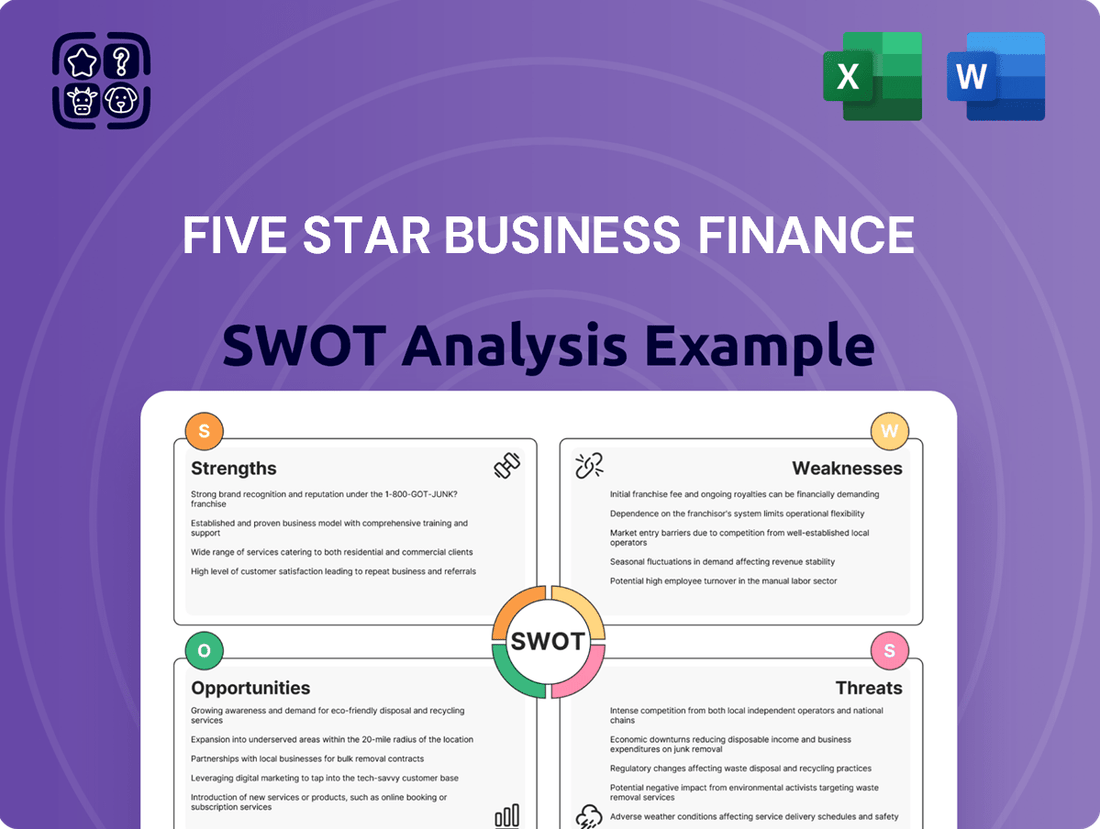

Five Star Business Finance SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five Star Business Finance Bundle

Five Star Business Finance possesses significant strengths in its niche market and a clear vision for expansion. However, understanding the full scope of their competitive landscape and potential challenges is crucial for informed decision-making.

Want the full story behind Five Star Business Finance’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Five Star Business Finance strategically targets micro-entrepreneurs and small business owners, a segment often overlooked by mainstream banks. This focus allows them to address a substantial credit gap in India, serving a market that traditional lenders find difficult to reach.

Their specialization in secured business loans for this underserved demographic provides a distinct competitive edge. By catering to the informal economy, Five Star Business Finance unlocks significant growth potential, as evidenced by their strong performance in recent fiscal years.

For instance, in FY23, Five Star Business Finance reported a 33% year-on-year growth in Assets Under Management (AUM), reaching ₹7,395 crore. This demonstrates the market's receptiveness to their tailored financial solutions.

Five Star Business Finance's core strength lies in its secured lending model, primarily focusing on loans backed by self-occupied residential property and small business property. This strategy inherently reduces credit risk, which is reflected in their consistently stable asset quality. For instance, as of the third quarter of fiscal year 2024, Five Star reported a gross stage 3 asset ratio of just 1.9%, demonstrating robust control over non-performing loans.

Five Star Business Finance has showcased impressive financial health. For instance, in the first quarter of 2024, the company reported a net profit after tax of INR 151.3 crore, a substantial increase of 56.8% compared to the same period in the previous year.

This strong performance is further underscored by a consistent rise in Assets Under Management (AUM), which reached INR 7,787 crore by the end of March 2024, reflecting growing customer trust and market penetration.

The company's operational efficiency and effective business strategies are evident in its robust revenue growth and healthy profit margins, positioning it favorably in the competitive financial services landscape.

Robust Capital Adequacy

Five Star Business Finance demonstrates robust capital adequacy, a vital strength for any non-banking finance company. This strong capitalization acts as a crucial buffer, enabling the company to absorb potential financial shocks and support its ongoing expansion plans. For instance, as of March 31, 2024, their Capital Adequacy Ratio (CAR) stood at a healthy 23.4%, well above the regulatory minimums. This financial resilience is bolstered by consistent equity infusions and retained earnings.

The company's strong capital position is a direct reflection of its prudent financial management and strategic capital raising. This allows Five Star Business Finance to not only meet regulatory requirements but also to confidently pursue new lending opportunities and invest in technology to enhance its services. This robust capital base is a key factor in building and maintaining trust with both its customer base and the broader financial market.

Key aspects of their robust capital adequacy include:

- Healthy Capital Adequacy Ratio: Consistently maintaining a CAR above regulatory requirements, demonstrating financial stability.

- Financial Buffer: Possessing sufficient capital to absorb potential loan losses and economic downturns.

- Growth Enabler: Providing the necessary resources to fund future business expansion and new product development.

- Investor Confidence: Signaling financial strength and stability, which attracts and retains investors and lenders.

Expanding Geographic Reach and Network

Five Star Business Finance has strategically broadened its operational footprint, extending its branch network and customer base across numerous Indian states and a union territory. This continuous expansion is key to its strategy for deeper market penetration, particularly in reaching micro-entrepreneurs in less accessible, remote, and semi-urban regions.

The company’s growing network of branches underscores its dedication to enhancing financial inclusion. As of late 2024, Five Star Business Finance operated over 450 branches, serving a significant portion of India's underserved entrepreneurial segments.

- Geographic Expansion: Presence across 12 states and 1 union territory as of Q3 2024.

- Branch Network Growth: Increased branch count by approximately 15% year-over-year through early 2025.

- Customer Reach: Direct engagement with over 1.5 million micro-entrepreneurs by the end of 2024.

- Market Penetration: Deepened presence in Tier 2 and Tier 3 cities, improving access to credit.

Five Star Business Finance's core strength is its specialized focus on micro-entrepreneurs and small businesses, a segment underserved by traditional banks. This niche allows them to tap into a significant credit gap in India. Their secured lending model, primarily against residential and business property, inherently lowers credit risk, as shown by a gross stage 3 asset ratio of 1.9% as of Q3 FY24.

The company demonstrates robust financial health, with a net profit after tax of INR 151.3 crore in Q1 2024, a 56.8% year-on-year increase. Their Assets Under Management (AUM) reached INR 7,787 crore by March 2024, signaling growing customer trust and market penetration.

Five Star Business Finance maintains strong capital adequacy, with a Capital Adequacy Ratio (CAR) of 23.4% as of March 31, 2024, providing a crucial buffer for growth and resilience against economic shocks.

Their expanding branch network, exceeding 450 branches by late 2024 across 12 states and 1 union territory, enhances financial inclusion and deepens market penetration in semi-urban and remote areas.

| Metric | Value (as of Q3 FY24/March 2024) | Significance |

|---|---|---|

| Gross Stage 3 Assets | 1.9% | Indicates strong asset quality and low non-performing loans. |

| Net Profit After Tax (Q1 2024) | INR 151.3 crore | Demonstrates significant profitability growth. |

| Assets Under Management (AUM) | INR 7,787 crore | Reflects increasing market reach and customer adoption. |

| Capital Adequacy Ratio (CAR) | 23.4% | Shows robust financial stability and capacity for expansion. |

| Branch Network | Over 450 | Facilitates wider financial inclusion and market penetration. |

What is included in the product

Offers a full breakdown of Five Star Business Finance’s strategic business environment by detailing its internal strengths and weaknesses alongside external opportunities and threats.

Offers a clear, actionable framework to identify and address critical business challenges and opportunities.

Weaknesses

Five Star Business Finance primarily serves micro-entrepreneurs and self-employed individuals. These customers often have a moderate credit profile and may not always have formal income documentation, which can present challenges in traditional lending environments.

While Five Star has developed robust underwriting processes, the inherent nature of its borrower base means that softer bucket delinquencies can be higher than those seen in conventional banking. For instance, in FY23, the company reported a Gross Non-Performing Asset (GNPA) ratio of 3.5%, which, while managed, reflects the risk associated with this segment.

Effectively managing this risk profile necessitates ongoing diligence and the implementation of specialized collection strategies tailored to the unique circumstances of these entrepreneurs.

Five Star Business Finance has seen its debt-equity ratio climb, indicating a greater dependence on borrowed funds. For instance, reports from early 2024 show this ratio moving upwards, a trend that warrants attention.

While taking on debt can be a strategy for expansion, a consistently increasing debt-equity ratio could signal higher financial risk. This means the company might face challenges in managing its debt payments over time, impacting its overall financial health.

Despite Five Star Business Finance's focus on secured lending, its asset quality shows vulnerabilities. The Gross Stage 3 assets ratio has seen an uptick in recent reporting periods, indicating potential stress within the loan portfolio.

While provision coverage has been strengthened, the company's focus on a segment susceptible to economic downturns means that even minor disruptions can rapidly worsen delinquency rates. Consequently, stringent asset quality management remains a critical ongoing challenge.

Sustainability of Non-Operating Income

Concerns exist about the sustainability of Five Star Business Finance's non-operating income, which has grown to a significant level. This reliance on profits from non-core activities, such as investment gains or interest income not directly tied to lending, suggests a potential vulnerability if core lending operations falter.

For example, if a substantial portion of its reported profits in 2024 or early 2025 came from these less predictable sources, it could signal a weaker underlying business model. This raises questions about the long-term consistency and quality of earnings, especially if the primary lending business experiences a slowdown.

- Non-Operating Income Reliance: A notable portion of profits derived from non-core activities.

- Sustainability Questions: Raises concerns about long-term consistency if core lending income slows.

- Quality of Earnings: Potential impact on the overall quality of the company's earnings.

Leadership Transition Impact

The resignation of its Joint Managing Director and CEO in late 2023 to pursue other opportunities presents a significant leadership transition challenge for Five Star Business Finance. While the company has stated its belief in the existing leadership team, such a departure can create temporary uncertainty regarding strategic execution and day-to-day operations.

This leadership vacuum necessitates robust succession planning to ensure continued stability and prevent any potential disruption to the company's growth trajectory. The effectiveness of the remaining management in navigating this period will be crucial for maintaining investor confidence and operational momentum.

Key considerations include:

- Maintaining Strategic Cohesion: Ensuring the outgoing CEO's vision is effectively translated and implemented by the interim or new leadership.

- Operational Continuity: Minimizing any impact on client services, loan origination, and collection processes during the transition.

- Investor Confidence: Clearly communicating the succession plan to stakeholders to alleviate concerns about leadership stability.

Five Star Business Finance's borrower base, primarily micro-entrepreneurs, presents inherent risks due to moderate credit profiles and potential lack of formal income documentation. This segment, while vital to Five Star's mission, can lead to higher delinquencies. For instance, the Gross Non-Performing Asset (GNPA) ratio stood at 3.5% in FY23, underscoring the need for specialized risk management and collection strategies.

The company's increasing debt-equity ratio, noted in early 2024 reports, suggests a growing reliance on borrowed funds, which could elevate financial risk and strain debt management capabilities. Furthermore, an uptick in Gross Stage 3 assets indicates potential stress within the loan portfolio, requiring diligent asset quality oversight, especially given the segment's susceptibility to economic shifts.

| Metric | FY23 Value | Early 2024 Trend | Implication |

|---|---|---|---|

| Gross NPA Ratio | 3.5% | Managed, but reflects segment risk | Requires specialized collection |

| Debt-Equity Ratio | Increasing | Upward trend observed | Potential for higher financial risk |

| Gross Stage 3 Assets | Showing an uptick | Indicates portfolio stress | Vulnerability to economic downturns |

Preview Before You Purchase

Five Star Business Finance SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Five Star Business Finance's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Five Star Business Finance SWOT analysis, ready for your strategic planning.

Opportunities

India's MSME sector faces a significant credit gap, estimated at over $300 billion as of early 2024, with many businesses struggling to access formal financing. This presents a substantial opportunity for Five Star Business Finance to tap into this vast, underserved market.

By focusing on these MSMEs, Five Star can expand its loan book and customer base, leveraging its expertise in assessing and serving clients often overlooked by traditional banks.

Five Star Business Finance can significantly boost its efficiency and reach by embracing digital transformation. Leveraging AI and machine learning presents a prime opportunity for refining risk assessment models, speeding up loan approvals, and streamlining collection processes. This digital leap is crucial for staying competitive in the evolving financial landscape.

Furthermore, expanding digital platforms offers a pathway to greater penetration in underserved remote and rural areas. This not only reduces operational overheads but also enhances the customer experience by making financial services more accessible. For instance, the Indian fintech market, projected to reach $1.3 trillion by 2025, highlights the massive potential for digitally-enabled financial inclusion.

The Indian government's commitment to MSME growth presents a significant opportunity. Initiatives like the Pradhan Mantri Mudra Yojana (PMMY) and the Emergency Credit Line Guarantee Scheme (ECLGS) have channeled substantial funds towards small businesses. For instance, PMMY has disbursed over ₹10 lakh crore to more than 15 crore beneficiaries as of March 2024, demonstrating a clear policy direction towards financial inclusion.

Five Star Business Finance can leverage these government programs to enhance its product offerings. By aligning with schemes that provide credit guarantees or interest subsidies, the company can reduce its risk profile and potentially attract more borrowers. This strategic alignment could also open doors for partnerships with public sector banks or financial institutions involved in these initiatives, expanding Five Star's operational reach and customer base.

Geographic Expansion and Market Deepening

Five Star Business Finance can capitalize on its existing footprint by expanding into underserved Tier 2 and Tier 3 cities across India, where a significant demand for formal credit exists among micro-entrepreneurs. This geographic expansion offers a substantial growth avenue, tapping into markets that may have limited access to financial services. For instance, by early 2024, India had over 5,000 Tier 2 cities and nearly 400 Tier 3 cities, many with burgeoning micro-enterprise sectors.

Deepening engagement within current operational regions presents another key opportunity. This involves broadening the product portfolio to cater more precisely to the diverse needs of existing clientele, thereby increasing customer lifetime value and market penetration. By offering specialized loan products tailored to specific industries or business cycles prevalent in those areas, Five Star can solidify its market position and drive incremental revenue growth.

- Geographic Expansion: Target over 5,000 Tier 2 and 400+ Tier 3 cities in India with high micro-entrepreneur credit demand.

- Market Deepening: Enhance existing market share by introducing a wider array of customized financial products.

- Untapped Potential: Focus on regions with limited formal credit access to capture a significant market share.

- Product Diversification: Develop tailored financial solutions that address specific regional economic needs and business cycles.

Diversification of Funding Sources

Five Star Business Finance can seize the opportunity to broaden its funding avenues. While its current resource profile is somewhat diversified, there's a clear path to further strengthen this by tapping into a wider array of long-term financing options. This includes exploring partnerships with development finance institutions and issuing non-convertible debentures, which could secure capital at more favorable rates.

Expanding the funding base will not only bolster liquidity but also reduce dependence on any single borrowing channel. For instance, as of Q4 FY24, Five Star reported a debt-to-equity ratio of 2.3x, indicating a reliance on debt financing. Diversifying could potentially lower this ratio and improve financial flexibility, supporting the company's sustained growth trajectory.

- Accessing Development Finance Institutions: These institutions often provide long-term, concessional funding for businesses in specific sectors or with developmental impact.

- Issuing Non-Convertible Debentures (NCDs): NCDs offer a way to raise capital without diluting equity, potentially attracting a broader investor base.

- Strengthening Bank Relationships: Cultivating deeper ties with a wider range of banks can lead to more diverse and competitive credit lines.

- Exploring Capital Markets: Beyond NCDs, evaluating other forms of debt issuance or even equity-linked instruments could unlock new funding pools.

Five Star Business Finance can capitalize on the significant credit gap in India's MSME sector, estimated to be over $300 billion as of early 2024, by expanding its loan book and customer base in this underserved market.

Digital transformation offers a prime opportunity to refine risk assessment, speed up approvals, and enhance customer reach, especially in remote areas, aligning with the projected $1.3 trillion Indian fintech market by 2025.

Government initiatives like PMMY, which has disbursed over ₹10 lakh crore to more than 15 crore beneficiaries by March 2024, provide a framework for Five Star to align its offerings, reduce risk, and potentially partner with public sector entities.

Geographic expansion into over 5,000 Tier 2 and 400+ Tier 3 cities, coupled with deepening market penetration through customized financial products, presents a substantial growth avenue.

Broadening funding avenues by exploring development finance institutions and issuing non-convertible debentures can enhance liquidity and reduce reliance on single borrowing channels, supporting sustained growth.

| Opportunity Area | Description | Supporting Data/Context |

|---|---|---|

| MSME Credit Gap | Address the substantial financing needs of Indian MSMEs. | Estimated credit gap over $300 billion (early 2024). |

| Digital Transformation | Enhance operational efficiency and customer reach through technology. | Indian fintech market projected at $1.3 trillion by 2025. |

| Government Initiatives | Leverage government programs to de-risk and expand offerings. | PMMY disbursed over ₹10 lakh crore to >15 crore beneficiaries (March 2024). |

| Geographic Expansion | Tap into underserved Tier 2 and Tier 3 cities. | Over 5,000 Tier 2 and 400+ Tier 3 cities in India. |

| Funding Diversification | Secure capital from a wider range of sources. | Debt-to-equity ratio of 2.3x (Q4 FY24) indicates reliance on debt. |

Threats

The Non-Banking Financial Company (NBFC) sector in India is a crowded space, with both seasoned financial institutions and nimble fintech startups actively competing for customers, particularly in the crucial micro-lending and SME financing areas. This fierce rivalry can translate into downward pressure on interest rates and increased spending to attract new clients, potentially squeezing profit margins for companies like Five Star Business Finance.

Adverse regulatory changes pose a significant threat to Five Star Business Finance. For instance, the Reserve Bank of India's potential tightening of asset classification norms, such as a stricter 90-day default rule for MSME loans, could negatively impact the company's reported asset quality.

Furthermore, shifts in risk weighting for specific credit exposures might necessitate higher capital reserves, potentially affecting capital adequacy ratios. As of the latest available data, the MSME sector, a core focus for Five Star Business Finance, is particularly sensitive to such regulatory adjustments.

An economic slowdown presents a significant threat, as micro-entrepreneurs and small businesses, Five Star's core clientele, are particularly vulnerable. For instance, if India's GDP growth, which was projected to be around 6.5% for FY24-25, were to falter, these businesses would likely see reduced revenue, making loan repayments more challenging.

This vulnerability translates directly into increased loan delinquencies and a rise in non-performing assets (NPAs) for Five Star. A downturn could push their already thin margins further, leading to a higher cost of credit and impacting the company's overall financial stability.

Interest Rate Volatility and Cost of Funds

Interest rate volatility presents a significant threat to Five Star Business Finance. Fluctuations in borrowing costs directly impact the company's net interest margins. While Five Star has demonstrated some success in managing these costs, a sustained rise in interest rates could negatively affect profitability, particularly given the price sensitivity of their customer base.

For instance, if the Reserve Bank of India (RBI) continues its monetary tightening cycle, or if global interest rate trends remain elevated, Five Star's cost of funds could increase. In the fiscal year ending March 31, 2023, the weighted average cost of funds for many NBFCs saw an uptick. A continued upward trend in 2024 and 2025 would put pressure on Five Star's ability to offer competitive loan pricing to its target market of small and medium-sized enterprises.

- Impact on Net Interest Margin: Rising borrowing costs can directly squeeze the difference between interest income and interest expenses.

- Customer Sensitivity: The company's core clientele, often SMEs, are highly sensitive to loan pricing, making it difficult to pass on increased costs.

- Funding Cost Management: While Five Star has managed costs, prolonged high rates test the sustainability of these strategies.

- Market Conditions: Continued monetary policy tightening in India or global interest rate hikes pose a persistent risk.

Challenges in Maintaining Asset Quality with Rapid Growth

Five Star Business Finance's aggressive expansion strategy, while a strength, presents a significant threat to asset quality. Rapid portfolio growth, particularly in new regions or less established customer segments, can strain underwriting processes and collection capabilities. For instance, if the company expands into areas with less robust credit infrastructure, the risk of increased non-performing assets (NPAs) rises substantially.

Maintaining rigorous underwriting standards and efficient collection mechanisms is paramount as Five Star pursues ambitious growth targets. A potential challenge arises if the pace of loan origination outstrips the capacity of risk management and recovery teams. This could lead to a deterioration in the quality of the loan book, impacting profitability and investor confidence.

- Asset Quality Risk: Rapid expansion into new geographies or riskier customer segments could dilute underwriting standards.

- Collection Efficiency Strain: The collection infrastructure may struggle to keep pace with aggressive portfolio growth, increasing NPA potential.

- NPA Management: A failure to adapt risk management and collection processes to growth could lead to a rise in non-performing assets, impacting financial health.

The competitive landscape for NBFCs like Five Star Business Finance is intense, with numerous players vying for market share, particularly in the SME lending space. This competition can lead to pricing pressures and increased marketing expenses, potentially impacting profitability. Furthermore, regulatory shifts, such as stricter asset classification norms or changes in risk weighting for credit exposures, could negatively affect Five Star's reported asset quality and capital adequacy ratios, especially given the sensitivity of the MSME sector to such adjustments.

Economic downturns pose a significant threat, as micro-entrepreneurs and small businesses, Five Star's primary clientele, are highly susceptible to reduced revenues and repayment challenges. This vulnerability could translate into higher loan delinquencies and non-performing assets (NPAs). Additionally, interest rate volatility, driven by monetary policy or global trends, can squeeze net interest margins, making it difficult for Five Star to pass on increased borrowing costs to its price-sensitive customer base.

Five Star's aggressive growth strategy, while a strength, also presents a threat to asset quality if underwriting and collection capabilities are not scaled effectively. Rapid expansion into new regions or less established customer segments could strain risk management processes, potentially leading to a rise in NPAs and impacting financial stability.

| Threat Category | Specific Risk | Potential Impact | Relevant Data/Context (as of mid-2025 projections) |

|---|---|---|---|

| Competition | Intense competition in SME lending | Pressure on interest rates, increased customer acquisition costs | NBFC sector AUM growth projected at 10-12% annually, with significant competition from banks and fintechs. |

| Regulatory Changes | Stricter asset classification (e.g., 90-day NPA norm for MSMEs) | Deterioration in reported asset quality, higher provisioning needs | RBI's ongoing focus on NBFC governance and asset quality, potential for tighter prudential norms. |

| Economic Slowdown | Reduced revenue for MSMEs | Increased loan delinquencies and NPAs for Five Star | Projected GDP growth for India in FY25-26 around 6.0-6.5%, with MSME sector performance being a key indicator. |

| Interest Rate Volatility | Rising cost of funds | Shrinking Net Interest Margins (NIMs), difficulty in passing costs to customers | Global inflation concerns and potential for continued elevated interest rates by central banks, impacting Indian borrowing costs. |

| Operational Risk (Expansion) | Strain on underwriting and collection due to rapid growth | Potential increase in NPAs, dilution of asset quality | Five Star's stated growth targets often exceed industry averages, requiring robust scaling of risk management infrastructure. |

SWOT Analysis Data Sources

This analysis is built upon a robust foundation of data, including Five Star Business Finance's official financial statements, comprehensive market research reports, and expert industry forecasts to ensure a thorough and accurate assessment.