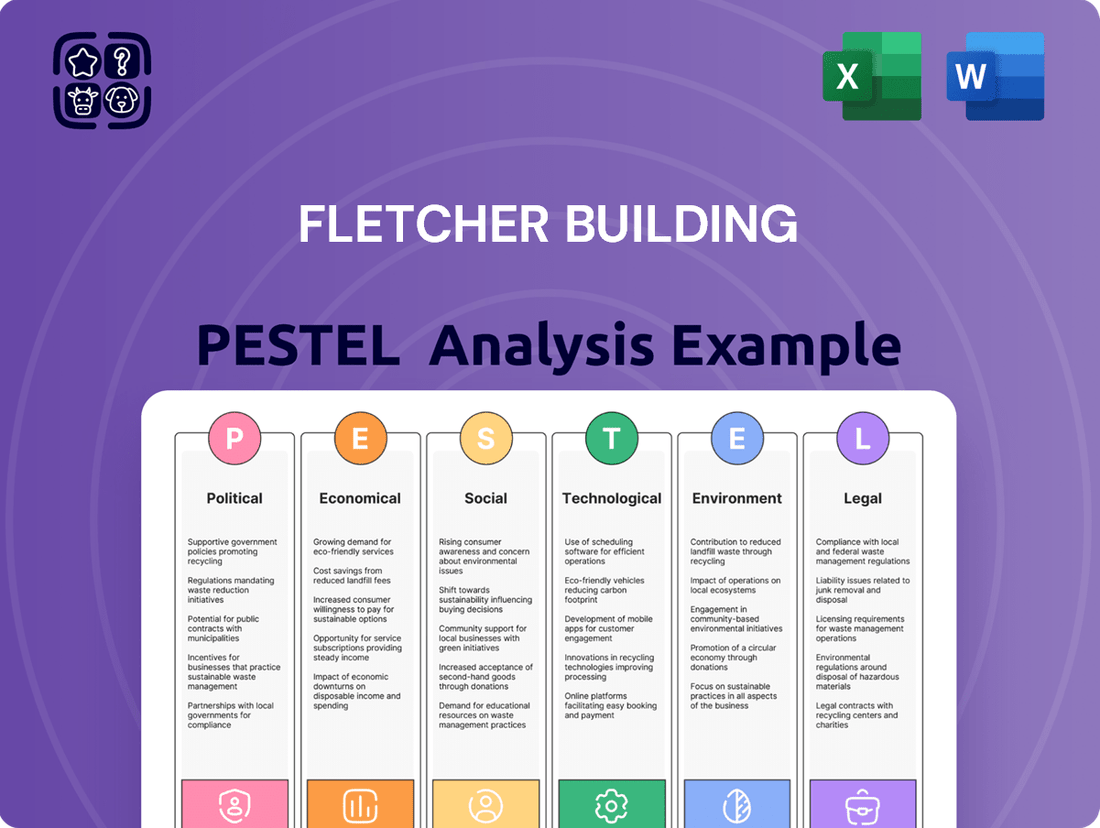

Fletcher Building PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fletcher Building Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Fletcher Building's trajectory. Our comprehensive PESTLE analysis provides the essential market intelligence to anticipate challenges and capitalize on opportunities. Download the full version now and gain a strategic advantage.

Political factors

Government investment in infrastructure plays a crucial role in shaping demand for Fletcher Building's products and services in both New Zealand and Australia. Increased public spending on essential projects like roads, railways, hospitals, and schools directly translates into higher demand for construction materials and expertise.

For instance, the New Zealand government's commitment to significant infrastructure upgrades, including the NZ Upgrade Programme, aims to boost economic activity. This program, with substantial funding allocated for transport and public facilities, is expected to provide a steady pipeline of work for companies like Fletcher Building through to 2025 and beyond. Similarly, Australia's ongoing infrastructure development, such as the Western Sydney Airport project and various state-level road and rail expansions, presents considerable opportunities.

Fletcher Building's performance is therefore closely tied to the pace and scale of these government-led initiatives. Changes in budget allocations or project timelines can significantly impact revenue streams and order books. For 2024, continued government focus on infrastructure renewal and expansion across both nations is anticipated to underpin demand for Fletcher Building's core offerings.

Changes in national and local building codes, such as New Zealand's Building Code and Australia's National Construction Code, directly impact Fletcher Building's product development and construction practices. Stricter energy efficiency standards or new seismic requirements necessitate product innovation and potentially higher material costs.

Compliance with evolving safety standards and material specifications, like those for fire resistance or sustainability, requires ongoing investment in research and development. For instance, updated requirements for timber treatment or concrete durability can influence Fletcher Building's manufacturing processes and supply chain management.

The costs associated with adhering to these regulations are significant, potentially impacting profit margins. However, Fletcher Building can gain a competitive advantage by proactively adopting new standards, positioning itself as a leader in compliant and sustainable building solutions, especially as regulatory scrutiny intensifies in both markets.

Fletcher Building operates in markets where political stability is generally high, but shifts in government policy can significantly influence its business. For instance, changes in housing affordability initiatives or infrastructure spending priorities in New Zealand and Australia directly affect demand for building materials and construction services. In 2023, New Zealand’s government continued to focus on addressing the housing crisis, which could lead to both opportunities and challenges for Fletcher Building’s residential development and construction segments.

Trade Policies and Import/Export Regulations

Trade policies, including tariffs and import/export regulations, significantly impact Fletcher Building's operational costs and the availability of essential raw materials for its manufacturing. For instance, changes in tariffs on steel or timber can directly increase the cost of goods sold, affecting profit margins. In 2024, ongoing geopolitical tensions and evolving trade agreements, such as those between Australia and China, continue to create uncertainty for global supply chains, potentially disrupting the flow of materials and increasing logistics expenses for Fletcher Building.

These policies also influence Fletcher Building's competitive landscape, particularly concerning imported products. Higher tariffs on imported building materials could make Fletcher Building's locally manufactured products more competitive, while reduced tariffs might intensify competition. The company's supply chain resilience is tested by these regulations, as they can necessitate diversification of sourcing or lead to increased inventory holding costs to mitigate potential disruptions.

- Tariff Impact: Increased tariffs on key inputs like steel, which saw global price volatility in late 2023 and early 2024, directly raise production costs for Fletcher Building.

- Supply Chain Risk: Import/export restrictions can force Fletcher Building to seek alternative, potentially more expensive, suppliers, impacting project timelines and budgets.

- Competitive Edge: Favorable trade policies for domestic manufacturing can enhance Fletcher Building's ability to compete against foreign competitors by leveling the playing field on material costs.

- Regulatory Compliance: Navigating complex and changing import/export regulations requires significant administrative resources and can introduce compliance risks if not managed effectively.

Labour Laws and Industrial Relations

Fletcher Building's operations are significantly shaped by labour laws and industrial relations in New Zealand and Australia. Changes in minimum wage policies, such as potential increases in Australia's national minimum wage, directly impact operational costs. For instance, the Fair Work Commission's 2023 decision to increase the minimum wage by 5.75% for many award-covered employees would have raised Fletcher Building's labour expenditure.

The company's workforce is subject to varying unionization rates and collective bargaining agreements across its diverse business units. High unionization in certain sectors can influence wage negotiations and working conditions, potentially affecting project timelines and profitability if disputes arise. Skilled labour shortages, a persistent issue in the construction and manufacturing industries, can further complicate operations, leading to increased recruitment costs and project delays.

Fletcher Building's ability to manage industrial relations effectively is crucial for maintaining operational stability and cost control. The company's 2024/2025 outlook will depend on its capacity to navigate these complexities, ensuring competitive labour practices while mitigating the risks associated with industrial disputes and workforce availability.

- Minimum Wage Impact: Increases in minimum wages in Australia and New Zealand directly affect Fletcher Building's labour costs across its operations.

- Unionization and Bargaining: Collective bargaining agreements and union presence can influence wage structures and working conditions, impacting operational flexibility and costs.

- Skilled Labour Shortages: Persistent shortages of skilled labour in the construction and manufacturing sectors can lead to project delays and increased recruitment expenses for Fletcher Building.

- Industrial Relations Environment: The overall industrial relations climate, including the potential for disputes, is a key factor in Fletcher Building's ability to maintain project schedules and profitability.

Government investment in infrastructure projects across New Zealand and Australia directly fuels demand for Fletcher Building's products. For instance, the Australian government's commitment to major transport infrastructure, such as the Western Sydney Airport, and New Zealand's ongoing NZ Upgrade Programme are expected to provide a steady stream of projects through 2025.

Changes in building codes, like New Zealand's Building Code and Australia's National Construction Code, necessitate product adaptation and can influence material costs. Adhering to stricter seismic or energy efficiency standards requires ongoing R&D investment, potentially impacting profit margins but offering a competitive edge in compliance.

Political stability is generally high, but policy shifts regarding housing affordability or infrastructure spending priorities directly impact Fletcher Building's markets. Trade policies, including tariffs on inputs like steel, can significantly affect production costs and the competitiveness of locally manufactured goods, as seen with global price volatility in late 2023 and early 2024.

Labour laws and industrial relations, including minimum wage adjustments and union agreements, directly influence Fletcher Building's operational costs. For example, Australia's Fair Work Commission's 2023 minimum wage increase impacted labour expenditure, and skilled labour shortages continue to pose challenges for project timelines and recruitment costs.

What is included in the product

This PESTLE analysis of Fletcher Building examines the influence of political, economic, social, technological, environmental, and legal factors on its operations and strategic planning.

It provides a comprehensive overview of external forces shaping Fletcher Building's industry and geographic markets, aiding in identifying potential threats and opportunities.

A PESTLE analysis of Fletcher Building provides a clear, summarized view of external factors impacting the company, reducing the pain of sifting through complex data for strategic decision-making.

Economic factors

Fluctuations in interest rates significantly influence mortgage affordability in New Zealand and Australia, directly impacting demand for new residential construction. As of early 2024, central banks in both nations have maintained elevated interest rates, making borrowing more expensive for potential homeowners. This trend generally cools the housing market, which in turn affects Fletcher Building's key segments like new builds and renovation projects.

New Zealand's economy is projected to see modest growth, with the IMF forecasting a 1.7% GDP increase for 2024 and 1.8% for 2025. This steady expansion is crucial for Fletcher Building, as it directly influences consumer and business confidence, driving demand for new housing and infrastructure projects. A healthy GDP trend typically translates to higher spending on construction materials and services, benefiting companies like Fletcher Building.

Australia's economic outlook also points towards continued, albeit potentially slower, growth. Forecasts suggest GDP growth around 1.6% for 2024 and 1.9% for 2025. This sustained economic activity underpins the construction sector, supporting Fletcher Building's operations through increased investment in both residential and commercial development. Strong GDP performance in both key markets is a positive indicator for the company's revenue streams.

Inflation significantly impacts Fletcher Building by increasing the cost of essential raw materials like steel and timber, as well as energy and labor. For instance, global inflation trends in 2024 and early 2025 have seen construction material prices fluctuate, with some key inputs experiencing double-digit percentage increases year-on-year.

Rising input costs directly threaten profit margins. If Fletcher Building cannot fully pass these higher expenses onto customers through price adjustments, its profitability will be squeezed. The company actively manages supply chain volatility through strategic sourcing and inventory management to mitigate these pressures, though disruptions can still affect project timelines and costs.

Exchange Rates

Exchange rate fluctuations significantly influence Fletcher Building's financial performance. For instance, a stronger New Zealand Dollar (NZD) makes imported raw materials cheaper but reduces the competitiveness of its exports. Conversely, a weaker NZD boosts export revenues but increases the cost of imported components.

The company's exposure to the Australian Dollar (AUD) is also critical, given its substantial operations in Australia. Movements between the NZD and AUD directly impact the translation of Australian earnings into NZD for reporting purposes. For example, in the first half of FY24, Fletcher Building reported that a 1% change in the NZD/AUD exchange rate would impact its net profit after tax by approximately NZD 2 million.

- NZD/AUD Impact: A stronger NZD against the AUD can reduce the reported value of Australian profits.

- Import Costs: Fluctuations in the NZD against major global currencies affect the cost of imported materials like steel and cement.

- Export Competitiveness: A weaker NZD generally enhances the price competitiveness of Fletcher Building's products in international markets.

- FY24 H1 Sensitivity: A 1% NZD/AUD shift impacted FY24 H1 NPAT by around NZD 2 million, highlighting direct financial sensitivity.

Consumer Confidence and Disposable Income

Consumer confidence and disposable income are key drivers for Fletcher Building, particularly in New Zealand and Australia. When consumers feel secure about their financial future and have more money left after essential expenses, they are more likely to invest in home improvements or purchase new properties. This directly boosts demand for Fletcher Building's extensive range of building materials and home improvement products.

In the first half of 2024, New Zealand's consumer confidence saw a slight uptick, though it remained cautious. For instance, the ANZ-Roy Morgan Consumer Confidence measure hovered around the 80-point mark, indicating a subdued but improving sentiment. Similarly, Australian consumer confidence, as measured by the Westpac-Melbourne Institute Index, showed some volatility but generally trended upwards through early 2024, reaching levels around 85-90 points at times. This improved sentiment, coupled with potential wage growth, translates to greater discretionary spending capacity.

- Impact on Housing: Higher disposable income fuels demand for both new housing construction and renovations, directly benefiting Fletcher Building's core markets.

- Retail Sales Boost: Strong consumer sentiment encourages spending on home improvement products and DIY projects, increasing sales for Fletcher Building's retail divisions like Mitre 10 and Placemakers.

- Economic Sensitivity: Fletcher Building's performance is therefore closely tied to macroeconomic indicators reflecting household financial health and optimism in NZ and Australia.

- Market Recovery: As confidence and incomes recover, the company is well-positioned to capitalize on renewed activity in the residential and renovation sectors.

Economic factors significantly shape Fletcher Building's operating environment. Elevated interest rates in New Zealand and Australia through early 2024 have dampened mortgage affordability, impacting new residential construction demand. Projected modest GDP growth in New Zealand (1.7% in 2024, 1.8% in 2025) and Australia (1.6% in 2024, 1.9% in 2025) provides a stable, albeit not booming, backdrop for construction activity.

| Economic Factor | Impact on Fletcher Building | 2024-2025 Data/Outlook |

|---|---|---|

| Interest Rates | Affects housing demand and borrowing costs. | Elevated in NZ/AU in early 2024. |

| GDP Growth (NZ) | Drives consumer and business confidence, construction demand. | Projected 1.7% (2024), 1.8% (2025). |

| GDP Growth (AU) | Supports construction sector investment. | Projected 1.6% (2024), 1.9% (2025). |

| Inflation | Increases raw material, energy, and labor costs. | Double-digit percentage increases for some materials in 2024. |

| Consumer Confidence | Influences spending on housing and renovations. | Slight uptick but cautious in NZ (around 80 pts); volatile but trending up in AU (around 85-90 pts) in early 2024. |

Preview the Actual Deliverable

Fletcher Building PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Fletcher Building delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the external forces shaping Fletcher Building's market landscape, enabling informed strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into the opportunities and threats Fletcher Building faces, crucial for competitive advantage.

Sociological factors

Population growth and urbanization are significant drivers for Fletcher Building in New Zealand and Australia. The increasing populations in both countries directly translate to a higher demand for new housing, commercial spaces, and essential infrastructure projects. For instance, New Zealand's population is projected to reach approximately 5.4 million by 2025, with continued urban migration to cities like Auckland and Wellington creating substantial opportunities for construction and building materials.

Australia's demographic trends are even more pronounced, with major urban centers such as Sydney, Melbourne, and Brisbane experiencing rapid expansion. This growth fuels demand for residential developments, commercial complexes, and infrastructure upgrades like transport networks. Fletcher Building is well-positioned to capitalize on these trends, particularly in regions identified for significant population influx and planned urban development projects throughout 2024 and 2025.

Societal shifts are significantly reshaping housing demands. There's a growing preference for smaller, more energy-efficient homes, alongside a surge in interest for smart home technology integration. Fletcher Building is responding by developing modular housing solutions and incorporating sustainable materials, reflecting a move towards more adaptable and eco-conscious construction.

Multi-generational living is also on the rise, driven by economic factors and changing family structures. This trend necessitates flexible floor plans and adaptable living spaces within new builds. Fletcher Building's design approach is evolving to accommodate these needs, offering options that cater to extended families living under one roof, thereby broadening their market appeal.

Societal awareness regarding environmental impact is soaring, driving demand for sustainable construction. Consumers increasingly favor eco-friendly materials and practices, pushing companies like Fletcher Building to adapt. This shift is not just a preference; it's becoming a significant market driver, influencing purchasing decisions and brand loyalty.

Regulatory bodies are responding to this heightened awareness by implementing stricter environmental standards for the construction sector. For instance, in 2024, several regions saw updated building codes mandating higher energy efficiency and the use of recycled content. This creates both challenges and opportunities for Fletcher Building to innovate and lead in offering greener building solutions, potentially capturing market share from less adaptable competitors.

Workforce Demographics and Skills Shortages

The construction industry, including Fletcher Building, faces significant workforce demographic shifts. An aging workforce is a growing concern, with many experienced tradespeople nearing retirement. For instance, in Australia, the average age of construction workers has been steadily increasing, creating a knowledge gap.

This demographic trend, coupled with challenges in attracting younger talent to the sector, contributes to skilled labour shortages. These shortages directly impact project timelines and increase costs, as companies compete for limited expertise. Fletcher Building, like its peers, is investing in recruitment and comprehensive training programs to bridge this gap and ensure a pipeline of skilled workers.

- Aging Workforce: A substantial portion of the experienced construction workforce is approaching retirement age, leading to a potential loss of critical skills and institutional knowledge.

- Talent Attraction: The industry struggles to attract new, younger talent, often due to perceptions of the work and competition from other sectors.

- Skills Gap Impact: Shortages in skilled trades like electricians, plumbers, and project managers directly affect project delivery, causing delays and escalating labor costs.

- Fletcher Building's Response: The company is actively engaged in apprenticeships, vocational training, and partnerships with educational institutions to build its future workforce.

Health and Safety Expectations

Societal and regulatory expectations for health and safety in construction are increasingly stringent. Fletcher Building, like its peers, must adhere to robust safety standards to protect its workforce and the public. This focus directly impacts operational procedures, demanding rigorous training and investment in safety equipment.

A strong societal emphasis on worker well-being significantly influences Fletcher Building's corporate social responsibility. This translates into proactive safety management systems, continuous improvement in training programs, and transparent reporting on safety performance. For instance, in the 2023 financial year, Fletcher Building reported a Total Recordable Injury Frequency Rate (TRIFR) of 4.5, demonstrating a commitment to reducing workplace incidents.

- Regulatory Compliance: Adherence to national and international health and safety legislation is non-negotiable, influencing every aspect of site operations.

- Worker Well-being: Societal pressure demands that companies prioritize the physical and mental health of their employees, leading to comprehensive support programs.

- Reputational Impact: A strong safety record enhances brand reputation, attracting talent and building trust with clients and stakeholders, while poor performance can lead to significant financial and reputational damage.

- Investment in Safety: Companies are expected to allocate substantial resources to safety training, personal protective equipment (PPE), and advanced safety technologies.

Societal shifts are increasingly favoring smaller, energy-efficient homes and smart technology integration, prompting Fletcher Building to develop modular housing and utilize sustainable materials. Multi-generational living is also on the rise, influencing design to accommodate flexible floor plans for extended families. This adaptability broadens their market appeal by catering to evolving family structures and preferences.

Technological factors

Fletcher Building is increasingly exploring advanced construction techniques like modular construction and off-site manufacturing to boost project efficiency. These methods can significantly reduce waste, with prefabrication potentially cutting material waste by up to 30% compared to traditional on-site building. This adoption is crucial for shortening project timelines, a key factor in the competitive construction landscape.

The adoption of prefabrication and modular building can lead to substantial cost savings for Fletcher Building. By moving a significant portion of construction to controlled factory environments, labor costs can be optimized, and the risk of weather-related delays, which often inflate budgets, is minimized. For instance, projects utilizing off-site manufacturing have reported cost reductions of 10-20%.

The construction sector is increasingly adopting Building Information Modeling (BIM) and other digital tools for design, planning, and project management. This trend is reshaping how projects are conceived and executed, moving towards more integrated and data-driven workflows.

Fletcher Building can harness these advanced digital capabilities to foster better collaboration among its teams and partners. By utilizing BIM, the company can improve design accuracy, proactively identify and minimize potential errors, and achieve more efficient resource allocation across its varied business units, ultimately boosting project delivery and profitability.

Fletcher Building is keenly aware of how material innovation drives the construction sector. Advancements like high-performance concrete, which offers superior strength and longevity, and sustainable insulation materials are becoming increasingly important. Composite materials, too, are gaining traction for their durability and lighter weight, potentially reducing transportation costs and installation time.

The company's commitment to research and development is crucial for staying ahead. For instance, Fletcher Building's investments in developing or adopting these cutting-edge materials directly impact its ability to offer more efficient and environmentally friendly building solutions. This focus on R&D ensures they can meet evolving customer demands and regulatory requirements for greener construction practices, a trend that is only set to accelerate.

Automation and Robotics in Manufacturing

Fletcher Building is increasingly integrating automation and robotics across its manufacturing operations, particularly in areas like concrete, steel, and insulation production. For instance, advancements in robotic welding and automated assembly lines for precast concrete components can significantly boost output. The company's focus on improving efficiency aligns with industry trends; in 2024, the global industrial robotics market was valued at approximately $50 billion, with significant growth projected in construction-related applications.

These technological investments are designed to yield tangible benefits. Increased production efficiency is a primary driver, leading to faster turnaround times for key building materials. Furthermore, enhanced product consistency is achieved through precise robotic execution, reducing material waste and improving quality control. Labour costs are also a key consideration, with automation offering a pathway to optimize workforce deployment and reduce reliance on manual processes, especially in hazardous environments.

- Increased Production Efficiency: Automation streamlines processes, allowing for higher output volumes of materials like concrete and steel.

- Enhanced Product Consistency: Robotic systems ensure uniform quality, minimizing defects and material waste in insulation and other products.

- Reduced Labour Costs: Automating repetitive or dangerous tasks can lead to more efficient labor allocation and lower operational expenses.

- Improved Workplace Safety: Robotics can handle hazardous tasks, reducing the risk of accidents and injuries in manufacturing facilities.

Data Analytics and Supply Chain Optimization

Data analytics is increasingly vital for Fletcher Building, offering significant potential to refine supply chain operations. By analyzing vast datasets, the company can achieve better inventory management, streamline logistics, and predict demand more accurately. This data-driven approach is key to enhancing efficiency across the board.

Leveraging advanced analytics allows Fletcher Building to optimize material procurement, ensuring they secure the best prices and timely deliveries. This also directly contributes to reducing waste throughout the construction process, a critical factor in both cost savings and environmental responsibility. For instance, by analyzing project timelines and material consumption patterns, Fletcher Building can minimize over-ordering and spoilage.

Furthermore, improved responsiveness to market demand is a direct benefit of sophisticated data analytics. Understanding trends and project pipelines allows for more agile adjustments in production and material allocation. This agility is crucial in the dynamic construction sector, where project schedules and material needs can shift rapidly.

- Data-driven inventory management: Reduced holding costs and minimized stockouts.

- Predictive logistics: Optimized delivery routes and schedules, lowering transportation expenses.

- Waste reduction: Improved material utilization through better forecasting and planning.

- Enhanced market responsiveness: Quicker adaptation to changing project demands and economic conditions.

Fletcher Building is increasingly integrating advanced digital tools like Building Information Modeling (BIM) and data analytics to enhance project planning and execution. These technologies foster better collaboration, improve design accuracy, and enable more efficient resource allocation, ultimately boosting project delivery and profitability. The company's focus on digital transformation is a key driver for operational excellence in the competitive construction landscape.

Legal factors

Fletcher Building operates under stringent legal frameworks in both New Zealand and Australia, mandating strict adherence to national and local building codes, fire safety regulations, and structural integrity standards. Failure to comply poses significant legal risks, including hefty fines, project delays, and potential litigation from regulatory bodies or affected parties. For instance, in 2023, the Australian Building Codes Board continued to emphasize stricter enforcement of the National Construction Code, with non-compliance penalties escalating for builders and developers.

The financial implications of non-compliance can be substantial, ranging from costly rectifications and reputational damage to outright project shutdowns. In 2024, Fletcher Building's commitment to robust compliance processes is crucial for mitigating these legal liabilities and ensuring operational continuity. This includes ongoing investment in training, quality assurance, and updated building material certifications to meet evolving regulatory requirements.

Fletcher Building operates under stringent environmental protection laws, encompassing critical areas like waste management, emissions control, water usage, and land remediation. These legal obligations are central to their operational compliance and reputation. For instance, in 2024, New Zealand's Resource Management Act continues to dictate strict guidelines for construction projects, impacting material sourcing and site management.

Securing and maintaining various permits and licenses is a legal necessity for Fletcher Building's diverse manufacturing and construction activities. These can range from air discharge permits for factories to resource consents for water extraction and land use. Failure to comply can result in significant penalties; for example, environmental breaches in Australia in 2023 led to substantial fines for construction firms, a precedent Fletcher Building must actively avoid.

Fletcher Building operates under stringent workplace health and safety legislation in both New Zealand and Australia, critical for its construction and manufacturing operations.

Compliance, including ensuring safe working environments and providing adequate training, is paramount to avoid significant legal penalties and costly worker injury claims. For instance, WorkSafe New Zealand reported a total of 59 work-related fatalities in the 2023 fiscal year, highlighting the severe consequences of non-compliance.

Failure to adhere to these regulations, such as those mandated by the Health and Safety at Work Act 2015 in New Zealand, can lead to substantial fines and severe reputational damage, impacting investor confidence and future business opportunities.

Competition and Anti-Trust Laws

Fletcher Building operates in markets where competition and anti-trust laws are significant. These regulations aim to prevent any single entity from dominating, ensuring fair pricing and preventing monopolistic practices in the building materials and construction sectors. The company must navigate these laws when considering pricing strategies, maintaining market share, and pursuing mergers or acquisitions to avoid regulatory scrutiny.

For instance, in Australia and New Zealand, competition authorities like the Australian Competition and Consumer Commission (ACCC) and the Commerce Commission New Zealand actively monitor market conduct. These bodies can investigate and penalize companies for anti-competitive behavior. Fletcher Building's market share in key segments, such as concrete or roofing, is subject to oversight to ensure it doesn't stifle smaller competitors or lead to unfair pricing for consumers.

- Regulatory Oversight: Fletcher Building faces scrutiny from bodies like the ACCC and Commerce Commission NZ regarding its market conduct.

- Merger & Acquisition Scrutiny: Any significant acquisitions by Fletcher Building would likely undergo review to ensure they do not unduly reduce competition.

- Pricing Practices: Anti-trust laws mandate that Fletcher Building avoids price-fixing or predatory pricing that could harm competitors or consumers.

- Market Share Monitoring: Dominant market positions are closely watched to prevent the abuse of market power within the construction and materials industries.

Consumer Protection and Product Liability Laws

Consumer protection and product liability laws are critical for Fletcher Building, ensuring customers are safeguarded against defective products and services. These regulations hold manufacturers accountable for any harm caused by product defects. For Fletcher Building, this means maintaining stringent quality control across its building materials and construction projects, coupled with transparent and robust warranties. In 2023, New Zealand's Commerce Commission reported a significant number of complaints related to building and construction services, highlighting the importance of compliance.

- Consumer Protection: Laws like the Consumer Guarantees Act in New Zealand ensure products and services meet certain standards of quality and fitness for purpose.

- Product Liability: Manufacturers and suppliers can be held liable for damages caused by faulty products, necessitating thorough safety testing and risk management.

- Quality Control: Fletcher Building must implement rigorous quality assurance processes for its building materials and construction practices to meet legal standards and customer expectations.

- Warranties: Clear and comprehensive warranties are essential to build customer trust and manage potential liabilities arising from product defects or construction issues.

Fletcher Building faces significant legal challenges related to building codes and safety regulations in both New Zealand and Australia. Non-compliance can result in hefty fines, project delays, and litigation, as seen with stricter enforcement of the National Construction Code in Australia in 2023. The company's 2024 focus on robust compliance, including training and material certifications, is vital for mitigating these risks.

Environmental laws, such as New Zealand's Resource Management Act, dictate strict guidelines for construction projects, impacting material sourcing and site management in 2024. Failure to comply with waste management, emissions control, and land remediation laws can lead to substantial penalties, as demonstrated by environmental breaches in Australia in 2023 that fined construction firms heavily.

Workplace health and safety legislation, like New Zealand's Health and Safety at Work Act 2015, is critical for Fletcher Building's operations. The severe consequences of non-compliance, including potential fatalities and costly injury claims, are underscored by WorkSafe New Zealand reporting 59 work-related fatalities in the 2023 fiscal year.

Competition and anti-trust laws in Australia and New Zealand, enforced by bodies like the ACCC, require Fletcher Building to avoid anti-competitive practices, price-fixing, or predatory pricing. Market share monitoring ensures fair pricing and prevents the abuse of market power, a key consideration for the company's pricing strategies and potential acquisitions.

Environmental factors

Fletcher Building faces increasing pressure from climate change concerns and evolving regulations targeting carbon emissions. Their manufacturing processes and extensive construction activities contribute to this footprint, necessitating a strategic shift towards sustainability. For instance, as of early 2024, many construction companies are facing stricter building codes and investor demands for verifiable emissions reductions, with some jurisdictions already implementing carbon pricing mechanisms that could impact material costs and operational expenses.

This environmental scrutiny drives an imperative for Fletcher Building to invest in cleaner technologies and explore the adoption of low-carbon materials. The company is likely evaluating options such as energy-efficient manufacturing equipment and sourcing materials with lower embodied carbon. Industry trends in 2024 and 2025 show a growing market for green building certifications and a premium on sustainable construction practices, directly influencing Fletcher Building's competitive positioning and project acquisition strategies.

Fletcher Building faces the environmental challenge of dwindling raw materials like aggregates, timber, and steel, crucial for its operations. The company is actively exploring the integration of recycled content into its products and prioritizing sustainable sourcing to mitigate these risks.

In response to resource scarcity, Fletcher Building is increasingly adopting circular economy principles. This strategic shift aims to minimize waste generation throughout its value chain and maximize the efficiency of resource utilization, as seen in their efforts to incorporate recycled aggregates in road construction projects.

Fletcher Building faces increasing scrutiny over construction and demolition waste, a significant environmental concern. Regulatory bodies globally are tightening rules on landfill disposal and promoting circular economy principles. For instance, in Australia, the NSW government aims to divert 80% of construction and demolition waste from landfill by 2027, a target Fletcher Building must actively address.

The company is responding with initiatives like on-site waste sorting and recycling programs to minimize landfill contributions. Fletcher Building's commitment to developing products with enhanced recyclability, such as their Formpave permeable paving which incorporates recycled materials, directly tackles this environmental factor.

Water Usage and Management

Fletcher Building's operations, particularly in manufacturing and on-site construction, involve significant water consumption. The company is increasingly focused on implementing strategies for efficient water use across its diverse business units. This includes exploring water-saving technologies in its plants and promoting responsible water management practices on its construction projects.

Compliance with evolving water abstraction regulations is a key consideration, especially in regions facing water scarcity. Fletcher Building aims to minimize its water footprint through initiatives such as wastewater treatment and recycling. For instance, in Australia, where water stress is a growing concern, adherence to strict water usage permits and reporting is paramount for projects.

- Water Efficiency Initiatives: Implementing closed-loop systems in manufacturing to reduce freshwater intake.

- Wastewater Management: Investing in advanced treatment technologies to ensure discharged water meets or exceeds regulatory standards.

- Regulatory Compliance: Actively monitoring and adhering to local and national water abstraction permits and reporting requirements.

- Water-Stressed Region Focus: Developing specific water management plans for projects located in areas identified as having high water stress.

Biodiversity and Land Use Impact

Fletcher Building's extensive operations, including quarries and manufacturing plants, inherently involve significant land use, posing potential risks to local biodiversity. Large-scale construction projects can also disrupt ecosystems. For instance, in 2023, the company managed numerous sites across Australia and New Zealand, each requiring careful environmental assessment to mitigate impacts on flora and fauna.

The company demonstrates a commitment to environmental stewardship through various initiatives. Fletcher Building focuses on the rehabilitation of sites post-operation, aiming to restore ecological value. Their responsible land management practices include biodiversity action plans and partnerships with conservation groups, as evidenced by ongoing projects in 2024 aimed at protecting native species in areas adjacent to their operations.

- Land Use Footprint: Fletcher Building operates numerous quarries and manufacturing facilities, necessitating careful management of land resources.

- Biodiversity Mitigation: The company implements strategies to minimize the impact of its operations on local ecosystems and native species.

- Site Rehabilitation: Post-operation, Fletcher Building is committed to rehabilitating land to support ecological recovery and biodiversity.

- Environmental Reporting: In their 2023 sustainability report, Fletcher Building detailed their efforts in biodiversity protection across their operational sites.

Environmental factors significantly shape Fletcher Building's strategy, with a strong emphasis on carbon emissions reduction and sustainable material sourcing. By early 2024, stricter building codes and investor demands for verifiable emissions reductions are compelling companies like Fletcher Building to adopt cleaner technologies and low-carbon materials, impacting operational costs and competitive positioning.

PESTLE Analysis Data Sources

Our Fletcher Building PESTLE Analysis is informed by a comprehensive review of official government publications, reputable industry associations, and leading financial news outlets. This approach ensures a robust understanding of the political, economic, and social landscapes impacting the construction sector.