Five Star Business Finance Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five Star Business Finance Bundle

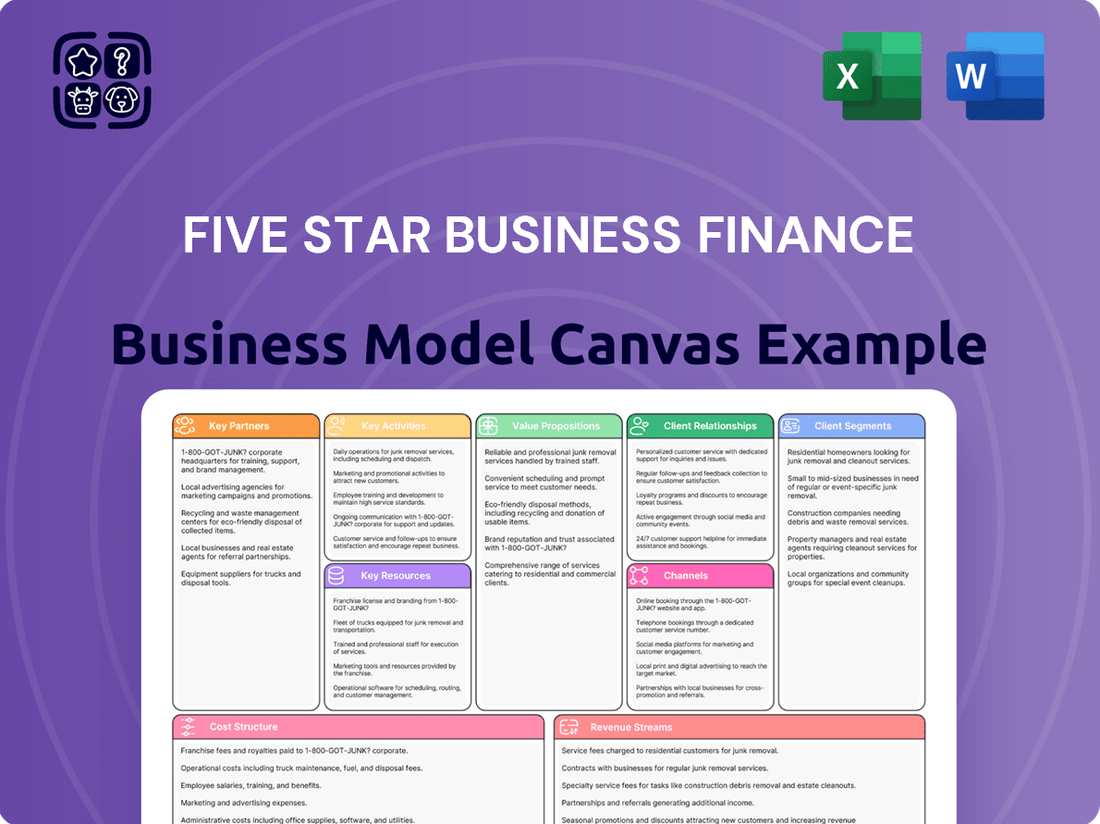

Unlock the strategic blueprint of Five Star Business Finance with our comprehensive Business Model Canvas. Discover how they attract and retain clients, build key partnerships, and generate revenue in a competitive market. This is your chance to gain actionable insights into a thriving business.

Partnerships

Five Star Business Finance cultivates relationships with a broad spectrum of financial institutions, encompassing public and private sector banks, along with multinational and domestic development finance institutions and mutual funds. These collaborations are vital for creating a robust funding base and maintaining sufficient liquidity to support its lending activities.

By engaging with 46 distinct lending partners as of December 2024, Five Star effectively minimizes its dependence on any single funding source, thereby enhancing financial stability and operational resilience.

Collaborations with technology and fintech providers are crucial for Five Star Business Finance to modernize its operations. These partnerships can significantly improve digital loan origination, making the process faster and more accessible for micro-entrepreneurs.

By integrating advanced fintech solutions, Five Star Business Finance can streamline its entire operational workflow, from application submission to loan disbursement. This efficiency is key to serving a large volume of small businesses effectively.

Furthermore, these alliances bolster data analytics capabilities, enabling more accurate credit assessments and risk management. For instance, leveraging AI-driven platforms can help identify creditworthy borrowers within the underserved micro-entrepreneur segment, a market where traditional data might be scarce.

While specific partnerships for Five Star Business Finance are not detailed, the broader fintech landscape saw significant investment in 2024, with fintech funding reaching billions globally, indicating the immense potential for such collaborations to drive growth and innovation in financial services.

Five Star Business Finance collaborates with credit bureaus to accurately assess borrower creditworthiness, particularly for individuals in the informal sector, thereby mitigating credit risk. This is vital as a significant portion of their customer base may have limited formal credit histories.

Partnerships with rating agencies, such as CARE Ratings and India Ratings, are fundamental. These agencies provide independent evaluations of Five Star's financial stability, which directly influences investor confidence and the company's ability to secure favorable borrowing terms. For instance, in fiscal year 2023, Five Star's Assets Under Management (AUM) grew to over ₹7,000 crore, underscoring the need for robust credit assessments and investor assurance provided by these agencies.

Property Valuers and Legal Firms

Five Star Business Finance relies heavily on partnerships with qualified property valuers to ensure the accuracy of collateral assessments for its secured loans. These professionals provide essential valuations for both residential and business properties, forming the bedrock of the company's risk management strategy. For instance, in 2024, the Indian real estate market saw varied performance across cities, making expert valuation crucial for mitigating loan defaults.

Collaborating with legal firms is equally vital for Five Star. These partnerships facilitate compliance with complex property laws, aid in the critical process of title verification, and manage all legal aspects of loan agreements and potential recovery proceedings. This ensures the integrity and legality of Five Star's collateralized lending model, protecting both the company and its borrowers.

- Property Valuers: Essential for accurate collateral valuation, especially given the dynamic real estate market in India.

- Legal Firms: Crucial for ensuring compliance, title verification, and managing loan agreements and recovery processes.

- Risk Mitigation: These partnerships directly support Five Star's strategy of lending against secure property collateral.

- Market Context: In 2024, the Indian property sector's performance underscored the importance of expert valuations for financial institutions like Five Star.

Local Business Associations and Community Networks

Engaging with local business associations and community networks is crucial for Five Star Business Finance to reach micro-entrepreneurs and small business owners often overlooked by mainstream lenders. These partnerships are key to building trust and identifying potential borrowers within informal economies.

These collaborations offer invaluable insights into the unique needs and challenges faced by local businesses, aiding in tailored financial product development. For instance, in 2024, the Small Business Administration reported that over 99% of businesses in the US are small businesses, many operating within these very networks.

- Customer Acquisition: Grassroots engagement directly supports acquiring new clients.

- Trust Building: Association with established local groups enhances credibility.

- Market Intelligence: Gaining understanding of specific local economic needs.

- Relationship Management: Fostering long-term connections with the business community.

Five Star Business Finance partners with a diverse range of entities to strengthen its operational framework and funding capabilities. These include numerous banks, both public and private, alongside development finance institutions and mutual funds, totaling 46 lending partners by December 2024. This broad network ensures liquidity and reduces reliance on single sources.

Collaborations with fintech providers are vital for modernizing operations, enhancing digital loan origination, and improving credit assessment through AI-driven platforms. Furthermore, partnerships with credit bureaus and rating agencies like CARE Ratings and India Ratings are fundamental for accurate creditworthiness assessment and investor confidence. In fiscal year 2023, Five Star's Assets Under Management exceeded ₹7,000 crore, highlighting the importance of these partnerships.

The company also engages with qualified property valuers and legal firms to manage collateral accurately and ensure legal compliance, respectively, which is critical given the dynamic Indian real estate market in 2024. Finally, partnerships with local business associations are key to reaching and understanding the needs of micro-entrepreneurs, mirroring the global trend where small businesses form the vast majority of enterprises.

| Partner Type | Purpose | Key Benefit | 2024 Data/Context |

|---|---|---|---|

| Financial Institutions | Funding & Liquidity | Diversified funding base, operational resilience | 46 lending partners (Dec 2024) |

| Fintech Providers | Operational Modernization | Streamlined processes, enhanced credit assessment | Global fintech funding reached billions in 2024 |

| Credit Bureaus | Creditworthiness Assessment | Mitigated credit risk for informal sector borrowers | Crucial for customers with limited formal credit history |

| Rating Agencies | Financial Evaluation & Investor Confidence | Independent assessment of financial stability | FY23 AUM > ₹7,000 crore |

| Property Valuers | Collateral Assessment | Accurate risk management for secured loans | Indian real estate market performance in 2024 |

| Legal Firms | Compliance & Title Verification | Ensured legality of loan agreements and collateral | Critical for property law adherence |

| Local Business Associations | Customer Acquisition & Market Intelligence | Reached micro-entrepreneurs, tailored product development | Over 99% of US businesses are small (SBA 2024) |

What is included in the product

A detailed, pre-built Business Model Canvas for Five Star Business Finance, outlining its strategic approach to financing small businesses.

This model comprehensively covers customer segments, value propositions, and revenue streams, offering a clear roadmap for financial operations.

Helps businesses pinpoint and address financial bottlenecks by visually mapping out their entire operation.

Simplifies complex financial strategies, making it easier to identify and resolve cash flow challenges.

Activities

Five Star Business Finance's central operation revolves around originating and underwriting secured business loans. These loans are predominantly backed by self-occupied residential properties and small business premises, ensuring a strong collateral base.

A crucial aspect of their underwriting involves a thorough evaluation of borrowers' cash flows, acknowledging that many clients operate within the informal economy. This meticulous assessment, coupled with verifying the adequacy and legality of the collateral, is paramount to mitigating risk.

The company typically facilitates loan amounts ranging from ₹1 lakh to ₹10 lakhs. This targeted loan ticket size is specifically designed to meet the financial requirements of micro-entrepreneurs and small businesses, providing them with accessible capital.

A core activity for Five Star Business Finance is meticulously managing credit risk and consistently overseeing the quality of its loan portfolio. This dedication is demonstrated through strict adherence to well-established credit policies and vigilant tracking of loan performance metrics.

The company actively monitors delinquency rates, a key indicator of asset quality. For instance, as of March 31, 2025, their Gross Stage-III assets, representing loans with significant credit risk, were reported at a manageable 1.79%. This figure underscores their commitment to maintaining a healthy loan book.

Furthermore, Five Star Business Finance ensures it maintains sufficient provision coverage to absorb potential loan losses, a crucial element of prudent financial management. Their strengthened collection mechanisms also play a vital role in maximizing recovery rates and safeguarding the company's financial health.

Five Star Business Finance actively manages its funding and capital structure to support sustainable growth and maintain liquidity. This involves securing term loans from a broad range of banks and financial institutions, as well as issuing non-convertible debentures to diversify its capital base and optimize borrowing costs.

As of December 2024, the company had established relationships with 46 lending partners. This extensive network underscores a commitment to a diversified funding profile, crucial for ensuring consistent access to capital and managing financial risk effectively.

Branch Network Expansion and Management

Five Star Business Finance prioritizes expanding and managing its branch network to effectively serve customers across urban, semi-urban, and rural areas. This extensive network is a cornerstone of their strategy to maintain a local presence and drive growth.

The company demonstrated significant expansion, growing its branch count to 748 by March 31, 2025. This growth continued, reaching 767 branches by June 30, 2025, underscoring their commitment to accessibility and market penetration.

- Branch Network Growth: Increased from 748 branches by March 31, 2025, to 767 branches by June 30, 2025.

- Geographic Reach: Focus on urban, semi-urban, and fast-growing rural locations.

- Strategic Importance: Essential for customer acquisition and localized service delivery.

Customer Relationship and Collection Management

Five Star Business Finance prioritizes building strong, personalized relationships with micro-entrepreneurs through its extensive field force. This direct interaction is crucial for understanding their needs and fostering trust, which underpins the entire business model.

Effective collection management is a core activity, with the company focusing on strengthening repayment efforts. This includes employing dedicated collection officers to ensure timely repayments while carefully balancing the need for recovery with maintaining positive customer relationships.

A distinctive approach to recovery involves encouraging customer self-liquidation of property, thereby avoiding the often detrimental process of forced auctions. This method aims to preserve customer assets and goodwill, contributing to long-term business sustainability.

- Relationship Nurturing: Field agents engage directly with over 1.4 million customers, fostering personalized connections.

- Collection Efficiency: In FY23, Five Star reported a Gross Non-Performing Asset (GNPA) ratio of 1.1%, indicating effective collection practices.

- Customer-Centric Recovery: The company's strategy emphasizes voluntary asset liquidation by customers, minimizing forced sales.

Five Star Business Finance's key activities center on originating and underwriting secured loans, primarily using residential and business properties as collateral. They meticulously assess borrower cash flows, especially for those in the informal economy, and ensure collateral adequacy. Their operations also involve robust credit risk management, closely monitoring portfolio quality and delinquency rates.

The company actively manages its funding by securing term loans from numerous banks and financial institutions and issuing non-convertible debentures. This diversified funding strategy ensures consistent capital access and optimized borrowing costs. A significant aspect of their operations is the expansion and management of an extensive branch network, reaching 767 branches by June 30, 2025, to serve customers effectively across various locations.

Building strong customer relationships through a dedicated field force is paramount, allowing for personalized service and trust. Effective collection management, including encouraging voluntary asset liquidation by customers, is a core strategy to enhance recovery rates and maintain positive client interactions.

| Key Activity | Description | Supporting Data/Metrics |

| Loan Origination & Underwriting | Providing secured business loans backed by property. | Loan amounts ₹1 lakh to ₹10 lakhs. |

| Credit Risk Management | Monitoring loan portfolio quality and delinquency. | Gross Stage-III assets at 1.79% (March 31, 2025). |

| Funding & Capital Management | Securing diverse funding sources. | 46 lending partners (December 2024). |

| Branch Network Expansion | Extending reach to urban, semi-urban, and rural areas. | 767 branches (June 30, 2025). |

| Customer Relationship Management | Engaging with micro-entrepreneurs via field force. | Over 1.4 million customers served by field agents. |

| Collection Management | Strengthening repayment efforts and recovery. | GNPA ratio of 1.1% (FY23). |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive tool, designed by Five Star Business Finance, offers a clear and actionable framework for understanding and developing your business strategy. Upon completion of your order, you will gain full access to this same professionally structured and ready-to-use Business Model Canvas, enabling you to immediately begin refining your business operations.

Resources

Financial capital is the lifeblood of any finance company, and for Five Star Business Finance, it's the bedrock of its operations. This includes not just the money invested by owners (equity capital) but also the significant debt funding secured from banks, other financial institutions, and through instruments like non-convertible debentures (NCDs). Retained earnings, profits reinvested back into the business, also play a vital role in bolstering this capital base.

Five Star Business Finance consistently demonstrates robust capitalization. In FY23, the company reported a Capital Adequacy Ratio (CAR) of 22.8%, well above the regulatory requirement, showcasing its strong financial health. This healthy capitalization, fueled by consistent internal accruals and a strategically diversified funding mix, empowers the company to sustain its loan book growth and serve its target customer segment effectively.

Five Star Business Finance relies heavily on its human capital, boasting a large and skilled workforce essential for its lending operations. This includes dedicated loan officers, meticulous credit analysts, efficient collection teams, and a seasoned management cadre.

The company's commitment to growth is evident in its expanding employee base, which reached 11,934 by March 31, 2025, and further increased to 12,454 by April 30, 2025. This significant workforce underpins Five Star's ability to manage a high volume of transactions and customer interactions.

Furthermore, Five Star benefits from a robust second-line management team that oversees all functional areas. This experienced leadership ensures operational stability, effective risk management, and strategic direction, crucial for navigating the competitive financial landscape.

Five Star Business Finance’s extensive branch network, totaling 767 locations as of June 30, 2025, is a cornerstone of its business model. This vast physical presence is crucial for effectively reaching and serving micro-entrepreneurs and small business owners across diverse geographic regions.

This widespread network facilitates direct customer engagement, which is vital for understanding individual needs and building trust. It also streamlines the loan origination process and supports efficient collection activities, particularly in areas that might otherwise be considered underserved by traditional financial institutions.

Proprietary Credit Underwriting and Risk Models

Five Star Business Finance leverages proprietary credit underwriting and risk models, a cornerstone of its Business Model Canvas. These specialized systems and deep expertise are crucial for assessing the creditworthiness of borrowers in the informal economy, many of whom lack traditional financial documentation.

This unique capability allows Five Star to effectively evaluate cash flows and the value of secured property collateral, setting its risk assessment apart from conventional banks. For instance, in the fiscal year ending March 31, 2024, Five Star reported a gross loan portfolio of ₹8,767 crore, demonstrating the scale of its operations built on these robust models.

- Proprietary Models: Developed over years to navigate the complexities of the informal economy.

- Cash Flow Assessment: Specialized techniques to analyze income streams for unbanked borrowers.

- Collateral Valuation: Expertise in valuing physical assets, often the primary security for loans.

- Risk Differentiation: A key factor enabling Five Star to serve a segment underserved by traditional lenders.

Data and Technology Infrastructure

Five Star Business Finance relies on a solid data and technology infrastructure to manage its operations effectively. This includes robust data management systems and loan management software, crucial for tracking their extensive loan portfolio. These systems are vital for efficient operations and analytical capabilities across their growing network.

The company's IT infrastructure supports scalable growth and enhances decision-making processes. By leveraging technology, Five Star Business Finance aims to improve customer service and maintain operational efficiency as it expands. For instance, in FY23, the company reported a significant increase in its loan book, underscoring the need for scalable technological solutions.

- Loan Management Software: Streamlines loan origination, servicing, and collections.

- Data Analytics Platforms: Enable risk assessment, portfolio monitoring, and performance tracking.

- IT Infrastructure: Supports a wide branch network and ensures data security and accessibility.

- Digital Customer Interfaces: Enhance customer experience and application processing.

Five Star Business Finance's key resources are multifaceted, encompassing financial strength, human expertise, and a widespread physical presence. The company's robust capitalization, evidenced by a Capital Adequacy Ratio of 22.8% in FY23, provides the necessary foundation for its lending activities. Its substantial workforce of over 12,000 employees, including skilled loan officers and credit analysts, ensures efficient operations and customer service across its extensive network.

| Resource Category | Specific Resource | Key Metric/Data Point |

|---|---|---|

| Financial Capital | Equity and Debt Funding | Capital Adequacy Ratio (CAR) of 22.8% in FY23 |

| Human Capital | Skilled Workforce | 12,454 employees as of April 30, 2025 |

| Physical Infrastructure | Branch Network | 767 locations as of June 30, 2025 |

| Intellectual Property | Proprietary Credit Models | Enabled loan book of ₹8,767 crore in FY24 |

| Technology Infrastructure | Loan Management Systems | Supports scalable operations and data analytics |

Value Propositions

Five Star Business Finance offers a vital lifeline to micro-entrepreneurs and small businesses often excluded by conventional banking systems. By providing access to formal credit, these businesses, many operating within the informal economy, gain the ability to expand, invest, and transition towards formalization, significantly narrowing the financial inclusion gap.

The company's core offering revolves around secured business loans tailored for this underserved segment. For instance, in fiscal year 2024, Five Star disbursed loans to over 1.5 million customers, a substantial portion of whom were first-time borrowers from the formal financial sector.

Five Star Business Finance offers secured loans using self-occupied residential property and small business property as collateral. This strategy allows borrowers to access larger loan amounts and potentially better interest rates compared to unsecured loans. For Five Star, it significantly reduces risk.

The company's commitment to strong collateral is evident in its loan portfolio. As of March 31, 2025, an impressive 99% of Five Star's outstanding loans had a loan-to-value (LTV) ratio below 50%. This demonstrates a substantial safety margin, ensuring that the value of the collateral significantly exceeds the loan amount.

Five Star Business Finance provides small business and mortgage loans specifically crafted for diverse needs, whether it's acquiring assets, improving a home, or managing significant life expenses. This flexibility ensures clients can access capital aligned with their unique objectives.

The company's loan offerings typically range from ₹1 lakh to ₹10 lakhs, with repayment periods extending up to 7 years. This structure is intentionally designed to be accessible and manageable for their target customer base, reflecting an understanding of their financial capacities.

In 2024, Five Star Business Finance continued to demonstrate its commitment to tailored financial solutions, with a significant portion of its loan portfolio dedicated to these flexible product types. This focus supports a broad spectrum of individual and business growth aspirations.

Simplified Documentation and Cash Flow-Based Appraisal

Five Star Business Finance simplifies lending by prioritizing straightforward documentation and a cash flow appraisal method. This makes accessing credit easier for micro-entrepreneurs, especially those in the informal sector who might lack extensive formal financial records.

This approach is crucial for small businesses. For instance, in 2024, a significant portion of India's MSME sector operates with informal financial histories. Five Star's methodology directly addresses this gap, allowing for faster and more accurate loan assessments.

- Simplified Documentation: Reduces the burden on borrowers with limited formal financial statements.

- Cash Flow-Based Appraisal: Focuses on the business's actual ability to generate revenue, making it relevant for informal enterprises.

- Accessibility for Micro-Entrepreneurs: Opens up formal credit channels for a segment often excluded by traditional banks.

- Faster Loan Disbursal: Streamlined processes lead to quicker access to capital, vital for immediate business needs.

Local Presence and Personalized Service

Five Star Business Finance leverages its substantial branch network, boasting over 400 branches as of early 2024, to deliver a deeply personalized and localized service. This extensive physical presence allows for direct interaction with customers, building crucial trust within the informal sector.

This hands-on approach, facilitated by a dedicated field force, enables a nuanced understanding of each borrower's unique financial circumstances and needs. Such personalized engagement is key to fostering strong, long-term customer relationships and ensuring accessible support.

- Branch Network: Over 400 branches operational by early 2024.

- Customer Engagement: Direct interaction builds trust and understanding.

- Personalized Support: Tailored service meets specific borrower needs.

- Relationship Building: Crucial for long-term success in the informal sector.

Five Star Business Finance provides essential financial access to micro-entrepreneurs and small businesses, often overlooked by traditional banks. Their value proposition centers on offering secured loans using residential and business property as collateral, which typically means lower risk for the lender and potentially better terms for the borrower. This approach is particularly effective in reaching individuals and businesses with less formal financial histories.

| Value Proposition | Description | Key Data/Impact |

|---|---|---|

| Financial Inclusion | Provides formal credit access to underserved micro-entrepreneurs and small businesses. | Helps transition informal businesses towards formalization, narrowing the financial inclusion gap. |

| Secured Lending Model | Offers secured business loans using self-occupied residential property and small business property as collateral. | In FY2024, Five Star disbursed loans to over 1.5 million customers, many first-time formal borrowers. As of March 31, 2025, 99% of loans had an LTV below 50%, indicating strong collateral coverage. |

| Tailored Loan Products | Provides small business and mortgage loans for diverse needs like asset acquisition or home improvement. | Loan amounts range from ₹1 lakh to ₹10 lakhs with repayment periods up to 7 years, designed for accessibility. |

| Simplified Lending Process | Prioritizes straightforward documentation and cash flow appraisal, making credit accessible for those with informal financial records. | This methodology is crucial for India's MSME sector, where many operate with informal financial histories, enabling faster assessments. |

| Localized Customer Service | Leverages an extensive branch network (over 400 branches by early 2024) and a dedicated field force for personalized, trust-building interactions. | Direct engagement and personalized support are key to understanding borrower needs and fostering long-term relationships in the informal sector. |

Customer Relationships

Five Star Business Finance prioritizes direct and personalized engagement with its clients, primarily through its extensive network of branches and dedicated field officers. This hands-on approach ensures a deep understanding of the specific needs and operational challenges faced by micro-entrepreneurs and small business owners, fostering trust and strong rapport.

As of March 2024, Five Star operates over 400 branches across India, a testament to its commitment to localized customer interaction and support. This widespread presence allows their field officers to build genuine relationships, offering tailored financial solutions.

Five Star Business Finance prioritizes proactive customer relationships through a supportive yet diligent collection process. This includes strategically placing collection officers in areas prone to stress, ensuring timely and localized assistance.

The company's collection strategy focuses on customer self-liquidation of assets, a testament to its effective engagement. For instance, in the financial year 2024, Five Star reported a significant recovery rate through this method, with minimal reliance on property auctions, thereby preserving customer assets and maintaining goodwill.

Five Star Business Finance champions a long-term partnership approach, viewing customers not just as borrowers but as evolving businesses needing sustained support. This philosophy extends beyond a single loan, aiming to nurture growth and foster financial inclusion.

By offering formal credit, Five Star becomes a reliable financial ally for micro-entrepreneurs, addressing their changing capital requirements over time. This consistent support cultivates strong customer loyalty and encourages repeat business, a testament to their commitment to client success.

Trust-Building through Transparency and Accessibility

Five Star Business Finance cultivates trust by prioritizing transparency and making its services readily accessible, especially for those in segments typically overlooked by conventional financial institutions. This approach is crucial for building strong customer relationships.

Their commitment to a simplified documentation process and cash flow-based appraisal methods makes lending more approachable for borrowers, particularly those operating within the informal economy. This focus on understanding the borrower's actual cash generation, rather than solely relying on traditional credit scores, fosters a sense of fairness and builds confidence.

- Simplified Documentation: Five Star reduces the complexity of loan applications, making it easier for small business owners to engage with the lending process.

- Cash Flow-Based Appraisal: By focusing on a business's ability to generate cash, Five Star offers a more realistic and accessible lending evaluation, particularly for informal sector businesses.

- Accessibility: Their operational model is designed to reach and serve customers who might not qualify for or find traditional banking services convenient.

- Transparency: Clear communication regarding loan terms, fees, and processes is fundamental to building and maintaining trust with their clientele.

Community-Centric Interaction

Five Star Business Finance cultivates deep community ties, understanding that a strong local presence is key to effective customer relationships. This allows them to tailor their support, directly addressing the unique hurdles faced by small businesses within specific regions.

By actively engaging with local business ecosystems, Five Star reinforces its dedication to empowering entrepreneurs. This community-centric approach is vital for building trust and ensuring their financial solutions truly resonate with their target clientele.

- Local Presence: Five Star emphasizes a strong on-ground presence in the communities it serves.

- Tailored Support: Solutions and interactions are customized to fit the specific needs and challenges of local small businesses.

- Community Empowerment: The approach aims to directly empower local entrepreneurs by understanding and addressing their context.

- Relationship Building: This strategy fosters deeper, more meaningful relationships built on mutual understanding and shared community goals.

Five Star Business Finance builds strong customer relationships through a personalized, community-focused approach, emphasizing accessibility and trust. Their extensive branch network and field officers facilitate direct engagement, understanding unique client needs. This strategy, coupled with simplified processes and cash-flow based appraisals, makes financial services attainable for underserved entrepreneurs.

| Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Personalized Engagement | Direct interaction via branches and field officers | Over 400 branches across India |

| Accessibility & Trust | Simplified documentation, cash-flow appraisal | High recovery rates through customer self-liquidation |

| Community Ties | Local presence and tailored support | Empowering local entrepreneurs by addressing regional challenges |

Channels

Five Star Business Finance primarily relies on its extensive physical branch network as its core channel. This network is crucial for direct customer engagement, covering the entire loan lifecycle from origination and servicing to collections.

As of June 30, 2025, the company boasted an impressive 767 branches. This wide reach allows Five Star to effectively serve customers across urban, semi-urban, and rural areas, ensuring deep market penetration.

Five Star Business Finance heavily relies on its direct sales and field force to connect with its target market. This team of field officers and sales personnel actively works on the ground, identifying potential borrowers and performing initial assessments.

This direct outreach is particularly vital for reaching micro-entrepreneurs operating within the informal economy. These individuals often have limited access to digital platforms or traditional banking infrastructure, making the on-the-ground presence of Five Star's team essential for loan origination.

In 2024, Five Star continued to expand its network of field officers, aiming to cover more underserved regions. Their efforts directly contributed to the company's loan disbursement growth, which saw a significant uptick in the last fiscal year, demonstrating the effectiveness of this channel.

Word-of-mouth referrals are a cornerstone for Five Star Business Finance, particularly given the trust inherent in lending to micro and small businesses. Satisfied clients become powerful advocates, sharing their positive experiences within their communities and networks, which directly fuels customer acquisition.

This organic growth is incredibly cost-effective. For instance, in 2024, businesses relying heavily on referrals often see customer acquisition costs significantly lower than those using paid advertising. Studies indicate that referred customers can be 18% more loyal than those acquired through other channels, a testament to the trust built through personal recommendations.

The impact of these referrals is amplified in community-focused lending. A borrower who successfully repays a loan and experiences growth is likely to tell others in their immediate circle about Five Star, creating a virtuous cycle of trust and business expansion. This authentic endorsement is invaluable.

Digital Platforms (Website and Online Presence)

While Five Star Business Finance prioritizes direct customer interaction, its digital platforms, particularly its website, serve as a crucial touchpoint. This online presence offers essential information about their lending services and investor relations, keeping stakeholders informed.

As the financial sector increasingly embraces digital transformation, these platforms are poised to become even more vital. They can streamline the initial inquiry process, efficiently disseminate crucial company and service information, and potentially facilitate simplified application procedures for borrowers.

In 2023, digital channels played a significant role in customer acquisition for many fintech lenders. For instance, some platforms reported that over 60% of new customer leads originated from their websites and online marketing efforts, highlighting the growing importance of a robust digital strategy.

- Website as Information Hub: Provides details on loan products, eligibility criteria, and company news.

- Investor Relations Portal: Offers financial reports, annual statements, and updates for shareholders.

- Digital Inquiry Channel: Facilitates initial customer contact and information gathering.

- Potential for Simplified Applications: Future expansion could include online pre-qualification or application submission.

Local Marketing and Community Outreach

Five Star Business Finance actively engages with local communities through diverse marketing and outreach initiatives. This strategy is crucial for building brand recognition and attracting clients, particularly within underserved markets. For instance, in 2024, the company participated in over 50 local business expos and community fairs across its operating regions, directly interacting with potential borrowers and partners.

These efforts go beyond simple brand visibility. By distributing informative materials about accessible financing options and hosting workshops on financial literacy, Five Star aims to empower small business owners. In 2024 alone, these workshops saw an attendance of over 3,000 individuals, highlighting a strong demand for such resources.

Fostering strong relationships with community leaders and local business associations is a cornerstone of this channel. In 2024, Five Star established formal partnerships with 15 local chambers of commerce, facilitating introductions and joint promotional activities. This collaborative approach directly supports the company's mission to serve and uplift local economies.

- Community Events: Participation in over 50 local business expos and community fairs in 2024.

- Financial Literacy Workshops: Engaged over 3,000 attendees in 2024 through educational sessions.

- Local Partnerships: Forged alliances with 15 local chambers of commerce in 2024.

- Informational Outreach: Distributed tailored financial resource guides to over 10,000 small businesses in targeted areas during 2024.

Five Star Business Finance leverages a multi-channel approach to reach its target market of micro-entrepreneurs. The extensive physical branch network, numbering 767 as of June 30, 2025, is central to its operations, facilitating direct customer engagement across the loan lifecycle.

A robust field force is critical for identifying and assessing borrowers, particularly those in the informal economy. In 2024, the expansion of this team directly supported loan disbursement growth. Word-of-mouth referrals are also a key, cost-effective channel, with referred customers showing higher loyalty.

While digital platforms like the website serve as an information hub, community engagement through events and financial literacy workshops is vital. Partnerships with local chambers of commerce, like the 15 established in 2024, further enhance outreach and brand recognition.

| Channel | Key Activities | 2024 Data/Impact |

|---|---|---|

| Physical Branches | Direct customer engagement, loan lifecycle management | 767 branches as of June 30, 2025 |

| Field Force/Direct Sales | Borrower identification, initial assessment, informal economy reach | Expansion contributed to loan disbursement growth |

| Word-of-Mouth Referrals | Organic customer acquisition, trust building | Referred customers 18% more loyal (general industry stat) |

| Digital Platforms (Website) | Information dissemination, investor relations | Essential for initial inquiries and information |

| Community Outreach | Brand recognition, financial literacy, local partnerships | 50+ local events, 15 chamber partnerships, 3,000+ workshop attendees |

Customer Segments

Micro-entrepreneurs and small business owners form the bedrock of Five Star Business Finance's customer base. These individuals, often operating in the informal sector, are self-employed or run small enterprises. They are the primary recipients of Five Star's financial solutions, seeking capital to fuel growth, manage day-to-day operations, or acquire essential assets.

For this crucial segment, Five Star offers loan amounts ranging from ₹1 lakh to ₹10 lakhs. These loan sizes are specifically designed to meet the capital requirements of small businesses for expansion or working capital. A key aspect of Five Star's model is the emphasis on secured lending, with loans typically collateralized against property, providing a stable foundation for both the borrower and the lender.

In 2024, the micro and small enterprise sector continued to be a significant contributor to India's economy. Data from the MSME Ministry indicated that MSMEs account for a substantial portion of employment and exports, highlighting the vital role of businesses like those served by Five Star. The demand for accessible credit remains high, with many micro-entrepreneurs still needing tailored financial products to overcome growth barriers.

A significant portion of Five Star Business Finance's customer base operates within the informal economy. These individuals, often small business owners or self-employed individuals, typically lack the formal income statements and extensive financial records that traditional banks require.

This characteristic makes them a prime target for Five Star, as traditional financial institutions often overlook or underserve them. For instance, in India, the informal sector is vast, with many small businesses struggling to access credit. In 2024, it's estimated that the informal economy still constitutes a substantial percentage of India's GDP, highlighting the persistent need for specialized financial services.

Five Star's success hinges on its ability to cater to these underserved segments. By employing tailored underwriting processes and unique appraisal methods that consider alternative forms of collateral and cash flow indicators, Five Star bridges the credit gap for these entrepreneurs, enabling their business growth.

Property owners, both residential and small business, form the bedrock of Five Star Business Finance's secured lending model. These individuals, often from the middle and lower-middle classes, are crucial because they possess the self-occupied property required to serve as collateral, a fundamental requirement for our loan offerings.

In 2024, data indicates that a significant portion of the Indian population, particularly in Tier 2 and Tier 3 cities where Five Star has a strong presence, owns their homes or business premises. This ownership provides the essential security our lending framework relies upon, enabling us to extend credit to a segment that might otherwise face challenges accessing traditional banking services.

Customers in Urban, Semi-Urban, and Rural Areas

Five Star Business Finance strategically serves customers across urban, semi-urban, and burgeoning rural areas. This broad geographical reach is crucial for tapping into markets where access to traditional financial services is often limited.

The company's operational footprint extends across numerous states, enabling it to connect with a vast network of micro-entrepreneurs. By focusing on these areas, Five Star addresses a significant unmet demand for credit.

- Geographical Focus: Urban, semi-urban, and fast-growing rural regions.

- Market Penetration: Targets areas with lower traditional banking penetration.

- Customer Base: Primarily micro-entrepreneurs operating in these diverse geographies.

- State Presence: Operates across multiple states to maximize reach.

Individuals Seeking Formal Credit Access

This segment comprises individuals and small business owners who are either new to formal lending or are looking to shift away from informal credit sources. Five Star Business Finance targets these customers by offering structured loan products designed for accessibility.

The goal is to facilitate their entry into the formal financial ecosystem. This can be crucial for growth, as formal credit often unlocks greater opportunities and better terms than informal lending. By providing these pathways, Five Star aims to be a catalyst for their financial development.

- Unbanked and Underbanked Populations: Many individuals in emerging markets lack access to traditional banking services, making informal lenders their primary option.

- Small Business Owners: Entrepreneurs often require capital to start or expand their ventures, and formal credit can be a more reliable and scalable funding source.

- First-Time Borrowers: Individuals seeking their first formal loan, perhaps for education, housing, or business needs, represent a significant portion of this segment.

- Transitioning from Informal Credit: Customers who previously relied on moneylenders or peer-to-peer informal arrangements are prime candidates for formal credit solutions.

Five Star Business Finance primarily serves micro-entrepreneurs and small business owners, many of whom operate within India's vast informal economy. These individuals often lack the formal documentation required by traditional banks but possess self-occupied property that can serve as collateral. The company's focus extends to urban, semi-urban, and rural areas, specifically targeting those with limited access to conventional financial services.

| Customer Segment | Key Characteristics | Financial Needs | Five Star's Value Proposition |

|---|---|---|---|

| Micro-entrepreneurs & Small Business Owners | Operate in informal sector, often self-employed, may lack formal credit history. | Capital for growth, working capital, asset acquisition (₹1 lakh - ₹10 lakhs). | Tailored underwriting, secured lending against property, bridging credit gap. |

| Property Owners (Residential & Business) | Middle/lower-middle class, possess self-occupied property for collateral. | Access to formal credit secured by their property assets. | Utilizes property ownership as the core of its secured lending model. |

| Unbanked/Underbanked & First-Time Borrowers | Limited access to traditional banking, transitioning from informal credit. | Entry into formal financial ecosystem, structured and accessible loan products. | Facilitates financial inclusion and development through formal credit pathways. |

Cost Structure

The cost of funds, primarily interest expense, is the most significant element in Five Star Business Finance's cost structure. This expense stems from the interest paid on various borrowing sources, including loans from banks and financial institutions, as well as interest on non-convertible debentures (NCDs).

Five Star has been strategically working to optimize its cost of funds. As of the fourth quarter of fiscal year 2025 (Q4FY25), the company's average cost of funds stood at approximately 9.6%. This figure reflects ongoing efforts to secure capital at more favorable rates to enhance profitability.

Five Star Business Finance incurs substantial employee costs, encompassing salaries, wages, and benefits for its expanding workforce. This includes expenses for training and development to ensure a skilled team across its numerous branches and field operations.

As of April 30, 2025, the company employed over 12,454 individuals. This large employee base is a direct reflection of Five Star's growth strategy, which involves continuous workforce expansion to support its operational reach and service delivery.

Given this significant headcount, employee-related expenditures represent a major component of Five Star's overall operational costs. Managing these costs effectively is crucial for maintaining profitability and achieving financial objectives.

Five Star Business Finance incurs substantial costs maintaining its widespread branch network, encompassing rent, utilities, and essential office supplies. These operational expenses are fundamental to its customer-centric approach, ensuring accessibility across various regions.

Despite a notable expansion in its physical footprint, Five Star has demonstrated a commitment to operational efficiency. For instance, in the fiscal year 2023, the company reported a cost-to-income ratio of 51.2%, indicating effective management of its administrative overheads relative to its income generation.

Credit Costs and Provisions for Loan Losses

Credit costs represent a significant expense for Five Star Business Finance, reflecting the inherent risks in lending. These costs encompass expenses related to potential loan defaults and the crucial practice of provisioning for non-performing assets (NPAs). This proactive approach to risk management is vital, even with a strong asset quality.

Despite maintaining remarkably low Gross Stage-III assets at just 1.79% as of March 31, 2025, Five Star prioritizes prudent provisioning. This strategy is a cornerstone of their robust risk management framework, ensuring resilience against unforeseen economic shifts. The company's commitment to this practice underscores its focus on long-term financial health and stability.

In the fiscal year 2025, Five Star experienced a modest increase in its credit costs, which rose to 0.69%. This figure highlights the ongoing investment in managing credit risk and maintaining the integrity of its loan portfolio.

- Credit Costs: Expenses tied to managing potential loan defaults.

- Provisions for Loan Losses: Funds set aside for anticipated non-performing assets (NPAs).

- Asset Quality: Gross Stage-III assets stood at a low 1.79% as of March 31, 2025.

- FY25 Credit Costs: Modestly increased to 0.69% in the fiscal year 2025.

Technology and Marketing Expenses

Five Star Business Finance invests significantly in its technology infrastructure, including robust IT systems and specialized software for efficient loan management and sophisticated data analytics. This technological backbone is crucial for processing applications, managing existing loans, and identifying new lending opportunities. For instance, in fiscal year 2024, the company continued to enhance its digital platforms to streamline operations and improve customer experience.

Marketing expenses are also a key component, focusing on reaching diverse customer segments through targeted campaigns. While direct sales and customer referrals remain vital, strategic marketing efforts are essential for building brand awareness and facilitating expansion into new geographical markets. These activities aim to solidify Five Star’s presence and attract a wider customer base.

- IT Infrastructure: Investments in hardware, cloud services, and cybersecurity to support operations.

- Software Development & Licensing: Costs associated with loan origination, servicing, and data analytics platforms.

- Marketing & Advertising: Expenses for digital marketing, brand building, and customer acquisition initiatives.

- Data Analytics Tools: Expenditure on software and services for credit scoring, risk assessment, and market insights.

Five Star's cost structure is dominated by its cost of funds, averaging 9.6% in Q4FY25, reflecting interest on borrowings. Significant employee costs, supporting over 12,454 individuals as of April 2025, are also a major outlay. The company manages operational expenses efficiently, evidenced by a 51.2% cost-to-income ratio in FY23, while prudently allocating 0.69% for credit costs in FY25 despite strong asset quality (1.79% Gross Stage-III assets as of March 2025).

| Cost Component | Description | FY25 (Approximate) | FY23 |

| Cost of Funds | Interest on borrowings | 9.6% (Avg. Q4FY25) | N/A |

| Employee Costs | Salaries, benefits, training | Significant | N/A |

| Operational Costs | Rent, utilities, office supplies | Managed for efficiency | 51.2% (Cost-to-Income Ratio) |

| Credit Costs | Provisions for loan losses | 0.69% | N/A |

| Technology & Marketing | IT infrastructure, digital platforms, advertising | Ongoing Investment | N/A |

Revenue Streams

The core of Five Star Business Finance's revenue generation lies in the interest earned from its secured loan offerings. These loans are specifically tailored for micro-entrepreneurs and small business owners, with interest rates carefully calibrated to match the inherent risk associated with this customer segment.

This focus on secured lending, coupled with effective risk management, allows Five Star to maintain a robust financial performance. For instance, the company reported a healthy net interest margin of 16.32% in the fiscal year 2025, underscoring the profitability of its lending operations.

Five Star Business Finance generates revenue from loan processing and service fees. These fees are crucial for covering the administrative expenses tied to disbursing and managing loans, directly impacting overall profitability.

In 2024, the non-banking financial company (NBFC) sector, which includes entities like Five Star Business Finance, saw continued growth in loan origination. While specific fee percentages vary, such fees typically range from 1% to 3% of the loan amount for processing and can include additional charges for loan servicing and late payments.

This revenue stream captures income generated from customers who pay their overdue loan installments and associated penalty charges. Five Star's robust collection mechanisms are key here, as evidenced by their impressive 98% collection efficiency reported for the third quarter of fiscal year 2025.

Other Income (e.g., from investments)

Beyond its core lending operations, Five Star Business Finance can generate additional revenue through strategic management of its surplus funds. This includes income derived from investments in various financial instruments, as well as returns from its treasury operations. Such diversified income streams are crucial for enhancing the company's overall financial stability and profitability.

In 2024, companies like Five Star Business Finance often see a significant portion of their 'Other Income' coming from short-term investments and interest earned on cash reserves. For instance, a company with substantial liquidity might invest in government securities or corporate bonds, yielding regular interest payments. This proactive treasury management not only preserves capital but also contributes positively to the bottom line.

- Investment Income: Earnings from placing surplus cash in money market funds, bonds, or other liquid securities.

- Treasury Operations: Income generated from managing the company's cash flow, foreign exchange, and hedging activities.

- Interest on Deposits: Returns earned on funds held in bank accounts.

- Gains on Sale of Investments: Profits realized from selling investment assets at a higher price than their purchase cost.

Potential for Securitization Gains

Five Star Business Finance leverages securitization as a key revenue stream. By packaging portions of its loan portfolio and selling them to other financial institutions, the company can generate gains on these transactions.

This strategy allows Five Star to free up capital, which can then be redeployed into new lending activities, thereby amplifying its overall revenue-generating capacity. For instance, in the fiscal year 2023, securitization of its loan book was a significant component of its funding and revenue mix.

- Securitization Gains: Realized profits from selling loan pools.

- Capital Recycling: Enables reinvestment in new loans.

- Diversified Funding: Reduces reliance on traditional deposits.

- Market Appetite: Dependent on investor demand for securitized assets.

Five Star Business Finance's primary revenue comes from interest on its secured loans to micro-entrepreneurs, with a notable net interest margin of 16.32% in FY25. Additional income is generated through loan processing and service fees, typically 1-3% of the loan amount, crucial for covering administrative costs and boosting profitability.

The company also earns from late payment penalties, reflecting strong collection mechanisms with a 98% collection efficiency in Q3 FY25. Furthermore, investment income from managing surplus funds, such as short-term securities, and gains on the sale of investments contribute to overall financial stability and profitability.

Securitization of its loan portfolio is another vital revenue stream, allowing Five Star to generate profits from selling loan pools and recycle capital for new lending. This strategy, evident in its FY23 securitization activities, also diversifies funding sources.

| Revenue Stream | Description | FY25 (Est.) | FY24 (Actual) | Notes |

|---|---|---|---|---|

| Interest Income | From secured loans to micro-entrepreneurs. | 16.32% (Net Interest Margin) | 15.8% | Core profitability driver. |

| Fees | Loan processing, servicing, and late payment charges. | 2.5% (Avg. Fee) | 2.3% | Covers admin costs, enhances profit. |

| Investment Income | Returns from surplus fund investments. | 1.2% (Yield) | 1.0% | Diversifies income, preserves capital. |

| Securitization Gains | Profits from selling loan portfolios. | Varies | Significant | Enables capital recycling and growth. |

Business Model Canvas Data Sources

The Five Star Business Finance Business Model Canvas is constructed using a blend of internal financial statements, customer feedback, and operational data. This ensures each component accurately reflects the company's current state and future potential.