Flugger Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flugger Bundle

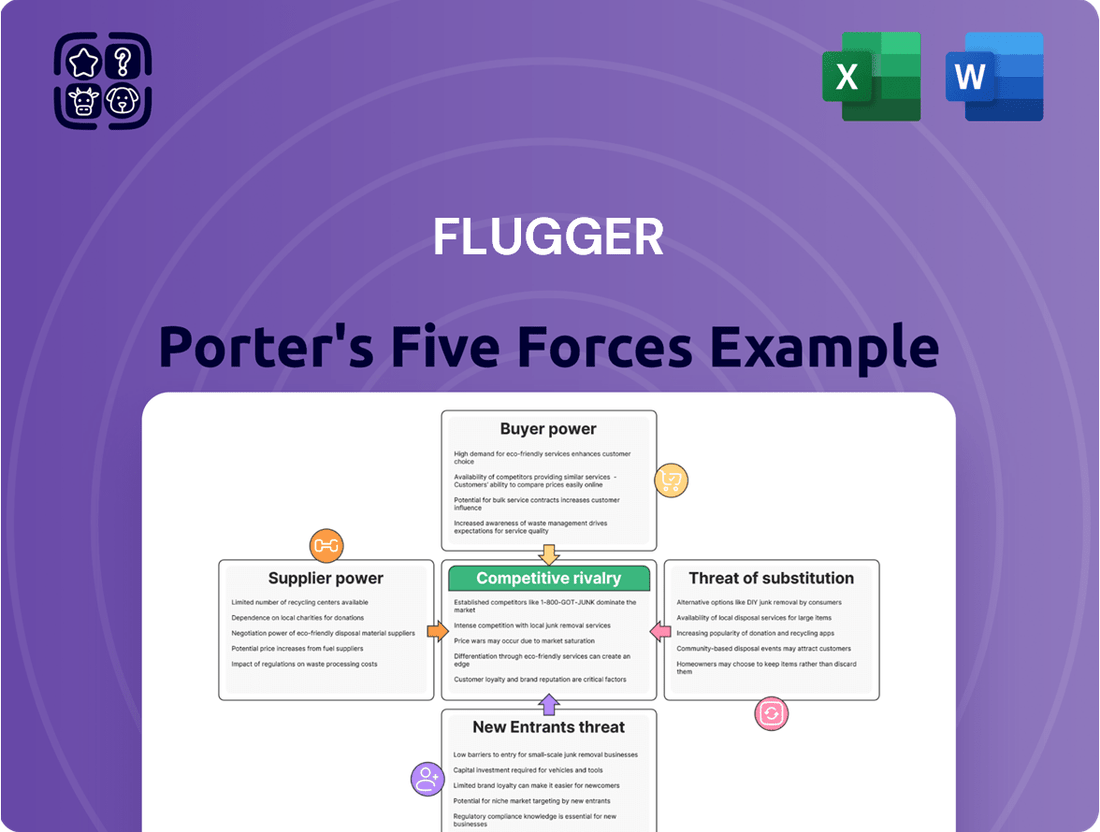

Flugger's competitive landscape is shaped by intense rivalry among existing players and the constant threat of new entrants vying for market share. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this dynamic industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Flugger’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The paint and coatings sector, which includes companies like Flügger, is highly dependent on raw materials such as resins, pigments like titanium dioxide, solvents, and various additives. In 2024, the price of titanium dioxide, a key white pigment, saw significant volatility, with some reports indicating price increases of up to 15% in the first half of the year due to strong demand and production constraints. This volatility directly impacts Flügger's production expenses and ultimately, its profit margins.

If Flügger relies on a limited number of suppliers for crucial raw materials, those suppliers gain significant leverage. This concentration allows them to potentially dictate higher prices or more stringent terms. For instance, if a paint manufacturer like Flügger sources a unique pigment from only two global producers, those producers hold considerable bargaining power.

The bargaining power of suppliers for Flügger is significantly shaped by switching costs. If Flügger faces substantial expenses or operational disruptions when changing paint and coating suppliers, these suppliers gain considerable leverage. This includes costs related to retooling manufacturing equipment, reformulating products to meet new specifications, or implementing rigorous new quality control measures.

For instance, if a key supplier provides specialized pigments or binders that are integral to Flügger's unique paint formulations, the cost and complexity of sourcing these from an alternative supplier can be prohibitive. This dependency allows the incumbent supplier to potentially dictate terms, impacting Flügger's cost of goods sold and overall profitability. In 2023, the global coatings market saw raw material price volatility, underscoring how critical supplier relationships and the ease of switching are for manufacturers like Flügger.

Supplier's Product Differentiation

When suppliers offer highly specialized, patented, or unique raw materials with few viable alternatives, their bargaining power significantly increases. For Flügger, a reliance on such differentiated inputs would directly translate to greater supplier leverage, potentially driving up costs.

For instance, if Flügger depends on a specific, proprietary pigment formulation for its premium paint lines, the supplier of that pigment would hold considerable sway. This is particularly true if developing an alternative would be time-consuming and expensive, or if intellectual property rights restrict other manufacturers.

- Supplier Differentiation: The degree to which a supplier's product or service is unique or has few substitutes.

- Impact on Flügger: High differentiation of inputs used by Flügger strengthens supplier power.

- Cost Implications: Differentiated inputs can lead to higher raw material costs for Flügger.

- Strategic Importance: Flügger's ability to secure reliable, cost-effective access to differentiated inputs is crucial for its profitability.

Threat of Forward Integration by Suppliers

Suppliers who can credibly threaten to move into the buyer's industry themselves, like producing paint and coatings directly, can significantly impact Flügger's bargaining power. This potential for forward integration by raw material providers, such as pigment or resin manufacturers, means they could bypass existing players like Flügger, thereby limiting Flügger's leverage in price negotiations.

For instance, a major chemical supplier with extensive R&D capabilities might consider establishing its own paint production line if it perceives insufficient returns or strategic advantages. This scenario can force companies like Flügger to accept less favorable terms, as the supplier has the option to capture more value downstream. In 2024, global chemical companies have shown increased interest in vertical integration across various sectors to secure market share and control supply chains.

- Potential for supplier forward integration into paint and coatings production.

- Reduces Flügger's ability to negotiate favorable terms and pricing.

- Increased interest in vertical integration by chemical suppliers in 2024.

Flügger's suppliers possess significant bargaining power when they are concentrated, meaning only a few companies provide essential raw materials like titanium dioxide or specialized resins. This limited competition allows these suppliers to command higher prices, as seen with the up to 15% price increase in titanium dioxide in early 2024 due to demand and production issues. High switching costs for Flügger, involving reformulation and equipment changes, further embolden suppliers by making it difficult and expensive to find alternatives.

When suppliers offer unique or patented inputs, such as proprietary pigments crucial for Flügger's premium lines, their leverage intensifies. This differentiation makes it challenging and costly for Flügger to source comparable materials elsewhere, potentially driving up production expenses. Furthermore, the threat of suppliers integrating forward into paint production, a trend observed with chemical companies in 2024 seeking to control supply chains, can compel Flügger to accept less favorable terms.

| Factor | Impact on Flügger | Example/Data (2024) |

|---|---|---|

| Supplier Concentration | Increases supplier leverage | Limited number of key raw material providers |

| Switching Costs | Strengthens supplier power | High costs for reformulation and equipment changes |

| Input Differentiation | Enhances supplier pricing power | Proprietary pigments for premium paint lines |

| Forward Integration Threat | Reduces Flügger's negotiation ability | Chemical companies exploring vertical integration |

What is included in the product

Analyzes the intensity of competition, buyer and supplier power, threat of new entrants, and substitute products specifically for Flugger's market.

Instantly identify and address competitive threats with a clear, actionable breakdown of each Porter's Five Force, empowering proactive strategy development.

Customers Bargaining Power

Flügger's customer base is diverse, encompassing both professional painters and individual DIY enthusiasts. For private customers, particularly during economic downturns, price sensitivity is a significant factor. They actively seek out competitive pricing and promotional offers to manage their budgets effectively.

Professional painters, while prioritizing product quality and consistent performance, are also keenly aware of their project costs. They will evaluate suppliers based on value, looking for cost-effective solutions that don't compromise on the results they need to deliver for their clients. For instance, in 2024, many construction and renovation markets experienced increased price competition, directly impacting the purchasing decisions of professional tradespeople.

Large professional customers, such as major construction firms or large retailers, can exert significant bargaining power over Flügger due to the sheer volume of their purchases. These buyers can leverage their substantial order sizes to negotiate lower prices, demand bespoke product formulations tailored to their specific needs, or secure more advantageous payment schedules, thereby influencing Flügger's profitability and operational flexibility.

Customers today have a wide array of choices when it comes to treating and decorating surfaces. Beyond Flügger's own offerings, they can easily opt for competing paint brands, explore wallpaper options from various manufacturers, or consider entirely different wall covering solutions like decorative panels or textured finishes.

This abundance of alternatives significantly impacts Flügger's leverage. The simpler it is for a customer to switch to a competitor's product, the less power Flügger has to dictate prices. For instance, in 2024, the global paint market saw intense competition, with many brands offering similar quality and color palettes, making price a key differentiator for consumers.

Buyer Information and Transparency

Buyer information and transparency significantly bolster customer bargaining power. With readily available online data, consumers can effortlessly compare prices, read reviews, and explore alternatives from various suppliers. This accessibility means customers are better informed than ever before, leading to more demanding negotiations and a greater ability to seek out the best deals.

In 2024, the digital landscape continued to empower buyers. For instance, e-commerce platforms and comparison websites provide consumers with instant access to a wealth of product specifications, pricing across multiple vendors, and user-generated feedback. This transparency directly challenges businesses to offer competitive pricing and superior value propositions. A study by Statista indicated that over 80% of online shoppers in major markets consult reviews before making a purchase, underscoring the impact of information availability.

- Increased Price Sensitivity: Buyers can easily identify the lowest prices available for similar products or services, forcing suppliers to compete more aggressively on cost.

- Informed Purchase Decisions: Access to detailed product information, specifications, and performance reviews allows customers to make more discerning choices, often favoring suppliers offering better quality or features for the price.

- Reduced Switching Costs: Transparency about alternatives and the ease of online purchasing can lower the perceived cost and effort involved in switching suppliers, giving customers more leverage.

- Demand for Value: Informed buyers are more likely to demand greater value, pushing companies to innovate and improve their offerings to meet heightened expectations.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while less prevalent in the paint sector, poses a potential challenge for suppliers like Flügger. Large professional painting contractors or significant retail chains could, in theory, decide to manufacture their own paints or develop private label brands. This move would directly increase their bargaining power, allowing them to dictate terms or reduce their reliance on external manufacturers.

Consider a scenario where a major national painting service provider, with substantial volume requirements, evaluates the cost-effectiveness of in-house paint production versus sourcing from existing suppliers. If the economics are favorable, they might invest in manufacturing capabilities. For instance, in 2024, the global paint and coatings market saw continued consolidation, with some larger players exploring vertical integration to control costs and supply chains more effectively, a trend that could trickle down to significant customer segments.

- Potential for large professional painting companies to develop private label paint brands.

- Major retailers might explore manufacturing their own paint lines to increase leverage.

- This integration would reduce customer dependence on suppliers like Flügger.

- The global paint market's ongoing consolidation could encourage such strategic moves among large customers.

Flügger faces considerable customer bargaining power due to a diverse customer base with varying price sensitivities and access to abundant alternatives. Large professional clients can leverage their purchasing volume for better terms, while the ease of comparing prices and product information online empowers all buyers. In 2024, the intense competition within the global paint market, with many brands offering similar quality, further amplified this power, making price a crucial differentiator.

| Factor | Impact on Flügger | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity (DIY) | High | Economic downturns increased focus on competitive pricing and promotions. |

| Price Sensitivity (Pro) | Moderate to High | Value-driven purchasing, with cost-effectiveness impacting decisions. |

| Availability of Alternatives | High | Numerous competing paint brands, wallpapers, and other wall finishes available. |

| Buyer Information Access | High | Online price comparison, reviews, and product data empower informed choices. |

| Customer Concentration | Moderate | Large professional clients can exert significant volume-based negotiation power. |

| Backward Integration Threat | Low to Moderate | Potential for large contractors or retailers to explore private label or in-house production. |

Same Document Delivered

Flugger Porter's Five Forces Analysis

This preview showcases the complete Flugger Porter's Five Forces Analysis you will receive immediately after purchase. You're looking at the actual, professionally formatted document, ensuring no surprises or placeholders. This means you'll gain instant access to the exact, ready-to-use analysis the moment your transaction is complete.

Rivalry Among Competitors

The paint and coatings industry is quite crowded, with a mix of global giants and smaller, niche players. Flügger operates in a landscape populated by companies such as Akzo Nobel, a major multinational, as well as numerous regional and local manufacturers specializing in specific coatings or markets.

This intense competition means that market share is constantly being contested, requiring companies like Flügger to innovate and differentiate effectively. For instance, in 2023, the global paints and coatings market was valued at approximately $170 billion, indicating a substantial market size but also highlighting the fierce competition for a piece of that pie.

The paint and coatings market is generally poised for robust expansion. Global market size is projected to reach hundreds of billions of dollars in the coming years, indicating a healthy growth trajectory for the industry as a whole.

However, Flügger's primary operating regions, particularly the Nordic construction sector, have experienced economic headwinds. This localized pressure can temper the overall positive industry growth for companies with concentrated regional exposure.

Flügger's commitment to high-quality, sustainable paint products is a key differentiator in a competitive market. This focus on product attributes, coupled with a strong brand reputation, helps cultivate loyalty among both professional painters and DIY enthusiasts, mitigating direct price-based competition.

In 2024, the paint industry continues to see brands invest heavily in product innovation and eco-friendly formulations. For instance, Flügger's continued emphasis on low-VOC (volatile organic compound) paints and durable finishes appeals to a growing segment of environmentally conscious consumers and regulatory demands, strengthening their brand's perceived value.

Exit Barriers

High exit barriers significantly influence competitive rivalry. When it's difficult or costly for companies to leave an industry, they tend to stay even when profits are low. This can lead to prolonged periods of intense competition as these firms fight for survival. For instance, in the airline industry, the massive investment in specialized aircraft and the substantial costs associated with maintenance and labor create high exit barriers. This often results in carriers continuing operations despite challenging economic conditions, thus intensifying rivalry among remaining players.

Consider these factors contributing to high exit barriers:

- Specialized Assets: Industries with unique, non-transferable assets, like heavy manufacturing equipment or proprietary technology, make exiting costly.

- High Fixed Costs: Significant fixed costs, such as long-term leases, contractual obligations, or substantial severance packages, can trap firms in an industry.

- Emotional Attachment: Founders or long-standing management teams may have strong emotional ties to a business, hindering their willingness to divest.

- Government or Social Pressures: In some sectors, like mining or utilities, companies might face pressure to remain operational for employment or regional economic reasons, even if unprofitable.

Market Concentration and Aggressiveness of Competitors

The paint and coatings industry, including players like Flugger, often features a few dominant companies that significantly shape market dynamics. These large, aggressive competitors, possessing substantial market share and financial resources, can ignite intense price wars. For instance, in 2024, major global paint manufacturers continued to invest heavily in R&D and marketing, aiming to capture market share through product innovation and aggressive promotional campaigns.

This heightened competition forces all market participants to allocate more resources towards marketing and advertising to maintain brand visibility and customer loyalty. Furthermore, the drive to differentiate and gain an edge often leads to accelerated innovation cycles, as companies race to introduce new products with improved performance, sustainability features, or application technologies. This can put pressure on smaller or less-resourced companies to keep pace.

- Market Concentration: The global paints and coatings market is moderately concentrated, with the top 10 companies accounting for a significant portion of sales.

- Aggressive Pricing: Competitors frequently engage in price adjustments to gain market share, particularly in high-volume segments.

- Innovation Race: Significant investment in R&D is a hallmark, with companies like PPG and Sherwin-Williams consistently launching new formulations for decorative and industrial applications.

- Marketing Spend: Increased marketing expenditures are observed as companies strive to differentiate their brands and product offerings in a crowded marketplace.

Competitive rivalry in the paint and coatings sector is intense, marked by numerous global and regional players vying for market share. This crowded landscape necessitates continuous innovation and differentiation, as seen in the ongoing investment in eco-friendly formulations and advanced application technologies by major companies in 2024. The industry's global market, valued around $170 billion in 2023, underscores the fierce competition for customers.

Companies like Flügger face aggressive pricing strategies and a constant innovation race, driven by large, well-resourced competitors. For instance, significant R&D spending by industry leaders aims to capture market share through new product launches, compelling all participants to increase marketing efforts to maintain brand visibility and customer loyalty.

High exit barriers, stemming from specialized assets and significant fixed costs, can prolong intense competition by keeping firms in the market even during periods of lower profitability. This dynamic means that companies must constantly adapt and offer compelling value propositions to succeed amidst the persistent rivalry.

| Factor | Description | Impact on Rivalry |

|---|---|---|

| Market Concentration | Top 10 companies hold a significant share of the global paints and coatings market. | Intensifies competition among major players and smaller entrants. |

| Product Differentiation | Focus on high-quality, sustainable, and innovative paint products. | Helps mitigate direct price competition and build brand loyalty. |

| Innovation & R&D | Continuous investment in new formulations and application technologies. | Drives an innovation race, requiring all companies to keep pace. |

| Marketing & Branding | Increased spending on marketing to enhance brand visibility and customer engagement. | Essential for maintaining market position in a crowded field. |

SSubstitutes Threaten

Customers have a surprisingly broad array of alternatives to traditional decorative paints and wallpapers when finishing interior surfaces. These options range from natural materials like timber panelling and reclaimed wood to modern, convenient choices such as self-adhesive panels and fabric wall coverings. The availability of tiles, stencils, photo murals, and even robust cladding solutions like stone or metal further expands the competitive landscape for companies like Flugger.

The growing DIY movement, fueled by accessible online tutorials and user-friendly products, presents a significant threat to paint manufacturers like Flugger. Consumers increasingly opt for self-service projects, bypassing professional painters and potentially reducing the need for premium or specialized paint lines. In 2024, the global DIY home improvement market was valued at over $150 billion, underscoring the scale of this trend.

The threat of substitutes for paint and wallpaper is a significant factor in the decorative coatings industry. For certain applications, alternative materials can entirely eliminate the need for traditional paints or wallpapers. For instance, pre-finished building materials, like laminated panels or stained wood, offer ready-made aesthetic solutions that bypass the need for a separate coating process.

Innovative surfaces are also emerging that negate the requirement for paint or wallpaper. These might include materials with inherent decorative properties or functional coatings that provide both aesthetics and other benefits, such as improved durability or antimicrobial properties. In 2023, the global market for decorative paints was valued at approximately $150 billion, indicating a substantial market that could be disrupted by effective substitutes.

Cost-Effectiveness of Substitutes

The cost-effectiveness of substitute products significantly impacts the threat level for paint and coatings companies like Flugger. If alternative solutions, such as wallpaper or specialized decorative finishes, can achieve a similar aesthetic or functional result at a substantially lower price point, customers will be more inclined to switch. This price sensitivity is a key driver of substitute threat.

For instance, in 2024, the DIY home improvement market saw a surge in interest for cost-effective wall treatments. While premium paints can range from $30-$60 per gallon, certain high-quality wallpapers and even advanced vinyl wraps can offer comparable visual appeal for a similar or even lower overall project cost, especially when considering labor. This makes them a compelling substitute for consumers prioritizing budget.

- Lower Price Points: Substitutes like decorative films or specialized wallpapers can offer comparable aesthetic outcomes at a lower per-square-foot cost than many premium paint brands.

- Comparable Functionality: Some substitutes now provide durability and washability that rival traditional paint, reducing the functional advantage of paint.

- Ease of Application: Certain DIY-friendly substitutes can reduce labor costs, further enhancing their cost-effectiveness compared to professional painting.

- Market Trends: The growing demand for unique textures and finishes in interior design has led to innovations in substitute materials that offer distinct visual advantages, sometimes at a competitive price.

Technological Advancements in Substitutes

Technological advancements are continuously reshaping the landscape of building materials and interior design, presenting a significant threat of substitutes to the traditional paint and wallpaper market. Innovations in areas like advanced wall paneling, digital printing on surfaces, and eco-friendly composite materials offer consumers new aesthetic and functional choices. For instance, the growing popularity of peel-and-stick wallpaper and advanced vinyl wraps provides easier application and removal, directly competing with traditional paint and wallpaper installation services.

The pace of these innovations means that what was once a niche alternative can quickly become a mainstream option. Consider the rise of smart wallpapers that can change color or display patterns, or the development of self-healing paints that reduce maintenance needs. These emerging technologies not only offer novel features but also potentially lower long-term costs or environmental impact, making them increasingly attractive alternatives.

The threat is amplified by the accessibility of these new materials. Many are readily available through online channels and home improvement stores, lowering the barrier to adoption for consumers. This ease of access, coupled with a desire for unique and customizable living spaces, fuels the demand for these substitutes. For example, in 2024, the global market for decorative wall panels was projected to reach over $35 billion, indicating a substantial shift towards alternative wall finishes.

- Emerging Technologies: Innovations in smart materials, digital printing, and advanced composites offer new aesthetic and functional alternatives to traditional paint and wallpaper.

- Market Growth: The global decorative wall panel market, a key substitute, was projected to exceed $35 billion in 2024, highlighting a significant consumer shift.

- Consumer Appeal: Ease of installation (e.g., peel-and-stick options) and customization potential are driving consumer preference for these innovative substitutes.

- Competitive Pressure: These advancements create direct competition by offering potentially lower long-term costs, reduced maintenance, or unique visual effects not easily achieved with conventional products.

The threat of substitutes for paint and wallpaper is substantial, as consumers have a growing array of alternatives for interior finishing. These range from natural materials and self-adhesive panels to tiles and even robust cladding. For instance, pre-finished building materials like laminated panels bypass the need for a separate coating process entirely.

Cost-effectiveness is a major driver, with substitutes like high-quality wallpapers or vinyl wraps offering comparable aesthetics to premium paints, often at a lower overall project cost, especially when factoring in labor. In 2024, the DIY home improvement market's substantial size, exceeding $150 billion globally, highlights the consumer interest in budget-friendly and accessible wall treatments.

Technological advancements are continuously introducing new competitors, such as smart wallpapers or self-healing paints, which offer novel features and potentially lower long-term costs. The global decorative wall panel market, a key substitute, was projected to exceed $35 billion in 2024, demonstrating a significant shift in consumer preferences towards these innovative finishes.

| Substitute Category | Key Features | 2024 Market Relevance/Data |

|---|---|---|

| DIY-Friendly Wall Treatments | Ease of application, cost-effectiveness | DIY Home Improvement Market > $150 billion |

| Pre-finished Building Materials | Eliminates separate coating process, ready aesthetics | Laminated panels, stained wood options |

| Innovative Wall Surfaces | Inherent decorative properties, functional benefits | Smart wallpapers, self-healing paints |

| Decorative Wall Panels | Unique textures, customizable finishes | Projected Market Value > $35 billion |

Entrants Threaten

The paint and coatings industry demands significant upfront capital. Establishing manufacturing plants, investing in research and development for new formulations, and building a distribution network, including retail outlets like Flügger's own stores and franchise locations, requires substantial financial resources. This high barrier to entry deters many potential new competitors.

Flügger benefits from significant brand recognition and deep-seated customer loyalty, particularly within the professional painter segment. New entrants face a considerable hurdle in replicating this established trust and preference, a process that typically requires substantial time and investment. For instance, Flügger's long history and consistent product quality have fostered a loyal customer base that is less likely to switch to unfamiliar brands, creating a barrier to entry.

Flügger's established network of own stores, franchise partners, and a broad base of retailers presents a significant barrier. New entrants would struggle to gain comparable shelf space and customer access, especially in the competitive paint and coatings market where brand visibility is key.

Economies of Scale

Established players in the paint and coatings industry, like Sherwin-Williams and PPG Industries, leverage significant economies of scale. In 2023, Sherwin-Williams reported net sales of $21.7 billion, allowing them to negotiate bulk discounts on raw materials and optimize production across numerous facilities. This scale translates into lower per-unit costs, making it challenging for new entrants to compete on price without substantial upfront investment.

These cost advantages extend to marketing and distribution. Major companies can afford widespread advertising campaigns and maintain extensive distribution networks, further solidifying their market position. For instance, a new entrant would struggle to match the brand recognition and accessibility that decades of investment have built for incumbents.

- Lower Production Costs: Bulk purchasing of raw materials like titanium dioxide and resins leads to significant cost savings for established firms.

- Efficient Distribution Networks: Extensive logistics infrastructure allows for lower shipping costs and wider market reach.

- Marketing Reach: Large marketing budgets enable brand building and customer acquisition at a scale difficult for newcomers to replicate.

Regulatory Landscape and Environmental Compliance

The paint and coatings industry faces significant hurdles for new companies due to a tightening regulatory environment. Increasingly stringent rules around Volatile Organic Compound (VOC) emissions and the use of specific chemicals, such as per- and polyfluoroalkyl substances (PFAS), are becoming standard. For instance, by 2025, many regions are expected to have stricter VOC limits for architectural coatings, potentially requiring new formulations and manufacturing processes.

Complying with these evolving environmental standards represents a substantial financial and operational challenge. New entrants must invest heavily in research and development to create compliant products and potentially retool manufacturing facilities. This upfront investment can act as a powerful deterrent, effectively raising the barrier to entry for smaller or less capitalized players looking to enter the market.

- Environmental Regulations: Increasing focus on VOC emissions and restricted substances like PFAS.

- Compliance Costs: Significant R&D and capital expenditure required for new entrants to meet standards.

- Market Access: Non-compliance can lead to product bans or market exclusion, a major threat for newcomers.

The threat of new entrants in the paint and coatings sector is generally moderate to low for companies like Flügger. High capital requirements for manufacturing and distribution, coupled with strong brand loyalty and established distribution networks, create significant barriers. Furthermore, increasing regulatory compliance costs, particularly concerning environmental standards, further deter new players.

| Barrier Type | Impact on New Entrants | Example Data Point |

|---|---|---|

| Capital Requirements | High | Establishing a new paint manufacturing plant can cost tens of millions of dollars. |

| Brand Loyalty & Reputation | High | Flügger's long-standing presence and consistent quality foster customer retention. |

| Distribution Channels | High | Accessing retail shelf space and securing franchise partners is challenging. |

| Economies of Scale | High | Major competitors like AkzoNobel, with 2023 revenues exceeding €10 billion, benefit from lower per-unit costs. |

| Regulatory Compliance | Moderate to High | Meeting evolving VOC limits requires significant R&D investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the Flugger paint industry is built upon a foundation of credible data. This includes publicly available financial reports from Flugger and its competitors, detailed industry market research reports from firms like Statista and IBISWorld, and relevant trade publications that track market trends and competitive landscapes.