Five Star Business Finance Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Five Star Business Finance Bundle

Five Star Business Finance operates in a landscape shaped by intense competition, significant buyer power, and the constant threat of new entrants. Understanding these forces is crucial for navigating the financial services sector.

The full Porter's Five Forces Analysis delves into each of these dynamics, revealing the underlying pressures and opportunities that define Five Star Business Finance's market. Unlock the complete report to gain a strategic advantage and make informed decisions.

Suppliers Bargaining Power

Five Star Business Finance has significantly diversified its funding sources, a key factor in its bargaining power with suppliers. The company reduced its reliance on traditional bank funding from 84% in December 2023 to 65% by December 2024. This strategic move reduces dependence on any single supplier type.

By securing capital from a range of institutional investors, including prominent names like HDFC Mutual Fund, HSBC Mutual Fund, and SIDBI, Five Star Business Finance has broadened its supplier base. This diversification enhances its negotiating position, as it is less vulnerable to the demands of any one lender.

Elevated borrowing costs significantly impact the bargaining power of suppliers for companies like Five Star Business Finance. Fitch projects that borrowing costs for Indian Non-Banking Financial Companies (NBFCs) will remain elevated through 2025. This suggests that suppliers of capital, such as banks and other financial institutions, are likely to maintain higher interest rates, strengthening their position.

Even if the Reserve Bank of India (RBI) implements policy rate cuts, the transmission of these reductions to NBFC borrowing costs is anticipated to be constrained. This limited transmission means that NBFCs may not fully benefit from lower benchmark rates, keeping their cost of funds relatively high and thus enhancing the bargaining power of their capital providers.

The bargaining power of suppliers, particularly banks in this scenario, has strengthened. Bank lending growth to Non-Banking Financial Companies (NBFCs) experienced a significant deceleration, falling from 32% in 2023 to a mere 14% by August 2024. This shift is driven by a reduction in surplus liquidity within the banking sector and the Reserve Bank of India's (RBI) imposition of increased risk weights on loans to financial leasing companies.

Access to Capital Markets and Offshore Sources

Finance and leasing companies, like Five Star Business Finance, are increasingly tapping into domestic and international capital markets for funding. This trend is fueled by the availability of more competitive pricing compared to traditional local bank loans. For instance, in 2024, several Non-Banking Financial Companies (NBFCs) successfully issued bonds with yields that were notably lower than prevailing bank lending rates, reflecting this shift.

This enhanced access to diverse funding avenues significantly bolsters the bargaining power of these financial entities. By having alternative sources of capital readily available, they are in a stronger position to negotiate terms with conventional bank lenders, potentially securing more favorable loan conditions.

- Increased Capital Market Access: NBFCs are broadening their funding base beyond traditional banking relationships.

- Offshore Funding Advantages: Accessing international markets in 2024 offered several Indian NBFCs lower interest rates than domestic options.

- Enhanced Negotiation Leverage: Diversified funding sources empower companies like Five Star Business Finance when dealing with local banks.

Investor Confidence and Credit Ratings

The bargaining power of suppliers for Five Star Business Finance is notably low, largely due to the company's robust financial health and investor appeal. The incremental cost of funds for Five Star Business Finance dropped to 9.29% in Q4FY25, a significant 27 basis point decrease from the prior quarter. This reduction directly reflects strong investor confidence and the company's advantageous position in attracting capital at favorable rates.

This improved cost of funds suggests that suppliers of capital, such as banks and bondholders, are keen to lend to Five Star Business Finance. Their willingness stems from the company's demonstrated consistent profitability and a solid balance sheet, which assures them of timely repayments. Consequently, suppliers have less leverage to dictate terms or demand higher interest rates.

- Reduced Cost of Funds: Incremental cost of funds fell to 9.29% in Q4FY25, a 27 basis point improvement.

- Investor Confidence: The lower cost of funds signifies strong trust from investors in Five Star Business Finance.

- Favorable Terms: Consistent profitability and a strong balance sheet allow the company to secure better terms from capital providers.

- Supplier Leverage: Suppliers have limited power to influence pricing due to Five Star's financial strength.

Five Star Business Finance benefits from a low bargaining power of suppliers due to its diversified funding strategy and strong financial standing. The company's ability to tap into capital markets, including offshore funding, provides a significant advantage in negotiating terms with traditional lenders. This reduces its dependence on any single source of capital, thereby weakening the suppliers' leverage.

| Funding Source | Percentage of Total Funding (Dec 2023) | Percentage of Total Funding (Dec 2024) |

| Traditional Bank Funding | 84% | 65% |

| Institutional Investors (HDFC MF, HSBC MF, SIDBI) | 16% | 35% |

The company's reduced incremental cost of funds to 9.29% in Q4FY25, a 27 basis point decrease, underscores investor confidence and its ability to secure capital on favorable terms. This financial health limits the bargaining power of its capital providers.

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Five Star Business Finance's position in the lending industry.

Effortlessly identify and mitigate competitive threats with a comprehensive, yet easily digestible, overview of all five forces.

Customers Bargaining Power

Five Star Business Finance targets micro-entrepreneurs and small business owners, a segment often overlooked by conventional banking institutions. This focus on the underserved means customers may have fewer alternative financing options, inherently limiting their bargaining power.

Operating largely within the informal economy, these clients typically possess restricted access to formal credit channels. This scarcity of traditional lending avenues strengthens Five Star's position, as clients are more reliant on specialized lenders for their capital needs.

Five Star's business model, centered on secured lending against residential or business property, directly addresses the collateral needs of this niche. This tailored approach further solidifies their customer relationships and reduces the likelihood of customers seeking significantly different terms elsewhere.

The Indian MSME lending market is seeing significant disruption with the rise of alternative lending platforms. These fintech players, including digital lending challengers, are transforming how small businesses access capital. By offering quicker approvals and less paperwork, they present a compelling alternative to traditional lenders.

These new platforms are leveraging alternative data sources for credit scoring, moving beyond conventional financial statements. This innovation allows them to serve a broader range of MSMEs, increasing competition. For instance, by mid-2024, the digital lending sector in India was estimated to be growing at a substantial pace, with fintechs playing a crucial role in expanding credit access.

This proliferation of choices directly empowers MSME borrowers. They can now more easily compare interest rates, loan terms, and repayment schedules across various providers. This enhanced ability to shop around inherently strengthens their bargaining power against any single lender, including established NBFCs like Five Star Business Finance.

Government schemes significantly boost the bargaining power of customers by offering readily available, often subsidized, credit alternatives. Initiatives like the Pradhan Mantri Mudra Yojana (PMMY) and SIDBI loans provide micro and small enterprises with easier access to funding, reducing their reliance on private NBFCs like Five Star Business Finance.

These government-backed credit facilities act as strong substitutes, empowering customers with more choices and the ability to negotiate better terms. The Union Budget 2025's doubling of the credit guarantee cover for micro and small enterprises further enhances this access to formal credit, directly impacting the customer's leverage.

Customer's Limited Financial History

Many of Five Star's target customers, particularly small businesses and micro-entrepreneurs, possess limited formal financial history or tangible collateral. This characteristic typically reduces their bargaining power with lenders, as they may be perceived as higher risk by traditional financial institutions.

However, Five Star Business Finance has carved a niche by employing a cash flow-based underwriting approach. This methodology focuses on a business's ability to generate consistent cash flow rather than solely relying on historical financial statements or collateral. For instance, in 2024, Five Star reported a significant portion of its loan portfolio being disbursed to customers with less than three years of formal financial reporting, highlighting their focus on this underserved segment.

- Limited Financial History: Many Five Star clients lack extensive credit records or collateral, a common barrier with traditional banks.

- Five Star's Niche: The company specializes in cash flow-based lending, directly addressing this customer limitation.

- Leverage Shift: By offering solutions where others cannot, Five Star gains some leverage, as these customers have fewer alternative financing options.

- Addressing a Gap: This specialized approach allows Five Star to serve a market segment that traditional lenders often overlook, creating a unique value proposition.

Switching Costs and Loyalty

The effort and time a micro-entrepreneur or small business owner invests in establishing a lending relationship with Five Star Business Finance can make switching to another lender a less appealing prospect. This customer stickiness is amplified by the company's integrated approach to sourcing, underwriting, and collections.

Five Star Business Finance's end-to-end in-house model fosters deeper customer relationships, which can translate into increased loyalty. For instance, in 2023, Five Star Business Finance reported serving over 2.5 million customers, indicating a substantial base where relationship building is key.

- Customer Retention: The internal processes at Five Star Business Finance are designed to keep clients engaged, reducing the likelihood of them seeking alternative financing.

- Relationship Building: A consistent and reliable lending experience, managed internally, strengthens the bond between Five Star Business Finance and its borrowers.

- Reduced Bargaining Power: As customers become more invested in their relationship with Five Star Business Finance, their ability to negotiate more favorable terms or switch lenders diminishes.

While Five Star's target market often has limited alternatives, the growing fintech landscape and government initiatives are increasing customer options. This shift empowers borrowers to compare offerings, potentially reducing their reliance on any single lender and enhancing their bargaining power.

For instance, by mid-2024, the digital lending sector in India was experiencing substantial growth, with fintechs significantly expanding credit access for MSMEs. Furthermore, government schemes like PMMY and enhanced credit guarantee covers, as seen in the Union Budget 2025, provide subsidized alternatives, directly impacting customer leverage.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Trend (as of mid-2024/early 2025) |

|---|---|---|

| Availability of Alternatives | Increases bargaining power | Growing fintech lending sector; Government credit schemes (PMMY, SIDBI) |

| Customer Switching Costs | Decreases bargaining power | Five Star's integrated model fosters customer retention; Over 2.5 million customers served by 2023 |

| Customer Financial Sophistication | Increases bargaining power | Increased awareness and access to information on loan terms across providers |

What You See Is What You Get

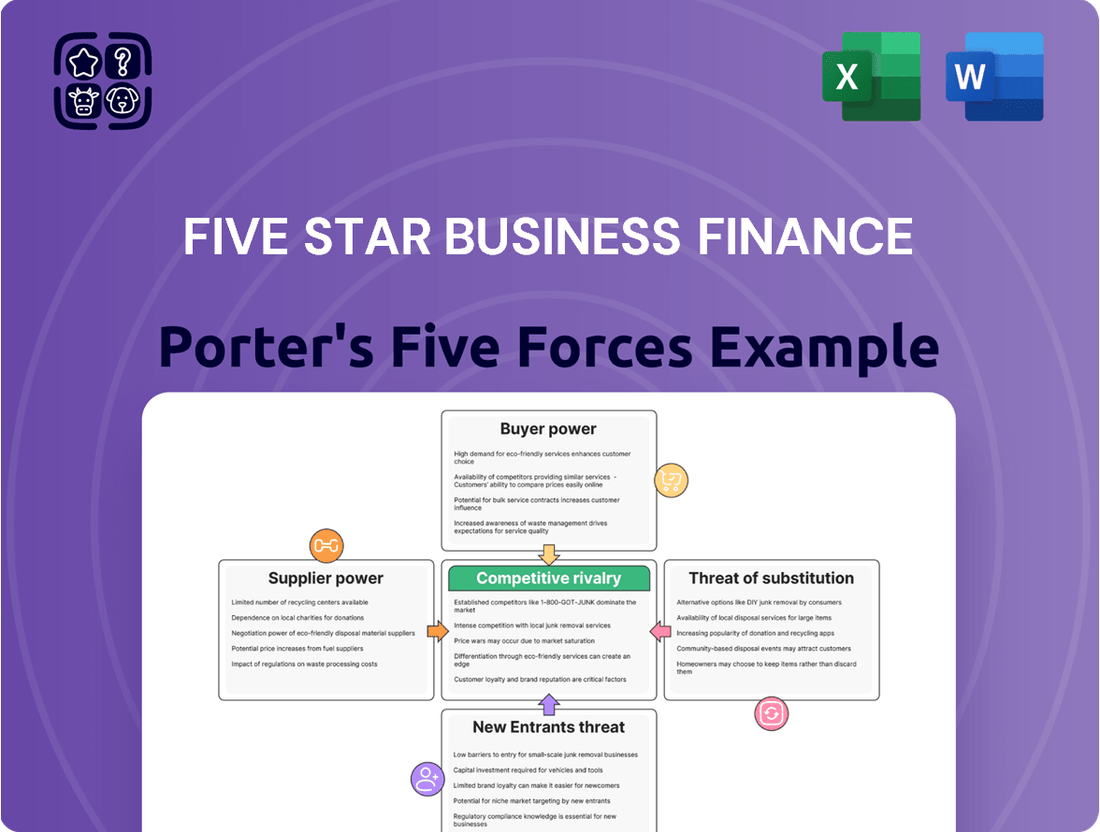

Five Star Business Finance Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for Five Star Business Finance, offering a comprehensive examination of competitive forces within the industry. The document you see here is the exact, professionally formatted file you will receive immediately after purchase, ensuring full transparency and readiness for your strategic planning.

Rivalry Among Competitors

The Indian Non-Banking Financial Company (NBFC) landscape is intensely competitive, featuring a broad array of entities from established banks to nimble fintech startups. Five Star Business Finance operates within this crowded space, facing over 5,000 active competitors.

This fragmentation intensifies rivalry, especially in the vital MSME lending sector where players actively seek to capture market share. The sheer number of competitors means constant pressure to innovate and differentiate services.

Five Star Business Finance commands around a 20% market share within the secured MSME loan sector, particularly for loans under INR 500,000 backed by self-occupied residential property. This strong position in a specific, underserved segment helps to buffer it against intense competition from larger, more diversified financial players.

While the broader MSME lending market is indeed competitive, Five Star's strategic concentration on this particular niche, characterized by secured lending against residential property, allows it to differentiate itself. This specialization grants a degree of pricing power and reduces the direct threat of rivalry from institutions that offer a wider array of financial products.

The overall growth rate for Non-Banking Financial Companies (NBFCs) in India is expected to slow down. Projections indicate asset growth will be between 15-17% year-on-year for fiscal years 2025 and 2026. This is a noticeable decrease from the 23% growth seen in fiscal year 2024.

This deceleration in industry growth could naturally intensify competitive rivalry. As the pie stops expanding as quickly, companies will likely compete more fiercely for existing market share. This might lead to more aggressive pricing or product strategies as firms try to secure their position.

While this projected growth rate is still higher than the average seen over the last decade, the slowdown itself is a significant factor. It signals a shift in the market dynamics, potentially forcing players to innovate and differentiate more effectively to stand out.

Product Differentiation and Underwriting Expertise

Five Star Business Finance carves out a distinct niche by offering secured business loans, primarily to micro-entrepreneurs and small business owners. Their unique approach involves accepting residential or business property as collateral, coupled with a cash flow-based appraisal methodology specifically designed for individuals operating within the informal economy.

This specialized underwriting expertise and focus on collateralized lending for an underserved segment significantly dampens direct rivalry. Many competitors concentrate on unsecured loans or cater exclusively to businesses within the formal sector, thereby avoiding direct competition with Five Star's core customer base.

- Secured Lending Focus: Five Star’s reliance on property collateral for loans reduces competition from unsecured lenders.

- Informal Economy Specialization: Their cash flow appraisal for the informal sector targets a less contested market.

- Reduced Direct Rivalry: Competitors focusing on formal sector or unsecured lending do not directly challenge Five Star’s primary market.

Regulatory Scrutiny and Asset Quality Concerns

Increased regulatory scrutiny, particularly concerning asset quality in areas like unsecured personal loans and microfinance, is prompting Non-Banking Financial Companies (NBFCs) to adopt more stringent credit policies. This heightened caution across the sector could temper overall loan growth, influencing competitive dynamics. For instance, the Reserve Bank of India's (RBI) focus on risk management in the NBFC sector, highlighted by various circulars and guidelines throughout 2024, underscores this trend.

This environment fosters a more disciplined competitive landscape, where NBFCs prioritizing robust asset quality and compliance may gain an advantage. As of early 2024, reports indicated a tightening of lending standards by several large NBFCs, particularly for segments perceived as higher risk, reflecting a direct response to regulatory pressures and a desire to maintain financial stability amidst economic uncertainties.

- Regulatory Focus: The RBI has intensified its oversight of NBFCs, emphasizing capital adequacy and asset quality management.

- Credit Tightening: Concerns over non-performing assets (NPAs) in specific loan categories are leading NBFCs to revise their underwriting criteria.

- Impact on Growth: A more cautious lending approach may moderate the pace of loan disbursement across the industry.

- Competitive Shift: NBFCs with stronger risk management frameworks are better positioned to navigate this evolving regulatory landscape.

The competitive rivalry for Five Star Business Finance is shaped by the sheer volume of players in the Indian NBFC sector, exceeding 5,000 entities. However, Five Star's strategic focus on secured MSME loans, particularly those under INR 500,000 backed by residential property, significantly reduces direct confrontation with many competitors. This specialization in an underserved segment, coupled with a unique underwriting approach for the informal economy, allows Five Star to navigate the intense market dynamics by carving out a distinct and less contested niche.

SSubstitutes Threaten

Informal lending channels present a substantial threat to Five Star Business Finance, particularly for micro-entrepreneurs and small business owners. These informal lenders, often local individuals or community groups, offer quick access to capital with minimal paperwork, a stark contrast to the more structured application processes of formal financial institutions. This accessibility is a key draw for businesses that may struggle to meet the collateral or credit history requirements of traditional banks.

The appeal of informal lending is amplified by its speed and perceived flexibility. For many small business owners, especially those in the unorganized sector, the ability to secure funds rapidly for immediate operational needs or unexpected expenses outweighs the potential for higher interest rates. In 2024, it's estimated that a significant portion of micro and small enterprises still rely on these informal sources for a portion of their funding, highlighting the persistent demand for such services.

Government-backed loan schemes present a significant threat of substitutes for NBFCs like Five Star Business Finance. Programs such as the Pradhan Mantri Mudra Yojana (PMMY) and those facilitated by the Small Industries Development Bank of India (SIDBI) offer credit to Micro, Small, and Medium Enterprises (MSMEs) with potentially lower interest rates and more accessible terms. For instance, PMMY loans can go up to ₹10 lakh, often with minimal collateral requirements, making them an attractive alternative for small business owners.

These government initiatives are increasingly streamlined and digitized, enhancing their appeal and ease of access for potential borrowers. This increased digital footprint means that small businesses can often apply for and receive funds more quickly than through traditional NBFC channels, directly competing for the same customer base. The availability of subsidized credit can divert a substantial portion of the market that might have otherwise sought financing from private lenders.

While Five Star Business Finance specializes in secured loans, a significant threat comes from unsecured alternatives. Customers can turn to banks or other Non-Banking Financial Companies (NBFCs) for unsecured personal or business loans. These options, though often carrying higher interest rates and demanding stronger credit profiles, provide a crucial advantage: they bypass the need for collateral.

Despite the collateral-free appeal, the unsecured lending segment is currently facing considerable headwinds. Data from the Reserve Bank of India (RBI) indicated a rise in stress and delinquencies within unsecured personal loan portfolios across the financial sector in late 2023 and early 2024. This elevated risk profile could indirectly impact the market by potentially tightening credit availability or increasing the cost of capital for lenders in this space.

Digital Lending Platforms and Fintechs

New-age fintech players and digital lending platforms are increasingly offering rapid loan approvals and fully digital application processes. They often utilize alternative data sources for credit scoring, providing a compelling alternative to traditional lenders.

These platforms can serve as significant substitutes by offering faster, more convenient access to capital, especially for digitally inclined micro-entrepreneurs. For instance, by mid-2024, several leading Indian fintech lenders reported processing times of under 24 hours for small business loans, a stark contrast to traditional bank timelines.

- Faster Approvals: Fintechs can approve loans in hours, compared to days or weeks for traditional institutions.

- Online Convenience: Entire application and disbursement process is digital, removing the need for physical branches.

- Alternative Data: Use of transaction history, social media, and other data for credit assessment, expanding access.

- Reduced Collateral Reliance: Emphasis on cash flow and digital footprint can lessen the importance of physical collateral.

Self-Financing and Internal Accruals

Self-financing and internal accruals represent a significant threat of substitutes for companies like Five Star Business Finance. Many small businesses and micro-entrepreneurs, particularly in India, depend on their own generated funds or informal networks for capital. This approach bypasses the need for formal lending institutions altogether.

The perceived complexity and cost associated with traditional loans, even from specialized Non-Banking Financial Companies (NBFCs), can drive businesses towards these internal funding methods. For instance, a significant portion of India's MSME sector, which is a core target for Five Star Business Finance, often relies on personal savings and retained earnings. In 2023-24, informal credit sources were estimated to meet a substantial part of the working capital needs for many micro and small enterprises, highlighting this substitute's prevalence.

- Reliance on Internal Funds: Many small businesses prioritize using retained earnings and owner’s capital over external debt.

- Informal Networks: Family, friends, and community lending circles provide an alternative funding stream.

- Cost and Complexity Avoidance: Businesses may shun formal loans due to perceived high interest rates, lengthy application processes, or collateral requirements.

- Prevalence in MSME Sector: A large segment of India's Micro, Small, and Medium Enterprises (MSMEs) historically relies heavily on self-funding and informal credit.

The threat of substitutes for Five Star Business Finance is multifaceted, encompassing informal lenders, government schemes, unsecured lending, and fintech platforms. These alternatives often compete by offering faster processing, less stringent collateral requirements, or lower interest rates, directly impacting the customer base of traditional NBFCs.

Government-backed initiatives like the Pradhan Mantri Mudra Yojana (PMMY) provide a significant substitute by offering loans up to ₹10 lakh with favorable terms, diverting potential borrowers. Similarly, new-age fintech lenders are leveraging digital processes and alternative data to approve loans in under 24 hours by mid-2024, presenting a strong competitive alternative.

Even self-financing and internal accruals remain a substantial substitute, particularly within India's MSME sector, where many businesses prefer using retained earnings over formal borrowing due to perceived costs and complexities.

| Substitute Category | Key Features Attracting Borrowers | Competitive Advantage for Five Star Business Finance |

|---|---|---|

| Informal Lending | Speed, minimal paperwork | Trust, regulatory compliance, structured loan products |

| Government Schemes (e.g., PMMY) | Lower interest rates, accessible terms | Personalized service, faster disbursement for specific segments |

| Unsecured Lending | No collateral requirement | Secured lending offers lower risk and potentially better rates for the borrower |

| Fintech Platforms | Digital convenience, rapid approvals | Established physical presence, deeper understanding of local market needs |

| Self-Financing/Internal Accruals | No interest burden, full control | Scalability, access to larger capital amounts than internal accruals allow |

Entrants Threaten

The Reserve Bank of India's (RBI) Scale-Based Regulation (SBR) framework significantly raises the bar for new entrants in the non-banking financial company (NBFC) sector. This framework categorizes NBFCs into different layers, with each higher layer facing more rigorous regulatory oversight and capital demands. For instance, new players must initially meet a minimum Net Owned Funds (NOF) of ₹10 crore, a substantial hurdle that deters smaller or less capitalized entities.

Furthermore, the regulatory landscape is continuously evolving. New rules set to take effect from January 2025 will impose even stricter compliance requirements, particularly for Housing Finance Companies (HFCs) that accept public deposits. This dynamic regulatory environment, coupled with the need to adhere to increasingly stringent prudential norms, creates formidable entry barriers, effectively limiting the threat of new competitors.

Establishing a new Non-Banking Financial Company (NBFC), particularly one like Five Star Business Finance that specializes in secured lending, demands a considerable amount of capital. New entrants would need substantial financial backing to not only build a robust loan portfolio but also to ensure they have enough liquid assets to manage their operations effectively.

Securing this necessary capital is becoming increasingly difficult. In 2024, NBFCs are facing elevated borrowing costs, making it more expensive for them to raise funds. Furthermore, there's been a noticeable slowdown in bank lending to the NBFC sector, creating a tighter credit environment that could pose a significant hurdle for any new player attempting to enter the market.

Five Star Business Finance's core strength lies in its specialized underwriting for micro-entrepreneurs and small businesses in the informal sector, often relying on cash flow analysis instead of traditional documentation. This unique capability, honed over time, presents a substantial hurdle for potential new entrants seeking to penetrate this market segment.

Building the necessary expertise and robust risk management frameworks tailored to this underserved demographic requires significant investment in time and experience. For instance, in 2024, the microfinance sector in India, where Five Star operates, continued to see growth, with outstanding microloans reaching over INR 2.5 trillion, highlighting the demand but also the specialized nature of the lending. New players would need to demonstrate a similar depth of understanding and operational efficiency to compete effectively.

Established Distribution Network and Trust

Five Star Business Finance boasts a significant competitive advantage due to its established distribution network and the trust it has cultivated. The company operates through an extensive network of 748 branches, strategically located across 10 states. This deep physical presence is crucial for serving its target market in the informal economy, where accessibility and personal relationships are paramount.

Building this level of reach and earning customer confidence within the informal sector is a substantial undertaking, requiring significant time and capital investment. New entrants would find it exceptionally difficult and costly to replicate this established infrastructure and the inherent trust that Five Star has developed over time. This makes it a formidable barrier for potential competitors seeking to enter the market.

- Extensive Branch Network: 748 branches across 10 states as of recent reports.

- Target Market Focus: Deep penetration into the underserved informal economy.

- Barrier to Entry: High capital and time investment required to replicate distribution and trust.

Competition from Existing Players

The threat of new entrants into the non-banking financial company (NBFC) sector, particularly for businesses like Five Star Business Finance, is significantly shaped by the intense competition from established players. This existing competitive landscape, dominated by numerous well-entrenched NBFCs and banks, creates a formidable barrier for newcomers. These incumbents benefit from substantial brand recognition, deeply cultivated customer relationships, and highly optimized operational efficiencies honed over years of market presence.

To gain traction, new entrants would need to present compelling value propositions, either through highly differentiated financial products or by offering significantly more competitive pricing structures. This is crucial for drawing customers away from these entrenched competitors who already possess a strong market foothold and customer loyalty.

In 2024, the Indian NBFC sector continued to demonstrate robust growth, with total assets of NBFCs reaching approximately INR 45 trillion (USD 540 billion) by March 2024, according to Reserve Bank of India data. This growth, while indicative of opportunity, also highlights the sheer scale and influence of existing market participants. For instance, major banks and large NBFCs often leverage economies of scale to offer lower interest rates and faster processing times, making it challenging for new, smaller entities to compete on cost alone.

- Established Market Dominance: Major banks and large NBFCs hold significant market share, often exceeding 70% of the credit market, making it difficult for new entrants to capture substantial business.

- Brand Loyalty and Trust: Incumbents benefit from years of building trust and brand recognition, which are critical factors in financial services where customer confidence is paramount.

- Economies of Scale: Existing players can leverage their size to achieve lower operating costs per unit, enabling them to offer more competitive pricing on loans and other financial products.

- Regulatory Expertise: Long-standing institutions possess a deep understanding of regulatory frameworks, which can be a complex hurdle for new companies navigating compliance requirements.

The threat of new entrants for Five Star Business Finance is significantly mitigated by stringent regulatory hurdles and substantial capital requirements. The Reserve Bank of India's Scale-Based Regulation framework, with its escalating capital demands for higher-tier NBFCs, acts as a strong deterrent. For instance, new players must meet a minimum Net Owned Funds of ₹10 crore, a considerable barrier.

Furthermore, the specialized underwriting expertise required to serve micro-entrepreneurs and the informal sector, a core competency of Five Star, is difficult and time-consuming to replicate. Building trust and an extensive distribution network, like Five Star's 748 branches, demands significant investment and years of experience, making it challenging for newcomers to compete effectively.

The existing competitive landscape, dominated by large, established NBFCs and banks that benefit from economies of scale and brand loyalty, further limits the threat. In 2024, the total assets of NBFCs reached approximately INR 45 trillion, underscoring the scale of incumbents, who can often offer more competitive pricing and faster services, presenting a formidable challenge for any new entrant.

Porter's Five Forces Analysis Data Sources

Our Five Star Business Finance Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and regulatory filings from key players in the financial services sector.