Fiskars Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fiskars Bundle

Fiskars navigates a competitive landscape shaped by powerful buyer bargaining, intense rivalry, and the ever-present threat of substitutes. Understanding these forces is crucial for any stakeholder looking to grasp Fiskars's strategic position.

The complete report reveals the real forces shaping Fiskars’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers can be significant for Fiskars if its production relies on a small number of specialized providers for critical components or raw materials. For instance, unique ceramic glazes for premium tableware or advanced composite materials for high-performance garden tools might be sourced from just a handful of global suppliers. This limited availability grants these suppliers considerable influence over pricing and supply conditions.

The bargaining power of suppliers for Fiskars is significantly influenced by switching costs. If Fiskars faces substantial expenses when changing suppliers, such as retooling manufacturing lines or redesigning products to accommodate new materials, this strengthens supplier leverage. For instance, maintaining the premium quality associated with brands like Iittala glass or Waterford crystal likely necessitates specific raw material suppliers, making it costly and potentially brand-damaging to switch.

Suppliers gain leverage when their inputs are distinctive and essential to Fiskars' product lines, with limited alternatives. For example, the specialized steel needed for Fiskars' high-performance garden tools or the unique clays utilized by its luxury ceramic brands like Iittala and Royal Copenhagen are often sourced from a select group of providers. This scarcity can enable these suppliers to dictate higher prices, directly affecting Fiskars' production expenses.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Fiskars' consumer product manufacturing or distribution channels significantly bolsters their bargaining power. If suppliers possess the capability and inclination to bypass Fiskars and reach end consumers directly, it creates a potent competitive pressure. This scenario forces Fiskars to weigh the potential for direct competition originating from its own supply base, potentially impacting pricing and market access.

While less probable for suppliers of basic raw materials, specialized component manufacturers might indeed pose this forward integration threat. For instance, a supplier of advanced ceramic blades for Fiskars' premium cutting tools could, in theory, establish its own branded consumer product line. This would directly challenge Fiskars' market position and necessitate a strategic response to mitigate the intensified competition.

- Supplier Forward Integration Risk: Suppliers moving into manufacturing or distribution increases their leverage over Fiskars.

- Specialized Component Threat: Manufacturers of key components, like advanced blades, are more likely to possess the capability for forward integration.

- Competitive Pressure: Fiskars must account for the possibility of its suppliers becoming direct competitors, potentially affecting pricing and market share.

Supplier's Importance to Fiskars' Cost Structure

The bargaining power of suppliers is a critical factor for Fiskars, especially when their inputs significantly contribute to the company's overall cost structure. If a particular raw material or component represents a substantial percentage of Fiskars' production expenses, suppliers of that item gain considerable leverage. For instance, a significant price hike on a key material could directly impact Fiskars' bottom line, as seen in the broader manufacturing sector where raw material costs have fluctuated. Fiskars' proactive strategies, such as implementing pricing adjustments and pursuing productivity enhancements, demonstrate a clear understanding of these cost pressures and their origins from suppliers.

Fiskars’ reliance on specific suppliers for essential components directly influences their bargaining power. If only a few suppliers can provide a critical material or component with the required quality and specifications, those suppliers hold a stronger position. This is particularly relevant in specialized industries where unique inputs are necessary. For example, in 2024, many companies in the consumer goods sector experienced supply chain disruptions that empowered their key material providers due to limited alternative sources.

- Supplier's input as a significant cost driver: If a key material or component constitutes a large portion of Fiskars' product cost, even minor price increases from that supplier can substantially impact Fiskars' profitability.

- Fiskars' mitigation strategies: The company's efforts to manage cost pressures, including adjusting prices and improving productivity, highlight their awareness of the impact of supplier costs.

The bargaining power of suppliers for Fiskars is amplified when their products are critical to Fiskars' operations and few alternatives exist. For instance, if Fiskars relies on a limited number of specialized manufacturers for high-quality ceramic glazes or advanced composite materials, these suppliers can command higher prices. This is particularly true if switching to a different supplier would involve significant costs or a decline in product quality, as seen with premium brands like Waterford crystal.

In 2024, the consumer goods sector experienced notable price increases for key raw materials, impacting companies like Fiskars. For example, certain specialty metals used in high-end kitchenware saw a price surge of up to 15% due to concentrated supply. This empowered suppliers by increasing their leverage over manufacturers who had limited options for sourcing these essential inputs without compromising product integrity or incurring substantial retooling expenses.

| Supplier Characteristic | Impact on Fiskars | Example for Fiskars |

|---|---|---|

| Concentrated Supply Base | Increases supplier leverage | Few suppliers for advanced ceramic glazes |

| High Switching Costs | Strengthens supplier position | Retooling for new material in Iittala glass production |

| Input Differentiation | Gives suppliers pricing power | Specialized steel for Fiskars garden tools |

| Potential for Forward Integration | Creates competitive threat | Component supplier entering consumer market |

What is included in the product

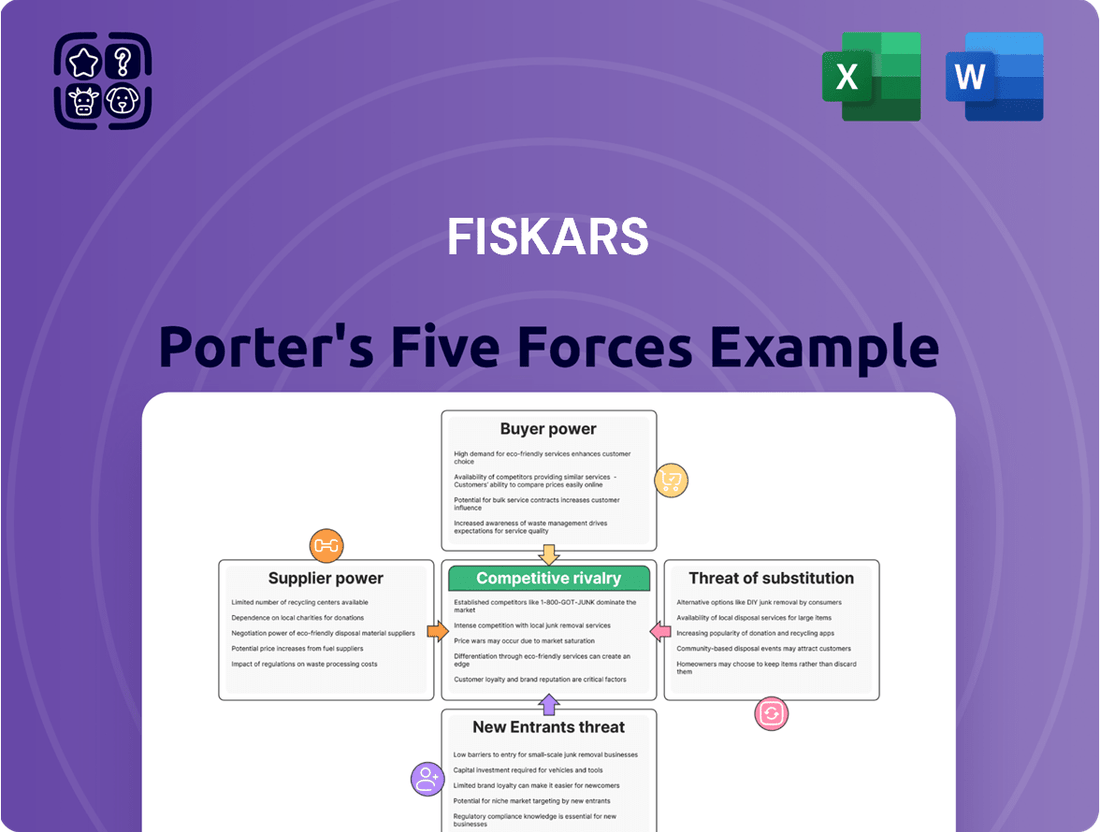

Analyzes the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes impacting Fiskars' market position.

Visually map competitive intensity with a dynamic threat matrix, revealing key areas of strategic vulnerability.

Customers Bargaining Power

Fiskars Group reaches a broad spectrum of customers across more than 100 countries through retail, e-commerce, and direct sales channels. This wide distribution network means that no single customer or customer group holds significant sway over the company's sales volume. For instance, while specific sales figures for individual customer segments aren't publicly detailed, the sheer breadth of their market presence in 2024 suggests a fragmented customer landscape.

The price sensitivity of Fiskars' end consumers isn't uniform; it shifts depending on the product. For instance, premium brands like Waterford and Iittala, known for luxury tableware, tend to attract buyers less swayed by price. Conversely, more practical items, such as Fiskars-branded garden tools or everyday kitchenware, encounter stronger price competition from rivals.

Economic headwinds can amplify consumer price sensitivity. In 2024, a dip in consumer confidence directly impacted demand across various sectors, including home and garden, where Fiskars operates. This trend is projected to continue into 2025, suggesting that price will remain a critical factor for many shoppers in these categories.

Customers wield more influence when numerous substitute products or brands are readily available. Fiskars operates within dynamic markets for home, garden, and outdoor goods, where consumers frequently encounter a wide array of alternatives. This abundance of choice naturally amplifies the bargaining power of these customers.

However, Fiskars actively works to mitigate this by leveraging the strength of its well-recognized brands, including Fiskars, Gerber, Iittala, and Waterford. These brands are crucial differentiators, aiming to cultivate customer loyalty and, in turn, diminish the inherent power customers might otherwise possess due to the availability of substitutes. For instance, in 2023, Fiskars reported that its brand awareness remained a significant asset, contributing to its market position despite competitive pressures.

Customer's Ability to Switch

The ease with which customers can switch to a competitor's offering significantly influences their bargaining power. For Fiskars, this varies greatly depending on the product category.

For many of Fiskars' common household and garden tools, switching costs are minimal. Consumers can easily opt for alternatives from brands like Gardena or Stanley. However, Fiskars also owns premium brands like Iittala, where brand loyalty and the perceived quality and design of products can create higher switching costs. For instance, a consumer invested in a full Iittala glassware set might be less inclined to switch due to the aesthetic and perceived durability, thus reducing their individual bargaining power.

In 2024, the consumer goods market continues to see intense competition, with price comparison becoming increasingly accessible online. However, strong brand equity, as cultivated by Fiskars with its heritage in quality and design, can act as a significant deterrent to switching. This is particularly true for products where consumers seek long-term value and a specific user experience, thereby mitigating the customer's ability to switch and lessening their bargaining power.

- Low Switching Costs: For basic gardening tools and kitchenware, customers can easily switch to competitors like Black+Decker or OXO.

- High Switching Costs: For premium Iittala glassware or specialized Fiskars tools, brand loyalty and unique design can increase switching costs.

- Brand Loyalty: Fiskars' established reputation for durability and design in 2024 helps retain customers, reducing their power to demand lower prices.

- Market Saturation: While the overall market for many Fiskars products is competitive, brand differentiation plays a key role in customer retention.

Direct-to-Consumer (DTC) Channel Growth

Fiskars Group's strategic expansion into Direct-to-Consumer (DTC) channels, encompassing both its physical stores and robust e-commerce operations, significantly bolsters its leverage against traditional retail partners. This DTC growth allows Fiskars to cultivate more direct relationships with its customer base and exert greater control over its pricing strategies. For instance, in the first quarter of 2025, the company reported a notable 9% increase in comparable DTC sales, underscoring the effectiveness of this approach.

This direct engagement inherently diminishes the bargaining power of intermediaries, as Fiskars can now effectively bypass them to connect directly with end consumers.

- DTC Sales Growth: Fiskars experienced a 9% increase in comparable DTC sales in Q1 2025.

- Channel Control: Direct sales channels provide greater control over pricing and customer interactions.

- Reduced Intermediary Power: Bypassing traditional retailers lessens their influence on Fiskars.

- Enhanced Customer Relationships: DTC fosters direct engagement and loyalty.

Fiskars' customer base is broad, spanning over 100 countries, which generally dilutes individual customer power. However, price sensitivity varies; premium brands like Iittala face less price pressure than everyday Fiskars-branded tools. Economic conditions in 2024, marked by lower consumer confidence, increased price sensitivity for many Fiskars products, a trend expected to persist into 2025.

The availability of numerous substitutes in the home and garden sectors empowers customers. Fiskars counters this by leveraging strong brands like Fiskars, Gerber, Iittala, and Waterford to foster loyalty. While switching costs are low for basic items, premium products with unique designs, such as Iittala glassware, can create higher switching costs for consumers, thereby reducing their bargaining power.

| Factor | Impact on Fiskars' Customer Bargaining Power | Supporting Data/Observation (2024-2025) |

| Customer Dispersion | Low | Wide distribution across 100+ countries limits individual customer influence. |

| Price Sensitivity | Mixed | High for everyday items, low for premium brands (e.g., Iittala). 2024 economic headwinds increased sensitivity for many products. |

| Availability of Substitutes | High | Numerous competitors in home, garden, and outdoor sectors. |

| Switching Costs | Low to High | Low for basic tools; higher for premium brands due to loyalty and design investment. |

| Brand Loyalty | Mitigating Factor | Established brands like Fiskars and Iittala help retain customers, reducing price demands. |

Full Version Awaits

Fiskars Porter's Five Forces Analysis

This preview showcases the exact Fiskars Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You're looking at the actual, fully formatted document, ensuring no surprises or placeholder content. Once you complete your purchase, you’ll get instant access to this precise, ready-to-use analysis, equipping you with valuable strategic insights.

Rivalry Among Competitors

Fiskars Group faces a dynamic competitive environment, populated by numerous players ranging from global giants to niche specialists. This diversity is evident across its core segments, including kitchenware, garden tools, and tableware, where it competes with established brands and emerging companies alike.

In 2024, the kitchenware market alone sees intense competition from companies like Groupe SEB, Meyer Corporation, and various private label manufacturers. Similarly, the gardening sector includes formidable rivals such as Husqvarna, STIHL, and numerous smaller, regional tool suppliers, all vying for consumer attention and market share.

Fiskars' strategic focus on strengthening its 'winning brands, winning channels, and winning countries' is a direct response to this multifaceted rivalry. This approach aims to consolidate its position in key markets and product categories, differentiating itself amidst a crowded and varied competitive landscape.

The consumer products market, particularly in the home and garden sector, has faced significant headwinds. Low consumer confidence in 2024 has directly impacted demand, making it a challenging environment for growth. This slowdown typically fuels more aggressive competition among established players.

In such a subdued market, competitive rivalry naturally intensifies. Companies are compelled to fight harder for every sale, often resorting to price reductions or increased promotional activities to capture a larger share of a market that isn't expanding. This dynamic puts pressure on profit margins for all participants.

Fiskars itself reflected this tough market reality, reporting a decrease in comparable net sales for 2024. This decline underscores the prevailing economic conditions and the heightened competitive pressures that businesses like Fiskars are navigating as they strive to maintain or increase their market standing.

Fiskars Group actively cultivates competitive advantage through its portfolio of well-recognized brands, including Fiskars, Gerber, Iittala, and Waterford. This strong brand equity and commitment to product differentiation are key strategies to mitigate intense rivalry by fostering customer loyalty and reducing price sensitivity. For instance, Fiskars' gardening tools are often chosen for their perceived quality and ergonomic design, a testament to their differentiation efforts.

Exit Barriers

High exit barriers in the consumer goods sector, including specialized machinery and existing supply agreements, can trap less profitable companies in the market. This situation fuels ongoing intense competition because businesses hesitate to withdraw even when losing money. For instance, in 2023, the European consumer goods sector saw several smaller players struggling with profitability but remaining operational due to the substantial investment in their production lines.

Fiskars, with its deeply integrated manufacturing facilities and extensive distribution channels built over decades, likely faces significant exit barriers. These assets, while crucial for current operations, represent substantial sunk costs that would be difficult to recover if the company decided to exit certain markets or product lines. This commitment to physical infrastructure and established logistics chains means Fiskars is inherently tied to its operational base, contributing to sustained rivalry.

- Specialized Assets: Fiskars' manufacturing plants are tailored for specific product categories, making them less adaptable for other industries.

- Distribution Networks: The cost and complexity of unwinding established relationships with retailers and logistics providers create a barrier.

- Brand Reputation: A significant portion of Fiskars' value is tied to its brand, which is difficult to divest or repurpose.

Industry Cost Structure

Industries with substantial fixed costs often pressure companies to maximize production, which can ignite price wars as firms vie for market share. Fiskars Group, despite its focus on cost control and efficiency, operates a global network, inherently carrying fixed costs related to manufacturing and distribution.

The ongoing impact of trade policies, such as U.S. tariffs on imported goods, further complicates the cost structure by increasing sourcing expenses. This added cost pressure can amplify competitive intensity within the industry as companies seek to offset these increases.

- Global Operations: Fiskars maintains production and distribution facilities worldwide, contributing to significant fixed operational costs.

- Tariff Impact: U.S. tariffs, implemented in recent years, have demonstrably increased the cost of sourcing raw materials and components for many manufacturers, including those in the consumer goods sector. For instance, in 2024, tariffs on certain steel and aluminum products continued to affect input costs for durable goods manufacturers.

- Capacity Utilization: The drive to achieve economies of scale necessitates high capacity utilization, making price competition a common tactic when demand fluctuates.

The competitive rivalry within Fiskars' markets is substantial, driven by a diverse array of global brands and specialized niche players. This intensity is amplified by economic conditions, such as the low consumer confidence observed in 2024, which forces companies to compete more aggressively on price and promotions, impacting overall profitability.

Fiskars counters this by leveraging its strong brand portfolio, including Fiskars, Gerber, Iittala, and Waterford, to foster customer loyalty and differentiate its offerings. High exit barriers within the consumer goods sector, stemming from specialized assets and established distribution networks, also contribute to sustained rivalry as companies find it difficult to leave the market.

Fiskars' global operations and associated fixed costs, coupled with external pressures like tariffs on imported goods in 2024, further fuel this competitive environment by increasing cost pressures and encouraging price-based competition to maintain capacity utilization.

| Competitor Example | Primary Market Segment | 2024 Market Share Estimate (Home & Garden) |

|---|---|---|

| Groupe SEB | Kitchenware | 5-7% |

| Husqvarna | Garden Tools | 10-12% |

| Meyer Corporation | Kitchenware | 4-6% |

| STIHL | Garden Tools | 15-18% |

SSubstitutes Threaten

The threat of substitutes for Fiskars Group's products is generally considered moderate to high across several of its key segments. For example, in the garden tools market, while Fiskars is recognized for its quality and innovation, consumers can readily find less expensive, albeit potentially lower-quality, alternatives from numerous other manufacturers. This availability of generic options puts pressure on Fiskars' pricing and market share.

Similarly, in the competitive kitchenware and tableware sectors, the landscape is flooded with brands offering products that perform the same basic functions. Consumers have extensive choices, ranging from budget-friendly plasticware to premium ceramic and stainless steel options from a multitude of competitors. This wide array of substitutes means consumers can easily switch if Fiskars' offerings do not meet their perceived value proposition.

Fiskars actively works to counter this threat by leveraging its strong brand reputation and focusing on product differentiation through superior design and functionality. For instance, in 2023, Fiskars continued to invest in product development, aiming to introduce innovative features that distinguish its offerings. This strategy is crucial to justify premium pricing and retain customer loyalty in the face of readily available alternatives.

The threat of substitute products for Fiskars is significantly influenced by the price-performance trade-off. If alternatives provide comparable functionality at a substantially lower cost, consumers may switch, especially for less critical applications. For instance, a budget-conscious gardener might choose a less robust, lower-priced tool for occasional use over a premium Fiskars item.

Fiskars' financial health, particularly its gross margin, plays a vital role in mitigating this threat. In 2023, Fiskars reported a net sales of €3.5 billion, with a focus on maintaining profitability. The company's ability to manage its cost of goods sold and operational expenses directly impacts its capacity to offer competitive pricing against substitutes without eroding its financial strength.

For many of Fiskars' core household and garden products, the threat of substitutes is amplified by low switching costs for consumers. It's generally easy and inexpensive for someone to pick up a different brand of scissors or a new kitchen gadget, meaning brand loyalty alone isn't a strong defense. For instance, in 2024, the global kitchenware market saw a plethora of brands offering similar functionality, with many entry-level products available for under $10, making a switch almost frictionless.

Propensity of Buyers to Substitute

The propensity of buyers to switch to substitutes is a significant factor for Fiskars. Economic conditions, such as the inflationary pressures experienced through 2024 and into early 2025, directly impact consumer disposable income. When budgets tighten, consumers are more likely to seek out lower-priced alternatives, even if they sacrifice some perceived quality or brand prestige.

This trend means Fiskars must actively communicate the enduring value and practical utility of its products, not just their aesthetic appeal. For instance, during economic downturns, the cost-effectiveness of durable, well-made tools that last longer can become a key selling point against cheaper, disposable options.

Several factors influence this buyer behavior:

- Economic Climate: Periods of economic uncertainty, like the projected slowdowns in some markets during 2024, increase price sensitivity.

- Availability of Alternatives: The market is often flooded with lower-cost brands offering similar basic functionality, making switching easier.

- Switching Costs: For many of Fiskars’ core products, like gardening tools or kitchenware, the cost and effort to switch to a substitute are relatively low.

- Brand Loyalty vs. Price: While Fiskars has brand recognition, extreme price differences can erode loyalty, especially for less differentiated product categories.

Innovation and Technological Advancements in Substitutes

The threat of substitutes for Fiskars is amplified by ongoing innovation and technological advancements. New materials, more efficient manufacturing processes, and the rise of digital solutions can create entirely new product categories that fulfill similar customer needs. For instance, smart home devices are increasingly performing functions previously handled by traditional home goods, potentially impacting sectors like kitchenware or home organization.

Fiskars' proactive approach to innovation is crucial in mitigating this threat. The company's commitment to design excellence and its strategic investments in digital transformation are key. By continuously developing new and improved products and exploring digital channels, Fiskars aims to stay ahead of emerging substitutes and maintain its competitive edge. For example, Fiskars reported a 2% increase in net sales in Q1 2024, reaching €276.5 million, demonstrating continued market presence amidst evolving consumer demands.

- Emerging Digital Solutions: Smart home technology can substitute traditional tools and appliances, altering consumer expectations for convenience and functionality.

- Material Science Breakthroughs: Advances in material science could yield lighter, more durable, or more sustainable alternatives to Fiskars' current product lines, particularly in gardening tools and cookware.

- Fiskars' Innovation Investment: Fiskars' ongoing investment in R&D, which formed a significant part of its 2023 operational expenses, is designed to preemptively address these substitute threats through product development.

- Digital Transformation: The company's focus on digital transformation, including e-commerce and enhanced customer experiences, helps to build brand loyalty and differentiate its offerings from potentially disruptive substitutes.

The threat of substitutes for Fiskars is significant due to the wide availability of lower-cost alternatives across its product categories. Consumers often face minimal switching costs, making them susceptible to price-driven decisions, especially during economic downturns like those seen in 2024. Fiskars counters this by emphasizing product quality, durability, and innovation, as evidenced by its continued investment in R&D to differentiate its offerings.

| Product Category | Substitute Threat Level | Key Factors Influencing Threat |

|---|---|---|

| Garden Tools | Moderate to High | Availability of generic brands, price sensitivity, low switching costs |

| Kitchenware & Tableware | High | Extensive market competition, wide price range of alternatives, functional parity |

| Home & Living | Moderate | Emerging digital solutions, material science advancements, brand loyalty vs. price |

Entrants Threaten

Fiskars Group, a global leader in consumer products for home and garden, leverages significant economies of scale. In 2024, the company's vast operational footprint across multiple continents allows for optimized sourcing and production, driving down per-unit costs. This scale makes it challenging for new entrants to match Fiskars' cost efficiencies, particularly in areas like raw material procurement and large-scale manufacturing.

Fiskars Group benefits from significant brand loyalty across its portfolio, including well-recognized names like Fiskars, Gerber, Iittala, and Waterford. This established trust means new entrants face a considerable hurdle in capturing market share. For instance, in 2023, Fiskars reported strong brand equity, a key factor in customer retention.

Entering the consumer products sector, particularly with a broad product range like Fiskars Group, demands substantial upfront capital. This investment covers everything from setting up manufacturing plants and robust supply chains to launching extensive marketing initiatives and building a strong retail presence, including direct-to-consumer platforms.

The sheer scale of financial commitment acts as a significant barrier. For context, Fiskars Group’s capital expenditure reached EUR 52.5 million in 2024, illustrating the considerable financial resources necessary to compete effectively. This high barrier to entry naturally discourages many potential new players from entering the market.

Access to Distribution Channels

Fiskars Group's extensive distribution network, encompassing over 100 countries through retail, e-commerce, and direct sales, presents a significant barrier. New entrants would face considerable difficulty in securing prime shelf space within established major retail chains, a process that is both time-consuming and capital-intensive.

The existing relationships Fiskars has cultivated with retailers and its well-developed global logistics infrastructure provide a substantial competitive advantage, making it challenging for newcomers to replicate this reach and efficiency.

- Established Retail Presence: Fiskars benefits from long-standing partnerships with major retailers globally.

- E-commerce Infrastructure: A robust online sales platform and logistics support are already in place.

- Direct Sales Capabilities: Direct customer engagement channels reduce reliance on intermediaries.

- Global Reach: Operations in over 100 countries require significant investment to match.

Government Policy and Regulations

Government policies and regulations significantly influence the threat of new entrants. For a company like Fiskars, navigating complex regulatory landscapes, including product safety standards and environmental compliance, can be a substantial barrier. For instance, in 2024, the U.S. continued to implement various tariffs impacting imported goods, directly increasing sourcing costs and creating challenges for any new company looking to enter the market without established supply chains and compliance expertise.

New entrants would face substantial costs and complexities in adhering to diverse international regulations, which can deter market entry. These regulatory hurdles can range from specific material requirements for products to differing labeling laws across regions. For example, compliance with the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation adds significant upfront costs and ongoing management for companies operating in or entering the European market.

- Regulatory Hurdles: Product safety, environmental standards, and import tariffs act as significant barriers.

- Increased Costs: U.S. tariffs in 2024, for example, raised sourcing costs, a challenge new entrants would also face.

- International Complexity: Compliance with diverse global regulations adds to the cost and difficulty of entering new markets.

The threat of new entrants for Fiskars Group is generally considered low due to several significant barriers. These include the substantial capital investment required, strong brand loyalty, and the complexity of navigating global regulations and distribution networks.

Fiskars' established economies of scale, particularly in sourcing and manufacturing, make it difficult for newcomers to achieve comparable cost efficiencies. For example, in 2024, the company's extensive global operations allowed for optimized production that new entrants would struggle to replicate without significant investment.

The high capital expenditure needed for manufacturing, supply chains, and marketing, coupled with the challenge of securing retail shelf space, acts as a deterrent. Fiskars' 2024 capital expenditure of EUR 52.5 million highlights the financial commitment necessary to compete effectively.

Furthermore, navigating diverse international regulations and maintaining compliance, such as with the EU's REACH standards, adds considerable cost and complexity for potential new market participants.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment needed for manufacturing, supply chain, and marketing. | Discourages entry due to substantial upfront costs. |

| Brand Loyalty | Established trust in brands like Fiskars, Gerber, Iittala. | New entrants must overcome significant customer preference. |

| Economies of Scale | Optimized sourcing and production due to global operations. | New entrants struggle to match cost efficiencies. |

| Distribution Network | Extensive reach in over 100 countries, including prime retail placement. | Difficult for newcomers to replicate reach and secure shelf space. |

| Regulatory Complexity | Navigating product safety, environmental, and import/export laws. | Adds cost and complexity, requiring specialized expertise. |

Porter's Five Forces Analysis Data Sources

Our Fiskars Porter's Five Forces analysis is built upon a robust foundation of data, including Fiskars' annual reports, investor presentations, and competitor financial filings. We also leverage industry-specific market research reports and trade publications to capture current market dynamics and competitive landscapes.