantial portion of the company's income, were discontinued, indicating they were likely unsustainable or unprofitable under their existing structures.

The divestiture of these programs, despite their past revenue generation, classifies them as 'dogs' within the BCG matrix framework. This classification highlights their drag on the company's financial performance, suggesting that flyExclusive is prioritizing more robust and profitable revenue streams moving forward.

flyExclusive, in its early days as a public entity, experienced substantial outside consulting expenses. These costs reached a high point of over $1.3 million monthly during the first quarter of 2024.

While these expenditures were crucial for the company's transition, they represent an area with limited direct financial return and no contribution to market share. This lack of profitability firmly places these consulting expenses in the 'dog' category within the BCG matrix framework.

The company has since made significant efforts to curb these costs, reflecting a strategic move to improve overall financial efficiency.

Certain Less Efficient Light Jet Operations

Certain less efficient light jet operations within flyExclusive's fleet, particularly older Cessna Citation models, could be classified as 'dogs' in a BCG matrix analysis. These aircraft might exhibit lower utilization rates and higher operational costs compared to newer, more fuel-efficient models. For instance, a light jet with significantly higher maintenance expenses per flight hour, coupled with lower charter demand due to its age or capabilities, would represent a 'dog' asset.

flyExclusive's stated focus on improving dispatch reliability across its fleet indicates that some aircraft or operational segments may have been underperforming. This suggests that certain light jet operations might be consuming resources without generating commensurate returns. In 2024, the private aviation sector saw continued demand, but operational efficiency remains a key differentiator for profitability.

- Underperforming Assets: Older Cessna Citation light jets with higher maintenance costs and lower fuel efficiency.

- Low Market Share/Growth: These specific aircraft may have a smaller share of the high-demand charter market compared to newer fleet members.

- Operational Challenges: Potential issues with dispatch reliability or higher operational expenditures per flight hour.

- Strategic Review: flyExclusive's focus on fleet modernization and reliability improvements suggests a proactive approach to addressing such 'dog' assets.

Underutilized Aircraft Assets Prior to Divestment

Before flyExclusive’s fleet modernization, aircraft that were frequently grounded or not generating enough revenue were considered ‘dogs’ in the BCG matrix. These assets, while part of the fleet, were not contributing significantly to market share or profitability. For instance, in early 2024, a portion of the older light jet fleet experienced lower utilization rates, potentially falling into this category.

The company's strategic focus on enhancing aircraft utilization and improving dispatch reliability directly tackles the ‘dog’ asset issue. By optimizing flight schedules and maintenance, flyExclusive aims to convert these underperforming assets into more productive contributors. This proactive approach is crucial for maximizing the return on its aviation investments.

- Low Utilization: Aircraft with less than 200 flight hours per quarter were flagged as potential dogs.

- Revenue Generation: Assets failing to meet a minimum revenue threshold of $50,000 per month were scrutinized.

- Fleet Modernization Impact: The introduction of newer, more efficient aircraft in 2024 is expected to reduce the number of dog assets by at least 15%.

- Operational Efficiency Gains: flyExclusive reported a 10% increase in overall fleet utilization in Q1 2024, indicating progress in addressing underutilized assets.

flyExclusive is strategically divesting older, underperforming aircraft, which were a significant drain on its finances. These legacy planes, costing up to $3.5 million monthly in early 2024, suffered from low dispatch availability and high operating expenses, acting as cash traps with minimal market share and growth potential.

The company's decision to terminate revenue programs, such as the one with Wheels Up, further classifies these as 'dogs' in the BCG matrix. This move signals a pivot towards more profitable and sustainable revenue streams, shedding liabilities that hindered financial performance.

Even certain consulting expenses, exceeding $1.3 million monthly in Q1 2024, are categorized as 'dogs' due to their limited direct financial return and lack of market share contribution, although they were deemed necessary for the company's transition.

Older light jets, like certain Cessna Citation models, with lower utilization rates and higher operational costs, also fall into the 'dog' category. These aircraft represent assets that consume resources without generating commensurate returns, especially in a competitive market where operational efficiency is key.

| Asset Type | BCG Category | Key Characteristics | Financial Impact (Early 2024) | Strategic Action |

|---|---|---|---|---|

| Legacy Aircraft | Dogs | Low dispatch availability, high operating costs | -$3.5 million/month | Divestiture |

| Terminated Revenue Programs (e.g., Wheels Up) | Dogs | Unsustainable or unprofitable structures | N/A (program discontinued) | Divestiture |

| Consulting Expenses | Dogs | Limited direct financial return, no market share contribution | >$1.3 million/month | Cost Reduction Efforts |

| Older Light Jets (e.g., Cessna Citation) | Dogs | Lower utilization, higher maintenance/fuel costs | N/A (specific data varies) | Fleet Modernization |

Question Marks

flyExclusive's strategic push into new geographies, specifically bolstering its Southeast presence with 15 additional jets, positions it as a question mark within the BCG matrix. This expansion targets a high-growth market for private aviation, a sector that saw significant demand increases in 2024.

While the Southeast is a burgeoning market, flyExclusive's current market share on these newly established routes is nascent. This necessitates substantial investment in marketing, operations, and brand building to capture a meaningful share, a common characteristic of question mark entities needing capital to prove their potential.

flyExclusive has introduced a new premium jet card program focused on super-midsize aircraft, specifically utilizing their Challenger 300 and Challenger 350 models. This move targets a segment experiencing significant growth within the private aviation market. The super-midsize category saw a notable increase in demand, with charter hours for these aircraft rising by approximately 15% year-over-year through Q3 2024, according to industry reports.

While the super-midsize market itself is expanding, the actual market penetration and long-term success of this particular new jet card offering remain uncertain. This positions it as a question mark within flyExclusive's portfolio, necessitating strategic investment to build brand awareness and secure customer adoption in a competitive landscape.

The potential merger with Jet.AI's aviation division is a significant question mark for flyExclusive within the BCG Matrix. This strategic move, aimed at bolstering flyExclusive's capital and customer base, introduces inherent integration risks. The success of this acquisition hinges on effectively merging operations and achieving projected market share gains and profitability, which remain uncertain as of mid-2025.

New Technology Integration (e.g., Digital Booking Platform Upgrades)

Investments in new technology, like flyExclusive's upgraded digital booking platform, position them within the question mark quadrant of the BCG matrix. This reflects their commitment to high-growth areas such as digital transformation within the aviation sector. While the potential for enhanced real-time scheduling and customer experience is significant, the direct, quantifiable impact on market share and immediate profitability is still unfolding, necessitating ongoing investment and strategic evaluation.

The aviation industry saw significant digital booking growth in 2024, with many companies investing heavily in platform upgrades to streamline operations and improve customer engagement. For flyExclusive, this means their digital booking platform is a strategic investment in a rapidly evolving market. The challenge lies in translating this technological advancement into a clear competitive advantage and increased revenue streams, which is typical for question mark assets.

- High Growth Potential: Digital transformation in aviation is a key growth driver, with platforms like flyExclusive's aiming to capture this market.

- Uncertain Market Share Impact: While promising, the exact effect of the upgraded platform on flyExclusive's market share is still being determined.

- Ongoing Investment Required: Continued financial commitment is necessary to fully realize the benefits and competitive edge of the new technology.

- Developing Profitability: The direct contribution of the digital booking platform to overall profitability is in its nascent stages, requiring further development and market traction.

Leveraging Russell 2000 Index Inclusion for Capital Raising

flyExclusive anticipates potential inclusion in the Russell 2000 Index by June 2025, a move designed to boost trading volume and liquidity. This increased market presence could significantly support capital raising initiatives, making it easier to attract investors and secure necessary funding for growth. The company is positioning itself to leverage this potential index inclusion to enhance its financial flexibility and pursue strategic expansion opportunities.

The actual impact of Russell 2000 inclusion on flyExclusive's market share and sustained growth remains a key consideration. While enhanced visibility and liquidity are expected benefits, the company must strategically deploy any capital raised to translate these advantages into tangible market gains and long-term development. Effective utilization of increased capital will be crucial for realizing the full potential of index inclusion.

- Increased Liquidity: Inclusion in the Russell 2000 typically leads to higher trading volumes, making it easier for investors to buy and sell shares.

- Enhanced Visibility: Being part of a widely tracked index like the Russell 2000 can attract greater attention from institutional investors and analysts.

- Capital Raising Support: The improved market profile and liquidity can make it more attractive and feasible for flyExclusive to raise additional capital through equity or debt offerings.

- Strategic Fund Deployment: The success of capital raising will hinge on flyExclusive's ability to effectively invest the funds in areas that drive market share growth and operational improvements.

Question marks represent business units or strategic initiatives with low market share in high-growth markets. These ventures require significant investment to grow their market share and eventually become stars. Without proper strategic direction and capital infusion, they risk becoming dogs.

flyExclusive's expansion into new Southeast markets and the launch of its super-midsize jet card program exemplify question marks. These initiatives are in a growing sector but have not yet established a dominant market position.

The company's investment in a new digital booking platform and the potential merger with Jet.AI's aviation division also fall into this category. Both are aimed at high-growth areas but their ultimate impact on market share and profitability is still uncertain.

Potential inclusion in the Russell 2000 index is another question mark, offering enhanced visibility and liquidity that could support capital raising for these growth initiatives. The success of these question marks hinges on strategic execution and effective capital deployment.

| Initiative | Market Growth | Current Market Share | Strategic Focus | Potential Outcome |

|---|---|---|---|---|

| Southeast Expansion | High | Low | Capture nascent demand, build brand | Star or Dog |

| Super-Midsize Jet Card | High | Low | Target premium segment, gain adoption | Star or Dog |

| Digital Booking Platform | High | Low | Enhance customer experience, streamline operations | Star or Dog |

| Jet.AI Merger | High (potential) | Low (potential) | Bolster capital and customer base, integration risk | Star or Dog |

| Russell 2000 Inclusion | N/A (Market Indicator) | N/A | Increase liquidity and visibility for capital raising | Facilitate growth of other initiatives |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.