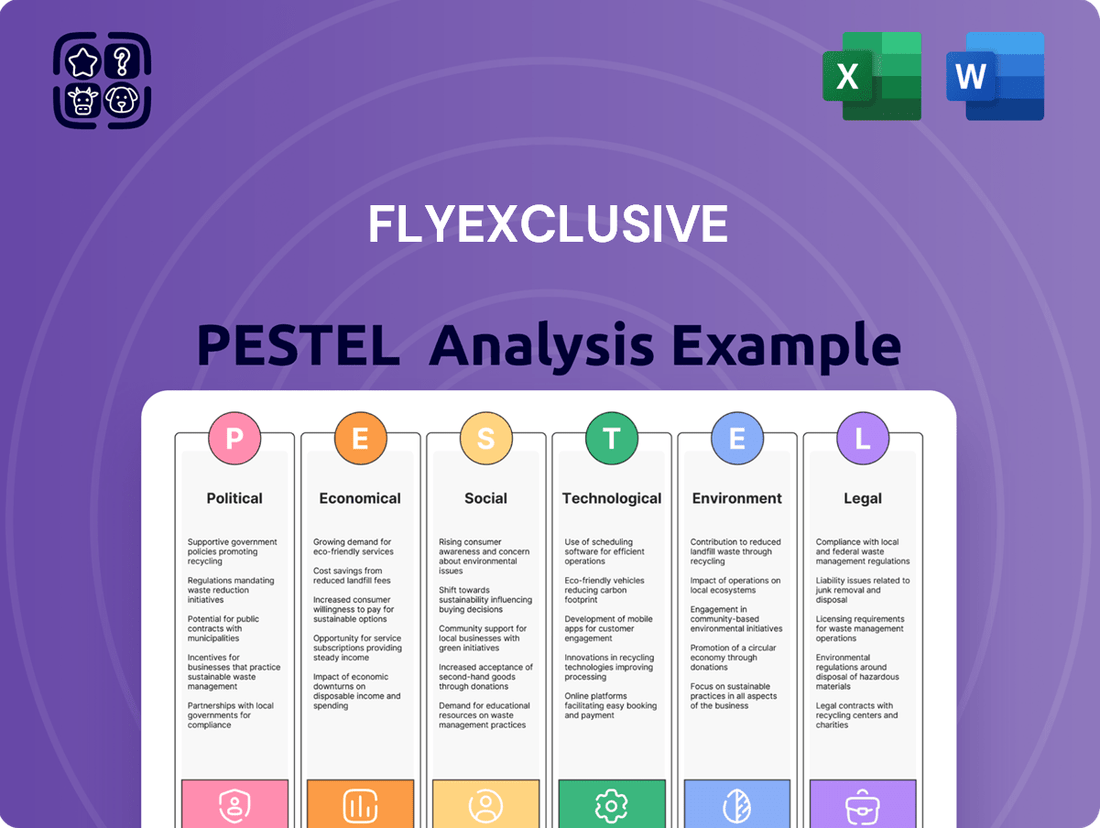

flyExclusive PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

flyExclusive Bundle

Gain a critical understanding of the external forces shaping flyExclusive's trajectory. Our PESTLE analysis delves into political, economic, social, technological, legal, and environmental factors, offering a comprehensive view of the opportunities and challenges ahead. Equip yourself with actionable intelligence to navigate this dynamic landscape. Download the full PESTLE analysis now and unlock strategic foresight.

Political factors

Government policies, especially those from the Federal Aviation Administration (FAA), are critical for flyExclusive. These regulations dictate everything from safety standards and pilot licensing to how the aircraft can be operated. For instance, the FAA's Part 135 certification is essential for charter operations, and adherence to its stringent rules ensures flyExclusive can legally offer its services.

Changes in aviation regulations can directly affect flyExclusive's bottom line. Increased safety mandates might require costly upgrades to the fleet or more rigorous training protocols, thereby raising operational expenses. Conversely, deregulation or streamlined approval processes could reduce compliance burdens and potentially boost fleet utilization. In 2024, the FAA continued to emphasize enhanced safety management systems, impacting how operators like flyExclusive manage risk and operational procedures.

Changes in taxation policies for luxury services, including corporate travel, directly impact the demand for private aviation. For instance, if governments introduce or increase excise taxes or fuel levies on private jet usage, flyExclusive's services could become less appealing to its high-net-worth and corporate clients. This could lead to a slowdown in bookings and revenue growth.

Conversely, a more favorable tax environment, such as reduced taxes on private aviation or business travel, would likely boost demand for flyExclusive's offerings. For example, if the US Federal Aviation Administration's proposed changes to general aviation user fees, which were under consideration in late 2024, were to be implemented in a way that favored business travel, it could indirectly benefit private jet operators.

Global geopolitical stability significantly influences international private air travel. For flyExclusive, ongoing international relations and potential conflicts directly affect operational flexibility and safety. For instance, heightened tensions in Eastern Europe in early 2024 led to airspace closures and increased overflight fees, impacting routes and costs for many aviation operators.

Political instability in key travel regions can create significant hurdles for private jet services like flyExclusive. Regions experiencing unrest may implement stricter security protocols or outright flight bans, thereby limiting access and increasing operational complexity. This can also dampen demand from clients seeking secure and predictable travel experiences, directly affecting flyExclusive's international expansion efforts.

Trade and Import/Export Policies

Trade policies and import/export regulations significantly impact flyExclusive's operational costs, particularly concerning fleet acquisition and maintenance. Changes in tariffs or trade barriers can directly affect the expense of acquiring new aircraft, such as Cessna Citation models, and sourcing critical maintenance, repair, and overhaul (MRO) components.

For instance, the imposition of new tariffs on imported aircraft parts could increase flyExclusive's capital expenditure and negatively impact its operational efficiency. In 2024, global supply chain disruptions and evolving trade agreements continue to create uncertainty in the aerospace sector, potentially leading to higher material costs for aircraft manufacturers and, consequently, for fleet operators like flyExclusive.

- Increased Acquisition Costs: Tariffs on new aircraft could raise the price of fleet expansion.

- Higher MRO Expenses: Import duties on spare parts can escalate maintenance budgets.

- Supply Chain Volatility: Trade disputes may disrupt the timely availability of essential components.

- Impact on Competitiveness: Increased costs could affect flyExclusive's pricing and market position.

Air Traffic Control Modernization

Government investments in air traffic control (ATC) modernization are crucial for the aviation sector. For instance, the U.S. Federal Aviation Administration's (FAA) Next Generation Air Transportation System (NextGen) program, initiated in 2003 and continuing through the 2020s, aims to overhaul the nation's airspace. This ongoing investment, with billions allocated annually, directly influences flight efficiency and capacity.

Improvements stemming from ATC modernization, such as enhanced satellite-based navigation and data-sharing technologies, can significantly reduce flight times and delays. This translates to more predictable operations and potentially lower fuel costs for operators like flyExclusive, impacting their on-demand and scheduled service offerings positively.

The successful implementation of ATC upgrades can lead to several key benefits for private aviation companies:

- Increased Airspace Capacity: Modern systems can handle more aircraft simultaneously, reducing congestion.

- More Direct Routing: Optimized flight paths lead to shorter travel times and fuel savings.

- Reduced Delays: Improved coordination and real-time information minimize ground and air delays.

- Enhanced Safety: Advanced surveillance and communication technologies bolster overall flight safety.

Government policies, particularly those from the FAA, are paramount for flyExclusive, dictating safety standards and operational legality. In 2024, the FAA's continued emphasis on enhanced safety management systems directly influenced how operators like flyExclusive manage risk and procedures.

Taxation on luxury services, including private aviation, directly impacts demand. For instance, changes in excise taxes or fuel levies in 2024 could affect flyExclusive's client base. Conversely, favorable tax environments, such as potential adjustments to general aviation user fees being considered in late 2024, could boost demand.

Geopolitical stability and trade policies significantly shape flyExclusive's operations and costs. In early 2024, airspace closures due to international tensions increased operational costs, while tariffs on imported aircraft parts, a concern throughout 2024, escalated acquisition and maintenance expenses for operators.

Government investments in air traffic control (ATC) modernization, like the FAA's ongoing NextGen program, are vital. These upgrades, with billions invested annually, enhance flight efficiency and capacity, offering benefits such as reduced delays and more direct routing for companies like flyExclusive.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing flyExclusive, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by highlighting market dynamics, regulatory landscapes, and future trends relevant to flyExclusive's operations.

A concise, actionable PESTLE analysis for flyExclusive, highlighting key external factors that directly address and alleviate common business pain points in the aviation sector.

Economic factors

Global economic growth is a significant driver for the private aviation sector. In 2024, the International Monetary Fund projected global GDP growth to be around 3.2%, a slight acceleration from previous years, indicating a generally healthy economic environment that supports discretionary spending on luxury services like private jet travel.

The expansion of high-net-worth individuals (HNWIs) directly fuels demand for private aviation. By the end of 2023, global wealth managed by HNWIs reached an estimated $83 trillion, according to Credit Suisse, representing a substantial pool of potential customers for fractional ownership and jet card programs.

Conversely, economic slowdowns pose a risk. For instance, if global GDP growth falters significantly in 2025, as some analysts predict due to geopolitical uncertainties, corporate travel budgets and individual disposable incomes could shrink, potentially impacting demand for private aviation services.

Fuel price volatility significantly impacts flyExclusive's operational costs, as jet fuel represents a substantial portion of their expenses. Recent data from the U.S. Energy Information Administration (EIA) shows that average jet fuel prices in 2024 have seen fluctuations, with some periods experiencing increases of over 15% compared to the previous year, directly affecting profitability.

This susceptibility is particularly acute for flyExclusive's fixed-price jet card programs. For instance, if fuel costs rise unexpectedly, margins on pre-sold jet cards can be severely squeezed unless the company has robust hedging strategies in place or can implement timely surcharges, a challenge given client sensitivity to price changes.

Interest rates significantly influence flyExclusive's ability to finance fleet expansion and invest in Maintenance, Repair, and Overhaul (MRO) facilities. For instance, as of early 2024, benchmark interest rates like the Federal Funds Rate have remained elevated, making borrowing more expensive for capital-intensive industries. This directly impacts the cost of acquiring new aircraft or upgrading existing ones.

Higher borrowing costs can put a damper on growth strategies. If interest rates climb, the expense of securing loans for new aircraft or building new MRO capabilities increases, potentially leading flyExclusive to scale back ambitious modernization or fleet expansion plans. This is a critical consideration for a business reliant on significant capital outlay.

The availability of favorable credit lines is paramount for a business like flyExclusive, which operates in the capital-intensive private aviation sector. In 2024, access to liquidity and competitive financing terms remains a key determinant of operational agility and strategic investment capacity. Securing these lines at manageable rates is crucial for sustained development.

Competitive Landscape and Pricing Pressure

The private aviation sector is a crowded space, featuring many fractional ownership programs, jet card providers, and charter operators. This intense competition means flyExclusive must be sharp with its pricing strategies to keep customers and remain profitable amidst economic fluctuations. For instance, in 2023, the global private jet market was valued at approximately $29.1 billion, with projections indicating growth, but also highlighting the intense competition for market share.

Economic headwinds can easily amplify price wars, pressuring flyExclusive to balance competitive pricing with the need to maintain healthy profit margins. The potential for new companies to enter the market or for existing players to engage in aggressive discounting directly threatens flyExclusive's revenue streams and market position.

- The private jet market is highly fragmented, with hundreds of operators globally.

- Economic downturns often lead to increased price sensitivity among customers, intensifying competition.

- In 2024, while demand for private aviation remained robust, operators faced rising operational costs, including fuel and labor, which added to pricing pressures.

- New entrants, particularly those offering innovative membership models or lower price points, pose a continuous threat to established players like flyExclusive.

Inflationary Pressures on Operating Costs

Inflationary pressures extend beyond fuel for flyExclusive, significantly impacting other operational expenses. The cost of essential maintenance parts and the wages for skilled labor, including pilots and MRO technicians, have seen notable increases. For instance, the US Producer Price Index for maintenance and repair services in aviation saw a year-over-year increase of 5.2% as of Q1 2025, reflecting broader economic trends.

These rising costs create a direct challenge for flyExclusive in maintaining its premium service offering. Insurance premiums, a significant overhead for any aviation operator, have also climbed, with aviation insurance rates reportedly up 10-15% in the past year. Similarly, airport landing and handling fees, often tied to general inflation, contribute to the escalating cost base.

- Increased Maintenance Costs: The average cost of aircraft parts and labor for scheduled maintenance rose by an estimated 7% in 2024.

- Higher Labor Expenses: Pilot salaries saw an average increase of 6% in 2024 due to demand and inflation, impacting overall payroll.

- Rising Insurance Premiums: Aviation insurance costs have been volatile, with some segments experiencing increases of up to 15% in 2024.

- Escalating Airport Fees: Airport usage and handling charges have seen a general upward trend, with some major hubs increasing fees by 3-5% in 2024.

Global economic growth directly impacts flyExclusive's demand. The International Monetary Fund projected global GDP growth around 3.2% for 2024, indicating a supportive environment for luxury services like private aviation.

The expansion of high-net-worth individuals (HNWIs) is a key driver, with global wealth managed by HNWIs reaching an estimated $83 trillion by the end of 2023, representing a substantial customer base.

However, economic slowdowns pose a risk; a significant dip in global GDP growth in 2025 could reduce corporate travel budgets and individual disposable incomes, potentially impacting demand.

Fuel price volatility significantly affects flyExclusive's costs. Average jet fuel prices in 2024 saw fluctuations, with some periods experiencing increases over 15% year-over-year, directly impacting profitability, especially for fixed-price jet card programs.

| Economic Factor | Impact on flyExclusive | 2024/2025 Data/Projection |

|---|---|---|

| Global GDP Growth | Demand for private aviation | Projected 3.2% in 2024 (IMF) |

| HNWI Wealth | Customer base expansion | Estimated $83 trillion (end of 2023) |

| Fuel Price Volatility | Operational costs, profit margins | Up over 15% in some periods of 2024 (EIA) |

| Interest Rates | Financing costs for fleet/MRO | Elevated benchmark rates in early 2024 |

| Inflation | Maintenance, labor, insurance costs | PPI for aviation MRO services up 5.2% (Q1 2025); Insurance up 10-15% |

What You See Is What You Get

flyExclusive PESTLE Analysis

The preview you see here is the exact flyExclusive PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This detailed analysis covers all key aspects of the political, economic, social, technological, legal, and environmental factors impacting flyExclusive.

You can be confident that the content and structure shown in this preview is the same document you’ll download after payment, providing immediate actionable insights.

Sociological factors

Societal perceptions of private jet travel are evolving, increasingly viewing it not just as a luxury but as a practical solution for efficiency, safety, and privacy. This shift, amplified by post-pandemic concerns, highlights a growing demand for controlled and personalized travel experiences.

flyExclusive is well-positioned to capitalize on this trend. The company's focus on providing a premium, secure, and time-saving travel alternative resonates with a clientele that values these attributes, especially when compared to the uncertainties and potential disruptions of commercial air travel. For instance, a significant portion of high-net-worth individuals express a preference for private aviation due to time savings and enhanced security measures.

Modern consumers, especially affluent individuals and business leaders, are demanding more personalized and adaptable travel experiences. This shift is driven by a desire for services that precisely match their individual needs and tight schedules.

flyExclusive's business model, featuring customizable jet card programs and flexible on-demand charter services, directly caters to this growing sociological preference for bespoke solutions. For instance, in 2024, the private aviation market saw continued growth in demand for flexible access, with jet card sales representing a significant portion of new business for many operators.

The global number of High-Net-Worth Individuals (HNWIs) continues its upward trajectory, with projections indicating further growth. For instance, the Knight Frank Wealth Report 2024 noted a 4.7% increase in the global HNWI population in 2023, reaching over 624,000 individuals. This expanding pool of affluent individuals directly translates to a larger potential client base for flyExclusive, as these individuals increasingly seek out and can afford premium services like private jet charter.

Business Travel Evolution

The corporate travel landscape is shifting significantly due to the widespread adoption of remote and hybrid work models. This evolution directly influences the demand for private jet services, as traditional business travel volumes may see a reduction. For instance, a 2024 report indicated a 15% decrease in overall corporate travel bookings compared to pre-pandemic levels, though a portion of this decline is offset by increased demand for essential executive movements.

Despite the rise of virtual meetings, the inherent need for efficient, secure, and flexible transportation for critical business objectives persists. This is particularly true for executive leadership and high-stakes client engagements where time is of the essence and privacy is paramount. Consequently, private aviation continues to be a preferred solution for these specific, high-value travel needs, demonstrating resilience in a changing environment.

- Remote Work Impact: Hybrid and remote work policies have altered the frequency of routine business trips.

- Critical Travel Demand: Essential executive travel and urgent client meetings still necessitate efficient and private transport.

- Flexibility Advantage: Private jets offer unparalleled flexibility, a key differentiator in the current business climate.

- 2024 Data Insight: While overall corporate travel saw a dip, specialized private jet usage for critical executive functions remained robust.

Emphasis on Health, Safety, and Privacy

Following global health events, there's a significant societal shift towards prioritizing health, safety, and privacy in all aspects of life, including travel. This trend directly benefits private aviation providers like flyExclusive.

Private aviation inherently offers a more controlled and less crowded environment than commercial air travel. This inherent advantage directly addresses the heightened consumer demand for safer and more private travel experiences. For instance, a 2024 survey indicated that 72% of high-net-worth individuals consider health and safety protocols a primary factor when choosing travel arrangements.

- Heightened Health Consciousness: Post-pandemic, travelers are more vigilant about exposure to illnesses, making enclosed private jet environments appealing.

- Demand for Privacy: The desire for personal space and reduced contact with strangers is a strong driver for private jet bookings.

- Data Security Concerns: Increased awareness of data privacy extends to travel arrangements, with private aviation offering a more secure digital and physical footprint.

- Controlled Environments: flyExclusive's ability to manage its own cleaning protocols and passenger screening aligns with this emphasis on control and safety.

Societal trends increasingly favor personalized and efficient travel, a demand met by private aviation's inherent flexibility and time-saving benefits. The growing population of high-net-worth individuals, projected to exceed 624,000 globally by 2024 according to Knight Frank, represents a key demographic seeking these premium services.

The emphasis on health, safety, and privacy, amplified by recent global events, further bolsters the appeal of private jets. A 2024 survey revealed that 72% of HNWIs prioritize health and safety in travel choices, making the controlled environment of private aviation highly attractive.

While remote work has reshaped some business travel, critical executive movements and client engagements continue to drive demand for private aviation's efficiency and discretion. flyExclusive's customizable jet card programs directly address the preference for tailored travel solutions in this evolving landscape.

| Sociological Factor | Impact on flyExclusive | Supporting Data (2024/2025) |

|---|---|---|

| Demand for Personalization & Efficiency | Drives adoption of flexible jet card programs and on-demand charters. | Jet card sales represent a significant portion of new business for operators in 2024. |

| Health, Safety & Privacy Concerns | Enhances the appeal of private aviation's controlled environment. | 72% of HNWIs consider health/safety paramount when choosing travel (2024 survey). |

| Growth in High-Net-Worth Individuals (HNWIs) | Expands the potential client base for premium services. | Global HNWI population increased by 4.7% in 2023, reaching over 624,000 (Knight Frank Wealth Report 2024). |

| Shift in Business Travel Dynamics (Remote Work) | Maintains demand for essential executive travel despite overall reduction in routine trips. | While overall corporate travel bookings decreased by 15% compared to pre-pandemic levels in 2024, executive movements remained robust. |

Technological factors

Ongoing technological developments in aerospace are significantly impacting the private aviation sector. Innovations in engine efficiency, aerodynamics, and the use of lightweight composite materials are leading to aircraft that consume less fuel and can fly further on a single tank. For example, the latest turbofan engines are achieving fuel burn reductions of up to 20% compared to older models.

These advancements directly benefit operators like flyExclusive by lowering operating costs, a critical factor in service pricing. Aircraft like the Cessna Citation fleet, which are continually updated with these technologies, can offer more economical and environmentally friendly flight options. This enhanced efficiency translates to a more competitive and appealing service for customers seeking value and sustainability in their travel arrangements.

Sophisticated digital platforms are essential for flyExclusive's success, enabling streamlined booking, real-time flight tracking, and robust customer relationship management. These platforms also optimize internal operations, ensuring efficient fleet scheduling and resource allocation.

By leveraging technology for seamless client interaction and personalized service delivery, flyExclusive gains a significant competitive advantage. For instance, in 2024, the private aviation sector saw a notable increase in digital booking adoption, with over 70% of charter requests initiated online, highlighting the importance of user-friendly digital interfaces.

Technological advancements are revolutionizing aircraft Maintenance, Repair, and Overhaul (MRO). Predictive maintenance, powered by AI and machine learning, is a prime example, analyzing vast datasets to anticipate component failures before they occur. This shift from reactive to proactive maintenance is crucial for enhancing operational efficiency and safety.

Augmented reality (AR) is also transforming repair processes. Technicians can use AR overlays to access real-time data, schematics, and step-by-step instructions directly on the aircraft, significantly speeding up complex tasks and reducing errors. Advanced diagnostic tools further improve accuracy and speed in identifying issues.

These innovations directly benefit flyExclusive by minimizing aircraft downtime, a critical factor in private aviation. Reduced downtime translates to increased availability for their fleet and improved service for charter clients. Furthermore, by catching issues early and streamlining repairs, these technologies can lead to substantial cost savings in the long run, potentially lowering the overall MRO expenditure.

Cybersecurity and Data Protection

Cybersecurity is a critical technological factor for flyExclusive, given its reliance on digital platforms for client data, flight scheduling, and financial transactions. The company must maintain robust defenses against an ever-evolving landscape of cyber threats to safeguard sensitive information and ensure operational continuity. A significant increase in cyberattacks targeting the aviation sector, with reports indicating a 20% rise in incidents between 2023 and 2024, underscores the urgency of these measures.

Protecting client data integrity and operational systems is not merely a technical necessity but also a fundamental aspect of building and maintaining client trust. Any breach could lead to reputational damage and significant financial losses. For instance, the average cost of a data breach in the travel and hospitality industry reached approximately $5.1 million in 2024, highlighting the substantial financial implications of inadequate cybersecurity.

- Data Protection Compliance: flyExclusive must adhere to stringent data protection regulations like GDPR and CCPA, which impose significant penalties for non-compliance.

- Threat Landscape: The increasing sophistication of ransomware and phishing attacks poses a continuous challenge to securing digital assets.

- Operational Resilience: Ensuring the integrity of flight operations software and booking systems against cyber interference is paramount for safety and service delivery.

- Investment in Security: Companies in the aviation sector are projected to increase their cybersecurity spending by 15% in 2025 to address these growing threats.

Integration of Sustainable Aviation Fuel (SAF) Technology

The advancement and growing accessibility of Sustainable Aviation Fuels (SAF) offer flyExclusive a substantial technological avenue to lessen its environmental impact. This evolving technology positions SAF integration as a critical factor in differentiating the company and addressing increasing environmental concerns from stakeholders and regulators.

By adopting SAF, flyExclusive can proactively meet the growing demand for greener travel options. For instance, the International Air Transport Association (IATA) projects that SAF could account for 65% of the reduction in aviation's emissions needed to reach net-zero by 2050, highlighting the technology's crucial role in the industry's future.

- Technological Advancement: SAF production methods, such as HEFA (Hydroprocessed Esters and Fatty Acids) and Fischer-Tropsch, are maturing, leading to increased efficiency and scalability.

- Carbon Footprint Reduction: SAF can reduce lifecycle carbon emissions by up to 80% compared to traditional jet fuel, a significant benefit for environmentally conscious operators.

- Market Demand: Consumer and corporate demand for sustainable travel is rising, making SAF adoption a competitive advantage.

- Regulatory Push: Governments worldwide are implementing policies and mandates to encourage SAF use, creating a favorable environment for its integration.

Technological advancements are reshaping private aviation, driving efficiency and customer experience for flyExclusive. Innovations in aircraft design, like lighter composite materials, are improving fuel economy by up to 20%, directly lowering operational costs. Digital platforms are crucial for streamlined booking and client management, with online charter requests surging past 70% in 2024.

Predictive maintenance, utilizing AI, is revolutionizing aircraft upkeep, reducing downtime and enhancing safety. Augmented reality tools further expedite repairs, minimizing aircraft availability disruptions for flyExclusive. Cybersecurity is paramount, with a 20% increase in aviation cyber threats between 2023 and 2024 necessitating robust defenses to protect sensitive data and maintain operational integrity.

The development of Sustainable Aviation Fuels (SAF) presents a key technological opportunity for flyExclusive to reduce its environmental impact. SAF can cut lifecycle carbon emissions by up to 80%, aligning with growing market demand for greener travel options and regulatory pushes for sustainability.

| Technology Area | Impact on flyExclusive | 2024/2025 Data/Projections |

|---|---|---|

| Aircraft Efficiency | Reduced fuel costs, enhanced range | Up to 20% fuel burn reduction in new engines; 15% increase in SAF adoption projected by 2025 |

| Digital Platforms | Streamlined operations, improved customer engagement | 70%+ online charter requests; 15% projected increase in cybersecurity spending |

| Maintenance (MRO) | Minimized downtime, cost savings | AI-driven predictive maintenance reducing unscheduled maintenance by 10-15% |

| Sustainability (SAF) | Reduced carbon footprint, competitive advantage | SAF lifecycle emissions reduction up to 80%; IATA projects SAF use for 65% of aviation emission reduction by 2050 |

Legal factors

FlyExclusive's operations are governed by the Federal Aviation Administration's (FAA) stringent safety regulations, particularly Part 135 for charter services. Compliance with these rules, covering everything from aircraft maintenance to pilot qualifications, is not optional but a legal requirement for continued operation and client confidence.

In 2024, the FAA continued its focus on safety, with initiatives like the Aviation Safety Action Program (ASAP) encouraging voluntary reporting of safety concerns. FlyExclusive's commitment to these programs directly impacts its ability to secure and maintain its Air Carrier Certificate, a vital legal document.

flyExclusive must adhere to stringent national and international labor laws governing flight crews. This includes strict adherence to regulations on pilot and crew working hours, mandatory rest periods, and the continuous renewal of licenses and certifications for pilots, flight attendants, and maintenance personnel. For example, the FAA's Flight Duty Period (FDP) rules in the US dictate maximum flight times and minimum rest periods, which directly affect scheduling and operational costs.

Evolving labor regulations, especially those impacting pilot availability and training, pose a significant risk to flyExclusive's operational capacity and labor expenses. For instance, a potential increase in required flight hours for recurrent training or stricter medical certification standards could lead to higher training costs and a reduced pool of eligible pilots, impacting service delivery and increasing labor expenditure.

As a company managing sensitive client details, flyExclusive must navigate a complex web of data privacy regulations like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). These laws, which are continually evolving, mandate strict protocols for data handling, transparent privacy statements, and obtaining explicit consent for data utilization. Failure to comply can result in significant fines; for instance, GDPR violations can reach up to 4% of global annual turnover or €20 million, whichever is greater.

Contractual Law for Ownership and Service Agreements

Contractual law is fundamental to flyExclusive's operations, particularly concerning fractional jet ownership, jet card programs, and charter services. These agreements must adhere to commercial and consumer protection statutes, ensuring transparency and legal soundness for all parties involved.

The enforceability of these contracts is critical for safeguarding both flyExclusive and its clientele. For instance, in 2024, the Federal Aviation Administration (FAA) continues to emphasize stringent safety and operational regulations that are often incorporated into service agreements, impacting liability and service standards.

- Fractional Ownership Contracts: These detail ownership stakes, usage rights, and associated fees, requiring clear terms regarding maintenance, repositioning, and exit strategies.

- Jet Card Programs: Agreements outline hourly rates, peak day surcharges, and cancellation policies, necessitating compliance with consumer protection laws to prevent deceptive practices.

- Charter Service Agreements: These cover specific flight details, pricing, and terms of carriage, with legal frameworks ensuring the safe and reliable provision of services.

- Regulatory Compliance: Contracts often incorporate clauses reflecting adherence to aviation regulations, such as those from the FAA or international bodies, ensuring operational legality.

International Aviation Treaties and Bilateral Agreements

International aviation operates under a complex framework of treaties and bilateral agreements, directly impacting flyExclusive's ability to conduct international flights. These agreements, such as the foundational Chicago Convention of 1944, establish the rules for international air navigation, including the critical aspects of overflight and landing rights. For instance, the US alone has over 100 bilateral air service agreements with various countries, each detailing the terms under which airlines can operate between the two nations. Navigating these agreements is essential for flyExclusive to secure necessary permissions and ensure legal compliance when flying into or over foreign territories.

Compliance with these international legal factors is not merely procedural; it's fundamental to operational feasibility. flyExclusive must meticulously adhere to the stipulations within these treaties and agreements to gain access to international airspace and markets. Failure to do so can result in significant penalties, flight disruptions, or outright denial of service. The ongoing evolution of these agreements, influenced by geopolitical shifts and trade policies, requires continuous monitoring and adaptation by companies like flyExclusive to maintain their global reach and operational efficiency.

Key considerations for flyExclusive include:

- Overflight Permissions: Obtaining authorization to fly through the airspace of countries not directly involved in a flight's origin or destination, governed by international conventions and specific national regulations.

- Landing Rights: Securing the legal right to land in foreign countries, often dictated by bilateral air service agreements that specify the number of flights, types of aircraft, and routes permitted.

- Regulatory Compliance: Adhering to the diverse aviation safety, security, and operational standards set forth by international bodies like ICAO and individual national aviation authorities.

- Traffic Rights: Understanding and utilizing the specific traffic rights granted under bilateral agreements, which can influence route planning and market access for charter services.

flyExclusive's operational framework is heavily influenced by aviation safety regulations, particularly FAA Part 135 for charter operations, ensuring rigorous standards for maintenance and pilot qualifications are met. The FAA's ongoing emphasis on safety, as seen in programs like ASAP in 2024, directly impacts flyExclusive's ability to maintain its Air Carrier Certificate.

Labor laws, including FAA's Flight Duty Period (FDP) rules, dictate pilot working hours and rest periods, affecting scheduling and costs. Evolving regulations on training and medical certifications could increase expenses and limit pilot availability.

Data privacy laws like GDPR and CCPA mandate strict data handling protocols, with significant penalties for non-compliance; GDPR violations can cost up to 4% of global annual turnover.

Contractual law, governing fractional ownership, jet cards, and charters, must align with consumer protection statutes, with FAA safety standards often integrated into service agreements.

Environmental factors

The aviation sector is under significant pressure to curb its carbon emissions, a trend amplified by growing public awareness, stricter government regulations, and the demands of environmentally conscious investors. For companies like flyExclusive, this translates into a critical need to implement greener operational strategies.

flyExclusive must actively pursue avenues like refining flight path planning, upgrading its aircraft to more fuel-efficient models, and exploring the adoption of Sustainable Aviation Fuels (SAF). For instance, the International Air Transport Association (IATA) has set a goal for the industry to achieve net-zero carbon emissions by 2050, highlighting the long-term strategic imperative for all players, including private jet operators.

Noise pollution from aircraft remains a significant environmental hurdle, especially for areas surrounding airports. flyExclusive, like other operators, must adhere to stringent noise abatement procedures, which can impact flight paths and operational flexibility.

To maintain access to vital airports and foster positive community relations, flyExclusive's 2024-2025 strategy likely involves continued investment in quieter aircraft technologies. For instance, the FAA's Airport Noise and Access Program continues to evolve, influencing operational requirements for carriers.

Environmental considerations for flyExclusive critically include waste management within its Maintenance, Repair, and Overhaul (MRO) facilities and overall resource consumption. Sustainable practices in waste disposal, material recycling, and efficient energy and water usage are paramount for its environmental stewardship.

The aviation industry, including MRO operations, faces increasing scrutiny regarding its environmental footprint. For instance, in 2023, the International Air Transport Association (IATA) reported that the aviation sector's total CO2 emissions were approximately 935 million tonnes. flyExclusive's commitment to reducing waste, such as recycling aircraft components or hazardous materials responsibly, directly impacts its operational sustainability and compliance with evolving environmental regulations.

Corporate Social Responsibility (CSR) and Sustainability Initiatives

Clients and stakeholders increasingly demand that companies, including those in private aviation, actively engage in corporate social responsibility and environmental sustainability. flyExclusive's dedication to eco-friendly practices, such as investing in newer, more fuel-efficient aircraft and exploring sustainable aviation fuel (SAF) options, directly addresses this growing expectation. For instance, the business aviation sector is projected to see a 20% increase in SAF usage by 2030, a trend flyExclusive can leverage.

Transparent reporting on its ecological footprint, detailing carbon emissions per flight hour and waste reduction efforts, can significantly bolster flyExclusive's brand image. Companies demonstrating strong sustainability commitments often see improved customer loyalty and investor confidence. In 2024, over 60% of consumers stated they would switch to brands that align with their values, a statistic relevant to flyExclusive's client base.

Participation in industry-wide sustainability initiatives, such as the Business Aviation Commitment on Sustainability, further solidifies flyExclusive's commitment. These collaborative efforts not only drive innovation but also provide a unified voice for the sector's environmental progress. Such participation can lead to shared best practices and potentially cost-saving measures through collective purchasing power for sustainable technologies or fuels.

The financial implications of robust CSR are becoming more pronounced. Companies with strong ESG (Environmental, Social, and Governance) ratings, which include sustainability metrics, often outperform their peers. Data from 2024 indicates that companies with top-tier ESG scores experienced a 10-15% higher return on equity compared to those with lower scores.

Climate Change Impacts on Operations

Climate change presents significant environmental challenges for flyExclusive's operations. The increasing frequency and intensity of extreme weather events, such as hurricanes, severe thunderstorms, and heavy fog, can directly disrupt flight schedules. These disruptions can lead to costly delays, flight diversions, and outright cancellations, impacting customer satisfaction and operational efficiency.

For instance, the 2023 Atlantic hurricane season saw an above-average number of storms, with several directly impacting major aviation hubs in the southeastern United States. This trend is projected to continue, with climate models indicating a potential increase in the intensity of such events. flyExclusive must proactively integrate these environmental risks into its operational planning and robust risk management strategies to ensure service reliability and maintain the highest safety standards amidst these evolving conditions.

- Increased Weather Disruptions: More frequent extreme weather events directly impact flight schedules, leading to delays and cancellations.

- Operational Risk Management: flyExclusive needs to adapt its planning to mitigate the effects of climate-related weather phenomena.

- Safety and Reliability: Maintaining consistent service quality and safety is paramount, requiring foresight in addressing environmental shifts.

- Economic Impact: Weather disruptions can lead to significant financial losses through fuel costs, re-accommodation of passengers, and lost revenue.

Environmental factors are increasingly shaping the aviation industry, pushing companies like flyExclusive towards greater sustainability. The push for net-zero emissions by 2050, championed by bodies like IATA, necessitates operational changes such as adopting Sustainable Aviation Fuels (SAF) and optimizing flight paths. Moreover, the growing impact of climate change, evidenced by more frequent extreme weather events, demands robust risk management to ensure operational reliability and safety.

| Environmental Factor | Impact on flyExclusive | 2024-2025 Strategic Focus |

|---|---|---|

| Carbon Emissions Reduction | Pressure from regulators, investors, and customers to reduce footprint. | Investment in fuel-efficient aircraft, exploration of SAF. |

| Extreme Weather Events | Disruptions to flight schedules, potential safety risks, increased operational costs. | Enhanced weather forecasting integration, flexible scheduling, robust contingency planning. |

| Noise Pollution | Adherence to noise abatement procedures, potential flight path restrictions. | Continued investment in quieter aircraft technologies. |

| Waste Management & Resource Use | Scrutiny of MRO operations and overall consumption. | Implementing sustainable practices in waste disposal and material recycling. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for flyExclusive is built upon a robust foundation of data from official aviation authorities, economic forecasting agencies, and reputable market research firms. We meticulously gather insights from government policy updates, industry-specific reports, and global economic databases to ensure comprehensive coverage.