flyExclusive Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

flyExclusive Bundle

flyExclusive's competitive landscape is shaped by intense rivalry and the significant bargaining power of its discerning clientele. Understanding these forces is crucial for navigating the private aviation market.

The full analysis reveals the strength and intensity of each market force affecting flyExclusive, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

The bargaining power of suppliers for flyExclusive is significantly influenced by the concentration of key component providers. For instance, suppliers of critical aircraft engines, such as Pratt & Whitney for Cessna Citation models, and specialized avionics systems are often limited to a few dominant players. This scarcity of alternatives grants these suppliers considerable leverage in dictating prices and contractual terms.

Furthermore, flyExclusive's reliance on specific aircraft manufacturers, like Textron Aviation for its Cessna fleet, amplifies supplier power. Transitioning to a different aircraft type represents a substantial capital investment and operational overhaul, making it difficult for flyExclusive to switch suppliers or manufacturers easily. This dependence solidifies the bargaining position of these core suppliers.

For flyExclusive, the cost and complexity associated with switching suppliers for essential components and Maintenance, Repair, and Overhaul (MRO) equipment are substantial. This involves significant investment in retraining skilled technicians, recalibrating specialized machinery, and potentially disrupting critical maintenance schedules and airworthiness certifications, thereby bolstering supplier leverage.

The uniqueness of inputs significantly influences supplier bargaining power. For flyExclusive, this is evident in the specialized components and Maintenance, Repair, and Overhaul (MRO) services required for its fleet of Cessna Citation aircraft. When these inputs are proprietary or demand highly specific expertise, suppliers gain leverage.

flyExclusive's in-house MRO capabilities highlight this dynamic. Access to specialized tools, unique parts, and a highly skilled technician base for Cessna Citation aircraft is critical. Providers of these specialized inputs, whether for parts or expertise, possess considerable bargaining power due to the limited availability of alternatives.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers in the private aviation sector, while generally low for aircraft manufacturers, presents a potential challenge for companies like flyExclusive. If key maintenance, repair, and overhaul (MRO) providers were to move into offering charter or fractional ownership programs, they could become direct competitors. This would significantly alter the competitive landscape by leveraging their existing operational expertise and customer relationships.

While a significant undertaking, some MRO providers might consider such a strategic shift to capture more value within the aviation ecosystem. For instance, a large MRO that services a substantial fleet of private jets could potentially leverage its infrastructure and technical knowledge to establish its own charter operations. This could put pressure on existing charter providers by introducing a new, potentially cost-competitive player into the market.

- Supplier Forward Integration Risk: Key suppliers, particularly MRO providers, could potentially enter the charter or fractional ownership market, directly competing with flyExclusive.

- Operational Shift: While aircraft manufacturers are unlikely to integrate forward, MROs could expand services, though this represents a substantial operational and capital investment.

- Competitive Impact: Successful forward integration by suppliers could introduce new competitors, potentially impacting pricing and market share for existing private aviation service providers.

Supplier Importance to flyExclusive

The bargaining power of suppliers is a critical factor for flyExclusive, as the continuous and reliable supply of aircraft parts and essential maintenance services directly underpins its operational capacity and safety standards. Any interruption from these suppliers can significantly affect fleet availability, directly impacting customer satisfaction and revenue generation. This makes flyExclusive's reliance on its suppliers substantial.

The aviation industry, in general, faces concentrated supplier bases for specialized parts and maintenance. For instance, major engine manufacturers like Pratt & Whitney and General Electric, or airframe manufacturers such as Textron Aviation (for Cessna Citation models used by flyExclusive), often hold considerable sway. In 2024, the lead times for certain specialized aircraft components remained a challenge, with some critical parts experiencing delivery delays of up to six months, a trend that continued from previous years.

- Supplier Concentration: The market for specific aviation components and certified maintenance services is often dominated by a few key players, granting them leverage.

- Switching Costs: The expense and complexity involved in changing suppliers for certified parts and maintenance can be prohibitive, increasing supplier power.

- Importance of Inputs: Aircraft parts and maintenance are non-substitutable for ensuring flight safety and operational readiness, making them essential inputs for flyExclusive.

- Supplier's Ability to Forward Integrate: While less common in this specific sector for flyExclusive's core needs, the potential for suppliers to offer their own services could increase their power.

The bargaining power of suppliers for flyExclusive is amplified by the concentrated nature of the aviation supply chain, particularly for specialized components and maintenance services. In 2024, extended lead times for critical aircraft parts, some exceeding six months, underscored the leverage held by dominant manufacturers like Textron Aviation for Cessna models. This reliance on a limited number of providers for essential inputs significantly strengthens their position in price negotiations and contract terms.

flyExclusive faces substantial switching costs when considering alternative suppliers for aircraft parts and MRO services, making it challenging to reduce supplier dependence. The need for specialized certifications, technician retraining, and potential operational disruptions when changing providers reinforces the power of existing suppliers, as these hurdles are significant financial and logistical burdens.

The uniqueness of certain aviation inputs, such as proprietary avionics or specific engine parts, further empowers suppliers. When these components are not readily available from multiple sources, flyExclusive must adhere to the terms dictated by the sole or few providers, as there are no viable substitutes that meet stringent aviation safety and performance standards.

| Supplier Type | Key Players (Examples for flyExclusive) | Impact on flyExclusive | 2024 Data Point |

|---|---|---|---|

| Aircraft Manufacturers | Textron Aviation (Cessna) | High dependence, significant switching costs | Continued reliance on Cessna for fleet expansion. |

| Engine Manufacturers | Pratt & Whitney, Honeywell | Limited alternatives, price leverage | Average lead time for certain engine components remained at 5-7 months. |

| Avionics Suppliers | Garmin, Honeywell | Proprietary technology, specialized MRO needs | Increased demand for advanced avionics upgrades led to tighter supply for specific modules. |

| MRO Service Providers | Authorized service centers, specialized third-party providers | High cost of switching, specialized expertise required | Hourly labor rates for certified technicians saw an average increase of 4-6% in 2024. |

What is included in the product

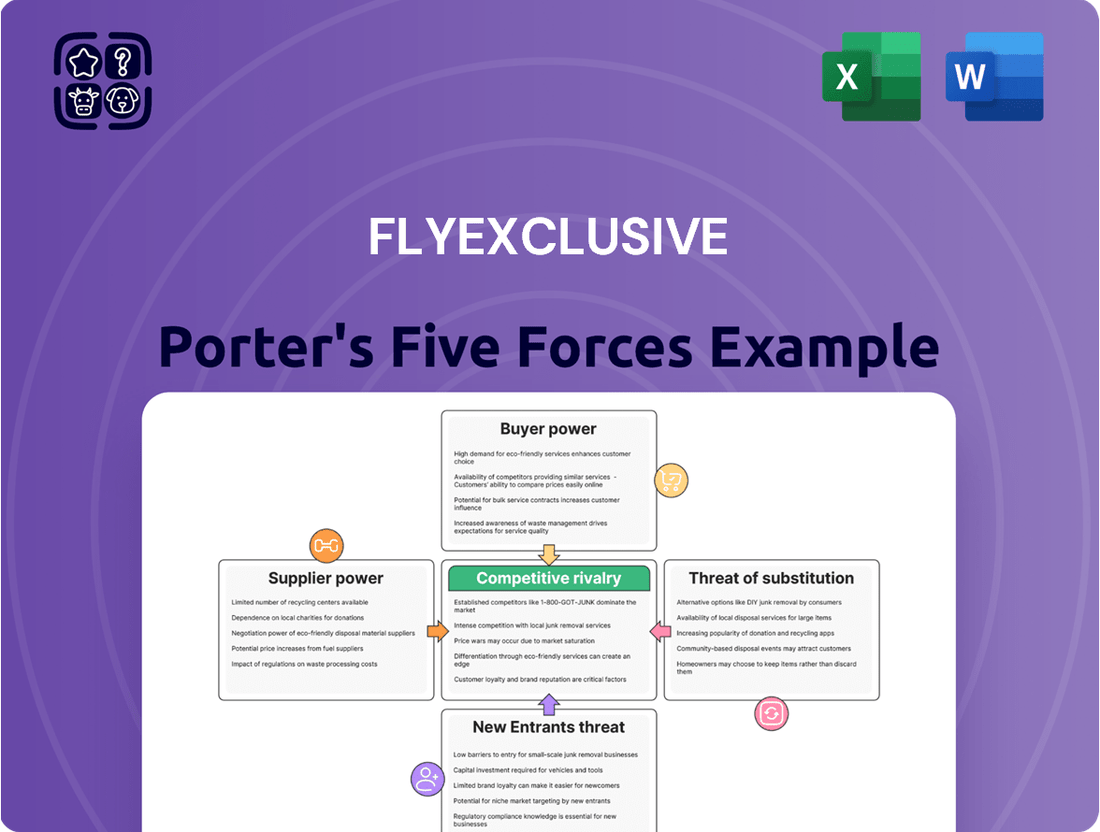

flyExclusive's Porter's Five Forces analysis reveals the intense competitive rivalry and buyer bargaining power within the private aviation sector, while also highlighting the significant barriers to entry and the moderate threat of substitutes.

Instantly identify and mitigate competitive threats with a dynamic, interactive Porter's Five Forces analysis tailored for flyExclusive's unique market position.

Customers Bargaining Power

Customer price sensitivity in private aviation, particularly for jet card programs and on-demand charters, is a significant factor. Many clients, especially those seeking comparable services, actively compare pricing. For instance, in 2024, the average hourly rate for a light jet charter could range from $3,000 to $5,000, making price a key differentiator.

However, for high-net-worth individuals and corporations, the calculus often shifts. Convenience, privacy, and reliability can outweigh minor price differences. A 2024 survey indicated that over 60% of corporate flight departments cited operational efficiency and aircraft availability as more critical than cost when selecting a provider.

The private aviation sector is characterized by a wide array of service providers, offering diverse solutions such as fractional ownership, jet cards, and on-demand charter flights. This extensive choice empowers customers, as they can readily compare offerings and pricing across numerous companies.

Major players like NetJets and Flexjet, alongside a multitude of smaller operators, create a competitive landscape where customers have significant leverage. For instance, in 2024, the number of Part 135 charter operators in the US alone exceeded 3,000, providing a vast selection for consumers.

The ability for customers to switch between private jet providers significantly influences bargaining power. For on-demand charter services, this switching is generally quite easy, meaning customers can readily move to a competitor if they find a better deal or service. This low barrier to entry for customers keeps providers competitive.

While fractional ownership models might have more involved contracts, the broader market for jet cards and ad-hoc charters presents a fluid landscape. In 2024, the private aviation market saw continued growth in charter demand, indicating a healthy number of options available to consumers. This accessibility empowers customers to shop around, putting pressure on providers like flyExclusive to offer attractive pricing and superior service to retain business.

Volume of Purchases by Customers

While individual charter clients may not wield significant individual bargaining power due to smaller purchase volumes, the collective impact of larger corporate accounts or members with substantial fractional ownership in flyExclusive can shift this dynamic. These larger clients, by virtue of the scale of their commitments, can exert more influence on pricing and service terms.

flyExclusive's strategy of catering to a broad spectrum of clients, from on-demand charter users to fractional ownership members, effectively diversifies its customer base. This diversification helps to dilute the concentrated bargaining power of any single large customer segment, thereby strengthening the company's position.

- Individual vs. Group Power: Individual charter bookings represent lower volume, limiting direct bargaining power. However, large corporate clients or those with significant fractional ownership stakes can negotiate more effectively due to the substantial value of their contracts.

- flyExclusive's Mitigation Strategy: The company's diverse service offerings, including on-demand charters and fractional ownership programs, attract varied customer segments. This broad appeal reduces reliance on any single large customer group, thereby managing overall customer bargaining power.

- Market Context (2024): The private aviation market in 2024 continued to see robust demand, particularly from corporate clients seeking flexibility and efficiency. While demand remained strong, competitive pressures among charter operators could still offer some leverage to well-positioned, high-volume clients.

Information Availability to Customers

Customers in the private aviation sector are increasingly well-informed. This heightened awareness stems from readily available data on pricing structures, the breadth of services offered, and crucially, the safety performance of different private jet operators. For instance, by mid-2024, numerous online portals and specialized brokers are actively aggregating and presenting this comparative data.

This ease of access to information significantly bolsters the bargaining power of customers. They can now efficiently compare offerings from various providers, leading to a more competitive market. This transparency allows clients to negotiate better terms, as they have a clear understanding of prevailing market rates and service standards.

- Enhanced Price Transparency: Online platforms allow for direct comparison of hourly rates and membership fees across different private jet companies.

- Service and Safety Benchmarking: Customers can easily access reviews and data on aircraft maintenance, pilot training, and operational safety records.

- Broker Facilitation: Third-party brokers provide curated information and often negotiate on behalf of clients, further empowering them.

- Increased Negotiation Leverage: Armed with market data, customers can more effectively negotiate pricing and service level agreements.

The bargaining power of customers in private aviation is substantial, driven by market transparency and a wide array of providers. Customers can easily compare pricing and service offerings, especially for on-demand charters and jet card programs. For example, in 2024, the sheer number of US Part 135 charter operators, exceeding 3,000, ensures customers have ample choice and thus leverage.

While individual clients might have limited power, large corporate accounts or those with significant fractional ownership can negotiate more effectively due to their volume. The availability of information on pricing, safety, and service quality further empowers customers to seek better terms, putting pressure on providers like flyExclusive to maintain competitive pricing and superior service.

| Customer Segment | Bargaining Power Driver | 2024 Market Insight |

|---|---|---|

| On-Demand Charter Users | Price Sensitivity & Ease of Switching | Hourly rates for light jets averaged $3,000-$5,000, making price a key differentiator. |

| Jet Card Holders | Program Flexibility & Provider Choice | Continued growth in charter demand provided more options for comparison. |

| Fractional Ownership Clients | Contract Size & Long-Term Commitment | High-net-worth individuals prioritized efficiency and availability over minor cost differences. |

| Corporate Flight Departments | Operational Efficiency & Reliability | Over 60% cited operational efficiency as more critical than cost. |

Preview Before You Purchase

flyExclusive Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual flyExclusive Porter's Five Forces analysis, detailing the competitive landscape of private aviation. Once you complete your purchase, you’ll get instant access to this exact file, providing a comprehensive understanding of industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes.

Rivalry Among Competitors

The private aviation sector is quite crowded, featuring a mix of large, well-known companies such as NetJets and Flexjet, alongside numerous smaller, regional charter services. This means flyExclusive operates in an environment where it faces competition from entities of varying scales and operational strategies.

In 2024, the fractional ownership and jet card market alone saw significant activity, with major players reporting robust demand. For instance, NetJets, a dominant force, continued to expand its fleet, indicating a healthy competitive landscape where scale is a key differentiator, but smaller operators can still carve out niches through specialized services or localized market expertise.

The private aviation market, especially fractional ownership and jet card programs, has experienced robust growth. For instance, in 2023, the global private jet market was valued at approximately $29.5 billion and is projected to reach $49.4 billion by 2030, growing at a compound annual growth rate of 7.6%. This expansion can often ease competitive pressures as demand outstrips supply.

However, the on-demand charter segment has faced headwinds, leading to a potential increase in rivalry. As fewer businesses and individuals opt for ad-hoc charters, companies in this space may compete more aggressively on price and service to secure available flight hours. This could particularly impact operators with a higher proportion of on-demand business.

flyExclusive distinguishes itself with its extensive fleet of Cessna Citation aircraft, a significant asset in the competitive private aviation market. This focus on a specific, high-quality aircraft type allows for operational efficiencies and a consistent customer experience. Furthermore, their vertically integrated Maintenance, Repair, and Overhaul (MRO) services provide a unique advantage, ensuring aircraft availability and quality control.

Despite these differentiators, the private aviation sector is characterized by numerous players offering similar services, intensifying competitive rivalry. Companies like NetJets and Wheels Up, for instance, also boast substantial fleets and comprehensive service offerings. This necessitates that flyExclusive continuously innovates in customer experience and service quality to maintain its competitive edge and attract discerning clientele.

Exit Barriers

High fixed costs are a significant factor in the private aviation sector, making it difficult for companies to leave the market. These costs include aircraft acquisition, ongoing maintenance, specialized hangarage, and the need for highly trained pilots and mechanics. For instance, the cost of a new light jet can easily exceed $10 million, and annual operating costs, including maintenance and crew, can run into hundreds of thousands of dollars per aircraft.

These substantial investments create considerable exit barriers. Companies often find it more economical to continue operating, even at reduced capacity or lower profit margins, rather than incur further losses by selling assets in a depressed market. This can lead to an oversupply of services and heightened competition, as firms are reluctant to exit and reduce capacity.

The persistence of these players, even in challenging economic conditions, directly fuels competitive rivalry. For example, during economic downturns, demand for private aviation typically falls, yet the number of operators often remains relatively stable due to these exit barriers. This dynamic was evident in the aftermath of the 2008 financial crisis, where many operators continued to compete, albeit with reduced utilization rates.

- High Fixed Costs: Aircraft ownership and maintenance represent substantial capital outlays.

- Specialized Infrastructure: Hangarage, ground support, and regulatory compliance add to fixed expenses.

- Skilled Personnel: Retaining certified pilots and mechanics contributes to ongoing operational costs.

- Reluctance to Exit: Companies often absorb losses rather than realize them through asset sales, prolonging competitive pressure.

Strategic Stakes

The private aviation market is highly attractive, driven by its affluent clientele and substantial revenue potential. This inherent appeal translates into high strategic stakes for companies vying for market share, fostering intense competition.

Companies in this sector are aggressively pursuing mergers and acquisitions, alongside expanding their service portfolios, as key strategies to secure a competitive advantage. For instance, in 2024, Vista Global Holding (VGH) continued its strategic consolidation, further solidifying its position in the fractional ownership and jet card segments.

- High Stakes: The private aviation market's appeal to high-net-worth individuals ensures significant revenue opportunities, making market share a critical objective.

- Competitive Actions: Companies are actively engaged in M&A and service expansion to differentiate themselves and capture greater market presence.

- Market Dynamics: This pursuit of competitive edge fuels a dynamic environment where strategic maneuvers are constant.

Competitive rivalry within private aviation is intense, driven by a crowded market with established giants like NetJets and numerous smaller operators. In 2024, the sector's robust growth, with the global market projected to reach $49.4 billion by 2030, attracts continuous investment and strategic moves, such as Vista Global Holding's consolidation efforts, further intensifying competition.

While flyExclusive leverages its focused fleet and MRO capabilities, it faces rivals like Wheels Up, which also offer extensive services. The high fixed costs, including aircraft acquisition exceeding $10 million for light jets, create significant exit barriers, meaning companies often persist even with lower margins, thus sustaining rivalry.

The market's inherent attractiveness to affluent clients ensures high strategic stakes, prompting aggressive M&A and service expansion. This dynamic environment necessitates constant innovation in customer experience and service quality for companies like flyExclusive to maintain their competitive edge.

| Competitor | Fleet Size (Approx.) | Key Service Offerings |

| NetJets | 700+ | Fractional Ownership, Jet Card |

| Wheels Up | 300+ | Membership, Charter, Jet Card |

| Flexjet | 200+ | Fractional Ownership, Jet Card |

SSubstitutes Threaten

For travelers prioritizing cost over convenience or speed, commercial airlines represent a significant substitute for private jet services. In 2024, the average domestic round-trip airfare was approximately $370, making it a considerably cheaper option for many journeys where time is not a critical factor.

Airlines are continuously enhancing their offerings, from improved seating and in-flight entertainment to expanded route networks and more attractive loyalty programs. These advancements can diminish the perceived value proposition of private aviation for a segment of the market, especially for shorter, less complex travel needs.

For shorter trips, especially in areas with robust high-speed rail, luxury car services and trains present a viable alternative to private aviation. For instance, the Northeast Corridor in the United States, a major travel artery, sees significant passenger volume on Amtrak's Acela service, offering a comfortable and efficient option for city-to-city travel that bypasses airport procedures.

These ground-based substitutes can be particularly appealing for travelers prioritizing direct city-center access or those who find the booking and logistical aspects of private jet charter less convenient for specific journeys. In 2024, continued investment in high-speed rail infrastructure in various global markets, such as Japan and parts of Europe, further strengthens these alternatives for certain routes.

Advances in virtual communication technologies, like Zoom and Microsoft Teams, present a significant threat to private aviation by offering alternatives for routine business meetings. In 2024, the continued adoption of hybrid work models means many companies may reduce travel budgets for non-essential trips, potentially impacting demand for shorter private jet flights.

However, the unique value proposition of private aviation for critical, time-sensitive, or high-stakes in-person engagements remains strong. For instance, when a deal hinges on a face-to-face negotiation or a critical board meeting, the efficiency and discretion of a private jet often outweigh the cost, especially when compared to the potential loss from delayed or canceled commercial flights.

Company-Owned Aircraft

Larger corporations with significant and consistent travel needs might consider purchasing their own aircraft. This direct ownership model bypasses the need for charter or fractional services, acting as a potent substitute for flyExclusive's business. For instance, in 2024, the demand for pre-owned business jets remained robust, with a notable number of large corporations evaluating the cost-benefit of full ownership versus managed charter solutions.

The decision to own an aircraft is often driven by factors like predictable usage patterns and the desire for complete control over scheduling and customization. This alternative directly competes with flyExclusive by offering a different approach to private air travel, potentially attracting clients who prioritize asset ownership and dedicated fleet management.

While flyExclusive offers flexibility and cost-efficiency for many, the outright ownership of a company aircraft presents a distinct threat. This is particularly true for businesses that have experienced substantial growth and whose travel volume has reached a threshold where owning a dedicated asset becomes financially viable and operationally advantageous.

The market for pre-owned corporate jets, a key substitute, saw continued activity in 2024, with transaction volumes indicating a sustained interest from corporations seeking to establish their own aviation assets. This trend underscores the competitive pressure flyExclusive faces from companies choosing the ownership route.

Other Private Aviation Models

Within private aviation, alternative models such as ad-hoc charter services offer flexibility for clients who don't require consistent private travel. For instance, fractional ownership programs or jet card memberships can be seen as substitutes for those seeking a degree of private flight access without the commitment of full ownership, especially for shorter, less frequent trips.

Even single-engine turboprops, while different in capacity and range, can substitute for certain client needs, particularly for regional travel where speed and cost efficiency are paramount. In 2024, the demand for flexible charter solutions remained robust, with many clients leveraging these options to manage travel expenses and operational needs effectively.

These alternative private aviation models directly compete by offering varying levels of access and cost structures. Clients might opt for these substitutes based on:

- Cost-effectiveness for infrequent travel.

- Flexibility in aircraft type and availability.

- Reduced commitment compared to longer-term private aviation solutions.

The threat of substitutes for flyExclusive is multifaceted, encompassing commercial airlines, high-speed rail, luxury ground transport, virtual communication, and even different private aviation models. Commercial airlines, with average domestic round-trip fares around $370 in 2024, remain a cost-effective alternative for price-sensitive travelers where time is not the primary concern. Advancements in virtual communication continue to reduce the need for in-person business meetings, impacting demand for shorter private jet flights, especially with the prevalence of hybrid work models in 2024.

| Substitute Type | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Commercial Airlines | Lower cost, extensive networks | Avg. domestic round-trip fare: ~$370 |

| High-Speed Rail/Luxury Ground Transport | City-center access, bypass airport hassles | Strong passenger volume on key corridors like Northeast Corridor |

| Virtual Communication | Cost savings on travel budgets | Continued adoption of hybrid work models |

| Aircraft Ownership | Full control, predictable usage | Robust demand for pre-owned business jets |

| Fractional/Jet Card Programs | Flexibility, reduced commitment | Strong demand for flexible charter solutions |

Entrants Threaten

The private aviation sector demands immense upfront capital. New players must fund aircraft acquisition or leasing, build robust operational infrastructure, and secure essential regulatory certifications. This financial hurdle significantly deters potential entrants.

flyExclusive's substantial investment in a large fleet, including over 90 aircraft as of early 2024, and its ownership of an in-house Maintenance, Repair, and Overhaul (MRO) facility, clearly illustrate these high capital barriers. Such integrated operations require hundreds of millions in investment, creating a formidable entry challenge.

The private aviation sector faces substantial regulatory burdens, acting as a significant deterrent to new competitors. Organizations like the Federal Aviation Administration (FAA) impose rigorous certification requirements, including those for charter operations (Part 135) and maintenance, repair, and overhaul (MRO) services (Part 145). These stringent standards necessitate considerable investment in compliance and operational procedures, making entry challenging.

New entrants in the private aviation sector face significant hurdles in establishing effective distribution channels and networks. Building a sales and marketing infrastructure capable of reaching high-net-worth individuals and corporate clients requires substantial investment and time. Existing operators, such as flyExclusive, have already cultivated strong relationships and brand recognition within this exclusive market.

Brand Loyalty and Customer Relationships

Established private aviation companies, like flyExclusive, leverage strong brand loyalty and deep customer relationships. These are cultivated through consistent service quality and a proven track record, creating significant barriers for newcomers. For instance, in 2024, the private jet charter market continued to see clients prioritize reliability and established reputations, making it challenging for new entrants to gain immediate traction without substantial investment in building trust.

New entrants face the daunting task of replicating the trust and service standards that existing players have spent years developing. This often necessitates considerable upfront capital expenditure not just on aircraft, but on marketing and customer service infrastructure to even begin competing. The private aviation sector, in particular, thrives on personal connections and a deep understanding of client needs, elements that are difficult and time-consuming to establish from scratch.

- Brand Loyalty: Existing operators benefit from repeat business and referrals, a significant advantage.

- Customer Relationships: Long-term partnerships are built on trust and personalized service.

- High Entry Costs: Newcomers need to invest heavily in reputation building and service excellence.

- Market Inertia: Customers often stick with providers they know and trust, slowing adoption of new brands.

Economies of Scale and Experience

The threat of new entrants in the private aviation sector, particularly for companies like flyExclusive, is significantly mitigated by substantial economies of scale and accumulated operational experience. Established players have invested heavily in large fleets and comprehensive, vertically integrated operations, including maintenance, repair, and overhaul (MRO) facilities. This infrastructure creates a formidable barrier, as new entrants would find it incredibly difficult and costly to achieve comparable efficiencies and service reliability in a short timeframe.

Consider the capital investment required. Building a fleet comparable to flyExclusive's, which operates a significant number of aircraft, demands hundreds of millions of dollars. Furthermore, developing the in-house MRO capabilities to support such a fleet adds another layer of complexity and expense that new companies would need to overcome. This operational depth translates directly into cost advantages and a consistent service experience that is hard for newcomers to match.

- Economies of Scale: flyExclusive’s large fleet allows for bulk purchasing of fuel, parts, and services, leading to lower per-unit costs.

- Vertical Integration: In-house MRO capabilities reduce reliance on third-party providers, improving cost control and turnaround times.

- Operational Experience: Years of managing complex flight operations, regulatory compliance, and customer service build expertise that is difficult for new entrants to acquire quickly.

- Capital Intensity: The high cost of acquiring and maintaining a modern private jet fleet acts as a significant deterrent to new market participants.

The threat of new entrants in the private aviation sector is considerably low due to the immense capital required for aircraft acquisition, operational infrastructure, and regulatory compliance. flyExclusive's significant investment in a fleet exceeding 90 aircraft and its ownership of an in-house MRO facility underscore these high barriers, demanding hundreds of millions in initial outlay.

Stringent regulatory requirements from bodies like the FAA, covering operations and maintenance, necessitate substantial investment in compliance, further deterring new players. Moreover, established companies like flyExclusive benefit from strong brand loyalty and deep customer relationships built over years of reliable service, making it difficult for newcomers to gain immediate traction in the market.

| Barrier Type | Description | Example (flyExclusive) |

|---|---|---|

| Capital Requirements | High upfront investment for aircraft, infrastructure, and certifications. | Fleet of over 90 aircraft, extensive operational facilities. |

| Regulatory Hurdles | Rigorous certification and compliance standards (e.g., FAA Part 135). | Need for extensive documentation and operational adherence. |

| Brand Loyalty & Relationships | Established trust and repeat business from high-net-worth clients. | Cultivated strong client base through consistent service quality. |

| Economies of Scale | Cost advantages from large fleet size and vertical integration. | Bulk purchasing power for fuel and parts, efficient MRO operations. |

Porter's Five Forces Analysis Data Sources

Our flyExclusive Porter's Five Forces analysis is built upon a foundation of data from company financial reports, industry-specific market research, and aviation sector news outlets. This blend ensures a comprehensive understanding of competitive dynamics within the private aviation market.