Fiskars SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fiskars Bundle

Fiskars leverages its strong brand recognition and commitment to quality as key strengths, while navigating the challenge of intense competition in the home and garden sector. Understanding these dynamics is crucial for anyone looking to invest or strategize within this market.

Want the full story behind Fiskars' innovative product development and potential market expansion opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Fiskars Group’s strength lies in its robust brand portfolio, featuring globally recognized names like Fiskars, Gerber, Iittala, and Waterford. This diverse collection covers key consumer segments such as home, garden, and outdoor recreation, enabling broad market reach. The company's heritage, stretching back to 1649, underpins significant brand equity and consumer loyalty.

Fiskars boasts a substantial global reach, serving customers in over 100 countries. This expansive international presence is a key strength, reducing the company's vulnerability to economic downturns in any single region. For instance, in 2023, Europe and the Americas represented significant portions of their net sales, demonstrating this geographical diversification.

The company effectively leverages a multi-channel sales strategy. This includes traditional retail partnerships, a growing e-commerce presence, and direct-to-consumer (DTC) channels. Fiskars Group reported strong growth in its DTC segment, particularly through its owned retail locations and online platforms, which reached approximately 25% of net sales in 2023, indicating a successful shift towards direct customer engagement.

Fiskars Group's dedication to sustainability is a significant strength, underscored by its impressive EcoVadis Platinum rating in 2024 and a CDP A- rating for climate actions. This commitment resonates strongly with a growing consumer base prioritizing eco-friendly purchases.

Their core purpose, Pioneering design to make the everyday extraordinary, reflects a deep-seated focus on creating products that are not only beautiful but also purposeful and functional. This design philosophy serves as a key differentiator in a competitive marketplace.

Strategic Focus on Commercial Excellence and DTC Growth

Fiskars Group's strategic emphasis on commercial excellence and Direct-to-Consumer (DTC) growth is a significant strength. This dual focus is one of four key transformation levers, alongside expansion in the U.S. and China. The company's commitment to DTC is yielding tangible results, evidenced by a 9% increase in DTC sales during the first quarter of 2025. This direct engagement fosters stronger consumer connections and offers the potential for improved profit margins.

The effectiveness of this strategy is highlighted by specific performance metrics:

- DTC Sales Growth: A 9% increase in Q1 2025 demonstrates successful execution of the DTC strategy.

- Strategic Pillars: Commercial excellence and DTC are central to Fiskars' four key transformation levers.

- Consumer Relationships: The DTC focus allows for more direct and meaningful interactions with customers.

- Margin Potential: Direct sales channels often provide opportunities for higher profit margins compared to traditional wholesale.

Operational Efficiency and Cost Management Initiatives

Fiskars has been actively implementing organizational changes and productivity initiatives to boost operational efficiency and combat rising costs. These strategic moves have proven effective, even in tough market conditions, as evidenced by improvements in comparable EBIT. The company anticipates these changes will yield approximately EUR 10 million in annual cost savings, with a significant portion expected to be realized in 2025.

- Enhanced Productivity: Fiskars' focus on productivity initiatives is designed to streamline operations and reduce waste, directly contributing to a leaner cost structure.

- Cost Mitigation Success: The company has demonstrated a capacity to manage costs effectively, leading to improved comparable EBIT even when facing market headwinds.

- Future Cost Savings: Planned organizational changes are projected to deliver around EUR 10 million in annual cost savings, with the bulk of this benefit anticipated in 2025.

Fiskars' strong brand portfolio, including Fiskars, Gerber, Iittala, and Waterford, provides broad market appeal across home, garden, and outdoor sectors. The company's long heritage, dating back to 1649, builds significant brand loyalty and trust among consumers.

The company's global presence in over 100 countries mitigates risks from regional economic fluctuations, with Europe and the Americas being key markets in 2023. Fiskars' multi-channel sales approach, heavily emphasizing a growing DTC segment which reached about 25% of net sales in 2023, enhances customer engagement and potential margins.

Fiskars' commitment to sustainability, recognized with an EcoVadis Platinum rating in 2024 and a CDP A- rating, aligns with consumer preferences for eco-friendly products. Their core purpose, "Pioneering design to make the everyday extraordinary," differentiates them through functional and aesthetically pleasing products.

Strategic focus on commercial excellence and DTC growth is a key transformation lever, evidenced by a 9% increase in DTC sales in Q1 2025. Operational efficiency initiatives are projected to yield EUR 10 million in annual cost savings, with a substantial portion realized in 2025.

| Strength | Description | Supporting Data |

|---|---|---|

| Brand Portfolio | Globally recognized brands (Fiskars, Gerber, Iittala, Waterford) serving diverse consumer segments. | Heritage dating back to 1649. |

| Global Reach | Operations in over 100 countries, reducing regional economic dependence. | Europe and Americas represented significant net sales in 2023. |

| Multi-Channel Sales & DTC | Effective mix of retail, e-commerce, and direct-to-consumer channels. | DTC sales reached ~25% of net sales in 2023; 9% DTC sales growth in Q1 2025. |

| Sustainability & Design | Commitment to eco-friendly practices and purposeful product design. | EcoVadis Platinum rating (2024), CDP A- rating. Core purpose: "Pioneering design to make the everyday extraordinary." |

| Operational Efficiency | Focus on productivity and cost-saving initiatives. | Projected EUR 10 million in annual cost savings, with significant realization in 2025. |

What is included in the product

Delivers a strategic overview of Fiskars’s internal and external business factors, highlighting its strong brand recognition and innovation capabilities against market competition and evolving consumer trends.

Fiskars' SWOT analysis offers a clear roadmap by identifying weaknesses and threats, enabling the company to proactively address potential challenges and mitigate risks before they impact operations.

Weaknesses

Fiskars Group's substantial reliance on the U.S. market, accounting for around 30% of its total net sales, presents a significant weakness. This concentration is even more pronounced within its Fiskars Business Area, which draws approximately 50% of its revenue from the U.S.

Recent U.S. tariff announcements have already demonstrated the adverse effects of this market dependency. These tariffs, coupled with a sharp downturn in U.S. demand, directly impacted Fiskars' sales performance, leading to a profit warning in late 2023, underscoring the vulnerability associated with its U.S. market concentration.

Declining consumer confidence presents a significant weakness for Fiskars Group. This sentiment directly impacts purchasing power and willingness to spend on discretionary items, which are core to Fiskars' product categories like home and garden. For instance, in Q1 2025, Fiskars observed a 7% decrease in comparable net sales in China, a market highly sensitive to consumer sentiment shifts, highlighting the vulnerability of their sales performance to economic headwinds.

Fiskars has publicly stated that it will miss its 2021-2025 strategy period financial targets for comparable net sales growth and comparable EBIT margin. This indicates the company is facing headwinds that are making it difficult to achieve its ambitious growth and profitability objectives.

The inability to meet these specific financial goals, set for the period concluding in 2025, highlights potential underlying issues in execution or external market conditions that are proving more persistent than anticipated.

Negative Free Cash Flow in Early Quarters

Fiskars Group often sees negative free cash flow in the first quarter, a trend that continued into Q1 2025. While this figure improved year-over-year, the recurring seasonality can strain liquidity. This necessitates proactive cash flow management to navigate the early part of the year effectively.

The Q1 2025 results highlight this challenge, with the company needing to carefully plan its finances to offset the initial cash burn. This pattern is a known weakness that requires ongoing attention to ensure operational stability throughout the fiscal year.

- Negative Q1 Free Cash Flow: Fiskars Group's Q1 2025 results showed negative free cash flow, a recurring seasonal pattern.

- Year-over-Year Improvement: Despite the negative figure, Q1 2025's free cash flow was an improvement compared to the prior year.

- Liquidity Pressure: The early-year cash deficit can create pressure on the company's liquidity.

- Cash Flow Management: This weakness underscores the need for diligent cash flow planning and management throughout the year.

Gross Margin Pressure and Sourcing Costs

Fiskars experienced a dip in its gross margin during the first quarter of 2025, even with ongoing initiatives focused on commercial excellence. This decline suggests that internal efficiency gains are currently being outpaced by external cost pressures.

Looking ahead, the projected increase in U.S. tariffs poses a significant threat, particularly to products sourced from China. This will likely lead to higher procurement expenses, directly impacting the company's ability to maintain its current gross profit margins. For instance, if tariffs on key components rise by 10%, it could translate to a substantial increase in cost of goods sold.

While Fiskars is implementing strategies to counteract these rising costs, the full impact of these mitigation efforts is anticipated to be delayed. This means the company may face a period of reduced profitability before these measures can effectively offset the increased sourcing expenses.

- Gross Margin Decline: Q1 2025 saw a decrease in gross margin, indicating immediate cost pressures.

- Tariff Impact: Expected U.S. tariff increases on Chinese imports will directly raise sourcing costs.

- Delayed Mitigation: Strategies to offset rising costs are in place but will take time to show full benefits.

Fiskars Group's significant exposure to the U.S. market, representing about 30% of its net sales, is a key vulnerability. This concentration is even more pronounced in its Fiskars Business Area, where U.S. sales account for roughly 50% of revenue.

The company's inability to meet its 2021-2025 strategy period financial targets for comparable net sales growth and comparable EBIT margin highlights underlying execution challenges or more persistent external market conditions than initially anticipated.

Fiskars often reports negative free cash flow in the first quarter, a trend that continued into Q1 2025, necessitating careful liquidity management to navigate early-year operational needs.

A decline in gross margin observed in Q1 2025, despite ongoing commercial excellence initiatives, suggests that external cost pressures are currently outweighing internal efficiency gains, with projected U.S. tariff increases poised to further exacerbate this issue.

Preview the Actual Deliverable

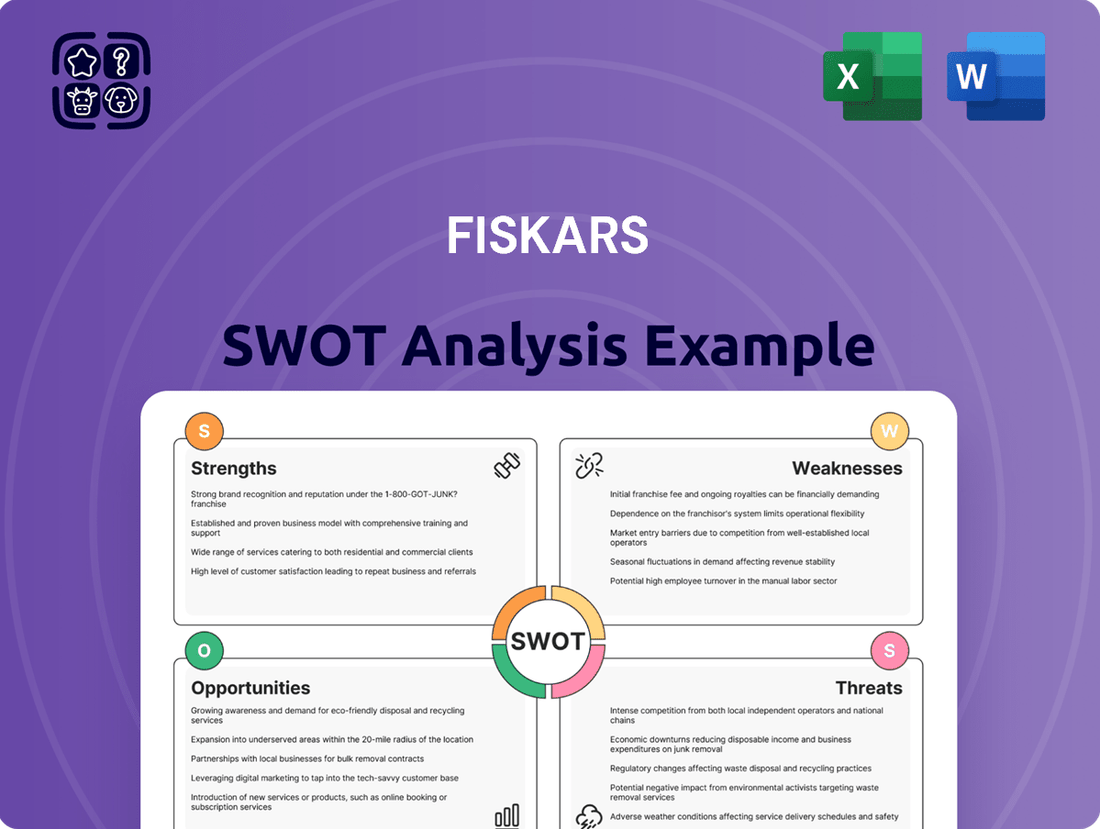

Fiskars SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This ensures transparency and allows you to assess the quality and depth of our Fiskars SWOT analysis before committing.

You are viewing a live preview of the actual SWOT analysis file for Fiskars. The complete version, offering a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase.

This is a real excerpt from the complete Fiskars SWOT analysis document. Once purchased, you’ll receive the full, editable version, providing you with all the insights needed for strategic planning.

Opportunities

Fiskars Group is actively pursuing direct-to-consumer (DTC) expansion, a strategic move that has already yielded promising results. In the first quarter of 2025, comparable DTC sales saw a healthy 9% increase, demonstrating the effectiveness of this approach.

By continuing to invest in its e-commerce platforms and physical retail stores, Fiskars can further solidify its brand presence and foster deeper customer relationships. This direct engagement not only enhances brand loyalty but also offers the potential for improved profit margins and invaluable insights into consumer preferences and behaviors.

Fiskars Group can capitalize on the significant anniversaries of several of its well-established brands, such as Fiskars itself, which has a rich history dating back to 1649. These milestones provide a prime opportunity for targeted marketing campaigns and special product releases throughout 2024 and 2025, aiming to reignite consumer interest and drive sales growth. For instance, a focused campaign around the Fiskars brand's 375th anniversary in 2024 could significantly boost brand visibility and recall.

The company's strategic commitment to investing in innovation, particularly within the core Fiskars business area, is set to fuel new product development. This focus is crucial for maintaining a competitive edge and capturing greater market share in the coming years. Fiskars Group's 2023 annual report highlighted continued investment in R&D, a trend expected to persist into 2024 and 2025, supporting the introduction of next-generation gardening tools and home products.

Fiskars Group is actively working to re-establish its sourcing base to create a more resilient supply chain, a strategic move prompted by ongoing tariff challenges. This initiative aims to optimize operations for the long haul.

By diversifying its sourcing locations, Fiskars can significantly lessen its dependence on any single region. This strategic shift is crucial for mitigating the potential impacts of fluctuating trade policies and broader geopolitical risks that could otherwise disrupt operations.

For instance, in 2023, global supply chain disruptions led to increased logistics costs for many companies, with some reporting rises of 10-20% in freight expenses. Fiskars' proactive diversification efforts in 2024 and 2025 are designed to preemptively address such cost escalations and ensure a steadier flow of goods.

Strategic Investments in Demand Creation and Marketing

Fiskars Group is strategically targeting growth in its Business Area Vita through significant investments in marketing and demand creation. For 2025, the company has earmarked approximately EUR 12 million for these initiatives. This focused spending aims to directly boost sales and enhance brand recognition.

These planned expenditures are expected to yield substantial returns by cultivating stronger consumer demand. By increasing brand visibility and engagement, Fiskars can solidify its market position and drive top-line revenue growth.

- Investment Focus: EUR 12 million allocated for marketing and demand creation in Business Area Vita for 2025.

- Objective: To drive top-line growth by increasing consumer demand.

- Benefit: Strengthening brand equity and market presence.

Operational Independence of Business Areas

Fiskars' strategic separation of its business areas, particularly the ongoing division from Vita, is designed to foster operational independence. This move aims to accelerate distinct growth trajectories and address varied investment requirements for each entity.

This decentralized structure is anticipated to enhance agility and the speed at which new initiatives can be implemented. By bringing each business closer to its respective consumer base, the company expects to unlock greater financial transparency and responsiveness.

For instance, the 2023 financial report indicated a strategic review was underway to optimize the group structure, with the intention of creating more focused business units. This operational independence is a key enabler for Fiskars to pursue its targeted growth strategies in its core segments.

- Accelerated Growth: Each business area can now pursue its unique growth opportunities without being constrained by the needs of other segments.

- Improved Agility: The decentralized structure allows for quicker decision-making and faster execution of strategies tailored to specific markets.

- Enhanced Consumer Focus: Operating more independently enables businesses to better understand and respond to the evolving needs of their target consumers.

- Financial Transparency: The separation can lead to clearer reporting of financial performance for each business unit, aiding in investor understanding and resource allocation.

Fiskars can leverage its strong brand heritage, with the Fiskars brand celebrating its 375th anniversary in 2024, to launch targeted marketing campaigns and special product editions throughout 2024 and 2025. The company's investment in innovation, particularly in its core business, is expected to drive new product development and market share gains, as evidenced by continued R&D spending highlighted in its 2023 annual report.

The strategic expansion into direct-to-consumer (DTC) channels is a significant opportunity, with comparable DTC sales already up 9% in Q1 2025, indicating strong growth potential. Furthermore, the company's focus on diversifying its sourcing base in 2024 and 2025 aims to mitigate risks associated with tariffs and geopolitical factors, potentially reducing logistics costs that saw a 10-20% increase for many companies in 2023.

Fiskars' dedicated investment of approximately EUR 12 million in marketing and demand creation for its Business Area Vita in 2025 presents a clear path to boosting sales and brand recognition. The ongoing strategic separation of business areas, including Vita, is designed to enhance agility and allow each segment to pursue tailored growth strategies, improving financial transparency and consumer focus.

Threats

New U.S. tariff announcements in early April 2025 have already impacted Fiskars Group, particularly due to its significant U.S. market exposure and reliance on sourcing from Asia. These tariffs directly increase the cost of goods, potentially squeezing profit margins or forcing price increases that could dampen consumer demand.

The indirect impacts on retailer demand and inventory behavior have materialized more rapidly and negatively than anticipated, posing an ongoing threat. Retailers, facing their own cost pressures and uncertainty, may reduce orders or hold less inventory, leading to slower sales for Fiskars.

The operating environment for Fiskars is anticipated to remain challenging through 2025, marked by limited market visibility and ongoing global economic uncertainties. This volatility directly affects consumer sentiment and demand across all its geographical segments, complicating forecasting and strategic planning.

For instance, persistent inflation and the potential for interest rate hikes in key markets like the US and Europe in 2024-2025 could dampen consumer spending on discretionary items, impacting Fiskars' sales volumes. The company's reliance on consumer spending means that economic downturns or unpredictable shifts in purchasing power pose a significant threat.

The consumer products sector is incredibly crowded, with new online-only brands constantly emerging, making it harder to capture consumer interest. This fierce rivalry can force established companies like Fiskars to lower prices and squeeze their profit margins, while also fighting to maintain their slice of the market.

Fluctuations in U.S. Dollar Exchange Rates

Fiskars Group’s financial performance is sensitive to fluctuations in the U.S. dollar exchange rate. While the company holds a net-buy position in U.S. dollars, which can be advantageous during periods of dollar weakening, it also faces translation risk impacting its Earnings Before Interest and Taxes (EBIT). This currency exposure represents a significant financial risk that management must actively monitor and manage.

For instance, in 2023, Fiskars reported that currency fluctuations had a notable impact on its results. A stronger U.S. dollar against the Euro, for example, would generally increase the reported value of U.S. dollar-denominated revenues and profits when translated back into Euros for reporting purposes. Conversely, a weaker dollar would have the opposite effect on reported earnings.

- Net-Buy Position: Fiskars benefits from a net-buy position in USD, potentially gaining from a weaker dollar in transactions.

- Translation Risk: A weakening U.S. dollar negatively impacts reported EBIT due to translation effects on foreign earnings.

- Financial Risk: Currency volatility introduces inherent financial risk that requires careful management.

Challenges with Specific Brands and Production Models

Fiskars faces challenges with specific brands, notably Waterford, which has seen weak performance, particularly in the United States. This underperformance directly impacted the Business Area Vita's comparable earnings before interest and taxes (EBIT). For instance, in the first half of 2024, Business Area Vita's comparable EBIT was SEK 12 million, a decrease from SEK 46 million in the same period of 2023, partly attributable to such brand-specific issues.

The production model for Waterford crystal presents a unique vulnerability. Scaling down crystal production efficiently when demand declines is inherently difficult. This inflexibility means that even with lower sales volumes, the costs associated with maintaining specialized production lines can remain high, creating a drag on profitability for this segment of Fiskars' diverse portfolio.

- Brand Underperformance: Waterford's weak sales in the U.S. negatively affected Business Area Vita's comparable EBIT in H1 2024.

- Production Inflexibility: Waterford's crystal manufacturing is hard to scale down, leading to higher fixed costs with declining volumes.

- Profitability Impact: The challenges with brands like Waterford and their production models can significantly reduce overall business area profitability.

New U.S. tariffs announced in April 2025 directly increase Fiskars' costs, especially given its reliance on Asian sourcing and significant U.S. market presence. These tariffs could force price hikes, potentially reducing consumer demand for Fiskars products.

The company faces intense competition from new online brands, which can pressure prices downward and erode profit margins. Furthermore, ongoing global economic uncertainties and potential interest rate hikes in key markets through 2025 could dampen consumer spending on discretionary items, impacting Fiskars' sales volumes.

Currency fluctuations, particularly involving the U.S. dollar, pose a financial risk. While Fiskars has a net-buy position in USD, which can offer benefits if the dollar weakens, translation risks can still affect reported earnings, as seen with impacts in 2023.

Specific brands like Waterford are underperforming, notably in the U.S., impacting business area profitability. For example, Business Area Vita's comparable EBIT dropped to SEK 12 million in H1 2024 from SEK 46 million in H1 2023, partly due to such issues. Waterford's specialized production also presents a challenge, as scaling down crystal manufacturing efficiently when demand falls is difficult, leading to high fixed costs.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, including Fiskars' official financial statements, comprehensive market research reports, and insights from industry experts, ensuring a well-rounded and accurate assessment.