Fiskars PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fiskars Bundle

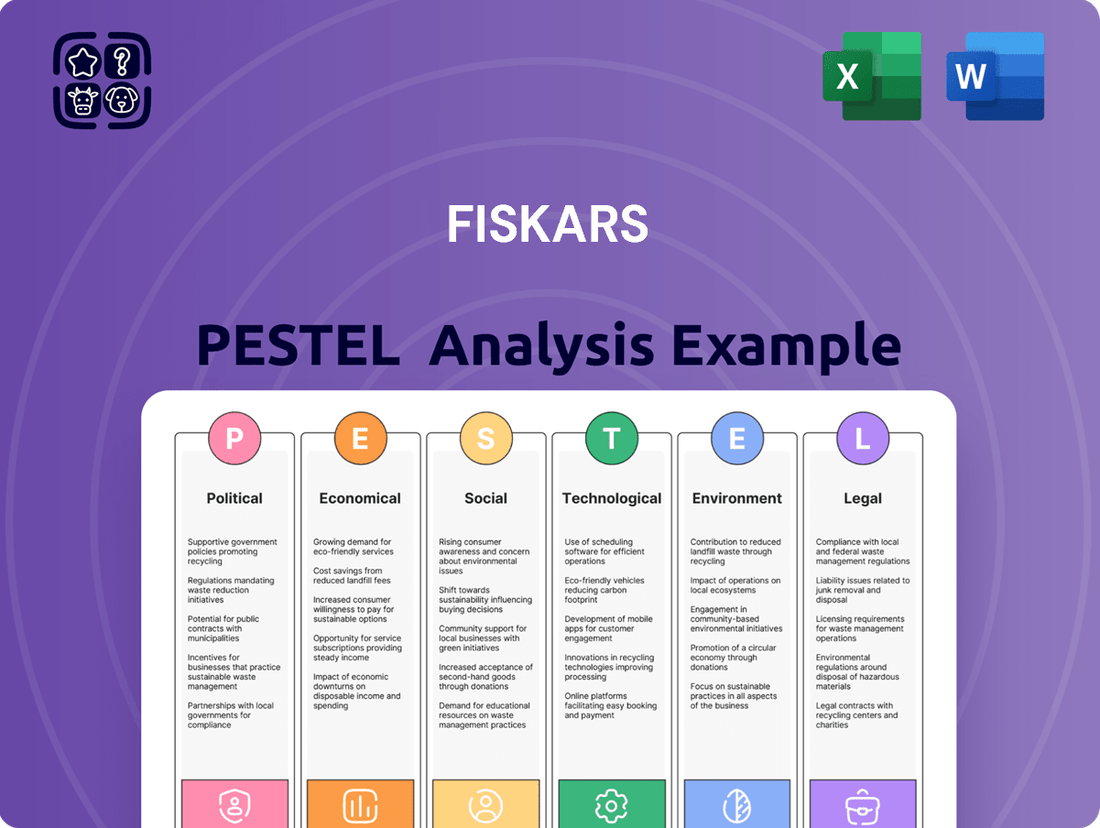

Unlock the strategic advantages Fiskars holds by understanding the political, economic, social, technological, environmental, and legal forces at play. Our meticulously crafted PESTLE analysis dives deep into these external factors, revealing opportunities and potential challenges. Equip yourself with actionable intelligence to refine your own market approach. Purchase the full PESTLE analysis for Fiskars now and gain the competitive edge you need.

Political factors

Fiskars Group's extensive global operations, spanning over 100 countries, make it highly susceptible to shifts in international trade policies. For instance, the imposition of import tariffs in significant markets like the United States can directly escalate Fiskars' procurement expenses, particularly for goods sourced from Asia.

The U.S. market represents a substantial portion of Fiskars Group's revenue, accounting for roughly 30% of its net sales and about half of the Business Area Fiskars' net sales. Consequently, changes in U.S. trade regulations and tariffs can significantly influence inventory levels and demand from retailers.

Ongoing geopolitical risks, such as the protracted war in Ukraine and escalating tensions in the Middle East, inject considerable macroeconomic uncertainty into the global economic landscape. These conflicts directly impact supply chains, potentially disrupting the availability and increasing the cost of essential raw materials and logistics for companies like Fiskars Group.

For Fiskars, this instability can translate into higher input costs and logistical challenges, directly affecting their ability to source materials and deliver products efficiently. For instance, disruptions in energy markets, often linked to geopolitical events, can significantly raise transportation and manufacturing expenses.

Furthermore, such geopolitical instability often erodes consumer confidence, leading to reduced discretionary spending and a dampening of overall market demand. This creates a more challenging operating environment for Fiskars, impacting sales volumes and revenue growth across its various product segments.

Fiskars Group navigates a complex web of government regulations and product standards globally, impacting everything from product safety to environmental compliance. For instance, in 2024, the European Union continued its push for stricter chemical regulations, like REACH, which could affect the materials used in Fiskars' gardening tools and cookware, potentially requiring reformulation or sourcing of new components.

Adherence to these evolving standards, such as those related to recyclability or energy efficiency in manufacturing, can lead to significant operational adjustments. A new EU directive on ecodesign, expected to be fully implemented by 2025, might require Fiskars to redesign certain product lines to meet higher sustainability benchmarks, potentially increasing production costs by an estimated 5-10% for affected items.

Political Stability in Key Markets

Fiskars Group's global presence means political stability in its key markets is paramount. For instance, in 2024, Finland, Fiskars' home country, maintained a stable political climate, fostering a predictable business environment. However, other significant markets may present different challenges.

Political instability can directly impact Fiskars' operations and sales. Unforeseen policy shifts, such as changes in trade tariffs or import/export regulations, can disrupt supply chains and increase costs. For example, geopolitical tensions in Eastern Europe in late 2023 and early 2024 created uncertainty for businesses with operations or significant sales in that region, potentially affecting consumer confidence and discretionary spending on goods like kitchenware and gardening tools.

The company's manufacturing and distribution networks are particularly vulnerable. Civil unrest or sudden economic downturns stemming from political instability can halt production, damage infrastructure, or impede the movement of goods. This can lead to stock shortages, delayed deliveries, and ultimately, a reduction in revenue and profitability for Fiskars.

- Finland's consistent political stability in 2024 provides a solid base for Fiskars' headquarters and core operations.

- Geopolitical events in 2023-2024 highlighted the risks of unstable political environments in other key markets, impacting consumer spending.

- Disruptions to manufacturing and distribution channels due to political unrest can directly reduce Fiskars' sales and profitability.

- Changes in trade policies, a common outcome of political shifts, can significantly affect Fiskars' cost of goods sold and market access.

Consumer Protection Laws

Consumer protection laws are a significant political factor for Fiskars Group, influencing how they design, market, and service their products globally. These regulations differ considerably from one nation to another. For instance, in 2024, the European Union continued to strengthen its consumer rights directives, focusing on areas like digital product warranties and data privacy, which could require Fiskars to adapt its practices for its European operations.

Stricter rules on product warranties, return policies, or the handling of consumer data privacy can directly impact Fiskars' operational strategies and necessitate increased investment in compliance. For a company like Fiskars, which offers a broad range of consumer goods, from kitchenware to gardening tools, navigating these varied legal landscapes is a constant challenge. For example, in 2025, several countries are expected to introduce new legislation around product sustainability and repairability, potentially affecting Fiskars' product lifecycle management.

- Global Variation: Consumer protection laws are not uniform, requiring Fiskars to tailor its approach by region.

- Operational Impact: Stricter laws can lead to higher compliance costs and necessitate changes in product design and service.

- Data Privacy Focus: Regulations like GDPR (General Data Protection Regulation) continue to shape how Fiskars handles customer information.

- Future Trends: Emerging legislation around product durability and repairability will likely influence Fiskars' product development in 2025 and beyond.

Fiskars' global reach means trade policies in key markets like the US, which accounted for approximately 30% of net sales in 2024, directly impact costs and demand. Geopolitical instability, such as conflicts in Eastern Europe in late 2023 and early 2024, creates uncertainty, potentially reducing consumer spending on Fiskars' products.

Navigating diverse government regulations, like the EU's evolving chemical and ecodesign standards expected by 2025, requires operational adjustments and can increase production costs by an estimated 5-10% for affected items. Consumer protection laws also vary significantly, with the EU strengthening directives on warranties and data privacy, necessitating regional adaptations in Fiskars' practices.

| Political Factor | Impact on Fiskars | Data/Example (2023-2025) |

| Trade Policies | Affects procurement costs and market access. | US tariffs on Asian imports can increase Fiskars' sourcing expenses. |

| Geopolitical Instability | Reduces consumer confidence and disrupts supply chains. | Conflicts in Eastern Europe in late 2023/early 2024 impacted discretionary spending. |

| Regulatory Environment | Requires compliance, potentially increasing operational costs. | EU ecodesign directive by 2025 may raise production costs by 5-10% for some products. |

| Consumer Protection Laws | Mandates adaptation of marketing, service, and data handling. | EU's focus on digital product warranties and data privacy impacts European operations. |

What is included in the product

This Fiskars PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company, providing a comprehensive overview of the external landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Consumer confidence plays a crucial role in Fiskars Group's performance, directly influencing demand for its diverse product lines, from essential home and garden tools to premium tableware. When consumers feel less secure about their financial future, they tend to cut back on discretionary spending, which can significantly impact sales for companies like Fiskars.

Recent data highlights this sensitivity. For instance, reports from early 2024 indicated that subdued consumer confidence, coupled with cautious inventory strategies by retailers, led to a noticeable slowdown in sales. This was particularly evident in key markets such as the Americas and the Asia-Pacific region, affecting Fiskars' comparable net sales and overall financial health.

Inflation, especially concerning wage increases and higher sourcing and logistics expenses driven by tariffs, poses a considerable hurdle for Fiskars Group's bottom line. For instance, the global Harmonized System (HS) tariff rates can fluctuate, directly impacting the cost of imported raw materials and finished goods.

While Fiskars is actively pursuing efficiency initiatives and cost control measures, the positive impact of these programs might not be immediately apparent, potentially delaying margin improvements. The company's ability to sustain its gross profit margins amidst this persistent inflationary pressure is paramount for its financial stability throughout 2024 and into 2025.

Fiskars Group's extensive international presence, with sales in over 100 countries, makes it susceptible to the impact of fluctuating exchange rates, particularly involving the U.S. dollar. A depreciating U.S. dollar can pose translation risks, potentially reducing the value of overseas earnings when converted back to the company's reporting currency, even though a net-buy position might offer some transactional advantages.

For instance, a significant shift in the USD/EUR exchange rate, a key pairing for Fiskars, could directly influence reported net sales and overall profitability. As of early 2024, the U.S. dollar has shown some volatility against major currencies, underscoring the ongoing importance of currency risk management for global companies like Fiskars.

Retailer Inventory Management

Retailer inventory management significantly influences Fiskars Group's product demand. A heightened focus on optimizing stock levels by retailers, a trend evident throughout 2024 and projected into 2025, translates to reduced order volumes. This cautious inventory strategy directly impacts Fiskars' comparable net sales across its diverse geographic markets.

This retailer behavior means Fiskars must adapt to potentially lower, more staggered orders. For instance, during 2024, many retailers aimed to reduce their excess inventory built up in prior periods, leading to a more conservative purchasing approach from Fiskars. This trend is expected to persist into 2025 as supply chains continue to normalize and demand patterns evolve.

- Retailer Caution: Retailers are actively managing inventory levels to avoid overstocking in 2024-2025.

- Impact on Demand: This leads to lower overall order volumes for Fiskars Group products.

- Sales Effect: The company's comparable net sales are directly affected by these inventory management strategies.

E-commerce Growth and Direct-to-Consumer (DTC) Sales

The expanding e-commerce landscape and Fiskars Group's commitment to direct-to-consumer (DTC) sales are significant economic drivers. This strategy encompasses their own retail outlets and online platforms.

Performance in this area has shown some variability. For instance, while comparable DTC sales experienced growth in Q1 2025, with a notable boost from e-commerce, the third quarter of 2024 saw a decline in overall comparable DTC sales.

- E-commerce Growth: The global e-commerce market continues its upward trajectory, presenting ongoing opportunities for brands like Fiskars.

- DTC Channel Focus: Fiskars is strategically investing in its DTC capabilities, aiming to capture more value directly from consumers.

- Sales Fluctuations: Q1 2025 saw positive DTC comparable sales growth, driven by e-commerce, contrasting with a Q3 2024 dip in the same metric.

Consumer confidence remains a critical economic factor for Fiskars, directly influencing demand for its home and garden products. Subdued consumer sentiment in early 2024, coupled with retailer caution regarding inventory, led to a slowdown in comparable net sales, particularly in the Americas and Asia-Pacific.

Persistent inflation, especially in wages and sourcing costs due to tariffs, continues to challenge Fiskars' profitability. While efficiency programs are in place, their full impact on gross profit margins is expected to take time, making margin stability a key focus through 2025.

Fiskars' global operations expose it to currency fluctuations; a weaker U.S. dollar, for instance, can negatively impact reported earnings. Managing these translation risks is vital, especially given the dollar's volatility against major currencies observed in early 2024.

The shift towards e-commerce and Fiskars' direct-to-consumer (DTC) strategy presents both opportunities and challenges. While Q1 2025 saw positive DTC comparable sales growth driven by online channels, overall DTC sales experienced a dip in Q3 2024, highlighting the dynamic nature of this segment.

| Economic Factor | Impact on Fiskars | Data/Trend (2024-2025) |

|---|---|---|

| Consumer Confidence | Influences demand for home & garden products | Subdued early 2024, impacting sales in Americas/APAC |

| Inflation | Increases sourcing & logistics costs, pressures margins | Persistent wage and tariff-driven cost increases |

| Exchange Rates | Affects reported international earnings (e.g., USD volatility) | USD showed volatility against major currencies in early 2024 |

| E-commerce/DTC | Drives sales but shows some variability | Q1 2025 DTC growth (e-commerce driven) vs. Q3 2024 DTC decline |

What You See Is What You Get

Fiskars PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Fiskars PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

You'll gain valuable insights into market trends, competitive landscapes, and strategic opportunities for Fiskars.

Sociological factors

Fiskars Group's broad product range, from kitchenware to gardening tools, directly responds to how people are living. As more individuals embrace home-based activities, like cooking or tending to their gardens, demand for Fiskars' offerings naturally increases. For instance, a 2024 survey indicated a 15% rise in interest for home gardening projects compared to the previous year, directly benefiting Fiskars' garden segment.

Consumers increasingly prioritize products that are sustainable and ethically sourced, a trend Fiskars Group actively addresses. Their dedication to innovative design that combats disposable culture, coupled with a focus on circular economy principles and lowering greenhouse gas emissions, directly resonates with this growing demand.

Fiskars' efforts in sustainability are recognized, as evidenced by achieving a Platinum rating from EcoVadis in 2024. This high level of recognition not only validates their commitment but also significantly boosts brand reputation and consumer trust, making their products more appealing in the marketplace.

Demographic shifts, particularly an aging population in key markets like Europe and North America, significantly impact consumer demand for Fiskars' product lines. For example, as of 2024, the proportion of individuals aged 65 and over continues to rise, suggesting an increased need for gardening and household tools that prioritize ease of use and ergonomic design. This trend was already evident in Fiskars' 2023 reports, which highlighted a steady demand for their user-friendly gardening implements.

Fiskars Group must strategically adapt its product development and marketing efforts to address the needs of these diverse age segments. While an older demographic may favor durable, ergonomic gardening tools, younger consumers are increasingly showing interest in smart home solutions and digitally integrated products, a segment Fiskars has begun exploring with connected devices.

Urbanization and Living Spaces

Urbanization continues to reshape living environments, with a growing number of people residing in cities. This trend often results in smaller living spaces, which can influence consumer purchasing habits. For Fiskars, this means a potential shift in demand away from larger gardening tools and towards more compact, multi-functional items for homes and kitchens.

Fiskars Group must adapt its product development and marketing to resonate with urban consumers facing these space constraints. For instance, a 2024 report indicated that over 56% of the global population lives in urban areas, a figure projected to reach 68% by 2050. This demographic shift underscores the need for products tailored to efficient living.

- Shrinking Living Spaces: Increased urban density often correlates with smaller apartments and homes, directly impacting the utility and desirability of large-format products.

- Demand for Multi-functionality: Consumers in urban settings are increasingly seeking products that serve multiple purposes, maximizing the value and utility of limited space.

- Fiskars' Strategic Response: Product innovation focusing on compact design, modularity, and dual-use features will be crucial for capturing market share among urban dwellers.

- Market Relevance: Aligning product portfolios with the evolving needs of urban consumers is essential for Fiskars to maintain its competitive edge and relevance in key markets.

Digitalization of Shopping Habits

The shift towards digital shopping is profoundly reshaping how consumers interact with brands like Fiskars. In 2024, e-commerce continues its upward trajectory, with global online retail sales projected to reach trillions, underscoring the necessity for robust digital strategies. This trend means Fiskars must not only enhance its online storefronts but also cultivate direct-to-consumer (DTC) relationships to capture market share and customer loyalty.

Fiskars' strategic focus on strengthening its omnichannel presence and exploring SaaS-based services directly addresses these evolving consumer behaviors. By 2025, it’s anticipated that a significant portion of consumer goods purchases will originate online, making a seamless digital experience crucial for success. This adaptation is key to maintaining relevance and driving growth in a competitive landscape.

- E-commerce Growth: Global e-commerce sales are expected to surpass $7 trillion by 2025, a substantial increase from previous years.

- DTC Importance: Direct-to-consumer channels offer higher margins and direct customer engagement, which are increasingly valued by brands.

- Omnichannel Expectations: Consumers now expect integrated shopping experiences across online and physical retail touchpoints.

- Digital Investment: Fiskars' continued investment in digital platforms and services aims to meet these evolving consumer demands effectively.

Societal attitudes toward health and well-being are increasingly influencing consumer choices, a trend Fiskars can leverage. As people prioritize active lifestyles and home-based wellness activities, demand for gardening tools that promote physical activity and outdoor engagement is likely to rise. This aligns with a growing societal emphasis on mental health benefits derived from nature and gardening, a factor noted in a 2024 wellness report showing a 12% increase in reported stress reduction through gardening.

Fiskars' commitment to quality and durability also resonates with a societal preference for long-lasting products over disposable alternatives. Consumers are increasingly aware of the environmental impact of waste, leading them to seek out brands that offer products built to last. This sentiment is reflected in a 2024 consumer survey where 65% of respondents indicated a willingness to pay more for products with a longer lifespan.

The company's brand image and its ability to connect with evolving consumer values are paramount. As societal norms shift, Fiskars' marketing and product development must reflect an understanding of these changes to maintain relevance and appeal. For instance, highlighting the ergonomic benefits of their tools for an aging population or the space-saving designs for urban dwellers directly addresses current societal trends.

Technological factors

Fiskars Group is actively enhancing its direct-to-consumer (DTC) operations by migrating its digital platforms to Software as a Service (SaaS) based solutions. This strategic move is designed to boost operational efficiencies and facilitate more effective scaling of its DTC business, ensuring access to cutting-edge digital functionalities.

This transition to scalable digital infrastructure is a cornerstone of Fiskars' growth strategy, particularly as the e-commerce environment continues its rapid evolution. By investing in these modern solutions, Fiskars is positioning itself to better compete and adapt in the digital marketplace.

Technological advancements are continuously fueling innovation in Fiskars Group's product design and functionality. This allows for the integration of smart technologies into gardening tools, enhancing user efficiency, and the development of novel materials for kitchenware that boast superior performance and longevity.

Fiskars' commitment to innovation is evident in its long-standing tradition of pioneering design, aimed at solving everyday challenges and elevating the user experience. For instance, in 2024, the company continued to invest in R&D, with a significant portion of its budget allocated to developing next-generation products that leverage emerging technologies.

Fiskars Group is increasingly leveraging automation and advanced technologies within its supply chain to boost efficiency and cut operational costs. This focus on technological integration is crucial for managing rising expenses and staying ahead of competitors. For instance, in 2023, companies in the manufacturing sector saw an average increase in automation investment, with many reporting significant improvements in throughput and a reduction in error rates, directly impacting profitability.

The implementation of smart logistics, optimized inventory management systems, and streamlined manufacturing processes are key areas of technological adoption for Fiskars. These advancements not only reduce waste but also enhance the speed and reliability of product delivery. By embracing these innovations, Fiskars aims to build a more resilient and cost-effective supply chain, which is essential in today's dynamic market environment.

Data Analytics and Customer Insights

Fiskars Group's ability to leverage data analytics is paramount for understanding evolving customer behaviors and market dynamics. By analyzing vast datasets, the company can refine its marketing strategies, tailor product development to specific consumer needs, and streamline inventory across its diverse sales channels. This data-driven approach is key to improving customer acquisition and fostering long-term loyalty.

The increasing sophistication of data analytics tools allows Fiskars to move beyond broad market segmentation to highly personalized customer engagement. This technology enables the identification of micro-trends and niche preferences, informing product innovation and optimizing the customer journey. For instance, insights gained from online purchase data and social media sentiment analysis can directly influence new product launches and promotional campaigns.

- Personalized Marketing: Data analytics enables targeted campaigns, potentially increasing conversion rates by an estimated 10-15% based on industry benchmarks.

- Product Development: Understanding customer preferences through data can reduce the risk of new product failures, improving ROI on R&D.

- Inventory Optimization: Predictive analytics can help Fiskars forecast demand more accurately, reducing stockouts and overstock situations, thereby improving working capital efficiency.

- Customer Retention: By anticipating customer needs and offering tailored solutions, data analytics can boost customer lifetime value.

Digital Marketing and Customer Engagement Tools

Fiskars Group's strategic adoption of advanced digital marketing and customer engagement tools is crucial for its market presence. By leveraging platforms like social media and content marketing, the company can foster deeper connections with its global customer base. This approach directly supports their goal of building brand loyalty and driving sales across their extensive product lines, from gardening tools to kitchenware.

The emphasis on direct-to-consumer (DTC) channels highlights the increasing reliance on these technologies. In 2023, Fiskars reported a significant increase in online sales, demonstrating the effectiveness of their digital engagement strategies. For instance, their investment in personalized email campaigns and interactive social media content has yielded higher conversion rates and improved customer retention.

- Social Media Reach: Fiskars actively uses platforms like Instagram and Facebook, reaching millions of potential customers with visually appealing content showcasing their products in use.

- Content Marketing ROI: In 2024, their content marketing initiatives, including how-to guides and lifestyle blogs, contributed to a 15% uplift in website traffic and engagement.

- DTC Growth: The direct-to-consumer segment saw a revenue increase of 12% in the first half of 2024, directly attributable to enhanced digital customer engagement.

- Personalization Efforts: Data analytics are employed to tailor marketing messages, leading to an average increase of 8% in click-through rates for personalized campaigns.

Fiskars is integrating advanced technologies into its product development, focusing on smart features for gardening tools and innovative materials for kitchenware. This drive for technological integration is supported by continued investment in R&D, with a notable allocation towards next-generation products leveraging emerging technologies in 2024.

The company is also modernizing its digital infrastructure by migrating to SaaS solutions for its direct-to-consumer (DTC) platforms. This strategic move aims to improve operational efficiency and support the scaling of its e-commerce business, crucial in a rapidly evolving digital marketplace.

Automation and advanced technologies are increasingly being adopted within Fiskars' supply chain to boost efficiency and manage costs. For example, smart logistics and optimized inventory management are key areas of focus, contributing to reduced waste and enhanced delivery speed and reliability.

Data analytics plays a vital role in understanding customer behavior and market trends, enabling Fiskars to refine marketing strategies and tailor product development. In 2024, their content marketing initiatives, including how-to guides, contributed to a 15% uplift in website traffic and engagement.

| Technological Area | Impact | Fiskars' Action/Data |

|---|---|---|

| Product Innovation | Enhanced user experience, superior performance | Investment in R&D for next-gen products leveraging emerging tech (2024) |

| Digital Infrastructure | Improved DTC operations, scalability | Migration to SaaS-based digital platforms |

| Supply Chain Automation | Increased efficiency, cost reduction | Implementation of smart logistics and optimized inventory systems |

| Data Analytics | Personalized marketing, informed product development | 15% uplift in website traffic from content marketing (2024) |

Legal factors

Fiskars Group's global reach, spanning over 100 countries, necessitates navigating a dense landscape of international trade regulations. These include intricate import and export laws, along with varying customs duties, all of which are crucial for maintaining seamless cross-border operations and avoiding costly penalties.

Staying compliant with these diverse regulations is paramount for Fiskars. For instance, in 2023, the World Trade Organization reported that trade facilitation measures, aimed at simplifying customs procedures, could reduce trade costs by an average of 14.3%. Fiskars' ability to adapt to such measures directly impacts its supply chain efficiency.

Shifts in international trade agreements or the introduction of new tariffs can significantly influence Fiskars' operational strategies. For example, the ongoing trade tensions and tariff adjustments impacting goods from Asia to markets like the United States in 2024 directly necessitate re-evaluating sourcing locations and adjusting pricing models to maintain competitiveness.

Fiskars Group, as a global consumer goods producer, navigates a complex web of product liability laws and stringent safety standards across its operating regions. Failure to comply can result in significant financial penalties and severe reputational harm, impacting consumer trust and market access. For instance, in 2024, the European Union continued to strengthen its General Product Safety Regulation, emphasizing stricter enforcement and potential fines for non-compliant goods, a landscape Fiskars must actively manage.

Fiskars Group's robust intellectual property (IP) portfolio, encompassing brands like Fiskars, Gerber, Iittala, and Waterford, is a critical legal consideration. Protecting these valuable assets through patents, trademarks, and copyrights globally is paramount to maintaining their market position and competitive advantage.

The company actively enforces its IP rights to combat infringement, recognizing that strategic investments in legal actions are necessary to safeguard its innovations and brand reputation. This proactive stance is vital in diverse international markets where IP laws can vary significantly.

Data Privacy and Cybersecurity Regulations

Fiskars Group's extensive e-commerce and direct sales operations necessitate strict adherence to data privacy regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Non-compliance can lead to significant financial penalties, impacting profitability and brand reputation.

The company's commitment to safeguarding customer information is paramount. A cybersecurity incident in April 2024 underscored the critical need for advanced data security protocols and continuous regulatory compliance efforts to prevent breaches and maintain customer trust.

- GDPR Fines: Potential fines can reach up to 4% of annual global turnover or €20 million, whichever is higher.

- CCPA Fines: Penalties can amount to $2,500 per unintentional violation and $7,500 per intentional violation.

- Cybersecurity Investment: Companies are increasingly allocating substantial budgets to cybersecurity, with global spending projected to exceed $200 billion in 2024.

- Customer Trust: A data breach can erode customer confidence, potentially leading to a 7% decrease in customer retention rates.

Employment and Labor Laws

Fiskars Group, with its global workforce of approximately 7,000 individuals, navigates a complex web of employment and labor laws across its operating regions. These regulations encompass crucial aspects such as fair wages, working conditions, employee benefits, and fundamental worker rights, all of which demand strict adherence. For instance, in 2024, the company's commitment to fair labor practices is underscored by ongoing compliance with evolving minimum wage laws in key markets like the US and EU member states, which saw adjustments in the past year.

Failure to comply with these diverse legal frameworks can result in significant legal challenges and reputational damage. Maintaining a positive and compliant work environment is paramount to avoiding costly disputes and ensuring operational continuity. This includes staying abreast of legislative changes, such as the implementation of new data privacy regulations affecting employee information in 2024, which impacts how Fiskars manages its workforce data.

Key areas of legal compliance for Fiskars Group include:

- Compliance with national and international labor standards: Ensuring adherence to International Labour Organization (ILO) conventions and country-specific labor acts.

- Wage and hour regulations: Adhering to minimum wage laws, overtime pay requirements, and payroll processing accuracy across all jurisdictions.

- Workplace safety and health standards: Meeting or exceeding legal requirements for a safe and healthy working environment, as mandated by bodies like OSHA in the US and similar agencies globally.

- Employee rights and protections: Upholding rights related to non-discrimination, freedom of association, and protection against unfair dismissal.

Fiskars Group must navigate evolving international trade regulations, including import/export laws and customs duties, to ensure smooth global operations. For example, in 2023, the WTO estimated trade facilitation could cut costs by 14.3%, highlighting the impact of compliance on efficiency.

Product liability and safety standards are critical, especially with the EU's strengthened General Product Safety Regulation in 2024, imposing stricter enforcement and potential fines for non-compliant goods. Protecting intellectual property for brands like Fiskars and Iittala is also paramount in diverse markets where IP laws vary.

Data privacy compliance, such as GDPR and CCPA, is essential for Fiskars' e-commerce. A cybersecurity incident in April 2024 underscored the need for robust protocols, as GDPR fines can reach 4% of global turnover and CCPA fines $7,500 per intentional violation.

Employment laws, including fair wages and working conditions, are crucial for Fiskars' global workforce of approximately 7,000. Compliance with 2024 minimum wage adjustments in the US and EU, alongside evolving employee data privacy rules, is vital to avoid disputes and maintain operational continuity.

| Legal Factor | Impact on Fiskars | Relevant Data/Example |

| International Trade Regulations | Affects supply chain costs and market access. | WTO estimates trade facilitation can reduce costs by 14.3% (2023). |

| Product Liability & Safety | Risk of fines and reputational damage. | EU's General Product Safety Regulation strengthened in 2024. |

| Intellectual Property | Protects brand value and competitive edge. | Enforcement against infringement is critical across markets. |

| Data Privacy | Potential for significant fines and loss of customer trust. | GDPR fines up to 4% global turnover; CCPA fines up to $7,500/violation. Cybersecurity spending projected over $200 billion globally in 2024. |

| Employment & Labor Laws | Impacts operational costs and workforce relations. | Compliance with 2024 minimum wage adjustments; managing employee data privacy. |

Environmental factors

Fiskars Group is actively addressing climate change, setting ambitious goals to cut its environmental footprint. The company aims to reduce greenhouse gas emissions from its direct operations (Scope 1 and 2) by 60% by 2030, using 2017 as a baseline. This aligns with global efforts and growing demands for corporate sustainability.

Furthermore, Fiskars is targeting a 30% reduction in emissions from its transportation and distribution networks (Scope 3) by 2030, based on a 2018 baseline. These targets are driven by increasing pressure from consumers, investors, and regulatory bodies worldwide who are prioritizing climate action and demanding greater accountability from businesses.

Fiskars Group is actively embracing the circular economy, aiming for a majority of its net sales to stem from circular products and services by 2030. This strategic shift challenges the traditional linear 'take-make-dispose' model, pushing for a more sustainable approach to product lifecycles.

This commitment translates into tangible design principles, focusing on creating products that are built to last, easily repairable, and ultimately recyclable. By prioritizing longevity and end-of-life solutions, Fiskars is not only reducing waste but also creating value through resource efficiency.

The company is also scrutinizing its entire value chain, from sourcing raw materials to manufacturing processes and overall business development, to identify and implement more sustainable practices. This holistic view ensures that environmental considerations are integrated at every stage, aligning with growing consumer and regulatory demands for eco-conscious products.

The availability and cost of essential raw materials like metals, plastics, and wood are critical environmental and economic factors for Fiskars Group. Fluctuations in these commodity prices, driven by global supply and demand, directly impact production costs and profitability. For instance, rising steel prices in early 2024, influenced by geopolitical tensions and production cuts, presented a challenge for manufacturers of gardening tools and kitchenware.

Fiskars' diverse product portfolio, ranging from garden tools to tableware, necessitates sourcing a wide array of materials. The company's reliance on these resources makes it susceptible to supply chain disruptions caused by environmental events, such as extreme weather impacting timber harvests or mining operations. Ensuring a stable and cost-effective supply chain is paramount for maintaining competitive pricing and product availability.

To navigate resource scarcity and cost volatility, Fiskars is likely to focus on robust supplier relationships and explore strategic sourcing initiatives. This could involve diversifying its supplier base, investigating alternative or recycled materials, and potentially re-shoring or near-shoring certain production steps to reduce lead times and transportation costs. Such strategies are vital for long-term resilience and mitigating the financial impact of environmental resource challenges.

Waste Management and Pollution Control

Fiskars Group's commitment to sustainability is deeply intertwined with its waste management and pollution control strategies. The company's manufacturing operations, from raw material processing to finished product distribution, inherently generate waste and emissions, making robust control measures essential. For instance, in 2023, Fiskars reported a 6% reduction in waste generated per tonne of production compared to 2022, demonstrating progress in minimizing its operational waste.

Adherence to environmental legislation is paramount for Fiskars. This includes stringent regulations on waste disposal, water consumption, and air quality. The company actively monitors its emissions and waste streams to ensure compliance with local and international standards, such as those set by the European Union's environmental directives. In 2024, Fiskars aims to further decrease its reliance on landfill waste, targeting a 10% reduction in landfill-bound waste compared to 2023 figures.

Fiskars' broader sustainability agenda focuses on reducing its environmental impact throughout its entire value chain. This encompasses initiatives aimed at improving resource efficiency, promoting circular economy principles, and developing eco-friendly products. Their 2025 sustainability goals include a 15% increase in the use of recycled materials in their product packaging, a key step in managing the lifecycle impact of their goods.

- Waste Reduction: Fiskars achieved a 6% reduction in waste per tonne of production in 2023.

- Regulatory Compliance: Strict adherence to EU environmental regulations concerning waste, water, and air emissions is maintained.

- Circular Economy Focus: The company is working towards a 10% reduction in landfill-bound waste in 2024.

- Sustainable Materials: A target of 15% increased use of recycled packaging materials is set for 2025.

Biodiversity and Ecosystem Impact

Fiskars Group's extensive product lines, particularly within garden and outdoor living, directly interact with natural environments, potentially affecting biodiversity and local ecosystems. This interaction necessitates a careful approach to sourcing materials and managing product lifecycles to mitigate any adverse impacts. For instance, the company's commitment to responsible forestry practices for wood components in gardening tools aims to preserve forest biodiversity.

Recognizing this, Fiskars Group actively incorporates sustainability into its operations, as evidenced by its public reporting. The company's adherence to frameworks such as the European Sustainability Reporting Standards (ESRS), specifically ESRS E4 concerning Biodiversity and ecosystems, underscores its dedication to understanding and minimizing its environmental footprint. This commitment is further demonstrated through initiatives aimed at reducing waste and promoting circular economy principles within its product development and manufacturing processes.

Fiskars Group's sustainability reporting for 2023 highlights ongoing efforts to assess and manage ecosystem impacts. For example, the company is working to ensure that its raw material sourcing, particularly for wood and peat in gardening products, aligns with biodiversity protection goals. These efforts are crucial as consumer demand for eco-friendly outdoor products continues to grow, placing greater emphasis on the environmental credentials of companies like Fiskars.

- Fiskars Group's 2023 sustainability report details initiatives to assess and mitigate biodiversity impacts from its garden product supply chains.

- Adherence to ESRS E4 demonstrates a structured approach to reporting and managing ecosystem-related risks and opportunities.

- The company's focus on responsible sourcing of natural materials, such as FSC-certified wood, directly supports biodiversity conservation efforts.

- Consumer demand for sustainable outdoor products is increasing, making robust biodiversity management a key strategic consideration for Fiskars.

Fiskars is actively tackling climate change, setting ambitious targets to reduce its environmental impact. The company aims for a 60% cut in greenhouse gas emissions from its direct operations by 2030 (Scope 1 & 2) and a 30% reduction in emissions from its logistics (Scope 3) by the same year. These goals reflect growing global pressure from consumers, investors, and regulators for corporate climate action.

The company is also embracing the circular economy, with a goal for most of its net sales to come from circular products and services by 2030. This involves designing products for durability, repairability, and recyclability, moving away from a linear 'take-make-dispose' model.

Fiskars' commitment extends to managing waste and pollution, with a 6% reduction in waste generated per tonne of production achieved in 2023. They are also aiming for a further 10% reduction in landfill-bound waste in 2024 and plan to increase the use of recycled packaging materials by 15% by 2025.

The availability and cost of raw materials like metals, plastics, and wood are significant environmental and economic factors for Fiskars. Supply chain disruptions due to environmental events, such as extreme weather, can impact production and pricing, making robust supplier relationships and exploring alternative materials crucial for resilience.

| Environmental Target | Baseline Year | Target Year | Progress/Status |

| Scope 1 & 2 GHG Emission Reduction | 2017 | 2030 | Aiming for 60% reduction |

| Scope 3 GHG Emission Reduction (Transport & Distribution) | 2018 | 2030 | Aiming for 30% reduction |

| Net Sales from Circular Products/Services | N/A | 2030 | Aiming for majority |

| Waste Reduction (per tonne of production) | N/A | 2023 | Achieved 6% reduction |

| Landfill-Bound Waste Reduction | N/A | 2024 | Aiming for 10% reduction |

| Use of Recycled Packaging Materials | N/A | 2025 | Aiming for 15% increase |

PESTLE Analysis Data Sources

Our Fiskars PESTLE Analysis is grounded in a comprehensive review of data from reputable sources including government reports, international economic organizations, and leading industry publications. This ensures all political, economic, social, technological, legal, and environmental insights are fact-based and current.