Flugger Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flugger Bundle

Uncover the strategic positioning of Flugger's product portfolio with our insightful BCG Matrix. See at a glance which products are driving growth, which are stable earners, and which require careful consideration.

This preview offers a glimpse into the power of the BCG Matrix for Flugger. To truly unlock actionable strategies and make informed decisions about resource allocation and future investments, you need the complete picture. Purchase the full BCG Matrix today for a detailed breakdown and a clear path forward.

Stars

Flügger's commitment to sustainability is evident in its eco-labeled wet goods, capturing an impressive 83% of total sales. This figure climbs even higher, exceeding 90%, for products sold directly under the Flügger brand.

The launch of the 'Flügger Organic' strategy in summer 2024 underscores their ambition to lead in a market increasingly shaped by consumer and regulatory pressure for greener alternatives. This initiative aims to further solidify their position as a key player in fostering a more sustainable industry.

Flügger stands as a dominant force in the Nordic region, most notably as the undisputed market leader in Denmark. This strong foothold in a mature market, characterized by stable demand, enables Flügger to leverage its position for continued growth.

The company's extensive network of physical Flügger Farver stores across the Nordics is a testament to its robust brand recognition and deep customer loyalty. This established presence is crucial for capitalizing on existing demand and potentially expanding its already significant market share through targeted strategies.

Flugger's Polish operations are a standout performer, contributing significantly to the company's overall expansion. In the first half of the 2024/25 financial year, international markets, with Poland at the forefront, saw a robust 19% growth. This impressive surge directly fuels Flugger's revenue and earnings, underscoring the strategic importance of this region.

The company's long-term vision for Poland is evident in its strategic moves. The acquisition of Unicell Poland in 2019 marked a pivotal moment, and ongoing investments in local production facilities continue to solidify Flugger's presence. These efforts are clearly aimed at capturing a larger share of this dynamic and rapidly expanding market.

Professional Painter Segment Focus

Flügger's strategic emphasis on the professional painter segment, a cornerstone of its 'Flügger Organic' growth plan, highlights a key customer group that drives consistent demand and value.

By offering expert advice, dependable product quality, and innovative solutions designed for efficiency and superior finishes, Flügger is solidifying its market leadership within this profitable niche. This targeted approach is yielding tangible success, with recent initiatives resonating strongly with painters across the Nordic countries.

- Targeted Customer Base: The professional painter segment represents a high-value customer group for Flügger, contributing significantly to consistent revenue streams.

- Strategic Alignment: This focus aligns directly with Flügger's 'Flügger Organic' strategy, emphasizing core business strengths for sustainable growth.

- Market Leadership: By providing tailored solutions and support, Flügger aims to enhance its leadership position in the professional painting market.

- Positive Reception: Initiatives aimed at this segment have been well-received, demonstrating effective engagement with painters in the Nordic region.

Innovation in Product Offerings (e.g., Dekso AÏR)

Flügger's introduction of innovative products, such as Dekso AÏR, highlights a strategic move to capture specialized market segments. Dekso AÏR, notable for being the first paint with Nordic Asthma & Allergy certification, directly addresses a growing consumer demand for healthier, certified building materials. This product exemplifies Flügger's dedication to research and development, aiming to meet sophisticated customer requirements and differentiate itself in a competitive landscape.

The company's focus on high-performance, niche products like Dekso AÏR is a key differentiator. This strategy allows Flügger to cater to markets prioritizing health and environmental certifications, such as the M1 certification achieved by other paint and filler products. Such specialized offerings are crucial for building brand loyalty and commanding premium pricing, especially as consumer awareness regarding indoor air quality and product safety continues to rise.

- Dekso AÏR Launch: Flügger introduced Dekso AÏR, the first paint certified by the Nordic Asthma & Allergy Association, in 2024.

- Market Demand: This product targets the increasing consumer preference for health-conscious and certified home improvement solutions.

- Competitive Edge: Innovations like Dekso AÏR, alongside M1 certifications for other products, bolster Flügger's market position and product differentiation.

Stars in the BCG matrix represent products or business units with high market share in a high-growth market. For Flügger, these are typically newer initiatives or markets where they are gaining significant traction. Their strategic focus on innovation and expanding into new, growing regions positions them to cultivate more Stars. The company's strong performance in Poland, for instance, with a 19% growth in international markets in H1 2024/25, highlights a potential Star. Furthermore, their commitment to sustainability and the launch of products like Dekso AÏR cater to a growing, high-potential market segment.

What is included in the product

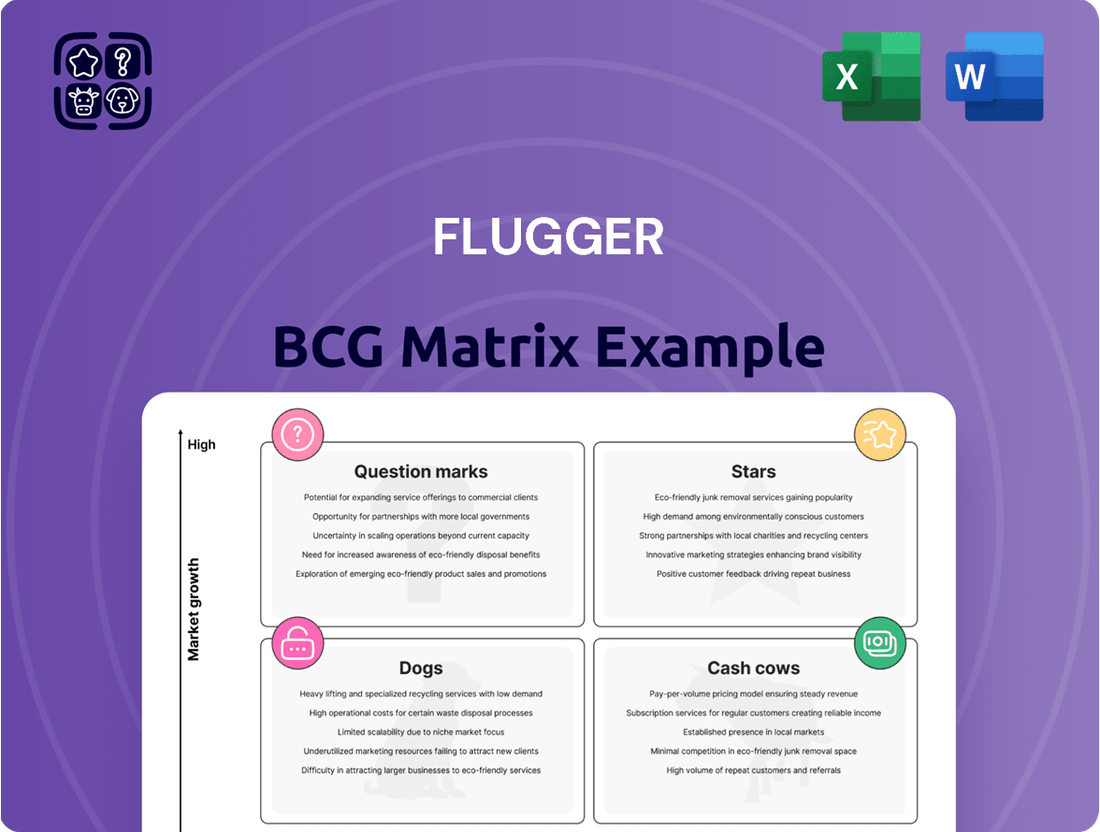

The Flugger BCG Matrix categorizes products into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

It provides strategic guidance on resource allocation for each product category.

Flugger BCG Matrix: A clear, visual snapshot of your portfolio, easing the pain of complex strategic decisions.

Cash Cows

Flügger Farver, Flügger's established retail chain, boasts 231 company-owned stores across the Nordics, Eastern Europe, and China, acting as a significant cash cow. This robust distribution network ensures consistent sales and reliable cash flow, minimizing the need for heavy promotional spending due to strong brand recognition built over years.

Flügger's core decorative paint and wood care products, encompassing a vast array of paints, varnishes, and essential tools, form the bedrock of its business. These established product lines likely command a significant market share within mature segments of the industry, consistently delivering robust revenue streams and healthy profit margins. Their enduring popularity with both professional tradespeople and DIY enthusiasts solidifies their role as dependable cash cows for the company.

Flügger's robust presence in Scandinavia, particularly in Denmark and Sweden, forms the bedrock of its operations. In 2023, the Nordic region accounted for a significant portion of its sales, demonstrating its established market leadership. These mature markets, while not experiencing explosive growth, offer a predictable and stable revenue stream, making them prime candidates for the Cash Cows quadrant of the BCG matrix.

Own Production Facilities (e.g., Kolding Plant)

Flügger's strategic ownership and operation of its own production facilities, exemplified by the significant Kolding plant in Denmark, are key drivers of its cost control and operational efficiency. This vertical integration allows the company to directly manage production processes, leading to better quality assurance and more predictable costs.

The Kolding facility alone is a powerhouse, producing an impressive volume of approximately 30 million liters of water-based paints, wood stains, and wallpaper adhesives each year. This substantial output, combined with other factories strategically located in different countries, enables Flügger to optimize its supply chains, reduce lead times, and ultimately improve its profit margins through economies of scale and streamlined logistics.

Recent investments in local production capabilities underscore Flügger's commitment to enhancing delivery reliability and maintaining high-quality standards across its product range. These investments are crucial in a dynamic market, ensuring that customers receive products promptly and consistently meet expectations.

- Kolding Plant Production: Approximately 30 million liters of paints, wood stains, and adhesives annually.

- Efficiency Gains: Ownership of production facilities contributes to cost control and optimized supply chains.

- Strategic Investments: Recent capital injections into local production bolster delivery reliability and product quality.

- Profitability Impact: Streamlined production and supply chains lead to improved profit margins.

Private Label Sales via Builder's Merchants

Flügger's private label sales through builder's merchants, managed by its Unicell Nordic unit, represent a significant cash cow. This strategy effectively taps into existing retail networks, expanding market reach beyond Flügger's dedicated stores.

This approach generates stable cash flow by utilizing established infrastructure, minimizing the need for new investments in retail space and associated operational costs. It allows Flügger to capture market share in segments where direct brand presence might be less impactful.

- Diversified Revenue Stream: Private label sales offer an additional, less capital-intensive revenue source compared to solely relying on branded retail.

- Leveraging Existing Networks: By partnering with builder's merchants, Flügger benefits from their established customer base and distribution channels.

- Cost Efficiency: This model reduces overhead costs associated with direct-to-consumer retail operations, enhancing profitability.

- Market Penetration: It allows Flügger to reach customers who might not typically visit specialized paint stores, thereby increasing brand visibility and sales volume.

Flügger's mature product lines, particularly its core decorative paints and wood care items, function as reliable cash cows. These products benefit from strong brand loyalty and consistent demand within established markets, generating predictable revenue streams with minimal marketing investment. The company's extensive retail network, including 231 company-owned stores, further solidifies the cash-generating capacity of these offerings.

The Nordic region, especially Denmark and Sweden, represents a significant revenue base for Flügger, acting as a prime example of a cash cow market. Despite slower growth rates, these mature markets provide stable and substantial cash flow, supported by Flügger's market leadership and established distribution. This consistent performance allows the company to allocate resources to other strategic areas.

Flügger's private label business through its Unicell Nordic unit also contributes significantly to its cash cow portfolio. By leveraging existing builder's merchant networks, this segment provides a cost-efficient way to generate stable income without requiring extensive new retail infrastructure. This strategy capitalizes on established channels for consistent cash generation.

| Category | Description | Revenue Contribution | Market Position | Growth Outlook |

| Core Paints & Wood Care | Established, high-demand products | High, consistent | Market Leader | Stable |

| Nordic Markets | Denmark, Sweden, Norway | Substantial | Strong Presence | Mature, stable |

| Private Label (Unicell) | Sales via builder's merchants | Steady | Growing indirectly | Moderate |

Delivered as Shown

Flugger BCG Matrix

The Flugger BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This means you get the full strategic analysis, ready for immediate implementation in your business planning. No additional steps or hidden content—just the professional-grade BCG Matrix report designed for actionable insights.

Dogs

Flügger's divestment of its Russian and Belarusian businesses clearly places these operations within the Dogs quadrant of the BCG Matrix. The company explicitly cited the war in Ukraine and sanctions as reasons for recognizing no future in these markets, a direct reflection of the high risk and low growth potential characteristic of this category.

While these segments may have shown positive EBIT contributions historically, the decision to exit signals that the overall investment became unprofitable. This unprofitability, coupled with the strategic move to divest, strongly suggests these were cash traps, consuming resources without generating sufficient returns or offering a clear path to future growth.

Flugger's international expansion outside of Poland, excluding Russia and Belarus, presents a challenge. These ventures may be consuming valuable resources without generating significant returns or market share. Identifying these underperforming regions is crucial for strategic resource allocation.

While Poland is a clear success story, other international markets might be struggling to gain traction. For instance, if a particular European country shows minimal sales growth and low profitability, it could be a candidate for review. Without a strong competitive edge or a clear market opportunity, these ventures can become a drain on the company's finances.

Detailed financial analysis of each international market is necessary to pinpoint specific underperformers. For example, if a market's revenue growth is consistently below 3% and its contribution margin is negative, it warrants close examination. This data-driven approach helps in making informed decisions about future investment or divestment.

Product lines in low-growth markets with low market share, often called Dogs in the BCG Matrix, are those struggling to gain traction. Think of products that have become outdated due to technological shifts or changing consumer tastes, leading to minimal demand. For instance, if Flugger had a line of traditional paint thinners that saw a significant drop in sales from 2023 to 2024 due to the rise of eco-friendly alternatives, this would fit the Dog category. These products typically yield very little profit and often cost more to support than they bring in.

Underperforming Franchise Stores

Underperforming franchise stores within the Flügger network represent the 'Dogs' in a BCG matrix analysis. These units typically exhibit a low market share in their local territories and operate in a slow-growing market segment. For instance, a franchise store in a declining rural area might struggle to attract sufficient customer traffic, leading to minimal sales and profitability.

These underperforming locations often require significant attention and resources without yielding proportional returns. They might be burdened by factors such as:

- Suboptimal site selection leading to low footfall.

- Ineffective local management impacting sales and operational efficiency.

- Intense local competition or changing consumer preferences in the immediate vicinity.

In 2024, while specific figures for Flügger's underperforming franchises aren't publicly detailed, a common industry benchmark suggests that such 'Dog' units can represent 10-20% of a franchise network’s total locations, disproportionately consuming management time and capital. These stores contribute minimally to overall cash flow and may even operate at a loss, necessitating a strategic review of their future within the company.

Inefficient or High-Cost Legacy Operations

Inefficient or High-Cost Legacy Operations represent business units or processes that consume significant resources but offer little strategic benefit. These can include outdated IT systems or legacy manufacturing equipment that are expensive to maintain and hinder agility. For instance, a company might still rely on manual data entry processes that are prone to errors and slow down operations, costing valuable time and potentially leading to financial losses. In 2024, many businesses are actively seeking to divest or modernize such operations to improve overall efficiency and reduce overhead.

These legacy areas often become cash drains, diverting capital that could be reinvested in growth initiatives or more innovative technologies. Consider a large retail chain that maintains numerous physical stores with outdated inventory management systems. Such systems can lead to stockouts or overstocking, impacting sales and increasing carrying costs. By 2024, the pressure to streamline operations means these segments are prime candidates for re-evaluation and potential divestment.

- High Maintenance Costs: Legacy systems can incur substantial ongoing costs for repairs, specialized personnel, and software licenses. For example, maintaining older server infrastructure can be significantly more expensive than cloud-based solutions.

- Lack of Competitive Advantage: Processes that are slow, inefficient, or technologically inferior do not contribute to a company's competitive edge in the market.

- Resource Drain: These operations consume financial, human, and time resources that could otherwise be allocated to more productive or strategic areas of the business.

- Reduced Agility: Outdated infrastructure can make it difficult for a company to adapt to changing market demands or implement new technologies quickly.

Dogs in the BCG Matrix represent business units or products with low market share in slow-growing industries. These segments often consume more resources than they generate, acting as cash drains. Identifying and managing these 'Dogs' is critical for optimizing resource allocation and improving overall company performance.

Flugger's divestment from Russia and Belarus exemplifies a strategic move away from 'Dog' segments. These markets, characterized by high risk and low growth potential due to geopolitical factors, were deemed unprofitable despite any historical EBIT contributions. This decision highlights the need to exit segments that are cash traps and offer no viable future growth prospects.

Underperforming franchise stores and legacy operations also fall into the 'Dog' category. These units, often hampered by poor site selection, ineffective management, or outdated technology, contribute minimally to profits and can disproportionately consume management attention and capital. Industry benchmarks suggest that such underperformers can account for 10-20% of a network's locations.

The key to managing 'Dogs' is a rigorous financial analysis to pinpoint specific underperformers, such as markets with revenue growth below 3% and negative contribution margins. Companies must be prepared to divest or modernize these segments to free up resources for more promising growth opportunities.

Question Marks

Flügger is actively building its e-commerce presence, notably through the 2021 acquisition of Malgodt ApS, an online retailer specializing in paints and coatings. This strategic move signals a commitment to digital growth, aiming to complement and boost sales in their physical stores.

While this digital push is designed to foster expansion, Flügger's current market share within the online paint and coatings sector is likely modest when contrasted with more established e-commerce giants. Significant capital investment will be crucial for scaling this digital channel and securing a more substantial footprint in the online marketplace.

New product innovations beyond core offerings often represent Flugger's 'Question Marks' in the BCG Matrix. These are ventures like advanced, eco-friendly facade coatings or specialized industrial protective paints that are still gaining market acceptance but show promise for significant future growth.

For instance, Flugger's recent foray into bio-based sealants, introduced in late 2023, exemplifies this category. While early sales figures are modest, market research indicates a strong demand for sustainable building materials, with the global market for green coatings projected to reach over $100 billion by 2028, suggesting substantial potential for these newer products.

These emerging product lines necessitate considerable investment in research and development, targeted marketing campaigns, and building new distribution channels to compete effectively. Success hinges on capturing a significant share of these nascent, high-growth markets before competitors do.

Flügger's strategy of international expansion into new, emerging markets beyond its established Nordic and Polish strongholds represents a classic 'Question Mark' in the BCG Matrix. These markets offer high growth prospects but currently have low market share for Flügger, necessitating significant investment in market entry strategies, brand building, and distribution networks to convert them into future Stars.

Strategic Partnerships with Building Supply Retailers

Flügger's strategy to expand within professional building supply retailers represents a significant move into a new distribution channel. This approach aims to tap into a wider professional customer base, offering substantial growth potential.

However, Flügger's market share within these partnerships is currently low, placing these initiatives in the "Question Marks" category of the BCG matrix. This means they require careful consideration and strategic investment to determine their future potential.

- High Growth Potential: Expanding into professional building supply retailers opens doors to a larger segment of the professional market, which is crucial for revenue growth.

- Low Initial Market Share: Despite the potential, Flügger's presence in these new channels is nascent, necessitating efforts to build brand recognition and customer loyalty.

- Investment Required: Significant investment in collaborative marketing and sales support is essential to achieve meaningful market penetration and convert potential into actual sales.

- Strategic Importance: These partnerships are key to Flügger's organic growth strategy, aiming to diversify its distribution network and strengthen its position in the professional market.

Initiatives to Attract New Customer Segments (e.g., younger demographics)

Flugger's strategic focus on attracting younger demographics, like Gen Z and Millennials, involves digital-first marketing campaigns and influencer collaborations. For instance, in 2024, Flugger increased its social media ad spend by 15% targeting these groups, aiming to build brand relevance. This requires adapting product offerings, perhaps with more sustainable or trend-aligned options, and investing in channels where these consumers are most active.

Initiatives to capture new customer segments, particularly younger ones, are crucial for future growth. These efforts often involve tailoring marketing messages and product features to resonate with their values and preferences. For example, a 2024 campaign might highlight eco-friendly product lines, which research indicates is a key purchasing driver for consumers under 30.

- Digital Engagement: Investing in platforms like TikTok and Instagram for targeted advertising and content creation.

- Product Innovation: Developing smaller, more affordable product sizes or starter kits appealing to budget-conscious younger consumers.

- Partnerships: Collaborating with relevant lifestyle influencers or brands to increase visibility and credibility.

- Sustainability Focus: Emphasizing environmentally friendly practices and product ingredients, a significant factor for younger buyers.

Question Marks in Flügger's BCG Matrix represent new ventures with high growth potential but currently low market share. These are strategic areas requiring significant investment to determine their future success. Flügger's expansion into new international markets and its focus on attracting younger demographics exemplify these "Question Marks."

These initiatives, while promising, demand careful resource allocation and strategic planning to navigate the uncertainties of market penetration and brand building. The success of these "Question Marks" is pivotal for Flügger's long-term growth trajectory.

Flügger's investment in developing and marketing bio-based sealants, for instance, falls into this category. The global market for green coatings is expected to exceed $100 billion by 2028, indicating a substantial opportunity for these nascent products.

Similarly, Flügger's increased social media ad spend by 15% in 2024 targeting Gen Z and Millennials highlights efforts to capture new customer segments. This strategic push aims to build brand relevance among younger consumers, a key demographic for future revenue streams.

| BCG Category | Flügger Initiative | Market Growth | Flügger Market Share | Investment Need | Potential Outcome |

|---|---|---|---|---|---|

| Question Mark | Expansion into new international markets | High | Low | High | Star or Dog |

| Question Mark | Targeting younger demographics (Gen Z/Millennials) | High | Low | High | Star or Dog |

| Question Mark | New eco-friendly facade coatings | High (projected >$100B by 2028 for green coatings) | Low | High | Star or Dog |

| Question Mark | Expansion into professional building supply retailers | Moderate to High | Low | Moderate to High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, competitor analysis, industry growth rates, and consumer trends, to provide a robust strategic overview.