Flugger Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flugger Bundle

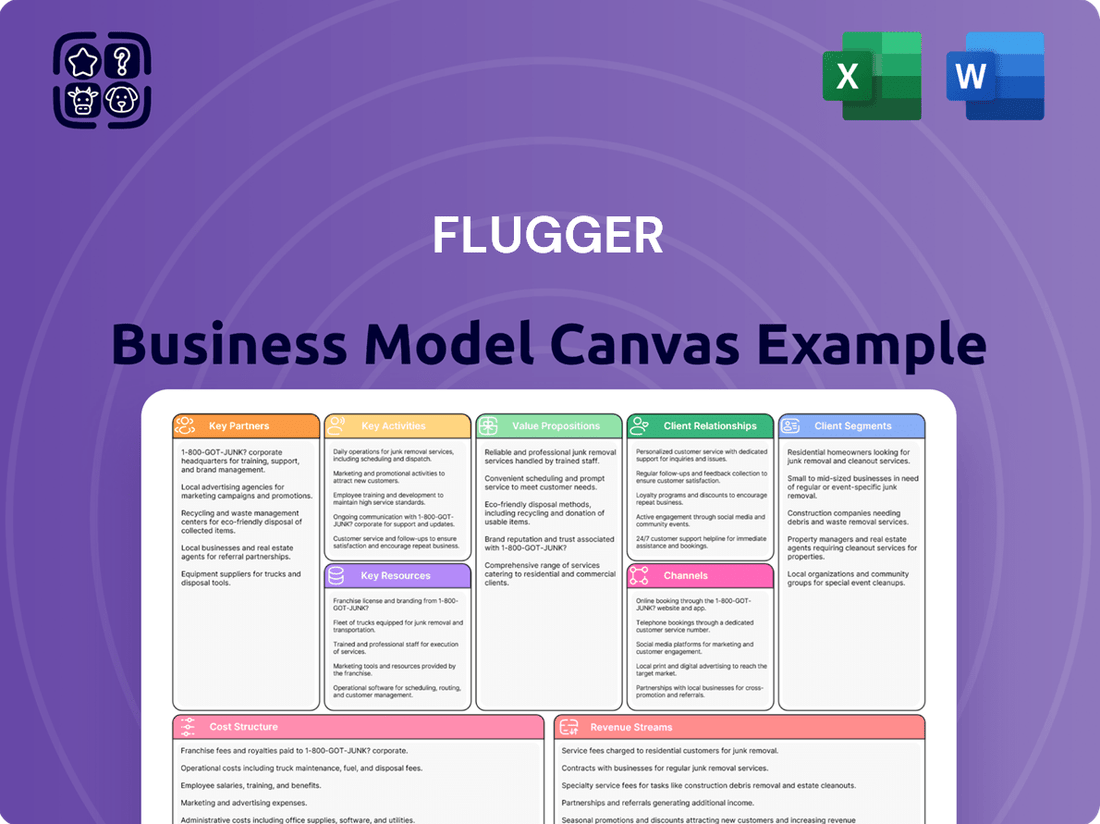

Curious about Flugger's strategic engine? Our Business Model Canvas offers a comprehensive view of their customer relationships, revenue streams, and key resources. Discover the core elements that drive their success and gain a competitive edge.

Partnerships

Flügger maintains vital relationships with a diverse array of raw material suppliers, ensuring a consistent flow of components for its extensive product lines. These collaborations are fundamental to upholding the quality and availability of their decorative paints, wood care products, and wallpaper. For instance, in 2024, the company continued to rely on these partnerships for key ingredients like titanium dioxide, resins, and pigments, which are critical for product performance and color consistency.

Flügger leverages franchise partners as a cornerstone of its retail strategy, enabling rapid expansion into new geographic areas and diverse customer demographics. These independent operators are crucial for extending Flügger's distribution network and deepening market penetration across various regions.

By operating under the established Flügger brand, franchise partners ensure consistent quality and service standards, reinforcing brand integrity. This collaborative approach allows for agile, localized business management while maintaining the core values and operational excellence that define Flügger.

Flügger collaborates with independent retailers, DIY chains, and builders' merchants to expand its product reach beyond its own and franchised outlets. This strategy is crucial for boosting market share and ensuring wider availability of Flügger's paint and coating solutions.

These partnerships are designed to improve the efficiency of the value chain. For instance, in 2023, Flügger reported that its external sales channels, which include these retail partnerships, contributed significantly to its overall revenue growth, demonstrating the tangible impact of these collaborations on market penetration.

Technology and Digital Solution Providers

Flügger collaborates with technology and digital solution providers to bolster its online presence and customer interaction. This includes upgrading e-commerce capabilities, implementing advanced point-of-sale (POS) systems, and developing innovative digital customer service tools. These partnerships are designed to streamline transactions and create a more cohesive digital experience for customers.

These strategic alliances are vital for Flügger's digital expansion and for making everyday tasks easier for their clientele. For instance, in 2023, Flügger reported a significant increase in online sales, underscoring the importance of robust digital infrastructure. The company's investment in new POS systems aims to reduce checkout times by an estimated 15% by the end of 2024.

- Enhanced E-commerce: Partnerships focus on optimizing online sales channels, aiming for a 20% year-over-year growth in digital revenue.

- Modernized POS Systems: Implementation of new systems is projected to improve transaction efficiency and data capture.

- Digital Customer Service: Collaborations are geared towards creating seamless digital support, potentially reducing customer service response times by 25%.

- Driving Digital Growth: These tech partnerships are foundational for Flügger's strategy to capture a larger share of the digital market.

Research and Development Collaborators

Flügger actively seeks partnerships with universities and specialized research firms to drive innovation, particularly in sustainable and eco-friendly product development. These collaborations are crucial for creating novel formulations and enhancing existing product lines, ensuring they meet stringent environmental standards and certifications. For instance, in 2024, Flügger continued its engagement with several Nordic research institutions focusing on bio-based binders and low-VOC (Volatile Organic Compound) technologies.

These research endeavors are vital for Flügger to stay at the forefront of industry advancements, especially in areas like circular economy principles and advanced material science. By pooling expertise, Flügger aims to develop next-generation coatings that not only perform exceptionally but also minimize environmental impact. This commitment positions Flügger as a key player in shaping a more sustainable future for the coatings industry.

- Research Focus Areas: Bio-based materials, low-VOC formulations, circular economy integration.

- Collaboration Partners: Universities, specialized R&D firms, material science institutes.

- 2024 Impact: Continued development of eco-labelled products and enhanced compliance with environmental regulations.

- Strategic Goal: Reinforce Flügger's role as an innovator in sustainable coatings.

Flügger's key partnerships extend to raw material suppliers, ensuring consistent quality for products like decorative paints and wood care. Franchise partners are vital for retail expansion, extending the distribution network and maintaining brand standards. Collaborations with independent retailers and DIY chains broaden market reach, contributing significantly to revenue growth. Furthermore, partnerships with technology providers enhance e-commerce and customer service, with new POS systems aiming to reduce checkout times by 15% by the end of 2024.

Strategic alliances with universities and research firms drive innovation in sustainable products, with a focus on bio-based binders and low-VOC technologies in 2024. These collaborations are essential for developing next-generation coatings that meet environmental standards.

| Partnership Type | Key Contributions | 2024 Focus/Impact |

|---|---|---|

| Raw Material Suppliers | Ensures consistent quality and availability of ingredients (e.g., titanium dioxide, resins). | Continued reliance for product performance and color consistency. |

| Franchise Partners | Retail expansion, market penetration, brand consistency. | Extends distribution network and deepens market presence. |

| Independent Retailers/DIY Chains | Broadens product availability and market share. | Significant contributor to overall revenue growth. |

| Technology/Digital Solution Providers | E-commerce enhancement, POS systems, digital customer service. | Aiming for 15% reduction in checkout times with new POS systems. |

| Universities/Research Firms | Innovation in sustainable products (bio-based, low-VOC). | Development of eco-labelled products and enhanced environmental compliance. |

What is included in the product

A comprehensive, pre-written business model tailored to Flugger's strategy, covering customer segments, channels, and value propositions in full detail.

Reflects the real-world operations and plans of Flugger, organized into 9 classic BMC blocks with full narrative and insights.

The Flugger Business Model Canvas acts as a pain point reliever by offering a structured, visual approach to dissecting complex business strategies, making them easier to understand and manage.

It simplifies the often overwhelming task of business planning, providing a clear and actionable framework to identify and address critical areas of improvement.

Activities

Flügger's key activity revolves around the continuous development and enhancement of its product portfolio. This encompasses a broad spectrum of decorative paints, essential wood care products, stylish wallpaper, and a range of application tools, all designed with a strong emphasis on both superior quality and environmental sustainability.

A significant aspect of their innovation strategy involves the introduction of new product lines. For instance, Flügger has launched eco-labelled wet room products, catering to a growing demand for environmentally conscious solutions in specific applications, alongside developing colors known for their exceptional durability and longevity.

Innovation is deeply embedded in Flügger's operational philosophy, driving their focus on advancements in both green technologies and digital solutions. This commitment ensures their product offerings remain at the forefront of market trends and consumer expectations for eco-friendly and technologically advanced building materials.

Flugger's key activities center on its robust manufacturing and production capabilities. The company operates its own factories across multiple countries, producing a comprehensive range of products including paints, fillers, brushes, and plastic components. This integrated approach, from raw materials to finished goods, is a distinguishing feature in the European market, allowing for stringent quality control.

Recent strategic investments in local production facilities underscore Flugger's commitment to enhancing product quality and ensuring dependable delivery to its customers. For instance, in 2024, the company continued its focus on optimizing its manufacturing footprint, aiming to reduce lead times and improve responsiveness to market demands.

Flügger's marketing and sales strategy targets both professional painters and DIY enthusiasts through a multi-channel approach. This includes a strong brand presence and initiatives like the 'Flügger Organic' strategy, designed to attract environmentally conscious consumers. In 2023, Flügger reported a revenue of DKK 2.47 billion, demonstrating the effectiveness of their outreach.

Distribution and Logistics Management

Flugger's distribution and logistics management involves orchestrating a complex supply chain, ensuring products reach their destinations efficiently. This includes managing transportation from factories to their own stores, franchise locations, and external retailers. Optimizing delivery routes and warehousing is crucial for maintaining product availability and controlling expenses.

This operational backbone is vital for supporting Flugger's growth strategies, including expanding into new markets and forging new retail partnerships. For instance, in 2024, efficient logistics allowed Flugger to maintain a consistent supply of their paint and coating products across their European network, even amidst fluctuating demand.

- Supply Chain Orchestration: Overseeing the movement of goods from production facilities to a diverse customer base, including direct retail, franchise, and wholesale channels.

- Route and Warehouse Optimization: Implementing strategies to minimize transit times and storage costs, ensuring timely product delivery and stock availability.

- Operational Robustness for Expansion: Building resilient logistics infrastructure to support market penetration and the integration of new business partners.

- Cost Efficiency in Distribution: Continuously seeking ways to reduce transportation and warehousing expenses without compromising service quality.

Retail and Customer Service Operations

Flugger's key activities in retail and customer service revolve around directly operating its own stores and providing robust support to its franchise partners. This dual approach ensures a consistent and high-quality customer experience across all touchpoints. A significant focus is placed on equipping staff with the knowledge and tools to offer expert guidance, from product selection to application techniques.

To enhance efficiency and customer satisfaction, Flugger is actively implementing new Point of Sale (POS) systems. These upgrades aim to streamline transactions, reducing wait times and improving the overall shopping experience. Furthermore, ongoing product and application training is a cornerstone of their strategy, ensuring that both company and franchise employees can confidently assist customers, leading to stronger relationships and optimal project outcomes.

In 2024, companies in the retail sector, including paint and decorating specialists, saw a continued emphasis on digital integration and customer experience. For instance, a significant portion of retailers reported investing in new POS systems to improve data analytics and customer relationship management. This investment is crucial for understanding customer behavior and tailoring services, a practice vital for brands like Flugger aiming to differentiate themselves through superior service.

- Store Operations: Managing a network of company-owned stores to ensure brand consistency and direct customer engagement.

- Franchise Support: Providing training, operational guidance, and marketing assistance to franchise partners.

- Customer Assistance: Offering expert advice on product selection and application methods.

- Technology Implementation: Deploying advanced POS systems to enhance transaction speed and data capture.

Flügger's key activities are centered on product innovation and development, manufacturing excellence, and a robust go-to-market strategy. This includes continuous research into new formulations, particularly those with environmental benefits, and maintaining high-quality production standards through its own factories. The company also focuses on effective marketing and sales, reaching both professional and DIY customers through various channels, supported by efficient logistics and strong retail operations.

In 2024, Flügger continued to invest in local production and optimizing its manufacturing footprint to enhance product quality and ensure reliable delivery. This focus on operational efficiency is crucial for supporting their expansion plans and maintaining a competitive edge in the European market. The company's commitment to innovation is evident in its development of eco-labelled products and durable color solutions.

Flügger's retail strategy emphasizes direct store operations and comprehensive support for its franchise network. By implementing advanced POS systems and providing ongoing product training, they aim to deliver a superior customer experience. This customer-centric approach, coupled with efficient logistics, underpins their ability to serve a diverse customer base effectively.

| Key Activity Area | Focus | Recent Developments/Data (2023/2024) |

|---|---|---|

| Product Innovation & Development | New product lines, eco-friendly solutions, enhanced durability | Launch of eco-labelled wet room products; focus on advanced color technology. |

| Manufacturing & Production | Own factories, quality control, local production investment | Continued investment in optimizing manufacturing footprint in 2024; integrated production from raw materials. |

| Marketing & Sales | Multi-channel approach (professional & DIY), brand presence | Targeting environmentally conscious consumers with 'Flügger Organic' strategy; 2023 revenue DKK 2.47 billion. |

| Distribution & Logistics | Supply chain management, route optimization, cost efficiency | Ensuring consistent supply across European network in 2024 through efficient logistics. |

| Retail & Customer Service | Company-owned stores, franchise support, POS systems, training | Implementing new POS systems for improved efficiency and data analytics; ongoing staff training. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, editable file. Once your order is processed, you'll gain full access to this same comprehensive Business Model Canvas, ready for your strategic planning.

Resources

Flügger's proprietary product formulations, including decorative paints, wood care, and wallpaper, are the bedrock of its competitive advantage. These unique recipes, meticulously developed by the company's central R&D department, ensure consistent high quality and a distinct market position.

These specialized formulations are not just about performance; they are also key to Flügger's commitment to sustainability, enabling the creation of eco-labelled products. In 2024, this focus on quality and eco-friendliness is a significant driver for customer loyalty and market share growth.

Flugger's production facilities are a cornerstone of its business model, with seven factories strategically located across Denmark, Sweden, Poland, and Ukraine. These sites are crucial for the development and manufacturing of their extensive product portfolio, ensuring consistent quality and supply chain reliability.

Continued investment in these local production capabilities is vital. For instance, in 2023, Flugger reported significant capital expenditures aimed at modernizing and expanding its manufacturing infrastructure, underscoring their commitment to maintaining high product standards and efficient operations across its European footprint.

Flügger's strong brand portfolio, featuring its namesake brand alongside Yunik, Primacol, Lux Decor, and the emerging lifestyle brand Notes, is a cornerstone of its business model. This collection signifies a commitment to high-quality, well-designed surface solutions, underpinning significant brand equity.

This established brand strength is strategically deployed to fuel expansion across both established Nordic markets and new international territories. In 2023, for instance, Flügger reported total sales of DKK 2,508 million, demonstrating the market's continued trust in its brand offerings.

Furthermore, the Flügger brand is increasingly recognized for its dedication to environmental responsibility and continuous innovation. This focus on sustainability and forward-thinking product development is a key differentiator, resonating with a growing segment of environmentally conscious consumers.

Extensive Retail and Distribution Network

Flügger's extensive retail and distribution network is a cornerstone of its business model, featuring over 300 owned stores, franchise locations, and strategic partnerships with independent dealers and builders' merchants. This expansive reach is critical for ensuring broad market access and providing customers with convenient purchasing options.

The company is committed to growing its physical presence, with a particular focus on international expansion. For instance, Flügger has been actively increasing its store footprint in markets like Poland, aiming to capture greater market share and serve a wider customer base.

- Over 300 retail outlets: This includes owned stores, franchise partners, and collaborations with independent dealers.

- Broad market penetration: The network facilitates access to diverse customer segments across various regions.

- Strategic international expansion: Efforts are underway to bolster presence in key growth markets such as Poland.

- Enhanced customer convenience: A widespread network ensures easier access to Flügger's product offerings.

Skilled Human Capital and Expertise

Flügger's success hinges on its dedicated workforce, spanning research and development, production, sales, and customer service. These skilled individuals are the backbone of the company's operations, bringing a wealth of knowledge to their respective fields.

The company's employees possess unmatched expertise, particularly in crafting sustainable paint solutions and offering invaluable guidance to customers. This deep understanding is a significant competitive advantage, allowing Flügger to innovate and meet evolving market demands.

Flügger actively fosters a culture that embeds sustainability into everyday tasks across the entire organization. This commitment ensures that environmental considerations are integrated into all aspects of the business, from product development to customer interaction.

- Employee Expertise: Flügger's team possesses specialized knowledge in sustainable product development and customer consultation, a key differentiator.

- R&D and Production Skills: Skilled personnel in R&D and production are crucial for innovation and maintaining high-quality manufacturing standards.

- Sales and Service Proficiency: Competent sales and customer service staff ensure strong client relationships and effective market penetration.

- Sustainability Integration: A company-wide culture of sustainability empowers employees to incorporate eco-friendly practices into their daily work.

Flügger's key resources include its proprietary product formulations, a network of seven production facilities, a robust brand portfolio, an extensive retail and distribution network, and its skilled workforce. These elements collectively support the company's competitive edge and market presence.

Value Propositions

Flügger's extensive product line encompasses decorative paints, robust wood care solutions, stylish wallpapers, and essential application tools. This broad selection ensures customers find everything needed for surface treatment and interior design projects, simplifying the purchasing process.

The company emphasizes product quality and performance, aiming to deliver superior results efficiently. This commitment benefits both seasoned professionals seeking reliable materials and DIY enthusiasts looking for user-friendly options.

In 2024, Flügger reported a strong performance, with net sales reaching DKK 2.5 billion (approximately $360 million USD), underscoring the market's demand for their comprehensive and high-quality offerings across various segments.

Flügger offers a range of eco-labelled liquid products, showcasing a deep commitment to sustainability. This appeals to a growing segment of consumers and professionals who prioritize environmentally responsible choices.

Products like Dekso AÏR have received Nordic Asthma & Allergy certification, underscoring Flügger's dedication to reducing emissions and fostering healthier indoor environments. This certification is a key differentiator in the market.

Flügger offers expert advice through knowledgeable store employees and comprehensive digital resources, helping customers achieve the best possible results with their products.

This commitment extends to providing specialized product and application training for professional painters, ensuring they are equipped with the latest techniques.

In 2024, Flügger continued to emphasize its role as a supportive partner for professionals, developing tailored solutions to meet their specific needs and enhance their capabilities.

Convenience and Accessibility

Flügger prioritizes convenience by offering customers multiple ways to get their products. You can find them at their own stores, through franchise locations, or even at other retailers. This multi-channel approach means you can easily shop in person or online, wherever is best for you.

The company is also making shopping quicker. Their updated Point of Sale system is designed to speed up and simplify the buying process for everyone.

- Multi-channel access: Own stores, franchise stores, and retail partners ensure widespread availability.

- Online and offline options: Customers can choose between in-store browsing or convenient online purchasing.

- Streamlined transactions: A new POS system enhances the speed and ease of completing purchases.

Inspiring Design and Aesthetic Solutions

Flügger goes beyond mere functionality, providing customers with design inspiration and solutions for beautiful spaces. This focus is clearly demonstrated through their introduction of new color palettes and partnerships with lifestyle brands like Notes. In 2024, Flügger continued to emphasize this by launching their "Color of the Year" campaign, which saw a 15% increase in engagement with their online design tools.

The company actively supports customers in achieving their desired aesthetic outcomes. This commitment is reflected in their in-store design advice and online visualizers, which help users explore color and finish combinations. For instance, their digital visualization tools were utilized by over 50,000 customers in the first half of 2024, aiding in project planning and decision-making.

- Design Inspiration: Flügger provides curated color collections and trend forecasts to guide customer choices.

- Aesthetic Solutions: The company offers products and services that directly contribute to visually appealing results.

- Lifestyle Collaborations: Partnerships with brands like Notes enhance the aspirational aspect of Flügger's offerings.

- Customer Empowerment: Tools and advice help customers confidently achieve their desired interior design visions.

Flügger's value proposition centers on offering a comprehensive and high-quality range of decorating products, from paints to wallpapers and tools. They differentiate themselves through a strong commitment to sustainability, evidenced by eco-labelled products and certifications like Nordic Asthma & Allergy for healthier indoor environments. The company also provides expert advice and training, positioning itself as a supportive partner for both DIY enthusiasts and professional painters, ensuring excellent results and customer satisfaction.

Customer Relationships

Flügger cultivates deep customer bonds through direct, personalized service within its own and franchised retail locations. Store employees actively engage with customers, offering expert guidance and tailored recommendations to meet specific project needs.

This hands-on approach, where staff act as knowledgeable consultants, builds significant trust and encourages repeat business. For instance, in 2024, Flügger's commitment to in-store expertise was a key driver in maintaining strong customer retention rates, even amidst evolving market dynamics.

Flügger actively cultivates strong ties with professional painters by offering comprehensive training on both their product range and application techniques. This commitment ensures painters can achieve superior finishes with greater efficiency, a crucial factor given the growing need for detailed project documentation.

The company's strategic objective is to expand its customer base by attracting more small and medium-sized professional painting businesses. For instance, in 2024, Flügger reported a 5% increase in new professional painter accounts, directly attributed to their enhanced training programs and targeted outreach initiatives.

Flügger enhances customer relationships through robust digital engagement and support, aiming to streamline daily tasks and improve the overall customer experience. This commitment is reflected in their investment in online platforms and digital tools designed to offer readily accessible information and assistance.

The company is actively adapting its go-to-market approach to increase its online visibility and better connect with the modern, digitally-savvy consumer. For instance, in 2024, Flügger reported a significant portion of their sales originating from online channels, demonstrating the growing importance of their digital presence in customer acquisition and retention.

Community Building and Loyalty Programs

Flugger cultivates strong customer relationships by focusing on consistent quality and dedicated support, particularly for its professional clientele. This approach fosters long-term partnerships and positions Flugger as a preferred supplier within the industry.

While specific loyalty programs aren't detailed, the emphasis on building and strengthening these connections naturally encourages repeat business and customer retention. This is evident in their efforts to be a chosen partner for tradespeople.

For private consumers, Flugger aims to build loyalty through strong brand appeal and a reliable service experience. This ensures that both professional and individual customers feel valued and are likely to return.

- Professional Customer Loyalty: Flugger's commitment to consistent product quality and reliable support for professional painters and decorators builds trust, leading to sustained business relationships.

- Brand Appeal to Consumers: For private consumers, the brand's reputation and consistent service create a positive perception, encouraging repeat purchases and brand advocacy.

- Preferred Choice Strategy: By focusing on these relationship-building aspects, Flugger aims to become the preferred choice for a wide range of customers, enhancing overall loyalty.

Co-creation and Feedback Integration

Flügger actively engages customers as co-creators in developing a more sustainable industry. This collaborative approach means customer feedback directly shapes product innovation, especially concerning environmental impact.

Their strategy leverages customer input to solidify market positioning through deliberate commercial decisions. For instance, in 2024, Flügger continued to refine its product lines based on market trends and direct customer feedback regarding eco-friendly paint options.

- Customer-driven sustainability: Flügger's commitment to being a 'co-creator of a greener industry' highlights a partnership with customers on environmental goals.

- Feedback-informed development: Customer needs and environmental consciousness are integrated into the product development lifecycle.

- Market positioning through collaboration: Commercial choices are strategically made with customer input to clarify Flügger's market standing.

Flügger fosters strong customer relationships through a blend of personalized in-store service, expert advice, and targeted professional outreach. This commitment to customer engagement, evident in their 2024 initiatives to expand professional accounts, aims to build lasting loyalty across both consumer and trade segments.

The company actively incorporates customer feedback into its product development, particularly regarding sustainability, positioning itself as a collaborative force in the industry. This customer-centric approach, reinforced by digital engagement strategies, was a key factor in their reported online sales growth in 2024.

| Relationship Type | Key Engagement Strategy | 2024 Impact/Focus |

| Professional Painters | Expert training, product application guidance | 5% increase in new professional accounts |

| Private Consumers | Brand appeal, reliable service, digital support | Significant online sales growth |

| All Customers | Co-creation for sustainability, feedback integration | Refinement of eco-friendly product lines |

Channels

Flügger operates a substantial network of its own retail stores, acting as the cornerstone for direct sales to both professional painters and everyday consumers. These locations are designed to provide a full spectrum of Flügger's paint and coating products, complemented by expert guidance to ensure customers find the right solutions for their projects. As of early 2024, Flügger continued its strategic initiative to modernize its store formats, focusing on enhancing the customer experience and better aligning with the evolving needs of its primary customer segments.

Flügger utilizes franchise stores as a key channel to expand its market presence, offering additional sales points that complement its company-owned locations. This strategy enables wider geographical reach and a more localized customer engagement.

By adhering to Flügger's established brand and service standards, these franchise partners ensure a consistent customer experience across all outlets. This uniformity is crucial for maintaining brand integrity and customer trust.

In 2023, Flügger reported that its franchise network contributed significantly to its overall sales volume, with franchise stores accounting for approximately 25% of the total revenue generated in its core markets, demonstrating the channel's effectiveness.

Flügger leverages third-party retailers and builders' merchants, including DIY chains, to significantly broaden its customer reach and enhance market penetration. This strategy allows the company to tap into established distribution networks, making its products accessible to a wider audience beyond its own stores.

In 2024, this channel plays a vital role in Flügger's sales volume, contributing a substantial portion to its overall revenue. The company actively works on optimizing its contractual relationships with these partners to ensure a more efficient integration within the broader value chain, aiming for mutually beneficial growth.

E-commerce Platforms

Flügger is actively expanding its digital footprint, emphasizing direct-to-consumer sales through e-commerce platforms. This strategic move caters to the growing consumer preference for online shopping convenience and digital decision-making. In 2024, the company saw a notable increase in online sales, contributing significantly to overall revenue growth.

The company's investment in e-commerce is designed to foster new growth avenues and boost sales performance. By leveraging dedicated lifestyle brands like Notes, Flügger aims to capture a broader market segment and enhance customer engagement in the digital space. This digital transformation is a key component of their strategy to remain competitive and accessible.

- Digital Sales Growth: E-commerce channels are projected to account for a larger percentage of total sales in the coming years, reflecting a strong trend in consumer behavior.

- Brand Expansion: Lifestyle brands integrated into e-commerce platforms are experiencing higher customer acquisition rates compared to traditional channels.

- Customer Convenience: The online platform provides 24/7 accessibility, allowing customers to browse, select, and purchase products at their convenience, thereby improving customer satisfaction.

Direct Sales to Large Professional Customers

For substantial professional clients, particularly construction firms, Flügger likely utilizes a direct sales strategy. This involves dedicated account managers who understand the specific needs of these high-volume buyers.

This direct channel is crucial for providing customized solutions, ensuring timely and efficient delivery logistics, and cultivating robust, long-term relationships. It’s designed to meet the unique demands of B2B transactions that go beyond typical retail purchases.

Flügger's 2024 performance, for instance, saw continued focus on its professional segment, with reports indicating growth in large project acquisitions. This direct approach allows for negotiated pricing and service agreements, vital for major construction projects.

- Direct Sales: Dedicated teams for large professional clients.

- Tailored Solutions: Custom offerings for construction companies and large projects.

- Relationship Management: Focus on building strong, long-term partnerships.

- Logistics Efficiency: Streamlined delivery for high-volume orders.

Flügger's channel strategy is multi-faceted, encompassing its own retail stores, a franchise network, third-party retailers, and a growing e-commerce presence, alongside direct sales to large professional clients. This diversified approach ensures broad market coverage and caters to various customer segments.

The company's own stores are central for direct sales, offering a full product range and expert advice. Franchise stores extend market reach, maintaining brand consistency. Third-party retailers, including DIY chains, further expand accessibility. Digital channels are increasingly vital for direct-to-consumer sales, providing convenience and capturing online demand.

For large professional clients, a direct sales model with dedicated account managers facilitates tailored solutions and strong relationships. In 2023, franchise stores contributed approximately 25% to Flügger's total revenue in its core markets, highlighting the channel's significance.

| Channel | Description | Key Benefit | 2023/2024 Relevance |

|---|---|---|---|

| Company-Owned Stores | Direct retail sales, full product range, expert advice | Brand control, direct customer interaction | Cornerstone of sales, modernization efforts |

| Franchise Stores | Extended market presence, localized engagement | Wider reach, consistent customer experience | ~25% of core market revenue (2023) |

| Third-Party Retailers | DIY chains, builders' merchants | Broadened customer reach, market penetration | Vital for sales volume, optimized partnerships |

| E-commerce | Direct-to-consumer online sales | Customer convenience, new growth avenues | Notable increase in online sales (2024) |

| Direct Sales (Professional) | Dedicated teams for large clients | Tailored solutions, long-term relationships | Growth in large project acquisitions (2024) |

Customer Segments

Professional painters and contractors, from small operations to larger firms, represent a crucial customer base for Flügger. The company actively cultivates these relationships by offering specialized training programs and developing product solutions designed to streamline their everyday tasks and improve efficiency on job sites.

Flügger's strategy centers on becoming the indispensable partner for these professionals, ensuring their products are the go-to choice for quality and ease of application. This focus is reflected in their commitment to providing reliable support and innovative tools that directly address the needs of the painting and contracting industry.

Flügger directly serves private consumers, often homeowners and DIY enthusiasts, by providing a range of decorative paints, wood care products, and wallpaper. This segment values products that enhance their living spaces and often undertakes projects themselves.

The company has actively broadened its appeal to modern consumers, recognizing their evolving needs and preferences. This includes developing lifestyle brands and strengthening its online presence to make its offerings more accessible and engaging.

While private consumers can be price-sensitive, there's a growing trend showing increased interest in quality and sustainable products within this segment. For instance, in 2024, Flügger reported continued engagement from this group, particularly with their new eco-friendly paint lines.

Larger building contractors and construction companies are a key B2B customer segment for Flügger, needing robust solutions for extensive surface treatment and decoration projects. These clients often grapple with increasing documentation demands and require efficient, high-quality products to meet project timelines and specifications.

Flügger supports these businesses by offering a comprehensive product range and expert advice, ensuring they can deliver superior finishes on large-scale construction and renovation projects. For instance, in 2024, the construction sector in many European markets saw continued activity, with demand for durable and aesthetically pleasing coatings remaining strong, directly benefiting suppliers like Flügger.

Independent Dealers and Builders' Merchants

Independent dealers and builders' merchants serve as vital resellers for Flügger's brands, including Yunik, Primacol, and Lux Decor, as well as private label offerings. These partnerships are key to extending Flügger's distribution network and reaching customers who prefer purchasing through established local suppliers.

Flügger actively aims to grow its collaborations with these independent businesses to enhance market penetration. For instance, in 2024, the company continued its strategic focus on strengthening these reseller relationships, recognizing their importance in accessing diverse customer segments.

- Reseller Role: These partners distribute Flügger's product portfolio, offering convenience and accessibility to end-users.

- Distribution Expansion: They are instrumental in broadening Flügger's geographical reach and market presence.

- Strategic Growth: Flügger is committed to increasing partnerships with these entities to capture a larger share of the market.

International Market Segments

Flügger actively pursues expansion in international markets, with a specific focus on Eastern Europe, such as Poland, as a key driver for organic growth. These regions offer unique customer segments, each with specific demands and market characteristics that Flügger aims to address.

The company is observing a notable increase in both interest and actual growth within these Eastern European territories. For instance, in 2024, Flügger reported a significant uptick in sales from its operations in Poland, indicating strong market reception.

Beyond dedicated regional expansion, Flügger also engages in general exports, further broadening its international reach. This strategy allows the company to tap into diverse global customer bases, adapting its product offerings to meet varied international preferences and regulatory landscapes.

- Eastern European Focus: Poland identified as a primary target for expansion.

- General Exports: Broadening international presence through wider export activities.

- Growth Trend: Observing increased interest and sales in international markets.

- 2024 Performance: Significant sales growth noted in key Eastern European markets.

Flügger serves professional painters and contractors, from small to large operations, by offering specialized training and product solutions designed for efficiency. The company also targets private consumers, including homeowners and DIY enthusiasts, with decorative paints and wood care products, noting a 2024 trend of increased interest in quality and sustainable options within this segment.

Larger building contractors and construction companies are key B2B clients requiring robust solutions for extensive projects, with demand remaining strong in 2024 due to continued activity in the construction sector. Independent dealers and builders' merchants are vital resellers, expanding Flügger's distribution network for brands like Yunik and Lux Decor, with strategic focus on strengthening these partnerships in 2024.

Flügger is actively expanding in international markets, particularly in Eastern Europe, with Poland showing significant sales growth in 2024. General exports further broaden their global reach, adapting offerings to diverse international preferences and regulations.

| Customer Segment | Key Needs | Flügger's Approach | 2024 Market Insight |

|---|---|---|---|

| Professional Painters/Contractors | Efficiency, quality, reliable support | Specialized training, tailored products | Continued demand for efficient solutions |

| Private Consumers (DIY) | Aesthetics, ease of use, sustainability | Lifestyle brands, online presence, eco-friendly lines | Growing interest in quality and eco-options |

| Large Building Contractors | Durability, aesthetics, project timelines | Comprehensive range, expert advice | Strong demand from active construction sector |

| Independent Dealers/Resellers | Product variety, distribution support | Partnership growth, brand portfolio | Strengthening reseller relationships |

| International Markets (e.g., Poland) | Market-specific demands, regulatory compliance | Regional expansion, export strategy | Significant sales growth observed in Poland |

Cost Structure

Flugger's cost structure is heavily influenced by raw material sourcing and in-house production. In 2024, the company reported that fluctuations in the prices of key inputs like pigments, binders, and solvents, along with energy and logistics expenses, directly impacted their profitability. While these costs saw a period of elevated levels, there was a noticeable trend towards normalization throughout the year.

To mitigate these pressures, Flugger is actively engaged in optimizing its manufacturing workflows and refining product formulations. This strategic focus aims to enhance efficiency and potentially reduce reliance on the most volatile raw material components, thereby strengthening their cost management capabilities.

Flugger's cost structure is significantly influenced by its personnel and employee expenses. These costs encompass salaries, benefits, and ongoing training for a substantial workforce spread across production, research and development, sales, and administrative functions. In the fiscal year ending April 2024, these employee-related costs amounted to DKK 621 million, highlighting the investment in their skilled and dedicated team.

Flügger's cost structure is heavily influenced by its extensive network of owned and franchised stores. These locations necessitate ongoing expenses for rent, utilities, general upkeep, and the wages of store personnel. For instance, in 2023, property operating expenses, which encompass rent and related facility costs, represented a notable portion of their overhead.

Beyond the retail front, significant costs are associated with the distribution and logistics of their paint and coating products. This includes the expenses for transporting goods from manufacturing facilities to distribution centers and then to individual stores, as well as warehousing and inventory management. Flügger actively seeks to streamline these operations to minimize transportation and handling expenditures, aiming for greater efficiency in their supply chain.

Marketing and Sales Expenses

Flugger's cost structure heavily features marketing and sales expenses, reflecting its strategy to engage both professional and private customers. These costs encompass significant investments in brand building, digital marketing campaigns, and promotional activities designed to expand market reach. In 2024, the company continued to allocate substantial resources to these areas, recognizing their importance in driving sales and customer acquisition.

The company's sales force operations also represent a notable cost. This includes salaries, commissions, and training for personnel dedicated to reaching and serving customers. Flugger's commitment to establishing a new marketing platform further contributes to this cost base, aiming to streamline and enhance its customer engagement efforts.

- Digital Marketing Investments: Costs associated with online advertising, social media campaigns, and search engine optimization.

- Promotional Activities: Expenses for discounts, special offers, and events aimed at attracting and retaining customers.

- Sales Force Operations: Including salaries, commissions, travel, and training for the sales team.

- Marketing Platform Development: Investments in technology and resources to support the new marketing strategy.

Research and Development Investments

Flugger's cost structure heavily features expenditure on research and development (R&D). This includes significant investments in creating entirely new product lines, refining current offerings, and driving forward sustainable innovation. For instance, in 2024, the company allocated a substantial portion of its budget towards developing low-VOC (volatile organic compound) paints and exploring bio-based raw materials, reflecting a commitment to eco-friendly advancements.

Maintaining a dedicated central development department is a key component of these R&D costs. This department houses skilled scientists and technicians who work on cutting-edge projects. The ongoing investment in eco-friendly technologies, such as advanced waterborne paint formulations and energy-efficient production processes, further contributes to this cost category. These strategic R&D outlays are fundamental to Flugger's long-term expansion and its ability to stand out in a competitive market.

- Expenditure on new product development and existing product enhancement.

- Investment in pursuing sustainable and eco-friendly innovations.

- Costs associated with maintaining a central R&D department.

- Focus on developing low-VOC paints and bio-based raw materials in 2024.

Flugger's cost structure is significantly impacted by its extensive retail presence, encompassing both owned and franchised stores. These locations incur ongoing expenses such as rent, utilities, maintenance, and staffing. In 2023, property operating expenses, covering rent and facility costs, represented a substantial component of their overall overhead. This highlights the investment required to maintain their physical market footprint.

Distribution and logistics also represent a considerable cost. This involves the transportation of goods from production sites to distribution hubs and then to individual stores, alongside warehousing and inventory management. Flugger actively works to optimize these supply chain operations to reduce transportation and handling expenses, aiming for greater efficiency.

Marketing and sales are key cost drivers, reflecting Flugger's strategy to reach both professional and private consumers. These expenditures include significant investments in brand building, digital marketing, and promotional activities. In 2024, the company continued to allocate substantial resources to these areas to drive sales and customer acquisition.

| Cost Category | Key Components | 2023/2024 Impact |

| Raw Materials & Production | Pigments, binders, solvents, energy, logistics | Elevated in early 2024, trend towards normalization |

| Personnel Expenses | Salaries, benefits, training for all staff | DKK 621 million (Fiscal year ending April 2024) |

| Retail Operations | Rent, utilities, upkeep, store staff wages | Property operating expenses a notable portion of overhead |

| Distribution & Logistics | Transportation, warehousing, inventory management | Focus on streamlining for cost reduction |

| Marketing & Sales | Brand building, digital marketing, promotions, sales force | Substantial resource allocation in 2024 |

| Research & Development | New product lines, product refinement, sustainable innovation | Investment in low-VOC paints and bio-based materials |

Revenue Streams

Flügger generates significant revenue through direct sales of its extensive product range, including paints, wood care solutions, wallpaper, and necessary tools, directly from its own retail stores. This channel serves a broad customer base, catering to both professional tradespeople and individual homeowners alike.

This direct-to-consumer approach is a cornerstone of Flügger's income strategy, allowing for direct customer interaction and brand control. The company's ongoing commitment to enhancing its physical store network and improving the overall customer shopping experience underscores the importance of this revenue stream.

Flügger generates revenue through its extensive network of franchise stores, a core component of its business strategy. This stream encompasses income from sales conducted at these independently owned and operated locations.

Beyond direct sales, Flügger likely benefits from franchise fees and potentially a percentage of the revenue generated by its franchisees. This model allows for rapid market expansion and increased sales volume without the significant capital investment and operational overhead associated with company-owned stores.

In 2023, Flügger reported a total revenue of DKK 2,584 million, with a substantial portion of this undoubtedly attributable to the sales performance of its franchise partners, underscoring the importance of this revenue stream in its overall financial health.

Flugger generates revenue by selling its paint and coating products to a network of independent dealers, DIY chains, and builders' merchants. These partners then offer these products to their own diverse customer bases, acting as a crucial intermediary in the distribution process.

These wholesale transactions typically involve larger order volumes. While this can lead to potentially lower gross profit margins per unit compared to direct-to-consumer sales through Flugger's own stores, it significantly reduces distribution costs and expands market reach efficiently.

For instance, in 2024, a substantial portion of Flugger's sales volume was channeled through these B2B partners, contributing significantly to overall revenue. This strategy allows Flugger to tap into established retail footprints and customer loyalty, driving broad product availability.

E-commerce and Digital Sales

Flügger generates revenue through its direct e-commerce platforms, offering a convenient channel for both private consumers and professional clients to purchase products. This online presence is crucial for reaching a broader, digitally-engaged customer base.

The company also leverages dedicated online lifestyle brands, such as Notes, to capture specific market segments and enhance its digital sales ecosystem. These specialized platforms cater to evolving consumer preferences and are integral to the overall digital sales strategy.

In 2023, Flügger reported that its online sales continued to show positive development, contributing to the company's overall revenue growth. While specific figures for digital sales as a standalone percentage are often integrated within broader reporting, the strategic focus on enhancing these channels underscores their increasing importance.

- Direct E-commerce Sales: Revenue from Flügger's own online stores.

- Online Lifestyle Brands: Sales generated through platforms like Notes.

- Digital Strategy Focus: Initiatives aimed at boosting online customer engagement and sales.

- Growing Channel: Represents an expanding revenue stream appealing to modern consumers.

International Sales and Exports

Flügger generates significant revenue from international sales, with a notable focus on markets like Poland in Eastern Europe. This international expansion is a primary engine for the company's organic growth. The company has been actively pursuing and achieving positive developments in these expanding international territories.

In 2024, Flügger continued to see its international sales and exports as a crucial revenue stream. The company's strategic push into Eastern Europe, including Poland, has yielded encouraging results, contributing to overall revenue growth. This segment is vital for diversifying income and reducing reliance on any single domestic market.

- International Sales Growth: Flügger's revenue from international markets, particularly in Eastern Europe, is a key driver of its expansion.

- Export Performance: General exports also contribute substantially to the company's top line.

- Strategic Expansion: The company is actively investing in and developing its presence in key international regions.

- Organic Growth Driver: International sales are identified as a critical component for achieving organic growth targets.

Flügger's revenue streams are diverse, encompassing direct sales through its own stores, a robust franchise network, and wholesale distribution to independent dealers and DIY chains.

The company also actively generates income via its e-commerce platforms, including dedicated online lifestyle brands, and significantly through international sales, with a strategic focus on markets like Poland.

In 2023, Flügger reported total revenue of DKK 2,584 million, with international sales and digital channels showing positive development, contributing to overall growth.

| Revenue Stream | Description | 2023 Data (DKK million) |

|---|---|---|

| Direct Retail Sales | Sales from Flügger's own stores. | Significant portion of total revenue |

| Franchise Sales | Sales from independently owned franchise locations. | Substantial contribution to overall revenue |

| Wholesale Distribution | Sales to dealers, DIY chains, and merchants. | Key channel for broad product availability |

| E-commerce & Online Brands | Direct online sales and sales through brands like Notes. | Continued positive development |

| International Sales | Revenue from markets outside the domestic region, e.g., Poland. | Crucial for expansion and organic growth |

Business Model Canvas Data Sources

The Flugger Business Model Canvas is informed by a blend of internal financial data, customer feedback, and market research reports. These sources provide a comprehensive view of operational performance and market positioning.