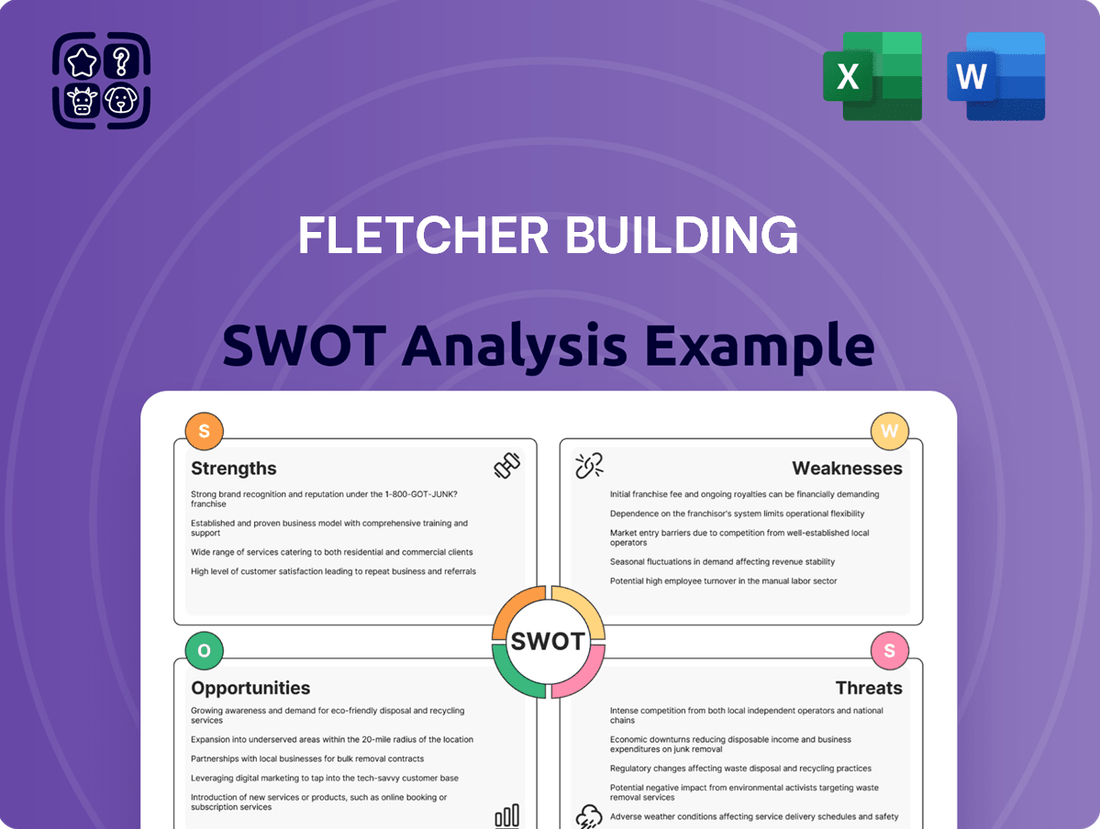

Fletcher Building SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fletcher Building Bundle

Fletcher Building, a titan in the construction sector, faces a dynamic market. While its established brand and diversified operations present significant strengths, potential economic downturns and supply chain disruptions pose considerable threats. Understanding these internal capabilities and external pressures is crucial for navigating the competitive landscape.

Want the full story behind Fletcher Building's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fletcher Building's integrated business model is a core strength, encompassing manufacturing, distribution, and construction services. This vertical integration allows for significant synergies across its operations, fostering cost efficiencies and enhanced control over the entire supply chain. For instance, in the 2024 financial year, the company reported a revenue of NZ$8.5 billion, demonstrating the scale and reach of its integrated approach.

Fletcher Building boasts a deeply entrenched market presence across Australia and New Zealand, its primary operational focus. This concentration has cultivated significant brand recognition and loyalty within these key markets. In FY23, New Zealand operations contributed approximately 48% of the group's revenue, highlighting the strategic importance of this region.

This established local dominance translates into robust distribution networks and an intimate understanding of regional customer needs and regulatory landscapes. Fletcher Building's consistent involvement in significant infrastructure projects within New Zealand, such as the Transmission Gully Motorway, further cements its strong market standing and reputation.

Fletcher Building boasts a diverse product portfolio, manufacturing and distributing a wide array of building materials such as concrete, steel, insulation, and timber. This broad offering allows them to meet varied construction demands, from housing to significant infrastructure projects.

This diversification is a key strength, significantly reducing the company's dependence on any single product line. It enables Fletcher Building to tap into a wide customer base, ensuring resilience against market fluctuations in specific sectors.

Focus on Sustainability

Fletcher Building's strong emphasis on sustainability is a significant advantage. The company has set ambitious targets, aiming for a 30% reduction in Scope 1 and 2 greenhouse gas (GHG) emissions by 2030, using 2018 as a baseline. By FY24, they had already achieved a commendable 19% reduction in these emissions.

This commitment resonates with the increasing global demand for environmentally responsible businesses. It positions Fletcher Building favorably to attract clients and investors who prioritize eco-friendly operations and investments, a trend that is only expected to grow in the coming years.

- Climate Commitments: Publicly stated targets for GHG emission reductions.

- Progress Achieved: 19% reduction in Scope 1 and 2 GHG emissions by FY24.

- Future Goals: Aiming for a 30% reduction by 2030 from a 2018 baseline.

- Market Alignment: Meets growing demand for sustainable business practices.

Strategic Leadership and Financial Restructuring

Fletcher Building has seen substantial leadership transitions and board revitalisation, injecting new viewpoints and driving operational enhancements. This strategic shift is designed to steer the company towards improved performance and governance.

The company's financial footing was significantly bolstered by a NZ$700 million equity raise completed in September 2024. This capital injection has effectively strengthened its balance sheet, leading to a reduction in net debt and consequently enhancing financial stability and operational flexibility.

- Leadership Renewal: Recent changes in senior leadership and board composition aim to bring fresh strategic direction.

- Equity Infusion: A NZ$700 million equity raise in September 2024 has fortified the company's financial position.

- Debt Reduction: The capital raise facilitated a notable decrease in net debt, improving financial health.

- Enhanced Flexibility: A stronger balance sheet provides greater capacity for future investments and operational agility.

Fletcher Building's integrated business model, spanning manufacturing, distribution, and construction, is a significant strength. This vertical integration fosters cost efficiencies and supply chain control. In FY24, the company reported NZ$8.5 billion in revenue, underscoring its operational scale.

The company holds a deeply entrenched market position in Australia and New Zealand, cultivating strong brand recognition and customer loyalty. New Zealand operations alone accounted for approximately 48% of group revenue in FY23, highlighting the strategic importance of this market.

Fletcher Building's diverse product portfolio, including concrete, steel, insulation, and timber, reduces reliance on any single product line. This broad offering allows the company to cater to a wide range of construction needs, from residential to large-scale infrastructure projects, providing resilience against sector-specific market fluctuations.

A strong commitment to sustainability is a key advantage, with Fletcher Building aiming for a 30% reduction in Scope 1 and 2 GHG emissions by 2030. By FY24, they had achieved a 19% reduction, aligning with growing market demand for environmentally responsible businesses.

| Strength | Description | Supporting Data |

| Integrated Business Model | Vertical integration across manufacturing, distribution, and construction. | FY24 Revenue: NZ$8.5 billion |

| Market Presence | Dominant position in Australia and New Zealand. | FY23 NZ Revenue Share: ~48% |

| Product Diversification | Wide range of building materials offered. | Resilience against sector-specific market fluctuations. |

| Sustainability Commitment | Targets for GHG emission reductions. | 19% Scope 1 & 2 GHG reduction by FY24 (target: 30% by 2030 from 2018 baseline). |

What is included in the product

Provides a comprehensive analysis of Fletcher Building's internal capabilities and external market dynamics, identifying key strengths, weaknesses, opportunities, and threats.

Highlights Fletcher Building's key vulnerabilities and opportunities for targeted risk mitigation and strategic advantage.

Weaknesses

Fletcher Building's performance is significantly exposed to the ups and downs of the construction sectors in New Zealand and Australia. This inherent cyclicality means that when these markets slow, the company feels the impact directly.

Recent financial reports for FY24 and the first half of FY25 highlight this vulnerability, with notable drops in revenue for its materials and distribution segments. This downturn is attributed to reduced demand and intense competition.

Specifically, market volumes in New Zealand experienced a substantial 25% decrease in FY24 when compared to the first half of FY23. Similarly, Australia saw a 15% decline in market volumes over the same comparative period.

Fletcher Building has been significantly impacted by cost overruns on legacy projects like the New Zealand International Convention Centre (NZICC) and the Wellington International Airport carpark. These issues have led to substantial financial provisions, with the NZICC alone contributing to a $135 million loss in the first half of FY2023 for the company's Building Products division.

Fletcher Building faces significant ongoing challenges with its Iplex pipe products, particularly in Western Australia, leading to substantial legal liabilities. These issues, primarily leaks, have already forced the company to make considerable provisions for rectification costs.

The financial impact is not just in immediate repair expenses; the ongoing problems have tarnished Fletcher Building's reputation, creating a persistent financial drain. There's also the looming threat of further class action lawsuits, which could escalate these liabilities even further.

High Leverage and Return on Capital Employed (ROCE) Concerns

Fletcher Building faces challenges with its financial structure. Despite a recent equity raise, its debt-to-equity ratio remains elevated, standing at 1.2x as of the first half of 2024, which is above the industry median of 0.9x. This higher leverage increases financial risk.

The company's operational efficiency is also a concern, as evidenced by its declining Return on Capital Employed (ROCE). Fletcher Building's ROCE fell to 6.5% in the first half of 2024, a notable decrease from 9.2% in the prior year, signaling potential inefficiencies in how it utilizes its capital to generate profits and suggesting difficulties in achieving robust organic growth.

- Higher Debt-to-Equity Ratio: 1.2x as of H1 2024, exceeding the industry median of 0.9x.

- Declining ROCE: Dropped to 6.5% in H1 2024 from 9.2% in H1 2023.

- Inefficient Capital Deployment: Low ROCE indicates challenges in generating returns from invested capital.

- Potential Growth Struggles: The combination of high leverage and low ROCE may hinder future organic growth prospects.

Challenging Trading Conditions and Volume Declines

Fletcher Building is navigating a tough market environment. This is due to slowing demand across the board, strong competition, and ongoing inflation impacting all its business areas.

The company anticipates a significant drop in sales volume for its materials and distribution segments.

- FY25 Volume Forecast: Market volumes in materials and distribution are expected to be 10% to 15% lower in FY25 compared to FY24.

- Broad Economic Slowdown: The challenging conditions stem from a general slowdown in economic activity, affecting customer spending and project pipelines.

- Competitive Pressures: Increased competition within its operating segments puts pressure on pricing and market share.

- Inflationary Impact: Rising costs due to inflation erode profit margins and affect the affordability of construction projects.

Fletcher Building faces significant challenges with legacy projects, notably the New Zealand International Convention Centre (NZICC), which resulted in a $135 million loss for its Building Products division in H1 FY2023 due to cost overruns. The company is also dealing with substantial legal liabilities stemming from issues with its Iplex pipe products in Western Australia, necessitating significant provisions for rectification and facing the risk of further litigation.

The company's financial structure is a concern, with a debt-to-equity ratio of 1.2x in H1 2024, exceeding the industry median of 0.9x, which elevates financial risk. This is compounded by a declining Return on Capital Employed (ROCE), which fell to 6.5% in H1 2024 from 9.2% in H1 2023, indicating potential inefficiencies in capital utilization and difficulties in achieving robust organic growth.

Market conditions present a weakness, with FY25 volume forecasts for materials and distribution expected to be 10% to 15% lower than FY24, driven by a broad economic slowdown, intense competition, and inflationary pressures impacting all business areas. This slowdown is already evident, with New Zealand market volumes down 25% and Australia down 15% in FY24 compared to H1 FY23.

What You See Is What You Get

Fletcher Building SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Fletcher Building's Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

Opportunities

A significant opportunity for Fletcher Building lies in the anticipated recovery of construction demand across New Zealand and Australia, expected to gain momentum from late 2025. This rebound is projected to be fueled by a combination of easing interest rates, ongoing population expansion, and substantial government spending on infrastructure projects. For instance, New Zealand's Treasury forecast a 3.5% annual growth in construction activity from 2026 to 2028, and Australia's infrastructure pipeline is valued at over AUD 200 billion for the coming years.

This potential market upturn presents a direct avenue for Fletcher Building to increase its sales volumes and enhance its profit margins. As demand for building materials and services picks up, the company is well-positioned to capitalize on these renewed opportunities, particularly in sectors like residential housing and commercial development, which are sensitive to economic conditions and interest rate movements.

Fletcher Building is well-positioned to capitalize on significant government investment in infrastructure across New Zealand and Australia. This presents a substantial growth avenue for its construction and building materials segments.

New Zealand's infrastructure pipeline is robust, estimated at $121.2 billion as of March 2024. A considerable portion, around $44 billion, is currently under construction, with an additional $11 billion in the procurement phase, directly benefiting Fletcher Building's project pipeline.

The increasing global focus on green building is a significant opportunity for Fletcher Building. As demand for eco-friendly materials and energy-efficient designs grows, the company can leverage its existing sustainability efforts. For instance, in 2023, the construction industry saw a notable rise in green building certifications, with projects prioritizing recycled content and reduced carbon footprints, areas where Fletcher Building has been investing.

Furthermore, the wider adoption of modular and prefabricated construction presents a chance for Fletcher Building to lead in innovation. These methods can improve efficiency and reduce waste, aligning with market demands for faster and more sustainable building solutions. The prefabricated construction market, projected to grow substantially in the coming years, offers a pathway for Fletcher Building to capture new market share and enhance its competitive edge.

Potential Divestment of Non-Core Assets

Fletcher Building is actively considering the divestment of certain non-core assets, specifically within its construction division. This includes businesses like Higgins, Brian Perry Civil, and Fletcher Construction Major Projects. The company is looking at these options as a way to simplify its overall structure and reduce its involvement in areas carrying significant risk, particularly from older, complex projects.

The potential sale of these construction assets is aimed at allowing Fletcher Building to sharpen its focus on its more stable and profitable manufacturing and distribution segments. This strategic pivot could lead to a more streamlined operational model and a stronger balance sheet.

- Streamlined Operations: Divesting non-core construction assets like Higgins and Brian Perry Civil would simplify Fletcher Building's business portfolio.

- Risk Mitigation: Reducing exposure to high-risk legacy projects within Fletcher Construction Major Projects can improve financial stability.

- Core Business Focus: The divestments would enable greater concentration on manufacturing and distribution, Fletcher Building's core strengths.

Operational Efficiency and Cost Reduction Programs

Fletcher Building is actively pursuing operational efficiency and cost reduction programs. These efforts are designed to streamline processes and reduce expenditures across the group. A key objective is achieving NZ$200 million in cost savings by FY25, which is crucial for bolstering financial resilience during periods of market volatility.

These initiatives are expected to directly improve the company's profitability and overall efficiency. By focusing on these areas, Fletcher Building aims to enhance its competitive position and financial health.

- Ongoing Optimization: The company's commitment to optimizing operational performance is a continuous process.

- Cost Reduction Target: A significant target of NZ$200 million in cost savings is set for FY25.

- Financial Resilience: These programs are intended to strengthen the company's ability to withstand challenging market conditions.

- Profitability Enhancement: Improved efficiency and reduced costs are directly linked to better profitability.

Fletcher Building can leverage the anticipated construction demand recovery in New Zealand and Australia, projected to strengthen from late 2025. This upturn, driven by easing interest rates and significant government infrastructure spending, offers a prime opportunity. For instance, Australia's infrastructure pipeline exceeds AUD 200 billion, while New Zealand's has a robust NZ$121.2 billion pipeline as of March 2024.

The company is also positioned to benefit from the growing global emphasis on green building practices and the increasing adoption of modular construction. These trends align with Fletcher Building's investments in sustainability and innovation, potentially capturing new market share and enhancing its competitive edge.

The potential divestment of non-core construction assets, such as Higgins and Brian Perry Civil, could allow Fletcher Building to sharpen its focus on its more profitable manufacturing and distribution segments, simplifying operations and strengthening its balance sheet.

Furthermore, the company's ongoing operational efficiency and cost reduction programs, targeting NZ$200 million in savings by FY25, are crucial for bolstering financial resilience and improving overall profitability in a dynamic market.

Threats

Persistent macroeconomic pressures, including high inflation and elevated construction costs, continue to pose a significant threat to Fletcher Building's profitability. These factors, coupled with a broad-based slowing of demand across key markets, create a challenging operating environment.

Fletcher Building anticipates further volume declines in its materials and distribution businesses for FY25, signaling a prolonged period of market weakness. This outlook underscores the ongoing impact of economic headwinds on the company's core operations.

The construction and building materials sectors in Australia and New Zealand are characterized by fierce competition, which directly translates into significant pricing pressures and squeezed profit margins for companies like Fletcher Building. This intense rivalry, particularly evident among tier two and three contractors, can quickly erode profitability and chip away at established market share.

Fletcher Building faces significant regulatory and legal risks, notably from ongoing litigation related to Iplex pipe failures. These legal challenges can lead to substantial financial penalties, impacting profitability and cash flow. For instance, the company has set aside provisions for potential liabilities, which have affected its financial performance in recent reporting periods, such as the first half of fiscal year 2024.

Supply Chain Disruptions and Material Cost Volatility

The construction sector, including companies like Fletcher Building, faces significant risks from global supply chain snags and unpredictable material prices. This vulnerability is amplified for energy-intensive products such as concrete and bricks, where production costs can swing wildly. For instance, global commodity prices saw notable increases in late 2023 and early 2024, impacting the cost of raw materials for construction.

These volatile conditions directly translate into higher operational expenses and can cause unwelcome project delays. Such disruptions can severely affect Fletcher Building's profitability and its ability to meet project deadlines, potentially impacting its market position and investor confidence.

- Vulnerability to Global Supply Chain Issues: The construction industry relies heavily on timely delivery of materials, making it susceptible to international shipping disruptions, geopolitical events, and labor shortages affecting logistics.

- Impact of Energy Prices on Material Costs: The production of cement and other building materials is energy-intensive. Fluctuations in global energy prices, such as those observed in oil and natural gas markets throughout 2023-2024, directly increase the cost of these essential inputs.

- Project Delays and Cost Overruns: When materials are delayed or cost more than anticipated, construction projects can face significant delays and budget overruns, impacting the financial viability and reputation of the contractor.

- Profitability Squeeze: Increased material and operational costs, if not fully passed on to clients, directly erode profit margins for construction firms like Fletcher Building.

Labor Shortages

Persistent labor shortages within the construction industry, particularly for skilled trades, remain a significant threat to Fletcher Building. This scarcity directly impacts the ability to maintain project timelines, potentially leading to costly delays. For instance, in 2024, industry-wide reports indicated a shortage of approximately 100,000 skilled construction workers in Australia alone, a situation mirrored in New Zealand.

These shortages can force companies like Fletcher Building to offer higher wages and improved benefits to attract and retain talent, thereby escalating labor expenses. This also means that projects might face extended completion schedules, impacting revenue recognition and potentially incurring penalties.

- Skilled Trade Deficit: Ongoing lack of qualified electricians, plumbers, and carpenters.

- Project Delays: Increased risk of missing contractual deadlines due to insufficient workforce.

- Cost Escalation: Higher wages and recruitment costs directly impacting project profitability.

- Reduced Capacity: Inability to take on as many projects as desired due to labor constraints.

Intensifying competition in Australia and New Zealand's building materials and construction sectors continues to pressure Fletcher Building's profit margins. This intense rivalry, particularly from smaller contractors, can lead to aggressive pricing strategies that erode profitability.

Fletcher Building faces significant legal and regulatory risks, notably from ongoing litigation concerning Iplex pipe failures, which has led to provisions impacting recent financial performance, such as the first half of FY24. Furthermore, the company anticipates further volume declines in its materials and distribution segments for FY25, reflecting broader market weakness.

Persistent labor shortages, especially for skilled trades, pose a substantial threat, potentially causing project delays and increasing labor costs. For instance, industry reports in 2024 highlighted a significant deficit of skilled construction workers in Australia, a trend also impacting New Zealand.

| Threat Category | Specific Risk | Potential Impact | Example/Data Point |

|---|---|---|---|

| Market Conditions | Intensifying Competition | Eroded Profit Margins | Aggressive pricing by tier two/three contractors |

| Economic Headwinds | Volume Declines (FY25 forecast) | Reduced Revenue & Profitability | Materials & Distribution segments |

| Legal & Regulatory | Iplex Pipe Litigation | Financial Penalties & Reputational Damage | Provisions impacting H1 FY24 results |

| Labor Market | Skilled Trade Shortages | Project Delays & Increased Labor Costs | ~100,000 skilled worker deficit in Australia (2024) |

SWOT Analysis Data Sources

This Fletcher Building SWOT analysis is built upon a foundation of credible data, drawing from publicly available financial reports, comprehensive industry market research, and insights from reputable construction and materials sector analysts.