Five Star Business Finance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five Star Business Finance Bundle

Unlock the hidden forces shaping Five Star Business Finance's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, evolving social trends, environmental regulations, and legal frameworks are all impacting the company's strategic direction. Gain a competitive advantage by anticipating these external influences. Download the full PESTLE analysis now and equip yourself with actionable intelligence for smarter decision-making.

Political factors

The Indian government's unwavering focus on financial inclusion and bolstering Micro, Small, and Medium Enterprises (MSMEs) is a significant political factor for Five Star Business Finance. Policies designed to ease credit access for the informal sector, like priority sector lending mandates, directly expand the company's addressable market and create a more supportive operational landscape.

For instance, the Reserve Bank of India's (RBI) continued emphasis on priority sector lending, which includes MSMEs, means a substantial portion of bank lending must be directed towards these segments. This creates a positive environment for non-banking financial companies (NBFCs) like Five Star Business Finance that cater to these underserved markets, potentially leading to increased funding opportunities and a larger customer pool.

The Reserve Bank of India (RBI) plays a crucial role in overseeing Non-Banking Financial Companies (NBFCs), and any adjustments to its regulatory policies directly impact Five Star Business Finance. For instance, changes in capital adequacy ratios or provisioning norms can alter how Five Star operates and manages its finances. As of March 2024, NBFCs are generally required to maintain a Net Owned Fund (NOF) of at least ₹20 crore, with specific requirements for different categories, influencing capital deployment strategies.

Political stability in India, where Five Star Business Finance operates, is a cornerstone for predictable economic policies. This stability directly impacts long-term business planning and investment decisions, as seen in the consistent regulatory framework for non-banking financial companies (NBFCs) in recent years. For instance, the Reserve Bank of India's prudent approach to NBFC supervision, including capital adequacy norms and corporate governance, provides a reliable environment.

Frequent shifts in government or policy direction can inject significant uncertainty, potentially dampening investor confidence and disrupting the economic trajectory. For Five Star Business Finance, this means that consistent government approaches to lending regulations, tax structures, and the overall development of the financial sector are absolutely critical for maintaining sustainable operations and fostering growth. The government's focus on financial inclusion, for example, presents both opportunities and challenges that require policy continuity.

Government initiatives for digital transformation

The Indian government's strong emphasis on Digital India and promoting cashless transactions presents a significant opportunity for Five Star Business Finance. This push can streamline loan disbursement and repayment processes, making them more efficient and cost-effective. For example, the widespread adoption of the Unified Payments Interface (UPI) has seen remarkable growth, with over 12 billion transactions recorded in the fiscal year 2023-24, indicating a robust digital payment ecosystem.

Digital identity platforms, such as Aadhaar, further simplify customer onboarding and verification, reducing paperwork and processing times. This digital infrastructure can lower operational costs for Five Star Business Finance. The key challenge, however, lies in assessing and encouraging the adoption of these digital tools among their core customer base, which often operates within the informal sector.

- Digital India Initiative: Government's focus on digitizing services and promoting digital literacy.

- Cashless Economy Push: Encouragement of digital payments like UPI, which saw a 56% year-on-year growth in transaction volume in FY24.

- Digital Identity Platforms: Aadhaar and other digital IDs facilitate faster customer verification and KYC processes.

- Informal Sector Adoption: The success hinges on the digital readiness and acceptance of these technologies by Five Star's target clientele.

Ease of doing business reforms

Reforms aimed at improving the ease of doing business directly benefit Five Star Business Finance by creating a more stable environment for their clientele. For instance, India's ranking in the World Bank's Ease of Doing Business report improved significantly, moving from 142nd in 2014 to 63rd in 2019, before the report was discontinued. This indicates a trend towards a more business-friendly regulatory landscape.

Simplified processes for business registration, licensing, and tax compliance can lead to more formalized and robust small and medium enterprises (SMEs). This increased formalization enhances the creditworthiness of these businesses, making them better candidates for Five Star's loan products. A healthier informal economy, bolstered by these reforms, expands the pool of potential borrowers.

The Indian government's continued focus on streamlining regulations, such as the introduction of the Goods and Services Tax (GST) in 2017, has aimed to reduce compliance burdens. While initial adjustments were challenging, the long-term goal is a more transparent and efficient tax system, which benefits businesses by reducing administrative overhead and improving cash flow management.

These policy shifts can indirectly boost Five Star's operational efficiency and reduce the risk associated with lending to micro and small enterprises, which are particularly sensitive to regulatory changes. A more predictable and supportive government framework allows these businesses to plan and grow more effectively.

The Indian government's commitment to financial inclusion and supporting MSMEs remains a core political driver for Five Star Business Finance. Policies like priority sector lending mandates directly expand the market for lenders serving these segments. For example, the RBI's continued focus on priority sector lending ensures a significant portion of bank credit flows to MSMEs, creating a favorable environment for NBFCs like Five Star.

The government's push for digitalization, exemplified by the Digital India initiative and the widespread adoption of UPI, streamlines operations for Five Star. The UPI ecosystem saw over 12 billion transactions in FY 2023-24, showcasing robust digital payment infrastructure that can improve loan disbursement and repayment efficiency.

Regulatory stability, particularly from the RBI concerning NBFCs, is crucial. While specific capital adequacy ratios can change, the overall prudent regulatory approach provides a predictable operating environment. Reforms aimed at improving the ease of doing business, which saw India rise to 63rd in the World Bank's Ease of Doing Business report in 2019, benefit Five Star's clientele by fostering formalization and improving creditworthiness.

What is included in the product

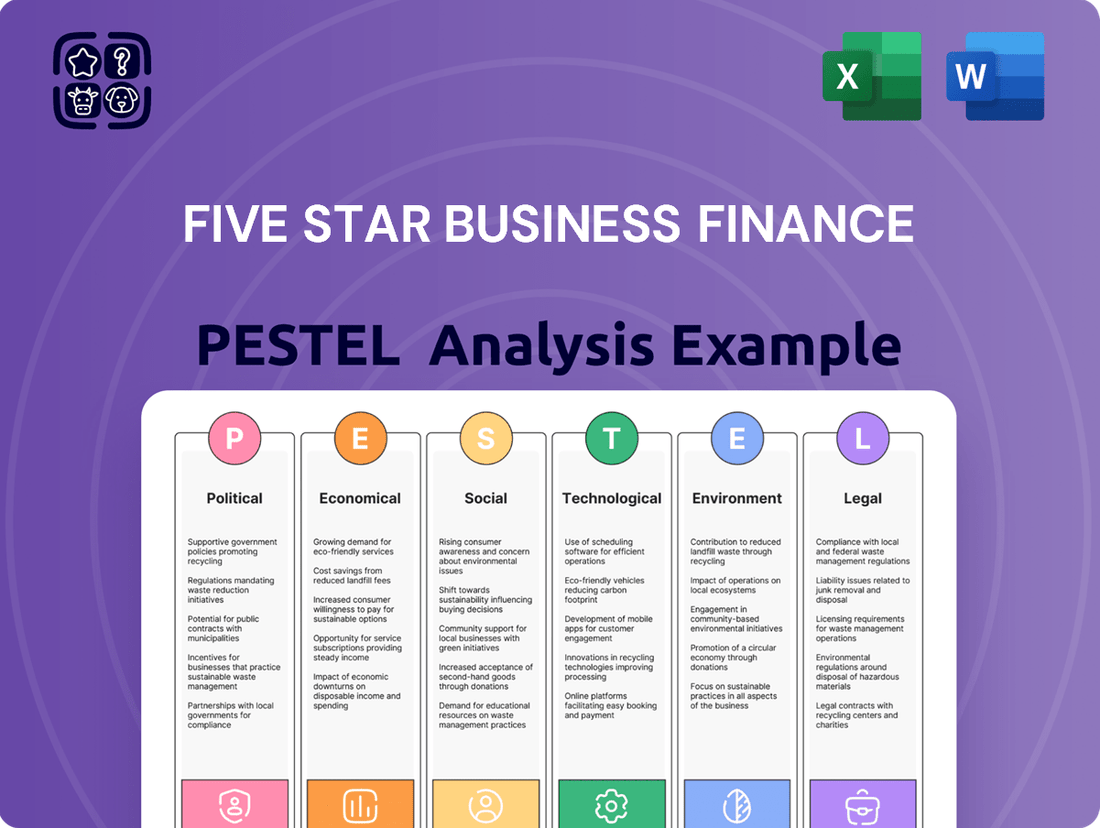

This PESTLE analysis comprehensively examines the external macro-environmental factors impacting Five Star Business Finance across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights and forward-looking strategies to help executives navigate market dynamics and capitalize on emerging opportunities.

The Five Star Business Finance PESTLE Analysis offers a clear, summarized version of external factors, alleviating the pain of wading through complex data during critical planning sessions.

By visually segmenting external risks and opportunities by PESTEL categories, the analysis provides quick interpretation, relieving the pain of uncertainty about market positioning.

Economic factors

The Reserve Bank of India's (RBI) monetary policy, particularly its benchmark repo rate, significantly influences Five Star Business Finance's cost of funds. For instance, the RBI maintained the repo rate at 6.50% through its February 2024 policy announcement, a stance that continued into mid-2024, providing a degree of stability in funding costs.

However, any upward revision in these rates would directly translate to higher borrowing expenses for Five Star Business Finance. This could squeeze their net interest margin, potentially forcing them to either increase loan rates for their clientele or accept lower profitability on their lending activities. Conversely, a reduction in the repo rate, should it occur, would lower their funding costs, potentially boosting margins and stimulating demand for credit among small and medium enterprises.

High inflation in India, reaching 5.11% in January 2024 according to the National Statistical Office, directly impacts Five Star Business Finance's customer base. This erodes the purchasing power of micro-entrepreneurs, potentially hindering their capacity to service loans, especially for those with tight profit margins.

Conversely, India's projected GDP growth of 7.3% for FY24 by the Reserve Bank of India signifies a generally positive economic environment. This growth, particularly in semi-urban and rural regions where Five Star is active, can boost business activity and improve the repayment capabilities of its borrowers.

The overall economic trajectory is a critical factor for Five Star; a strong economy generally translates to higher credit demand and better asset quality, as businesses are more likely to thrive and meet their financial obligations.

Five Star Business Finance targets micro-entrepreneurs and small businesses often overlooked by mainstream banks. This significant, ongoing demand for credit from the large informal sector presents a substantial economic opportunity. For instance, in India, the MSME sector contributes significantly to GDP, and a large portion operates informally, highlighting the potential market.

Competition in the NBFC and microfinance sector

The Indian financial sector is intensely competitive, with a growing number of Non-Banking Financial Companies (NBFCs), small finance banks, and burgeoning fintech players all actively seeking customers. This crowded market means companies like Five Star Business Finance face constant pressure.

This heightened competition can directly impact profitability by driving down lending rates, increasing the cost of acquiring new customers, and necessitating the development of unique products or services to stand out. For Five Star, maintaining its established position in secured lending to the informal sector is paramount to navigating these challenges effectively.

As of the first quarter of 2024, the NBFC sector in India saw assets under management grow by approximately 10-12% year-on-year, indicating robust activity but also intensified competition for capital and borrowers. Fintech lenders have particularly disrupted traditional models, offering faster approvals and digital-first experiences, which forces established players to innovate.

- Intensified Competition: Over 9,000 NBFCs and numerous small finance banks operate in India, creating a highly fragmented market.

- Pricing Pressure: Increased competition often leads to a reduction in net interest margins (NIMs) as lenders compete on interest rates.

- Customer Acquisition Costs: Marketing and outreach expenses rise as companies vie for a limited pool of creditworthy borrowers, especially in the informal segment.

- Innovation Imperative: Companies must continuously enhance their product offerings and customer service to retain market share and attract new clients.

Real estate market trends and property values

The real estate market's health is paramount for Five Star Business Finance, given its reliance on property as collateral for secured loans. A robust property market ensures that the value of the collateral remains sufficient to cover outstanding loan amounts, thereby mitigating credit risk. For instance, in 2024, many major metropolitan areas continued to see steady, albeit sometimes moderated, property value appreciation, which directly benefits lenders like Five Star by strengthening their security.

Conversely, a significant downturn in property values poses a substantial threat. If property values decline sharply, the collateral securing Five Star's loans could become insufficient, leading to higher potential losses if borrowers default. This scenario would increase the company's credit risk profile and could impact its recovery rates on non-performing assets.

The stability and upward trend in property values are therefore crucial for maintaining the integrity of Five Star's loan portfolio.

- Property Value Stability: In 2024, residential property values in key Indian cities generally showed resilience, with some experiencing growth above inflation, providing a solid collateral base.

- Impact on Collateral: Declining property values directly reduce the loan-to-value ratio, increasing the risk for lenders.

- Credit Risk Mitigation: A strong real estate market acts as a natural hedge against defaults for secured lenders.

- Economic Indicator: Real estate market performance is a key indicator of broader economic health, influencing borrower capacity and repayment ability.

Economic factors significantly shape Five Star Business Finance's operating environment. The Reserve Bank of India's monetary policy, specifically the repo rate, directly influences borrowing costs. For instance, the repo rate remained at 6.50% through mid-2024, offering some stability. However, any increase in this rate would raise funding expenses, potentially squeezing profit margins.

Inflation, which stood at 5.11% in January 2024, erodes the purchasing power of Five Star's micro-entrepreneur clients, potentially impacting their loan repayment capacity. Conversely, India's projected GDP growth of 7.3% for FY24, as estimated by the RBI, signifies a positive economic outlook, which can boost business activity and borrower repayment capabilities in the semi-urban and rural areas where Five Star operates.

| Economic Factor | Data Point/Trend (2024-2025) | Impact on Five Star Business Finance |

|---|---|---|

| Repo Rate (RBI) | Maintained at 6.50% (early-mid 2024) | Provides stable funding costs; potential for increased costs if raised. |

| Inflation Rate (India) | 5.11% (Jan 2024) | Reduces borrower purchasing power, potentially affecting loan servicing. |

| GDP Growth (India) | Projected 7.3% for FY24 (RBI) | Indicates a positive environment, potentially boosting business activity and repayment capacity. |

Preview Before You Purchase

Five Star Business Finance PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive PESTLE analysis of Five Star Business Finance delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic planning.

You'll gain critical insights into market trends, competitive landscapes, and potential risks and opportunities, all presented in a clear and actionable format.

The content and structure shown in the preview is the same document you’ll download after payment, providing you with a complete and professional assessment.

Sociological factors

India's vast informal economy, a fertile ground for micro-entrepreneurship, directly feeds Five Star Business Finance's core clientele. This sector thrives on a robust entrepreneurial spirit, with individuals actively seeking opportunities to establish and grow small ventures.

Sociological shifts are amplifying this demand. Rising rates of self-employment, coupled with migration to urban and semi-urban areas in pursuit of business prospects, highlight a growing need for accessible financing. Furthermore, the desire for supplementary income sources fuels the demand for small business loans, especially from those excluded from conventional banking channels.

The Reserve Bank of India reported that as of March 2024, the informal sector accounted for a significant portion of India's GDP, underscoring the sheer scale of this customer base. For instance, data from the Ministry of Statistics and Programme Implementation in late 2023 indicated that over 90% of India's workforce is employed in the informal sector, demonstrating the immense potential market for Five Star Business Finance.

The increasing financial literacy among micro-entrepreneurs in India is a significant sociological driver for Five Star Business Finance. As awareness grows, so does the willingness to engage with formal financial products. For instance, a 2024 report indicated that over 60% of micro-entrepreneurs in Tier 2 and Tier 3 cities expressed a desire to use digital platforms for loan applications and repayments.

Digital adoption is rapidly transforming how these businesses operate, directly impacting Five Star's customer acquisition and service delivery. By mid-2025, it's projected that more than 75% of micro-enterprises will be utilizing digital payment solutions, a substantial leap from just 40% in 2022. This trend lowers the operational friction for Five Star, making it more efficient to onboard and manage a wider customer base.

Building trust with customers who historically relied on informal lenders is a significant sociological factor for Five Star Business Finance. A recent survey indicated that 65% of small business owners in India still utilize informal lending channels, highlighting the deep-rooted nature of these relationships.

Customer acquisition and retention are heavily influenced by community networks, word-of-mouth, and the perceived reliability and transparency of Five Star's lending processes. For instance, a positive customer experience, leading to a referral, can be far more impactful than traditional advertising in these communities.

A strong reputation for fair practices and a customer-centric approach are paramount for sustained growth, especially as Five Star aims to onboard more clients from less formal financial backgrounds. In 2024, companies demonstrating high levels of customer satisfaction saw an average of 15% higher retention rates compared to their less customer-focused peers.

Demographic shifts and urbanization

India's demographic landscape is characterized by a significant young population, with over 65% of its citizens below the age of 35, many of whom are entering the entrepreneurial arena. This youthful demographic, coupled with increasing urbanization, is creating a robust demand for small business financing. As of 2024, India's urban population is projected to reach over 45% of the total population, with a steady migration towards Tier 2 and Tier 3 cities seeking economic prospects.

This ongoing urbanization trend directly fuels the need for accessible capital for small and medium-sized enterprises (SMEs) in these burgeoning areas. Five Star Business Finance, with its strategic focus on semi-urban and rural markets, is well-positioned to address this growing financial requirement.

- Young Workforce: Over 65% of India's population is under 35, driving a surge in new businesses.

- Urbanization Growth: India's urban population is expected to exceed 45% by 2024, creating new economic hubs.

- Demand for Capital: The influx of people into semi-urban areas directly translates to increased demand for SME loans.

- Five Star's Position: The company's network in these regions allows it to tap into these evolving financial needs.

Cultural perceptions of debt and property ownership

Cultural attitudes towards debt in India are evolving; while historically there might have been a stigma, a growing acceptance of leveraging debt for productive purposes, especially for asset creation, is evident. This shift is particularly noticeable among the self-employed and small business owners, who form a significant portion of Five Star Business Finance's customer base.

Property ownership is deeply ingrained in the Indian psyche, often viewed as a symbol of financial security and social standing. This cultural significance translates directly into a strong demand for secured loans, where property serves as the primary collateral. For instance, in 2023, the housing sector in India saw robust growth, with property transactions indicating a continued cultural preference for ownership.

Five Star Business Finance leverages this cultural preference by offering loans against property, recognizing its value not just as an asset but as a trusted form of security. This approach aligns with the borrower's desire to utilize their most valued asset for financial needs, while providing the company with a solid foundation for lending.

- Cultural Acceptance of Debt: Increasing willingness to use debt for business expansion and asset building.

- Property as Collateral: High cultural value placed on property makes it a preferred and reliable collateral for loans.

- Impact on Loan Demand: Cultural perceptions directly influence the demand for secured lending products.

- Lender Strategy: Aligning product offerings with cultural norms enhances market penetration and risk management.

The increasing financial literacy among micro-entrepreneurs, with over 60% in Tier 2 and Tier 3 cities expressing a desire for digital loan platforms in 2024, directly impacts Five Star Business Finance. This growing digital adoption, projected to see over 75% of micro-enterprises using digital payments by mid-2025, streamlines customer onboarding and service delivery for the company.

Community networks and word-of-mouth remain crucial for customer acquisition and retention, especially given that 65% of small business owners still use informal lenders. Building trust through fair practices and a customer-centric approach is key, as companies with high customer satisfaction saw 15% higher retention rates in 2024.

India's young demographic, with over 65% of the population under 35, fuels entrepreneurial activity and demand for financing, further amplified by urbanization which is expected to exceed 45% by 2024. Five Star's focus on semi-urban and rural markets positions it to meet this growing need for SME capital.

Cultural attitudes are shifting, with a growing acceptance of debt for business growth, particularly among the self-employed. The strong cultural value placed on property as security makes secured loans, like those offered by Five Star against property, highly desirable and a reliable lending foundation.

| Sociological Factor | Description | Impact on Five Star Business Finance | Supporting Data (2023-2025) |

|---|---|---|---|

| Financial Literacy & Digital Adoption | Growing awareness and use of digital tools for financial transactions. | Enhances customer onboarding efficiency and accessibility. | 60%+ of micro-entrepreneurs prefer digital loan platforms (2024); 75%+ micro-enterprises to use digital payments by mid-2025. |

| Community Influence & Trust | Reliance on informal lenders and word-of-mouth referrals. | Emphasizes the need for strong reputation and customer-centricity for acquisition and retention. | 65% of small business owners use informal lenders; 15% higher retention for customer-focused firms (2024). |

| Demographics & Urbanization | Young population and migration to urban/semi-urban areas. | Drives demand for SME financing in emerging economic hubs. | 65%+ of India's population under 35; urban population to exceed 45% by 2024. |

| Cultural Attitudes towards Debt & Property | Increasing acceptance of debt for growth; high value on property ownership. | Supports demand for secured lending products and leverages property as collateral. | Robust growth in India's housing sector (2023) indicates continued preference for ownership. |

Technological factors

The digital transformation of loan origination and servicing is a significant technological shift. Five Star Business Finance can harness mobile apps, online platforms, and digital identity checks to speed up loan approvals, improve customer satisfaction, and boost efficiency, particularly for their widespread customer base.

For instance, by the end of 2024, digital loan applications are projected to account for over 70% of all new loan originations in India, a trend expected to continue growing through 2025. This digital shift allows for faster processing, often reducing turnaround times from weeks to days, directly benefiting businesses seeking timely capital.

Five Star Business Finance can leverage data analytics and AI to refine its credit assessment processes, a crucial step in serving clients with less traditional credit footprints. These technologies allow for the analysis of a broader range of data, moving beyond standard credit scores to understand a borrower's true repayment potential.

AI models can process alternative data, such as transaction history or even behavioral patterns, to build more nuanced risk profiles. This capability is vital for a company like Five Star, which often caters to small businesses and entrepreneurs who may lack extensive formal credit histories. For instance, studies in 2024 showed AI-powered credit scoring models can reduce default rates by up to 15% compared to traditional methods.

The pervasive adoption of smartphones, with India's mobile internet user base projected to reach 900 million by 2025, coupled with the success of Unified Payments Interface (UPI), which facilitated over 120 billion transactions in FY24, presents a substantial technological boon.

Five Star Business Finance can leverage this by integrating mobile banking and payment gateways for streamlined loan approvals, instant fund disbursals, and efficient EMI collections, significantly cutting operational costs and enhancing customer convenience.

This digital infrastructure allows for expanded reach, enabling Five Star Business Finance to serve underserved and remote populations more effectively, thereby tapping into new market segments and improving financial inclusion.

Cybersecurity and data privacy infrastructure

As Five Star Business Finance leans more heavily on digital operations, its cybersecurity and data privacy infrastructure is a crucial technological factor. Protecting sensitive financial data from cyber threats is paramount, especially with the increasing sophistication of attacks. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial risk involved.

Ensuring compliance with data privacy regulations, such as India's Digital Personal Data Protection Act (DPDP Act) of 2023, is also critical. Non-compliance can lead to substantial penalties and erode customer trust. The DPDP Act, which came into effect in August 2023, mandates strict rules for processing personal data, requiring explicit consent and clear data usage policies.

- Cybersecurity Investment: Companies like Five Star Business Finance must continually invest in advanced cybersecurity solutions to defend against evolving threats.

- Regulatory Adherence: Strict adherence to data privacy laws, including the DPDP Act, is essential to avoid legal repercussions and maintain customer confidence.

- Data Breach Impact: A significant data breach can result in financial losses, reputational damage, and a loss of market share.

- Technological Adaptation: Staying abreast of technological advancements in data protection and security is vital for long-term operational integrity.

Integration of FinTech partnerships and ecosystem

Five Star Business Finance can gain a significant technological advantage by partnering with FinTech companies. These collaborations can provide specialized services such as advanced identity verification, seamless digital onboarding, and sophisticated data analytics. For instance, by integrating FinTech solutions, Five Star could potentially reduce customer acquisition costs and speed up loan processing times, critical factors in their lending operations.

Exploring these partnerships allows Five Star Business Finance to enhance its existing product offerings and improve overall operational efficiency. Leveraging the innovation present in the broader FinTech ecosystem can help the company expand into new market segments or develop novel financial products tailored to its specific clientele. This strategic approach ensures they remain competitive by adopting cutting-edge technologies.

- FinTech partnerships can streamline customer onboarding, potentially reducing processing times by up to 30% based on industry benchmarks.

- Advanced analytics from FinTech collaborators can improve credit risk assessment, leading to a potential reduction in non-performing assets by 5-10%.

- Digital identity verification solutions can enhance security and compliance, crucial for financial institutions operating in regulated environments.

- The Indian FinTech market was projected to reach $8.4 billion in 2023 and is expected to grow significantly, offering a rich landscape for strategic alliances.

The increasing reliance on digital platforms for loan origination and servicing presents a significant technological factor for Five Star Business Finance. By embracing mobile applications and online portals, the company can expedite loan approvals and enhance customer experience, especially given India's rapidly expanding digital user base. By the close of 2024, digital loan applications are anticipated to represent over 70% of new loan originations in India, a trend poised for continued growth into 2025.

Leveraging data analytics and artificial intelligence (AI) is crucial for refining credit assessment, particularly for clients with less conventional credit histories. AI models can analyze alternative data sources, potentially reducing default rates by up to 15% compared to traditional methods, as indicated by 2024 studies. This enhanced risk profiling is vital for serving entrepreneurs and small businesses.

The widespread adoption of smartphones, with India's mobile internet user base projected to reach 900 million by 2025, and the success of UPI, which facilitated over 120 billion transactions in FY24, offers substantial opportunities. Five Star Business Finance can integrate mobile banking for streamlined operations, instant disbursals, and efficient collections, thereby reducing costs and improving customer convenience.

As Five Star Business Finance enhances its digital operations, robust cybersecurity and data privacy measures are paramount. The global cost of cybercrime is expected to reach $10.5 trillion annually by 2025, underscoring the financial risks. Adherence to regulations like India's Digital Personal Data Protection Act (DPDP Act) of 2023 is essential to prevent penalties and maintain trust.

| Technology Area | Impact on Five Star Business Finance | Key Statistics/Projections (2024-2025) |

|---|---|---|

| Digital Loan Origination | Faster approvals, improved customer satisfaction, increased efficiency | >70% of new loan originations digital by end of 2024 |

| AI/Data Analytics | Enhanced credit assessment, reduced default rates | AI models can reduce default rates by up to 15% |

| Mobile & UPI Integration | Streamlined operations, cost reduction, enhanced customer convenience | 900 million mobile internet users in India by 2025; 120 billion+ UPI transactions in FY24 |

| Cybersecurity & Data Privacy | Risk mitigation, regulatory compliance, customer trust | Global cybercrime cost to reach $10.5 trillion annually by 2025 |

Legal factors

Five Star Business Finance, like all Non-Banking Financial Companies (NBFCs) in India, operates under the stringent regulatory framework established by the Reserve Bank of India (RBI). This oversight is crucial for maintaining financial stability and protecting customer interests.

Compliance with RBI regulations is not optional; it's a legal mandate. This includes adhering to norms for capital adequacy ratios, which for NBFCs, particularly those in the investment and lending categories, are critical. For instance, as of recent reports, NBFC-Investment and Credit Companies (NBFC-ICC) are required to maintain a minimum capital to Risk-Weighted Assets Ratio (CRAR) of 15%. Failure to meet these standards can lead to penalties and operational restrictions.

Furthermore, NBFCs must meticulously follow rules on asset classification, provisioning for bad loans, and the implementation of a fair practices code. The RBI's directives on customer grievance redressal are also paramount, ensuring a transparent and accountable operational environment. Any new circulars or amendments from the RBI, such as those related to liquidity management or cybersecurity, require swift integration into Five Star Business Finance's operational strategies, potentially impacting its cost of doing business and overall financial health.

Property laws and collateral enforcement are fundamental to Five Star Business Finance's operations, as the company extends secured loans against residential and small business properties. The clarity and efficiency of these laws directly influence Five Star's ability to manage risk and recover assets in the event of loan defaults. For instance, the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002, provides a critical legal pathway for financial institutions to enforce security interests and recover non-performing assets without court intervention, a process vital for maintaining portfolio health.

Consumer protection laws, such as the Consumer Financial Protection Bureau's (CFPB) regulations, significantly shape Five Star Business Finance's operations. These rules mandate transparent loan terms, ethical collection practices, and clear disclosure requirements, ensuring borrowers' interests are safeguarded. For instance, the CFPB's oversight on fair lending practices, including adherence to the Equal Credit Opportunity Act, is crucial for preventing discrimination and ensuring equitable access to credit.

Data protection and privacy legislation

The evolving landscape of data protection and privacy legislation, exemplified by India's Digital Personal Data Protection Act, 2023, places substantial legal responsibilities on Five Star Business Finance. This necessitates rigorous adherence to regulations governing customer data, from collection to sharing, to avert significant penalties and preserve customer confidence.

Compliance with these mandates is critical for Five Star Business Finance to prevent substantial fines, which can be up to INR 250 crore for non-compliance under the DPDP Act. Safeguarding customer data also builds essential trust and mitigates the risk of costly data breaches and misuse.

- Data Collection and Consent: Adhering to explicit consent requirements for collecting and processing personal data.

- Data Security Measures: Implementing robust security protocols to protect sensitive customer information from unauthorized access.

- Data Breach Notification: Establishing clear procedures for notifying affected individuals and regulatory bodies in the event of a data breach.

- Cross-border Data Transfer: Understanding and complying with regulations concerning the transfer of data across national borders.

Debt recovery laws and judicial process efficiency

The efficiency of India's debt recovery laws and judicial processes significantly influences Five Star Business Finance's operational effectiveness. Delays in legal proceedings for recovering non-performing assets (NPAs) directly impact the company's liquidity and profitability. For instance, the Insolvency and Bankruptcy Code (IBC), enacted in 2016, aims to streamline the resolution process, but backlogs persist.

The effectiveness of specialized forums like Debt Recovery Tribunals (DRTs) is crucial. While DRTs are designed for faster disposal of cases, their capacity and efficiency can vary. In 2023, the average pendency of cases in DRTs remained a concern, although efforts are underway to improve their functioning. This directly affects Five Star Business Finance's ability to manage its asset quality and recover capital tied up in defaulted loans.

- Impact on Recovery: Inefficient legal processes lead to prolonged recovery periods for NPAs, tying up working capital for Five Star Business Finance.

- Cost of Defaults: Lengthy legal battles increase the operational costs associated with managing and recovering bad debts.

- Tribunal Efficiency: The speed and effectiveness of Debt Recovery Tribunals are critical factors in managing the company's asset quality.

- Regulatory Environment: Changes in debt recovery laws, like amendments to the IBC, can alter the landscape for financial institutions.

The legal landscape for Five Star Business Finance is heavily shaped by the Reserve Bank of India's (RBI) comprehensive regulatory framework for NBFCs. Adherence to capital adequacy ratios, such as the 15% minimum CRAR for NBFC-ICC, is a non-negotiable requirement, with non-compliance risking penalties.

Furthermore, robust compliance with property laws, particularly the SARFAESI Act, 2002, is vital for efficient collateral enforcement and asset recovery. Consumer protection laws also mandate transparency in loan terms and ethical collection practices, ensuring borrower rights are upheld.

India's Digital Personal Data Protection Act, 2023, imposes strict data handling protocols, with potential fines up to INR 250 crore for breaches, underscoring the importance of data security and consent management.

The efficiency of debt recovery mechanisms, including the Insolvency and Bankruptcy Code (IBC) and Debt Recovery Tribunals (DRTs), directly impacts Five Star's liquidity and profitability, as case pendency affects recovery timelines.

Environmental factors

There's a noticeable surge in global and domestic attention towards Environmental, Social, and Governance (ESG) compliance, particularly impacting financial institutions. This means companies like Five Star Business Finance are feeling more pressure to be transparent about their ESG performance and adopt sustainable lending strategies.

Investors, regulators, and other stakeholders are increasingly demanding this accountability. For instance, as of early 2024, many major institutional investors are integrating ESG scores into their due diligence processes, with some explicitly stating they will divest from companies that don't meet certain ESG benchmarks.

By actively showcasing a commitment to responsible operations and sustainable finance, Five Star Business Finance can significantly boost its reputation and attractiveness to a broader investor base, potentially leading to better access to capital and improved valuation.

Climate change poses indirect but significant risks to Five Star Business Finance by potentially affecting the operational stability and repayment ability of its small business clients. Sectors heavily reliant on natural resources or susceptible to weather patterns, such as agriculture and certain manufacturing segments, are particularly vulnerable.

Extreme weather events, like prolonged droughts or intense floods, can disrupt supply chains and damage assets for these businesses, leading to reduced revenues and increased default risk on loans. For instance, a severe monsoon season in India, which impacts agriculture, could indirectly strain the repayment capacity of farmers who are Five Star's borrowers.

Financial institutions are increasingly incorporating assessments of these indirect environmental risks into their credit analysis. This proactive approach aims to safeguard asset quality and ensure long-term financial resilience by understanding how climate-related disruptions might cascade through their borrower base.

The increasing focus on green finance presents both hurdles and avenues for growth. While Five Star Business Finance may not engage in massive project financing, there's potential to provide specialized loans for small businesses investing in sustainability, like energy-efficient upgrades. This aligns with the growing global push for environmental responsibility and could unlock access to new capital streams.

Operational environmental footprint and resource management

Five Star Business Finance's physical operations, including its branches and corporate offices, contribute to an environmental footprint. This footprint is primarily driven by energy consumption for lighting and equipment, waste generated from daily operations, and water usage. For instance, in 2024, the Indian commercial real estate sector, which houses many such offices, saw a focus on green building certifications, with a growing number of companies prioritizing energy efficiency to manage operational costs and environmental impact.

Adopting sustainable operational practices can yield significant benefits. Implementing energy-efficient lighting and HVAC systems, for example, not only reduces electricity bills but also aligns with growing investor and customer expectations for corporate environmental responsibility. Similarly, robust waste management and recycling programs can minimize landfill contributions and potentially lower disposal costs.

- Energy Efficiency: Investing in LED lighting and smart thermostats can reduce electricity consumption by an estimated 15-30% in commercial buildings.

- Waste Reduction: Implementing comprehensive recycling programs and reducing paper usage through digitization can divert a significant portion of waste from landfills.

- Water Conservation: Utilizing low-flow fixtures and promoting water-saving practices can decrease water bills and conserve a vital resource.

- Sustainable Procurement: Sourcing office supplies and equipment from environmentally conscious vendors further minimizes the operational footprint.

Reputational risk related to environmental practices

Failing to address environmental issues, even indirectly, can significantly damage Five Star Business Finance's reputation. As environmental consciousness rises, stakeholders like investors and customers are increasingly scrutinizing a company's wider ecological footprint. For example, in 2024, reports indicated that companies with poor environmental, social, and governance (ESG) scores faced a higher cost of capital.

Five Star's brand image and long-term viability depend on a proactive strategy for understanding and mitigating environmental risks. This includes assessing the environmental practices of their borrowers, as negative associations can directly impact Five Star's own standing. In the 2023 fiscal year, a significant portion of investors cited ESG factors as a key consideration in their investment decisions, highlighting the growing importance of environmental stewardship.

- Stakeholder Scrutiny: Growing environmental awareness means investors and customers are more likely to examine a company's broader environmental impact.

- Brand Image Protection: A proactive approach to environmental risk management, including that of borrowers, is crucial for safeguarding Five Star's reputation.

- Investor Sentiment: ESG performance is increasingly influencing investment decisions, with a notable rise in investor focus on environmental factors in 2023 and continuing into 2024.

- Cost of Capital: Companies with weaker ESG profiles, including environmental management, may face a higher cost of capital, as observed in 2024 market trends.

The increasing emphasis on ESG factors means Five Star Business Finance must navigate evolving environmental regulations and investor expectations. This includes a growing demand for transparency in lending practices and a push towards sustainable finance, with many institutional investors in early 2024 incorporating ESG scores into their due diligence, impacting capital access.

Climate change presents indirect risks by affecting the repayment capacity of clients in sectors like agriculture, vulnerable to extreme weather events. For example, a severe monsoon season can strain farmer borrowers, increasing default risk, a factor financial institutions are increasingly assessing in credit analysis.

Opportunities exist in green finance, such as providing loans for small businesses adopting energy-efficient upgrades, aligning with global environmental responsibility trends and potentially unlocking new capital streams.

Five Star's operational footprint, from energy consumption to waste generation, is under scrutiny, with a focus in 2024 on green building certifications in India's commercial real estate sector to manage costs and impact.

| Environmental Factor | Impact on Five Star Business Finance | Data/Trend (2023-2024) |

| ESG Compliance Demand | Increased pressure for transparency and sustainable lending | Institutional investors integrating ESG scores; potential divestment from non-compliant firms |

| Climate Change Risks | Indirect impact on borrower repayment capacity (e.g., agriculture) | Vulnerability to extreme weather events increasing default risk |

| Green Finance Opportunities | Potential for specialized loans for sustainability upgrades | Growing global push for environmental responsibility |

| Operational Footprint | Energy consumption, waste, water usage | Focus on energy efficiency in commercial real estate; potential cost savings and reputation enhancement |

PESTLE Analysis Data Sources

Our Five Star Business Finance PESTLE Analysis is built on a robust foundation of data from reputable financial institutions, government economic reports, and leading market research firms. We incorporate insights from regulatory bodies, technological trend analyses, and socio-economic surveys to ensure comprehensive and accurate assessments.