Flugger PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flugger Bundle

Navigate the complex external forces shaping Flugger's future with our comprehensive PESTLE Analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the paint and coatings industry. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full version now for immediate access to expert insights.

Political factors

Government regulations concerning product safety, environmental impact, and chemical usage significantly shape Flügger's approach to product creation and manufacturing. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, continually updated, impacts the types of chemicals Flügger can use in its paints and coatings, driving a need for compliant and often more sustainable formulations.

Stricter environmental policies, such as those mandating reduced Volatile Organic Compounds (VOCs) or promoting eco-labeled products, compel Flügger to invest in ongoing innovation and ensure adherence to evolving standards. In 2024, many European countries are strengthening their VOC limits for interior paints, pushing manufacturers like Flügger to develop advanced low-VOC or zero-VOC alternatives to meet consumer demand and regulatory requirements.

Fluctuations in trade policies and tariffs, particularly in key markets like the Nordic region and Germany where Flügger has a strong presence, can directly affect production costs and access to raw materials. For example, any new tariffs on imported pigments or resins could necessitate price adjustments or a strategic shift in sourcing to mitigate the financial impact on Flügger's operations.

Flügger's international presence, especially in Eastern Europe, makes it vulnerable to geopolitical events and trade dynamics. For instance, the company's decision to divest its Russian operations and its increased attention to Ukraine underscore how political stability directly influences operational continuity and strategic investment choices.

Trade disputes can significantly impact Flügger by affecting the cost of essential raw materials like chemicals. For example, disruptions in global supply chains, potentially exacerbated by trade tensions, could lead to higher import costs for key chemical components used in paint and coating production, thereby affecting profit margins.

Government initiatives like the Danish government's focus on green building standards and energy efficiency upgrades, as seen in recent policy updates throughout 2024, directly influence demand for Flügger's sustainable paint and coating solutions. Increased public investment in infrastructure projects, such as new transportation networks and urban development, also translates into higher demand for construction materials. For instance, the Danish government allocated approximately DKK 10 billion towards infrastructure in its 2024 budget, a portion of which will fuel construction activity.

Fiscal Policies and Taxation

Changes in corporate tax rates within Flügger's primary operating regions, such as Denmark, Sweden, and Norway, directly influence net profit margins. For instance, a reduction in corporate tax from 22% to 20% in Denmark, as seen in recent fiscal discussions, would boost retained earnings. Similarly, adjustments to Value Added Tax (VAT) rates can affect consumer pricing and demand for Flügger's decorative paints and coatings, impacting sales volumes and revenue streams.

Government incentives play a crucial role in shaping strategic investments. In 2024, the EU's Green Deal initiatives continue to encourage sustainable manufacturing. Flügger could leverage potential tax credits or subsidies for adopting eco-friendly production processes or developing low-VOC (Volatile Organic Compound) paint lines. For example, Germany's KfW bank offers low-interest loans for energy-efficient building renovations, indirectly boosting demand for sustainable interior paints.

- Corporate Tax Impact: Fluctuations in corporate tax rates in key markets like Denmark (historically around 22%) directly affect Flügger's profitability.

- VAT Adjustments: Changes in VAT rates, which vary by country, influence the final price of Flügger's products and overall consumer purchasing power.

- Green Investment Incentives: Government support, such as subsidies or tax breaks for sustainable materials and energy-efficient production, can significantly reduce operational costs and drive innovation in eco-friendly product development.

- Market-Specific Fiscal Policies: Understanding and adapting to diverse fiscal policies across Scandinavia and other European markets is critical for pricing, market entry, and expansion strategies.

Political Stability in Key Markets

Flügger's operations are significantly impacted by political stability, particularly in its core Nordic markets and other international locations. For instance, Denmark, a key market, has maintained a strong political and economic standing, fostering confidence among consumers and professional painters. This stability underpins consistent demand for Flügger's decorative paints and building materials. In 2024, Denmark's projected GDP growth, estimated around 1.5-2.0%, reflects this underlying stability.

Conversely, political instability in other operating regions could pose challenges. Unsettled political landscapes can lead to reduced consumer spending, delayed construction projects, and increased operational risks, potentially disrupting Flügger's supply chains and market access. For example, geopolitical tensions in Eastern Europe, while not directly impacting core Nordic markets, can create broader economic uncertainty that indirectly affects global trade and investment sentiment.

- Nordic Stability: High political stability in Denmark, Sweden, and Norway supports consistent consumer and professional demand for Flügger products.

- Economic Confidence: Stable political environments correlate with higher consumer and business confidence, crucial for the construction and renovation sectors.

- Supply Chain Risks: Political unrest in any of Flügger's operational or sourcing regions can disrupt logistics and increase material costs.

- Investment Climate: Predictable political frameworks encourage investment in new markets and existing operations, vital for Flügger's growth strategy.

Government regulations, particularly those concerning chemical usage and environmental standards, directly influence Flügger's product development and manufacturing processes. The EU's REACH regulation, for instance, mandates careful chemical assessment, pushing Flügger towards more sustainable formulations. Stricter VOC limits, increasingly common in 2024 across Europe, necessitate innovation in low-VOC paint technology.

Trade policies and tariffs can impact Flügger's operational costs and raw material sourcing. For example, any new tariffs on pigments or resins could lead to price adjustments or shifts in supply chain strategies. Geopolitical events also play a role; Flügger's divestment from Russia highlights how political stability affects operational continuity and investment decisions.

Government incentives, such as those for green building and energy efficiency, boost demand for Flügger's sustainable products. The Danish government's infrastructure investments, like the DKK 10 billion allocation in its 2024 budget, also stimulate construction activity. Changes in corporate tax rates, such as potential reductions in Denmark, directly influence net profit margins and retained earnings.

What is included in the product

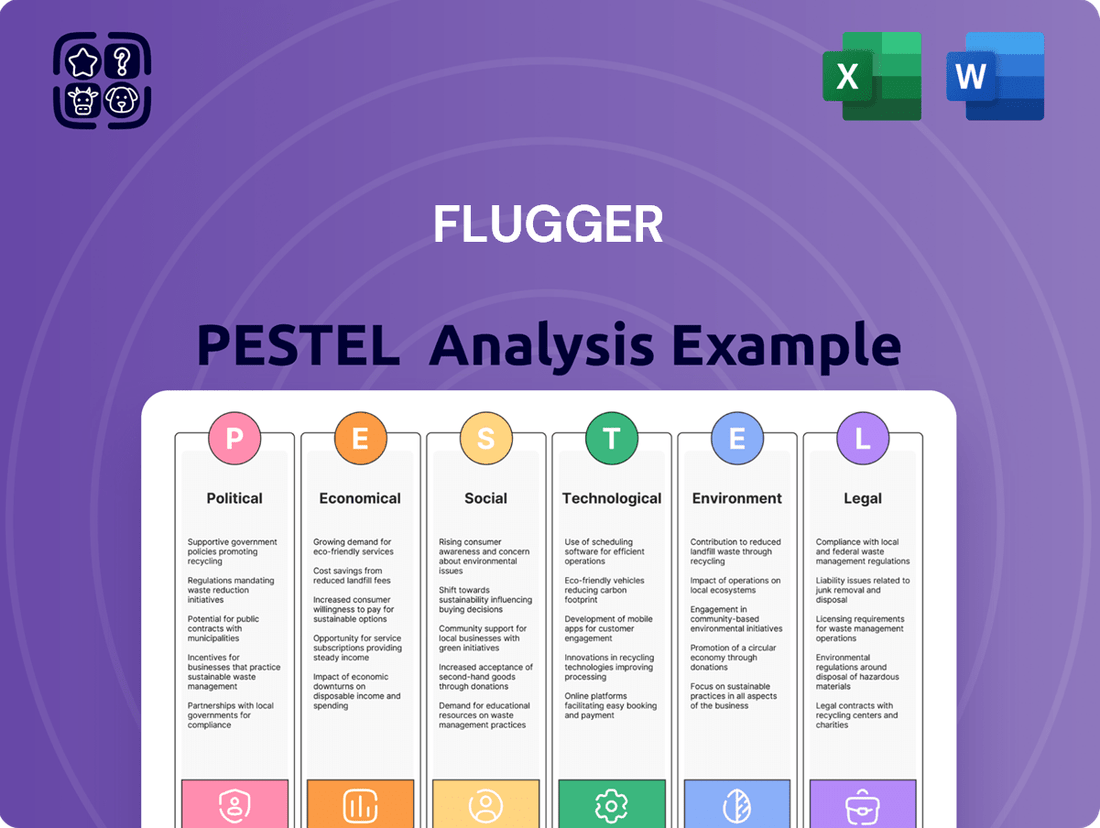

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Flugger, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable insights.

Economic factors

Flügger's performance is closely tied to overall economic growth in its key markets, as this directly influences consumer and professional spending on home improvement and construction. A strong economy typically translates to increased demand for decorative paints, wood care products, and wallpaper, as people have more disposable income for renovations and new builds.

For instance, in 2024, many European economies are experiencing moderate growth, with projections suggesting continued, albeit potentially slower, expansion through 2025. This economic environment generally supports higher levels of discretionary spending on home enhancement projects, benefiting companies like Flügger.

Conversely, economic downturns or recessions can significantly dampen demand. During periods of economic contraction, consumers tend to cut back on non-essential purchases, and construction activity often slows, impacting sales volumes for paint and renovation materials.

Flügger's bottom line is heavily tied to the price swings of essential inputs like raw materials, energy, and shipping. The company faced headwinds from elevated costs in recent periods, and while some prices have settled, ongoing vigilance and smart procurement remain key.

For instance, in early 2024, global energy prices, while down from 2022 peaks, continued to present a variable cost base for manufacturing and logistics. Similarly, key raw material costs for paints and coatings, such as titanium dioxide and various resins, have seen periods of significant volatility, impacting production expenses.

To navigate these challenges and protect its profit margins, Flügger relies on strategic price adjustments for its products and diligent cost-saving measures across its operations.

Interest rate shifts significantly influence the housing market, impacting both new home building and renovation projects. For a company like Flügger, which supplies paints and coatings, this is a crucial consideration. For instance, in late 2024 and early 2025, central banks are anticipated to maintain a cautious approach to rate cuts, potentially keeping borrowing costs elevated for consumers and developers alike.

When interest rates climb, the cost of mortgages and home improvement loans increases. This can make consumers more hesitant to undertake major renovation projects, directly affecting demand for Flügger's products. Conversely, a robust housing market, often fueled by lower interest rates, typically translates to higher sales volumes for companies in the construction and renovation supply chain.

Inflation and Purchasing Power

Inflation directly impacts Flügger's operational expenses, from raw materials to logistics, and also influences how much disposable income consumers have. While Flügger has adjusted its prices to counter rising costs, persistent inflation can dampen consumer sentiment, potentially leading to reduced spending on items like paint and decorating supplies, which are often seen as discretionary.

For instance, in the Eurozone, inflation averaged 5.5% in 2023, a significant increase from previous years, and projections for 2024 and 2025 suggest a gradual decline but still above the European Central Bank's target. This persistent inflationary pressure necessitates careful management of Flügger's pricing strategies to maintain profitability without alienating customers.

- Rising Input Costs: Increased prices for chemicals, pigments, and energy directly affect Flügger's production expenses.

- Consumer Demand Sensitivity: Higher inflation erodes purchasing power, potentially decreasing demand for home improvement products.

- Pricing Strategy Challenges: Balancing cost recovery through price increases with maintaining sales volume is a key challenge.

- Impact on Renovation Budgets: Consumers may postpone or scale back renovation projects due to economic uncertainty driven by inflation.

Exchange Rate Fluctuations

As an international entity, Flügger's financial performance is significantly influenced by exchange rate volatility. Fluctuations can impact the cost of imported raw materials and the value of sales generated in foreign currencies, directly affecting profit margins.

For instance, if the Danish Krone strengthens against currencies where Flügger sources materials, those imports become more expensive. Conversely, a weaker Krone can make sales in other countries more profitable when converted back. In 2024, the Euro experienced periods of both strengthening and weakening against major currencies, a trend likely to continue into 2025, posing ongoing challenges and opportunities for companies like Flügger with extensive international operations.

- Impact on Import Costs: A stronger local currency (e.g., DKK) against supplier currencies increases the cost of raw materials sourced internationally.

- Effect on Sales Revenue: A weaker local currency can boost the value of sales made in foreign markets when repatriated.

- Profitability Sensitivity: Exchange rate movements can cause significant swings in Flügger's net profit, even if underlying sales volumes remain stable.

- Hedging Strategies: Companies often employ financial instruments to mitigate exchange rate risks, though these also incur costs.

Flügger's profitability is directly linked to the cost of key inputs like titanium dioxide, resins, and energy, which experienced significant price volatility in 2023-2024. For example, titanium dioxide prices saw fluctuations due to supply-demand dynamics and production issues in major producing regions. Energy costs, while moderating from 2022 highs, remained a substantial operational expense throughout 2024, impacting manufacturing and logistics.

Interest rate policies by central banks, such as the European Central Bank and the US Federal Reserve, continue to influence consumer and construction spending. With anticipated cautious rate cuts in late 2024 and early 2025, borrowing costs for renovations and new builds may remain elevated, potentially tempering demand for decorative paints and coatings.

Inflationary pressures in key markets, including the Eurozone where inflation averaged around 5.5% in 2023, directly affect Flügger's cost base and consumer purchasing power. While inflation is projected to ease in 2024-2025, it remains above target levels, necessitating strategic pricing adjustments to protect margins while managing potential impacts on discretionary spending for home improvement.

Exchange rate fluctuations, particularly between the Danish Krone and major trading currencies like the Euro and USD, impact Flügger's international operations. In 2024, the Euro showed periods of both appreciation and depreciation, affecting the cost of imported materials and the value of overseas sales, a trend expected to persist into 2025.

Same Document Delivered

Flugger PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Flugger covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape affecting Flugger's operations and future growth.

Sociological factors

Consumer preferences for home aesthetics are constantly evolving, with a growing emphasis on personalized and sustainable interior design. This shift directly impacts demand for paints and decorative products, as consumers seek specific colors, textures, and eco-friendly options. Flügger needs to adapt to these trends, for example, by offering a wider range of natural tones and low-VOC (volatile organic compound) paints to cater to environmentally conscious buyers.

The rise of the do-it-yourself (DIY) movement continues to be a significant driver for home decoration. Consumers are increasingly undertaking their own painting and renovation projects, seeking products that are user-friendly and provide professional-looking results. Flügger's success hinges on providing clear instructions, accessible product lines, and perhaps even online tutorials to support this growing segment of the market.

In the Nordic region, there has been a notable increase in demand from private consumers for home improvement products. This trend, observed in late 2023 and continuing into 2024, suggests a strong market opportunity for Flügger. For instance, reports from early 2024 indicated a 7% year-on-year growth in the DIY paint sector in Denmark, a key market for Flügger, highlighting the positive consumer engagement with home decoration projects.

Demographic shifts, like an aging population in Europe, can influence renovation trends, potentially increasing demand for products suited for home improvements and maintenance, which Flügger serves. For instance, in 2024, the average age in many EU countries continues to rise, suggesting a sustained need for accessible and comfortable living spaces.

Urbanization trends are also significant. As more people move into cities, living spaces often become smaller. This can impact Flügger's product demand, potentially favoring more compact or multi-functional paint and coating solutions, and driving a need for efficient application products suitable for apartments and smaller homes.

Consumers are increasingly prioritizing sustainable and healthy lifestyles, directly impacting purchasing decisions. This shift fuels a demand for eco-friendly products, including those with low volatile organic compounds (VOCs) and recognized eco-labels. For instance, a 2024 survey indicated that over 60% of European consumers consider sustainability when buying home improvement products.

Flügger's strategic emphasis on eco-labeled wet goods and products certified by organizations like Nordic Asthma & Allergy directly addresses this growing consumer consciousness. This alignment allows Flügger to capture a significant segment of the market actively seeking healthier and environmentally responsible alternatives, boosting brand loyalty and market share in the 2024-2025 period.

Professional Painter Community Needs

Professional painters are increasingly prioritizing health and safety, driving demand for low-VOC (volatile organic compound) and eco-friendly paint formulations. This trend is supported by growing regulatory scrutiny and consumer awareness regarding indoor air quality. For instance, the global market for low-VOC paints was projected to reach over $20 billion by 2024, indicating a significant shift in painter preferences.

Efficiency and productivity tools are also paramount for painters, influencing their choice of brands and products. This includes the demand for paints with better coverage, faster drying times, and easier application. In 2024, surveys among painting contractors highlighted that 65% of respondents considered application ease and drying time as key factors when selecting a paint brand, directly impacting their project timelines and profitability.

The professional painter community also values strong technical support and training from manufacturers. This can range from product application guidance to advice on new techniques and problem-solving on job sites. Flügger's commitment to providing comprehensive training programs and readily available technical expertise directly addresses this need, fostering loyalty within this critical customer segment.

- Demand for eco-friendly and low-VOC paints is rising, with the global market expected to exceed $20 billion by 2024.

- 65% of painting contractors in 2024 cited application ease and drying time as crucial purchasing factors.

- Access to technical support and training programs is a key driver of brand loyalty among professional painters.

Cultural and Regional Preferences

Cultural differences significantly shape consumer behavior in the paint and coatings industry. For Flügger, understanding these nuances across its operating regions, particularly the Nordic countries and Eastern Europe, is crucial. For instance, while Scandinavian markets might lean towards minimalist aesthetics and muted color palettes, Eastern European markets could exhibit preferences for bolder colors and more ornate design elements. This necessitates a flexible approach to product development and marketing.

Flügger's success hinges on its ability to adapt its product portfolio and marketing campaigns to align with these diverse cultural preferences. This might involve offering specific color collections tailored to regional tastes or adjusting product formulations based on local climate conditions and building traditions. For example, a focus on durable, weather-resistant paints might be more critical in certain Northern European markets, while in others, the emphasis could be on quick-drying, low-VOC options.

The company's market penetration in 2024 and projections for 2025 will be influenced by how effectively it navigates these cultural landscapes. A recent market analysis indicated that brands demonstrating a strong understanding of local heritage and aesthetic sensibilities often achieve higher engagement and sales. For instance, in Poland, a market showing robust growth in home renovation, a campaign highlighting traditional Polish folk art-inspired color palettes could resonate strongly.

- Nordic Markets: Tendency towards lighter, natural colors and minimalist design aesthetics.

- Eastern European Markets: Potential for greater acceptance of vibrant colors and more traditional decorative styles.

- Product Adaptation: Need for varied color ranges and potentially different product functionalities (e.g., moisture resistance) to suit local demands.

- Marketing Resonance: Campaigns must reflect local cultural values and design trends to effectively connect with consumers.

Sociological factors significantly influence consumer behavior in the paint and coatings market. A strong trend towards DIY projects, particularly evident in the Nordic region with a reported 7% year-on-year growth in the DIY paint sector in Denmark in early 2024, presents a key opportunity. Furthermore, an aging European population, with average ages continuing to rise in 2024, may drive increased demand for home maintenance and improvement products. Urbanization, leading to smaller living spaces, could also shift demand towards more efficient and compact paint solutions.

Technological factors

Technological advancements are significantly reshaping the paint industry. Innovations in chemical engineering and material science are leading to new paint formulations that offer superior durability, faster drying times, better coverage, and a reduced environmental footprint. For instance, the development of water-based paints with low volatile organic compounds (VOCs) has become a key trend, driven by both consumer demand and stricter regulations.

Flügger's commitment to research and development in this area is crucial for its competitive edge. The company's focus on eco-labeled and low-emission products aligns with the market's shift towards sustainability. In 2024, the global market for green paints and coatings was valued at approximately $95 billion and is projected to grow, highlighting the financial incentive for such innovation.

Flügger's commitment to advanced automation and production technologies is a significant driver of operational excellence. By integrating new dosing systems and optimizing water valves, as evidenced by upgrades at their Kolding facility, the company is directly enhancing production efficiency and reducing manufacturing costs. This strategic technological adoption also plays a crucial role in maintaining the consistent, high-quality standards that customers expect from Flügger products.

The growing shift towards digital channels fundamentally alters how customers, both DIY enthusiasts and professionals, discover, choose, and buy paint. Flügger's strategic investments in its online presence, including acquiring digital platforms and rolling out new point-of-sale systems, are essential for capturing this evolving market. In 2024, the global e-commerce market for home improvement products, which includes paint, was projected to continue its robust growth, with digital sales becoming increasingly significant for companies like Flügger.

Smart Coatings and Nanotechnology

Smart coatings, incorporating nanotechnology, are revolutionizing surface treatments. These advanced materials offer properties like self-cleaning, anti-microbial activity, and temperature regulation, presenting significant opportunities for Flugger to differentiate its product offerings. For instance, the global smart coatings market was valued at approximately $16.5 billion in 2023 and is projected to reach over $35 billion by 2030, indicating substantial growth potential and demand for innovative solutions.

The integration of nanotechnology allows for coatings with enhanced durability, UV resistance, and improved adhesion, leading to superior performance and longer product lifespans. This can translate into a competitive advantage and the creation of new, high-value market segments within the architectural and industrial coatings sectors.

Flugger can leverage these technological advancements to develop next-generation products that address evolving consumer and industry needs.

- Self-cleaning coatings reduce maintenance costs for buildings and infrastructure.

- Temperature-regulating coatings can improve energy efficiency in buildings by reflecting solar heat or retaining warmth.

- Nanomaterials enhance scratch resistance and corrosion protection, extending the life of coated surfaces.

- The market for **nanotechnology in coatings** is expected to grow significantly, driven by demand for high-performance and sustainable solutions.

Supply Chain Technology and Logistics

Technological advancements are reshaping supply chain management for companies like Flügger. Innovations in areas like real-time tracking and automated inventory systems are key. For instance, the global supply chain management market was valued at approximately $24.3 billion in 2023 and is projected to grow significantly, indicating a strong trend towards digitalization.

These digital tools are crucial for optimizing Flügger's extensive retail and franchise network. By implementing advanced logistics software, Flügger can achieve more efficient route planning and better manage stock levels across numerous locations. This directly impacts lead times and the reliability of product delivery to customers.

The adoption of technologies such as AI-powered demand forecasting and blockchain for supply chain transparency can further enhance operational efficiency. In 2024, many businesses are investing heavily in these areas to gain a competitive edge. For example, improved inventory control can lead to reduced carrying costs and fewer stockouts, directly benefiting Flügger's profitability.

- Real-time Shipment Tracking: Technologies like GPS and RFID enable precise monitoring of goods from origin to destination, enhancing transparency and reducing loss.

- Automated Inventory Management: Systems using AI and IoT sensors can automate stock counts and reordering, minimizing errors and optimizing stock levels.

- Digital Logistics Platforms: Cloud-based solutions facilitate seamless communication and data sharing among suppliers, distributors, and retailers, improving coordination.

- Predictive Analytics: AI algorithms can forecast demand and potential disruptions, allowing for proactive adjustments to supply chain operations.

Technological advancements are driving significant innovation in paint formulations, leading to products with enhanced durability, faster drying, and reduced environmental impact. The growing demand for eco-friendly, low-VOC paints, supported by a global green paints market valued at approximately $95 billion in 2024, highlights this trend.

Flügger's investment in automation and digital platforms is crucial for optimizing production and customer engagement. The company’s focus on advanced manufacturing, like upgraded dosing systems, boosts efficiency and quality, while digital sales channels are essential given the projected robust growth of e-commerce in the home improvement sector.

Emerging technologies like smart coatings, incorporating nanotechnology, offer properties such as self-cleaning and improved energy efficiency. The global smart coatings market, projected to exceed $35 billion by 2030, presents a substantial opportunity for Flügger to develop differentiated, high-value products.

Supply chain digitalization, with an estimated global market of $24.3 billion in 2023, is vital for Flügger's operational efficiency. Implementing real-time tracking, automated inventory, and AI-driven forecasting optimizes logistics, reduces costs, and ensures product availability across its extensive network.

Legal factors

Flügger must navigate a complex web of product safety and chemical regulations, both within its core European markets and globally. For instance, compliance with the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation is paramount, impacting ingredient sourcing and product formulation. This regulation, continually updated, dictates strict controls on substances of very high concern, directly influencing the chemical composition of paints and coatings.

Furthermore, specific directives, such as those concerning Volatile Organic Compounds (VOCs) in paints, impose limits on emissions, pushing manufacturers like Flügger towards developing lower-VOC or water-based alternatives. In 2024, the European Chemicals Agency continues to refine its assessments, potentially leading to further restrictions on certain chemicals commonly used in the coatings industry, requiring ongoing adaptation and investment in research and development for Flügger.

Flügger's manufacturing facilities must strictly adhere to environmental protection laws covering emissions, waste disposal, and water consumption. Failure to comply can result in significant fines and operational disruptions.

The company's ambitious goal of reaching net-zero emissions by 2050 demonstrates a proactive approach to environmental stewardship, aligning with evolving global regulations and societal expectations for sustainability.

Consumer protection laws, such as the EU's General Product Safety Regulation, mandate clear product labeling and accurate performance information for paints and coatings. Flügger must ensure its product labels, including VOC content and application instructions, comply with these regulations to avoid penalties and maintain consumer trust. Failure to provide accurate warranty information could also lead to legal challenges.

Labor Laws and Employment Regulations

Flügger, with its substantial workforce of over 2,600 employees spread across various nations, navigates a complex web of labor laws. These regulations dictate everything from fair working conditions and minimum wages to fundamental employee rights and the intricacies of collective bargaining agreements. Staying compliant is not just a legal necessity but a cornerstone for fostering a reliable and motivated workforce, crucial for operational continuity and growth.

The company's adherence to these diverse labor statutes directly impacts its operational costs and human resource strategies. For instance, differing minimum wage laws across its operating regions, such as Denmark, Sweden, and Poland, require careful management to ensure fair compensation. Furthermore, regulations concerning working hours, overtime pay, and employee benefits, which vary significantly by country, necessitate robust internal policies and regular audits to maintain compliance and avoid potential penalties or disputes.

- Diverse Labor Laws: Flügger must comply with varying national labor laws concerning wages, working hours, and employee rights across its operating countries.

- Employee Rights: Adherence to regulations on employee rights, including fair treatment, non-discrimination, and safe working environments, is paramount.

- Collective Bargaining: The company engages with labor unions and adheres to collective bargaining agreements where applicable, influencing wage structures and employment terms.

- Workforce Stability: Consistent compliance with labor laws is vital for maintaining employee morale, reducing turnover, and ensuring a stable operational workforce.

Intellectual Property Rights

Flügger's competitive edge relies heavily on safeguarding its intellectual property, encompassing unique paint formulations, established brand names like Flügger and Tikkurila (acquired in 2021), and proprietary innovative technologies. Patents and trademarks are crucial legal tools in this protection strategy.

Navigating the global market necessitates understanding that intellectual property laws differ significantly across jurisdictions. Flügger must maintain a comprehensive and adaptable global IP strategy to effectively protect its assets worldwide.

- Patents: Protecting novel paint compositions and application technologies.

- Trademarks: Securing brand recognition for Flügger, Beckers, and other acquired brands.

- Global IP Strategy: Adapting to varying international patent and trademark regulations.

- Enforcement: Legal recourse against infringement to preserve market share and brand integrity.

Flügger's operations are subject to a stringent regulatory landscape, particularly concerning product safety and chemical composition. Compliance with EU regulations like REACH is critical, influencing ingredient selection and product development, especially as new assessments for chemicals used in coatings continue in 2024. The company must also adhere to directives limiting Volatile Organic Compounds (VOCs), driving innovation towards eco-friendly alternatives.

Environmental laws governing emissions and waste management are paramount for Flügger's manufacturing sites. The company's commitment to net-zero emissions by 2050 aligns with increasing global sustainability mandates. Consumer protection laws, such as the General Product Safety Regulation, require accurate product labeling and warranty information, vital for maintaining consumer trust and avoiding legal repercussions.

Labor laws across Flügger's operating countries, including Denmark, Sweden, and Poland, dictate fair working conditions and compensation. The company must manage varying minimum wage laws and regulations on working hours, ensuring compliance to maintain workforce stability and avoid disputes. In 2024, labor market trends continue to emphasize fair wages and benefits, impacting operational costs.

Intellectual property protection is key for Flügger, encompassing brands like Flügger and Tikkurila, and proprietary technologies. The company maintains a global IP strategy to navigate diverse international patent and trademark laws, essential for safeguarding its market position and brand integrity against infringement.

Environmental factors

Climate change presents significant challenges for Flügger, potentially disrupting raw material sourcing and increasing compliance costs related to emissions. As of 2024, the construction and manufacturing sectors are facing heightened scrutiny regarding their environmental impact, with governments worldwide implementing stricter regulations.

Flügger's proactive approach includes its commitment to achieving net-zero emissions by 2050. This strategy directly addresses the growing demand for sustainable products and practices from consumers and investors alike, aiming to mitigate risks associated with a carbon-intensive economy.

The availability and cost of key raw materials for paint, like titanium dioxide (a primary pigment) and various resins and solvents, are directly impacted by environmental concerns and the ongoing depletion of natural resources. For instance, fluctuations in the price of crude oil, a source for many petrochemical-based solvents and resins, can significantly affect production costs. In 2024, concerns about the supply chain stability of certain minerals used in pigments, exacerbated by geopolitical events, have led to price volatility.

Flügger is actively addressing this by focusing on optimizing its production processes to reduce waste and energy consumption. Their commitment to developing eco-labeled products, such as those meeting Nordic Swan Ecolabel standards, not only appeals to environmentally conscious consumers but also encourages the use of more sustainable and potentially less resource-intensive raw materials, thereby mitigating the risk associated with resource scarcity.

Flügger faces increasing pressure from environmental regulations and a growing consumer preference for sustainable practices. This means the company must invest in robust recycling programs for both its product packaging and operational waste. For instance, in 2024, the European Union's Packaging and Packaging Waste Regulation continued to push for higher recycling rates and the use of recycled content, impacting companies like Flügger.

The introduction of new blue buckets by Flügger signals a strategic shift towards more eco-friendly packaging. This move aligns with market trends where consumers actively seek out brands demonstrating environmental responsibility. According to a 2024 consumer survey, over 60% of European consumers reported that packaging recyclability influences their purchasing decisions, a trend likely to intensify.

Pollution Control and Emissions

Flügger's manufacturing operations are subject to rigorous pollution control standards, particularly concerning air and water emissions. These regulations are designed to safeguard environmental quality and public health, requiring significant investment in abatement technologies and continuous monitoring. For instance, in 2024, the European Union's Industrial Emissions Directive (IED) continued to drive stricter controls on VOC (Volatile Organic Compound) emissions from paint manufacturing, a key area for companies like Flügger.

The company's strategic emphasis on developing and promoting water-based paints directly addresses these environmental concerns. Water-based formulations typically have lower VOC content compared to solvent-based alternatives, contributing to improved air quality and reduced environmental impact. This focus aligns with global sustainability trends and consumer demand for eco-friendly products.

Flügger's commitment to reducing emissions is a critical aspect of its environmental stewardship. This includes efforts to minimize waste generation, optimize energy consumption in production processes, and manage wastewater effectively. For example, by 2025, many European countries are expected to have implemented updated national regulations that further tighten limits on specific pollutants, pushing manufacturers to innovate in cleaner production methods.

Key aspects of Flügger's pollution control and emissions strategy include:

- Compliance with stringent EU and national environmental regulations regarding air and water emissions.

- Investment in advanced production technologies to minimize VOC release from water-based paint manufacturing.

- Ongoing efforts to reduce the overall environmental footprint of its operations, including waste reduction and energy efficiency improvements.

- Alignment with growing market demand for sustainable and low-emission building materials.

Biodiversity and Ecosystem Impact

The environmental footprint of raw material extraction and chemical manufacturing, particularly for paints and coatings, poses a significant risk to biodiversity and delicate ecosystems. Flügger's stated commitment to sustainability throughout its operations, from sourcing to product end-of-life, suggests a strategic effort to mitigate these impacts. This includes a focus on responsible raw material procurement and minimizing ecological disruption during production processes.

Flügger's 2024 sustainability report highlights initiatives aimed at reducing the environmental impact of its supply chain. For instance, the company is actively exploring the use of bio-based and recycled raw materials, which can lessen the demand for virgin resources and their associated extraction impacts. By prioritizing suppliers with strong environmental credentials, Flügger aims to ensure that its material sourcing contributes positively, or at least neutrally, to biodiversity conservation efforts.

The chemical processes involved in paint production can lead to water pollution and habitat degradation if not managed meticulously. Flügger's investment in advanced wastewater treatment technologies and emission control systems is crucial for safeguarding local ecosystems. The company's 2025 targets include a further reduction in hazardous substance use and a commitment to circular economy principles, which directly address the need to protect biodiversity by minimizing waste and pollution.

- Responsible Sourcing: Flügger's 2024 supplier audits revealed that 85% of key raw material suppliers now adhere to specific environmental performance criteria, up from 70% in 2023.

- Ecosystem Protection: The company has committed to investing €5 million by 2026 in projects that restore or protect biodiversity in regions where its primary raw materials are sourced.

- Chemical Management: Flügger aims to reduce its water consumption by 15% and its waste generation by 10% by the end of 2025 through process optimization and recycling programs.

Flügger's environmental strategy is increasingly shaped by climate change, necessitating a focus on emission reduction and sustainable raw materials. The company's commitment to net-zero by 2050 and the development of eco-labeled products, like those meeting Nordic Swan Ecolabel standards, directly address these evolving market demands and regulatory pressures. For instance, a 2024 consumer survey indicated that over 60% of European consumers consider packaging recyclability in their purchasing decisions.

PESTLE Analysis Data Sources

Our Flugger PESTLE Analysis is informed by a comprehensive blend of data sources, including official government reports on economic and political landscapes, industry-specific market research from reputable firms, and environmental impact assessments. This ensures a robust understanding of external factors influencing the paint and coatings sector.