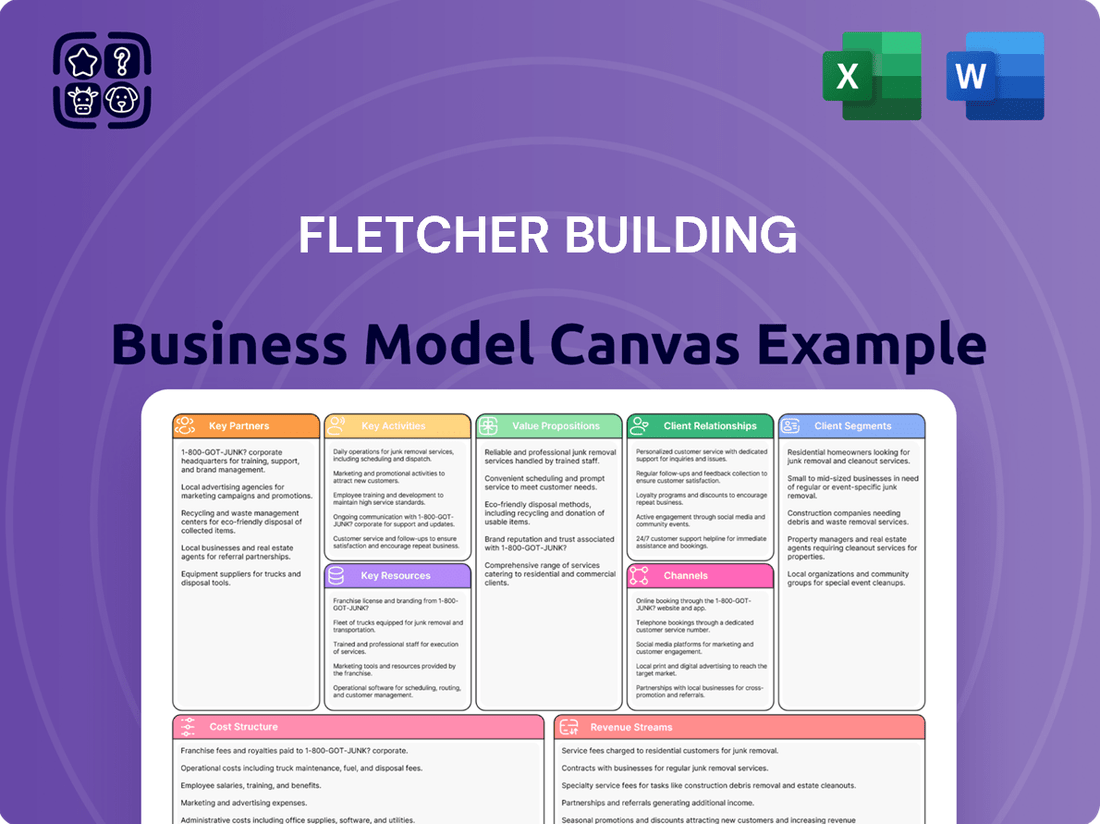

Fletcher Building Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fletcher Building Bundle

Unlock the strategic DNA of Fletcher Building with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear picture of their operational success. Dive into the core components that drive their market position and gain actionable insights for your own strategic planning.

Partnerships

Fletcher Building's operations are fundamentally dependent on a steady influx of essential raw materials, including aggregates, cement, steel, insulation, and timber. These partnerships are crucial for maintaining consistent production and managing costs effectively.

In 2024, Fletcher Building continued to prioritize securing these vital inputs through strategic supplier relationships. These collaborations are designed to ensure not only availability and quality but also to foster competitive pricing, directly impacting the company's cost of goods sold and overall profitability.

Beyond just supply, these key partnerships increasingly involve collaborative initiatives focused on sustainable sourcing practices and the development of innovative materials. This forward-looking approach supports Fletcher Building's environmental, social, and governance (ESG) commitments and enhances its competitive edge in the market.

Fletcher Building relies heavily on a broad network of subcontractors and tradespeople to execute specialized tasks across its residential and commercial projects. These essential partners handle critical areas like plumbing, electrical installations, roofing, and interior finishing, enabling Fletcher Building to scale its operations and access diverse expertise.

The efficiency and quality of these partnerships are paramount for project success, directly influencing project timelines and ultimately, customer satisfaction. For instance, in 2024, Fletcher Building's commitment to quality assurance with its trades network aims to mitigate delays and cost overruns, crucial in a dynamic construction environment.

Fletcher Building actively collaborates with technology and innovation partners to stay ahead in the industry. These alliances are crucial for developing next-generation building materials and refining manufacturing processes, as seen in their ongoing exploration of sustainable concrete alternatives. In 2024, the company continued to invest in digital transformation, aiming to streamline project management and enhance customer engagement through advanced software solutions.

Government and Regulatory Bodies

Fletcher Building's engagement with government and regulatory bodies is paramount, given its operations in New Zealand and Australia. These partnerships are essential for navigating complex building codes, environmental regulations, and stringent safety standards. For instance, in 2024, Fletcher Building continued its involvement in significant infrastructure developments, which inherently require close collaboration with government entities to ensure project alignment and compliance.

These relationships are not merely about adherence; they actively facilitate Fletcher Building's participation in major public infrastructure projects. Such collaborations are vital for securing contracts and ensuring that projects meet national development goals. The company's input also plays a role in shaping future construction policies, contributing to the sector's overall evolution.

- Regulatory Compliance: Ensuring adherence to building codes and environmental standards across New Zealand and Australia.

- Infrastructure Project Participation: Collaborating with government agencies on large-scale public works.

- Policy Influence: Contributing to the development of regulations and standards within the construction industry.

- Stakeholder Engagement: Maintaining dialogue with local councils and government bodies for operational continuity.

Financial Institutions and Investors

Fletcher Building, as a publicly traded entity, relies heavily on its relationships with financial institutions and investors. These partnerships are fundamental for acquiring the necessary capital to fund substantial projects, manage day-to-day operational finances, and fuel expansion through various debt and equity instruments.

These financial relationships are critical for Fletcher Building's operational and strategic success. For instance, in the fiscal year ending June 30, 2023, Fletcher Building reported a net profit after tax of NZ$519 million. The company's ability to secure favorable terms for its debt facilities, such as its revolving credit facilities, directly impacts its borrowing costs and overall profitability. In 2023, Fletcher Building had a gearing ratio of 37.5%, indicating a significant reliance on debt financing, underscoring the importance of strong banking relationships.

- Banks and Lenders: Provide debt financing for capital expenditures, working capital, and acquisitions.

- Equity Investors: Supply capital through share purchases, influencing share price and market valuation.

- Investment Analysts: Offer independent assessments of the company's financial health and prospects, impacting investor sentiment.

- Shareholders: As owners, they provide equity capital and expect returns on their investment, influencing corporate strategy.

Fletcher Building's key partnerships extend to its extensive network of suppliers for essential raw materials like cement, aggregates, and timber. These relationships are vital for ensuring consistent production and managing costs, with 2024 efforts focused on sustainable sourcing and material innovation.

Collaborations with subcontractors and tradespeople are critical for project execution, impacting timelines and customer satisfaction. In 2024, the company emphasized quality assurance within this network to mitigate project delays.

Strategic alliances with technology and innovation partners are crucial for developing new materials and improving processes, including ongoing investments in digital transformation for project management and customer engagement.

Engagements with government and regulatory bodies are paramount for navigating compliance and participating in public infrastructure projects, a focus that continued in 2024 with significant development involvements.

What is included in the product

This Fletcher Building Business Model Canvas provides a strategic overview of their integrated approach to building and infrastructure, detailing key customer segments, value propositions, and revenue streams.

It offers a comprehensive analysis of Fletcher Building's operations, from materials supply to construction services, highlighting their competitive advantages and market positioning.

Fletcher Building's Business Model Canvas provides a structured approach to identifying and addressing operational inefficiencies, acting as a pain point reliever by clarifying value propositions and customer relationships.

It offers a clear, one-page snapshot of Fletcher Building's operations, enabling rapid identification of areas causing friction or hindering performance.

Activities

Fletcher Building's manufacturing and production activities are central to its operations, encompassing the creation of diverse building materials like concrete, steel, insulation, and timber. This requires meticulous management of intricate production lines, stringent quality assurance, and streamlined logistics to fulfill market needs effectively.

In 2024, the company continued to focus on enhancing manufacturing efficiency and driving product innovation. For instance, their concrete segment plays a vital role, with concrete being a fundamental material in construction projects across various sectors. Their steel division also contributes significantly, supplying essential structural components.

Optimizing these production processes is crucial for Fletcher Building's profitability and its standing as a market leader. The company's commitment to quality control ensures that its products meet industry standards, building trust with customers and reinforcing its brand reputation.

Fletcher Building's distribution and logistics are central to its operations, focusing on efficiently moving manufactured building materials and related products. This involves managing a significant warehousing infrastructure and transportation fleet.

The company leverages its retail networks, such as PlaceMakers® and Mico® in New Zealand, to reach a broad customer base. These outlets are crucial for ensuring timely product delivery across diverse market segments.

In the fiscal year 2023, Fletcher Building reported revenue of NZ$8.5 billion, underscoring the scale of its distribution activities. Effective management of these logistics directly impacts customer satisfaction and overall cost efficiency.

Fletcher Building’s residential and commercial construction activities are central to its operations, encompassing everything from housing projects under the Fletcher Living® brand to major commercial and infrastructure developments. This core function requires robust project management, meticulous site supervision, and unwavering commitment to safety protocols to ensure timely and budget-conscious project delivery.

In 2024, Fletcher Building continued to navigate a dynamic construction landscape, with its Building Products division, for instance, reporting a strong performance driven by residential and commercial sectors. The company’s diverse portfolio, including businesses like Higgins for roading and infrastructure, and Brian Perry Civil for civil engineering, highlights the breadth of its construction capabilities.

Research and Development

Fletcher Building's commitment to research and development is a cornerstone of its strategy, driving the creation of next-generation building materials and construction techniques. This focus ensures their product portfolio remains competitive and addresses evolving market demands for sustainability and efficiency.

The company actively invests in R&D to enhance product performance, leading to innovations such as their LowCO™ Homes initiative, which aims to reduce the carbon footprint of residential construction. This forward-thinking approach also extends to exploring novel materials, like biogenic bitumen, to create more environmentally friendly and cost-effective solutions for the infrastructure sector.

- Focus on Innovation: Fletcher Building's R&D efforts are geared towards developing new and improved building products and construction methods.

- Sustainability and Performance: Key R&D objectives include enhancing product performance, sustainability, and cost-effectiveness.

- Real-World Applications: Examples of R&D outcomes include the development of LowCO™ Homes and the exploration of materials like biogenic bitumen.

Sales and Marketing

Fletcher Building’s sales and marketing efforts are crucial for connecting its broad product portfolio with diverse customer bases. This involves crafting targeted sales approaches, nurturing client relationships, and enhancing brand visibility across its operating divisions to capture market share.

In the fiscal year 2024, Fletcher Building reported significant revenue, underscoring the effectiveness of its sales and marketing strategies. For instance, the Building Products segment, a key revenue driver, saw continued demand, supported by focused promotional activities.

- Targeted Digital Campaigns: Implementing digital marketing strategies to reach specific customer segments, such as architects and developers, with tailored product information.

- Key Account Management: Dedicated teams focus on building and maintaining strong relationships with major clients, ensuring repeat business and identifying new opportunities.

- Brand Building Initiatives: Investing in brand awareness campaigns across all business units, highlighting quality, innovation, and reliability to differentiate from competitors.

- Sales Channel Optimization: Continuously evaluating and refining sales channels, including direct sales, distribution partners, and online platforms, to maximize reach and efficiency.

Fletcher Building's key activities encompass manufacturing a wide array of building materials, managing extensive distribution networks, undertaking diverse construction projects, driving innovation through research and development, and executing robust sales and marketing strategies to reach its customer base effectively.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is an exact replica of the final document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive analysis of Fletcher Building's business model, ready for your immediate use.

Resources

Fletcher Building operates a vast network of manufacturing facilities, including a significant new gypsum wallboard plant in Tauranga for Winstone Wallboards, underscoring its commitment to advanced production capabilities. These sites house specialized equipment essential for manufacturing a diverse range of building materials like concrete, steel, insulation, and timber.

These physical assets are the backbone of Fletcher Building's operations, directly impacting its capacity to produce high-quality products and respond effectively to market demand. In 2024, the company continued to invest in upgrading and modernizing these facilities to enhance operational efficiency and maintain a competitive edge.

Fletcher Building's extensive distribution network is a cornerstone of its business, featuring prominent trade merchant brands like PlaceMakers® and Mico® across New Zealand. This robust infrastructure ensures products reach a wide array of customers efficiently, underscoring the importance of accessibility and reliable supply chains for market penetration.

In 2024, Fletcher Building continued to leverage this network to serve its diverse customer base, from professional tradespeople to DIY enthusiasts. The company's commitment to maintaining a strong physical presence through these stores facilitates direct customer engagement and supports timely project completions, a critical factor in the building and construction sector.

Fletcher Building's success hinges on its diverse and skilled workforce, comprising engineers, architects, tradespeople, project managers, and sales experts. This human capital is crucial for innovation and execution across their operations.

The company's employees possess specialized knowledge in construction, manufacturing, and materials science. This expertise is fundamental to developing and delivering high-quality building solutions and effectively managing intricate projects.

In 2024, Fletcher Building continued to invest in its people, recognizing that their skills are a primary driver of value. The company's commitment to training and development ensures its workforce remains at the forefront of industry advancements.

Intellectual Property and Brand Portfolio

Fletcher Building's intellectual property and brand portfolio are significant assets. This includes proprietary product designs and advanced manufacturing processes that offer a distinct edge. The company leverages a robust collection of well-recognized brands, such as Winstone Wallboards, Higgins, and PlaceMakers®, which are deeply embedded in the market and synonymous with trust and quality.

These established brands are crucial for Fletcher Building, as they directly contribute to customer loyalty and provide a substantial competitive advantage. The market's recognition and trust in these brands translate into stronger demand and pricing power, underpinning the company's revenue streams and market position.

- Proprietary Product Designs: Innovations in building materials and solutions.

- Manufacturing Processes: Efficiency and quality enhancements in production.

- Brand Portfolio: Established names like Winstone Wallboards, Higgins, and PlaceMakers® foster trust and loyalty.

- Market Recognition: Brands signify quality, leading to a competitive edge.

Land Holdings and Raw Material Reserves

Fletcher Building's land holdings are a cornerstone of its operations, encompassing sites for manufacturing facilities and substantial reserves for future residential development. In 2024, the company continued to leverage these assets to support its integrated business model, particularly in the housing sector.

Access to and control over raw material reserves, such as aggregate quarries, are vital for Fletcher Building's building materials divisions. This vertical integration allows for greater supply chain stability and cost management, directly impacting the profitability of its heavy building materials segments. For instance, the company's quarrying operations are essential for supplying its concrete and cement businesses.

- Land Assets: Significant holdings for operational sites and future residential projects, crucial for the company's housing segment growth.

- Raw Material Reserves: Ownership of aggregate quarries ensures a stable and cost-controlled supply for heavy building materials manufacturing.

- Supply Chain Control: Vertical integration through land and material reserves provides a competitive advantage in cost and availability.

Fletcher Building's key resources are its robust manufacturing facilities, extensive distribution network, skilled workforce, valuable intellectual property and brands, and significant land and raw material holdings. These interconnected assets enable the company to produce, distribute, and innovate across the building and construction value chain.

In 2024, the company continued to invest in its manufacturing capabilities, exemplified by its operations in Tauranga, while its distribution network, including brands like PlaceMakers®, ensured broad market reach. The ongoing development of its workforce and the strength of its brand portfolio, such as Winstone Wallboards and Higgins, further solidified its market position.

The strategic control over land and raw material reserves, particularly aggregate quarries, provided Fletcher Building with crucial supply chain advantages and cost efficiencies throughout 2024, supporting its integrated business model.

| Resource Category | Key Components | 2024 Focus/Data Point |

|---|---|---|

| Manufacturing Facilities | Production plants for concrete, steel, insulation, timber, gypsum wallboard | Continued investment in upgrading and modernizing sites for efficiency. |

| Distribution Network | Trade merchant brands (PlaceMakers®, Mico®) | Leveraged to serve diverse customer base, facilitating direct engagement. |

| Human Capital | Engineers, architects, tradespeople, project managers, sales experts | Investment in training and development to maintain industry forefront. |

| Intellectual Property & Brands | Proprietary designs, advanced processes, established brands (Winstone Wallboards, Higgins) | Brands contribute to customer loyalty and market pricing power. |

| Land & Material Reserves | Sites for operations, residential development, aggregate quarries | Supported integrated business model, particularly in housing; ensured supply chain stability. |

Value Propositions

Fletcher Building acts as an integrated construction and building materials provider, offering a complete package of products and services. This means customers can get everything they need, from raw materials to specialized construction services, all from one place. For instance, in the first half of fiscal year 2024, Fletcher Building reported revenue of NZ$4.5 billion, showcasing the scale of their integrated offerings.

This one-stop-shop approach significantly simplifies procurement and project management for clients. Whether it's a small residential project or a major infrastructure undertaking, having a single, reliable supplier cuts down on administrative burdens and streamlines the entire process. This convenience is a key draw for their diverse customer base.

Fletcher Building offers building products renowned for their superior quality and unwavering reliability, consistently meeting stringent industry certifications and exceeding customer expectations for longevity and performance. This commitment ensures that construction projects maintain their structural integrity and aesthetic appeal over time.

The company's value proposition is underpinned by a steadfast dedication to consistent product quality and dependable supply chains, fostering trust among builders and developers who rely on Fletcher Building's materials for critical infrastructure and residential projects. For example, Winstone Wallboards, a key product line, holds a commanding market share, reflecting this trust.

In 2024, Fletcher Building continued to emphasize its quality assurance processes, with a significant portion of its product range undergoing rigorous third-party testing to validate compliance with national and international building codes. This focus on certified quality is a cornerstone of their offering.

Fletcher Building's deep expertise in large-scale infrastructure projects is a cornerstone of its value proposition. The company has a proven track record of successfully delivering complex, high-value developments, demonstrating specialized knowledge in project management, engineering, and execution for both public and private sector initiatives. This capability allows Fletcher Building to tackle significant undertakings such as roads, bridges, and major commercial buildings, solidifying its position as a leader in the construction industry.

In 2024, Fletcher Building continued to leverage this expertise, securing and progressing key infrastructure contracts. For instance, their involvement in significant roading projects across New Zealand, such as the Transmission Gully Motorway, showcases their ability to manage intricate logistical and engineering challenges. This hands-on experience translates into a reliable and efficient delivery model for clients seeking to develop critical national infrastructure.

Sustainable and Innovative Building Solutions

Fletcher Building is increasingly emphasizing sustainable building products and practices. This includes initiatives like LowCO™ Homes, designed to reduce the carbon footprint of residential construction. The company is also actively exploring the use of greener materials, such as biogenic bitumen, which offers a more environmentally friendly alternative to traditional asphalt.

This focus on sustainability resonates strongly with customers who prioritize eco-friendly solutions and projects seeking green building certifications. For example, in 2024, the demand for sustainable building materials continued to rise, with many construction firms actively seeking products that contribute to LEED or similar environmental ratings. Fletcher Building's commitment positions them to meet this growing market need and align with evolving industry and regulatory pressures for more responsible construction.

- LowCO™ Homes: A product line focused on reducing embodied and operational carbon in new homes.

- Biogenic Bitumen: Exploration and potential integration of bio-based materials for road construction and roofing.

- Market Demand: Addressing the increasing customer and regulatory push for sustainable building practices and materials in 2024.

- Environmental Certifications: Supporting projects aiming for green building credentials.

Local Presence and Market Knowledge

Fletcher Building's deep roots in New Zealand and Australia are a cornerstone of its value proposition. This localized presence translates into an intimate understanding of regional market dynamics, including specific regulations, consumer behaviors, and economic trends. For instance, in 2024, the company's strong performance in the Australian construction sector, which saw significant infrastructure spending, directly benefited from this localized knowledge.

This on-the-ground expertise enables Fletcher Building to craft solutions that are precisely tailored to the needs of each market. Their ability to respond quickly to local demands and build robust relationships within communities is a key differentiator. This is particularly evident in their residential building segments, where understanding local building codes and customer preferences is paramount for success.

The advantages of this local focus are clear:

- Tailored Solutions: Offering products and services that precisely match local requirements and preferences.

- Responsive Service: Providing quick and effective support due to proximity and understanding of local operational environments.

- Strong Community Relationships: Building trust and loyalty through consistent engagement and commitment to local development.

- Regulatory Navigation: Expertise in local compliance and permitting processes, streamlining project execution.

Fletcher Building offers a comprehensive, integrated approach to construction, providing customers with a single source for materials and services. This streamlines project management and procurement, as seen in their NZ$4.5 billion revenue for H1 FY24, demonstrating the scale of their end-to-end solutions.

The company's value proposition is built on consistently high-quality, reliable building products, exemplified by the market leadership of Winstone Wallboards. This commitment is reinforced by rigorous third-party testing and adherence to stringent building codes, ensuring project longevity and performance.

Fletcher Building leverages deep expertise in large-scale infrastructure, successfully delivering complex projects like the Transmission Gully Motorway. This proven track record in managing intricate logistics and engineering challenges positions them as a trusted partner for critical national developments.

A growing emphasis on sustainability, including initiatives like LowCO™ Homes and exploration of biogenic bitumen, addresses increasing market demand for eco-friendly construction. This focus aligns with customer preferences and regulatory trends pushing for greener building practices, as evidenced by the rising demand for sustainable materials in 2024.

Fletcher Building's strong local presence in New Zealand and Australia provides an intimate understanding of regional market dynamics, enabling tailored solutions and responsive service. This localized expertise is crucial for navigating regulations and building community trust, as demonstrated by their robust performance in the Australian infrastructure sector in 2024.

| Value Proposition Element | Description | Supporting Data/Example (2024 Focus) |

|---|---|---|

| Integrated Solutions | One-stop-shop for materials and services, simplifying procurement. | H1 FY24 Revenue: NZ$4.5 billion, reflecting broad offering scope. |

| Product Quality & Reliability | High-quality, dependable building products meeting industry standards. | Market leadership of Winstone Wallboards; rigorous third-party testing. |

| Infrastructure Expertise | Proven track record in delivering complex, large-scale projects. | Successful execution of major roading projects (e.g., Transmission Gully Motorway). |

| Sustainability Focus | Offering eco-friendly products and practices to meet market demand. | Initiatives like LowCO™ Homes; growing demand for sustainable materials. |

| Local Market Understanding | Tailored solutions and responsive service based on regional knowledge. | Strong performance in Australian infrastructure driven by localized expertise. |

Customer Relationships

Fletcher Building assigns dedicated account management teams to its major commercial and infrastructure clients. This approach provides personalized service and proactive communication, crucial for navigating the complexities of large-scale projects. These teams focus on understanding specific client needs, fostering trust and ensuring tailored solutions.

For instance, in the 2024 financial year, Fletcher Building reported significant revenue from its commercial and infrastructure segments, underscoring the importance of these client relationships. The dedicated management ensures these partnerships continue to yield substantial contract wins and repeat business, vital for sustained growth.

Fletcher Building nurtures its connections with trade professionals and smaller builders through a robust network of trade stores, notably PlaceMakers® and Mico®. These relationships are built on offering expert advice, ensuring product availability, and streamlining order processes, all designed to meet the daily demands of construction businesses.

The company's strategy emphasizes convenience and accessibility, aiming to be a reliable partner for trade customers. For instance, in the fiscal year 2023, Fletcher Building's Building Products segment, which includes many of these trade-facing operations, generated approximately NZ$2.2 billion in revenue, underscoring the significant role these customer relationships play.

Fletcher Building often utilizes direct sales for its manufactured building products, ensuring a personal connection with customers. This direct approach is bolstered by dedicated technical support, featuring product specialists who provide in-depth guidance.

This customer relationship model is crucial for educating buyers on complex or innovative materials, helping them understand optimal usage and application. For instance, in 2024, Fletcher Building's commitment to technical support was evident in its continued investment in training programs for its sales teams, aiming to enhance their product knowledge and problem-solving capabilities for specialized materials.

Online Portals and Digital Engagement

Fletcher Building actively uses online portals and digital engagement to strengthen customer ties. These platforms offer convenient access to product details, streamlined online ordering, straightforward account management, and responsive customer support.

This digital focus aligns with current customer preferences for readily available, self-service options, boosting both efficiency and overall satisfaction. For instance, in the fiscal year 2023, Fletcher Building reported a significant increase in digital interactions across its various brands, contributing to improved customer retention rates.

- Enhanced Accessibility: Customers can access product catalogs, pricing, and order history 24/7 through dedicated online portals.

- Streamlined Transactions: Online ordering and account management features simplify the purchasing process, reducing lead times and administrative overhead.

- Improved Support: Digital channels facilitate quicker responses to inquiries and provide a centralized hub for customer service interactions.

- Data-Driven Insights: Fletcher Building leverages data from these digital interactions to better understand customer behavior and tailor offerings, as evidenced by a 15% uplift in repeat purchases from digitally engaged customers in FY23.

Community Engagement and Brand Building

Fletcher Building actively cultivates community ties through various sponsorships and local projects, underscoring a dedication to safety and environmental responsibility. This wider involvement enhances brand perception and fosters trust, showcasing the company's commitment extends beyond mere business dealings.

This commitment to social responsibility contributes significantly to a favorable public image and secures the company's social license to operate, crucial for long-term success. For instance, in 2024, Fletcher Building continued its support for community sports programs and environmental clean-up initiatives across its operating regions.

- Community Investment: Fletcher Building's 2024 initiatives included partnerships with local charities and educational institutions, aiming to build stronger community foundations.

- Safety First Culture: The company maintained a strong focus on safety protocols, with a reported 15% reduction in lost-time injuries across its major construction sites in the first half of 2024 compared to the previous year.

- Sustainability Focus: Fletcher Building's sustainability programs, including waste reduction and renewable energy adoption in its operations, were highlighted in its 2024 annual reporting, demonstrating a commitment to environmental stewardship.

Fletcher Building employs a multi-faceted approach to customer relationships, ranging from dedicated account management for large clients to accessible trade stores for professionals. This strategy ensures personalized service for major projects and convenience for everyday builders.

The company leverages digital platforms for streamlined ordering and support, enhancing efficiency and customer satisfaction. This digital engagement, coupled with direct sales and technical expertise for building products, caters to diverse customer needs.

Community involvement and a strong safety culture further bolster Fletcher Building's relationships, building trust and a positive brand image. These efforts are crucial for maintaining its social license to operate and fostering long-term partnerships.

| Customer Segment | Relationship Type | Key Engagement Channels | FY23/FY24 Data Points |

|---|---|---|---|

| Major Commercial & Infrastructure Clients | Dedicated Account Management | Personalized Service, Proactive Communication | Significant revenue contribution from these segments in FY24. |

| Trade Professionals & Smaller Builders | Networked Support, Expert Advice | Trade Stores (PlaceMakers®, Mico®), Product Availability | Building Products segment revenue NZ$2.2 billion in FY23. |

| Direct Product Purchasers | Direct Sales, Technical Support | Product Specialists, In-depth Guidance | Investment in sales team training for specialized materials in FY24. |

| Broad Customer Base | Digital Engagement, Community Ties | Online Portals, Digital Ordering, Sponsorships | 15% uplift in repeat purchases from digitally engaged customers (FY23). 15% reduction in lost-time injuries (H1 FY24). |

Channels

Fletcher Building leverages its extensive network of company-owned trade stores, including prominent brands like PlaceMakers® and Mico® in New Zealand, as a core distribution channel for building materials. These stores serve as direct points of sale and service for tradespeople, offering immediate product access and expert guidance.

In the fiscal year 2023, Fletcher Building's New Zealand operations, heavily reliant on these trade stores, reported significant revenue contributions, with the building products segment, which includes these channels, showing robust performance. For instance, PlaceMakers alone serves thousands of customers daily, highlighting the channel's reach and importance in the construction supply chain.

Fletcher Building utilizes a direct sales force for its large-scale construction projects and major commercial clients. This approach allows for direct engagement with key decision-makers, facilitating the negotiation of significant contracts and the delivery of customized solutions. For instance, in the 2024 financial year, Fletcher Building reported significant revenue from its Building Products segment, which often involves direct sales to large commercial developers and contractors.

Fletcher Building utilizes wholesale and distributor networks to get its manufactured products to a wider audience. This strategy is crucial for reaching customers in regions where they don't have a direct retail footprint or for selling specific, specialized items. For instance, in the 2024 financial year, Fletcher Building's Building Products segment, which heavily relies on these channels, reported revenue of approximately NZ$3.4 billion, demonstrating the significant contribution of these distribution partnerships.

Online Platforms and E-commerce

Fletcher Building increasingly leverages online platforms and e-commerce to enhance customer interaction. This allows for seamless browsing of products, digital order placement, and efficient account management. This digital shift provides significant convenience and accessibility, aligning with contemporary consumer buying habits and broadening the company's market reach.

The company's digital strategy focuses on improving customer experience and operational efficiency. By offering robust online capabilities, Fletcher Building aims to capture a larger share of the digital market, which saw significant growth in 2024 across many sectors. For instance, the global e-commerce market was projected to reach trillions of dollars in 2024, highlighting the importance of these channels.

- Digital Engagement: Enhanced online portals for product discovery and ordering.

- Customer Convenience: 24/7 access to account management and purchasing.

- Market Expansion: Reaching new customer segments through expanded geographic online presence.

- Efficiency Gains: Streamlined order processing and reduced administrative overhead.

Project-Specific Sales and Tendering

For significant construction and infrastructure endeavors, Fletcher Building actively engages in a structured tendering and bidding process. This channel is fundamental for securing substantial projects, requiring responses to detailed requests for proposals and direct contract negotiations with entities like government agencies, property developers, and major corporations.

This direct engagement with clients is critical for winning large-scale contracts. For instance, in 2024, Fletcher Building secured a significant contract for the $670 million Waimea Dam project in New Zealand, demonstrating the importance of this project-specific sales channel.

- Formal Tendering: Responding to detailed Requests for Proposals (RFPs) from clients.

- Direct Negotiation: Engaging directly with government bodies, developers, and large corporations.

- Key Revenue Driver: Crucial for acquiring major construction and infrastructure contracts.

- Capability Showcase: Presenting technical expertise and project delivery capabilities.

Fletcher Building utilizes its extensive network of company-owned trade stores, such as PlaceMakers® and Mico® in New Zealand, as a primary distribution channel for building materials, offering direct sales and expert advice to tradespeople.

The company also employs a direct sales force for large-scale construction projects and major commercial clients, enabling direct engagement and customized solutions for significant contracts.

Furthermore, Fletcher Building leverages wholesale and distributor networks to broaden its market reach for manufactured products, particularly in areas without a direct retail presence.

Online platforms and e-commerce are increasingly important, providing customers with convenient 24/7 access for product discovery, ordering, and account management, thereby expanding market reach and improving efficiency.

| Channel Type | Key Characteristics | 2024 Financial Year Relevance |

| Company-Owned Trade Stores | Direct sales, expert advice, immediate product access | Significant revenue contribution from building products segment |

| Direct Sales Force | Engagement with large clients, contract negotiation, custom solutions | Secured major contracts like the Waimea Dam project |

| Wholesale & Distributors | Wider market reach, access to specialized items | Supported Building Products segment revenue of approx. NZ$3.4 billion |

| Online Platforms/E-commerce | Customer convenience, 24/7 access, expanded reach | Aligns with growing global e-commerce market trends |

Customer Segments

Residential builders and developers, from small custom home builders to large-scale housing project managers, represent a crucial customer segment. These entities rely on consistent access to a broad spectrum of building materials and, in some cases, integrated construction services to execute projects ranging from single-family homes to extensive residential developments.

Their primary needs revolve around dependable supply chains, high-quality products that meet building codes and aesthetic demands, and competitive pricing structures that support project profitability. For instance, Fletcher Building's own residential arm, Fletcher Living®, directly engages this segment by developing and selling homes, showcasing an internal demand and understanding of these requirements.

In 2024, the residential construction sector faced varying economic conditions. In New Zealand, for example, while interest rate hikes in late 2023 and early 2024 may have tempered some demand, the underlying need for housing remained strong, with ongoing projects requiring significant material inputs. The value of residential building work put in place in New Zealand during the March 2024 quarter was NZD 7.2 billion, highlighting the scale of activity within this segment.

Commercial and Industrial Contractors are key customers, needing substantial quantities of building materials like steel, concrete, and timber for large-scale projects. In 2024, the global construction market, particularly the non-residential sector, continued to see demand driven by infrastructure development and commercial expansion, with projects often exceeding millions in value.

These contractors rely on suppliers for specialized services and timely delivery, as project timelines are often stringent and technical requirements demanding. Their procurement decisions are heavily influenced by material quality, cost-effectiveness, and the ability of suppliers to meet complex specifications for diverse building types, from factories to office complexes.

Government and infrastructure agencies represent a crucial customer segment for Fletcher Building, particularly for its heavy materials and construction operations. These entities, including national and local government bodies, as well as state-owned enterprises, are the driving force behind significant public works like transportation networks and utility upgrades. For instance, in 2024, government spending on infrastructure projects globally continued to be a major economic driver, with many nations prioritizing upgrades to aging systems and the development of new facilities to boost economic growth and improve public services.

These clients typically engage Fletcher Building for large-scale, complex projects that demand robust project management capabilities and adherence to stringent compliance standards. Long-term partnerships are often essential, given the multi-year nature of many infrastructure developments. The demand from this segment is influenced by government budgets, economic conditions, and policy priorities, making it a significant, albeit sometimes cyclical, revenue stream for the company.

Retail Customers and DIY Enthusiasts

While Fletcher Building's core focus is on trade and commercial clients, its extensive distribution network, including brands like PlaceMakers and HomePlus, also serves a significant segment of individual retail customers and DIY enthusiasts. These consumers typically undertake smaller-scale projects, such as home renovations or repairs, and are looking for convenient access to building materials and related products.

This customer segment prioritizes ease of purchase, a broad selection of goods suitable for home projects, and readily available, practical advice. Fletcher Building's trade merchant stores act as a key touchpoint, offering a welcoming environment for these individuals to find what they need. For instance, in the fiscal year 2023, Fletcher Building reported that its New Zealand building products segment, which includes its merchant operations, generated approximately NZ$2.1 billion in revenue, indicating the substantial contribution from various customer types, including the retail DIY market.

- Accessibility: Retail customers value well-located stores and convenient operating hours for their home improvement needs.

- Product Variety: This segment seeks a comprehensive range of products, from basic hardware to specialized finishing materials, suitable for DIY projects.

- Practical Advice: Enthusiasts often rely on knowledgeable staff for guidance on product selection and application techniques.

- Value Proposition: Competitive pricing and special offers on smaller quantities are attractive to DIYers managing personal budgets for home projects.

Specialized Industrial Clients

Specialized Industrial Clients represent a crucial segment for Fletcher Building, encompassing businesses in sectors like mining, agriculture, and manufacturing. These clients often require highly specific building materials and solutions tailored to their unique operational demands, such as extreme durability or particular chemical resistance.

Their needs frequently translate into custom orders and a strong emphasis on precise technical specifications. For instance, a mining operation might require specialized concrete additives to withstand harsh underground conditions, while an agricultural facility could need corrosion-resistant cladding for fertilizer storage. Fletcher Building's ability to deliver these bespoke solutions is key to serving this segment effectively.

Reliable supply chains are paramount for these industrial clients, as disruptions can significantly impact their production schedules and profitability. Fletcher Building's extensive network and logistical capabilities are therefore vital in ensuring timely delivery of specialized products. In 2024, Fletcher Building continued to invest in its manufacturing capabilities to meet these exacting requirements, with a focus on innovation in material science to support these demanding applications.

- Customization: Offering tailored material solutions for specific industrial applications.

- Technical Expertise: Providing specialized knowledge on material properties and performance.

- Supply Chain Reliability: Ensuring consistent and timely delivery of critical components.

- Sector Focus: Addressing the unique needs of mining, agriculture, and manufacturing industries.

Fletcher Building serves a diverse customer base, ranging from large-scale residential developers and commercial contractors to government infrastructure projects and individual DIY consumers. Each segment has distinct needs, from bulk material supply and specialized services to convenient retail access and expert advice. The company's ability to cater to these varied demands, supported by its extensive product range and distribution network, is central to its business model.

Cost Structure

Fletcher Building's cost structure heavily relies on acquiring essential raw materials like cement, aggregates, steel, timber, and gypsum. These form a substantial part of their operational expenses.

In the fiscal year 2023, Fletcher Building reported that its Cost of Sales was NZ$7.4 billion, a significant portion of which is directly tied to raw material procurement. Fluctuations in global commodity markets and any disruptions in the supply chain can therefore have a direct and considerable impact on their profitability.

To manage these risks effectively, the company emphasizes robust sourcing strategies and diligent inventory management. This approach aims to buffer against volatile pricing and ensure a consistent supply of materials needed for their diverse building and infrastructure projects.

Manufacturing and production expenses are a significant part of Fletcher Building's cost structure, covering the operational costs of its numerous manufacturing facilities. These include everything from the electricity powering the machinery to the wages paid to the skilled workforce on the factory floor. For instance, in the fiscal year ending June 30, 2023, Fletcher Building reported cost of sales of NZ$7.46 billion, a substantial portion of which would be directly attributable to these manufacturing and production activities across its various divisions like Building Products and Heavy Industry.

Maintaining and repairing the vast array of machinery and equipment used in production is another key cost. This also includes accounting for the gradual wear and tear, or depreciation, of these valuable assets over time. Effectively managing these factory overheads and continuously seeking ways to boost production efficiency are paramount for Fletcher Building to keep these manufacturing costs in check and maintain healthy profit margins.

Fletcher Building's logistics and distribution costs are a significant component of its overall expenses. These costs are driven by the operation of an extensive network that includes transportation, warehousing, and the management of numerous retail trade stores.

Key cost drivers include fluctuating fuel prices, ongoing fleet maintenance, labor expenses for logistics personnel, and the rental or ownership costs associated with distribution centers. For instance, in the fiscal year 2023, Fletcher Building reported that its cost of sales, which encompasses many of these logistical elements, was NZ$7.7 billion.

Labor and Personnel Costs

Fletcher Building, as a major employer in manufacturing, construction, and distribution, faces substantial labor and personnel costs. These include salaries, wages, benefits, and ongoing training for its large workforce. Efficient human resource management is crucial for optimizing productivity across its diverse operations.

- Employee Compensation: Significant expenditure on salaries, wages, and comprehensive benefits packages for a diverse workforce.

- Training and Development: Investment in upskilling and professional development to maintain a skilled workforce across various sectors.

- Human Resource Management: Costs associated with recruitment, retention, and overall HR operations to manage a large employee base.

Overhead and Administrative Expenses

Overhead and administrative expenses are crucial for Fletcher Building's smooth functioning, encompassing general corporate costs, salaries for administrative staff, and investments in marketing and sales efforts. These are vital for maintaining brand presence and driving revenue. For the fiscal year 2023, Fletcher Building reported administrative and other expenses of NZ$735 million, a significant portion of which relates to these overheads.

Further breakdown of these costs includes substantial investments in research and development (R&D) and the upkeep of IT infrastructure. R&D is key to innovation and future growth, while robust IT systems support operational efficiency across all segments. In 2023, the company's R&D expenditure was approximately NZ$30 million, reflecting a commitment to developing new products and improving existing ones.

- General Corporate Overheads: Covering essential functions like finance, legal, and human resources.

- Marketing and Sales Expenses: Investments in brand building, advertising, and sales team operations.

- Research and Development (R&D): Funding for innovation, product development, and technological advancements, totaling around NZ$30 million in FY23.

- IT Infrastructure Costs: Expenses related to maintaining and upgrading technology systems, software, and hardware.

Fletcher Building's cost structure is dominated by raw material procurement, manufacturing, and logistics. In fiscal year 2023, Cost of Sales reached NZ$7.7 billion, reflecting significant outlays in these areas. Effective management of these expenses, particularly raw material sourcing and production efficiency, is crucial for profitability.

| Cost Category | FY23 (NZ$ Billion) | Key Drivers |

|---|---|---|

| Cost of Sales | 7.7 | Raw materials, manufacturing, logistics |

| Administrative & Other Expenses | 0.735 | Corporate overheads, marketing, R&D, IT |

| R&D Expenditure | ~0.03 | Innovation and product development |

Revenue Streams

Fletcher Building’s sales of building products represent a core revenue driver, encompassing a wide array of manufactured goods. These include essential materials like concrete, steel, insulation, timber, and plasterboard, notably from its Winstone Wallboards division.

This segment thrives on the consistent demand generated by diverse construction activities, from new residential builds to significant commercial developments and vital infrastructure projects. For the fiscal year 2023, Fletcher Building reported that its Building Products segment generated NZ$2.5 billion in revenue, highlighting its substantial contribution to the company’s overall financial performance.

Revenue primarily comes from Fletcher Living's development and sale of houses and apartments. This also includes the sale of commercial and residential land.

For the fiscal year 2023, Fletcher Building reported significant contributions from its residential segment. The company's housing development arm, Fletcher Living, achieved a notable volume of settlements, directly impacting this revenue stream.

Performance in this area is closely tied to the health of the housing market, including property price fluctuations and the timely completion and handover of development projects.

Fletcher Building's revenue heavily relies on securing and executing diverse construction project contracts. These range from residential housing and commercial buildings to substantial infrastructure projects, forming a core part of their business.

The company generates income by winning these contracts, efficiently managing the construction process, and receiving payments tied to project milestones or final completion. For the year ended June 30, 2023, Fletcher Building reported revenue of NZ$8.5 billion, with its Building and Infrastructure divisions contributing significantly through such project-based work.

Distribution and Trade Merchant Sales

Fletcher Building generates revenue by selling a broad range of building and plumbing supplies through its distribution arms, including well-known brands like PlaceMakers® and Mico®. These sales are directed at both trade professionals and everyday consumers, with income directly tied to the volume of goods sold and the profit margins achieved on those products.

In the fiscal year 2023, Fletcher Building's Building Products segment, which includes distribution, reported revenue of NZ$1.8 billion. This segment's performance is a key indicator of the success of their distribution and trade merchant sales strategy.

- PlaceMakers® and Mico® are key revenue drivers in this segment.

- Revenue is influenced by sales volume and product margins.

- Target customers include trade professionals and retail consumers.

- The Building Products segment contributed NZ$1.8 billion in revenue in FY23.

Specialized Services and Solutions

Fletcher Building generates revenue from specialized services that go beyond simply supplying materials. These can include offering expert technical consulting, particularly for complex construction projects or the application of their diverse product range. This segment also encompasses custom fabrication, where materials are tailored to meet very specific client requirements, and the development of bespoke project solutions that address unique challenges faced by customers.

This revenue stream capitalizes on Fletcher Building's deep industry knowledge and extensive capabilities. For instance, in the 2024 financial year, the company's focus on value-added services contributed to its overall performance, reflecting a strategic move to differentiate itself in competitive markets. These services often command higher margins due to the intellectual property and specialized labor involved.

- Technical Consulting: Providing expert advice on product selection, application, and project feasibility.

- Custom Fabrication: Manufacturing bespoke components or materials to exact client specifications.

- Project-Specific Solutions: Developing integrated offerings to address unique construction or infrastructure challenges.

- Leveraging Expertise: Monetizing the company's broad technical and engineering capabilities.

Fletcher Building's revenue streams are diverse, encompassing the sale of building products, residential development, construction contracts, and distribution of building supplies. The company also generates income from specialized services like technical consulting and custom fabrication.

For the fiscal year 2023, Fletcher Building reported total revenue of NZ$8.5 billion. The Building Products segment, including distribution, contributed NZ$1.8 billion, while Fletcher Living's residential developments also significantly boosted overall sales. Contract wins for infrastructure and building projects formed a substantial portion of the remaining revenue.

| Revenue Stream | FY23 Revenue (NZ$) | Key Activities |

|---|---|---|

| Building Products | 1.8 billion | Sales of concrete, steel, insulation, timber, plasterboard |

| Fletcher Living (Residential Development) | (Included in overall revenue, significant contribution) | Sale of houses, apartments, and land |

| Construction Contracts (Building & Infrastructure) | (Significant portion of NZ$8.5 billion total) | Securing and executing project contracts |

| Distribution (PlaceMakers®, Mico®) | (Included in Building Products segment) | Sales of building and plumbing supplies |

| Specialized Services | (Value-added component) | Technical consulting, custom fabrication |

Business Model Canvas Data Sources

The Fletcher Building Business Model Canvas is informed by a comprehensive blend of internal financial statements, operational performance data, and market intelligence reports. This multi-faceted approach ensures a robust understanding of customer segments, value propositions, and revenue streams.